The cryptocurrency market has no shortage of projects that soar to astronomical heights, only to crash spectacularly within weeks or even days. These hype-driven coins ride waves of social media buzz, celebrity endorsements, and FOMO-fuelled speculation, often leaving late investors with heavy losses. Unlike projects with genuine utility and sound fundamentals, hype-driven coins derive their value from excitement rather than innovation or real-world application.

For investors navigating this volatile landscape, the ability to distinguish between sustainable projects and those built on shaky foundations is crucial. Spotting the warning signs early, before the inevitable crash, can mean the difference between protecting one’s capital and becoming another cautionary tale. This article explores the key red flags in tokenomics, marketing tactics, project fundamentals, and price action that signal when a coin is propelled by hype rather than substance.

Key Takeaways

- Hype-driven coins often display excessive token concentration amongst early holders, increasing the risk of coordinated sell-offs that can crash prices dramatically.

- Warning signs include aggressive influencer-driven marketing without substance, anonymous development teams, and vague use cases that fail to demonstrate real-world utility.

- Parabolic price movements without consolidation phases signal unsustainable growth driven by FOMO rather than genuine adoption or fundamentals.

- Scrutinising tokenomics, including supply distribution and vesting schedules, is essential to spot hype-driven coins before they collapse.

- Protecting your capital requires independent research, resistance to social media hype, and disciplined risk management strategies.

- Sustainable crypto projects distinguish themselves through transparent teams, clear problem-solving use cases, and organic community growth rather than speculative buzz.

Understanding the Anatomy of Hype-Driven Coins

Hype-driven coins are characterised by excessive excitement and aggressive promotion that inflates their value far beyond what their actual utility or fundamental worth would justify. These projects thrive on speculation, virality, and the buzz generated across social media platforms rather than technical innovation or tangible real-world applications.

Unlike established cryptocurrencies with proven track records and clear use cases, hype-driven coins often emerge suddenly, riding a wave of social sentiment. Their prices can skyrocket in a matter of days, creating the illusion of a golden investment opportunity. But, this rapid ascent is rarely supported by solid development work, partnerships, or adoption metrics.

What Makes a Coin Hype-Driven?

Several distinct characteristics set hype-driven coins apart from legitimate projects. The most prominent is viral marketing on social platforms. Memes, trending hashtags, and coordinated campaigns flood Twitter, Reddit, and TikTok, creating an echo chamber of enthusiasm that draws in curious investors.

Celebrity and influencer endorsements amplify this effect dramatically. A single tweet from a high-profile figure can trigger a surge in demand, with followers rushing to buy tokens without conducting proper due diligence. These endorsements rarely involve genuine understanding of the project’s technology or long-term viability, they’re often paid promotions or casual mentions that carry outsized weight.

FOMO (fear of missing out) is the psychological fuel that drives hype-driven coins to unsustainable heights. When investors see prices climbing rapidly and social media buzzing with success stories, the urge to jump in becomes overwhelming. This mass buying behaviour, undertaken with little research or understanding, creates artificial demand that collapses once the initial excitement fades. The result is a boom-and-bust cycle that enriches early holders whilst leaving latecomers with depreciating assets.

Red Flags in Tokenomics and Supply Distribution

Tokenomics, the economic model governing a cryptocurrency’s supply, distribution, and incentive structure, often provides the clearest early warning signs of a hype-driven project. When the distribution model favours insiders or lacks transparency, the risk of a sudden crash increases dramatically.

Excessive Token Concentration Among Early Holders

One of the most alarming red flags is when a small group of wallets controls the majority of a token’s supply. This concentration gives early holders or project insiders disproportionate power over the market. If these large holders decide to sell simultaneously, often referred to as a “pump and dump” scheme, the resulting supply flood can trigger a catastrophic price collapse.

Investors should examine blockchain explorers to review the top wallet holdings. If the top 10 or 20 addresses control more than 50% of the total supply, it’s a significant warning sign. Legitimate projects typically have broader distribution patterns, with tokens spread across a larger community of holders. High concentration suggests that the project may be designed to benefit a select few at the expense of retail investors.

Unrealistic Supply Schedules and Vesting Periods

The timing and structure of token unlocks also reveal much about a project’s intentions. Vesting periods are designed to align the interests of team members, early investors, and the broader community by preventing insiders from immediately dumping their allocations.

When a project has poorly structured vesting schedules, or none at all, insiders can flood the market with tokens before the project has achieved meaningful adoption or developed real utility. Rapid unlocks, especially during periods of hype-driven price spikes, allow early participants to cash out whilst retail investors are still buying in.

Projects that front-load large percentages of supply to team members and advisers with short or non-existent lock-up periods show a lack of long-term commitment. If developers can sell freely within weeks or months of launch, it suggests they’re more interested in quick profits than building a sustainable ecosystem.

Warning Signs in Marketing and Community Behaviour

Marketing strategies and community dynamics offer critical insight into whether a project is built on substance or hype. When promotion tactics prioritise spectacle over transparency, investors should proceed with caution.

Over-Reliance on Influencer Endorsements

Celebrity tweets, YouTube shout-outs, and influencer-driven campaigns can generate enormous short-term attention, but they’re not substitutes for credible development or genuine utility. When a project’s primary marketing strategy revolves around paying influencers to create buzz, it often means the underlying product lacks compelling features worth promoting on its own merits.

Influencer endorsements are particularly dangerous because they exploit trust relationships between content creators and their audiences. Followers may assume that an endorsement implies due diligence or personal investment, when in reality the influencer may have been paid to promote the token without fully understanding, or caring about, its fundamentals.

Projects with legitimate value tend to build communities organically through technical achievements, partnerships, and real-world adoption. Whilst they may use influencer marketing as part of a broader strategy, it’s not their sole avenue for generating interest.

Aggressive Promotion Without Substance

A project that markets itself relentlessly but offers little transparency about its technology, roadmap, or team is a major warning sign. Hype-driven coins often feature slick websites, bold claims, and endless social media content, but when investors dig deeper, they find vague whitepapers, missing technical documentation, or no evidence of actual development progress.

Aggressive promotion without substance often manifests as constant announcements of “partnerships” that turn out to be informal agreements, overhyped “product launches” that are little more than beta tests, and exaggerated claims about solving problems the project isn’t equipped to address. The marketing noise is designed to maintain momentum and keep the hype alive, distracting from the lack of meaningful progress.

Investors should ask: What has this project actually built? Is there a working product or prototype? Are there independent reviews or audits? If the answers are elusive or buried beneath layers of promotional content, it’s a sign the project may be more spectacle than substance.

Evaluating the Project’s Fundamentals and Utility

Beyond marketing and tokenomics, the core question investors must ask is simple: Does this project solve a real problem, and is its solution viable? Hype-driven coins often fail this test spectacularly.

Lack of Clear Use Case or Real-World Application

If a project’s purpose is vague, overly ambitious, or disconnected from any tangible problem, it’s likely built for speculation rather than long-term value creation. Legitimate cryptocurrencies and blockchain projects address specific needs, whether that’s enabling decentralised finance, improving supply chain transparency, or facilitating cross-border payments.

Hype-driven coins, by contrast, often pitch themselves with buzzwords and grand visions but offer little detail on how they’ll achieve their goals. Their whitepapers may be filled with jargon and aspirational language whilst avoiding specifics about technology, competitive advantages, or adoption strategies.

Investors should scrutinise whether the project’s proposed use case genuinely benefits from blockchain technology or if it’s simply applying crypto to a problem that already has adequate solutions. If the answer isn’t clear, or if the project seems to be chasing trends without a coherent strategy, it’s a red flag.

Absent or Anonymous Development Team

Transparency around the development team is a cornerstone of credible projects. When team members have public profiles, verifiable track records, and relevant expertise, it builds trust and accountability. Conversely, projects led by anonymous or pseudonymous teams, without compelling reasons for anonymity, raise immediate concerns.

Whilst some legitimate projects (such as Bitcoin itself) have anonymous origins, the broader crypto ecosystem has matured to a point where investors rightly expect transparency. An absent or anonymous team makes it nearly impossible to assess whether the project has the expertise and commitment needed to deliver on its promises.

Also, anonymity provides an easy exit for developers who may be planning to abandon the project or execute a rug pull. Without accountability, there’s little to stop insiders from cashing out and disappearing when the hype fades. Investors should verify team credentials, review past projects, and look for independent endorsements from reputable figures in the blockchain space.

Price Action Patterns That Signal Unsustainable Growth

Whilst fundamental analysis provides essential context, price charts often tell their own story. Certain patterns in price action and trading volume are hallmarks of unsustainable, hype-driven growth.

Parabolic Price Movements Without Consolidation

Parabolic price rises, where a coin’s value shoots up rapidly in a near-vertical trajectory, are visually striking and emotionally compelling. They create the impression that anyone who buys now will get rich quickly. But, these sharp increases with little or no consolidation are classic signs of speculative bubbles.

Healthy projects typically experience periods of price appreciation followed by consolidation phases, where the price stabilises and the market digests gains. This pattern reflects organic growth driven by adoption, development milestones, and sustained interest. In contrast, parabolic moves without consolidation suggest that buying is driven purely by hype and FOMO, with no underlying support to sustain the price.

When a coin’s chart shows a near-vertical climb, it’s often only a matter of time before the inevitable correction, or crash. Early investors and insiders recognise these patterns and frequently take profits at or near the peak, leaving late entrants holding depreciated assets.

Volume Spikes Followed by Declining Interest

Trading volume is another critical indicator. Hype-driven coins often experience massive volume spikes as social media buzz reaches fever pitch. These spikes represent a frenzy of buying activity, with investors piling in to avoid missing out.

But, when that initial excitement fades, often within days or weeks, trading volume drops sharply. Declining volume signals that interest is waning and liquidity is drying up. Without sustained trading activity, even modest sell orders can trigger significant price drops.

Investors should watch for patterns where volume surges during price rallies but fails to return during subsequent price movements. This divergence suggests that the initial interest was speculative and temporary, rather than indicative of genuine long-term demand. Once the hype cycle ends, the coin is left with a diminished and disengaged community, making recovery difficult.

Protecting Yourself From Hype-Driven Crashes

Avoiding losses from hype-driven coins requires discipline, scepticism, and a commitment to independent research. Whilst the allure of quick profits is tempting, the vast majority of these projects leave investors worse off.

The first and most important step is to always review a project’s fundamentals and use cases. Ask hard questions about what problem the project solves, whether blockchain technology is the right solution, and how the project differentiates itself from competitors. If the answers are vague or unconvincing, walk away.

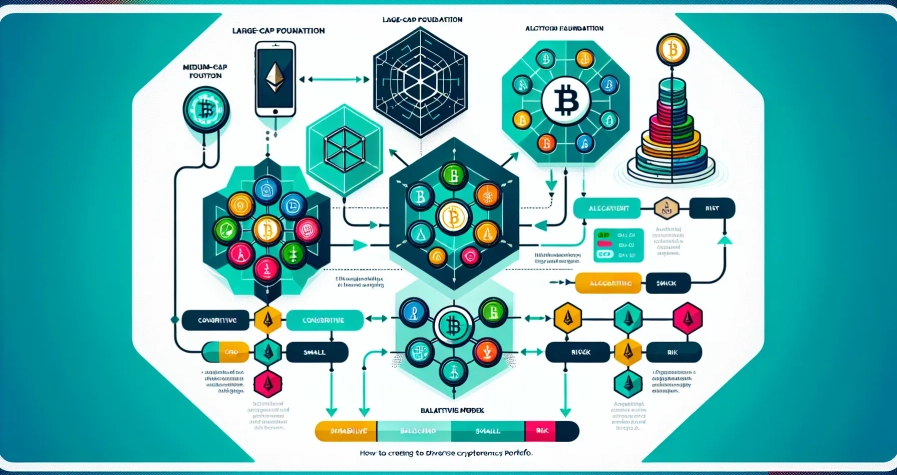

Next, investigate tokenomics thoroughly. Examine the supply distribution, vesting schedules, and holder concentration. Use blockchain explorers to verify claims and identify red flags. Projects with transparent, fair token distribution are far less likely to experience coordinated sell-offs or rug pulls.

Be particularly cautious of projects with anonymous or unverifiable teams. Whilst anonymity isn’t automatically disqualifying, it should prompt extra scrutiny. Look for independent audits, peer reviews, and endorsements from respected figures in the crypto space.

Resist the temptation to invest based solely on social media trends or influencer endorsements. Hype is designed to bypass rational decision-making and exploit emotional impulses. Instead, use independent research, consult multiple sources, and consider the project’s long-term viability.

Finally, employ rigorous risk management. Never invest more than you can afford to lose, and avoid concentrating your portfolio in speculative assets. Diversification, position sizing, and setting stop-loss orders can help mitigate the impact of sudden crashes. Remember that in the world of hype-driven coins, the house always wins, and the house is usually the insiders who designed the tokenomics and marketing strategy.

Conclusion

Spotting hype-driven coins before they crash is as much about recognising patterns as it is about maintaining discipline in the face of FOMO. The warning signs are rarely subtle, excessive token concentration, anonymous teams, influencer-driven marketing, and parabolic price movements all signal that a project is built on speculation rather than substance.

Investors who take the time to scrutinise tokenomics, evaluate fundamentals, and question marketing narratives can protect themselves from the inevitable crashes that follow hype cycles. Whilst the crypto market will always have room for speculative plays, lasting success comes from identifying projects with genuine utility, transparent teams, and sustainable growth models. The key is to look past the noise, ask the right questions, and invest with both eyes open.

Frequently Asked Questions

How can I spot hype-driven coins before they crash?

Look for red flags such as excessive token concentration among early holders, anonymous development teams, aggressive influencer marketing without substance, and parabolic price movements without consolidation. These warning signs indicate a project built on speculation rather than genuine utility.

What are the warning signs in tokenomics that indicate a potential crash?

Key warning signs include when the top 10-20 wallet addresses control over 50% of total supply, poorly structured or absent vesting periods, and rapid token unlock schedules. These factors give insiders disproportionate power to trigger sudden price collapses through coordinated selling.

Why do celebrity endorsements of cryptocurrencies pose risks to investors?

Celebrity endorsements often exploit trust relationships without genuine due diligence. Influencers may be paid to promote tokens they don’t fully understand, creating artificial hype that drives FOMO-based buying. This short-term buzz rarely reflects a project’s actual fundamentals or long-term viability.

What is a pump and dump scheme in cryptocurrency?

A pump and dump occurs when early holders or insiders artificially inflate a coin’s price through coordinated buying and hype, then simultaneously sell their holdings. This floods the market with supply, triggering a catastrophic price collapse that leaves late investors with heavy losses.

How do I check if a cryptocurrency has a fair token distribution?

Use blockchain explorers to review the top wallet holdings and verify supply distribution claims. Legitimate projects typically have tokens spread across a larger community rather than concentrated among a few addresses. Check for transparent vesting schedules and lock-up periods for team members.

What does parabolic price movement mean for a cryptocurrency’s stability?

Parabolic price rises—near-vertical climbs without consolidation phases—signal unsustainable, speculative bubbles driven by FOMO rather than organic growth. Healthy projects experience appreciation followed by stabilisation periods, whereas parabolic movements typically precede sharp corrections or crashes.