Key Takeaways

- Crypto whales are major market players holding substantial cryptocurrency amounts (1,000+ BTC or 10,000+ ETH) who can trigger significant price movements through single large transactions, making them essential to understand for any serious crypto investor.

- Three main whale categories exist: individual high-net-worth investors (like early adopters and successful miners), institutional whales (corporations, hedge funds, and government entities), and exchange wallets that hold customer funds across major platforms.

- Whale activities dramatically impact markets through price manipulation and volatility creation, with the ability to cause 5-15% price swings within hours due to concentrated ownership where just 1,000 wallets control approximately 35% of all Bitcoin.

- Track whale movements using specialised tools such as Nansen, Glassnode, and Whale Alert services, which provide real-time notifications of large transactions and detailed on-chain analysis to help anticipate market shifts.

- Whale movements offer both opportunities and risks – whilst they can provide investment opportunities during sell-offs and improve market liquidity, they also create increased volatility, price manipulation risks, and information asymmetry that disadvantages retail investors.

- Understanding whale strategies is crucial as famous whales like MicroStrategy and institutional players employ sophisticated approaches including OTC trading, strategic timing, and systematic accumulation during market downturns to maximise their influence whilst protecting massive holdings.

Ever wondered who’s behind those massive price swings in Bitcoin or Ethereum? You’ve likely witnessed the work of crypto whales – the heavyweight investors who hold enormous amounts of cryptocurrency and can move markets with a single trade.

These digital titans control significant portions of various cryptocurrencies, often holding millions or billions of pounds worth of assets. When they decide to buy or sell, their actions create ripple effects that can send prices soaring or plummeting within minutes. Understanding crypto whales isn’t just fascinating – it’s essential for anyone serious about cryptocurrency investing.

Whether you’re a seasoned trader or just starting your crypto journey, knowing how these market movers operate can help you make smarter investment decisions and better navigate the volatile world of digital currencies.

What Are Crypto Whales?

Crypto whales represent individual investors or institutions that control substantial amounts of cryptocurrency in their digital wallets. You’ll encounter these major players across various cryptocurrencies, with Bitcoin whales typically holding 1,000 BTC or more and Ethereum whales possessing 10,000 ETH or greater amounts.

The cryptocurrency community categorises these large holders based on their wallet balances and market influence. Bitcoin addresses containing between 100-999 BTC classify as “sharks”, whilst those with 10,000+ BTC earn the distinction of “humpback whales”. Ethereum’s classification system follows similar patterns, with addresses holding 1,000-9,999 ETH considered significant players and those exceeding 100,000 ETH ranking as dominant market forces.

These digital asset titans emerge from diverse backgrounds including early cryptocurrency adopters, institutional investment funds, cryptocurrency exchanges, mining operations and high-net-worth individuals. Early Bitcoin investors like the Winklevoss twins accumulated substantial holdings when prices remained below $100 per coin, whilst institutional players such as MicroStrategy and Tesla have built enormous positions through strategic corporate acquisitions.

Exchange platforms often rank among the largest crypto whales due to customer fund custody requirements. Binance, Coinbase and Kraken maintain massive cryptocurrency reserves to facilitate trading operations and meet withdrawal demands. Mining pools and individual miners who retained their rewards from the early days of cryptocurrency also constitute a significant portion of the whale population.

| Crypto Whale Category | Bitcoin Holdings | Ethereum Holdings | Market Impact Level |

|---|---|---|---|

| Small Whale | 100-999 BTC | 1,000-9,999 ETH | Moderate |

| Large Whale | 1,000-9,999 BTC | 10,000-99,999 ETH | High |

| Mega Whale | 10,000+ BTC | 100,000+ ETH | Extreme |

Your understanding of crypto whales extends beyond simple wallet balances to encompass their strategic positioning within the broader cryptocurrency ecosystem. These entities command respect and attention because single transactions from their wallets can trigger significant price movements across entire markets.

Types of Crypto Whales

Crypto whales operate across three primary categories, each bringing distinct characteristics and market influence to the cryptocurrency ecosystem. Understanding these classifications helps you identify which entities drive specific market movements.

Individual High Net Worth Investors

Individual high net worth crypto whales represent the original architects of the cryptocurrency revolution. These investors typically include early adopters who recognised Bitcoin’s potential before mainstream adoption, successful miners from the network’s early days, and sophisticated traders who accumulated vast holdings through strategic market positioning.

You can observe some of the most legendary examples in cryptocurrency history. Satoshi Nakamoto, Bitcoin’s mysterious creator, holds approximately 1 million BTC across multiple wallets that remain untouched since the network’s inception. Ethereum founder Vitalik Buterin maintains substantial ETH holdings, whilst Coinbase CEO Brian Armstrong ranks amongst the largest individual Bitcoin holders globally.

These individual whales often maintain publicly trackable wallet addresses, allowing blockchain analysts and retail investors to monitor their transaction patterns. Their movements frequently signal market sentiment shifts, as their investment decisions reflect deep understanding of cryptocurrency fundamentals and technological developments.

Institutional Whales

Institutional crypto whales encompass corporations, hedge funds, investment firms, and government entities that allocate significant capital to digital assets. These organisations bring traditional finance expertise and substantial resources to cryptocurrency markets, often implementing sophisticated trading strategies across multiple exchanges.

Corporate institutional whales include companies like MicroStrategy, which holds over 158,000 BTC as part of its treasury strategy. Tesla previously maintained significant Bitcoin reserves before reducing its position, whilst Square (now Block) continues holding substantial cryptocurrency investments. Investment firms such as Grayscale Bitcoin Trust manage billions in cryptocurrency assets on behalf of institutional clients.

Government entities also participate as institutional whales, with countries like El Salvador adding Bitcoin to their national reserves. These institutional players often conduct over-the-counter transactions to minimise market impact whilst building substantial positions.

Exchange Wallets

Exchange wallets represent unintentional crypto whales that accumulate massive cryptocurrency reserves through customer deposits and trading activities. Major cryptocurrency exchanges like Binance, Coinbase, Kraken, and Bitfinex maintain enormous wallet balances to facilitate user transactions and withdrawals.

These platforms function as custodial services, holding millions of users’ cryptocurrency assets in hot and cold storage systems. Binance’s wallet addresses frequently rank amongst the largest Bitcoin and Ethereum holders globally, containing funds belonging to millions of individual users rather than the exchange itself.

Exchange whale movements often reflect customer activity rather than strategic investment decisions. Large withdrawals might indicate institutional clients moving funds to cold storage, whilst significant deposits could suggest preparation for major selling events. Understanding this distinction prevents misinterpretation of exchange wallet activity as directional market signals.

How Crypto Whales Impact the Market

Crypto whales possess extraordinary market influence through their ability to execute massive transactions that can dramatically shift cryptocurrency prices within minutes. Their trading activities create ripple effects across the entire digital asset ecosystem, affecting both short-term price movements and long-term market trends.

Price Manipulation and Volatility

Price manipulation occurs when crypto whales execute large buy or sell orders that overwhelm existing market liquidity. A single whale selling thousands of Bitcoins can flood the market with supply, driving prices down as smaller buy orders can’t absorb the massive volume. Conversely, when whales make substantial purchases, they reduce available supply and push prices upward by consuming existing sell orders.

You’ll often observe sharp price swings triggered by whale activity, with Bitcoin experiencing drops of 5-15% within hours following major sell-offs. These movements create artificial demand or supply conditions that smaller investors struggle to counteract. The concentrated nature of cryptocurrency ownership means that just 1,000 wallets control approximately 35% of all Bitcoin, amplifying the impact of individual whale decisions on market prices.

Whale transactions frequently trigger cascading effects as automated trading algorithms and retail investors react to sudden price movements. When a whale sells 2,000 Bitcoin at once, the resulting price drop often triggers stop-loss orders from other traders, creating additional selling pressure that magnifies the initial impact.

Market Sentiment Influence

Market sentiment shifts dramatically when you observe whale behaviour patterns, as other investors interpret large transactions as signals about future price direction. Whale purchases often generate bullish sentiment across social media platforms and trading communities, with retail investors viewing substantial accumulation as validation of their investment thesis.

Your trading decisions may be influenced by whale activity tracking platforms that monitor large wallet movements in real-time. When whales transfer significant amounts to exchanges, it typically signals potential selling pressure and creates bearish sentiment. Alternatively, whales moving cryptocurrency from exchanges to cold storage suggests long-term holding intentions and generates optimistic market sentiment.

The psychological impact of whale movements extends beyond immediate price effects, creating fear and greed cycles that amplify market volatility. Retail investors frequently mirror whale behaviour, buying when whales accumulate and selling during whale distribution phases, which reinforces existing price trends and creates momentum-driven market movements.

Identifying Crypto Whale Activity

Crypto whale activity becomes identifiable through tracking large transactions and significant changes in wallet holdings across blockchain networks. You can monitor these market-moving transactions using specialised analytical tools and real-time alert services.

On-Chain Analysis Tools

On-chain analysis platforms provide comprehensive insights into whale behaviour by examining blockchain data and transaction patterns. You gain access to detailed wallet tracking that reveals accumulation patterns, distribution strategies, and portfolio movements across different cryptocurrencies.

Nansen offers premium analytics for detailed on-chain portfolio analysis, particularly focusing on whale behaviour within DeFi protocols. You can track individual wallet performance, identify smart money movements, and analyse trading patterns of significant holders across Ethereum and other networks.

Glassnode delivers institutional-grade analytics covering fund flows, exchange inflows and outflows, and accumulation trends. You receive data on whale accumulation phases, distribution patterns, and long-term holder behaviour through comprehensive charts and metrics.

Lookonchain specialises in real-time whale movement analysis, identifying large transactions, wallet clustering, and trading behaviour patterns. You can monitor specific whale addresses, track their trading strategies, and receive insights into market timing decisions.

These platforms enable you to:

- Monitor whale wallet balances across multiple cryptocurrencies

- Track large transaction flows between addresses and exchanges

- Analyse accumulation and distribution patterns over time

- Identify correlation between whale movements and price action

- Access historical data for pattern recognition and strategy development

Whale Alert Services

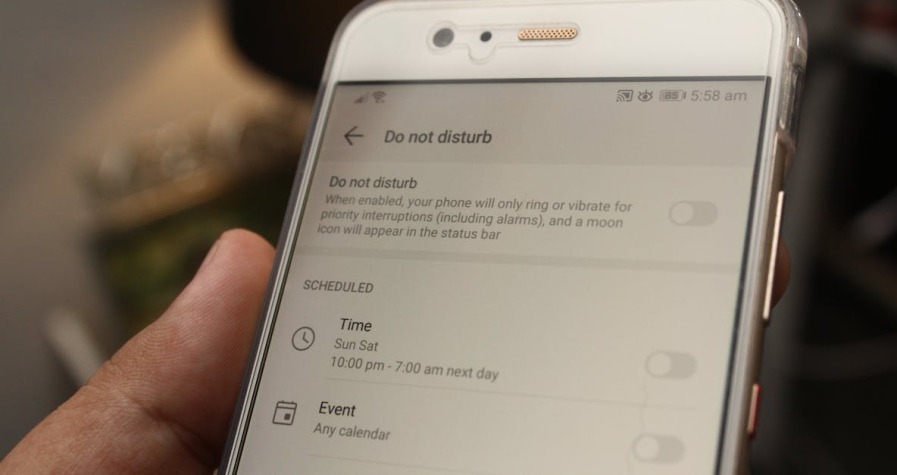

Whale Alert services broadcast large cryptocurrency transactions in real-time across social media platforms and messaging channels. You receive immediate notifications when significant transfers occur, allowing you to react quickly to potential market-moving events.

Whale Alert tracks transactions exceeding predetermined thresholds across major cryptocurrencies, broadcasting alerts through Twitter, Telegram, and Discord channels. You can monitor billion-dollar transfers between wallets, exchange deposits and withdrawals, and institutional movements that signal market direction changes.

WhaleBot provides automated notifications for large transactions with customisable threshold settings for different cryptocurrencies. You can filter alerts based on transaction size, cryptocurrency type, and wallet categories to focus on the most relevant market signals.

Walletscan offers detailed transaction analysis with additional context about wallet types, exchange classifications, and historical behaviour patterns. You receive enhanced alerts that include wallet labelling, transaction purposes, and potential market implications.

- Subscribe to multiple alert services on Twitter and Telegram for comprehensive coverage

- Set specific notification thresholds for Bitcoin (typically 500+ BTC), Ethereum (5,000+ ETH), and major altcoins

- Combine real-time alerts with deeper analytical platforms like Nansen for context and strategy insights

- Focus on exchange-related transfers as they often indicate imminent buying or selling pressure

- Monitor dormant wallet activations, as these frequently signal significant market movements

Famous Crypto Whales and Their Strategies

Famous crypto whales employ sophisticated trading strategies that maximise their market influence whilst protecting their massive holdings. These market participants often remain anonymous due to the pseudonymous nature of blockchain technology, yet their trading patterns reveal distinctive approaches to crypto investment.

Satoshi Nakamoto represents the most legendary crypto whale, holding approximately 1 million Bitcoin across multiple addresses. These holdings remain untouched since 2011, creating a permanent reduction in Bitcoin’s circulating supply and maintaining significant upward pressure on prices.

Vitalik Buterin, Ethereum’s co-founder, demonstrates strategic philanthropy through his whale activities. He donated over $1 billion worth of SHIB tokens to COVID-19 relief efforts in India during 2021, showcasing how whale movements can serve humanitarian purposes whilst impacting token valuations.

MicroStrategy’s Michael Saylor transformed his corporation into a Bitcoin whale through systematic accumulation strategies. The company holds over 174,530 Bitcoin as of 2024, employing dollar-cost averaging and debt financing to build their position across multiple market cycles.

Institutional Whale Strategies

Large-scale institutional whales utilise three primary trading approaches that distinguish them from retail investors:

Over-the-counter (OTC) trading allows whales to execute massive transactions without creating immediate market disruption. These private trades occur between parties at predetermined prices, preventing the order book manipulation that typically accompanies large market orders.

Accumulation during market downturns represents a common whale strategy where large holders increase their positions when prices decline. This approach takes advantage of reduced liquidity and panic selling from retail investors.

Strategic timing of market entries and exits involves coordinating large transactions with market events, earnings announcements, or regulatory developments to amplify price movements in their favour.

Exchange and Corporate Whale Behaviour

Major cryptocurrency exchanges function as unintentional whales through their custody of customer funds. Binance, Coinbase, and Kraken hold billions of dollars in cryptocurrency across their hot and cold storage wallets.

Grayscale Bitcoin Trust operates as an institutional whale through its Bitcoin holdings that back GBTC shares. The trust’s trading activities and premium fluctuations create secondary market effects that influence Bitcoin pricing.

Tesla’s Bitcoin holdings under Elon Musk’s leadership demonstrated how corporate treasury strategies can impact cryptocurrency markets. The company’s $1.5 billion Bitcoin purchase in 2021 triggered significant price appreciation across the entire crypto market.

Anonymous Whale Identification Patterns

Blockchain analysis reveals several anonymous whales through their distinctive trading signatures:

The “47” whale controls multiple Bitcoin addresses beginning with “1P5ZED” and has consistently accumulated Bitcoin since 2019. This entity’s methodical purchasing patterns suggest long-term investment strategies rather than short-term trading.

Ethereum’s “Mr. 100” represents an anonymous whale who regularly purchases exactly 100 ETH during market dips. This consistent behaviour pattern has made them identifiable despite maintaining anonymity.

DeFi protocol whales include anonymous entities who provide massive liquidity to decentralised exchanges. These whales earn substantial fees through liquidity provision whilst maintaining the ability to influence token prices through strategic withdrawals.

The Risks and Benefits of Whale Movements

Crypto whale activities create significant market dynamics that directly affect your investment experience. Understanding these movements helps you navigate the volatile cryptocurrency landscape more effectively.

Benefits for Retail Investors

Market liquidity improves when whales execute large transactions that increase trading volume. You can buy and sell cryptocurrencies more easily without causing significant price fluctuations when whales maintain active trading positions. This enhanced liquidity benefits your portfolio management and reduces transaction costs.

Market stimulation occurs when whales make substantial purchases that drive prices upward. These large-scale acquisitions create bullish momentum that attracts additional investors to the market. You often witness price rallies following major whale accumulation periods, particularly during market recovery phases.

Investment opportunities emerge during whale sell-offs that cause temporary price dips. You can potentially acquire quality assets at lower prices when whales execute large-scale distributions. These market corrections provide entry points for strategic accumulation, especially during oversold conditions.

Price discovery and long-term holding patterns from institutional whales remove coins from active circulation. You benefit from increased scarcity as whales store substantial amounts in cold storage wallets. This reduced supply often supports price stability and creates upward pressure on valuations over extended periods.

Potential Downsides

Price manipulation risks increase when whales place large buy or sell walls that artificially influence market prices. You face misleading market signals when whales execute coordinated trading strategies designed to trigger specific price movements. These manipulation tactics can lead you to make poorly timed investment decisions based on artificial market conditions.

Market volatility intensifies during sudden large-scale whale transactions that create sharp price fluctuations. You experience increased portfolio risk when whales execute massive sell orders that overwhelm market liquidity. These volatile periods can result in significant losses if you’re caught on the wrong side of rapid price movements.

Information asymmetry disadvantages retail investors who lack access to insider information or advanced trading algorithms. You compete against whales who often possess superior market intelligence and sophisticated analytical tools. This uneven playing field limits your ability to react quickly to market-moving events.

Delayed reaction problems arise because whale activities remain anonymous and difficult to detect promptly. You may miss optimal entry or exit opportunities when whale movements aren’t immediately visible through standard market channels. The time gap between whale actions and public awareness can significantly impact your trading performance.

How to Track and Follow Whale Activity

You can monitor crypto whale movements through multiple blockchain analysis methods that reveal large-scale trading patterns and accumulation strategies. These tracking approaches provide real-time insights into market-moving transactions and help you anticipate potential price shifts.

Blockchain Explorers for Direct Wallet Monitoring

Blockchain explorers offer the most direct approach to tracking whale activity across different cryptocurrency networks. Etherscan provides comprehensive Ethereum wallet analysis, allowing you to monitor specific addresses and their transaction histories. Solscan delivers similar functionality for Solana-based transactions, whilst TRONSCAN tracks large movements on the TRON network.

These platforms display real-time wallet balances, transaction volumes, and transfer patterns without requiring specialised knowledge. You can bookmark whale addresses to receive instant notifications when large transfers occur. However, most blockchain explorers lack wallet labelling features, making it challenging to identify the actual owners behind significant addresses.

Professional Analytics Platforms

Specialised blockchain analytics platforms provide advanced whale tracking capabilities beyond basic blockchain explorers. Nansen offers comprehensive whale wallet labelling, behavioural analysis, and institutional classification features. The platform identifies exchange wallets, DeFi protocols, and individual whale addresses through sophisticated data aggregation methods.

Glassnode delivers detailed on-chain metrics including whale accumulation patterns, distribution trends, and market concentration statistics. Their analytics reveal when large holders increase or decrease their positions, providing insights into potential market direction changes. Lookonchain specialises in real-time whale transaction alerts combined with detailed wallet profiling and trading pattern analysis.

| Platform | Primary Features | Focus Area |

|---|---|---|

| Nansen | Wallet labelling, smart money tracking | Ethereum ecosystem |

| Glassnode | On-chain metrics, accumulation data | Bitcoin and major altcoins |

| Lookonchain | Real-time alerts, trading patterns | Multi-chain analysis |

Whale Alert Services and Social Media Integration

Whale alert services broadcast significant cryptocurrency transfers across social media platforms, providing instant notifications of market-moving transactions. These services typically monitor transfers exceeding predetermined thresholds, such as 1,000 BTC or $10 million in other cryptocurrencies.

Twitter accounts like @whale_alert and @BitcoinWhales deliver real-time notifications directly to your social media feeds. Telegram channels provide more detailed whale activity updates with enhanced filtering options based on specific cryptocurrencies or transaction sizes. Discord communities often combine whale alerts with market analysis discussions, offering contextual insights into transaction significance.

Custom Alert Systems and Portfolio Trackers

Advanced traders utilise custom alert systems to monitor specific whale addresses and transaction patterns. CoinStats enables personalised whale wallet tracking with configurable notification thresholds and frequency settings. These tools send immediate alerts when monitored addresses execute large transactions or significant balance changes occur.

Portfolio tracking applications integrate whale monitoring features with broader market analysis tools. You can set alerts for whale movements in specific cryptocurrencies whilst simultaneously tracking your own portfolio performance. Custom webhook integrations allow you to receive whale alerts through preferred communication channels including email, SMS, or dedicated trading applications.

Interpreting Whale Transaction Data

Understanding whale transaction patterns requires analysing multiple data points beyond simple transfer amounts. Exchange inflows typically indicate potential selling pressure, whilst transfers to cold storage wallets suggest long-term accumulation strategies. Large transactions during specific market conditions provide stronger signals than isolated transfers.

Timing analysis reveals crucial insights into whale intentions and market positioning. Transactions occurring during market downturns often represent accumulation opportunities, whilst large transfers during price peaks may signal distribution phases. Cross-referencing multiple whale activities helps identify coordinated movements or broader institutional strategies affecting market sentiment.

Conclusion

Crypto whales remain one of the most powerful forces shaping the cryptocurrency markets today. Their ability to move prices with single transactions makes them essential players you simply can’t ignore when developing your trading strategy.

By tracking whale activity through on-chain analysis tools and alert services you’ll gain valuable insights into potential market movements before they happen. Whether you’re a seasoned trader or just starting your crypto journey understanding whale behaviour gives you a significant advantage in this volatile landscape.

Remember that while whale movements can signal opportunities they can also create risks. Stay informed monitor multiple data sources and always consider the broader context when interpreting large transactions. Your success in crypto often depends on how well you can read these market giants and adapt your strategy accordingly.

Frequently Asked Questions

What are crypto whales?

Crypto whales are large investors or institutions holding substantial amounts of cryptocurrency in their digital wallets. Bitcoin whales typically hold 1,000 BTC or more, whilst Ethereum whales possess 10,000 ETH or greater. These major players include early adopters, institutional investment funds, exchanges, and high-net-worth individuals who can significantly influence market prices through their trading activities.

How do crypto whales impact cryptocurrency prices?

Crypto whales can dramatically shift cryptocurrency prices within minutes through large transactions that overwhelm market liquidity. Their trades trigger cascading effects as automated algorithms and retail investors react to sudden price movements. Since approximately 1,000 wallets control 35% of all Bitcoin, individual whale decisions have amplified impacts on market prices and sentiment.

Who are the most famous crypto whales?

Notable crypto whales include Satoshi Nakamoto, who holds approximately 1 million Bitcoin, and Vitalik Buterin, known for strategic philanthropy. Institutional whales like MicroStrategy and Tesla have allocated significant capital to digital assets. Major exchanges such as Binance and Coinbase also rank among the largest crypto whales due to customer fund custody requirements.

How can I track crypto whale activity?

You can track whale activity through blockchain explorers like Etherscan and Solscan, professional analytics platforms such as Nansen and Glassnode, and whale alert services on social media. These tools provide real-time notifications of large transactions, wallet tracking capabilities, and detailed analysis of accumulation patterns and trading behaviours of significant cryptocurrency holders.

What are the risks of whale movements for retail investors?

Retail investors face information asymmetry and delayed reactions to whale activities, making timely investment decisions challenging. Whale movements can lead to price manipulation, increased volatility, and sudden market shifts that catch smaller investors off-guard. However, understanding whale behaviour can help retail traders make more informed decisions in the volatile cryptocurrency market.

What’s the difference between individual and institutional crypto whales?

Individual crypto whales are high-net-worth investors and early adopters whose transaction patterns can signal market sentiment shifts. Institutional whales consist of corporations and investment firms employing sophisticated trading strategies and systematic accumulation approaches. Exchange wallets represent unintentional whales, with their movements reflecting user activity rather than strategic investment decisions.