Key Takeaways

- A custodial wallet is a third-party managed cryptocurrency storage solution where service providers hold and control your private keys, similar to how traditional banks manage your account whilst you own the funds.

- Custodial wallets offer enhanced security and user convenience through enterprise-grade infrastructure, professional customer support, simplified interfaces, and familiar account recovery methods using email or SMS verification.

- The main disadvantage is limited control over your assets, as you cannot access your private keys directly and remain dependent on the provider’s platform availability and operational decisions.

- Three primary types exist: exchange wallets for active trading, mobile app wallets for everyday transactions, and web-based wallets for cross-device portfolio management – each serving different user needs and experience levels.

- When choosing a custodial wallet, prioritise security features such as multi-signature technology, cold storage allocation (95%+ offline), insurance coverage, and regulatory compliance from reputable providers with proven track records.

- Custodial wallets suit beginners and convenience-focused users, whilst non-custodial wallets better serve experienced users who prioritise complete asset control and are comfortable managing private keys independently.

When you’re diving into the world of cryptocurrency, you’ll quickly encounter the term “custodial wallet” – but what exactly does it mean? Understanding this fundamental concept is crucial for making informed decisions about how you store and manage your digital assets.

A custodial wallet represents one of the two main approaches to cryptocurrency storage, where a third party holds and manages your private keys on your behalf. Think of it like a traditional bank account – you own the funds, but the institution controls the security infrastructure and handles the technical complexities for you.

Whether you’re a complete beginner or looking to expand your crypto knowledge, grasping the mechanics of custodial wallets will help you navigate the digital currency landscape with confidence. Let’s explore how these wallets work, their advantages and drawbacks, and when they might be the right choice for your cryptocurrency journey.

What Is a Custodial Wallet?

A custodial wallet operates through a third-party service that holds and manages your cryptocurrency private keys on your behalf. The service provider maintains complete control over your digital assets whilst you access them through their platform interface.

Unlike traditional self-custody wallets where you retain private key ownership, custodial wallets function similarly to conventional bank accounts. You deposit cryptocurrency into the wallet, and the custodian manages the technical aspects of storage and security infrastructure.

Key Characteristics of Custodial Wallets

Custodial wallets feature several distinct elements that differentiate them from non-custodial alternatives:

- Third-party control: The service provider manages your private keys and executes transactions

- Account-based access: You log in using credentials rather than managing seed phrases

- Integrated services: Many custodial wallets offer trading, staking and lending features

- Customer support: Professional assistance available for technical issues and account recovery

- Regulatory compliance: Licensed providers adhere to financial regulations and reporting requirements

How Custodial Wallets Function

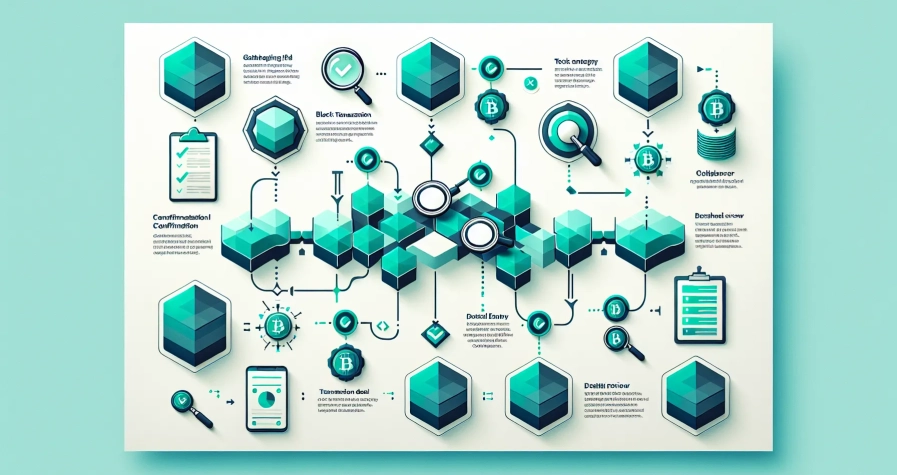

When you create a custodial wallet account, the provider generates and stores your private keys within their secure infrastructure. Your cryptocurrency exists on the blockchain, but you access it through the custodian’s interface rather than direct blockchain interaction.

The custodian processes your transactions when you send or receive cryptocurrency. They verify your identity through their platform before executing any transfers on your behalf. This process creates an additional security layer whilst removing the technical complexity of direct blockchain management.

| Feature | Custodial Wallet | Non-Custodial Wallet |

|---|---|---|

| Private Key Control | Service provider | User |

| Account Recovery | Platform support | Self-managed |

| Transaction Processing | Third-party execution | Direct blockchain |

| Technical Knowledge Required | Minimal | Moderate to high |

| Regulatory Oversight | Yes | No |

How Custodial Wallets Work

Custodial wallets function through a systematic process where third-party providers manage your cryptocurrency assets whilst you interact with their platform interface. These services handle the technical complexities of blockchain transactions behind the scenes.

The Role of Third-Party Service Providers

Third-party service providers act as intermediaries between you and the blockchain network. They operate secure infrastructure systems that connect to multiple blockchain networks including Bitcoin, Ethereum and other cryptocurrency protocols.

These providers offer several operational functions:

- Transaction processing – Execute buy, sell and transfer orders on your behalf

- Account management – Maintain user databases with encrypted login credentials

- Security protocols – Implement multi-factor authentication and fraud detection systems

- Regulatory compliance – Follow Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements

- Customer support – Provide technical assistance for account issues and transaction queries

Major custodial wallet providers like Coinbase, Binance and Kraken process millions of transactions daily across their platforms. They maintain hot wallets for immediate liquidity and cold storage systems for enhanced security of dormant funds.

Key Management and Storage

Key management represents the core operational component of custodial wallet services. Your private keys remain stored on the provider’s secure servers rather than on your personal devices.

Custodial providers implement hierarchical deterministic (HD) wallet architecture to generate unique key pairs for each user account. They utilise enterprise-grade security measures including:

| Security Layer | Implementation Method |

|---|---|

| Hardware Security Modules (HSMs) | Tamper-resistant devices storing encryption keys |

| Multi-signature protocols | Requiring multiple authorisations for transactions |

| Cold storage systems | Offline storage for 90-95% of user funds |

| Encryption standards | AES-256 encryption for data protection |

When you initiate a transaction the provider’s system automatically signs it using your stored private keys. This process occurs within secure enclaves that isolate key operations from external network access. The signed transaction then broadcasts to the relevant blockchain network for confirmation and recording in the distributed ledger.

Types of Custodial Wallets

Custodial wallets come in three primary formats that cater to different user preferences and trading requirements. Each type offers distinct advantages depending on your cryptocurrency management needs and trading frequency.

Exchange Wallets

Exchange wallets integrate directly into cryptocurrency trading platforms like Coinbase, Binance, and Kraken. These wallets store your digital assets on the exchange’s servers whilst providing seamless access to trading features and market liquidity.

Major exchanges process over 100 million transactions monthly through their integrated wallet systems. You access your funds using your exchange account credentials rather than managing private keys directly.

Key characteristics of exchange wallets:

- Instant trading access – Execute trades immediately without transferring funds between platforms

- Advanced order types – Access limit orders, stop-losses, and futures trading directly from your wallet

- Liquidity pools – Benefit from high trading volumes and tight bid-ask spreads

- Multi-asset support – Store hundreds of different cryptocurrencies in a single platform

- Professional tools – Utilise charting software, market analysis, and automated trading bots

Exchange wallets suit active traders who require frequent access to markets and advanced trading functionality.

Mobile App Wallets

Mobile app wallets operate through dedicated smartphone applications that connect to custodial service providers. These wallets prioritise user convenience and accessibility whilst maintaining professional-grade security standards.

Popular mobile custodial wallets include PayPal’s crypto wallet, Cash App, and Revolut, serving over 50 million active users globally. You manage your cryptocurrency holdings through intuitive mobile interfaces designed for everyday transactions.

Features of mobile app wallets:

- Biometric security – Access accounts using fingerprint or facial recognition technology

- Push notifications – Receive real-time alerts for transactions and price movements

- QR code scanning – Send and receive payments by scanning QR codes at merchants

- Peer-to-peer transfers – Send cryptocurrency to contacts using phone numbers or usernames

- Spending integration – Connect to debit cards for cryptocurrency payments at retail locations

Mobile app wallets appeal to casual users who prioritise convenience and simple transaction management over advanced trading features.

Web-Based Wallets

Web-based wallets function through internet browsers and provide access to custodial services without downloading specific software. These platforms offer comprehensive cryptocurrency management tools accessible from any device with internet connectivity.

Leading web-based custodial wallets include Blockchain.com, BitGo, and Gemini’s web platform, collectively managing over $10 billion in digital assets. You access your wallet by logging into the provider’s website using secure authentication methods.

Advantages of web-based wallets:

- Cross-device compatibility – Access your wallet from computers, tablets, and smartphones

- Automatic updates – Benefit from the latest security patches and features without manual installation

- Portfolio tracking – Monitor asset performance across multiple cryptocurrencies with real-time data

- Tax reporting tools – Generate transaction reports for accounting and regulatory compliance

- API integration – Connect third-party applications for automated portfolio management

Web-based wallets serve users who require flexible access across multiple devices and comprehensive portfolio management capabilities.

Advantages of Custodial Wallets

Custodial wallets offer significant benefits that make cryptocurrency management more accessible and secure for users at all experience levels. These advantages address common challenges faced when managing digital assets independently.

Enhanced Security Features

Custodial wallet providers implement enterprise-grade security measures that exceed individual user capabilities. Major providers like Coinbase and Binance allocate over $100 million annually to security infrastructure, including hardware security modules (HSMs), multi-signature authentication, and advanced encryption protocols.

Professional Security Infrastructure:

- Cold storage systems protect 95-98% of user funds offline

- Multi-factor authentication prevents unauthorised account access

- Real-time fraud detection monitors suspicious transaction patterns

- Insurance coverage protects against platform breaches and theft

- Regular security audits ensure compliance with international standards

Advanced Threat Protection:

- Dedicated cybersecurity teams monitor threats 24/7

- Automated systems detect and block suspicious activities

- Regular penetration testing identifies potential vulnerabilities

- Institutional-grade firewalls protect against external attacks

User-Friendly Experience

Custodial wallets eliminate technical barriers that often prevent mainstream cryptocurrency adoption. These platforms simplify complex blockchain interactions through intuitive interfaces and automated processes.

Simplified Interface Design:

- Dashboard displays portfolio balances and transaction history clearly

- One-click buying and selling eliminates complex exchange procedures

- Mobile applications enable cryptocurrency management on-the-go

- Integrated charts and market data support informed trading decisions

Automated Transaction Management:

- Platforms handle gas fee calculations automatically

- Transaction broadcasting occurs without user intervention

- Network congestion management optimises transaction timing

- Built-in conversion tools enable seamless asset exchanges

Customer Support Services:

- Live chat assistance resolves technical issues immediately

- Educational resources help users understand cryptocurrency fundamentals

- Account managers provide personalised guidance for high-value clients

- Multi-language support accommodates global user bases

Recovery Options

Custodial wallets provide comprehensive account recovery mechanisms that protect users from permanent asset loss. Traditional recovery methods replace the complexity of seed phrase management with familiar authentication processes.

Account Recovery Methods:

| Recovery Type | Processing Time | Requirements |

|---|---|---|

| Email verification | 5-10 minutes | Registered email address |

| SMS authentication | 2-5 minutes | Verified phone number |

| Identity verification | 24-48 hours | Government-issued ID |

| Support ticket | 1-7 days | Account ownership proof |

Password Reset Procedures:

- Automated email links restore account access quickly

- Security questions provide additional identity verification

- Biometric authentication enables instant mobile access

- Two-factor authentication codes secure sensitive operations

- Account freezing prevents unauthorised transactions during disputes

- Dispute resolution processes handle compromised accounts

- Insurance policies cover verified losses from security breaches

- Legal frameworks protect user rights under financial regulations

Disadvantages of Custodial Wallets

Custodial wallets present specific limitations that you must consider when selecting a cryptocurrency storage solution. These drawbacks primarily centre around control, security dependencies, and regulatory constraints.

Limited Control Over Private Keys

You don’t possess direct access to your private keys when using custodial wallets. The third-party provider maintains complete ownership and control of these cryptographic credentials that authenticate transactions and prove ownership of your digital assets.

Your cryptocurrency access depends entirely on the custodial service’s platform availability and operational status. If the provider experiences technical difficulties, maintenance periods, or system outages, you cannot access or transfer your funds until services resume normal operation.

The provider makes all technical decisions regarding wallet updates, security protocols, and transaction fees without requiring your consent. You cannot implement personal security preferences, choose alternative transaction methods, or modify wallet configurations to suit specific requirements.

Withdrawal limitations often apply to custodial wallets, with providers setting daily, weekly, or monthly limits on the amounts you can transfer. These restrictions may prevent you from accessing your full balance during market opportunities or urgent financial situations.

Potential Security Risks

Custodial wallets create concentrated targets for cybercriminals due to the large amounts of cryptocurrency stored on centralised platforms. Major exchanges like Mt. Gox lost 850,000 Bitcoin in 2014, whilst QuadrigaCX users lost access to £145 million in 2019 following the founder’s death.

Your funds face counterparty risk when stored with custodial providers, meaning the company’s financial stability directly affects your asset security. Poor management decisions, insolvency, or fraudulent activities by the provider can result in permanent loss of your cryptocurrency holdings.

Technical vulnerabilities in the provider’s infrastructure expose your assets to potential breaches. Even industry-leading platforms experience security incidents, with Binance losing £32 million in 2019 and KuCoin suffering a £210 million hack in 2020.

Phishing attacks and social engineering schemes target custodial wallet users more frequently than self-custody alternatives. Criminals create fake websites, emails, and customer support channels to steal your login credentials and gain unauthorised access to your accounts.

Regulatory Concerns

Government regulations can force custodial wallet providers to freeze, confiscate, or restrict access to your cryptocurrency holdings. Recent examples include Canadian authorities freezing crypto accounts during the Freedom Convoy protests and various jurisdictions implementing asset seizure orders.

Compliance requirements may result in account closures or service restrictions based on your geographical location, transaction history, or regulatory changes. Providers must adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations that can limit your financial privacy.

Tax reporting obligations become more complex when using custodial wallets, as providers may automatically report your transaction data to relevant authorities. This mandatory disclosure reduces your financial privacy and may create unexpected tax liabilities.

Regulatory uncertainty surrounding cryptocurrency legislation means custodial wallet providers might suddenly alter their terms of service, implement new restrictions, or cease operations in specific jurisdictions. These changes can occur with minimal notice and may force you to find alternative storage solutions.

Custodial vs Non-Custodial Wallets

Custodial and non-custodial wallets represent two fundamentally different approaches to cryptocurrency storage and management. Your choice between these wallet types directly impacts your control over digital assets, security responsibilities, and overall user experience.

Key Differences

The distinction between custodial and non-custodial wallets centres on private key ownership and control mechanisms. Non-custodial wallets grant you complete ownership of your private keys, whilst custodial wallets place this responsibility with third-party providers.

| Feature | Custodial Wallets | Non-Custodial Wallets |

|---|---|---|

| Private Key Control | Provider holds keys | You control keys directly |

| Transaction Approval | Provider processes automatically | You sign each transaction |

| Account Recovery | Email/SMS verification | Seed phrase required |

| Technical Knowledge Required | Minimal | Moderate to high |

| Security Responsibility | Provider manages | You manage entirely |

| Regulatory Compliance | Provider ensures | You handle independently |

| Transaction Fees | Often higher | Network fees only |

| Offline Storage | Provider’s discretion | You choose method |

Custodial wallets function through centralised platforms that manage your cryptocurrency holdings, similar to traditional banking systems. These providers implement enterprise-grade security protocols, handle regulatory compliance, and offer customer support services for technical issues.

Non-custodial wallets operate through decentralised applications or software that connects directly to blockchain networks. You maintain exclusive access to your private keys through seed phrases, typically consisting of 12 to 24 randomly generated words that restore wallet access.

Security models differ significantly between these wallet types. Custodial providers employ multi-signature protocols, hardware security modules, and cold storage systems to protect user funds. Non-custodial wallets rely on your ability to secure seed phrases and implement proper backup procedures.

Recovery processes vary substantially across wallet categories. Custodial wallet recovery involves standard authentication methods like email verification, SMS codes, and identity documentation. Non-custodial wallet recovery requires your seed phrase, making loss of this information irreversible.

Which Option Is Right for You?

Your wallet choice depends on your cryptocurrency experience level, security preferences, and intended usage patterns. Custodial wallets suit users who prioritise convenience over complete control, whilst non-custodial wallets appeal to those valuing maximum security autonomy.

Choose custodial wallets if you:

- Are new to cryptocurrency and prefer simplified management

- Trade frequently on exchanges and require instant liquidity

- Want professional customer support for technical issues

- Prefer familiar recovery methods like email verification

- Need integrated services such as staking and lending

- Value regulatory compliance and institutional backing

Choose non-custodial wallets if you:

- Understand blockchain technology and private key management

- Prioritise complete control over your digital assets

- Are comfortable with technical wallet operations

- Can securely store and backup seed phrases

- Want to minimise counterparty risk exposure

- Prefer direct interaction with decentralised protocols

Trading frequency influences wallet selection significantly. Active traders benefit from custodial wallets’ instant access to exchange features and market liquidity. Long-term holders often prefer non-custodial wallets for enhanced security and reduced third-party dependencies.

Security expertise plays a crucial role in wallet selection. Custodial wallets transfer security responsibilities to professional providers with dedicated teams and advanced infrastructure. Non-custodial wallets require your understanding of proper security practices, including seed phrase storage and phishing attack recognition.

Portfolio size considerations affect wallet choice decisions. Smaller cryptocurrency holdings often suit custodial wallet convenience, whilst substantial portfolios may justify non-custodial wallet complexity for enhanced security control.

Many experienced users employ hybrid approaches, maintaining custodial wallets for active trading and non-custodial wallets for long-term storage. This strategy combines convenience benefits with security advantages, optimising both accessibility and asset protection.

Choosing the Right Custodial Wallet

Selecting an appropriate custodial wallet requires careful evaluation of security features, provider reputation, and regulatory compliance standards. Your choice significantly impacts the safety and accessibility of your cryptocurrency holdings.

Security Considerations

Security measures distinguish quality custodial wallet providers from those with inadequate protection protocols. You must evaluate multiple security layers when comparing different providers.

Multi-signature technology forms the foundation of secure custodial wallets. Leading providers like Coinbase and BitGo implement 2-of-3 or 3-of-5 multi-signature schemes, requiring multiple cryptographic signatures for transaction approval. This approach prevents single points of failure and reduces unauthorised access risks.

Cold storage allocation represents another critical security factor. Premium custodial providers store 95-98% of user funds in offline cold storage systems, keeping only necessary operational funds in hot wallets for daily transactions. Kraken maintains 95% of customer assets in cold storage, whilst Gemini stores over 90% of digital assets offline.

Insurance coverage provides additional protection against potential losses. Major custodial providers offer insurance policies covering digital assets stored on their platforms:

| Provider | Insurance Coverage | Coverage Amount |

|---|---|---|

| Coinbase | FDIC and Lloyd’s | Up to £200,000 |

| Gemini | Aon insurance | Full cold storage |

| BitGo | Lloyd’s of London | Up to $100 million |

Security certifications demonstrate a provider’s commitment to industry standards. Look for SOC 2 Type II compliance, ISO 27001 certification, and regular security audits conducted by independent third parties. These certifications validate the effectiveness of internal controls and security protocols.

Reputation and Compliance

Provider reputation directly correlates with the safety and reliability of your cryptocurrency storage experience. Established custodial wallet providers demonstrate consistent operational history and regulatory adherence.

Operational track record reveals provider stability and trustworthiness. Companies operating for 5+ years with consistent uptime records and no major security breaches present lower risk profiles. Coinbase has operated since 2012 without significant fund losses, whilst Kraken maintains a 99.95% uptime record since 2011.

Regulatory compliance ensures providers operate within legal frameworks and maintain proper oversight. Licensed custodial providers undergo regular audits and must meet specific capital requirements:

- FCA authorisation for UK operations

- FinCEN registration in the United States

- MiCA compliance for European Union services

- AUSTRAC registration for Australian operations

Financial backing indicates provider stability during market volatility. Well-capitalised providers with venture capital funding or public listings demonstrate long-term viability. Publicly traded companies like Coinbase (NASDAQ: COIN) provide additional transparency through quarterly financial reporting.

Customer service quality affects your ability to resolve issues quickly. Providers offering 24/7 support, multiple contact channels, and dedicated account managers ensure prompt assistance during critical situations. Response time benchmarks for quality providers include:

- Live chat responses within 2-5 minutes

- Email replies within 4-24 hours

- Phone support availability during business hours

- Dedicated support for high-value accounts

Transparency measures build trust through clear communication about security practices, fee structures, and operational procedures. Reputable providers publish regular transparency reports, security audit results, and clear terms of service outlining user rights and provider responsibilities.

Conclusion

Choosing a custodial wallet ultimately depends on your priorities and cryptocurrency experience level. If you value convenience and prefer having customer support available when issues arise then custodial wallets offer an excellent entry point into the crypto world.

Remember that you’re trading some control for simplicity when you opt for custodial storage. Your success with these wallets largely depends on selecting reputable providers with strong security measures and transparent practices.

Whether you’re a beginner seeking ease of use or an experienced trader requiring integrated services custodial wallets can serve as valuable tools in your cryptocurrency journey. The key lies in understanding their limitations whilst leveraging their strengths to meet your specific needs.

Frequently Asked Questions

What is a custodial wallet?

A custodial wallet is a cryptocurrency storage solution where a third-party provider manages and holds your private keys, similar to how a traditional bank manages your account. The provider controls your digital assets whilst you access them through their platform using login credentials. This arrangement simplifies cryptocurrency management but requires trusting the provider with your funds.

How do custodial wallets work?

Custodial wallets operate through third-party providers who act as intermediaries between you and the blockchain. When you create an account, the provider generates and securely stores your private keys on their servers. They process transactions on your behalf, sign them using your stored keys, and broadcast them to the blockchain network for confirmation.

What are the main types of custodial wallets?

The three primary types are exchange wallets (integrated into trading platforms for active traders), mobile app wallets (convenient for casual users with features like biometric security), and web-based wallets (accessible from any device with comprehensive management tools). Each type caters to different user preferences and trading requirements.

What are the advantages of using custodial wallets?

Custodial wallets offer enhanced security through enterprise-grade measures, simplified user experience with intuitive interfaces, comprehensive customer support, and easy account recovery through familiar authentication methods. They eliminate technical barriers and provide automated transaction management, making cryptocurrency accessible to users of all experience levels.

What are the risks of custodial wallets?

Key risks include lack of direct control over private keys, dependency on the provider’s platform, potential security vulnerabilities from cyber attacks, counterparty risk related to the provider’s financial stability, and regulatory constraints that may lead to account restrictions or freezes.

How do custodial wallets differ from non-custodial wallets?

Custodial wallets involve third-party control of private keys with account-based access, whilst non-custodial wallets give users complete ownership of their private keys. Custodial wallets offer easier recovery through standard authentication, whereas non-custodial wallets require seed phrases. The choice depends on your preference for convenience versus control.

How do I choose the right custodial wallet?

Evaluate security features like multi-signature technology and cold storage, assess the provider’s reputation and regulatory compliance, check for insurance coverage and security certifications, review customer service quality, and consider transparency measures. Choose based on your experience level, security preferences, and intended usage patterns.

Are custodial wallets safe for storing cryptocurrency?

Custodial wallets can be safe when provided by reputable companies with strong security measures, including cold storage systems, multi-factor authentication, and fraud detection. However, they do carry inherent risks such as potential hacking attempts and reliance on the provider’s security protocols. Research the provider’s track record thoroughly.

Can I recover my funds if I lose access to my custodial wallet?

Yes, custodial wallets typically offer comprehensive account recovery through familiar methods like email verification, SMS authentication, identity verification, and support ticket systems. This process is generally simpler than non-custodial wallet recovery, which requires seed phrases that users must securely store themselves.