Cryptocurrency has steadily moved from niche investment asset to mainstream payment method, and more retailers are embracing digital currencies for everyday purchases. The promise of lower fees, faster cross-border transactions, and greater financial autonomy makes crypto an attractive option for online shoppers. Yet, the same features that make cryptocurrency appealing, irreversibility, pseudonymity, and decentralisation, also introduce risks that traditional payment methods don’t carry. Without chargebacks or widespread regulatory protections, a single mistake can cost shoppers dearly.

Learning how to use crypto for online shopping safely isn’t just about understanding blockchain technology, it’s about knowing which platforms to trust, how to secure digital wallets, and what precautions to take before hitting ‘pay’. Whether someone is buying electronics with Bitcoin or subscribing to services using stablecoins, a disciplined approach to security and due diligence is essential. This guide walks through the practical steps shoppers need to protect their funds, verify merchants, and navigate the evolving landscape of cryptocurrency commerce with confidence.

Key Takeaways

- Learning how to use crypto for online shopping safely requires understanding secure wallet management, merchant verification, and proper transaction protocols before making any purchase.

- Always double-check wallet addresses character by character before sending cryptocurrency, as blockchain transactions are irreversible and cannot be recovered if sent to the wrong recipient.

- Crypto payment processors like BitPay and Coinbase Commerce offer greater consumer protection and dispute resolution compared to direct wallet-to-wallet payments, making them safer for unfamiliar merchants.

- Keep only small amounts needed for immediate purchases in hot wallets, whilst storing larger cryptocurrency holdings in offline cold wallets to minimise security risks.

- Enable two-factor authentication and securely back up your seed phrase in a physical location, as anyone with access to your private keys can permanently control your funds.

- Verify merchant legitimacy through independent reviews, FCA registration checks, and official company records before using crypto for online shopping, especially with newer or unknown retailers.

Understanding Cryptocurrency Payment Options

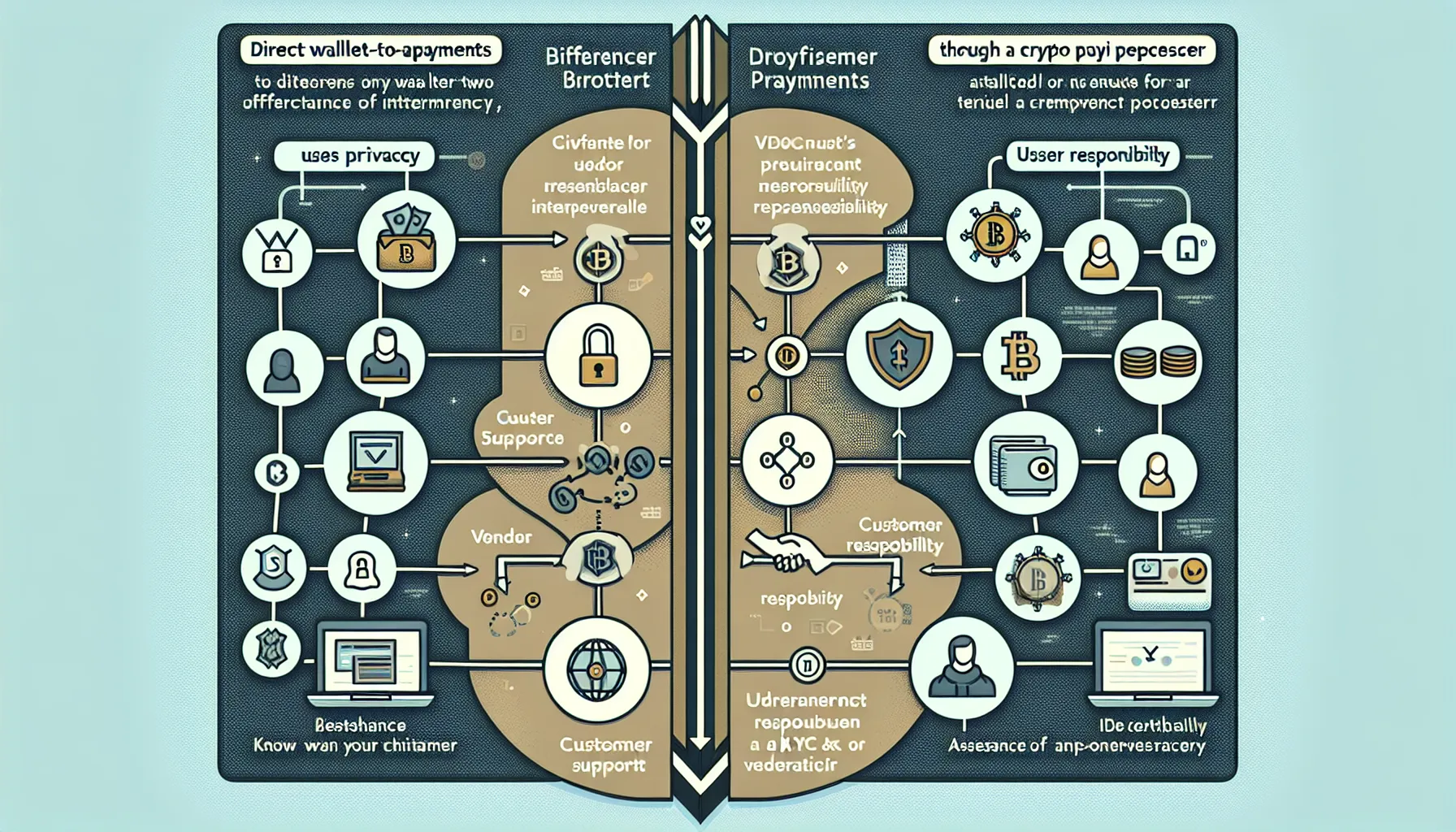

When paying with crypto online, shoppers typically encounter two primary methods: direct wallet-to-wallet payments and transactions facilitated by crypto payment processors. Each approach has distinct characteristics that affect security, convenience, and user experience.

Direct payments involve transferring cryptocurrency straight from a personal wallet to the merchant’s wallet address. This method offers maximum privacy and eliminates intermediaries, but it also places full responsibility on the shopper. There’s no customer support to call if the address is wrong, and refunds depend entirely on the merchant’s willingness to send funds back. For those comfortable managing their own wallets and confident in the merchant’s legitimacy, direct payments can be straightforward and efficient.

Crypto payment processors such as BitPay, Coinbase Commerce, and others serve as intermediaries that simplify the transaction process. These platforms often convert cryptocurrency into fiat currency on behalf of merchants, reducing volatility risk and making crypto acceptance easier for retailers. For shoppers, payment processors typically offer more user-friendly interfaces, customer support, and in some cases, dispute resolution mechanisms. But, they may require Know Your Customer (KYC) verification, which reduces anonymity, and sometimes charge additional processing fees.

Popular Cryptocurrencies Accepted by Retailers

Not all digital currencies enjoy equal acceptance among online merchants. Bitcoin (BTC) remains the most widely recognised and accepted cryptocurrency, largely due to its first-mover advantage and brand recognition. Ethereum (ETH) follows closely behind, supported by its robust smart contract capabilities and extensive developer ecosystem. Litecoin (LTC) appeals to some merchants because of its faster transaction times and lower fees compared to Bitcoin.

Stablecoins have gained significant traction in recent years, particularly USDT (Tether) and USDC (USD Coin). These assets are pegged to fiat currencies, typically the US dollar, which eliminates the price volatility that makes other cryptocurrencies less practical for everyday purchases. For shoppers and merchants alike, stablecoins offer the technological benefits of blockchain without the anxiety of watching values fluctuate between checkout and confirmation.

Some retailers accept a broader range of altcoins, but acceptance varies widely. Shoppers should always verify which currencies a particular merchant supports before attempting a purchase, as sending an unsupported cryptocurrency can result in permanent loss of funds.

Direct Payments vs Crypto Payment Processors

Choosing between direct payments and payment processors involves weighing privacy, security, ease of use, and recourse options. Direct payments provide greater privacy since transactions occur peer-to-peer without third-party data collection. But, this privacy comes with increased risk, users bear sole responsibility for security, and mistakes such as copying an incorrect address cannot be reversed. Refunds and dispute resolution are difficult, relying entirely on merchant cooperation.

Crypto payment processors enhance security through provider safeguards, including fraud detection, secure checkout pages, and sometimes insurance against certain losses. The user experience is markedly simpler, with clear instructions, QR codes, and customer support available if issues arise. Many processors help refunds and disputes, offering a layer of protection closer to traditional payment methods. The trade-off is reduced privacy, as KYC requirements may link transactions to real-world identities, and additional fees can increase the overall cost.

For regular online shopping, especially with unfamiliar merchants, payment processors generally offer a better balance of security and convenience. Direct payments suit experienced users dealing with trusted merchants where privacy is paramount and the technical demands are manageable.

Choosing Secure Platforms and Merchants

The decentralised and pseudonymous nature of cryptocurrency creates opportunities for fraudulent merchants and fake platforms. Unlike traditional e-commerce where credit card companies and banks provide fraud protection, crypto shoppers must perform their own due diligence before parting with funds. Selecting secure platforms and verifying merchant legitimacy are critical first steps in safe crypto shopping.

Shoppers should prioritise platforms that demonstrate clear commitment to security and regulatory compliance. Look for encryption (HTTPS) across the entire site, two-factor authentication (2FA) for accounts, and transparent privacy policies that explain how personal and transaction data are handled. Merchants operating legally should comply with local regulations and, in the UK, crypto service providers should be registered with the Financial Conduct Authority (FCA). Checking the FCA register can confirm whether a platform or payment processor is authorised to operate.

Established brands with physical locations, clear contact information, and a history of positive customer experiences are generally safer choices. Newer or unknown merchants require extra scrutiny. Shoppers should be cautious of deals that seem too good to be true, as these are common bait for scams.

Verifying Merchant Legitimacy

Before making a crypto payment, shoppers should investigate the merchant’s background and reputation. Established businesses typically have verifiable registration details, including company numbers, registered addresses, and contact information that can be independently confirmed. A quick search for the company on official registers or business directories can reveal whether the entity exists and operates legitimately.

Customer reviews provide valuable insight, but they must be approached critically. Genuine reviews appear on independent platforms such as Trustpilot, Google Reviews, or industry-specific forums, and they include both positive and negative feedback with specific details. Fake review sites or suspiciously uniform five-star ratings are red flags. Shoppers should look for patterns, multiple reviews mentioning the same issues or praising the same features are more credible than generic statements.

Another warning sign is pressure to act quickly. Scammers create artificial urgency to prevent careful consideration. Legitimate merchants don’t rush customers or insist on immediate payment. If a site lacks clear contact details, has poorly written content, or operates solely through social media accounts, it’s best to walk away.

Phishing attempts are common in the crypto space. Shoppers should type URLs directly into browsers rather than clicking links in emails or messages, and they should verify that the website address matches exactly, watching for subtle misspellings or extra characters that indicate fake sites.

Recognising Trusted Payment Gateways

Payment gateways serve as the checkout interface between shoppers and merchants, and their trustworthiness directly affects transaction security. Reputable gateways are often endorsed by major cryptocurrency exchanges or have established industry reputations. Well-known names such as BitPay, Coinbase Commerce, and CoinGate have track records and transparent operations that inspire confidence.

When evaluating a payment gateway, shoppers should confirm the connection is secure by checking for HTTPS and a padlock icon in the browser address bar. The gateway should provide official contact details, clear terms of service, and information about the company behind it. Legitimate gateways typically offer customer support and publish security practices.

Cross-referencing the gateway with merchant registration can also help. If a merchant claims to use a particular payment processor, visiting the processor’s official website and searching their merchant directory (if available) can confirm the relationship. Discrepancies or inability to verify the gateway’s authenticity should prompt shoppers to reconsider the purchase.

Setting Up a Secure Crypto Wallet

A crypto wallet is the gateway to digital assets, and its security directly determines the safety of online shopping transactions. Wallets come in various forms, each offering different balances between convenience and security. Choosing the right wallet and configuring it properly are foundational steps in protecting funds.

Reputable wallet providers should be the starting point. Well-established software wallets such as Exodus, Electrum, or official wallets from major exchanges have been vetted by large user bases and security researchers. Hardware wallets from manufacturers such as Ledger or Trezor provide additional security for larger holdings. Shoppers should download wallets only from official websites or app stores, as fake wallet apps are a common attack vector.

Encryption and strong passwords are non-negotiable. Wallets should be protected with complex, unique passwords that aren’t reused elsewhere. Many wallets offer additional encryption for stored data, which should be enabled. Password managers can help generate and store secure credentials without the risk of forgetting them.

Hot Wallets vs Cold Wallets for Shopping

Hot wallets are connected to the internet and include software wallets on computers or mobile devices, as well as wallets provided by exchanges. Their constant connectivity makes them convenient for online shopping, funds are readily accessible, transactions are quick, and integration with payment processors is usually seamless. But, this convenience comes at the cost of increased vulnerability. Hot wallets are exposed to malware, phishing attacks, and exchange hacks.

For day-to-day spending and online shopping, hot wallets are practical. Shoppers should keep only the amounts needed for near-term purchases in hot wallets, treating them like the cash carried in a physical wallet, enough for transactions but not life savings.

Cold wallets, which remain offline, include hardware devices and paper wallets. They provide superior security because they’re isolated from internet-based threats. Hardware wallets store private keys on dedicated devices that never expose those keys to connected computers, even when signing transactions. Cold wallets are ideal for storing larger amounts of cryptocurrency that aren’t needed frequently.

A sensible approach combines both: use a cold wallet to securely store the bulk of holdings, and transfer smaller amounts to a hot wallet as needed for shopping. This strategy minimises risk exposure while maintaining the convenience necessary for everyday transactions.

Essential Security Features to Enable

Two-factor authentication (2FA) adds a critical layer of protection. Even if a password is compromised, 2FA requires a second verification step, typically a code from an authentication app such as Google Authenticator or Authy. Shoppers should enable 2FA on wallets, exchanges, and any accounts associated with crypto holdings. SMS-based 2FA is better than nothing but less secure than app-based methods due to SIM-swapping attacks.

Backup and recovery mechanisms must be configured immediately after wallet creation. Most wallets generate a seed phrase, a series of 12 to 24 words that can restore access if the device is lost or damaged. This seed phrase should be written down (never stored digitally or photographed) and kept in a secure, private location. Anyone with access to the seed phrase can control the funds, so treating it like a key to a safe is essential.

Regular software updates protect against newly discovered vulnerabilities. Wallet and exchange apps should be kept current, as updates often include security patches. Shoppers should enable automatic updates where possible or check manually on a regular schedule.

Finally, shoppers should be cautious about wallet permissions and integrations. Connecting wallets to unfamiliar websites or signing transactions without fully understanding them can expose funds to theft through malicious smart contracts or scams.

Best Practices for Safe Crypto Transactions

Even with secure wallets and verified merchants, safe crypto transactions require careful attention to detail during the payment process itself. Small errors or overlooked steps can lead to permanent loss of funds, so disciplined habits are essential.

One of the most fundamental practices is double-checking recipient wallet addresses before confirming any transaction. Cryptocurrency addresses are long strings of alphanumeric characters, and even a single incorrect character sends funds to the wrong destination, irreversibly. Malware exists that alters copied addresses in clipboards, so shoppers should verify addresses character by character, or better yet, scan QR codes provided by merchants to reduce manual entry errors.

Shoppers should only share their public wallet address when receiving payments. Private keys or seed phrases must never be entered on merchant websites or shared with anyone. Legitimate merchants and payment processors will never ask for private keys.

Keeping wallet and exchange apps updated, as mentioned previously, reduces vulnerability to exploits. Outdated software can contain security flaws that attackers actively exploit, so staying current is a simple but effective safeguard.

It’s also wise to start with small test transactions when dealing with a new merchant or platform, especially for larger purchases. Sending a small amount first to confirm the address is correct and the merchant processes it properly can prevent costly mistakes.

Double-Checking Payment Addresses

The irreversible nature of blockchain transactions makes address verification the single most important step before sending funds. Address poisoning attacks, where scammers send tiny amounts from addresses that look similar to legitimate ones in transaction history, can trick users into copying the wrong address. Shoppers should always obtain addresses directly from the merchant’s official checkout page or invoice, never from email or chat unless independently verified.

Many wallets and payment systems now include address whitelisting, allowing users to save and label trusted addresses. Using this feature reduces the risk of error on repeat purchases and provides a quick reference for verified recipients.

QR codes, when scanned from the merchant’s official site, offer a safer alternative to manual copy-paste. But, shoppers must still confirm they’re scanning codes from legitimate sources, as phishing sites can display fraudulent QR codes.

Understanding Transaction Fees and Timing

Cryptocurrency transaction fees vary significantly depending on the currency used and current network congestion. Bitcoin and Ethereum, the two most popular cryptocurrencies, often experience high fees during periods of heavy network usage. Shoppers can sometimes adjust fee levels when sending transactions, higher fees result in faster confirmation, while lower fees may delay processing.

Payment processors typically calculate and display total costs, including any network fees and their own service charges, before the transaction is finalised. Shoppers should review these carefully to avoid surprises. Some processors absorb network fees, while others pass them directly to the customer.

Confirmation times also vary. Bitcoin transactions generally require several minutes to over an hour for full confirmation, depending on network activity and fee paid. Ethereum can be faster but is similarly variable. Stablecoins and altcoins built on faster blockchains may confirm in seconds. Payment processors usually provide estimated confirmation times, and many merchants wait for at least one or more confirmations before considering payment complete and processing orders.

Shoppers should account for these timing considerations, especially when purchasing time-sensitive goods or services. Starting the payment process with sufficient lead time prevents frustration and ensures transactions are confirmed before deadlines.

Protecting Your Privacy When Shopping

Cryptocurrency offers varying degrees of privacy depending on how it’s used. Bitcoin and most major cryptocurrencies are pseudonymous rather than anonymous, transactions are recorded on public blockchains, and with sufficient effort, they can often be traced to real-world identities, particularly if linked to KYC-verified exchange accounts.

Shoppers who prioritise privacy can take several steps to reduce their digital footprint. Privacy-focused cryptocurrencies such as Monero or Zcash use advanced cryptographic techniques to obscure transaction details, though they’re accepted by fewer merchants. For more common currencies, using mixers or tumblers can obscure transaction trails, although these services introduce their own risks and may violate terms of service with some platforms.

Avoiding oversharing personal information on merchant websites is equally important. Even with crypto’s pseudonymity, linking purchases to physical addresses, phone numbers, and email accounts creates data trails. Shoppers should provide only the information necessary to complete transactions and receive goods. Using dedicated email addresses or privacy-focused services for crypto shopping can compartmentalise data exposure.

VPN usage adds another layer of privacy by masking IP addresses and geographic locations. This prevents merchants and third parties from easily correlating transactions with physical locations or internet service providers. But, VPNs should be from reputable providers that don’t log user activity.

Shoppers should also be mindful of browser tracking and cookies. Using privacy-focused browsers or browser extensions that block trackers can limit the amount of data collected during shopping sessions. Clearing cookies regularly and avoiding persistent logins to merchant accounts further reduces tracking.

Eventually, privacy in crypto shopping is about layers, no single measure provides complete anonymity, but combining several practices significantly reduces exposure. Shoppers must weigh their privacy priorities against the practicality and availability of privacy-enhancing methods.

What to Do If Something Goes Wrong

Even though best precautions, things can still go wrong when shopping with cryptocurrency. The decentralised nature of digital currencies means traditional consumer protections often don’t apply, and recourse is limited compared to credit card or bank transfers. But, shoppers aren’t entirely without options when facing problems.

If a shopper suspects they’ve fallen victim to a scam or has lost funds to fraud, immediate action is important. In the UK, victims should contact the police through Action Fraud, the national reporting centre for fraud and cybercrime. Reporting to local police can also be appropriate depending on circumstances. While law enforcement recovery of cryptocurrency is difficult, reports contribute to broader investigations and intelligence about scam operations.

The Financial Conduct Authority should also be notified if the incident involves a UK-registered crypto firm or payment processor. The FCA maintains lists of unauthorised firms and scams, and reporting helps protect others from similar schemes.

If funds were moved through an exchange or payment processor, contacting their support teams promptly can sometimes help. Whilst these platforms cannot reverse blockchain transactions, they may be able to freeze accounts involved in fraud, assist with investigations, or provide transaction records useful for reports and potential legal action.

Preserving all evidence is crucial. Screenshots of websites, wallet addresses, transaction IDs, email correspondence, and any other documentation should be saved immediately. Websites can disappear quickly, and having detailed records strengthens any reports or claims.

Shoppers should also inform their banks if fraudsters obtained any traditional financial information during the scam. Though crypto transactions themselves don’t involve banks, associated phishing or identity theft might put other accounts at risk.

Handling Disputed or Failed Transactions

Transaction disputes in cryptocurrency are fundamentally more challenging than with traditional payments. Direct crypto payments are irreversible by design, once confirmed on the blockchain, they cannot be undone by any party. Refunds depend entirely on the merchant’s willingness and ability to send funds back, and there’s no equivalent to credit card chargebacks.

If a transaction fails to confirm or appears stuck, shoppers should first check the transaction status using a blockchain explorer. These tools allow anyone to search transaction IDs and see confirmation status, fees paid, and other details. Sometimes transactions remain pending due to low fees: in such cases, some wallets offer options to increase fees or cancel transactions before confirmation.

When merchants don’t deliver goods or services after payment confirmation, shoppers should document the issue and contact the merchant directly with clear evidence of payment (transaction ID, screenshots, order details). Polite but firm communication often resolves honest misunderstandings.

If the merchant is unresponsive or refuses to resolve the issue, shoppers have limited recourse. Payment processors sometimes offer dispute mechanisms or buyer protection programmes, shoppers should review the processor’s terms and contact their support. But, these protections vary widely and aren’t guaranteed.

Public reviews and complaints on consumer platforms can sometimes motivate merchants to resolve issues to protect their reputations, but this approach should be factual and measured. Legal action is possible for larger amounts, though recovering crypto through courts is complex and often impractical for smaller purchases.

The lack of robust consumer protection underscores why merchant verification and platform security matter so much in crypto shopping. Prevention through due diligence is far more effective than attempting to recover funds after problems arise.

Conclusion

Using cryptocurrency for online shopping opens up new possibilities for digital commerce, but it demands a higher level of personal responsibility than traditional payment methods. The benefits, privacy, lower fees for cross-border purchases, and financial autonomy, come with the trade-off of limited regulatory protection and irreversible transactions. Every step, from selecting a wallet to clicking ‘confirm payment’, requires careful attention and well-informed choice-making.

Successful crypto shopping isn’t about mastering complex technology, it’s about consistent adherence to security fundamentals. Shoppers who verify merchant legitimacy, use secure wallets with proper backups and 2FA, double-check payment addresses, and remain cautious about sharing personal information can enjoy crypto’s advantages whilst minimising risks. Starting with small transactions, using reputable payment processors for unfamiliar merchants, and keeping the bulk of holdings in cold storage further reduce exposure.

The regulatory landscape around cryptocurrency continues to evolve, and future developments may bring more consumer protections and standardised security practices. Until then, shoppers must exercise vigilance at every stage. The irreversibility of blockchain transactions means mistakes are costly, but they’re also largely preventable through disciplined habits and healthy scepticism.

As more merchants embrace cryptocurrency and payment infrastructure matures, the shopping experience will likely become smoother and safer. For now, those willing to take the extra precautions can participate in this emerging payment ecosystem with confidence, knowing that informed caution is the best defence in a space where traditional safety nets don’t yet exist.

Frequently Asked Questions

How can I use crypto for online shopping safely?

Use secure wallets with two-factor authentication, verify merchant legitimacy through reviews and official registries, double-check payment addresses before sending funds, and start with small test transactions when dealing with new merchants to minimise risk.

What is the difference between hot wallets and cold wallets for crypto shopping?

Hot wallets are internet-connected and convenient for shopping but more vulnerable to attacks. Cold wallets remain offline, offering superior security for storing larger amounts. Keep shopping funds in hot wallets and savings in cold storage.

Can I get a refund if something goes wrong with my crypto purchase?

Cryptocurrency transactions are irreversible, so refunds depend entirely on merchant cooperation. Unlike credit cards, there are no chargebacks. Some payment processors offer limited dispute mechanisms, but prevention through merchant verification is essential.

Which cryptocurrencies are most widely accepted by online retailers?

Bitcoin remains the most widely accepted, followed by Ethereum. Stablecoins like USDT and USDC are increasingly popular because they eliminate price volatility. Litecoin is also accepted by some merchants for faster, lower-cost transactions.

Are crypto payment processors safer than direct wallet-to-wallet payments?

Payment processors generally offer better security for regular shoppers, providing fraud detection, customer support, and sometimes dispute resolution. Direct payments offer more privacy but place full responsibility on the user with no recourse for errors.

Do I need to pay tax on purchases made with cryptocurrency?

In most jurisdictions, including the UK, spending cryptocurrency is a taxable event. You may owe capital gains tax on any increase in value from when you acquired the crypto to when you spent it, requiring accurate record-keeping.