Key Takeaways

- Crypto bridges are essential infrastructure that connect isolated blockchain networks, enabling seamless transfer of digital assets and data between different ecosystems through smart contracts that lock tokens on one chain and mint equivalent versions on another.

- Two main bridge types exist: trusted bridges rely on centralised entities for faster transactions but introduce custody risks, whilst trustless bridges operate through decentralised smart contracts offering superior security but slower processing times.

- Bridges unlock significant benefits including enhanced access to liquidity pools across networks, portfolio diversification opportunities, lower transaction costs, and participation in DeFi protocols previously inaccessible with your existing holdings.

- Security risks remain substantial due to smart contract vulnerabilities, centralisation risks, and complex technical architecture—bridges have been prime targets for major hacks resulting in hundreds of millions in losses.

- Safe usage requires careful selection of reputable, audited bridges with strong security track records, thorough verification of transaction details, and maintaining sufficient gas fees on both source and destination chains.

- The future promises enhanced security through zero-knowledge proofs, DAO governance, modular designs, and universal interoperability standards that will make cross-chain interactions as seamless as single-chain transactions.

You’ve probably encountered the frustrating reality of holding crypto assets on different blockchains that simply can’t communicate with each other. Whether you’re trying to move your Ethereum tokens to a faster network or access DeFi protocols on another chain, you’ll quickly discover that blockchains operate like isolated islands.

This is where crypto bridges come into play. Crypto bridges are protocols that connect separate blockchain networks, allowing you to transfer digital assets and data between them seamlessly. Think of them as digital highways that enable your tokens to travel from one blockchain ecosystem to another.

Understanding how crypto bridges work isn’t just useful—it’s essential for navigating today’s multi-chain landscape. With hundreds of blockchains now operating independently, bridges have become the critical infrastructure that makes cross-chain transactions possible, opening up new opportunities for trading, lending and earning yield across different networks.

What Is a Crypto Bridge?

A crypto bridge is a protocol that enables you to transfer digital assets and data between different blockchain networks. These bridges create interoperability between otherwise isolated blockchain ecosystems by establishing secure connections that facilitate cross-chain transactions.

Crypto bridges operate through smart contracts that lock your assets on the source blockchain and mint equivalent tokens on the destination blockchain. When you initiate a transfer from Ethereum to Polygon, for example, the bridge locks your tokens on Ethereum and creates wrapped versions on Polygon. This mechanism maintains the total supply whilst enabling you to access your assets across multiple networks.

The primary function of crypto bridges extends beyond simple token transfers. These protocols enable you to:

- Transfer native tokens between Layer 1 blockchains like Bitcoin and Ethereum

- Move assets from mainnet to Layer 2 solutions such as Arbitrum or Optimism

- Access DeFi protocols on different chains using your existing token holdings

- Participate in governance across multiple blockchain ecosystems

- Exploit arbitrage opportunities by moving assets where prices differ

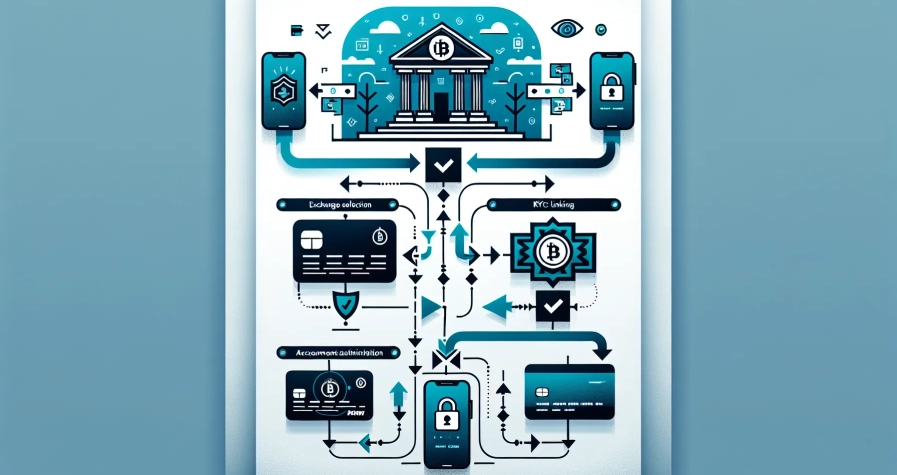

Crypto bridges fall into two main categories based on their operational structure. Trusted bridges rely on centralised entities or federations to validate and execute transfers, whilst trustless bridges use smart contracts and cryptographic proofs for autonomous operation. Each type presents different security models and operational requirements for your cross-chain activities.

The bridge mechanism typically involves a burn-and-mint or lock-and-mint process. Your original tokens remain secured on the source chain whilst equivalent representations become available on the destination chain. This approach ensures that you can move value across blockchain boundaries without creating additional token supply or compromising network security.

How Do Crypto Bridges Work?

Crypto bridges operate through sophisticated technical mechanisms that coordinate asset transfers between different blockchain networks. These protocols use smart contracts, validators, and oracles to ensure secure cross-chain transactions whilst maintaining economic integrity.

The Technical Process Behind Cross-Chain Transfers

The cross-chain transfer process begins when you initiate a transaction on the source blockchain by interacting with a bridge’s smart contract. You deposit or lock your tokens into this smart contract, which serves as collateral and triggers the bridge protocol.

Validators or relayers continuously monitor these locking events across the network. Once they verify your transaction, these validators initiate the equivalent asset creation process on the destination chain. Cross-chain oracles play a crucial role by providing accurate information about the locked assets and ensuring data consistency between blockchains.

Smart contracts on the destination chain then mint wrapped or pegged versions of your original tokens. These newly created tokens maintain a 1:1 value relationship with your locked assets, preserving the economic balance across both networks.

Off-chain relayers coordinate the entire process by communicating between different blockchain networks. They ensure that locked funds on the source chain always correspond exactly to minted wrapped tokens on the destination chain, preventing asset duplication or unauthorised creation.

Lock and Mint Mechanisms

Lock and mint represents the most commonly used mechanism in crypto bridge operations. When you want to transfer tokens from Ethereum to Binance Smart Chain, the bridge locks your original tokens in a smart contract on Ethereum and mints equivalent wrapped tokens on Binance Smart Chain.

These wrapped tokens function as IOUs (I Owe You certificates) that represent your original assets held in custody. The wrapped tokens carry the same value as your locked assets and can be used for trading, lending, or other DeFi activities on the destination blockchain.

Returning your assets requires burning the wrapped tokens on the destination chain. This burning process triggers the smart contract on the source chain to release your originally locked tokens back to your wallet.

Alternative mechanisms include burn and mint operations, where tokens are permanently destroyed on one chain before being created on another. Lock and unlock mechanisms utilise existing liquidity pools on the destination chain, unlocking native tokens rather than creating wrapped versions.

| Mechanism Type | Source Chain Action | Destination Chain Action | Asset Type Created |

|---|---|---|---|

| Lock and Mint | Lock original tokens | Mint wrapped tokens | Wrapped/pegged tokens |

| Burn and Mint | Burn original tokens | Mint new tokens | Native or wrapped tokens |

| Lock and Unlock | Lock tokens | Unlock from pool | Native tokens |

Types of Crypto Bridges

Crypto bridges fall into two main categories based on their security models and operational structures. Each type offers distinct advantages and trade-offs that affect your cross-chain transaction experience.

Trusted Bridges

Trusted bridges rely on a central entity or known group of validators to verify and facilitate your cross-chain transfers. You must deposit your assets with these bridge operators during the transfer process since they maintain custody of your tokens while facilitating the transaction.

These centralised bridges offer faster transaction speeds and support for multiple blockchain networks compared to their decentralised counterparts. You’ll typically experience shorter waiting times and more flexible asset transfer options when using trusted bridge protocols.

The custody model introduces specific risks that you should consider before using trusted bridges:

- Centralisation risks: Bridge operators can freeze your assets or impose transfer restrictions

- Security vulnerabilities: Centralised control points create attractive targets for hackers

- Trust requirements: You must rely on the bridge operator’s security measures and operational integrity

Popular trusted bridge examples include centralised exchange bridges and some institutional-grade cross-chain protocols that prioritise speed over decentralisation.

Trustless Bridges

Trustless bridges operate through decentralised smart contracts and cryptographic proofs without requiring any central authority to verify transactions. You maintain full control and ownership of your assets throughout the entire transfer process since these bridges don’t hold custody of your tokens.

These decentralised protocols align with blockchain’s core principles by eliminating single points of failure and removing the need to trust third-party operators. Your transactions are validated through mathematical proofs and consensus mechanisms rather than human intermediaries.

Trustless bridges present certain operational limitations:

- Processing speed: Transactions often take longer due to complex verification processes

- Network support: Fewer blockchain networks are supported compared to trusted alternatives

- Technical complexity: Smart contract vulnerabilities can expose users to sophisticated attack vectors

Despite these constraints, trustless bridges offer superior security through cryptographic verification and maintain the decentralised ethos that defines blockchain technology. Examples include protocol-native bridges and community-governed cross-chain solutions that prioritise security over convenience.

Benefits of Using Crypto Bridges

Crypto bridges unlock significant advantages that transform how you interact with blockchain ecosystems. These protocols expand your access to diverse financial opportunities across multiple networks whilst reducing dependency on centralised exchanges.

Enhanced Liquidity Access

Crypto bridges dramatically increase your access to liquidity pools across various blockchain networks, enabling seamless movement of assets to platforms with deeper markets. By bridging Bitcoin to Ethereum through wrapped tokens like WBTC, you can participate in Ethereum’s extensive DeFi ecosystem whilst maintaining exposure to Bitcoin’s value. This cross-chain liquidity access means you can:

- Access lending protocols on different blockchains using your existing assets

- Provide liquidity to decentralised exchanges across multiple networks

- Participate in yield farming opportunities that weren’t previously available

- Move assets to chains with higher trading volumes for better price discovery

The enhanced liquidity particularly benefits DeFi platforms by creating larger, more interconnected pools of capital that improve trading efficiency and reduce slippage across the entire ecosystem.

Portfolio Diversification Opportunities

Crypto bridges enable you to diversify your portfolio across multiple blockchain ecosystems without converting your assets through centralised exchanges. Each blockchain network hosts unique applications, NFT collections, and financial services that were previously inaccessible without selling your existing holdings.

You can participate in Solana’s high-speed gaming applications whilst maintaining your Ethereum-based DeFi positions, or explore Polygon’s cost-effective NFT marketplaces using assets originally held on other chains. This diversification extends to:

- Gaming tokens and metaverse assets across different blockchains

- Staking opportunities on various proof-of-stake networks

- Access to region-specific or niche DeFi protocols

- Participation in governance tokens from multiple ecosystems

Lower transaction costs represent another diversification benefit, as you can move assets to less congested networks like Avalanche or Fantom when Ethereum gas fees become prohibitive. This flexibility allows you to optimise your transaction costs whilst maintaining exposure to multiple blockchain innovations simultaneously.

Risks and Security Considerations

Crypto bridges expose users to significant security risks that stem from their complex technical architecture and governance models. Understanding these vulnerabilities helps you make informed decisions when transferring assets across blockchain networks.

Smart Contract Vulnerabilities

Smart contract flaws represent the primary security threat when you use crypto bridges for cross-chain transfers. These protocols rely on smart contracts to lock your assets on one blockchain and mint equivalent tokens on another, creating multiple attack vectors that malicious actors can exploit.

Code vulnerabilities in bridge smart contracts enable attackers to manipulate asset transfers or steal funds through exploitable pathways. Improper access controls often grant excessive privileges to single addresses, creating “one-owner” contract scenarios where compromised administrative keys can drain entire bridge reserves.

Contract upgrade mechanisms introduce additional risks when developers retain the ability to modify bridge logic without sufficient safeguards. Attackers targeting these upgrade functions can alter contract behaviour to redirect your assets or create unauthorised token mints.

The following table summarises key smart contract vulnerabilities:

| Vulnerability Type | Impact | Examples |

|---|---|---|

| Code exploits | Direct asset theft through contract bugs | Logic flaws enabling unauthorised withdrawals |

| Access control failures | Administrative privilege abuse | One-owner contracts with compromised keys |

| Upgrade risks | Malicious contract modifications | Unauthorised changes to bridge parameters |

Centralisation Risks

Trusted bridges require you to deposit assets with custodians or validators, creating single points of failure that contradict blockchain’s decentralised principles. These centralised elements expose your funds to theft, mismanagement, or validator collusion.

Private key compromise represents the most devastating centralisation risk, as attackers gaining control of multisignature wallets or contract upgrade keys can instantly drain bridge funds. Major incidents between 2022 and 2024 demonstrate this vulnerability’s severity, with compromised keys affecting Ronin Bridge ($625 million), Harmony ($100 million), and Multichain bridges.

Validator set control creates additional centralisation vectors when small groups of validators can approve cross-chain transactions without sufficient decentralisation. Compromised validator keys or coordinated attacks against these limited validator sets can result in unauthorised asset transfers.

The centralisation risks include:

- Custodial control: Bridge operators holding direct custody of your deposited assets

- Key management failures: Inadequate protection of critical private keys controlling bridge operations

- Validator concentration: Limited validator sets creating consensus manipulation opportunities

- Governance capture: Centralised decision-making processes affecting bridge security parameters

These risks persist even in bridges marketed as “trustless,” as many retain centralised components in their architecture or governance structures that can compromise your asset security.

Popular Crypto Bridge Platforms

Your choice of crypto bridge platform significantly impacts your cross-chain experience through varying features, security models, and supported blockchain networks. Each platform offers distinct approaches to facilitating asset transfers while managing hundreds of millions of dollars in locked assets.

Portal Bridge

Portal Bridge operates as a decentralised cross-chain protocol using guardian networks to verify transfers across multiple blockchain ecosystems. The platform supports both token and NFT transfers through its sophisticated validation system, making it suitable for DeFi applications and gaming projects. You can bridge assets between Ethereum, Solana, BNB Smart Chain, Polygon, Avalanche, Terra, and Gnosis Chain through Portal Bridge’s infrastructure.

The guardian system provides enhanced security by requiring multiple validators to confirm transactions before processing cross-chain transfers. This approach reduces centralisation risks while maintaining efficient transaction processing across supported networks.

Connext

Connext focuses specifically on Layer 2 Ethereum interoperability without requiring external validators for transaction verification. The platform eliminates trust dependencies by using optimistic mechanisms and dispute resolution systems that operate directly through smart contracts. Your assets remain secure through Connext’s validator-free architecture when transferring between BNB Smart Chain, Ethereum, Polygon, Arbitrum, Avalanche, Moonriver, Optimism, Fantom, and Gnosis Chain.

This approach provides faster settlement times for Ethereum Layer 2 networks while maintaining decentralised security guarantees throughout the bridging process.

Just Cryptos

Just Cryptos connects TRON ecosystem projects to various blockchain networks through comprehensive asset support including Bitcoin, Ethereum, Litecoin, Dogecoin, and NFTs. The platform maintains integration with Poloniex exchange, providing additional liquidity options for cross-chain transfers. You can access TRON network applications while maintaining exposure to Bitcoin, Litecoin, Dogecoin, and Ethereum ecosystem assets through this bridge.

The platform’s connection to centralised exchange infrastructure offers enhanced liquidity for major cryptocurrency pairs while supporting diverse asset types across different blockchain architectures.

BNB Chain Bridge

BNB Chain Bridge integrates directly with Binance’s ecosystem to provide fast, low-cost transfers supporting both BEP-20 and ERC-20 token standards. Your transaction costs remain minimal when transferring assets between Binance Smart Chain, Ethereum, Solana, and Tron through this platform’s optimised infrastructure. The bridge leverages Binance’s established security protocols and high-performance network architecture.

Transaction speeds exceed many competing platforms due to BNB Chain’s consensus mechanism and the bridge’s integration with Binance’s centralised infrastructure components.

| Platform | Key Features | Supported Networks | Security Model |

|---|---|---|---|

| Portal Bridge | Decentralised guardians, NFT support, DeFi integration | Ethereum, Solana, BNB Smart Chain, Polygon, Avalanche, Terra, Gnosis Chain | Multi-guardian validation |

| Connext | Layer 2 focus, no external validators, optimistic processing | BNB Smart Chain, Ethereum, Polygon, Arbitrum, Avalanche, Moonriver, Optimism, Fantom, Gnosis Chain | Validator-free smart contracts |

| Just Cryptos | TRON ecosystem, Bitcoin support, Poloniex integration | TRON, Ethereum, Bitcoin, Litecoin, Dogecoin | Centralised with exchange backing |

| BNB Chain Bridge | Binance ecosystem, fast transfers, low costs | Binance Smart Chain, Ethereum, Solana, Tron | Binance security protocols |

Your platform selection depends on specific requirements including supported networks, security preferences, transaction costs, and desired asset types. Decentralised bridges like Portal Bridge and Connext offer enhanced security through trustless mechanisms, while platforms like BNB Chain Bridge provide faster processing through centralised components.

How to Use a Crypto Bridge Safely

Crypto bridges remain among the most targeted vectors for hacks due to their complex and sometimes centralised architecture. Diligent selection and cautious operation are essential for security when transferring assets across blockchain networks.

Choosing a Reputable Bridge

Select bridges with strong security track records, open protocols and positive user feedback to minimise risks during cross-chain transfers. Audited bridges from reputable providers such as Phantom, Wormhole and Allbridge offer stronger security histories and undergo regular reviews from independent security firms.

Consider bridges that offer decentralisation over highly centralised ones, as centralisation creates single points of failure and security risks. Trustless bridges provide superior security by eliminating reliance on central authorities, though they may process transactions more slowly than their trusted counterparts.

Evaluate transaction speed, fees and supported networks to find the optimal solution for your specific requirements. Compare multiple platforms to identify bridges that balance security features with practical considerations like cost-effectiveness and processing times.

Use aggregators that dynamically pick the best bridge routes to increase efficiency and reduce risk exposure across different protocols. These tools automatically select optimal pathways based on current network conditions and security assessments.

Best Security Practices

Verify transaction details carefully before approval, including wallet addresses, token contracts and chains involved in the transfer process. Double-checking these elements prevents costly mistakes and protects against potential fraud attempts.

Maintain sufficient native tokens for gas fees on both source and destination chains before initiating any cross-chain transfer. Insufficient gas can result in failed transactions and potential asset loss during the bridging process.

Monitor smart contracts that lock and unlock assets, as these may contain vulnerabilities that expose your funds to potential exploits. Research recent security audits and vulnerability disclosures for your chosen bridge protocol.

Track transaction progress using blockchain explorers and monitoring tools to confirm completion of bridge transfers across both networks. This verification ensures your assets arrive safely at their intended destination.

Stay updated with the latest security developments and use bridges with strong encryption protocols and transparent terms of service. Follow official channels and security researchers to remain informed about emerging threats and protective measures.

The Future of Cross-Chain Technology

Cross-chain technology is evolving rapidly towards enhanced security, scalability and efficiency through breakthrough innovations in cryptography and consensus algorithms. You’ll witness significant improvements in bridge protocols as developers implement advanced zero-knowledge proofs, multi-party computation and sophisticated validation mechanisms that reduce vulnerabilities whilst maintaining decentralisation.

Community-governed bridges through decentralised autonomous organisations (DAOs) are emerging as the preferred governance model, reducing reliance on central authorities and enhancing trustlessness. You can expect these DAO-governed protocols to implement transparent decision-making processes for protocol upgrades, security measures and fee structures, creating more democratic and resilient cross-chain infrastructure.

The technical architecture of future bridges will incorporate several key advancements:

- Modular bridge designs that separate consensus, data availability and execution layers for improved security isolation

- Intent-based bridging allowing you to specify desired outcomes rather than transaction paths

- Unified liquidity protocols that aggregate liquidity across multiple chains automatically

- Real-time fraud detection using machine learning algorithms to identify suspicious transactions

Security enhancements will fundamentally transform how you interact with cross-chain protocols. Advanced cryptographic techniques including threshold signatures and multi-signature schemes will eliminate single points of failure, whilst formal verification methods will ensure smart contract correctness before deployment. You’ll benefit from insurance protocols specifically designed for bridge transactions, providing additional protection for your cross-chain transfers.

Scalability improvements will address current throughput limitations through optimistic rollup integration and state channel implementations. These technologies will enable you to execute thousands of cross-chain transactions per second whilst maintaining the security guarantees of the underlying blockchains. Batch processing capabilities will reduce gas costs significantly, making frequent cross-chain interactions economically viable.

Interoperability standards are converging towards universal protocols that support seamless communication between any blockchain networks. You’ll experience simplified user interfaces that abstract complex technical processes, making cross-chain interactions as straightforward as single-chain transactions. Cross-chain smart contracts will execute automatically across multiple networks, enabling sophisticated DeFi strategies without manual intervention.

The regulatory landscape will shape bridge development through compliance frameworks that balance innovation with consumer protection. You can anticipate standardised security auditing requirements and mandatory insurance coverage for major bridge protocols, creating safer environments for cross-chain asset management whilst preserving decentralised principles.

Conclusion

Crypto bridges represent a fundamental shift in how you interact with blockchain ecosystems. They’re transforming the fragmented multi-chain landscape into an interconnected network where your assets can move freely between different protocols.

While these tools offer unprecedented opportunities for portfolio diversification and DeFi participation you must remain vigilant about security risks. The technology continues to evolve rapidly with innovations like zero-knowledge proofs and intent-based bridging promising safer and more efficient cross-chain experiences.

Your success with crypto bridges depends on choosing reputable platforms understanding the risks involved and following proper security practices. As the technology matures you’ll likely see even more seamless cross-chain interactions that make blockchain interoperability as simple as using a single network.

Frequently Asked Questions

What is a crypto bridge?

A crypto bridge is a protocol that enables the transfer of digital assets and data between different blockchain networks. It establishes interoperability by creating secure connections that allow tokens to move from one blockchain to another, essentially acting as a digital highway connecting isolated blockchain ecosystems that cannot naturally communicate with each other.

How do crypto bridges work?

Crypto bridges operate using smart contracts that lock assets on the source blockchain and mint equivalent wrapped tokens on the destination blockchain. When you want to transfer assets back, the wrapped tokens are burned, and the original locked tokens are released. This lock-and-mint mechanism ensures the total supply of assets remains unchanged whilst enabling cross-chain functionality.

What are the main types of crypto bridges?

There are two primary types: trusted and trustless bridges. Trusted bridges rely on a central entity or known validators to facilitate transfers, offering faster speeds but requiring trust in a third party. Trustless bridges operate through decentralised smart contracts, providing superior security and user control but potentially slower processing speeds and fewer supported networks.

What are the benefits of using crypto bridges?

Crypto bridges provide access to diverse DeFi opportunities across multiple networks, enhanced liquidity from various blockchain pools, and portfolio diversification without using centralised exchanges. They enable participation in unique applications, NFT collections, and yield farming opportunities whilst allowing users to optimise transaction costs by moving assets to less congested networks.

What are the main risks of crypto bridges?

Key risks include smart contract vulnerabilities that could lead to asset theft, centralisation risks in trusted bridges creating single points of failure, and potential code exploits or access control failures. The complex technical architecture makes bridges attractive targets for hackers, with significant security breaches occurring in the past due to these vulnerabilities.

How can I use crypto bridges safely?

Choose reputable bridges with strong security track records and favour decentralised options. Verify all transaction details carefully, maintain sufficient gas fees, and monitor transactions using blockchain explorers. Stay informed about security developments, use bridges with established protocols, and consider using aggregators to find optimal routes whilst minimising exposure to risks.

Which crypto bridge platforms are most popular?

Popular platforms include Portal Bridge for decentralised cross-chain transfers, Connext for Layer 2 Ethereum interoperability, Just Cryptos for TRON ecosystem connections, and BNB Chain Bridge for Binance ecosystem transfers. Each platform offers different features, security models, and supported networks, so choose based on your specific requirements and risk tolerance.

What does the future hold for crypto bridge technology?

Future developments include enhanced security through zero-knowledge proofs, improved scalability enabling thousands of transactions per second, and better user experiences through intent-based bridging. Innovations like unified liquidity protocols, real-time fraud detection, and community-governed DAOs will make cross-chain transactions more secure, efficient, and user-friendly whilst maintaining decentralised principles.