Cryptocurrency trading has revolutionised how you handle digital assets but with great financial freedom comes the need for enhanced security. Your crypto transactions can expose sensitive information to hackers cybercriminals and even government surveillance making privacy protection crucial for safe trading.

A Virtual Private Network (VPN) creates an encrypted tunnel between your device and the internet masking your real IP address and location whilst securing your connection. This powerful tool has become essential for crypto enthusiasts who want to protect their trading activities from prying eyes and potential security threats.

Whether you’re concerned about personal privacy regulatory restrictions or simply want to add an extra layer of security to your digital wallet activities using a VPN properly can significantly enhance your cryptocurrency experience. Understanding the right approach ensures you’ll trade with confidence whilst maintaining your anonymity online.

Why Use a VPN for Crypto Transactions

VPN technology addresses multiple vulnerabilities in cryptocurrency trading whilst providing essential safeguards for your digital assets. Your crypto activities gain substantial protection when you implement VPN encryption protocols during transactions.

Privacy Protection

Privacy protection becomes paramount when conducting crypto transactions as blockchain networks record every movement permanently. Your IP address links directly to wallet addresses when you trade without VPN protection, creating a traceable digital fingerprint for cybercriminals and surveillance entities.

VPN services mask your real IP address by routing traffic through encrypted servers located in different countries. This process breaks the connection between your identity and wallet addresses, preventing third parties from tracking your trading patterns or wallet holdings.

Financial institutions and government agencies can’t monitor your crypto activities when you use VPN encryption. Your internet service provider sees only encrypted data packets travelling to VPN servers rather than specific cryptocurrency exchanges or wallet applications.

Personal information remains private during Know Your Customer (KYC) verification processes when VPN protection encrypts your data transmission. Identity theft risks decrease significantly as hackers can’t intercept sensitive documents or personal details during exchange registration procedures.

Security Enhancement

Security enhancement through VPN technology protects your crypto assets from sophisticated cyber attacks targeting digital currency users. Man-in-the-middle attacks become ineffective when VPN encryption scrambles data packets between your device and cryptocurrency platforms.

Public Wi-Fi networks pose substantial risks to crypto traders as these connections lack encryption protocols. VPN protection creates secure tunnels through unsecured networks, preventing hackers from intercepting login credentials or private keys during transactions.

Banking-grade encryption standards protect your cryptocurrency wallet access when VPN services implement AES-256 protocols. These encryption methods require billions of years for modern computers to crack, ensuring your private keys remain secure during online activities.

Phishing attacks targeting crypto users become less effective when VPN services include malware protection features. DNS filtering blocks access to fraudulent websites mimicking legitimate exchanges, preventing credential theft and wallet compromise.

Bypassing Geographical Restrictions

Bypassing geographical restrictions enables access to cryptocurrency exchanges unavailable in your region, expanding trading opportunities and market access. Many countries restrict or ban specific crypto platforms, limiting your ability to diversify investments or access certain digital assets.

Cryptocurrency regulations vary significantly between countries, with some nations prohibiting specific coins or trading activities entirely. VPN technology allows you to connect through servers in crypto-friendly jurisdictions, accessing restricted platforms whilst maintaining legal compliance in your home country.

Exchange arbitrage opportunities increase when you can access multiple international platforms simultaneously. Price differences between regional markets create profit potential that geographical restrictions would otherwise prevent you from exploiting.

DeFi protocols and yield farming platforms often restrict access based on IP geolocation to comply with local regulations. VPN connections through permitted countries enable participation in lucrative decentralised finance opportunities that geographic limitations would block.

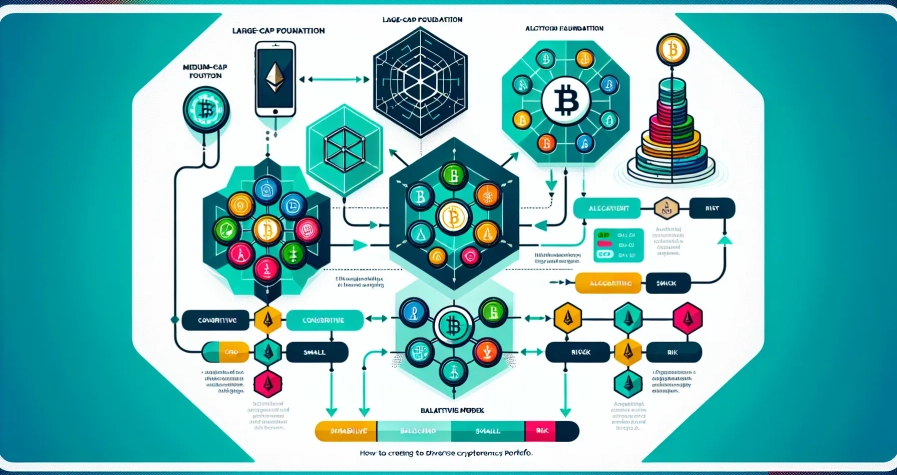

Choosing the Right VPN for Cryptocurrency

Selecting an appropriate VPN for cryptocurrency transactions requires evaluating specific criteria that directly impact your trading security and performance. The choice you make affects your ability to protect sensitive wallet information whilst maintaining optimal trading speeds across multiple exchanges.

Key Features to Look For

No-logs policy forms the foundation of VPN selection for cryptocurrency users. Your VPN provider must maintain a strict no-logs policy to ensure trading activities remain anonymous and untraceable by authorities or third parties. This policy prevents the storage of connection timestamps, IP addresses, and browsing data.

High-speed connections with low latency enable active trading without interruptions or delays. Cryptocurrency markets operate 24/7 with rapid price fluctuations, making connection speed critical for executing timely trades. Look for VPN providers offering unlimited bandwidth and servers optimised for trading platforms.

Strong encryption protocols such as AES-256 protect your transaction data from interception during transmission. This military-grade encryption standard secures wallet access credentials, trading commands, and personal information from cybercriminals monitoring network traffic.

Kill switch functionality blocks all internet traffic automatically when your VPN connection drops unexpectedly. This feature prevents IP address leaks that could expose your real location and trading activities to exchanges or malicious actors monitoring your connection.

Wide server network coverage across multiple countries provides access to cryptocurrency exchanges operating in different jurisdictions. Choose providers offering servers in regions where major exchanges like Binance, Coinbase Pro, and Kraken operate without restrictions.

Multi-device compatibility supports simultaneous connections across Windows, macOS, Android, iOS, and router configurations. This feature allows you to secure trading activities on desktop platforms whilst monitoring portfolio performance on mobile devices.

Cryptocurrency payment acceptance enhances privacy by allowing subscription payments through Bitcoin, Ethereum, or USDT. Providers accepting crypto payments demonstrate commitment to user anonymity and understand the privacy requirements of cryptocurrency traders.

Recommended VPN Protocols

WireGuard protocol delivers optimal performance for cryptocurrency trading through lightweight code architecture and fast connection speeds. This modern protocol maintains strong security whilst reducing latency, making it ideal for high-frequency trading and real-time market monitoring.

OpenVPN protocol provides reliable encryption and stability across different operating systems, particularly excelling on Windows platforms. The protocol’s proven track record and open-source nature ensure transparency and continuous security improvements from the global development community.

Both protocols offer superior encryption strength compared to legacy options like PPTP or L2TP, ensuring your cryptocurrency transactions remain protected against sophisticated attack vectors. WireGuard typically provides faster connection speeds, whilst OpenVPN offers broader compatibility across older systems and network configurations.

Choose VPN providers supporting both protocols to maximise flexibility based on your specific trading requirements and device capabilities. Leading providers like NordVPN combine these protocols with dedicated IP options, reducing the risk of exchange blocking whilst maintaining anonymity for your cryptocurrency trading activities.

Setting Up Your VPN for Crypto Trading

Setting up your VPN properly ensures maximum security and performance for your cryptocurrency transactions. The configuration process involves two critical phases that directly impact your trading safety and access to global exchanges.

Installation and Configuration

Download the VPN application from your chosen provider’s official website or authorised app store for your specific device. Most reputable VPN services support Windows, macOS, Linux, Android, and iOS platforms with dedicated applications optimised for each operating system.

Install the application following the provider’s setup wizard and create your account credentials. Popular providers like NordVPN, ExpressVPN, ProtonVPN, and NymVPN offer streamlined installation processes with automatic configuration settings for optimal crypto trading security.

Configure essential privacy settings immediately after installation to prevent data leaks during transactions. Enable the kill switch feature in your VPN client to automatically disconnect your internet connection if the VPN drops unexpectedly. This prevents your real IP address from being exposed during active crypto trading sessions.

Disable WebRTC in your browser settings to prevent IP leaks through web-based applications. Navigate to your browser’s advanced settings and turn off WebRTC functionality, as this protocol can bypass VPN protection and reveal your actual location to cryptocurrency exchanges.

Activate DNS leak protection within your VPN application settings to ensure all DNS queries route through encrypted VPN servers. This prevents your internet service provider from monitoring which cryptocurrency websites you visit and protects your trading patterns from external surveillance.

Connecting to Optimal Servers

Select VPN servers located in countries where your preferred cryptocurrency exchanges operate without regulatory restrictions. Countries like Switzerland, the Netherlands, and certain US states offer favourable crypto trading environments with minimal platform limitations.

Avoid connecting to servers in regions with strict cryptocurrency bans, including China, Turkey, and other jurisdictions that actively block crypto-related services. These locations can trigger automatic account suspensions or trading restrictions on major exchanges.

Choose servers geographically closer to your exchange’s data centres to minimise latency and improve transaction speeds. Lower ping times ensure your buy and sell orders execute quickly during volatile market conditions, preventing potential losses from delayed trades.

Maintain connection stability by avoiding frequent server changes once you’ve established successful access to your crypto platforms. Consistent IP addresses reduce the likelihood of triggering security alerts or temporary account locks from exchange fraud detection systems.

Test your connection speed and stability before executing large cryptocurrency transactions. Run speed tests and verify your IP address appears correctly in your target jurisdiction using online IP checking tools to confirm your VPN setup functions properly.

Best Practices for VPN and Crypto Security

Maintaining robust VPN and crypto security requires consistent application of proven practices beyond basic setup. These fundamental approaches protect your digital assets whilst maximising the effectiveness of your VPN connection during cryptocurrency transactions.

Additional Security Measures

Password management forms the cornerstone of comprehensive crypto security. Create unique, complex passwords exceeding 12 characters for each cryptocurrency exchange, wallet and VPN account. Password managers like Bitwarden or 1Password generate and store these credentials securely, eliminating the risk of password reuse across multiple platforms.

Two-factor authentication (2FA) adds an essential security layer to your cryptocurrency accounts. Enable 2FA on exchanges, wallets and your VPN service using authenticator apps such as Google Authenticator or Authy rather than SMS-based verification. Hardware keys like YubiKey provide the highest level of 2FA protection for high-value trading accounts.

Device security updates maintain protection against emerging threats. Install operating system updates within 48 hours of release, particularly security patches that address cryptocurrency-related vulnerabilities. Keep your antivirus software current and perform weekly scans to detect potential malware targeting crypto wallets or trading applications.

VPN encryption standards determine the strength of your connection protection. Select VPN providers offering AES-256 encryption with secure protocols like OpenVPN or WireGuard. These protocols provide military-grade encryption that protects your trading data from interception during transmission to cryptocurrency exchanges.

Regular software maintenance ensures optimal VPN performance and security. Update your VPN application monthly to receive the latest security patches and feature improvements. Configure automatic updates where possible to maintain continuous protection without manual intervention.

Common Mistakes to Avoid

Free VPN services compromise cryptocurrency security through inadequate encryption and questionable privacy policies. These services often monetise user data, sell browsing information to third parties, and lack the infrastructure to support secure cryptocurrency trading. Premium VPN providers invest in robust security measures that protect your financial transactions.

Kill switch neglect exposes your real IP address during VPN disconnections. Configure the kill switch feature immediately after VPN installation to automatically block internet traffic when your VPN connection drops unexpectedly. This prevents cryptocurrency exchanges from detecting your actual location during trading sessions.

WebRTC vulnerabilities leak your real IP address despite active VPN connections. Disable WebRTC in Chrome (chrome://settings/content/all), Firefox (media.peerconnection.enabled = false) and other browsers before accessing cryptocurrency platforms. Browser extensions like WebRTC Leak Shield provide additional protection against IP disclosure.

Frequent server switching triggers security alerts on cryptocurrency exchanges. Maintain consistent server connections throughout your trading sessions to avoid automatic account restrictions. Choose servers in crypto-friendly jurisdictions like Switzerland, Singapore or the Netherlands for optimal regulatory compatibility.

Mobile device oversight leaves smartphones and tablets vulnerable during crypto transactions. Install VPN applications on all devices accessing cryptocurrency accounts, including mobile wallets and exchange apps. Configure automatic VPN activation when connecting to public Wi-Fi networks to maintain continuous protection.

Connection verification failures allow unprotected cryptocurrency trading. Test your VPN connection using IP leak detection tools like ipleak.net before accessing exchanges or wallets. Verify that your displayed location matches your selected VPN server and that no DNS or WebRTC leaks expose your real identity.

Legal Considerations and Compliance

Legal compliance forms a critical component when using VPNs for crypto transactions. Understanding regulations and tax obligations protects you from potential legal consequences whilst maintaining secure trading practices.

Understanding Local Regulations

Local regulations determine the legality of your crypto trading activities across different jurisdictions. Trading on sanctioned exchanges or using VPNs to evade regional restrictions related to sanctioned countries violates international law and can result in serious legal troubles.

UK cryptoasset businesses must register with the Financial Conduct Authority (FCA) and comply with comprehensive anti-money laundering (AML) regulations. These requirements ensure legitimate operations and protect against financial crime within the cryptocurrency ecosystem.

Key regulatory compliance areas include:

- Exchange access: Connecting to VPN servers in countries where your preferred crypto exchanges operate legally

- Sanctions compliance: Avoiding platforms or regions subject to international sanctions

- Licensing requirements: Ensuring service providers maintain proper FCA registration

- AML obligations: Following know-your-customer (KYC) procedures and reporting suspicious activities

Consider using dedicated IP addresses through your VPN to reduce exchange detection whilst maintaining compliance with platform terms of service. This approach balances privacy protection with regulatory adherence.

Tax Implications

HMRC doesn’t classify cryptoassets as money but treats crypto trading profits as taxable income. Corporation Tax or Capital Gains Tax applies depending on whether your activities constitute trading or asset disposal.

UK tax treatment includes:

| Tax Type | Application | Rate |

|---|---|---|

| Corporation Tax | Business trading activities | 19-25% |

| Capital Gains Tax | Asset disposal | 10-20% |

| VAT | Goods/services paid with crypto | Standard rates |

VAT applies to goods or services purchased with cryptocurrency but not to token transfers themselves. All income and gains from crypto transactions require accurate reporting to tax authorities to avoid penalties.

Use specialised crypto tax compliance tools to track your transactions across multiple exchanges and wallets. These services help calculate your tax obligations whilst maintaining records that satisfy HMRC requirements for cryptocurrency activities.

Report all crypto-related income regardless of the jurisdiction where you executed trades through your VPN connection. Tax evasion carries severe penalties including criminal prosecution for serious cases.

Troubleshooting Common VPN Issues

VPN connection problems can disrupt your crypto trading activities and compromise security protocols. Identifying and resolving these issues quickly ensures continuous protection for your cryptocurrency transactions.

Connection Problems

Network congestion and server overload frequently cause slow speeds or dropped connections during peak trading hours. Your VPN provider’s servers may experience high traffic volumes that affect connection stability and transaction processing speeds.

Incorrect VPN configuration or outdated software prevents successful connections to your preferred trading platforms. Crypto exchanges often implement advanced security measures that conflict with misconfigured VPN settings, resulting in access denials or authentication failures.

ISP throttling and restrictive firewall settings commonly block VPN traffic, particularly when your internet service provider detects encrypted connections. Router configurations may also interfere with VPN protocols, preventing secure access to cryptocurrency exchanges and wallet applications.

Common Connection Solutions:

- Verify your internet connection stability before initiating crypto trading sessions

- Switch to alternative VPN servers or protocols, changing from TCP to UDP or WireGuard for improved performance

- Update VPN client software and server configurations regularly to maintain compatibility with exchange security updates

- Review firewall and router settings to allow VPN traffic on required ports for crypto applications

- Clear browser cache and cookies that may store conflicting connection data from previous trading sessions

Performance Optimisation

Testing your internet speed without the VPN versus with the VPN active identifies specific performance bottlenecks affecting crypto trading. Speed reductions exceeding 50% indicate server congestion or suboptimal protocol selection for your trading requirements.

Choosing servers with lower load percentages and closer geographical proximity reduces latency during time-sensitive cryptocurrency transactions. High-frequency trading strategies require consistent connection speeds to capitalise on market opportunities and price fluctuations.

Switching to faster VPN protocols like WireGuard improves connection speeds whilst maintaining security standards. Consider adjusting encryption levels from AES-256 to AES-128 if security demands permit moderate protection for routine trading activities.

- Monitor server load statistics through your VPN provider’s application dashboard

- Close bandwidth-consuming applications including streaming services, file downloads, and automatic software updates

- Select VPN servers located in crypto-friendly jurisdictions with robust internet infrastructure

- Configure split tunnelling to route only crypto-related traffic through the VPN whilst maintaining direct connections for other applications

- Schedule large transactions during off-peak hours when server loads are typically lower

Conclusion

Using a VPN for crypto transactions isn’t just an optional security measure—it’s become essential for protecting your digital assets and personal information. The cryptocurrency landscape continues to evolve with increasing regulatory scrutiny and sophisticated cyber threats that target traders worldwide.

Your trading success depends on implementing comprehensive security practices that go beyond basic password protection. A quality VPN serves as your first line of defence whilst ensuring you can access global markets and maintain your privacy throughout every transaction.

Remember that technology alone won’t guarantee your security. You’ll need to stay informed about changing regulations combine your VPN usage with other security measures and regularly review your setup to address emerging threats in the crypto space.

Frequently Asked Questions

Why do I need a VPN for cryptocurrency trading?

A VPN encrypts your internet connection and masks your IP address, protecting your sensitive trading data from hackers and surveillance. This is crucial because cryptocurrency transactions are permanently recorded on blockchain networks, linking your IP to wallet addresses. VPNs prevent third parties from tracking your trading patterns and reduce risks of identity theft during KYC processes.

How does a VPN protect my crypto transactions?

VPNs use banking-grade encryption (AES-256) to secure your connection and prevent man-in-the-middle attacks, especially on public Wi-Fi. They hide your real IP address, making it impossible for cybercriminals to trace transactions back to you. Additionally, many VPNs include malware protection features that help defend against phishing attacks targeting crypto users.

Can I use a VPN to access restricted cryptocurrency exchanges?

Yes, VPNs allow you to bypass geographical restrictions by connecting to servers in different countries. This enables access to exchanges unavailable in your region and participation in DeFi protocols that may be geographically blocked. However, you must ensure compliance with local regulations and exchange terms of service to avoid legal issues.

What VPN features are essential for crypto trading?

Key features include a strict no-logs policy, high-speed connections for timely trades, strong AES-256 encryption, and a kill switch to prevent data exposure. Multi-device compatibility, wide server coverage, and cryptocurrency payment acceptance enhance privacy. Protocols like WireGuard and OpenVPN are recommended for optimal performance and reliability.

Are there legal risks when using VPNs for crypto trading?

Using VPNs to access sanctioned exchanges or evade regional restrictions can violate international law. You must comply with local regulations, tax obligations, and AML requirements. In the UK, crypto profits are subject to Capital Gains Tax, and all transactions must be accurately reported to HMRC to avoid penalties.

Should I use a free VPN for cryptocurrency trading?

No, free VPNs pose significant security risks including data logging, weak encryption, and potential malware. They often lack essential features like kill switches and may sell your data to third parties. For crypto trading, invest in a reputable paid VPN service with proven security credentials and transparent privacy policies.

How do I set up a VPN for crypto trading?

Download the VPN application from official sources and configure privacy settings including kill switch activation, WebRTC disabling, and DNS leak protection. Connect to servers in crypto-friendly jurisdictions with favourable regulations. Always verify your IP address and test connection speed before executing significant transactions to ensure proper functionality.

What common VPN mistakes should crypto traders avoid?

Avoid using free VPNs, neglecting kill switch features, and failing to verify VPN connections before trading. Don’t connect to servers in countries with strict crypto bans, and never ignore regular security updates. Always use unique passwords with two-factor authentication and ensure comprehensive security measures across all devices accessing your accounts.