Transferring cryptocurrency between exchanges is a routine task for many traders and investors, but it’s also one fraught with potential pitfalls. One wrong character in an address, an incompatible network selection, or a phishing attack can mean the permanent loss of your funds. Unlike traditional banking, there’s no customer service line to reverse a mistaken transaction, once crypto leaves your wallet, it’s gone unless the recipient voluntarily returns it.

Whether you’re chasing better trading pairs, lower fees, improved liquidity, or simply diversifying your holdings across platforms, understanding how to move crypto safely between exchanges is essential. The process itself is straightforward: you withdraw from one platform and deposit to another. But the devil is in the details, network compatibility, security protocols, withdrawal limits, and even regulatory compliance all play a role in ensuring your transfer goes smoothly.

This guide will walk you through every step of transferring crypto safely between exchanges, from pre-transfer checks to post-transfer monitoring. You’ll learn how to verify account security, choose the right blockchain network, avoid common scams, and troubleshoot issues if something goes wrong. By the end, you’ll have the confidence to move your digital assets securely, efficiently, and with minimal risk.

Key Takeaways

- Always verify network compatibility between exchanges before initiating a transfer to avoid permanent loss of funds when transferring crypto between exchanges.

- Conduct a small test transfer first to confirm the deposit address, network selection, and memo/tag requirements are correct before sending larger amounts.

- Enable two-factor authentication and withdrawal whitelists on both exchanges to protect against unauthorised access and phishing attacks.

- Double-check the first and last six characters of wallet addresses after pasting to ensure clipboard malware hasn’t replaced the address with a scammer’s.

- Use blockchain explorers to monitor transaction confirmations in real-time and verify that funds arrive at the receiving exchange successfully.

- Time your transfers during off-peak hours or weekends to minimise network congestion fees, especially on high-cost networks like Ethereum.

Understanding the Basics of Exchange-to-Exchange Transfers

At its core, transferring crypto between exchanges involves withdrawing digital assets from one platform and depositing them into another. You’re essentially sending cryptocurrency from a wallet address controlled by Exchange A to a wallet address controlled by Exchange B, both of which are under your ownership.

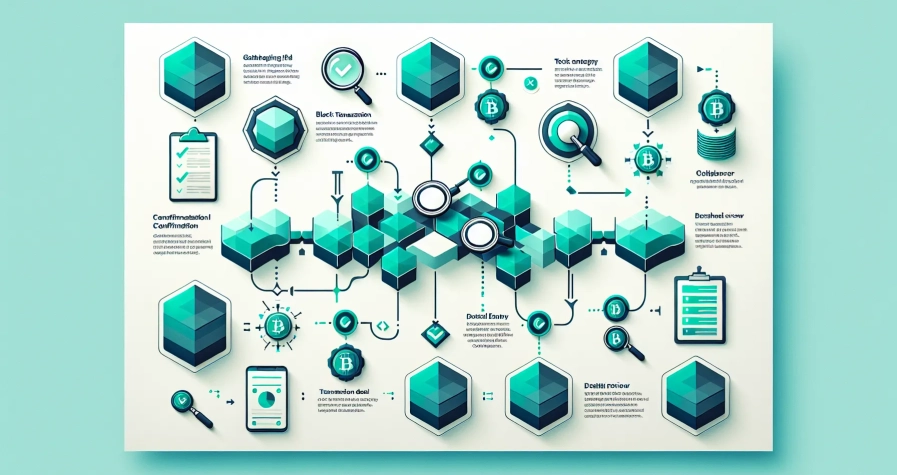

This process relies on blockchain technology. When you initiate a withdrawal, the sending exchange broadcasts a transaction to the relevant blockchain network. Miners or validators then confirm the transaction, and once it’s validated, the funds appear in your destination wallet. The time this takes varies depending on network congestion, the blockchain in question, and the number of confirmations required by the receiving exchange.

It’s worth noting that whilst the concept is simple, the execution requires precision. Unlike bank transfers where you might have some recourse if something goes wrong, blockchain transactions are irreversible. If you send Bitcoin to an Ethereum address, or use the wrong network entirely, there’s often no way to recover those funds. That’s why understanding the fundamentals, and following a methodical process, is absolutely critical.

Why You Might Need to Transfer Crypto Between Exchanges

There are plenty of legitimate reasons why you’d want to move crypto between platforms. Perhaps the exchange you’re currently using doesn’t list a particular token you want to trade, or maybe another platform offers significantly lower trading fees. Liquidity is another factor, larger exchanges often have deeper order books, which means you can execute larger trades without significant price slippage.

Staking opportunities also drive transfers. Some exchanges offer attractive annual percentage yields (APY) on certain tokens, whilst others don’t support staking at all. If you’re holding assets long-term, moving them to a platform with better staking rewards can make a meaningful difference to your returns.

Security and regulatory considerations matter too. You might prefer to spread your holdings across multiple exchanges to reduce the risk of losing everything if one platform is hacked or goes insolvent. Alternatively, regulatory changes in your jurisdiction might prompt you to move funds to a compliant exchange that operates under appropriate licences.

Finally, some traders use exchange-to-exchange transfers as part of arbitrage strategies, exploiting price differences between platforms. Whilst this can be profitable, it requires speed and precision, making safe transfer practices even more important.

Common Risks Associated with Crypto Transfers

Even though the straightforward nature of crypto transfers, several risks can turn a routine transaction into a costly mistake. The most common, and most devastating, is sending funds to the wrong address. Crypto addresses are long strings of alphanumeric characters, and a single typo can result in your assets being sent into a digital void. Some malware even replaces copied addresses with the attacker’s address, so you might paste what you think is the correct destination, only to send your funds to a scammer.

Network incompatibility is another frequent issue. Many tokens exist on multiple blockchains, USDT, for instance, is available on Ethereum (ERC-20), Binance Smart Chain (BEP-20), Tron (TRC-20), and several others. If you withdraw USDT on the Ethereum network but the receiving exchange only accepts it on Tron, your funds could be stuck or lost entirely.

Phishing attacks are rampant in the crypto space. Attackers create fake exchange websites that look nearly identical to the real thing. If you log in and attempt a transfer from a phishing site, you’re handing over your credentials, and potentially your funds, to criminals. Always double-check URLs and bookmark official exchange sites.

Withdrawal limits and freezes can also disrupt transfers. Exchanges impose daily or weekly withdrawal limits, especially for unverified accounts. Also, regulatory checks under Know Your Customer (KYC) and Anti-Money Laundering (AML) rules can trigger temporary holds on withdrawals, delaying your transfer or requiring additional documentation. Being aware of these constraints before initiating a transfer helps you plan accordingly and avoid frustration.

Pre-Transfer Preparation and Verification Steps

Before you even think about initiating a transfer, proper preparation is essential. Rushing through this stage is where most mistakes happen, so take your time to verify everything.

First and foremost, ensure that both your sending and receiving exchanges have your account fully set up and verified. This means completing any required KYC or AML verification processes. Many exchanges won’t allow withdrawals, or will impose severe limits, until you’ve submitted identification documents and passed their compliance checks. Even if you’ve been trading on a platform for a while, withdrawal privileges often require a higher verification tier.

Check the current status of both platforms. Exchanges occasionally disable deposits or withdrawals for specific tokens due to network upgrades, maintenance, or security concerns. There’s nothing worse than sending funds only to discover the receiving exchange has temporarily suspended deposits for that particular asset. Most exchanges publish status updates on their websites or social media channels, so a quick check can save you considerable hassle.

It’s also wise to review any recent announcements about token swaps, rebrands, or delistings. If a token is being delisted from the destination exchange, you’ll want to know before you transfer it there. Similarly, if a project is undergoing a token migration (moving from one blockchain to another), transfers during the transition period can sometimes result in complications.

Verifying Account Security on Both Exchanges

Security should be your top priority when preparing to transfer crypto. Start by enabling two-factor authentication (2FA) on both exchanges if you haven’t already. 2FA adds an extra layer of protection by requiring a time-based code from an authenticator app (like Google Authenticator or Authy) plus to your password. SMS-based 2FA is better than nothing, but app-based authentication is significantly more secure since SMS messages can be intercepted through SIM-swapping attacks.

Many exchanges also offer withdrawal whitelist features, sometimes called withdrawal address management. This allows you to pre-approve specific wallet addresses, and any withdrawal attempts to non-whitelisted addresses will be blocked. Whilst this adds an extra step to the process (you’ll need to whitelist the destination address and often wait 24–48 hours before it’s active), it provides excellent protection against unauthorised withdrawals.

Review your account’s security settings and recent activity. Check your login history to ensure there are no unfamiliar IP addresses or devices accessing your account. If you spot anything suspicious, change your password immediately and contact the exchange’s support team. Strong, unique passwords are non-negotiable, use a password manager if you struggle to remember complex credentials.

Finally, consider the security of the email address associated with your exchange accounts. If your email is compromised, an attacker could potentially reset your exchange password and bypass other security measures. Enable 2FA on your email account as well, and be cautious about where you access it.

Checking Network Compatibility and Token Standards

One of the most critical, and often overlooked, aspects of crypto transfers is ensuring network compatibility between exchanges. As mentioned earlier, many tokens exist on multiple blockchains, and selecting the wrong network can result in permanent loss of funds.

Before initiating a withdrawal, check which networks the sending exchange supports for your chosen token. Then, verify that the receiving exchange accepts deposits on the same network. For example, if you’re transferring Tether (USDT), both exchanges must support the same network, whether that’s Ethereum’s ERC-20, Binance Smart Chain’s BEP-20, Tron’s TRC-20, or another option.

Token standards matter because they define how a token operates on a particular blockchain. An ERC-20 token can only be sent to an Ethereum address, whilst a BEP-20 token requires a Binance Smart Chain address. Even though the token might be called the same thing (like USDT), the underlying blockchain infrastructure is different, and mixing them up causes problems.

Some exchanges offer guidance during the withdrawal process, displaying warnings if you select a network that’s incompatible with the token. But, don’t rely entirely on these warnings, always manually verify network compatibility yourself. Check both the withdrawal page on the sending exchange and the deposit page on the receiving exchange to confirm they’re aligned.

Another consideration is the impact of regulatory compliance on network availability. Under certain regulations, such as the Travel Rule, exchanges may only support specific networks for particular tokens or jurisdictions. If you’re transferring to or from an exchange that operates under strict regulatory oversight, available networks might be limited, so plan accordingly.

Understanding Transaction Fees and Network Congestion

Every crypto transfer involves fees, and understanding these costs helps you move funds efficiently. There are typically two types of fees to consider: the exchange’s withdrawal fee and the network transaction fee (sometimes called the gas fee or miner fee).

Exchange withdrawal fees vary widely between platforms and tokens. Some exchanges charge a flat fee regardless of the amount you’re withdrawing, whilst others use a percentage-based model. These fees can range from negligible (a few cents) to quite significant (tens of dollars, especially during periods of high network congestion). Always check the fee schedule before initiating a transfer, you’ll usually find this information on the withdrawal page or in the exchange’s fee documentation.

Network transaction fees are paid to miners or validators who process and confirm your transaction on the blockchain. These fees fluctuate based on network congestion. When many people are trying to make transactions simultaneously, fees rise as users compete to have their transactions processed quickly. Bitcoin and Ethereum are particularly prone to high fees during busy periods, whilst networks like Tron or Binance Smart Chain often offer lower-cost alternatives.

Deposit fees are less common, but some exchanges do charge them. Check the receiving exchange’s fee structure to understand the total cost of your transfer.

Timing matters when it comes to fees and congestion. Blockchain networks tend to be less congested during weekends or off-peak hours (relative to major trading markets). If your transfer isn’t urgent, waiting for a quieter period can save you money. Several websites and tools track real-time network congestion and fee estimates, helping you choose the optimal time to initiate your transfer.

Step-by-Step Guide to Transferring Crypto Safely

Now that you’ve completed all your preparation, it’s time to execute the actual transfer. Following a methodical, step-by-step process significantly reduces the risk of errors.

Obtaining the Correct Deposit Address

Your first task is to obtain the deposit address from the receiving exchange. Log in to the destination platform and navigate to the deposit section. Select the specific cryptocurrency you’re planning to transfer, being precise here is crucial, as selecting the wrong token will give you an incompatible address.

Once you’ve selected the token, you’ll typically need to choose the network. As discussed earlier, make sure you select the same network you’ll be using on the sending exchange. The platform will then generate or display a deposit address, a long string of letters and numbers, sometimes accompanied by a QR code.

Some exchanges generate a new deposit address each time you visit the deposit page, whilst others provide a static address that remains the same. Both approaches are valid, though if you’re given a new address each time, make sure you’re using the most recently generated one.

For certain cryptocurrencies, particularly those like XRP, XLM, EOS, or BNB, you’ll also need a memo, tag, or destination tag plus to the wallet address. This is an extra piece of information that helps the exchange identify which specific user account the deposit belongs to. If your chosen crypto requires this, the exchange will clearly indicate it on the deposit page. Make a note of both the address and the memo/tag, as you’ll need both when initiating the withdrawal.

Double-Checking Address Details Before Sending

Once you have the deposit address (and memo/tag if applicable), it’s time to move to the sending exchange. But before you paste that address anywhere, take a moment to verify you’ve copied it correctly.

Crypto addresses are long and complex, making manual entry virtually impossible without errors. Always use copy and paste, never attempt to type an address by hand. But, be aware that some sophisticated malware can detect when you’ve copied a crypto address and replace it with the attacker’s address. This is why verification is essential.

After pasting the address into the withdrawal field, visually compare at least the first six and last six characters with the original address on the receiving exchange. Whilst it’s tedious, this simple check can prevent catastrophic loss. Some users go further and check characters in the middle as well.

If you’re using a memo or destination tag, verify that too. An incorrect or missing memo can result in your deposit not being credited to your account, and recovering those funds often requires contacting exchange support, a process that can take days or weeks.

Double-check the network selection on the withdrawal page. Confirm it matches exactly what you selected on the deposit side. This is your last line of defence against a network mismatch.

Finally, review the withdrawal amount and ensure you’re sending what you intend to send. Take note of the fee that will be deducted, so you know exactly how much will arrive at the destination.

Conducting a Small Test Transfer First

Here’s where patience pays dividends: before sending your entire balance, conduct a small test transfer. This is especially important if it’s your first time transferring between these particular exchanges, or if you’re dealing with a significant amount of crypto.

A test transfer involves sending a minimal amount, just enough to verify that everything works correctly. For Bitcoin, that might be 0.001 BTC: for stablecoins, perhaps $5 or $10. The goal isn’t to move meaningful value, but to confirm that the deposit address is correct, the network is compatible, and the receiving exchange will credit the funds to your account.

Yes, you’ll pay transaction fees twice (once for the test, once for the main transfer), but this cost is trivial compared to the potential loss if something goes wrong with a large transfer. Think of it as insurance.

Once you’ve initiated the test transfer, wait for it to be fully confirmed and credited to your account on the receiving exchange. Don’t rush this step. Depending on the blockchain and network congestion, confirmations can take anywhere from a few minutes to over an hour. Most exchanges require multiple confirmations before they credit deposits, Bitcoin typically requires three to six confirmations, for instance.

Initiating the Full Transfer with Proper Confirmations

After your test transfer has been successfully received and credited to your account, you can proceed with confidence to transfer the remaining balance. Return to the sending exchange’s withdrawal page and repeat the process, this time entering the full amount you wish to transfer.

Again, verify all details: the destination address, network selection, amount, and any memo or tag requirements. Even though you’ve done this once successfully, don’t skip the verification step. A fresh set of eyes (or a second look) can catch errors that fatigue or familiarity might cause you to miss.

Once you’ve confirmed everything is correct, authorise the withdrawal. Most exchanges will require you to confirm the transaction via 2FA, enter your authentication code when prompted. Some platforms also send a confirmation email with a link you must click before the withdrawal is processed. This is an additional security measure to prevent unauthorised withdrawals.

After you’ve authorised the withdrawal, the sending exchange will usually provide a transaction ID (TXID) or transaction hash. Save this information, you’ll need it to track the transfer’s progress and to provide to customer support if any issues arise.

Now comes the waiting game. Withdrawal processing times vary. Some exchanges process withdrawals almost instantly, whilst others batch them and process at set intervals (every hour, for example). Once the withdrawal is broadcast to the blockchain, the transfer is in the hands of the network validators. Keep an eye on the receiving exchange’s deposit page to see when the funds arrive.

Critical Security Measures to Implement

Security doesn’t end once you’ve initiated your transfer. Throughout the entire process, and as a matter of ongoing practice, you should maintain rigorous security standards to protect your crypto assets.

Using Two-Factor Authentication and Withdrawal Whitelists

We’ve already touched on 2FA, but it bears repeating: if you’re not using two-factor authentication on your exchange accounts, you’re leaving the door wide open for attackers. Enable 2FA using an authenticator app rather than SMS whenever possible. Apps like Google Authenticator, Authy, or hardware-based solutions like YubiKey provide robust protection that’s resistant to common attack vectors.

When setting up 2FA, the exchange will provide backup codes. Store these securely, preferably written down and kept in a safe place, separate from your computer. If you lose access to your 2FA device, these backup codes are your only way to regain account access without going through a potentially lengthy support process.

Withdrawal whitelists add another powerful layer of security. By enabling this feature, you’re essentially telling the exchange, “Only allow withdrawals to these specific addresses that I’ve pre-approved.” If an attacker somehow gains access to your account, they won’t be able to withdraw funds to their own address because it won’t be on your whitelist.

The trade-off is convenience, adding a new address to your whitelist usually requires a waiting period (typically 24 to 48 hours) before you can use it. For regular traders who need flexibility, this might feel restrictive, but for most users, the security benefit far outweighs the minor inconvenience.

Some exchanges also offer anti-phishing codes, a custom phrase that appears in official emails from the exchange. If you receive an email that doesn’t include your anti-phishing code, you know it’s fake. Set this up if your exchange offers it.

Avoiding Phishing Scams and Fraudulent Platforms

Phishing is one of the most prevalent threats in the crypto space, and attackers are becoming increasingly sophisticated. Phishing scams typically involve fake websites that mimic legitimate exchanges, fake emails appearing to be from exchanges, or fraudulent social media accounts impersonating customer support.

The golden rule: always access exchanges by typing the URL directly into your browser or using a saved bookmark. Never click links in emails, social media messages, or search engine advertisements, as these can lead to convincing but fraudulent sites. If you must click a link, hover over it first to check the actual destination URL, phishing sites often use lookalike domains with subtle differences (like “binance.com” vs “binanse.com”).

Check for HTTPS encryption and a valid security certificate. Modern browsers display a padlock icon in the address bar when a site uses HTTPS. Click on the padlock to view certificate details and verify the site’s authenticity. If there’s no padlock, or if your browser warns you about certificate issues, do not proceed.

Be extremely wary of unsolicited communications. Legitimate exchanges will never ask you for your password, 2FA codes, or withdrawal credentials via email, Telegram, Discord, or any other channel. If someone claiming to be from exchange support contacts you asking for sensitive information, it’s a scam. Always initiate contact with support through official channels if you need assistance.

Scammers also create fake mobile apps. Only download exchange apps from official app stores, and verify the developer name matches the legitimate exchange. Check reviews and download counts as well, fake apps often have few downloads and suspicious reviews.

Securing Your Devices and Network Connections

Your computer, phone, and internet connection are all potential points of vulnerability. Keeping your devices secure is essential for protecting your crypto assets during transfers and beyond.

Keep your operating system, web browser, and all software up to date. Security patches are released regularly to address newly discovered vulnerabilities, and running outdated software leaves you exposed to known exploits. Enable automatic updates where possible.

Use reputable antivirus and anti-malware software, and run regular scans. Some malware is specifically designed to target crypto users, keyloggers that capture your passwords, clipboard hijackers that replace copied addresses, or screen capture tools that record your activities.

Avoid using public Wi-Fi networks when accessing exchange accounts or initiating transfers. Public networks are often unsecured, making it easy for attackers to intercept your data. If you must use public Wi-Fi, connect through a reputable VPN (virtual private network) that encrypts your traffic.

Consider using a dedicated device for crypto activities if you’re managing significant amounts. An old laptop or tablet that’s used exclusively for crypto, with no other software installed and no casual web browsing, significantly reduces exposure to malware and other threats.

Finally, be cautious about browser extensions. Some are legitimate and helpful, but others can be malicious or become compromised. Only install extensions from trusted developers, keep them updated, and periodically review which extensions have access to your browsing data.

Network Selection and Blockchain Considerations

Choosing the right blockchain network for your transfer is arguably the most technically critical decision you’ll make. Get it wrong, and you could lose your funds permanently.

Choosing the Right Network for Your Transfer

When you’re initiating a withdrawal, the exchange will typically present you with multiple network options if the token exists on several blockchains. For example, when withdrawing USDT, you might see options for Ethereum (ERC-20), Binance Smart Chain (BEP-20), Tron (TRC-20), Polygon, Arbitrum, and others.

Your primary consideration must be compatibility: the network you select must be supported by the receiving exchange for deposits. If the sending exchange offers five network options but the receiving exchange only accepts three, you must choose one of the three that overlap.

Beyond compatibility, consider fees and speed. Ethereum transactions can be quite expensive during periods of high network congestion, whilst Tron or Binance Smart Chain often offer much lower fees. But, faster, cheaper networks sometimes require more confirmations before exchanges credit your deposit, which can offset the speed advantage.

Security and decentralisation are also factors, though less immediately relevant for short-term transfers. More established networks like Ethereum and Bitcoin have stronger security due to their size and decentralisation, whilst newer or smaller networks might carry slightly higher risk of network issues or even attacks (though this is rare for major tokens on reputable chains).

Some exchanges have default network selections, which can be convenient, or dangerous if you don’t pay attention. Always manually verify the network rather than assuming the default is correct.

If you’re transferring a native blockchain token (like BTC, ETH, or BNB), you don’t have network options to choose from, there’s only one Bitcoin network, one Ethereum network, and so on. The complexity arises primarily with tokens that have been issued on multiple chains.

Understanding Memo, Tag, and Destination Tag Requirements

Certain cryptocurrencies require additional information beyond just the wallet address for transfers to be properly credited. This extra identifier goes by various names: memo (XLM, EOS), destination tag (XRP), or message (various platforms). These fields serve a crucial purpose in helping exchanges route incoming deposits to the correct user account.

Here’s why they’re necessary: some cryptocurrencies use a single master wallet address for all users on an exchange. When you make a deposit, the exchange needs a way to determine which specific user account should receive the credit. The memo or tag provides that identification.

If you forget to include the required memo or destination tag, your funds will arrive at the exchange’s wallet but won’t be automatically credited to your account. The crypto isn’t lost forever, but recovering it requires contacting the exchange’s customer support, providing transaction details, and waiting for manual intervention, a process that can take days or even weeks.

When you view the deposit information for a coin that requires a memo or tag, the exchange will prominently display both the wallet address and the memo/tag. Make absolutely certain you copy both pieces of information and include them when initiating the withdrawal from the sending exchange.

The withdrawal form will have separate fields for the address and the memo/tag. Don’t try to combine them or leave the memo/tag field blank. If you’re unsure whether a particular crypto requires a memo or tag, check the receiving exchange’s deposit page, if one is needed, it will be clearly indicated.

Different cryptocurrencies use different terminology, but the concept is the same: XRP uses “destination tag,” XLM uses “memo,” EOS uses “memo,” whilst BNB (on Binance Chain, not BSC) uses “memo.” Pay attention to the specific terminology used by your exchange to avoid confusion.

Monitoring and Troubleshooting Your Transfer

After you’ve initiated your transfer, your work isn’t quite done yet. Monitoring the transaction’s progress helps ensure it arrives successfully, and knowing how to troubleshoot common issues can save considerable stress if something doesn’t go as planned.

Tracking Your Transaction on the Blockchain

One of the advantages of blockchain technology is transparency, you can track your transaction in real-time using a blockchain explorer. When you initiated the withdrawal, the sending exchange should have provided you with a transaction ID (TXID) or transaction hash. This is a unique identifier for your specific transaction.

To track your transfer, visit the blockchain explorer appropriate for the network you’re using. For Bitcoin, that might be blockchain.com or blockchair.com: for Ethereum, etherscan.io: for Binance Smart Chain, bscscan.com, and so forth. Different blockchains have different popular explorers, but they all serve the same purpose.

Enter your transaction ID into the explorer’s search field. The resulting page will show detailed information about your transaction, including:

- The sending and receiving addresses

- The amount transferred

- The transaction fee

- The timestamp when it was broadcast to the network

- The number of confirmations it has received

- Its current status (pending, confirmed, or failed)

Confirmations are crucial. Each time a new block is added to the blockchain after the block containing your transaction, you receive an additional confirmation. Most exchanges require a specific number of confirmations before they credit deposits to your account. Bitcoin typically requires three to six confirmations, whilst Ethereum might require twelve to thirty-five, depending on the exchange’s risk tolerance.

The blockchain explorer updates in real-time, so you can refresh the page periodically to watch confirmations accumulate. Once your transaction has reached the required number of confirmations, check the receiving exchange’s deposit history to confirm the funds have been credited to your account.

What to Do If Your Transfer Is Delayed or Missing

Most transfers complete smoothly, but occasionally things go wrong or take longer than expected. Here’s how to troubleshoot common issues.

First, check the transaction status on the blockchain explorer. If the transaction shows as “pending” or “unconfirmed,” it’s been broadcast to the network but not yet included in a block. This can happen during periods of high network congestion or if the transaction fee was set too low to attract miners’ attention quickly. In this case, you’ll need to wait, there’s nothing you can do to speed it up once it’s been broadcast.

If the transaction shows as “failed” on the blockchain explorer, the funds should remain in your sending exchange account. Check your balance there to confirm. Failed transactions typically occur due to insufficient gas fees on networks like Ethereum, though this is relatively rare with exchange-managed withdrawals.

If the blockchain explorer shows your transaction as confirmed with many confirmations, but the receiving exchange hasn’t credited your account, verify that you sent to the correct address and used the correct network. Check the deposit history on the receiving exchange, sometimes there’s a delay between blockchain confirmation and the exchange’s internal systems crediting your account.

If you sent to the wrong address, unfortunately there’s usually no recourse, blockchain transactions are irreversible. If you used the wrong network (for example, sending ERC-20 USDT to an exchange that only accepts TRC-20), the funds might be recoverable, but you’ll need to contact the receiving exchange’s support team. Some exchanges can assist with recovering mis-sent funds, though they often charge a significant fee for this service and it can take weeks or months.

If you forgot to include a required memo or destination tag, contact the receiving exchange’s support immediately. Provide them with your transaction hash, the amount sent, the timestamp, and any other requested information. They’ll manually credit your account once they verify the transaction, though this process isn’t instant.

For delayed transfers where everything appears correct, check both exchanges’ status pages to see if there are known issues with deposits or withdrawals for your specific asset. Network upgrades, maintenance, or security incidents can temporarily suspend deposits.

If you’ve checked everything and still can’t resolve the issue, contact customer support on both exchanges. Provide your transaction ID, screenshots from the blockchain explorer, and a clear description of the problem. Be patient, support teams at crypto exchanges are often overwhelmed with tickets, and responses can take several days.

Best Practices for Regular Exchange Transfers

If you transfer crypto between exchanges regularly, whether for trading, arbitrage, or portfolio management, adopting consistent best practices will make the process more efficient and reduce your risk over time.

Maintaining Accurate Records of All Transactions

Record-keeping might not be the most exciting aspect of crypto trading, but it’s essential for both tax compliance and your own financial tracking. Every transfer between exchanges is a taxable event in many jurisdictions, and even if it isn’t where you live, maintaining detailed records protects you in case of future regulatory changes or audits.

At minimum, your records should include:

- The date and time of each transfer

- The cryptocurrency and amount sent

- The sending and receiving exchanges (or wallet addresses)

- The purpose of the transfer (trading, staking, arbitrage, etc.)

- The network used and any fees paid

- The transaction ID for blockchain verification

Spreadsheets work for some people, whilst others prefer dedicated crypto portfolio tracking apps that automatically import transaction data from exchanges via API connections. Tools like CoinTracker, Koinly, or CryptoTaxCalculator can simplify record-keeping and generate tax reports, though you’ll need to verify their accuracy.

Good records also help you track patterns in your own behaviour. You might discover, for instance, that you’re paying more in fees than you realised, or that certain transfer routes are more efficient than others. This data-driven approach to managing transfers can save money and time over the long term.

From a security perspective, maintaining logs of your transactions helps you quickly identify unauthorised activity. If you review your records regularly and notice a transfer you didn’t make, you can take immediate action to secure your accounts.

Timing Your Transfers to Minimise Fees and Delays

Transaction fees and processing times aren’t constant, they fluctuate based on network congestion, time of day, and day of week. Learning to time your transfers strategically can result in significant savings, especially if you’re moving funds frequently or in large amounts.

Network congestion tends to follow predictable patterns. Weekends typically see lower activity on many blockchains, resulting in lower fees. Similarly, late night and early morning hours (relative to major financial centres in North America, Europe, and Asia) often have less congestion. If your transfer isn’t time-sensitive, waiting for these quieter periods can cut your fees substantially.

For Ethereum in particular, gas fees can vary wildly, from a few dollars to over a hundred during extreme congestion. Websites like Etherscan’s Gas Tracker or apps like BlockNative’s Gas Estimator show real-time gas prices and historical trends, helping you identify optimal windows for transfers.

Some tokens and networks are simply more economical than others. If both exchanges support multiple networks for a particular token, choosing Tron or Binance Smart Chain over Ethereum can reduce fees from $10–20 to under a dollar. Always check whether the cheaper network option is suitable for your needs before defaulting to the most familiar one.

Be mindful of exchange processing times as well. Some platforms batch withdrawals and process them at specific intervals (every hour, every six hours, etc.), whilst others process continuously. Understanding your exchanges’ withdrawal schedules helps you avoid situations where you initiate a transfer expecting immediate processing, only to wait hours for the next batch.

Finally, consider market volatility. If you’re transferring assets that might experience significant price movement during the transfer period, you’re exposed to price risk. For holdings you intend to trade actively, using faster networks or transferring stablecoins (and then converting on the destination exchange) might be preferable to slower transfers of volatile assets.

Conclusion

Transferring cryptocurrency between exchanges doesn’t have to be nerve-wracking, but it does demand careful attention to detail and a methodical approach. Every step matters, from verifying network compatibility and confirming addresses to implementing robust security measures and monitoring your transaction’s progress.

The irreversible nature of blockchain transactions means there’s no safety net if you make a mistake. But by following the process outlined in this guide, completing proper preparation, conducting test transfers, using 2FA and withdrawal whitelists, choosing the correct network, and maintaining accurate records, you’ll dramatically reduce your risk of loss.

As the crypto ecosystem continues to mature, exchanges are implementing better safeguards and clearer interfaces to help users avoid common pitfalls. Travel Rule compliance, improved network selection guidance, and more sophisticated security features are all steps in the right direction. But, the responsibility for securing your assets eventually rests with you.

Treat each transfer, no matter how routine it becomes, with the same level of care. Double-check addresses, verify networks, monitor confirmations, and keep detailed records. The few extra minutes this takes could save you from devastating losses or lengthy recovery processes.

Whether you’re moving crypto to access better trading opportunities, diversify your holdings across platforms, or simply take advantage of different exchanges’ features, safe transfer practices are fundamental to protecting your digital assets. With the knowledge and best practices you’ve learned here, you’re well-equipped to navigate exchange-to-exchange transfers confidently and securely.

Frequently Asked Questions

How do I transfer crypto safely between exchanges without losing funds?

Always verify the deposit address matches exactly, select the correct blockchain network on both exchanges, and conduct a small test transfer first. Enable two-factor authentication and double-check memo or destination tag requirements before sending your full amount.

What happens if I use the wrong network when transferring crypto between exchanges?

Using an incompatible network can result in permanent loss of funds or require lengthy recovery through exchange support. Always confirm both exchanges support the same network (ERC-20, BEP-20, TRC-20, etc.) before initiating your transfer.

Why do some crypto transfers require a memo or destination tag?

Certain cryptocurrencies like XRP, XLM, and EOS use a shared exchange wallet address for all users. The memo or destination tag identifies which specific account should receive the deposit, ensuring proper crediting of your funds.

How long does it take to transfer cryptocurrency between exchanges?

Transfer times vary by blockchain network and required confirmations. Bitcoin typically takes 30–60 minutes with 3–6 confirmations, whilst Ethereum may require 12–35 confirmations. Network congestion and exchange processing times also affect duration.

Can I cancel a crypto transaction after sending it to another exchange?

No, blockchain transactions are irreversible once broadcast to the network. Unlike traditional banking, there’s no way to cancel or reverse a crypto transfer, which is why verification before sending is absolutely critical.

What are the cheapest blockchain networks for transferring crypto between exchanges?

Networks like Tron (TRC-20) and Binance Smart Chain (BEP-20) typically offer significantly lower fees than Ethereum (ERC-20), often under a dollar compared to $10–50 during congestion. Always verify both exchanges support your chosen network.