Many cryptocurrency holders are familiar with the concept of staking,locking up tokens to help secure a blockchain network while earning passive rewards. It’s a popular way to put idle digital assets to work. But here’s the thing: Litecoin (LTC) doesn’t actually support staking in the traditional sense. Why? Because Litecoin operates on a Proof-of-Work (PoW) consensus mechanism, much like Bitcoin, where miners,not stakers,validate transactions and secure the network.

That doesn’t mean Litecoin holders are out of options when it comes to earning interest or yield on their holdings. In fact, there are several methods available, from centralized lending platforms to decentralized finance (DeFi) protocols and interest-bearing crypto savings accounts. While these aren’t true “staking” in the blockchain sense, they do offer opportunities to generate returns on LTC. This article explores how Litecoin holders can earn interest, the platforms and strategies available, and the risks and best practices to keep in mind.

Key Takeaways

- Litecoin cannot be staked in the traditional sense because it uses Proof-of-Work consensus, not Proof-of-Stake, so any “staking” offers are actually lending or yield products.

- You can earn interest on your Litecoin through centralized lending platforms, crypto savings accounts, DeFi protocols using wrapped LTC, and liquidity pools on decentralized exchanges.

- Centralized platforms like Binance and Kraken offer simple interest-earning options but require trusting third parties with custody of your coins.

- DeFi yield farming with wrapped Litecoin can generate higher returns but comes with added risks like impermanent loss, smart contract vulnerabilities, and gas fees.

- Always research platform security, diversify across multiple services, understand fee structures, and choose reputable providers to maximize returns safely while earning interest on Litecoin.

- Flexible withdrawal options and realistic yield expectations help protect against market volatility and platform failures when putting your LTC to work.

Understanding Litecoin and Earning Opportunities

Litecoin was created in 2011 as a faster, lighter alternative to Bitcoin. It’s designed for quick, low-cost transactions and has built a reputation as one of the most enduring cryptocurrencies in the space. Like Bitcoin, Litecoin relies on a Proof-of-Work consensus model, where miners use computational power to solve complex puzzles and add new blocks to the blockchain. This system is robust and secure, but it doesn’t involve staking or delegated participation from regular token holders.

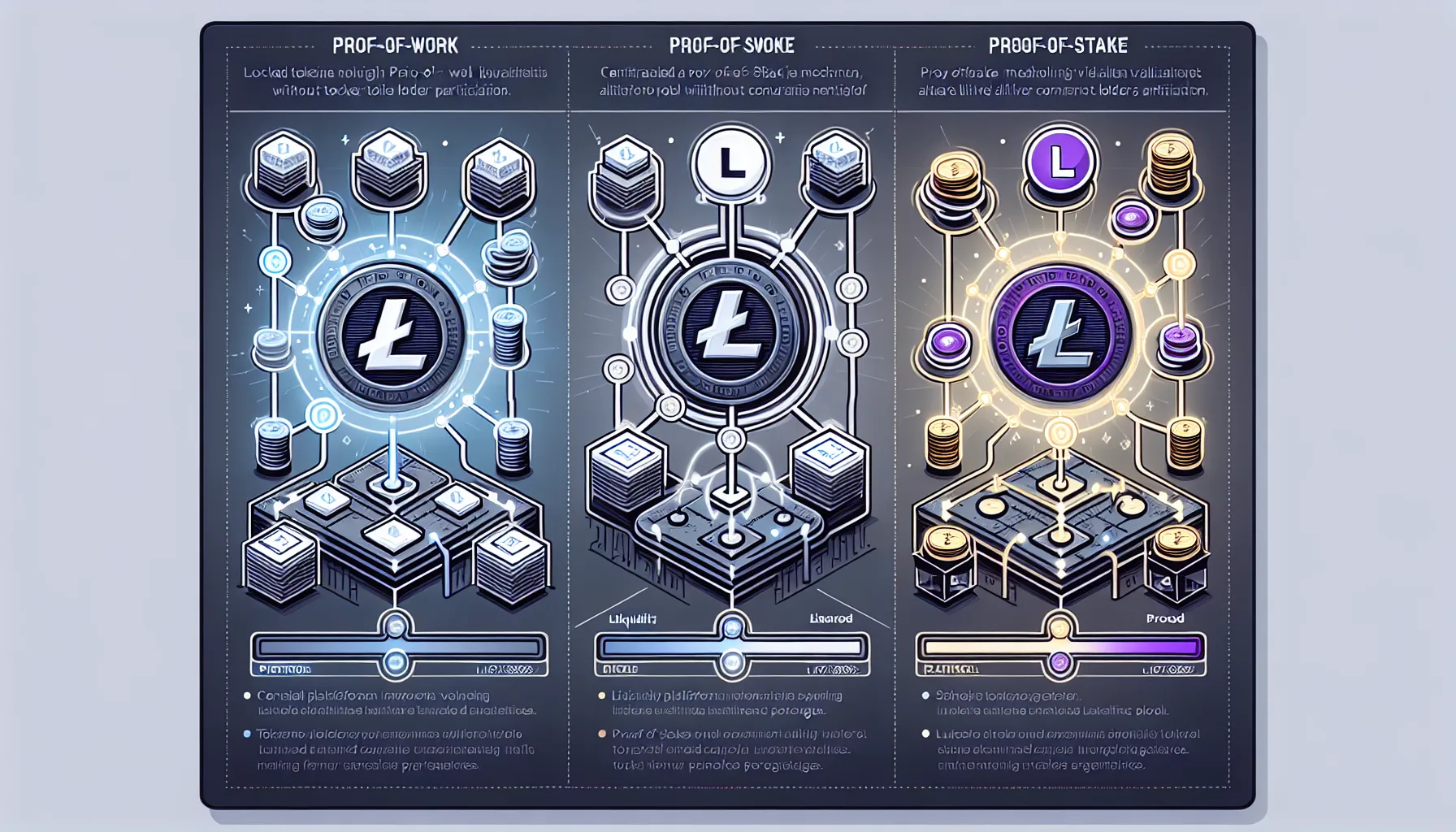

That’s an important distinction. In Proof-of-Stake (PoS) networks,think Ethereum after The Merge, Cardano, or Polkadot,users can lock up their tokens to help validate transactions and, in return, earn staking rewards. Litecoin doesn’t have that mechanism. So when someone talks about “staking Litecoin,” what they really mean is earning yield by lending it out, depositing it on a platform, or using it in DeFi protocols. The coins aren’t validating network transactions: they’re simply being put to work in various financial products.

Why Litecoin Cannot Be Staked

To be blunt: there is no native staking on the Litecoin blockchain. Staking, in its truest form, is a feature of Proof-of-Stake blockchains where participants lock tokens to help secure the network and validate new blocks. Litecoin’s PoW architecture doesn’t support this,miners do the heavy lifting, and there’s no slot for token holders to participate in consensus.

This means that any platform or service offering “Litecoin staking” is using the term loosely. What they’re actually offering is some form of lending, savings deposit, or yield generation via third-party mechanisms. The LTC holders deposit is not being used to validate blocks on the Litecoin network: instead, it’s likely being lent out to borrowers, deployed in trading strategies, or wrapped and used in DeFi protocols on other blockchains.

Understanding this distinction is critical. It means that the risk profile is different. True staking involves protocol-level penalties (like slashing) for bad behaviour, but it’s generally transparent and on-chain. Off-chain lending or centralized yield products introduce counterparty risk, platform security concerns, and regulatory uncertainty. Knowing what you’re actually doing with your LTC is the first step in making informed decisions.

Alternative Ways to Earn Interest on Litecoin

Even though native staking isn’t an option, Litecoin holders have several alternatives for earning yield. The most common methods include:

- Centralized lending platforms: Services like Binance, Kraken, and HTX allow users to deposit Litecoin and earn interest. These platforms typically pool user deposits and lend them out to borrowers or use them in other revenue-generating activities. Interest rates vary, and some platforms offer flexible (withdraw anytime) or fixed-term (locked) products.

- Crypto savings accounts: Similar to a traditional savings account, some platforms let users deposit LTC and earn a variable or fixed APY. These are usually custodial services, meaning the platform holds the coins.

- DeFi lending and yield farming: Decentralized finance protocols on Ethereum, Binance Smart Chain, and other networks offer ways to earn yield on crypto. Since Litecoin isn’t natively compatible with most DeFi platforms, users often need to convert LTC to a “wrapped” token (like wLTC) that can interact with smart contracts.

- Liquidity provision: By supplying Litecoin (often wrapped) to liquidity pools on decentralized exchanges (DEXs), users can earn a share of trading fees plus additional token incentives.

Each of these methods comes with its own risk-return profile, technical requirements, and liquidity considerations. The right choice depends on factors like risk tolerance, desired flexibility, and comfort with DeFi versus centralized platforms.

Earning Interest Through Crypto Lending Platforms

Lending platforms are among the most straightforward ways to earn interest on Litecoin. They act as intermediaries, connecting lenders (users who deposit crypto) with borrowers who need liquidity. In return for depositing LTC, lenders earn interest paid by borrowers, minus the platform’s cut.

Centralized Lending Platforms

Centralized exchanges and crypto financial services dominate this space. Platforms like Binance, Kraken, HTX (formerly Huobi), and others offer LTC interest products. Here’s how they typically work:

- Flexible savings: Users deposit LTC and can withdraw anytime. Interest accrues daily and is usually lower than fixed-term products but offers maximum liquidity.

- Fixed-term deposits: Users lock LTC for a set period (e.g., 30, 60, or 90 days) in exchange for higher APY. Early withdrawal may forfeit interest or incur penalties.

Reported interest rates on LTC vary widely. While some promotions or limited-time offers can advertise APYs exceeding 100%, typical rates for Litecoin are much more modest,often in the single digits, depending on market conditions and platform policies. It’s important to read the fine print: some high rates apply only to small amounts or short promotional windows.

Centralized platforms offer convenience and user-friendly interfaces, but they come with trade-offs. Users must trust the platform with custody of their coins, and there’s always a risk of hacks, mismanagement, or insolvency (as seen in high-profile failures like Celsius and BlockFi). Regulatory oversight varies by jurisdiction, so it’s wise to choose platforms with strong track records and transparent operations.

Decentralized Finance (DeFi) Options

For those comfortable with a bit more complexity, DeFi protocols offer non-custodial ways to earn yield on Litecoin. Because Litecoin isn’t natively compatible with most DeFi ecosystems (which are built on Ethereum, Binance Smart Chain, Avalanche, etc.), users typically need to use wrapped Litecoin (wLTC),a tokenized representation of LTC on another blockchain.

Once wrapped, LTC can be deposited into DeFi lending protocols like Aave, Compound, or others that support wLTC. Users earn interest paid by borrowers on these platforms. The advantage? No centralized custodian. The downside? Smart contract risk, the need to manage private keys, and the technical overhead of bridging and wrapping assets.

DeFi lending rates fluctuate based on supply and demand within each protocol. When borrowing demand is high, lenders earn more: when it’s low, rates drop. Most DeFi platforms offer variable rates, though some have introduced fixed-rate products. Users should also be aware of gas fees (especially on Ethereum) and the risks inherent in smart contracts and cross-chain bridges.

Using Interest-Bearing Crypto Savings Accounts

Crypto savings accounts function much like traditional bank savings accounts, but with cryptocurrency. Users deposit their LTC, and the platform pays interest over time. The coins are typically used by the platform for lending, trading, or other revenue-generating activities.

Several platforms have offered crypto savings products, though the landscape has shifted following regulatory crackdowns and platform failures in recent years. Services that remain operational often emphasize compliance, insurance, and transparency. Some examples include certain features on Kraken, Nexo, and YouHodler, though availability and terms vary by region.

Interest rates for LTC savings accounts are generally variable and influenced by market conditions. Platforms may adjust rates frequently based on supply, demand, and their own risk management policies. Unlike bank accounts insured by the FDIC, most crypto savings accounts don’t have equivalent protections, so users bear the risk of platform failure or loss.

The appeal of crypto savings accounts is simplicity. There’s no need to understand liquidity pools, wrapping tokens, or interacting with smart contracts. Deposit your LTC, watch the balance grow, and withdraw when needed (subject to any lock-up terms). But simplicity comes with centralization risk. Users must trust the platform’s solvency, security practices, and legal standing. It’s essential to research a platform’s reputation, security audits, insurance coverage, and regulatory status before committing significant funds.

Yield Farming and Liquidity Pools with Litecoin

Yield farming and liquidity provision are more advanced strategies that can generate higher returns,but also carry greater complexity and risk. These methods are popular in the DeFi space, where users provide assets to decentralized exchange (DEX) liquidity pools and earn rewards in return.

How to Participate in Liquidity Pools

Liquidity pools are smart contracts that hold pairs of tokens (e.g., LTC/USDT or wLTC/ETH) to help trading on DEXs like Uniswap, PancakeSwap, or SushiSwap. When traders swap tokens, they pay a small fee, which is distributed to liquidity providers (LPs) proportionally to their share of the pool.

To participate, a user deposits an equal value of two tokens into the pool. For example, if someone wants to provide liquidity to a wLTC/USDT pool, they’d need to deposit both wLTC and USDT. In return, they receive LP tokens representing their share of the pool. Over time, they earn a portion of trading fees, and some platforms offer additional incentive tokens to attract liquidity.

Yield farming takes this a step further by maximizing returns through multiple layers of rewards,staking LP tokens in additional protocols, chasing high-APY opportunities, and frequently moving assets between pools. It’s a more active, hands-on strategy that requires monitoring market conditions, gas fees, and changing yields.

The potential returns can be attractive, but so are the risks. Price volatility can lead to impermanent loss, a phenomenon where the value of tokens in a pool diverges, resulting in less value than if the user had simply held the tokens. Smart contract bugs, rug pulls, and exploits are also real dangers in the DeFi world.

Wrapped Litecoin for DeFi Access

Since Litecoin operates on its own blockchain and isn’t compatible with Ethereum-based DeFi protocols, users need to convert LTC into a wrapped token. Wrapped Litecoin (wLTC) is an ERC-20 or BEP-20 token pegged 1:1 to LTC, making it usable on Ethereum, Binance Smart Chain, and other networks.

Wrapping LTC typically involves using a bridge service or centralized exchange that holds the native LTC and issues the equivalent wLTC on another blockchain. This process introduces additional trust and technical risk,the bridge or custodian must be reliable, and cross-chain transactions can sometimes fail or be exploited.

Once wrapped, wLTC can be used across a wide range of DeFi applications: lending protocols, liquidity pools, yield aggregators, and more. When a user wants to return to native LTC, they unwrap the token through the same service. It’s a powerful way to unlock DeFi opportunities for Litecoin holders, but it’s not without friction or risk. Users should only use established, audited bridges and be mindful of gas fees and transaction times.

Risks and Considerations When Earning Interest

Earning interest on Litecoin sounds appealing, but it’s crucial to understand the risks involved. Unlike holding LTC in a personal wallet, where users control their private keys, earning yield typically requires trusting third parties or interacting with smart contracts,both of which introduce vulnerabilities.

Platform Security and Custody Risks

When users deposit Litecoin on a centralized platform, they’re entrusting that platform with custody of their funds. This introduces counterparty risk: the platform could be hacked, mismanage funds, face regulatory action, or even become insolvent. History has shown that even well-known platforms can fail,Celsius, Voyager, and BlockFi are recent cautionary tales.

To mitigate these risks, users should:

- Choose platforms with strong security practices, including cold storage, multi-signature wallets, and regular audits.

- Look for platforms that offer insurance or proof-of-reserves to demonstrate solvency.

- Avoid keeping all funds on a single platform,diversification reduces exposure to any one point of failure.

- Stay informed about regulatory developments that could impact platform operations.

In the DeFi space, custody risk is reduced (since users maintain control of their private keys), but smart contract risk takes its place. Bugs, exploits, or malicious code in a protocol can lead to loss of funds, and there’s often no recourse or customer support.

Market Volatility and Impermanent Loss

Cryptocurrency markets are notoriously volatile, and this affects yield strategies in several ways. For lending or savings accounts, volatility primarily impacts the value of the interest earned,if LTC’s price drops significantly, even a high APY may not offset the loss in dollar terms.

For liquidity providers, there’s the additional risk of impermanent loss. This occurs when the price ratio between the two tokens in a pool changes. If LTC appreciates significantly relative to its paired asset (say, USDT), the liquidity pool automatically rebalances, resulting in the LP holding less LTC and more of the paired token than they started with. If the price swing is large, the LP may end up with less total value than if they had simply held both tokens separately.

Impermanent loss is “impermanent” because it can reverse if prices return to their original ratio, but if the LP withdraws during unfavorable conditions, the loss becomes permanent. Trading fees and incentive rewards can offset impermanent loss, but it’s a key consideration for anyone participating in liquidity pools. Understanding the math and monitoring pool performance is essential for managing this risk.

Best Practices for Maximizing Returns Safely

Earning yield on Litecoin doesn’t have to be a high-stakes gamble. With thoughtful planning and risk management, users can generate returns while minimizing exposure to the most serious pitfalls. Here are some best practices:

Do your assignments. Before depositing LTC on any platform, research its history, security measures, and user reviews. Look for transparency around how the platform generates yield, where funds are held, and what protections are in place. Platforms that publish proof-of-reserves or undergo regular third-party audits inspire more confidence.

Diversify across platforms and strategies. Don’t put all your Litecoin in one basket. Spreading funds across multiple reputable platforms or a mix of centralized and decentralized options reduces the impact if one fails. Similarly, combining lending, savings, and liquidity strategies can balance risk and reward.

Prefer flexible withdrawal options. Lock-up periods can offer higher yields, but they also trap funds during market downturns or emergencies. Flexible products allow users to react quickly to changing conditions. The slightly lower APY is often worth the added liquidity and peace of mind.

Stay informed about fees. Transaction fees, withdrawal fees, and gas costs can eat into returns, especially on Ethereum-based DeFi protocols. Factor these into calculations and choose networks or platforms with reasonable fee structures.

Understand the regulatory landscape. Crypto regulations are evolving rapidly, and platforms operating in certain jurisdictions may face restrictions or shutdowns. Favor platforms that are compliant with local regulations and have clear legal structures.

Be realistic about yields. If a platform is offering APYs that seem too good to be true, they probably are. Extremely high rates are often unsustainable, reliant on incentive tokens that may lose value, or indicative of high risk. Moderate, consistent returns from established platforms are usually safer bets.

Keep security tight. Use strong, unique passwords, enable two-factor authentication (2FA), and consider hardware wallets for storing funds not actively earning yield. Be wary of phishing attempts and never share private keys or seed phrases.

By following these practices, Litecoin holders can navigate the yield landscape with greater confidence and build a strategy that aligns with their risk tolerance and financial goals.

Conclusion

Litecoin may not support traditional staking, but that doesn’t mean holders are stuck with idle assets. Through centralized lending platforms, crypto savings accounts, DeFi protocols, and liquidity pools, there are multiple avenues to earn interest or yield on LTC. Each method comes with its own set of trade-offs,centralized platforms offer ease of use but require trust, while DeFi provides decentralization at the cost of complexity and smart contract risk.

The key to success is understanding what you’re actually doing with your Litecoin. “Staking” LTC isn’t validating blockchain transactions: it’s lending, depositing, or wrapping your coins to generate returns through third parties or DeFi mechanisms. That distinction matters because it shapes the risks you’re taking on.

Whether someone is a cautious investor seeking steady, modest returns or a more adventurous participant willing to explore yield farming and liquidity provision, the opportunities are there. What matters most is doing thorough research, diversifying exposure, staying informed about risks, and choosing reputable platforms with strong security and transparency. With the right approach, Litecoin holders can put their assets to work and earn passive income,even without native staking.

Frequently Asked Questions

Can you stake Litecoin to earn passive income?

No, Litecoin cannot be staked in the traditional sense because it operates on a Proof-of-Work consensus mechanism, not Proof-of-Stake. Miners, not stakers, secure the Litecoin network. However, you can earn interest by lending your LTC on centralized platforms or using DeFi protocols.

What are the best ways to earn interest on Litecoin?

Litecoin holders can earn interest through centralized lending platforms like Binance and Kraken, crypto savings accounts, DeFi lending protocols using wrapped Litecoin, or by providing liquidity to decentralized exchange pools. Each method has different risk and return profiles.

What is wrapped Litecoin and why is it needed for DeFi?

Wrapped Litecoin (wLTC) is a tokenized version of LTC on blockchains like Ethereum or Binance Smart Chain. Since Litecoin operates on its own blockchain, it must be wrapped to interact with DeFi smart contracts, enabling access to lending protocols and liquidity pools.

What is impermanent loss in crypto liquidity pools?

Impermanent loss occurs when the price ratio between two tokens in a liquidity pool changes. If one asset appreciates significantly, the pool rebalances automatically, potentially leaving liquidity providers with less total value than if they had simply held the tokens separately.

Is earning interest on Litecoin safe?

Earning interest on Litecoin carries risks including platform security breaches, custody risks with centralized services, smart contract vulnerabilities in DeFi, and market volatility. Users should research platforms thoroughly, diversify holdings, and only use reputable services with strong security measures.

What’s the difference between Proof-of-Work and Proof-of-Stake blockchains?

Proof-of-Work blockchains like Litecoin and Bitcoin use miners who solve computational puzzles to validate transactions. Proof-of-Stake blockchains like Ethereum and Cardano allow token holders to lock up coins to validate blocks and earn staking rewards directly.