Cryptocurrency trading has opened doors for investors looking to diversify beyond traditional assets, and Litecoin stands out as one of the most accessible entry points. Created in 2011 by Charlie Lee, a former Google engineer, Litecoin was designed as a “lighter” alternative to Bitcoin,hence the name. It offers faster transaction speeds, lower fees, and a solid track record that has kept it relevant in an ever-expanding crypto landscape.

For new investors, Litecoin presents a compelling opportunity. Its high liquidity makes it easy to buy and sell, while its established reputation reduces some of the uncertainty that comes with newer, less-tested cryptocurrencies. Whether someone is interested in day trading to capitalize on market volatility or holding long-term for potential appreciation, understanding how to trade Litecoin is a crucial first step. This guide walks through the fundamentals,from setting up accounts and securing digital wallets to executing trades and managing risk,so beginners can start their Litecoin trading journey with confidence.

Key Takeaways

- Litecoin offers faster transaction speeds and lower fees than Bitcoin, making it an accessible entry point for new cryptocurrency investors.

- Learning how to trade Litecoin starts with choosing a secure exchange, setting up a digital wallet, and understanding different order types like market and limit orders.

- Beginners can use strategies like swing trading or long-term holding, combined with stop-loss and take-profit orders to manage risk effectively.

- Reading price charts and technical indicators such as moving averages, RSI, and volume helps traders make informed decisions when trading Litecoin.

- All cryptocurrency trades are taxable events in most countries, so maintaining detailed records of every Litecoin transaction is essential for compliance and performance tracking.

What Is Litecoin and Why Trade It?

Litecoin (LTC) is a peer-to-peer cryptocurrency that operates on blockchain technology, much like Bitcoin. Launched in October 2011, it was designed to address some of Bitcoin’s limitations, particularly around transaction speed and cost. While Bitcoin has become known as “digital gold”,a store of value,Litecoin is often called “digital silver,” emphasizing its utility for everyday transactions and trading.

One of the main reasons traders gravitate toward Litecoin is its liquidity. It’s listed on virtually every major cryptocurrency exchange, which means buying and selling LTC is straightforward and typically comes with tight spreads. This liquidity also translates to more predictable price movements compared to obscure altcoins, making it easier for beginners to analyze and trade.

Another appeal is Litecoin’s longevity. In a market where projects come and go, Litecoin has weathered multiple market cycles and continues to maintain a strong developer community and user base. This track record provides a level of trust that newer cryptocurrencies haven’t yet earned.

Finally, Litecoin’s lower price per coin (compared to Bitcoin) makes it psychologically easier for new investors to get started. Instead of buying a fraction of a Bitcoin, traders can own whole units of Litecoin, which can feel more tangible and easier to manage.

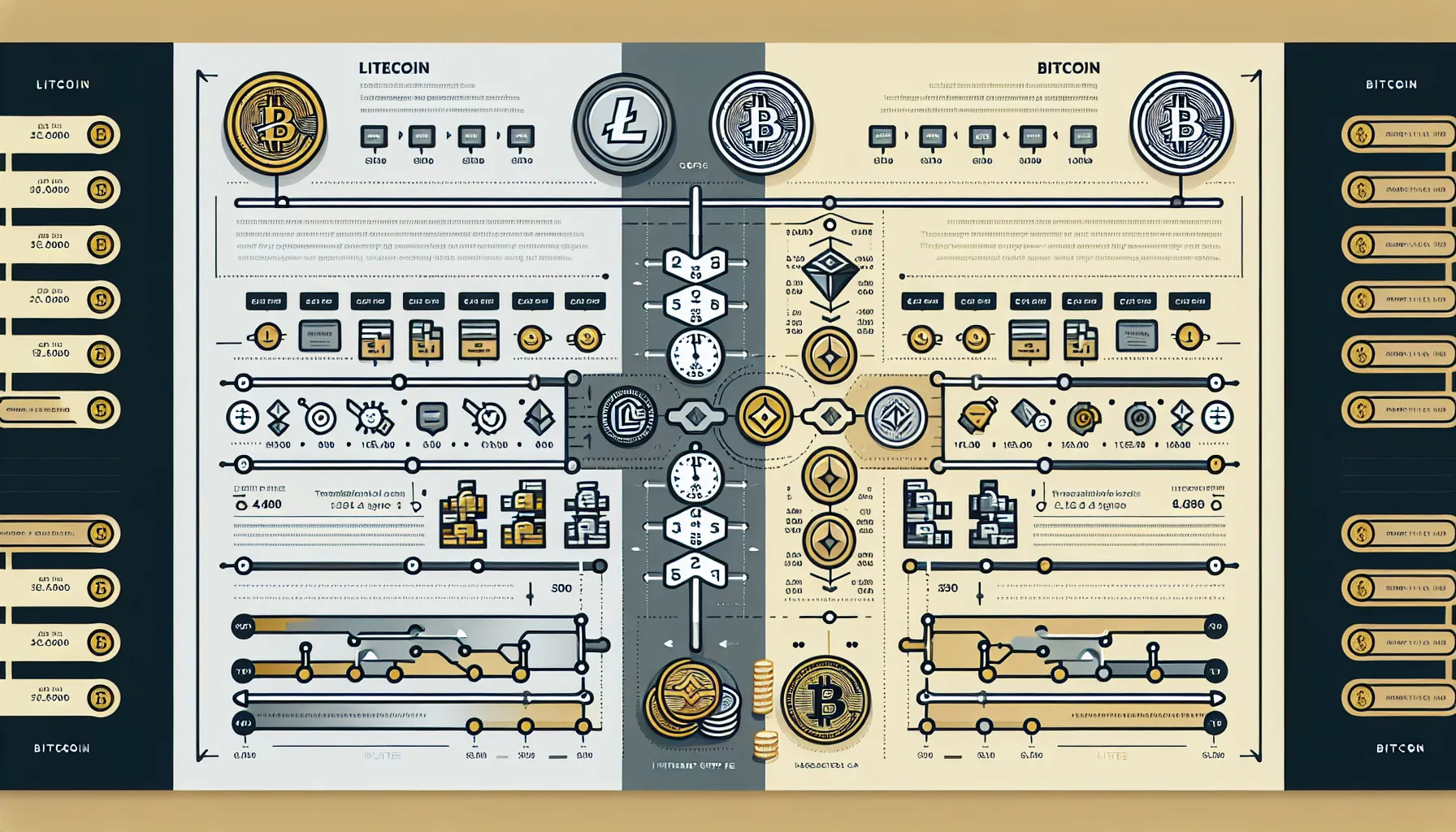

Understanding the Differences Between Litecoin and Bitcoin

While Litecoin and Bitcoin share fundamental similarities,both use proof-of-work consensus, have capped supplies, and operate on decentralized networks,their differences are what make Litecoin attractive for specific use cases.

Transaction Speed: Bitcoin’s block time is approximately 10 minutes, meaning it takes that long for a new block of transactions to be confirmed. Litecoin, on the other hand, generates blocks every 2.5 minutes. This four-times-faster confirmation speed makes Litecoin better suited for merchants and traders who need quicker settlement times.

Transaction Fees: Because Litecoin processes transactions more quickly and has historically lower demand than Bitcoin, its fees tend to be significantly cheaper. For someone making frequent trades or small payments, those savings add up.

Supply Cap: Bitcoin has a maximum supply of 21 million coins, while Litecoin’s cap is set at 84 million,exactly four times higher. This larger supply doesn’t dilute value per se, but it does mean more coins are available in circulation.

Hashing Algorithm: Bitcoin uses SHA-256, while Litecoin uses Scrypt. Without getting too technical, Scrypt was chosen to make mining more accessible to individuals using consumer-grade hardware, though large-scale mining operations eventually dominated both networks.

Market Position: Bitcoin is the dominant cryptocurrency by market cap and is often viewed as a hedge or long-term investment. Litecoin, while smaller, is seen as more functional for payments and active trading. Many traders use Litecoin as a testing ground before diving deeper into Bitcoin or other assets.

Understanding these differences helps new investors decide when and why to trade Litecoin. If speed, lower fees, and active trading appeal more than holding a “digital gold” asset, Litecoin might be the better fit.

Setting Up Your Trading Foundation

Before anyone can trade Litecoin, they need to establish the infrastructure,an exchange account and, ideally, a secure wallet. This foundation is critical not just for executing trades, but for protecting assets from theft, hacks, and user error.

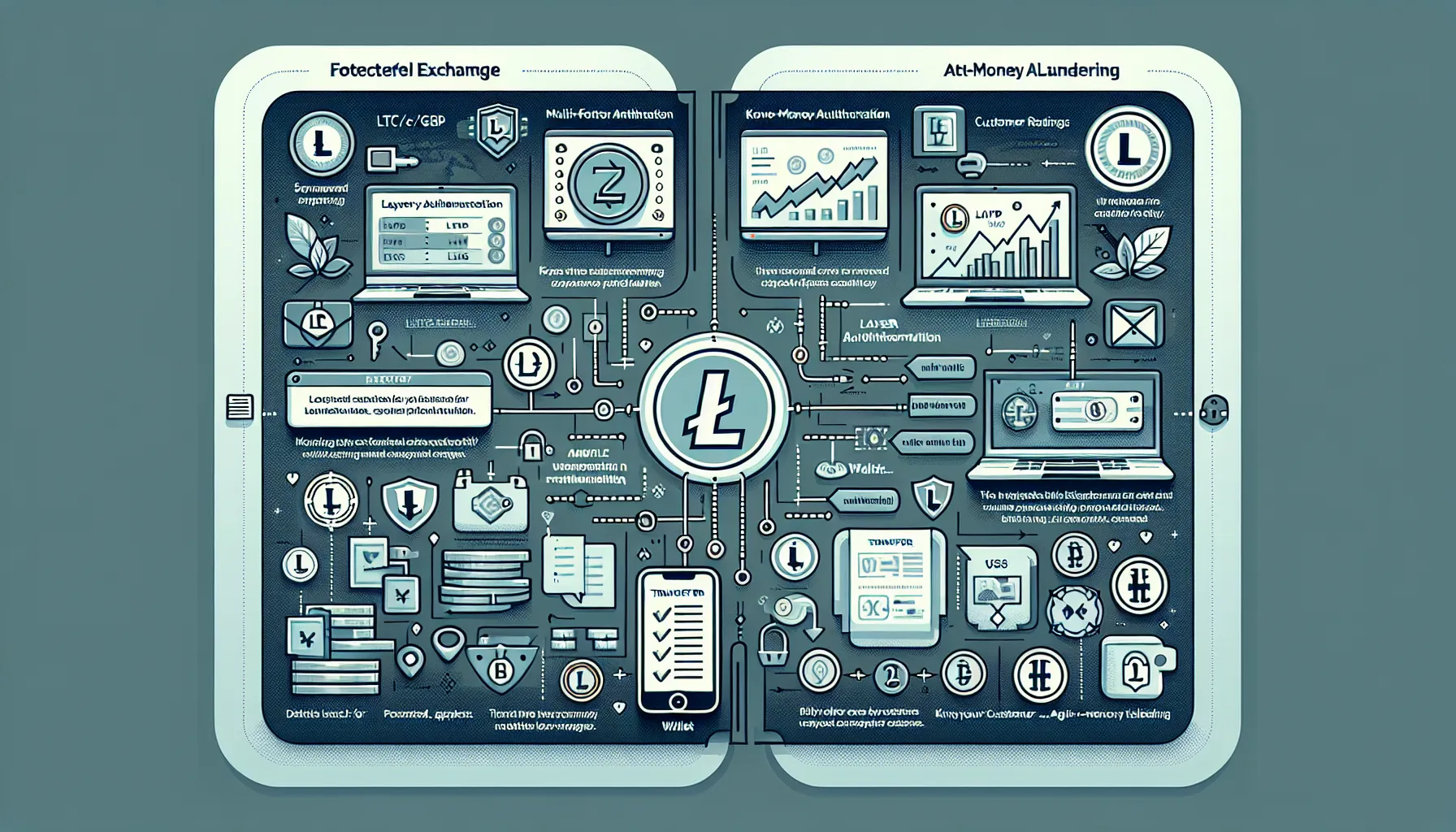

Choosing the Right Cryptocurrency Exchange

The exchange is where trades happen. Not all exchanges are created equal, so choosing one that’s reputable, secure, and user-friendly is essential.

Security Features: Look for platforms that offer two-factor authentication (2FA), withdrawal whitelists, and cold storage for the majority of user funds. Exchanges that comply with Anti-Money Laundering (AML) regulations and Know Your Customer (KYC) requirements tend to be more trustworthy and less likely to face sudden shutdowns.

Litecoin Support: While most major exchanges list Litecoin, it’s worth confirming that the platform supports LTC trading pairs with fiat currencies (like USD, EUR) or stablecoins (like USDT). This makes it easier to move in and out of positions.

Fees: Trading fees vary widely. Some exchanges charge a flat percentage per trade, while others use a tiered system based on volume. Beginners should compare fee structures and factor them into their trading strategy, as frequent trading can rack up costs quickly.

User Experience: A clean, intuitive interface matters, especially for those new to crypto. Complicated dashboards can lead to costly mistakes. Many exchanges offer demo or paper trading modes, which let users practice without risking real money.

Reputation and Reviews: Check online reviews, community forums, and any history of hacks or customer service issues. An exchange that’s been around for years and has a solid reputation is generally safer than a new, unknown platform.

Once an exchange is selected, the next step is account creation and verification. This typically involves providing an email address, setting a strong password, and completing identity verification (uploading a government-issued ID and sometimes proof of address). The verification process can take anywhere from a few minutes to several days, depending on the platform.

Creating and Securing Your Digital Wallet

While exchanges allow users to store Litecoin in an account wallet, keeping large amounts on an exchange isn’t ideal. Exchanges are frequent targets for hackers, and if the platform is compromised, funds can be lost. That’s where a personal digital wallet comes in.

Types of Wallets: There are several options, each with trade-offs. Software wallets (desktop or mobile apps) offer convenience and are suitable for active traders. Hardware wallets (physical devices like Ledger or Trezor) provide the highest security by keeping private keys offline. Paper wallets,printed QR codes representing keys,are another cold storage option, though less practical for frequent trading.

Non-Custodial vs. Custodial: A non-custodial wallet means the user controls the private keys, which is more secure but also means they’re solely responsible if keys are lost. Custodial wallets (like those on exchanges) are managed by a third party, which is convenient but introduces counterparty risk.

Security Best Practices: Always enable two-factor authentication on wallets and exchanges. Back up wallet credentials,seed phrases, private keys,and store them securely offline (never in email or cloud storage that could be hacked). Use strong, unique passwords and consider a password manager.

Funding the Wallet: Once a wallet is set up, users can transfer Litecoin from the exchange to the wallet address. Double-check addresses before sending: crypto transactions are irreversible. For beginners, it’s wise to send a small test transaction first to confirm everything works correctly.

By taking the time to choose a secure exchange and wallet, new investors lay the groundwork for safe and effective Litecoin trading.

How to Buy Your First Litecoin

With an exchange account funded and a wallet ready, purchasing Litecoin is straightforward. But understanding order types and the buying process helps avoid common pitfalls.

Step 1: Fund Your Account

Most exchanges accept bank transfers, credit or debit cards, and sometimes other cryptocurrencies. Bank transfers are usually cheaper but slower, while card purchases are instant but come with higher fees. Some platforms also allow deposits via PayPal or other payment processors. Once funds appear in the account (which can take minutes to days depending on the method), it’s time to place an order.

Step 2: Select the Trading Pair

Navigate to the trading section and choose the appropriate Litecoin pair. For U.S. investors, this is often LTC/USD. If fiat isn’t available, LTC/USDT (Tether, a stablecoin) is a common alternative. The trading pair determines what currency is used to buy Litecoin.

Step 3: Choose Your Order Type

There are two main order types beginners should know:

- Market Order: This executes immediately at the current market price. It’s the simplest option and guarantees the trade will go through, but the exact price may vary slightly due to market fluctuations, especially in volatile conditions.

- Limit Order: This lets the buyer set a specific price at which they’re willing to purchase Litecoin. The order only executes if the market reaches that price. Limit orders offer more control and can help secure better prices, but there’s no guarantee the order will fill if the market doesn’t move as expected.

For a first purchase, many beginners opt for a market order to keep things simple. As they gain experience, limit orders become useful for optimizing entry points.

Step 4: Enter the Amount and Confirm

Specify how much Litecoin to buy,either in LTC units or in dollar value. The platform will show the total cost, including fees. Review everything carefully, then confirm the order.

Step 5: Monitor the Transaction

Once the order is placed, it should appear in the account’s transaction history or portfolio section. For market orders, this happens almost instantly. Limit orders may take longer, and users can cancel them if they change their minds before execution.

Step 6: Transfer to a Wallet (Optional but Recommended)

After the purchase, consider moving the Litecoin from the exchange to a personal wallet, especially if holding for the long term or if the amount is significant. This reduces exposure to exchange hacks and gives the user full control over their assets.

Buying Litecoin doesn’t have to be intimidating. With a clear understanding of order types and a careful approach to each step, new investors can execute their first trade confidently and securely.

Essential Trading Strategies for Beginners

Once someone owns Litecoin, the question becomes: what next? Holding is one approach, but active trading offers opportunities to capitalize on price movements. Different strategies suit different goals, time commitments, and risk tolerances.

Scalping: This involves making many small trades throughout the day, aiming to profit from tiny price changes. Scalpers might hold a position for seconds or minutes. It’s fast-paced and requires constant attention, plus quick reflexes and low fees to be profitable. It’s not ideal for beginners unless they have significant time and a high tolerance for stress.

Swing Trading: Swing traders hold positions for days or weeks, trying to capture larger price swings. This strategy is less time-intensive than scalping and allows traders to take advantage of medium-term trends. It requires some skill in technical analysis and patience to wait for setups, but it’s more accessible for those who can’t monitor charts all day.

Range Trading: When Litecoin’s price moves sideways within a defined range, traders can buy near the support level (the low end) and sell near the resistance level (the high end). This works well in stable or consolidating markets, but it requires recognizing when a range is established and being ready to exit if the price breaks out.

Technical Indicators: Many traders use tools like Bollinger Bands (which show volatility and potential overbought/oversold conditions), the MACD (Moving Average Convergence Divergence, which signals momentum shifts), Ichimoku Cloud (a comprehensive indicator for trend direction and support/resistance), and volume analysis to inform their decisions. Beginners don’t need to master all of these at once: starting with one or two and learning how they behave with Litecoin’s price action is a solid approach.

Day Trading vs. Long-Term Holding

Two of the most common strategies are day trading and long-term holding, and each has distinct characteristics.

Day Trading involves opening and closing positions within a single day, often multiple times. The goal is to profit from intraday volatility. Day traders rely heavily on technical analysis, real-time charts, and fast execution. The upside is the potential for quick gains and the ability to avoid overnight risk (since positions are closed before the market “sleeps”). The downside? It’s time-consuming, stressful, and transaction fees can eat into profits. It’s also easy to make emotional decisions in the heat of the moment.

Long-Term Holding (often called “HODLing” in crypto circles) means buying Litecoin and keeping it for months or years, betting on long-term price appreciation. This strategy requires less day-to-day involvement and avoids the stress of constant trading. It’s well-suited to those who believe in Litecoin’s fundamentals and are willing to ride out short-term volatility. The risk is that prices could decline over the holding period, and opportunity costs if better investments emerge.

Which is better? It depends on the individual. Day trading offers more action and potential for frequent gains, but it demands time, discipline, and experience. Long-term holding is more passive and can benefit from compound growth, but it requires patience and conviction.

Many investors blend both approaches,holding a core position while trading a smaller portion actively.

Setting Stop-Loss and Take-Profit Orders

No trading strategy is complete without risk management, and two of the most important tools are stop-loss and take-profit orders.

Stop-Loss Orders: These automatically sell Litecoin if the price drops to a predetermined level, limiting potential losses. For example, if someone buys LTC at $100 and sets a stop-loss at $90, the position will close if the price falls to $90, capping the loss at 10%. Stop-losses protect against unexpected downturns and help traders stick to their risk limits rather than holding onto losing positions out of hope.

Take-Profit Orders: These do the opposite,automatically selling when the price reaches a target profit level. If that same trader sets a take-profit at $120, the position closes once LTC hits that price, locking in a 20% gain. This removes the temptation to get greedy and wait for even higher prices, which might never come.

Using both tools together creates a clear exit strategy, whether the trade goes well or poorly. Beginners should get comfortable placing these orders from the start: they’re essential for disciplined, emotion-free trading.

Reading Litecoin Price Charts and Market Indicators

Price charts are the trader’s map, showing where Litecoin has been and offering clues about where it might go. Learning to read them is a foundational skill.

Candlestick Charts: These are the most popular format. Each “candlestick” represents a specific time period (1 minute, 1 hour, 1 day, etc.) and shows four key prices: open, close, high, and low. A green (or white) candle means the price closed higher than it opened: a red (or black) candle means it closed lower. The “wicks” show the highest and lowest prices during that period. Patterns formed by multiple candlesticks,like “doji,” “hammer,” or “engulfing”,can signal potential reversals or continuations.

Moving Averages: These smooth out price data to reveal trends. A simple moving average (SMA) calculates the average price over a set number of periods (e.g., 50 days). When the current price is above the moving average, it often indicates an uptrend: below suggests a downtrend. Traders also watch for “crossovers,” like when a short-term moving average crosses above a long-term one, which can signal a buying opportunity.

Volume: This shows how much Litecoin is being traded. High volume during a price increase suggests strong buying interest and can confirm a trend. Low volume might indicate weak conviction, making a move less reliable. Volume spikes often accompany major price movements or news events.

Support and Resistance: Support is a price level where buying interest is strong enough to prevent further decline: resistance is where selling pressure tends to cap gains. Identifying these levels helps traders decide where to enter or exit. When resistance is broken, it often becomes new support, and vice versa.

Indicators: Tools like the Relative Strength Index (RSI) measure whether Litecoin is overbought (above 70, possibly due for a pullback) or oversold (below 30, possibly due for a bounce). The MACD indicator tracks momentum and can signal when trends are gaining or losing steam. Bollinger Bands expand and contract with volatility, helping traders spot breakouts or consolidations.

No single indicator is perfect, and false signals happen. The best approach is to use a combination of tools and confirm signals with multiple data points before making a trade. Beginners should practice reading charts on a demo account or with small amounts until they’re comfortable interpreting the information.

Over time, chart reading becomes second nature, turning abstract price movements into actionable insights.

Managing Risk and Avoiding Common Mistakes

Cryptocurrency markets are notoriously volatile, and Litecoin is no exception. Managing risk isn’t just smart,it’s essential for long-term survival and success.

Only Trade What You Can Afford to Lose: This is rule number one. Crypto markets can swing wildly, and there’s always the possibility of losing a significant portion,or all,of an investment. Money needed for rent, bills, or emergencies should never be put at risk.

Diversify: Putting all funds into a single asset, even one as established as Litecoin, concentrates risk. Spreading investments across different cryptocurrencies, or even different asset classes, helps cushion against any one position going south.

Don’t Chase Losses: After a losing trade, the temptation to immediately jump back in and “win it back” can be overwhelming. This often leads to impulsive, poorly thought-out decisions and deeper losses. Taking a break, reviewing what went wrong, and sticking to a plan is the better path.

Avoid Emotional Trading: Fear and greed are the trader’s worst enemies. Buying during a hype-fueled rally or panic-selling during a dip often results in buying high and selling low,the opposite of what works. Having a clear trading plan with predefined entry, exit, and risk parameters helps keep emotions in check.

Start Small: There’s no need to go all-in on the first trade. Starting with a small position allows beginners to learn the mechanics, test strategies, and build confidence without risking serious capital. As skills improve, position sizes can grow.

Set Risk Limits: Decide in advance how much of the portfolio can be risked on a single trade (many pros suggest no more than 1-2%). Use stop-loss orders to enforce these limits automatically.

Stay Informed, But Don’t Overtrade: Keeping up with news, market trends, and technical developments is important, but overtrading,making too many trades out of boredom or FOMO (fear of missing out),is a common pitfall. Quality over quantity matters.

Beware of Scams: The crypto space has its share of fraudsters. Be skeptical of “guaranteed returns,” unsolicited investment advice, and platforms that seem too good to be true. Stick to well-known exchanges and wallets.

Mistakes are part of the learning process, but many can be avoided by approaching trading with discipline, humility, and a commitment to continuous learning.

Tax Implications and Record-Keeping for Litecoin Trading

It’s easy to get caught up in the excitement of trading and forget that tax authorities are watching. In most countries, profits from cryptocurrency trading are taxable, and failing to report them can lead to penalties or legal trouble.

Taxable Events: Generally, any time Litecoin is sold, traded for another cryptocurrency, or used to purchase goods or services, it creates a taxable event. Even swapping LTC for Bitcoin or Ethereum can trigger capital gains or losses. Simply holding Litecoin isn’t taxable, but the moment it’s disposed of, the IRS (or equivalent authority) wants to know.

Capital Gains and Losses: If Litecoin is sold for more than it was purchased, the profit is considered a capital gain. In the U.S., short-term gains (assets held less than a year) are taxed as ordinary income, while long-term gains benefit from lower tax rates. Losses can offset gains and may be deductible, which is one reason detailed record-keeping is crucial.

Record-Keeping: Traders should maintain records of every transaction: date, amount of LTC bought or sold, price in fiat currency, fees paid, and the purpose of the trade. Many exchanges provide transaction histories that can be exported, but relying solely on these isn’t always enough,especially if using multiple platforms or wallets. Dedicated crypto tax software (like CoinTracking, Koinly, or CryptoTrader.Tax) can automate much of this process, importing data and generating reports.

International Variations: Tax rules vary by country. Some nations treat crypto as property, others as currency, and a few have no crypto taxes at all. It’s important to consult local regulations or a tax professional familiar with cryptocurrency to ensure compliance.

Why It Matters: Beyond legal obligations, good record-keeping helps traders evaluate performance, refine strategies, and make better decisions. Knowing exactly which trades were profitable and which weren’t is invaluable for improvement.

Taxes might not be the most exciting part of trading, but treating them seriously from the start saves headaches down the line and keeps trading activities above board.

Conclusion

Trading Litecoin offers new investors a gateway into the world of cryptocurrency with a coin that balances speed, affordability, and a proven track record. By understanding what makes Litecoin unique, setting up secure accounts and wallets, and learning how to execute trades and manage risk, beginners can navigate the market with greater confidence and competence.

Success in trading isn’t about making perfect decisions every time,it’s about building a solid foundation, learning from mistakes, and continuously refining strategies. Whether someone chooses to day trade, swing trade, or hold Litecoin for the long haul, the principles of security, discipline, and well-informed choice-making remain constant.

The crypto market will always carry risk, but with the right preparation and mindset, trading Litecoin can be both a practical investment strategy and an educational journey into the future of finance. Keep learning, stay cautious, and remember that every expert trader was once a beginner taking their first tentative steps into the market.

Frequently Asked Questions

What is Litecoin and why is it good for beginners?

Litecoin is a peer-to-peer cryptocurrency launched in 2011, often called ‘digital silver.’ It’s ideal for beginners due to its high liquidity, lower price per coin, faster transaction speeds than Bitcoin, and established track record across multiple market cycles.

How do I buy my first Litecoin?

To buy Litecoin, create an account on a reputable cryptocurrency exchange, complete identity verification, fund your account via bank transfer or card, select the LTC trading pair, choose a market or limit order, and confirm your purchase.

What’s the difference between a market order and a limit order when trading Litecoin?

A market order executes immediately at the current price, guaranteeing the trade but with slight price variation. A limit order lets you set a specific purchase price, offering more control but no guarantee the order will fill.

Should I keep my Litecoin on an exchange or in a wallet?

While exchanges offer convenience, storing large amounts in a personal wallet is safer. Hardware wallets provide the highest security by keeping private keys offline, protecting against exchange hacks and giving you full control over your assets.

What is a stop-loss order and why do I need one?

A stop-loss order automatically sells your Litecoin when the price drops to a predetermined level, limiting potential losses. It’s essential for risk management, protecting against unexpected downturns and helping traders maintain discipline rather than emotional decision-making.

Are cryptocurrency gains from trading Litecoin taxable?

Yes, in most countries including the U.S., selling, trading, or using Litecoin creates a taxable event. Profits are treated as capital gains, and detailed transaction records are essential for accurate reporting and compliance with tax authorities.