Getting into cryptocurrency is exciting, but one wrong move can mean losing everything. Unlike a bank that might reimburse you for fraud, crypto transactions are final, there’s no customer service line to ring when things go sideways. That’s why securing your first crypto wallet isn’t just a good idea: it’s absolutely critical.

The good news? Wallet security isn’t rocket science. It’s about building the right habits from day one and understanding that your digital assets are only as safe as the practices you put in place. Whether someone’s holding £100 or £100,000 in crypto, the principles remain the same: protect the private keys, stay vigilant against threats, and never get complacent.

This guide walks through everything a newcomer needs to know to secure their first crypto wallet like a seasoned pro, from choosing the right wallet type to avoiding the traps that catch out even experienced users.

Key Takeaways

- Securing your first crypto wallet requires protecting private keys and building smart security habits from day one, as crypto transactions are irreversible with no central authority to reverse losses.

- Hardware wallets provide the highest security for large or long-term holdings by keeping private keys completely offline, whilst software wallets suit everyday transactions with smaller amounts.

- Always write down your recovery phrase by hand and store it in multiple secure physical locations—never digitally—as anyone with access to it can drain your wallet instantly.

- Enable multi-factor authentication using authenticator apps or hardware security keys rather than SMS to add a crucial second layer of protection against unauthorised access.

- Avoid phishing scams by manually verifying URLs, never sharing private keys or recovery phrases with anyone, and treating unsolicited communications with suspicion.

- Conduct regular security audits to update wallet software, review connected apps, test backup recovery processes, and ensure defences evolve alongside emerging threats.

Understanding the Basics of Crypto Wallet Security

Before diving into strategies and tools, it’s essential to grasp what a crypto wallet actually does. Even though the name, wallets don’t store cryptocurrency itself. Instead, they hold the private keys, cryptographic credentials that prove ownership and allow transactions to be authorised. Lose those keys, and the funds are gone forever. There’s no password reset button.

This is fundamentally different from traditional banking. If someone’s debit card gets stolen, they can ring the bank, freeze the account, and often recover the money. Cryptocurrency operates on decentralised networks with no central authority to reverse transactions or restore lost keys. Once crypto leaves a wallet, it’s irreversible.

That immutability is what makes blockchain technology powerful, but it also places full responsibility on the user. Security isn’t outsourced to a financial institution, it’s a personal obligation. Understanding this mindset shift is the first step towards proper wallet security.

Why Your Wallet Is Only as Safe as Your Security Practices

Technology can only do so much. Even the most advanced hardware wallet becomes useless if someone writes their recovery phrase on a Post-it note stuck to their monitor or falls for a phishing scam. The weakest link in crypto security is almost always human behaviour.

Poor password habits, neglecting backups, or clicking suspicious links all undermine even the best wallet technology. Scammers know this and actively exploit user mistakes rather than trying to crack encryption. They’ll impersonate customer support, create fake websites that look legitimate, or send urgent messages designed to panic people into handing over sensitive information.

Vigilance matters more than any single piece of software. Someone could have the latest hardware wallet but still lose everything by typing their recovery phrase into a phishing site. Conversely, even a basic software wallet can remain secure in the hands of a disciplined user who follows proper protocols.

The bottom line: wallet security is less about choosing the “perfect” technology and more about cultivating smart, consistent habits. It’s the daily choices, double-checking URLs, keeping backups offline, never sharing private keys, that determine whether crypto stays safe or disappears.

Choosing the Right Type of Wallet for Maximum Protection

Not all wallets are created equal, and the right choice depends on how someone plans to use their cryptocurrency. Each wallet type presents different trade-offs between convenience and security.

Software wallets (mobile or desktop apps) connect to the internet, making them convenient for frequent transactions. They’re perfect for everyday use, paying for goods, trading, or moving crypto between exchanges. But that constant connectivity also exposes them to online threats like malware, hacking attempts, and phishing attacks. Software wallets work best for smaller amounts that someone needs regular access to, not for life savings.

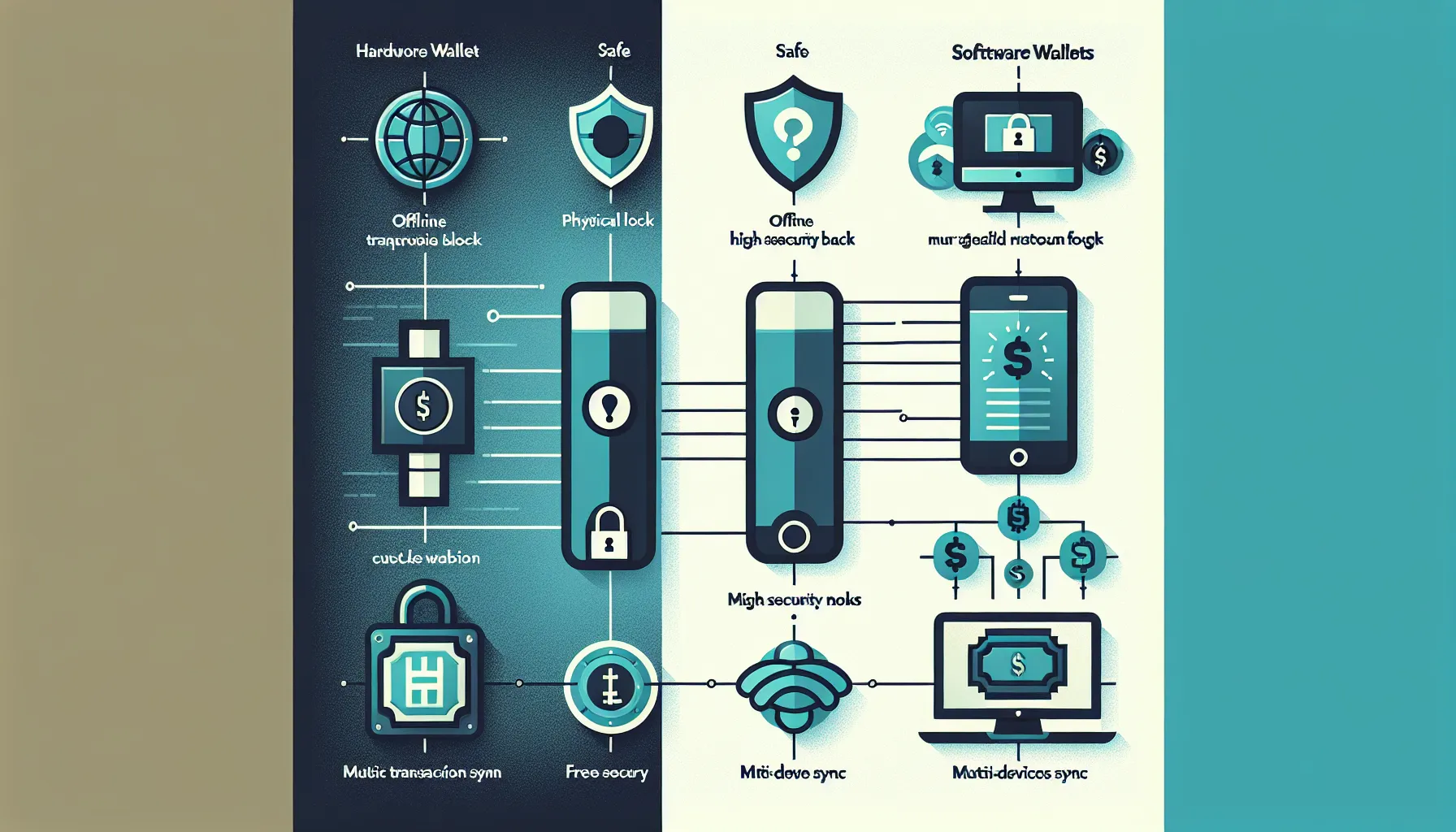

Hardware wallets are physical devices that store private keys completely offline. They’re the gold standard for security, especially for larger holdings or long-term investments. Because they never connect directly to the internet (they sign transactions offline and only transmit the signed data), they’re nearly immune to remote hacking. The main risks are physical: losing the device or having it stolen. But, as long as the recovery phrase is backed up properly, funds remain recoverable even if the hardware itself is lost.

Browser extensions and exchange wallets offer maximum convenience but come with heightened risk. Exchange wallets, where the platform holds the private keys, make users dependent on that company’s security. If the exchange gets hacked or goes bankrupt, funds could vanish. Browser wallets are slightly better since users control the keys, but they’re still vulnerable to malicious extensions, compromised websites, and phishing. These should only be used for small, expendable amounts.

For most newcomers, a hybrid approach makes sense: use a software wallet for day-to-day transactions and a hardware wallet to store the bulk of holdings securely offline. This balances accessibility with robust protection.

Hardware Wallets vs Software Wallets: Security Trade-Offs

Understanding the core differences helps clarify when to use each type:

| Hardware Wallets | Software Wallets | |

|---|---|---|

| Connectivity | Offline (cold storage) | Online (hot storage) |

| Main Risk | Physical theft or loss | Malware, hacking, phishing |

| Use Case | Large/long-term holdings | Daily transactions/small balances |

| Security Level | Very high | Moderate to low |

| Convenience | Requires physical access | Immediate, from any device |

| Cost | Upfront purchase (£50–£200+) | Often free |

Hardware wallets shine when security is the absolute priority. They’re ideal for anyone holding significant value or planning to invest for the long haul. Software wallets, on the other hand, excel at flexibility and speed, making them indispensable for active users who need constant access.

The key is matching the wallet type to the risk profile. A student experimenting with £50 worth of crypto doesn’t need a £150 hardware wallet. But someone holding thousands of pounds in Bitcoin or Ethereum? That hardware wallet isn’t optional, it’s essential insurance.

Setting Up Your Wallet with Security-First Configuration

The initial setup is where many security vulnerabilities begin, often without the user realising. Taking the time to configure a wallet properly from the outset can prevent catastrophic mistakes down the line.

First and foremost, only download wallet software from official, verified sources. Fake wallet apps and malicious browser extensions are rampant, designed to steal credentials the moment they’re entered. Double-check the URL, confirm the developer’s identity, and read recent reviews. If something feels off, it probably is.

Once the wallet’s installed, keep everything updated. Developers regularly patch security flaws and improve defences against new threats. Running outdated software is like leaving the front door unlocked, it’s an invitation for trouble.

Before moving significant funds into a new wallet, test the process with a small transfer. Send a tiny amount, practice receiving it, and make sure the backup and recovery process works as expected. This trial run reveals any configuration issues or misunderstandings while the stakes are still low. Better to discover a problem with £5 at risk than £5,000.

Creating an Unbreakable Password Strategy

Passwords are the first line of defence, yet they’re often treated as an afterthought. A weak or reused password can unravel even the most secure wallet setup.

An effective password should be long (at least 16 characters), complex (mixing uppercase, lowercase, numbers, and symbols), and entirely unique to that wallet. Avoid anything remotely guessable, no birthdays, pet names, or common phrases. The goal is randomness that’s impossible for attackers to brute-force or guess.

Trying to remember dozens of complex passwords is unrealistic, and that’s where password managers come in. Tools like Bitwarden, 1Password, or KeePass generate and store strong passwords securely, so users only need to remember one master password. This eliminates the temptation to reuse passwords across sites, which is one of the most common ways accounts get compromised.

For crypto wallets, some users go a step further by storing the password offline entirely, written down and kept in a secure location like a safe. This removes any digital attack vector, though it requires careful physical security.

Never, under any circumstances, should a password be saved in a browser, emailed to oneself, or stored in an unencrypted text file. These are low-hanging fruit for hackers.

Properly Backing Up Your Recovery Phrase

The recovery phrase (also called a seed phrase) is the master key to a crypto wallet. It’s a series of 12 to 24 words generated during setup that can restore access to the wallet if the device is lost, stolen, or damaged. Protecting this phrase is non-negotiable.

Write it down by hand. Don’t type it into a computer, take a photo, or store it in the cloud. Digital copies can be hacked, intercepted, or accidentally shared. Physical paper, kept offline, remains the safest method.

Store the written phrase in multiple secure locations. A fireproof safe is ideal, but even a locked drawer or safety deposit box works. Having backups in different physical locations guards against disasters like fire, flood, or theft. If one copy is destroyed or stolen, another remains safe.

Never share the recovery phrase with anyone, not friends, not family, and certainly not customer support. No legitimate service will ever ask for it. Anyone who has access to those words has full control over the wallet and can drain it instantly.

Some users engrave their recovery phrase onto metal plates, which offer even greater durability than paper. Products designed specifically for this purpose can withstand extreme temperatures and corrosion, providing peace of mind for long-term holders.

The cardinal rule: treat the recovery phrase like a bank vault combination. Guard it jealously, back it up redundantly, and assume that anyone who sees it can steal everything.

Implementing Multi-Layer Authentication Measures

Relying on a single password, no matter how strong, leaves a wallet vulnerable. Multi-layer authentication (often called two-factor authentication or 2FA) adds an extra checkpoint that dramatically reduces the risk of unauthorised access.

Two-factor authentication requires two separate credentials to log in: something the user knows (the password) and something they have (a second device or token). Even if an attacker steals the password, they still can’t access the wallet without the second factor.

Most crypto wallets and exchanges support 2FA, and enabling it should be one of the first steps during setup. The most common methods are:

- Authenticator apps (like Google Authenticator, Authy, or Microsoft Authenticator): These generate time-based one-time codes that refresh every 30 seconds. They’re far more secure than SMS because they aren’t vulnerable to SIM-swapping attacks, where criminals hijack a phone number to intercept text messages.

- SMS-based 2FA: Better than nothing, but less secure. Mobile networks can be compromised, and attackers with access to a phone number can bypass this layer entirely. If authenticator apps are available, always choose them over SMS.

- Hardware security keys (like YubiKey): The most robust option. These physical devices plug into a computer or connect via NFC and provide cryptographic proof of identity. They’re nearly impossible to phish or duplicate.

For wallets holding substantial value, combining multiple layers, password, authenticator app, and hardware key, creates formidable defence in depth. Each additional layer makes an attacker’s job exponentially harder.

It’s also wise to store backup codes securely when setting up 2FA. These codes allow access if the authenticator app or device is lost. Keep them offline, written down, and stored alongside the recovery phrase.

Protecting Your Wallet from Common Attack Vectors

Even with strong passwords and 2FA in place, attackers constantly probe for weaknesses. Understanding the most common threats and how to counter them is essential for maintaining long-term security.

Avoid public Wi-Fi at all costs when accessing a crypto wallet. Open networks in cafés, airports, or hotels are prime hunting grounds for hackers. They can intercept data, inject malicious code, or set up fake hotspots designed to capture login credentials. If wallet access is necessary while out, use a trusted mobile data connection or a reputable VPN.

Keep private keys offline whenever possible. Hot wallets (connected to the internet) should only hold amounts someone’s comfortable losing. The bulk of holdings should remain in cold storage, hardware wallets or even paper wallets that never touch a networked device.

Update software religiously. Wallet applications, operating systems, and antivirus tools all receive regular updates that patch newly discovered vulnerabilities. Delaying updates leaves doors open for exploits that have already been fixed. Set devices to update automatically where possible, and manually check for wallet app updates frequently.

Avoiding Phishing Scams and Fraudulent Websites

Phishing is the number one method attackers use to steal cryptocurrency. These scams involve fake websites, emails, or messages designed to trick users into revealing their private keys or recovery phrases.

Always verify URLs manually. Phishing sites often use addresses that look nearly identical to legitimate ones, replacing a single letter or using a different domain extension (.com vs .co, for example). Bookmark the official wallet or exchange site and only access it through that bookmark, never by clicking links in emails or messages.

Be sceptical of unsolicited communications. If an email claims there’s a problem with the wallet and urges immediate action, pause and verify independently. Contact the service directly through official channels rather than replying or clicking embedded links.

No legitimate company will ever ask for a recovery phrase or private key. Not in an email, not in a support chat, not over the phone. If someone requests this information, it’s a scam, full stop.

Some attackers impersonate well-known figures in the crypto space, offering giveaways or investment opportunities. These are always fraudulent. Real giveaways don’t require sending crypto first or providing private information.

Securing Your Devices Against Malware

Malware, malicious software designed to steal data or control devices, poses a constant threat. Keyloggers can capture passwords as they’re typed, clipboard hijackers can swap wallet addresses during copy-paste, and remote access trojans can grant attackers full control of a device.

Install reputable antivirus and anti-malware software on all devices used for crypto. Keep it updated and run regular scans. Whilst no antivirus is foolproof, it catches the majority of common threats.

Avoid downloading unknown apps, browser extensions, or pirated software. These are frequent vectors for malware. Stick to official app stores and verified publishers. Even then, check reviews and permissions carefully, some malicious apps slip through.

Browser extensions in particular deserve scrutiny. Some crypto users have lost funds to malicious extensions that monitor activity or inject fake transaction prompts. Only install extensions from trusted developers, and review them periodically to ensure none have been compromised in updates.

For high-value wallets, consider using a dedicated device, a computer or phone used solely for crypto and nothing else. This reduces the attack surface dramatically, as there’s no web browsing, social media, or other activity that might introduce malware.

Best Practices for Long-Term Wallet Management

Securing a wallet isn’t a one-time task, it’s an ongoing commitment. Threats evolve, software updates roll out, and personal circumstances change. Staying secure over the long haul requires regular attention and smart habits.

Limit hot wallet funds to working amounts. Only keep in software wallets what’s needed for immediate use, think of it as the cash in a physical wallet. Everything else should live in cold storage, protected offline. This minimises exposure if a hot wallet is ever compromised.

Maintain records for tax and audit purposes. In the UK, HM Revenue & Customs treats cryptocurrency as an asset subject to Capital Gains Tax. Keeping detailed transaction records, dates, amounts, purposes, makes tax season far less painful and ensures compliance. Some wallets and portfolio trackers offer built-in reporting features that simplify this.

Conduct periodic security reviews. Every few months, take stock: Are passwords still strong and unique? Is 2FA enabled everywhere possible? Are backups still secure and accessible? Has any software fallen out of date? This routine check-up catches issues before they become crises.

If personal circumstances change, moving house, changing devices, or sharing living space, re-evaluate security measures. What worked in a private flat might not be adequate in a shared house or while travelling.

Regular Security Audits and Updates

The crypto landscape changes rapidly. New vulnerabilities are discovered, wallet software improves, and attack methods become more sophisticated. Regular audits ensure defences keep pace.

Check for wallet and app updates at least monthly, if not more frequently. Developers often release patches in response to newly identified threats, and using outdated software can leave wallets exposed to known exploits.

Review enabled permissions and connected apps. Over time, it’s easy to accumulate third-party connections, portfolio trackers, tax tools, DeFi platforms, that have varying levels of access. Revoke anything no longer needed or trusted.

Test backups periodically to confirm they actually work. There’s nothing worse than discovering during an emergency that a recovery phrase was written down incorrectly or that a backup file has become corrupted. Every six months or so, verify that the recovery process functions as expected (using a test wallet or small amount, not the main holdings).

Stay informed about emerging threats. Follow reputable crypto security sources, join community forums, and keep an ear to the ground for new scam tactics or vulnerabilities. Knowledge is the best defence, the more someone understands current risks, the better equipped they are to avoid them.

Finally, consider adjusting strategies as holdings grow. What’s adequate security for £500 might be woefully insufficient for £50,000. As the value increases, so should the investment in security, better hardware wallets, more secure physical storage, perhaps even multi-signature setups that require multiple devices to authorise transactions.

Conclusion

Securing a first crypto wallet isn’t about memorising a long list of rules, it’s about adopting a security-first mindset and building habits that become second nature. The technology provides the tools, but eventually, a wallet’s safety rests on the decisions made every day.

Robust passwords, secure backups, multi-factor authentication, and vigilance against phishing and malware form the foundation of wallet security. Choosing the right type of wallet for the use case, keeping software updated, and conducting regular audits add layers of protection that together make funds remarkably difficult to compromise.

Threats will continue to evolve, and so must defences. But anyone willing to take security seriously, to treat private keys like the irreplaceable assets they are, can confidently navigate the crypto world without becoming another cautionary tale. The effort invested in securing a wallet today pays dividends in peace of mind and financial safety for years to come.

Frequently Asked Questions

What happens if I lose my crypto wallet recovery phrase?

If you lose your recovery phrase, you permanently lose access to your cryptocurrency. Unlike banks, there’s no password reset or customer service to help recover funds. This is why backing up your seed phrase in multiple secure, offline locations is absolutely critical.

How do hardware wallets protect cryptocurrency better than software wallets?

Hardware wallets store private keys completely offline, making them immune to online hacking, malware, and phishing attacks. They sign transactions offline and only transmit signed data, providing the gold standard for securing larger holdings or long-term investments.

Should I use SMS or an authenticator app for two-factor authentication on my crypto wallet?

Always choose authenticator apps like Google Authenticator or Authy over SMS. Authenticator apps generate time-based codes and aren’t vulnerable to SIM-swapping attacks, where criminals hijack your phone number to intercept text messages and bypass security.

Can I store my crypto wallet recovery phrase in the cloud or take a photo?

Never store your recovery phrase digitally—no cloud storage, photos, or typed documents. Digital copies can be hacked or accidentally shared. Write it down by hand and keep it in secure physical locations like fireproof safes or safety deposit boxes.

What is the difference between hot and cold crypto wallets?

Hot wallets are connected to the internet, offering convenience for frequent transactions but higher risk from online threats. Cold wallets remain offline (like hardware or paper wallets), providing maximum security for storing larger amounts long-term with minimal hacking risk.

How often should I update my crypto wallet software for security?

Check for wallet and app updates at least monthly. Developers regularly patch security vulnerabilities and improve defences against new threats. Running outdated software leaves your wallet exposed to known exploits that have already been fixed.