When you’re moving money around in the cryptocurrency world, transaction fees can make or break your experience. Send $50 worth of Bitcoin during a busy day, and you might pay $10 or more in fees. Try the same with Litecoin, and you’ll likely spend just a few cents. That’s not a typo,Litecoin transactions often cost more than 100 times less than Bitcoin’s.

But why the massive difference? Both cryptocurrencies use similar proof-of-work technology, yet Litecoin consistently delivers faster confirmations and rock-bottom fees. The answer lies in deliberate design choices made when Litecoin launched in 2011 as a “lighter” alternative to Bitcoin. Understanding these differences isn’t just academic,it can help users choose the right tool for their needs, whether they’re making microtransactions, sending international payments, or simply trying to avoid expensive fees during network congestion.

Key Takeaways

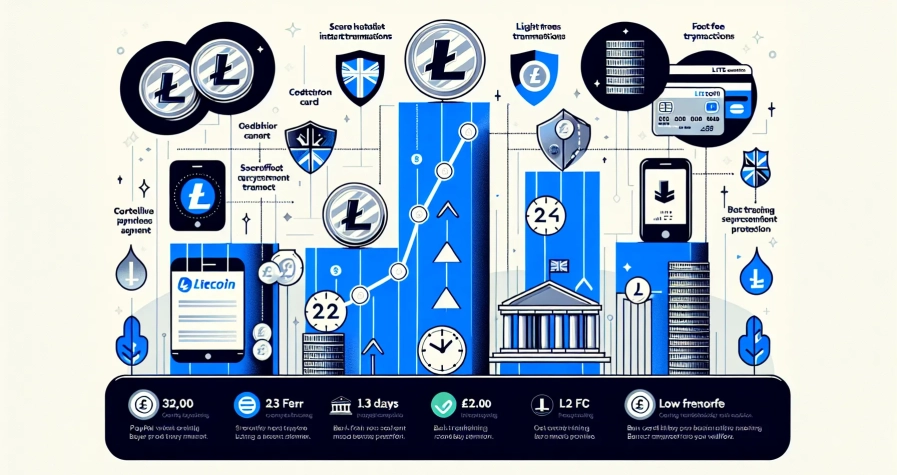

- Litecoin fees typically cost $0.03–$0.04 per transaction, over 100 times cheaper than Bitcoin’s average $7.60 fee.

- Litecoin’s 2.5-minute block generation time is four times faster than Bitcoin’s 10 minutes, enabling quicker confirmations and lower congestion.

- Litecoin fees remain consistently low because the network processes more transactions per block and operates below maximum capacity most of the time.

- Litecoin is ideal for micropayments, frequent transactions, and international transfers where minimizing costs matters most.

- Bitcoin offers stronger network security and broader adoption, making it better suited for large-value storage despite higher transaction fees.

- Understanding Litecoin fees versus Bitcoin fees helps users choose the right cryptocurrency based on transaction frequency, amount, and purpose.

Understanding Cryptocurrency Transaction Fees

Before diving into the specifics of Litecoin and Bitcoin, it helps to understand why cryptocurrency networks charge fees at all.

Transaction fees serve two essential purposes in blockchain networks. First, they compensate miners,the individuals or entities running powerful computers to validate transactions and secure the network. Mining requires electricity, hardware, and time, so fees provide an economic incentive to keep the process running smoothly. Without this incentive, miners wouldn’t have much reason to prioritize transaction processing, and the entire network could grind to a halt.

Second, fees act as a spam filter. If transactions were completely free, malicious actors could flood the network with thousands of tiny, meaningless transactions, clogging the system and making it unusable for legitimate users. By requiring even a small fee, blockchains ensure that every transaction represents a real economic action, not just digital noise.

Most cryptocurrency networks operate on a competitive fee market. When the network gets busy, users can opt to pay higher fees to have their transactions processed faster. Think of it like bidding for priority service,those willing to pay more get bumped to the front of the line. During periods of low activity, fees naturally drop because there’s less competition for space in each block. This dynamic pricing model means fees fluctuate based on supply and demand, and it’s where Litecoin and Bitcoin start to diverge significantly.

How Litecoin Transaction Fees Work

Litecoin’s fee structure follows the same basic principles as Bitcoin, but with some important differences in execution.

Litecoin fees are primarily determined by the size of the transaction in bytes, not the dollar amount being sent. A simple transaction moving coins from one address to another might be around 250 bytes, while more complex transactions involving multiple inputs or outputs can be larger. The network calculates fees based on this data size and the current level of demand.

Here’s where Litecoin’s design gives it an edge: even during periods of high demand, the network processes significantly more transactions per block. Litecoin’s faster block generation time,2.5 minutes compared to Bitcoin’s 10 minutes,means the network clears its transaction queue four times faster. This increased throughput reduces the backlog of pending transactions, which in turn keeps fee competition minimal.

In practical terms, Litecoin transactions typically cost between $0.03 and $0.04, regardless of whether you’re sending $10 or $10,000. During extreme network congestion, fees might spike slightly, but they rarely exceed a few cents. This predictability makes Litecoin particularly appealing for users who need to budget their transaction costs or make frequent small payments. The network doesn’t force users into bidding wars just to get their transactions confirmed in a reasonable timeframe.

The Cost Breakdown: Litecoin vs. Bitcoin Fees

Average Fee Comparison

The numbers tell a striking story when you compare the two networks side by side:

| Cryptocurrency | Average Fee (USD) | Block Time |

|---|---|---|

| Litecoin | $0.03–$0.04 | 2.5 minutes |

| Bitcoin | $7.60 | 10 minutes |

Litecoin’s average transaction fee hovers around three to four cents, while Bitcoin’s average sits at approximately $7.60. That’s more than a 100-fold difference. To put it in perspective, if you’re making a $20 purchase with Bitcoin, you might pay nearly 40% in fees during busy periods. The same transaction on Litecoin would cost you less than 0.2% in fees.

The confirmation time difference compounds this advantage. Bitcoin users wait an average of 10 minutes for their first confirmation, and many merchants require multiple confirmations for larger transactions,meaning 30 minutes or more before the payment is truly settled. Litecoin users get their first confirmation in about 2.5 minutes, with full settlement often completed in under 10 minutes.

It’s worth noting that Bitcoin’s fees can swing wildly depending on network conditions. During the 2021 bull run, average Bitcoin transaction fees spiked above $60 at peak congestion. Litecoin, by contrast, maintained its sub-dollar fees even during comparable periods of heightened activity.

Why Litecoin Fees Remain Lower

Several interconnected factors keep Litecoin’s fees consistently low, even as its blockchain processes thousands of daily transactions.

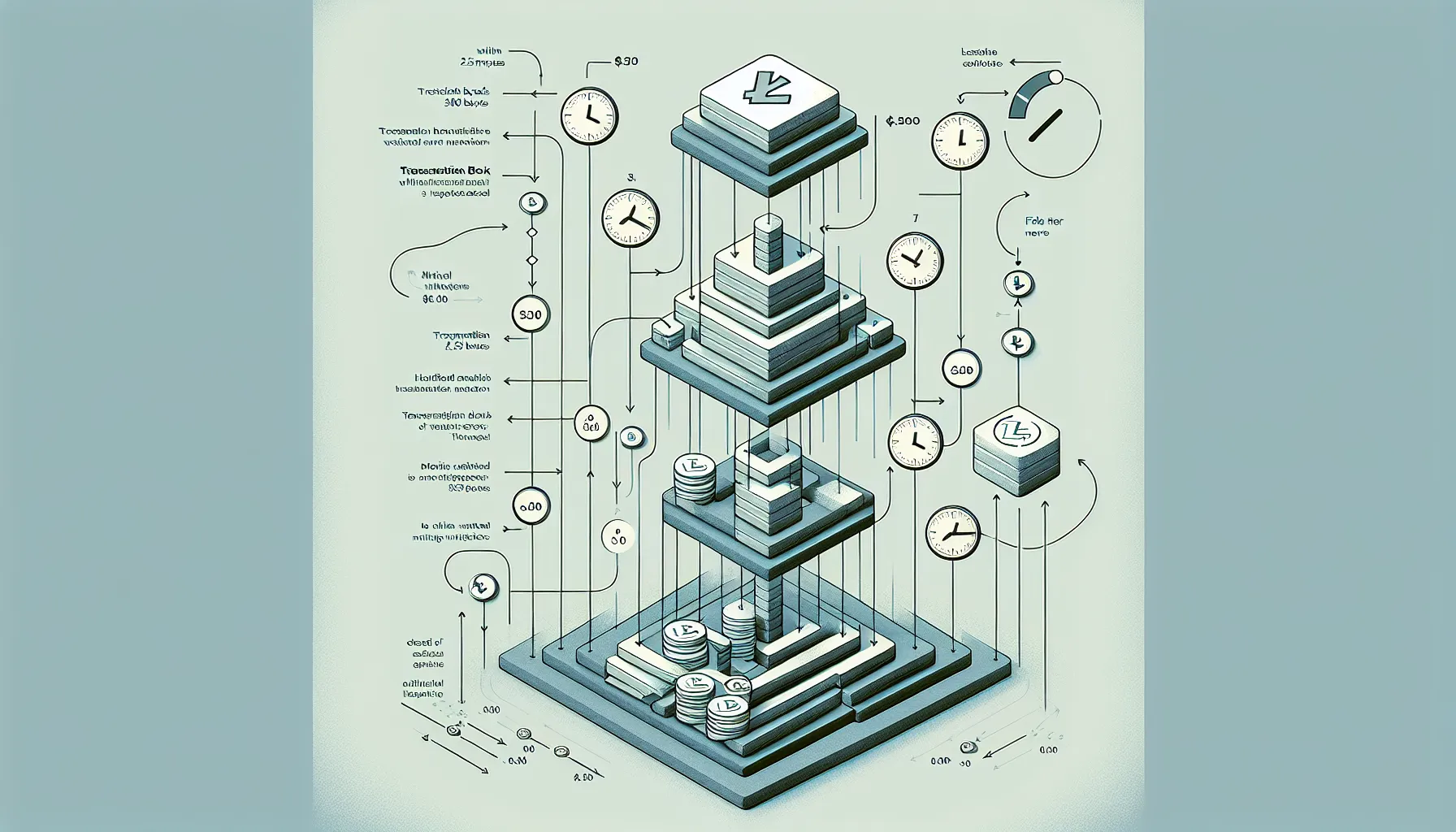

The primary driver is Litecoin’s faster block time. By generating blocks every 2.5 minutes instead of every 10, Litecoin effectively quadruples its transaction processing capacity compared to Bitcoin. More blocks mean more space for transactions, which reduces the scarcity that drives up fees.

Larger throughput plays a critical role as well. Each Litecoin block can accommodate more transactions per unit of time, meaning there’s less competition for inclusion in the next block. When users don’t have to compete aggressively to get their transactions processed quickly, fees stay low naturally.

Finally, Litecoin experiences less overall network congestion than Bitcoin. Bitcoin handles significantly higher transaction volume in absolute terms and attracts more attention during market volatility, creating sustained periods of congestion. Litecoin’s more moderate adoption level means the network operates well below its maximum capacity most of the time, leaving plenty of room for new transactions without triggering fee spikes.

Technical Factors Behind Litecoin’s Speed Advantage

Block Time Differences

The single most important technical difference between Litecoin and Bitcoin is their block generation interval. Litecoin was specifically designed to produce blocks every 2.5 minutes, exactly four times faster than Bitcoin’s 10-minute target.

This might seem like a simple tweak, but it has cascading effects throughout the network. Faster block times mean users don’t wait as long for their transactions to receive the first confirmation. For everyday transactions,buying coffee, paying for services, or transferring funds between wallets,this speed difference is immediately noticeable.

Faster blocks also mean the network can recover more quickly from temporary congestion. If a sudden surge of transactions hits the Bitcoin network, it might take several blocks (an hour or more) to clear the backlog. Litecoin’s network would process the same backlog in roughly 15 minutes because it’s generating blocks four times as frequently.

There is a trade-off here: faster block times increase the likelihood of temporary blockchain forks, where two miners find valid blocks simultaneously and the network must resolve which chain is correct. But, Litecoin’s consensus mechanism handles these situations gracefully, and the practical impact on users is negligible.

Network Capacity and Throughput

Beyond block time alone, Litecoin’s overall network architecture supports higher throughput than Bitcoin.

Bitcoin processes roughly 3 to 7 transactions per second on average. Litecoin, thanks to its shorter block intervals, can handle approximately 12 to 28 transactions per second under similar conditions. This isn’t a revolutionary difference,both networks pale in comparison to traditional payment processors like Visa,but it’s enough to keep Litecoin’s mempool (the queue of unconfirmed transactions) relatively clear most of the time.

Less congestion in the mempool translates directly to lower fees. When there’s available space in upcoming blocks, users don’t need to outbid each other for priority. The base fee,determined by the transaction’s byte size,is usually sufficient to get confirmed in the next block or two.

Litecoin also benefits from adopting technologies like Segregated Witness (SegWit) relatively early. SegWit separates transaction signature data from the main transaction data, effectively increasing the number of transactions that fit into each block. This upgrade further boosted Litecoin’s effective throughput without requiring changes to the block size limit itself.

The Role of Network Demand in Fee Pricing

Network demand is the invisible hand that shapes transaction fees across all proof-of-work cryptocurrencies.

When demand for block space exceeds available supply, users face a choice: wait potentially hours (or days) for their low-fee transaction to clear, or pay a premium to jump the queue. During Bitcoin’s most congested periods, this fee market becomes intensely competitive. Users routinely pay $20, $50, or even more to ensure their transactions confirm within a reasonable timeframe.

Litecoin’s network, by design, is more resistant to this kind of fee spiral. Because blocks are generated four times faster and the network generally operates below capacity, there’s less sustained pressure on fees even when demand increases. A temporary surge in Litecoin transactions might raise fees from three cents to ten cents,still a bargain compared to Bitcoin’s typical rates.

This dynamic also affects how users interact with each network. Bitcoin users often need to monitor network conditions, use fee estimation tools, and make strategic decisions about timing their transactions. Litecoin users can generally send transactions without much thought,the fees are predictable and low enough that optimization isn’t necessary for most use cases.

It’s also worth noting that Bitcoin’s higher profile attracts more speculative trading activity, which drives additional transaction volume during market volatility. When Bitcoin’s price is moving rapidly, exchanges and traders flood the network with transactions, pushing fees higher. Litecoin experiences similar patterns but at a smaller scale, which helps maintain its fee advantage.

When Litecoin’s Cost Benefits Matter Most

Litecoin’s fee structure isn’t just cheaper in the abstract,it enables specific use cases that would be impractical or impossible with Bitcoin’s higher costs.

Micropayments represent one of the clearest applications. If you want to send $5 to someone, paying a $10 Bitcoin fee obviously doesn’t make sense. Even a $2 fee would eat up 40% of the transaction value. Litecoin’s sub-dollar fees make these small transactions economically viable, opening the door for tipping content creators, paying for digital goods, or splitting bills with friends.

Frequent transactions benefit enormously from Litecoin’s cost structure. Someone making daily or weekly cryptocurrency payments would quickly rack up hundreds of dollars in Bitcoin fees over a year. With Litecoin, that same transaction volume might cost just a few dollars total. This makes Litecoin more practical for regular commerce and recurring payments.

International transfers are another sweet spot. Traditional remittance services often charge 5-10% or more for international money transfers, with processing times measured in days. Litecoin offers a faster, cheaper alternative,transactions settle in minutes and cost pennies, regardless of the amount being sent or the recipient’s location.

Merchant payments also favor Litecoin’s speed and low costs. Merchants accepting cryptocurrency need relatively quick settlement to manage their cash flow and reduce exposure to price volatility. Litecoin’s 2.5-minute confirmations provide a reasonable balance between security and speed, while the low fees don’t significantly cut into profit margins on smaller purchases.

For any scenario where you need to move cryptocurrency multiple times,converting between wallets, consolidating funds, or testing systems,Litecoin’s economics are simply more forgiving than Bitcoin’s.

Trade-Offs to Consider

While Litecoin’s fee and speed advantages are real, they don’t come without compromises.

Network security is arguably the biggest trade-off. Bitcoin’s massive mining network,powered by specialized hardware consuming enormous amounts of electricity,makes it extraordinarily difficult to attack. Litecoin uses a different mining algorithm (Scrypt instead of SHA-256), which initially made it more resistant to ASIC mining, but its total hash rate and miner participation remain significantly lower than Bitcoin’s. For users storing substantial value long-term, Bitcoin’s superior security may outweigh Litecoin’s transaction benefits.

Liquidity and adoption favor Bitcoin heavily. Bitcoin is accepted by more merchants, supported by more exchanges, and integrated into more financial products than Litecoin. It’s easier to buy Bitcoin with traditional currency, easier to spend it, and easier to convert it back to fiat. This network effect makes Bitcoin more practical for many users even though its higher fees.

Price stability,or rather, the lack of it,affects both cryptocurrencies, but Bitcoin’s larger market cap and deeper liquidity generally result in slightly less volatility. For merchants or users concerned about price swings, Bitcoin’s relative stability might be worth the extra transaction cost.

Brand recognition also matters in a space where trust and adoption drive value. Bitcoin is synonymous with cryptocurrency in the public consciousness. Litecoin, while respected in crypto circles, doesn’t carry the same weight with mainstream audiences or institutional investors.

Finally, Bitcoin’s perceived status as “digital gold” gives it a different value proposition than Litecoin’s “digital silver” positioning. If you’re primarily interested in a store of value or long-term investment, Bitcoin’s slower, more expensive transactions may be acceptable since you’re not planning to move the funds frequently anyway.

Conclusion

Litecoin’s design deliberately prioritized transaction speed and cost efficiency, and the results speak for themselves. With fees typically 100 times lower than Bitcoin’s and confirmation times four times faster, Litecoin offers a compelling alternative for users who need to move cryptocurrency frequently or in small amounts.

These advantages stem from specific technical choices,shorter block times, higher throughput capacity, and generally lower network congestion. They’re not marketing claims but measurable differences that affect real-world use. For micropayments, everyday transactions, or situations where minimizing fees matters, Litecoin simply makes more economic sense.

That said, cheaper and faster doesn’t automatically mean better for every purpose. Bitcoin’s higher fees come with stronger network security, broader adoption, and deeper liquidity. The choice between them depends on what you’re trying to accomplish. Moving $10,000 once a year for long-term storage? Bitcoin’s security and recognition might justify the higher fee. Making regular small payments or experimenting with cryptocurrency? Litecoin’s economics are hard to beat.

Understanding these trade-offs helps users make informed decisions rather than defaulting to the most recognized name. Both cryptocurrencies have earned their place in the ecosystem by serving different needs effectively.

Frequently Asked Questions

Why are Litecoin fees so much cheaper than Bitcoin fees?

Litecoin fees are cheaper due to faster block generation (2.5 minutes vs. 10 minutes), higher transaction throughput, and lower network congestion. These design choices create less competition for block space, keeping average fees around $0.03–$0.04 compared to Bitcoin’s $7.60.

How long does it take for a Litecoin transaction to confirm?

Litecoin transactions receive their first confirmation in approximately 2.5 minutes, with full settlement often completed in under 10 minutes. This is four times faster than Bitcoin’s 10-minute average confirmation time.

Is Litecoin better than Bitcoin for sending small amounts?

Yes, Litecoin is more practical for micropayments and small transactions. Sending $10 on Litecoin costs just a few cents, while Bitcoin fees could exceed the transaction value itself, making small transfers economically unviable.

Can Litecoin handle the same transaction volume as Bitcoin?

Litecoin processes approximately 12–28 transactions per second compared to Bitcoin’s 3–7, thanks to faster block times and SegWit adoption. While neither matches traditional payment processors, Litecoin’s higher capacity helps maintain lower fees.

What is the main trade-off when using Litecoin instead of Bitcoin?

The primary trade-off is network security and adoption. Bitcoin has significantly higher hash rate, broader merchant acceptance, and deeper liquidity. While Litecoin offers cheaper and faster transactions, Bitcoin provides stronger security for storing large amounts long-term.

Do cryptocurrency transaction fees depend on the amount being sent?

No, both Litecoin and Bitcoin fees are based on transaction size in bytes, not the dollar amount transferred. Sending $10 or $10,000 costs the same if the transaction data size is identical, which makes low fees especially valuable for smaller payments.