For anyone transacting in crypto, whether sending tokens, minting NFTs, or interacting with DeFi protocols, gas fees remain one of the most frustrating variables. One day a transaction costs pennies: the next, it’s several pounds. Multiply that unpredictability across dozens of blockchains, each with its own fee structure, and the confusion compounds quickly.

In 2025, the landscape has matured. The simplest way to compare gas fees across blockchains is to leverage real-time gas fee aggregator tools that consolidate live rates from multiple networks into a single, intuitive dashboard. These platforms empower users to make swift, informed decisions, minimise costs, and avoid the sting of unexpected fee spikes. This article explores what gas fees are, the factors that drive them, and the most effective tools and strategies for comparing and reducing them across today’s most popular blockchains.

Key Takeaways

- Real-time gas fee tracking platforms now make it simple to compare gas fees across blockchains from a single interface, helping users identify the most cost-effective networks and transaction windows.

- Gas fees vary significantly between blockchains due to network congestion, transaction complexity, blockchain design, and consensus mechanisms, making it essential to understand these factors before transacting.

- Ethereum Layer 2 solutions like Arbitrum, Optimism, and Polygon offer fees as low as a few pence, reducing costs by up to 90% compared to Layer 1 whilst maintaining security.

- Tools such as Gasfees.org, Token Metrics, and native blockchain explorers like Etherscan provide live data and historical trends to help users strategically time transactions during off-peak hours.

- Alternative Layer 1 blockchains like Solana, Binance Smart Chain, and TRON offer near-zero transaction costs, making them ideal for simple transfers and microtransactions.

- Adopting strategies such as using Layer 2 networks, transacting during off-peak hours, and choosing low-fee blockchains for suitable tasks can dramatically reduce gas costs in 2025.

Key Takeaways

- Real-time gas fee aggregator tools like Gasfees.org and Moralis provide the simplest way to compare gas fees across blockchains in 2025, consolidating live rates into a single dashboard.

- Gas fees fluctuate based on network congestion, consensus mechanisms, and transaction complexity, making timing and blockchain selection critical for cost savings.

- Layer 2 solutions like Arbitrum, Optimism, and zkSync reduce Ethereum transaction costs by up to 90%, offering fees below £0.10 compared to mainnet’s £0.50–£2+.

- Transacting during off-peak hours, such as late evenings or weekends in major time zones, can significantly lower gas fees due to reduced network demand.

- Alternative layer 1 blockchains like Solana, Polygon, and Algorand offer consistently low fees (often under £0.01), making them ideal for cost-conscious users and high-frequency transactions.

Understanding Gas Fees: What They Are and Why They Matter

At their core, gas fees are the transaction costs users pay to execute actions on a blockchain. Whether someone is sending tokens to a friend, swapping assets on a decentralised exchange, or deploying a smart contract, validators (or miners, depending on the consensus mechanism) must process and record that transaction. Gas fees compensate them for the computational work and energy expended.

But gas fees aren’t just about payment, they serve a broader purpose. They regulate network demand, acting as an economic throttle that prevents spam and ensures scarce block space is allocated efficiently. When fees rise, frivolous or low-priority transactions become less attractive, allowing critical operations to proceed. This mechanism helps maintain blockchain security and consistency, particularly on networks with limited throughput.

For users, understanding gas fees matters because they directly affect profitability and user experience. A trader executing high-frequency swaps can see profits eroded by fees. An NFT creator might delay a mint if Ethereum gas prices spike. And for developers building decentralised applications, high or unpredictable fees can deter adoption. In short, gas fees are a fundamental cost of doing business on-chain, and in 2025, managing them intelligently is more important than ever.

Key Factors That Influence Gas Fees on Different Blockchains

Gas fees aren’t static. They fluctuate based on a combination of network-specific and situational factors. Understanding these drivers helps users anticipate costs and choose the right blockchain for their needs.

Network Congestion and Demand

The most immediate factor is network congestion. When many users attempt to transact simultaneously, block space becomes scarce. Validators prioritise transactions offering higher fees, leading to a bidding war that pushes prices up. This is especially visible on Ethereum during NFT drops or popular DeFi events, where gas can surge from under a pound to over ten pounds within minutes.

Conversely, during quieter periods, late evenings or weekends in major time zones, demand drops, and fees often follow. Monitoring these patterns can yield significant savings.

Consensus Mechanisms and Blockchain Architecture

The underlying consensus mechanism and architecture profoundly shape fee dynamics. Ethereum’s transition to Proof-of-Stake post-merge improved efficiency and reduced energy costs, but the real fee relief came from layer 2 rollups and protocol upgrades like EIP-4844, which lowered data costs.

Meanwhile, blockchains like Solana and Algorand employ advanced consensus algorithms and larger block sizes, enabling high throughput with minimal fees. Solana’s typical transaction cost hovers below $0.001, a stark contrast to Ethereum’s layer 1. Proof-of-Work chains, on the other hand, tend to have higher and more volatile fees due to slower block times and energy-intensive validation.

Transaction Complexity and Smart Contract Interactions

Not all transactions are equal. A simple token transfer requires far less computational effort than a complex smart contract interaction. Minting an NFT, executing a multi-step DeFi swap, or deploying a contract all demand more gas because they involve more operations, storage writes, and logic execution.

Users can sometimes reduce fees by simplifying transactions, batching operations, using more efficient contract code, or choosing protocols optimised for lower gas consumption. Understanding this factor helps users plan their on-chain activity more cost-effectively.

The Most Reliable Tools for Comparing Gas Fees in 2025

In 2025, users no longer need to visit a dozen blockchain explorers to gauge gas fees. A new generation of aggregator tools and enhanced explorer features make cross-chain comparisons straightforward.

Real-Time Gas Fee Trackers and Aggregators

Gas fee aggregators are the simplest and most powerful tools for multi-chain comparisons. Platforms like Gasfees.org and Moralis display live fee data for over 100 blockchains in a single dashboard. Users can filter by network, transaction type, and timeframe, making it easy to spot the cheapest option at any given moment.

These tools update in real time, reflecting current network conditions rather than outdated averages. Many also offer historical charts, allowing users to identify trends, such as recurring fee spikes during certain hours, and plan accordingly. Some even provide alerts, notifying users when fees drop below a chosen threshold.

The key advantage? Speed and convenience. Instead of manually checking Etherscan, then Solscan, then BscScan, users get a unified view that supports rapid decision-making.

Blockchain Explorer Features

Blockchain explorers remain invaluable, especially for deep dives into a single network. Etherscan, Solscan, Polygonscan, and similar platforms provide up-to-date gas prices, fee breakdowns by transaction type, and historical trends. They also display gas limits, base fees, and priority fees (on EIP-1559-enabled chains), giving advanced users granular control.

Explorers are particularly useful when a user is already committed to a specific blockchain and wants to optimise timing or fee settings. Combined with aggregators, they form a comprehensive toolkit for managing transaction costs across the crypto ecosystem.

Step-by-Step Guide to Comparing Gas Fees Effectively

Comparing gas fees across blockchains doesn’t have to be complicated. Follow these steps for a streamlined, effective approach:

- Choose a reputable gas tracker supporting multiple chains.

Start with a platform like Gasfees.org or Moralis that aggregates data from a wide range of networks. Ensure it covers the blockchains you use most frequently.

- Select your source and destination blockchains.

If you’re bridging assets or choosing where to deploy a contract, identify the relevant networks. The tracker will display current fee estimates for each.

- Compare real-time fees for your transaction type.

Not all transactions cost the same. A simple token transfer on Ethereum might cost £0.50, whilst a complex DeFi swap could run £2 or more. Make sure you’re comparing like-for-like operations.

- Evaluate layer 2 or sidechain options where available.

If you’re focused on Ethereum but fees are high, check whether layer 2 solutions like Arbitrum, Optimism, or zkSync support your intended action. These rollups can reduce costs by 90% or more, making them a compelling alternative to mainnet.

- Monitor and act.

Set alerts or revisit the tracker before transacting. Gas fees can change rapidly, and a few minutes’ wait can sometimes save pounds.

By following this workflow, users can consistently identify the most cost-effective blockchain and timing for their transactions, ensuring they never overpay unnecessarily.

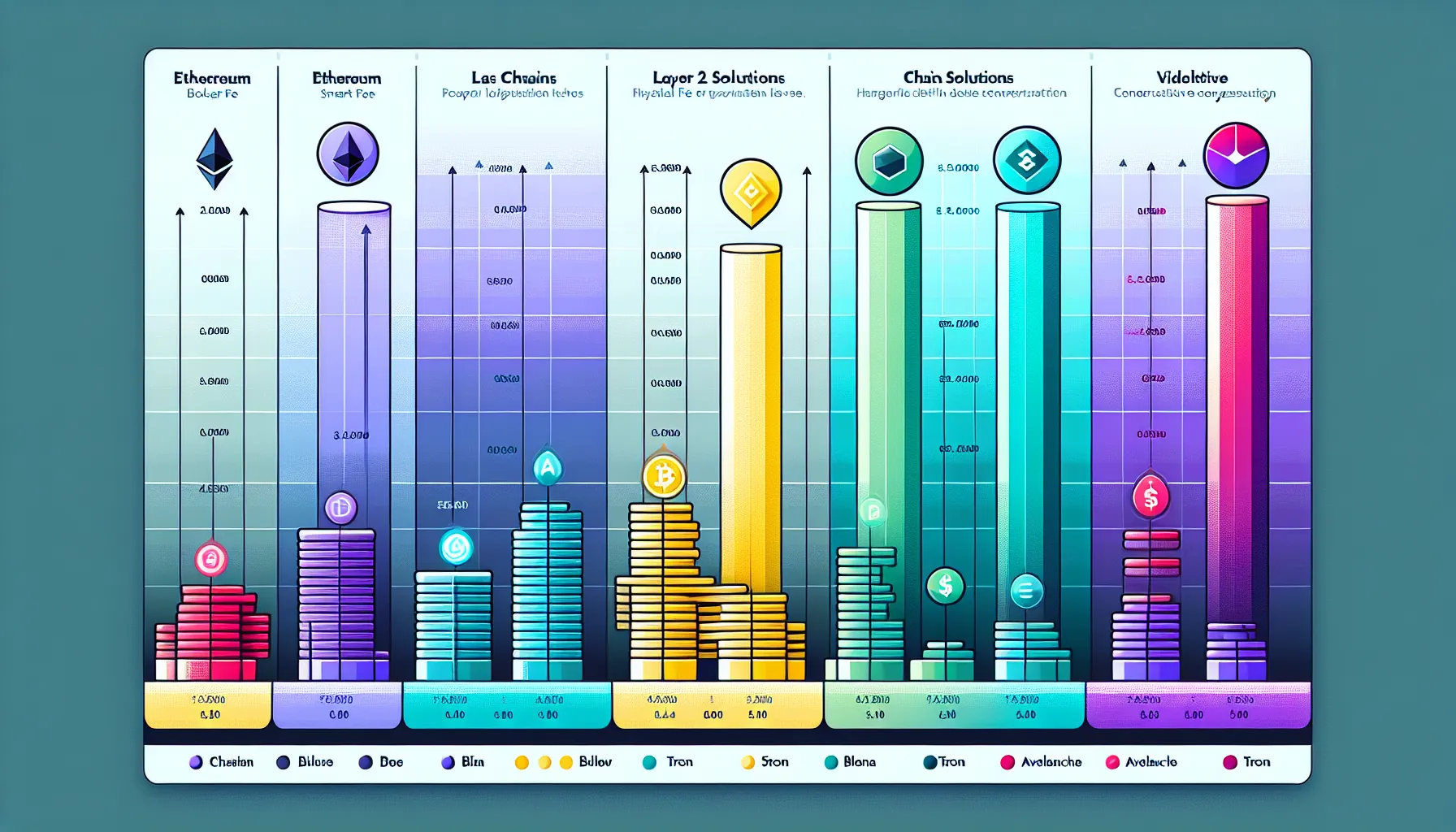

Gas Fee Comparison Across Popular Blockchains

Understanding typical fee ranges across leading blockchains helps users set realistic expectations and choose the right network for their needs. The landscape in 2025 is diverse, with layer 1 and layer 2 options catering to different use cases and budgets.

Ethereum and Layer 2 Solutions

Ethereum’s layer 1 remains the most established smart contract platform, but its fees, whilst significantly lower than the 2021 peak, can still range from around £0.50 to over £2 depending on network activity. Complex DeFi interactions or NFT mints can push costs higher during congested periods.

The real game-changer has been layer 2 rollups. Solutions like Arbitrum, Optimism, and zkSync bundle hundreds of transactions off-chain before settling them on Ethereum’s mainnet, drastically reducing per-transaction costs. Typical fees on these networks now sit below £0.10, often closer to a few pence. They inherit Ethereum’s security whilst delivering near-instant confirmations and minimal fees, making them ideal for everyday DeFi, gaming, and NFT activity.

For users committed to the Ethereum ecosystem, layer 2s offer the best of both worlds: robust security and affordability.

Alternative Layer 1 Blockchains

Beyond Ethereum, several alternative layer 1 blockchains have carved out niches by prioritising speed and low costs.

- Solana continues to lead in throughput, processing thousands of transactions per second with fees typically below $0.001 (less than a penny). Its high performance makes it popular for gaming, payments, and high-frequency trading.

- Polygon and Binance Smart Chain (BSC) occupy a middle ground, offering fees around £0.01. Both have mature DeFi ecosystems and broad wallet support, making them accessible entry points for cost-conscious users.

- TRON and Algorand also maintain consistently low fees, often under £0.001 to £0.05, with fast confirmation times. TRON has found success in stablecoin transfers, whilst Algorand appeals to enterprise and sustainability-focused projects.

The table below summarises typical fee ranges in 2025:

| Blockchain | Typical Fee (2025) | Notes |

|---|---|---|

| Ethereum (L1) | ~£0.50–£2+ | Fees dropped after upgrades: can spike with complex DeFi interactions |

| Arbitrum, zkSync | <£0.10 | Layer 2 rollups, drastically reduce costs and congestion |

| Solana | <£0.001 | High throughput, low and stable fees |

| Polygon, BSC | ~£0.01 | Popular low-fee alternatives for DeFi and games |

| TRON, Algorand | <£0.001–£0.05 | Consistently low fees: fast confirmations |

This diversity means users can almost always find a network that balances cost, speed, and security for their specific use case.

Practical Tips for Minimising Transaction Costs

Beyond choosing the right blockchain, users can adopt several strategies to drive transaction costs even lower.

Transact during off-peak hours. Network congestion follows predictable patterns tied to global activity. Late evenings or weekends in major time zones, especially UTC and US Eastern, tend to see lower demand and cheaper fees. Scheduling non-urgent transactions for these windows can yield meaningful savings.

Utilise layer 2 solutions or sidechains where available. If you’re active in the Ethereum ecosystem, moving operations to Arbitrum, Optimism, or zkSync can cut costs by 90% or more without sacrificing functionality. Many dApps now support these networks natively.

Use gas trackers to avoid fee spikes and select optimal times. Real-time aggregators and alert features let users wait for favourable conditions rather than transacting blindly. A few minutes’ patience can save pounds.

Simplify transactions when possible. Batching operations, avoiding unnecessary contract interactions, and using gas-efficient protocols all reduce computational overhead. Developers can also optimise smart contract code to lower user costs.

Regularly monitor and compare tools for the latest fee landscapes. The blockchain space evolves rapidly. New layer 2s launch, protocols upgrade, and fee dynamics shift. Staying informed ensures users continue to benefit from the most cost-effective options.

By combining these tactics with the cross-chain comparison tools discussed earlier, users can consistently minimise transaction costs and maximise the value of their on-chain activity.

Conclusion

In 2025, comparing gas fees across blockchains no longer requires hours of research or technical expertise. Real-time aggregator tools have democratised access to live fee data, enabling users to make informed, cost-effective decisions in seconds. Whether someone is choosing between Ethereum and Solana, evaluating layer 2 rollups, or simply timing a transaction to avoid peak congestion, the right tools and strategies make all the difference.

Gas fees will always fluctuate, that’s the nature of decentralised networks responding to supply and demand. But by understanding the factors that drive costs, leveraging reliable comparison platforms, and adopting smart transacting habits, users can take control of their on-chain expenses. The result? More efficient operations, better user experiences, and a crypto journey that’s both affordable and empowering.

Frequently Asked Questions

What is the simplest way to compare gas fees across blockchains in 2025?

The simplest method is to use real-time gas fee aggregator tools like Gasfees.org or Moralis. These platforms consolidate live rates from over 100 blockchains into a single dashboard, allowing users to compare fees instantly and make informed decisions without visiting multiple blockchain explorers.

Why do gas fees vary so much between different blockchains?

Gas fees vary due to differences in network congestion, consensus mechanisms, blockchain architecture, and transaction complexity. High-throughput chains like Solana maintain fees below £0.001, whilst Ethereum layer 1 can range from £0.50 to over £2 depending on demand and smart contract interactions.

How can I reduce my transaction costs when using Ethereum?

To minimise Ethereum costs, use layer 2 solutions like Arbitrum, Optimism, or zkSync, which reduce fees by up to 90%. Additionally, transact during off-peak hours, monitor gas trackers for optimal timing, and avoid unnecessary complex smart contract interactions whenever possible.

When is the best time to transact to get lower gas fees?

The best times are typically late evenings or weekends in major time zones (UTC and US Eastern), when network congestion is lowest. Using real-time gas trackers with alert features helps you identify these low-demand windows and schedule non-urgent transactions accordingly for significant savings.

Are layer 2 blockchain solutions as secure as Ethereum mainnet?

Yes, layer 2 rollups like Arbitrum, Optimism, and zkSync inherit Ethereum’s security because they bundle transactions off-chain and settle final proofs on Ethereum’s mainnet. They offer the same robust security guarantees whilst delivering dramatically lower fees and faster confirmation times.

Which blockchain has the lowest transaction fees in 2025?

Solana consistently offers the lowest fees, typically below £0.001 per transaction, thanks to its high throughput and efficient consensus mechanism. TRON and Algorand also maintain extremely low fees, ranging from £0.001 to £0.05, making them cost-effective for frequent transactions and stablecoin transfers.

Frequently Asked Questions

What is the simplest way to compare gas fees across blockchains in 2025?

The simplest way is to use multi-chain gas fee trackers like Gasfees.org or Token Metrics, which aggregate real-time data from multiple blockchains in one dashboard. These platforms display current fees, historical trends, and optimal transaction windows across Ethereum, Binance Smart Chain, Solana, Polygon, and other networks.

Why do gas fees vary so much between different blockchains?

Gas fees vary due to network congestion, transaction complexity, blockchain design, and consensus mechanisms. High-throughput chains like Solana offer near-zero fees, whilst Ethereum’s Layer 1 can experience spikes during busy periods. Layer 2 solutions and optimised chains like Binance Smart Chain deliberately keep costs low.

When is the best time to make blockchain transactions to save on gas fees?

Gas fees are typically lowest during off-peak hours, such as late evenings and weekends relative to major financial centres like London and New York. Monitoring gas trackers and setting alerts for when fees drop below your threshold helps identify the most cost-effective transaction windows.

How much do Ethereum Layer 2 transactions cost compared to Layer 1?

Ethereum Layer 2 solutions like Arbitrum, Optimism, and Base typically cost just a few pence to under £0.10 for most transactions—up to 90% cheaper than Layer 1. Following the Dencun upgrade, average Layer 2 gas prices dropped by over 95%, making them ideal for everyday use.

Which blockchain has the lowest gas fees for token transfers?

Solana and TRON typically offer the lowest gas fees for token transfers, with costs measured in fractions of a penny. Binance Smart Chain also provides ultra-low fees under £0.10 for most transactions, making these chains popular for simple transfers and cost-sensitive operations.

Can I set alerts to notify me when gas fees drop?

Yes, blockchain explorers like Etherscan allow you to set custom gas price alerts that notify you when fees drop below your specified threshold. This feature is ideal for non-urgent transactions, enabling you to transact during favourable conditions without constant manual monitoring.