Cryptocurrency investing can feel like navigating a minefield. Prices swing wildly, news headlines shift sentiment overnight, and the constant question looms: is now the right time to buy? For beginners especially, this volatility often leads to paralysis, or worse, panic-driven decisions that drain accounts faster than a botched trade.

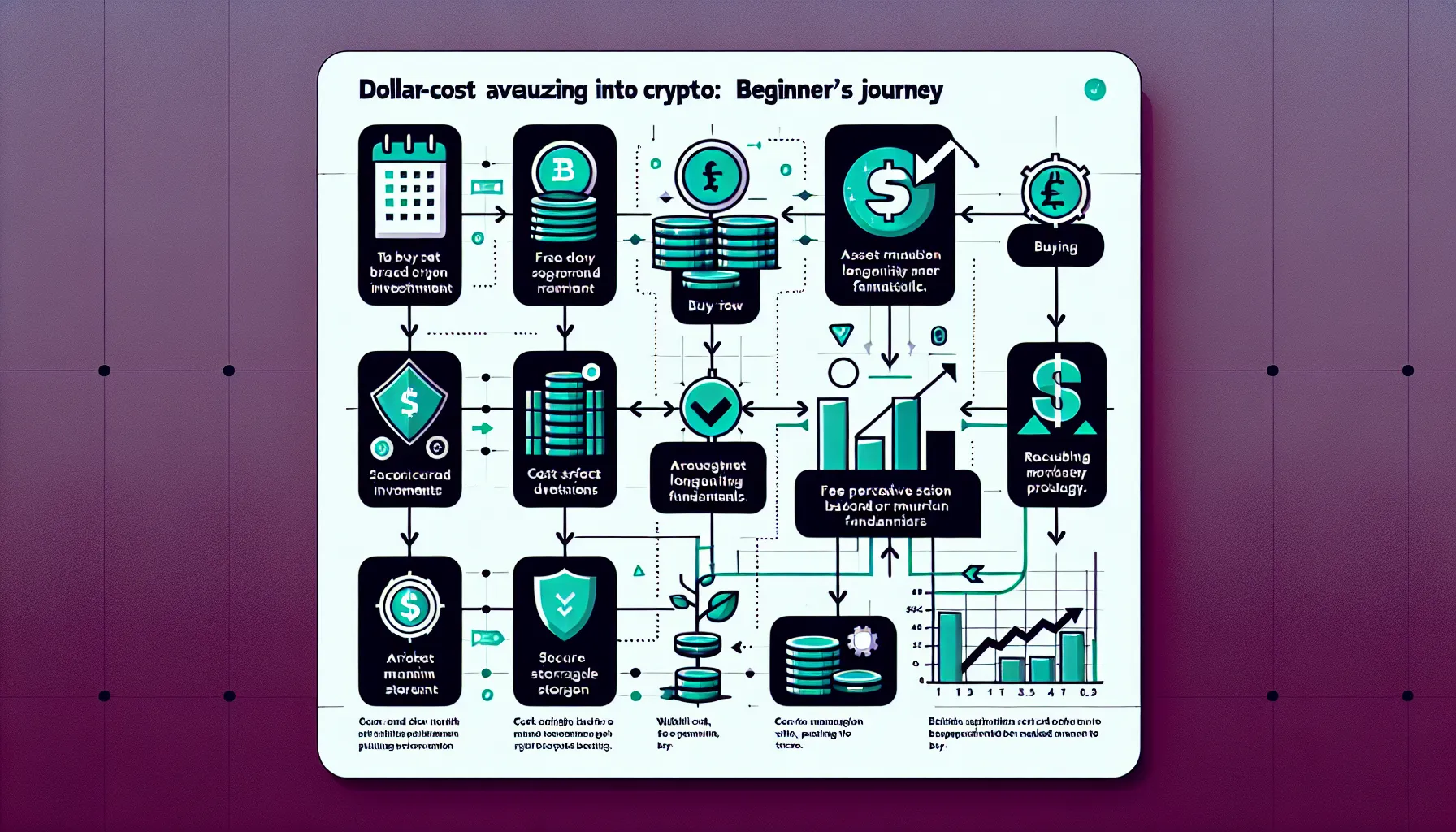

Enter dollar-cost averaging (DCA), an investment approach that sidesteps the guessing game entirely. Rather than trying to time the market perfectly, a fool’s errand even for seasoned traders, DCA investors commit to purchasing fixed amounts of cryptocurrency at regular intervals, regardless of whether prices are soaring or plummeting. It’s not glamorous, and it won’t make you rich overnight. But for newcomers who want to build a crypto portfolio without the sleepless nights, it’s one of the smartest strategies available.

This guide walks through everything beginners need to know: what DCA actually is, why it suits crypto’s chaotic nature, how to choose assets worth holding, which platforms make automation easy, and the common pitfalls that undermine even well-intentioned plans. By the end, you’ll have a clear roadmap for starting your own DCA journey, no crystal ball required.

Key Takeaways

- Dollar-cost averaging into crypto involves investing fixed amounts at regular intervals, removing the need to time volatile markets perfectly.

- For beginners, DCA eliminates emotional trading decisions by automating purchases, ensuring consistency through both market rallies and crashes.

- Bitcoin and Ethereum are the most sensible starting points for a crypto DCA strategy due to their proven longevity and fundamental strength.

- Choosing a platform with automated recurring buy functionality and transparent fees is essential for successful dollar-cost averaging.

- The greatest advantage of DCA emerges during market downturns, when fixed investments acquire more cryptocurrency at reduced prices.

- Maintaining unwavering discipline and avoiding panic-selling during price drops is crucial for long-term DCA success.

What Is Dollar-Cost Averaging and Why Use It for Crypto?

Dollar-cost averaging is an investment strategy where an investor purchases a fixed monetary amount of an asset at regular intervals over an extended period, ignoring short-term price movements. Instead of deploying a lump sum all at once, the capital is split into smaller increments and spread across multiple purchases at varying prices.

The principle is elegantly simple: when prices fall, your fixed investment buys more units: when prices rise, it buys fewer. Over time, this approach smooths out the cost basis and removes the pressure of predicting market peaks and troughs, a task that even professional traders rarely achieve consistently.

For cryptocurrency specifically, DCA proves especially effective because crypto markets exhibit far greater volatility than traditional equities. Bitcoin can swing 20% in a week: altcoins can double or halve in days. Rather than stressing about whether today’s price is a bargain or a trap, DCA investors simply follow their schedule. The strategy assumes that, over the long term, prices will trend upwards, a belief that underpins most investment approaches.

It’s worth noting that DCA doesn’t guarantee profitability. If the chosen cryptocurrency enters a prolonged decline and never recovers, even the most disciplined DCA plan won’t save the portfolio. Success hinges on selecting assets with genuine long-term potential and the patience to see the strategy through.

The Benefits of DCA for Crypto Beginners

For newcomers to cryptocurrency, dollar-cost averaging offers several compelling advantages that address common beginner challenges.

Emotion removal: Perhaps the greatest benefit is psychological. By automating purchases, investors eliminate the emotional rollercoaster that comes with watching prices fluctuate. There’s no temptation to panic-sell during crashes or FOMO-buy during rallies. The decision is made once, then executed mechanically.

Lower average cost basis: During inevitable market downturns, regular purchases acquire more cryptocurrency at reduced prices. Over an extended period, this can significantly lower the average cost per unit compared to a single lump-sum purchase at an inopportune moment. For instance, spreading £50,000 across five purchases at varying prices, £15,000, £12,000, £10,000, £11,000, and £14,000, yields a better average than investing the entire sum at £15,000.

Minimal complexity: Unlike technical analysis, chart reading, or active trading, DCA requires almost no ongoing effort. Choose a cryptocurrency, decide how much to invest per interval, set the frequency, and let the system run. It’s investing reduced to its essential components.

Volatility smoothing: Regular purchases help flatten the impact of price swings. Whilst crypto’s notorious volatility remains, its effect on your portfolio becomes less jarring when you’re consistently buying through ups and downs rather than reacting to each move.

Accessibility: DCA suits investors with limited capital. Rather than needing a large lump sum, beginners can start with small, manageable amounts, £10 weekly or £50 monthly, and still participate meaningfully in the market.

The strategy isn’t without limitations. In a consistently rising market, lump-sum investing would theoretically outperform DCA, since earlier exposure captures more growth. But predicting such markets in advance is impossible, which brings us back to DCA’s core appeal: it removes the need to predict at all.

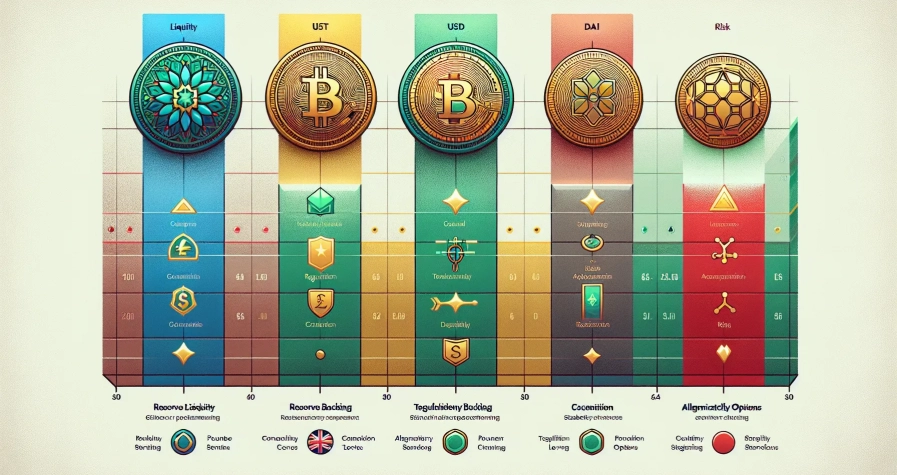

Choosing the Right Cryptocurrency for Your DCA Strategy

Before committing to any DCA plan, thorough research into potential assets is non-negotiable. Since this strategy spans months or years, choosing assets with staying power is crucial. A promising-sounding project that collapses six months in will sabotage even the most disciplined approach.

Several factors warrant consideration:

Longevity and track record: Favour cryptocurrencies that have survived multiple market cycles. Assets that have weathered bear markets, regulatory challenges, and technological shifts demonstrate resilience that newer projects simply can’t claim.

Fundamental strength: Investigate the technology underpinning the cryptocurrency. What problem does it solve? Who’s developing it? Is the development team active and transparent? Does the project have a clear roadmap? These fundamentals provide insight into whether the asset has substance beyond speculative hype.

Market metrics: Examine trading volume and liquidity. High-volume assets with deep liquidity are easier to buy and sell without significant price slippage. Low-volume tokens carry higher risk and may prove difficult to exit.

Market sentiment and trends: Whilst you shouldn’t chase hype, understanding prevailing sentiment helps gauge whether an asset faces headwinds or tailwinds. Regulatory crackdowns, technological breakthroughs, or institutional adoption all influence long-term prospects.

Personal conviction: DCA works best when investors genuinely believe in an asset’s long-term potential. If you’re unconvinced or investing based on someone else’s enthusiasm, you’ll struggle to maintain discipline when prices tumble.

Bitcoin and Ethereum: The Beginner-Friendly Options

For beginners, Bitcoin and Ethereum represent the most sensible starting points. Both are the largest cryptocurrencies by market capitalisation, with established infrastructure, widespread adoption, and proven longevity.

Bitcoin, launched in 2009, remains the original cryptocurrency and commands unmatched recognition. Its fixed supply cap of 21 million coins and status as “digital gold” make it a popular store-of-value choice. Institutional investors, from MicroStrategy to pension funds, have allocated capital to Bitcoin, lending it credibility that newer projects lack.

Ethereum, meanwhile, powers a vast ecosystem of decentralised applications, smart contracts, and DeFi protocols. Its utility extends far beyond simple transactions, making it the foundation for much of crypto’s innovation. The successful transition to proof-of-stake in 2022 demonstrated the network’s ability to evolve and address scalability concerns.

Both assets have survived multiple bear markets, regulatory scrutiny, and technological challenges. Whilst they’re not immune to volatility or risk, no cryptocurrency is, they offer relative stability compared to the thousands of smaller altcoins. For a beginner’s DCA strategy, starting with one or both provides a solid foundation.

Diversifying Beyond the Top Two

Once comfortable with a Bitcoin or Ethereum DCA strategy, some investors consider diversifying into other cryptocurrencies. This can increase potential returns but also introduces additional risk.

If exploring diversification, apply the same rigorous criteria: longevity, strong fundamentals, healthy trading volume, and genuine conviction in the project’s future. Avoid the temptation to chase the latest trending token or spread capital too thinly across dozens of assets.

A focused portfolio of two to four well-researched cryptocurrencies typically serves beginners better than a sprawling collection of speculative bets. Concentration allows for deeper understanding of each asset and simplifies portfolio management.

Selecting a Cryptocurrency Exchange or Platform

Choosing the right platform is critical for DCA success. Not all exchanges offer the same features, fees, or reliability, and the wrong choice can introduce friction that undermines your strategy.

Key Features to Look for in a DCA-Friendly Platform

When evaluating exchanges, prioritise these features:

Recurring buy functionality: The platform should offer automated, scheduled purchases. Manual buying defeats DCA’s purpose by reintroducing emotional decision-making and requiring ongoing effort. Look for clear options to set purchase frequency (weekly, fortnightly, monthly) and amounts.

Transparent and reasonable fees: Fee structures vary widely. Some exchanges charge percentage-based fees per transaction, others impose flat fees, and some combine both. High fees erode returns over time, especially with frequent small purchases. Compare platforms carefully and calculate how fees will impact your specific DCA plan.

User-friendly interface: Beginners benefit from intuitive platforms that don’t require a steep learning curve. Complicated interfaces increase the likelihood of errors and frustration.

Strong security measures: Cryptocurrency exchanges are prime targets for hackers. Prioritise platforms with robust security: two-factor authentication, cold storage for user funds, insurance policies, and a clean track record without major breaches.

Asset availability: Ensure the platform supports the cryptocurrencies you intend to purchase. Whilst major exchanges list Bitcoin and Ethereum, availability of other assets varies.

Reliable execution: Your platform must consistently execute scheduled purchases without failures or delays. Read reviews and user experiences to gauge reliability.

Regulatory compliance: In the UK, look for platforms registered with the Financial Conduct Authority (FCA). Compliance doesn’t eliminate risk but provides some regulatory oversight and consumer protection.

Major exchanges such as Kraken, Binance, and Coinbase offer dedicated DCA tools and recurring buy features for numerous cryptocurrencies. Regional platforms may also provide competitive options with lower fees or better customer support for UK users. Take time to compare at least three platforms before committing.

Setting Up Your Dollar-Cost Averaging Plan

With your chosen cryptocurrency and platform selected, it’s time to structure your DCA plan. This involves determining how much to invest, how frequently, and ensuring the process runs automatically.

Determining Your Investment Amount and Frequency

Start by calculating how much capital you can comfortably commit long-term. The keyword here is “comfortable”, DCA requires consistency through market downturns, euphoric rallies, and everything between. If you overextend and need to pause contributions, you undermine the strategy’s effectiveness.

Common approaches include:

- £10 weekly (£520 annually)

- £50 fortnightly (£1,300 annually)

- £100 monthly (£1,200 annually)

- £250 monthly (£3,000 annually)

There’s no objectively correct amount. What matters is that the figure aligns with your financial situation and doesn’t strain your budget. You should be able to sustain contributions even during market crashes when prices are low, these periods are actually when DCA delivers its greatest advantage.

Financial sustainability: Ensure regular purchases won’t compromise essential expenses or emergency savings. DCA works best as part of a broader financial plan, not as a replacement for prudent money management.

Realistic expectations: Start conservatively. It’s better to begin with £25 monthly and increase later than to start at £200, panic during a downturn, and abandon the strategy entirely.

Frequency considerations: More frequent purchases (weekly) provide slightly better volatility smoothing than less frequent ones (monthly), but they also incur more transaction fees. Balance smoothing benefits against fee costs based on your platform’s structure.

Automating Your Purchases

Once you’ve settled on an amount and frequency, set up automated recurring purchases. Most modern cryptocurrency platforms make this straightforward:

- Navigate to the recurring buy or DCA section of your chosen exchange

- Select the cryptocurrency you’re purchasing

- Specify the fixed amount per purchase (e.g., £100)

- Choose your frequency (weekly, fortnightly, monthly)

- Select your preferred purchase date or day (e.g., every Monday, or the 1st of each month)

- Review and confirm the recurring order

After setup, the platform executes purchases automatically according to your schedule. You’ll typically receive email confirmations for each transaction, but no manual intervention is required.

Important: Ensure your linked bank account or payment method maintains sufficient funds to cover each purchase. Failed transactions due to insufficient funds can disrupt your DCA rhythm and sometimes incur additional fees.

Periodically review your automation settings, perhaps quarterly, to ensure everything’s functioning correctly and to reassess whether your contribution amount still aligns with your financial situation.

Managing Fees and Maximising Your Returns

Whilst DCA simplifies cryptocurrency investing, managing costs and maintaining discipline significantly impact long-term results.

Understand fee structures thoroughly: Trading fees vary dramatically across platforms. Some charge 0.5% per transaction, others 1% or more. For a £100 monthly DCA plan, a 1% fee costs £12 annually, modest initially, but compounded over years and across a growing portfolio, fees become substantial. Platforms like Kraken and Binance often offer tiered fee structures where frequent traders or higher-volume users pay reduced rates. Investigate whether your platform provides such benefits.

Consider maker vs taker fees: Some exchanges distinguish between market orders (taker fees) and limit orders (maker fees). Automated DCA purchases typically execute as market orders, incurring taker fees. If your platform allows, setting limit orders slightly below market price can occasionally reduce fees, though this adds complexity that may not suit beginners.

Reinvestment strategy: As your portfolio grows, decide whether to reinvest gains or maintain your fixed DCA amount. Some investors increase contributions as their income grows: others maintain consistency regardless of portfolio performance. Neither approach is inherently superior, choose based on your financial goals and risk tolerance.

Storage considerations: Leaving cryptocurrency on exchanges exposes you to platform risk (hacks, insolvency). For long-term holdings, consider transferring assets to a personal wallet, hardware wallets offer the strongest security. But, frequent transfers incur network fees, so batch transfers (e.g., quarterly) make more sense than moving every purchase immediately.

Tax awareness: In the UK, cryptocurrency disposals (including sales, trades, and some transfers) may trigger Capital Gains Tax obligations. Keep records of all purchases, amounts, dates, and prices. DCA’s regular transactions create a detailed trail, but proper record-keeping from the start simplifies tax reporting later.

Long-term focus: The most crucial aspect of maximising returns is maintaining your DCA discipline regardless of short-term price movements. The strategy assumes prices will recover and grow over years, not months. Obsessing over daily fluctuations misses the point entirely.

Common Mistakes to Avoid When DCA Into Crypto

Even a straightforward strategy like DCA can be derailed by predictable errors. Awareness of these pitfalls helps beginners navigate their investment journey more successfully.

Abandoning the strategy during downturns: This is perhaps the most damaging mistake. When prices crash 40% or 50%, the natural instinct is to stop buying or even sell. But market dips benefit DCA investors precisely because fixed investments acquire more cryptocurrency at lower prices. Maintaining discipline during these periods, when it’s psychologically hardest, is when DCA delivers its greatest advantage.

Investing money needed short-term: DCA is a long-term strategy spanning years, not months. Using funds you’ll need for a house deposit, wedding, or emergency expenses is a recipe for forced selling at inopportune moments. Only invest capital you can genuinely afford to lock away for the foreseeable future.

Over-diversifying too quickly: Beginners sometimes spread capital across ten or twenty different cryptocurrencies, diluting their focus and complicating portfolio management. Start with one or two established assets. Deep understanding of a few holdings serves you better than superficial knowledge of many.

Panic-selling: DCA assumes prices will recover over time. Selling during a crash locks in losses and negates the entire strategy. If you’re tempted to panic-sell, it may indicate you’ve invested more than you can afford or chosen assets you don’t truly believe in.

Ignoring fees: High transaction fees quietly erode returns, especially with frequent small purchases. A platform charging 1.5% per transaction versus one charging 0.3% creates a significant long-term difference. Don’t overlook this seemingly minor detail.

Inconsistent contributions: Skipping purchases because “prices are too high” or “I’ll wait for a dip” undermines DCA’s core principle. The strategy works because you purchase consistently regardless of price. Trying to time the market defeats the purpose.

Choosing trendy assets over solid fundamentals: DCA amplifies mistakes in asset selection. If you DCA into a fundamentally weak cryptocurrency that eventually collapses, your consistent buying simply accelerates losses. Prioritise longevity and fundamentals over hype.

Neglecting security: Accumulating cryptocurrency over months or years builds a portfolio worth protecting. Using weak passwords, skipping two-factor authentication, or leaving significant holdings on exchanges indefinitely invites disaster. Carry out proper security practices from day one.

Conclusion

Dollar-cost averaging offers beginners a rational, emotionally neutral path into cryptocurrency investing without the impossible task of timing volatile markets. By committing to regular, fixed investments in established cryptocurrencies like Bitcoin or Ethereum, newcomers can build portfolios systematically whilst smoothing out the impact of price swings.

Success hinges on several key principles: choosing cryptocurrencies with proven longevity and strong fundamentals, selecting platforms that offer reliable automation and reasonable fees, determining contribution amounts you can sustain indefinitely, and maintaining unwavering discipline through market cycles. The strategy isn’t glamorous, there are no overnight fortunes or exciting trades. But for investors prioritising long-term growth over short-term speculation, DCA provides a framework that works.

The hardest part isn’t setting up the automation or choosing a platform. It’s maintaining consistency when prices plummet and every instinct screams to stop buying. Remember that market downturns are when DCA delivers its greatest advantage, allowing your fixed investments to acquire more cryptocurrency at reduced prices. If you genuinely believe in your chosen assets’ long-term potential, and you should, otherwise why invest at all?, these periods represent opportunity rather than catastrophe.

Start small, automate everything possible, and resist the temptation to tinker with your strategy every time prices move. DCA rewards patience and discipline far more than it rewards cleverness or market predictions. For beginners overwhelmed by cryptocurrency’s complexity and volatility, that simplicity is perhaps the strategy’s greatest strength.

Frequently Asked Questions

What is dollar-cost averaging in cryptocurrency investing?

Dollar-cost averaging (DCA) is an investment strategy where you purchase a fixed monetary amount of cryptocurrency at regular intervals, regardless of price fluctuations. This approach removes the pressure of timing the market and smooths out your average cost basis over time.

How much money should I start with when dollar-cost averaging into crypto?

Start with an amount you can comfortably sustain long-term without straining your budget. Common approaches range from £10 weekly to £250 monthly. The key is consistency, so choose an amount that won’t compromise essential expenses or emergency savings.

Which cryptocurrency is best for beginners using dollar-cost averaging?

Bitcoin and Ethereum are the most sensible starting points for beginners. Both have proven longevity, established infrastructure, widespread adoption, and have survived multiple market cycles, offering relative stability compared to smaller altcoins whilst still participating in crypto’s growth potential.

Should I stop dollar-cost averaging when cryptocurrency prices crash?

No, maintaining purchases during downturns is crucial. Market dips actually benefit DCA investors because your fixed investment acquires more cryptocurrency at lower prices. Abandoning the strategy during crashes undermines its core advantage of smoothing volatility over time.

Can dollar-cost averaging guarantee profits in cryptocurrency?

No, DCA doesn’t guarantee profitability. If your chosen cryptocurrency enters a prolonged decline and never recovers, even disciplined DCA won’t save your portfolio. Success depends on selecting assets with genuine long-term potential and maintaining patience throughout market cycles.

How do exchange fees affect my dollar-cost averaging returns?

Transaction fees significantly impact long-term returns, especially with frequent purchases. A platform charging 1.5% per transaction versus 0.3% creates substantial differences over years. Always compare fee structures across exchanges, as high fees quietly erode your cryptocurrency investment gains over time.