Litecoin has carved out its place as one of the most reliable and widely-used cryptocurrencies, often called the “silver to Bitcoin’s gold.” But with that popularity comes unwanted attention from scammers looking to exploit vulnerabilities and inexperienced holders. Every year, thousands of cryptocurrency users lose funds to phishing attacks, fake exchanges, social engineering, and sophisticated scams designed to drain wallets before victims realise what’s happening.

The good news? Most of these threats are entirely preventable. Securing Litecoin doesn’t require a technical degree or expensive equipment,just a clear understanding of the risks and a commitment to following best practices. From choosing the right wallet to recognizing red flags in unsolicited messages, protecting digital assets is all about vigilance and well-informed choice-making. This guide breaks down the most common threats facing Litecoin holders in 2025 and provides actionable steps to keep coins safe from scammers.

Key Takeaways

- Litecoin security requires multiple layers of protection, including hardware wallets, two-factor authentication, and constant vigilance against phishing attempts.

- Never share your private keys, seed phrases, or recovery words with anyone—legitimate support teams will never ask for this information.

- Hardware wallets like Ledger or Trezor offer the strongest protection for long-term Litecoin storage by keeping private keys offline and away from hackers.

- Always verify wallet addresses character by character before sending Litecoin, as transactions are irreversible and cannot be recovered if sent to the wrong address.

- Keep minimal funds on exchanges and withdraw Litecoin to personal wallets where you control the keys—exchanges are vulnerable to hacks and regulatory seizures.

- Be skeptical of unsolicited messages, giveaway scams, and investment opportunities promising guaranteed returns, as these are common tactics used by cryptocurrency scammers.

Understanding Common Litecoin Scams

Scammers have refined their tactics over the years, targeting Litecoin holders with increasingly sophisticated schemes. Recognizing these common threats is the first line of defence.

Phishing Attacks and Fake Websites

Phishing remains one of the most prevalent threats in the cryptocurrency space. Scammers create fake websites that closely mimic legitimate Litecoin wallets, exchanges, or services. These sites often use URLs that are nearly identical to the real ones,maybe swapping a single letter or adding an extra character. The goal is simple: trick users into entering their login credentials, private keys, or seed phrases.

Email phishing is equally dangerous. Users receive messages that appear to come from reputable services, often claiming there’s a security issue with their account or that they need to verify their identity. These emails include links that lead to cloned websites designed to harvest sensitive information.

To stay safe, always double-check URLs before entering any information. Look for HTTPS and verify the exact spelling of the domain. Better yet, bookmark trusted sites and access them only through those saved links. Never click on links in unsolicited emails, even if they look legitimate. When in doubt, navigate directly to the service’s website by typing the address manually.

Social Engineering and Impersonation Scams

Social engineering exploits human psychology rather than technical vulnerabilities. Scammers impersonate customer support representatives, well-known cryptocurrency influencers, or even friends to build trust and manipulate victims into revealing private information or sending funds.

These scams often start with a direct message on social media or messaging apps. The impersonator might claim they’re from a wallet provider’s support team and need to “verify” the user’s account. Others pose as successful traders offering to help grow portfolios or promising insider knowledge on upcoming price movements.

The cardinal rule here is simple: legitimate support teams will never ask for private keys, seed phrases, or passwords. They don’t need that information to help with account issues. Anyone requesting such details is a scammer, no exceptions. If someone reaches out unsolicited with investment advice or offers that seem too good to be true, they probably are.

Ponzi Schemes and Fake Investment Opportunities

Ponzi schemes in the crypto world promise astronomical returns with little to no risk. These fraudulent platforms claim to use advanced trading algorithms, mining operations, or staking programs to generate guaranteed profits. In reality, they’re paying early investors with funds from new investors, creating an unsustainable cycle that eventually collapses.

Fake investment platforms often feature professional-looking websites, fabricated testimonials, and promises of daily or weekly returns that far exceed what’s realistic in legitimate markets. Some even operate for months, paying out initially to build credibility before disappearing with everyone’s funds.

Before investing Litecoin anywhere, research thoroughly. Check for regulatory compliance, search for independent reviews, and be skeptical of guarantees. Legitimate investments carry risk, and anyone promising otherwise is likely running a scam. If an opportunity promises 10% weekly returns or claims to have “zero risk,” walk away.

Choosing the Right Wallet for Maximum Security

The wallet used to store Litecoin directly impacts security. Not all wallets offer the same level of protection, and choosing the right one depends on how the coins will be used and the amount being stored.

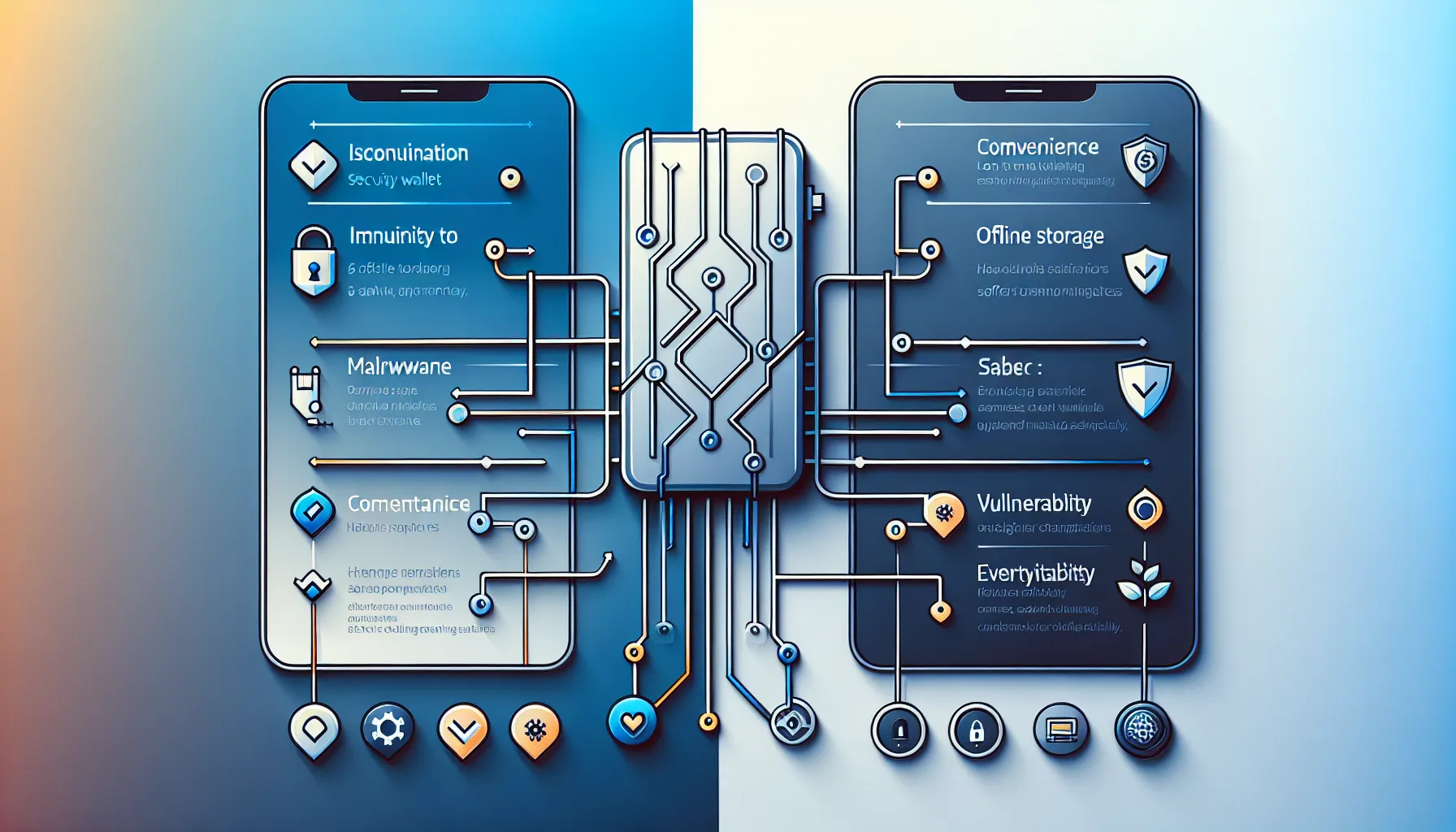

Hardware Wallets vs. Software Wallets

Hardware wallets represent the gold standard for cryptocurrency security. Devices like Ledger, Trezor, and OneKey store private keys on physical hardware that never connects directly to the internet. Even when plugged into a computer to make transactions, the private keys remain isolated on the device. This makes them virtually immune to remote hacking attempts, malware, or phishing attacks.

They’re ideal for long-term storage and larger holdings. If someone’s strategy involves buying Litecoin and holding it for months or years, a hardware wallet is worth the investment. The upfront cost (typically $50-$200) is minimal compared to the potential loss from a compromised software wallet.

Software wallets, on the other hand, offer convenience for frequent transactions. These apps run on computers or smartphones and provide quick access to funds. But, they’re more vulnerable to online threats since private keys are stored on internet-connected devices. Malware, keyloggers, or compromised operating systems can potentially expose these keys.

For everyday spending or smaller amounts, software wallets can be practical,but they require extra security measures like strong passwords, regular updates, and antivirus protection. Many experienced users employ both: hardware wallets for the bulk of their holdings and software wallets for spending money.

Key Features to Look for in a Secure Wallet

When evaluating wallets, certain features indicate stronger security. Open-source code allows independent security researchers to audit the wallet for vulnerabilities, providing transparency that closed-source options can’t match. Regular updates show the development team is actively addressing potential security issues.

Multi-signature support adds an extra layer of protection by requiring multiple private keys to authorize transactions. This is particularly useful for shared funds or business accounts. Passphrase protection (sometimes called a “25th word”) creates an additional secret that must be combined with the seed phrase to access funds.

Strong customer support and an active community also matter. If issues arise, responsive support can make the difference between recovering funds and losing them. Check reviews, forums, and social media to gauge the wallet provider’s reputation before trusting them with assets.

Protecting Your Private Keys and Seed Phrases

Private keys and seed phrases are the absolute keys to cryptocurrency holdings. Anyone with access to them controls the coins,no exceptions, no reversals. This makes their protection paramount.

Safe Storage Methods for Recovery Phrases

When setting up a wallet, it generates a recovery phrase (typically 12-24 words) that can restore access to funds if the device is lost or damaged. This phrase must be stored securely offline.

Write it down on paper,never store it digitally on computers, phones, or cloud services. Digital storage creates vulnerabilities to hacking, while cloud services can be breached or shut down. For enhanced durability, consider metal backup solutions designed specifically for seed phrases. These withstand fire, water damage, and corrosion far better than paper.

Store the written phrase in multiple secure locations. A fireproof safe at home is a good start, but consider keeping a duplicate in a bank safety deposit box or with a trusted family member in a different location. This protects against physical disasters like fires or floods.

Never photograph the recovery phrase or save it in password managers, note-taking apps, or email drafts. Avoid splitting it up and storing parts in different places unless using a proper multi-signature setup,half a seed phrase is useless but having parts scattered can lead to permanent loss if one location becomes inaccessible.

What Never to Share Online

Certain information should never be shared with anyone, under any circumstances:

- Seed phrases/recovery phrases: The 12-24 words that restore wallet access

- Private keys: The cryptographic keys that authorize transactions

- Two-factor authentication codes: One-time passwords generated by authenticator apps

- Full wallet addresses in public forums: While receiving addresses are meant to be shared for payments, posting them publicly can reveal transaction history and holdings

No legitimate service, support team, or company will ever ask for this information. Anyone making such a request is attempting theft. Even if a message appears to come from an official source or a trusted contact, verify through alternative communication channels before responding.

Securing Your Transactions

Transactions on the Litecoin blockchain are irreversible. Once coins are sent, there’s no customer service to call, no bank to reverse the charge. This makes transaction security critical.

Verifying Wallet Addresses Before Sending

One of the most costly mistakes in cryptocurrency is sending funds to the wrong address. Litecoin addresses are long strings of letters and numbers, and a single character difference means coins arrive at a completely different wallet,usually lost forever.

Before confirming any transaction, verify the entire receiving address character by character. Don’t just check the first and last few characters: sophisticated malware exists that replaces copied addresses with scammer-controlled ones that match the beginning and end of the legitimate address.

For large transactions, consider sending a small test amount first to confirm the address is correct. Once the test transaction arrives successfully, send the remainder. The small transaction fee is worth the peace of mind.

Be particularly cautious with addresses received through messaging apps or email. If possible, verify through a second communication channel. For regular recipients, save verified addresses in a secure, offline document rather than relying on message history.

Using Two-Factor Authentication

Two-factor authentication (2FA) adds a crucial security layer to accounts by requiring a second form of verification beyond just a password. Even if a password is compromised through phishing or a data breach, 2FA prevents unauthorized access.

Authenticator apps like Google Authenticator, Authy, or hardware-based options like YubiKey are the most secure 2FA methods. They generate time-based codes that expire quickly, making them difficult for attackers to intercept or reuse.

Avoid SMS-based 2FA when possible. While better than no 2FA at all, text messages are vulnerable to SIM-swapping attacks where scammers convince mobile carriers to transfer a phone number to a device they control.

Enable 2FA on every account that supports it: exchanges, wallets, email accounts, and any service connected to cryptocurrency holdings. Store backup codes in the same secure location as recovery phrases in case the 2FA device is lost.

Best Practices for Exchange Security

Cryptocurrency exchanges serve as convenient platforms for buying, selling, and trading Litecoin. But, they also present significant security risks since they hold users’ funds in centralized wallets that become attractive targets for hackers.

Recognizing Legitimate Exchanges

Not all exchanges are created equal, and some are outright scams designed to steal deposits. Before trusting an exchange with funds, verify its legitimacy through multiple channels.

Check for regulatory compliance and licensing. Reputable exchanges operate under financial regulations in their jurisdictions and are transparent about their legal status. Look for registration with regulatory bodies like FinCEN in the United States or equivalent agencies elsewhere.

Research the exchange’s history and reputation. Established platforms like Coinbase, Kraken, and Binance have years of operation and extensive user bases. Search for independent reviews, check community forums like Reddit, and look for any history of security breaches or customer complaints about withdrawal issues.

Legitimate exchanges have professional websites, clear terms of service, accessible customer support, and transparent fee structures. Be wary of platforms promising unrealistic trading bonuses, guaranteed returns, or those that pressure users to deposit quickly.

Limiting Funds Kept on Exchanges

Even the most secure exchanges carry risks. Hacks, insolvency, or regulatory seizures can result in lost funds. The cryptocurrency mantra “not your keys, not your coins” exists for good reason,when funds sit on an exchange, the exchange controls the private keys, not the user.

Use exchanges for their intended purpose: trading and converting between currencies. Keep only the amount needed for active trading on the platform. Once trading is complete, withdraw Litecoin to a personal wallet where the user controls the private keys.

For long-term holdings, there’s no reason to leave coins on an exchange. The convenience isn’t worth the risk. Set a personal rule,perhaps withdrawing anything over a certain amount or transferring funds to cold storage weekly. Many exchange hacks have resulted in total losses for users, and even though some platforms offering insurance, recovery is never guaranteed.

Staying Safe on Social Media and Forums

Social media platforms and cryptocurrency forums are valuable resources for news and community engagement, but they’re also hunting grounds for scammers.

Be immediately suspicious of unsolicited direct messages, especially from accounts claiming to represent exchanges, wallets, or offering investment advice. Scammers create fake accounts that mimic official company profiles, using similar names, logos, and even verified-looking badges.

Giveaway scams are rampant. These typically promise to “double” any Litecoin sent to a specific address or offer free coins in exchange for a small “verification” payment. No legitimate person or company operates this way. If Elon Musk or any other public figure appears to be offering free cryptocurrency, it’s a scam,their accounts have either been compromised or someone created a convincing fake.

When engaging in cryptocurrency communities, avoid sharing specific details about holdings or trading strategies. Broadcasting that someone just bought a large amount of Litecoin makes them a target for scammers who’ll attempt social engineering attacks or phishing.

Verify account authenticity before trusting information. Check for official verification badges, examine follower counts and posting history, and cross-reference usernames with information from the company’s official website. When in doubt, navigate directly to the company’s website and contact them through official channels rather than responding to social media messages.

What to Do If You’ve Been Scammed

Even though best efforts, scams sometimes succeed. Quick action after realizing what happened can make a difference, though recovering cryptocurrency is notoriously difficult due to the irreversible nature of blockchain transactions.

First, document everything. Take screenshots of all communications, transaction IDs, wallet addresses involved, websites visited, and any other evidence. This documentation will be crucial for reports to authorities and potentially for warning others.

Report the incident to relevant authorities. In the United States, file reports with the FBI’s Internet Crime Complaint Centre (IC3), the Federal Trade Commission (FTC), and local law enforcement. Other countries have equivalent agencies. While cryptocurrency scams are challenging to prosecute, reports contribute to larger investigations and help authorities identify patterns.

If the scam involved an exchange or service, contact their support team immediately. While they typically can’t reverse transactions, they may be able to freeze accounts, provide additional information, or at least flag the scammer’s accounts to prevent future victims.

Change all passwords and security credentials that might have been compromised. If a phishing attack obtained login information, assume those credentials are now being tested on other platforms. Enable or update 2FA on all accounts.

Warn the community. Post about the experience on relevant forums, subreddits, and social media (without revealing excessive personal information). Detailed scam reports help others recognise similar schemes and can sometimes lead to identifying the scammers or finding other victims for coordinated action.

Finally, learn from the experience. Analyze what red flags were missed or what security practices weren’t followed, and adjust accordingly. Most cryptocurrency users who’ve been around long enough have a cautionary tale,the goal is ensuring it only happens once.

Conclusion

Protecting Litecoin from scammers isn’t about implementing one perfect security measure,it’s about building layers of defence that work together. Hardware wallets keep private keys offline. Two-factor authentication blocks unauthorized access. Skepticism toward unsolicited offers prevents social engineering. Verification of addresses avoids costly mistakes.

The cryptocurrency space offers tremendous opportunities but requires users to take responsibility for their own security in ways traditional banking never demanded. There’s no customer service number to call when funds disappear, no FDIC insurance to recover losses. This reality might seem daunting, but it also means complete control over assets when proper precautions are in place.

Staying informed about evolving threats is just as important as implementing current best practices. Scammers adapt their tactics constantly, developing new schemes as old ones become widely recognized. Follow security-focused cryptocurrency news sources, participate in community discussions, and maintain a healthy skepticism toward anything that seems too good to be true.

For anyone holding Litecoin in 2025, security should be an ongoing practice rather than a one-time setup. Regular reviews of wallet security, keeping software updated, and staying vigilant against new scam tactics all contribute to long-term safety. The effort invested in protection is minimal compared to the potential consequences of a successful attack. By following these guidelines and remaining alert, Litecoin holders can significantly reduce their risk and maintain control over their digital assets for years to come.

Frequently Asked Questions

What is the safest way to store Litecoin long-term?

Hardware wallets like Ledger, Trezor, or OneKey offer the safest storage for long-term Litecoin holdings. They keep private keys offline on physical devices, making them virtually immune to remote hacking, phishing, and malware attacks.

How can I protect my Litecoin from phishing scams?

Always verify URLs before entering credentials, bookmark trusted sites, and never click links in unsolicited emails. Legitimate services never ask for private keys or seed phrases. Check for HTTPS and exact domain spelling to avoid fake websites.

Should I keep my Litecoin on a cryptocurrency exchange?

Only keep Litecoin on exchanges for active trading purposes. Withdraw coins to a personal wallet where you control the private keys for long-term storage. Exchange hacks and insolvency can result in total fund loss.

Where should I store my Litecoin recovery phrase?

Write your recovery phrase on paper and store it in multiple secure offline locations like a fireproof safe or bank safety deposit box. Never store it digitally, photograph it, or save it in cloud services or password managers.

Can I recover my Litecoin if I send it to the wrong address?

No, Litecoin transactions are irreversible once confirmed on the blockchain. Always verify the entire receiving address character-by-character before sending, and consider sending a small test amount first for large transactions to prevent permanent loss.

What is the difference between hardware and software wallets for cryptocurrency?

Hardware wallets store private keys on physical offline devices, offering maximum security for long-term holdings. Software wallets are apps on internet-connected devices, providing convenience for frequent transactions but with higher vulnerability to online threats and malware.