Cryptocurrency has evolved far beyond speculative trading. What once existed purely in digital exchanges now serves as a practical payment method for everyday purchases, from groceries and coffee to flights and online subscriptions. Yet many people who hold Bitcoin, Ethereum, or other digital assets remain unsure how to actually use them in the real world.

The good news? Paying with crypto has become surprisingly straightforward. Whether someone prefers direct wallet-to-wallet transfers or the tap-and-go simplicity of a crypto-backed debit card, multiple pathways exist to convert digital holdings into tangible goods and services. This guide walks through the essential methods, setup steps, and practical considerations for anyone ready to spend their cryptocurrency beyond the screen.

Key Takeaways

- Paying for real-world purchases using cryptocurrency can be done through direct wallet-to-wallet transfers or crypto-backed debit cards that work at any standard card terminal.

- Cryptocurrency debit cards from platforms like Crypto.com, Binance, and Coinbase automatically convert digital assets to GBP at the point of sale, offering tap-and-go convenience without merchant crypto adoption.

- Setting up payments requires an FCA-registered exchange account with KYC verification, and a mobile wallet app for scanning QR codes at checkout counters.

- HMRC treats every crypto purchase as a taxable disposal event, requiring users to calculate capital gains or losses on each transaction against their original acquisition cost.

- Transaction fees and confirmation times vary significantly by blockchain, with Bitcoin sometimes taking up to an hour whilst newer networks settle almost instantly.

- Double-checking recipient wallet addresses and enabling two-factor authentication are essential security practices, as cryptocurrency transactions are irreversible with no bank to reverse mistakes.

Understanding Cryptocurrency Payment Methods

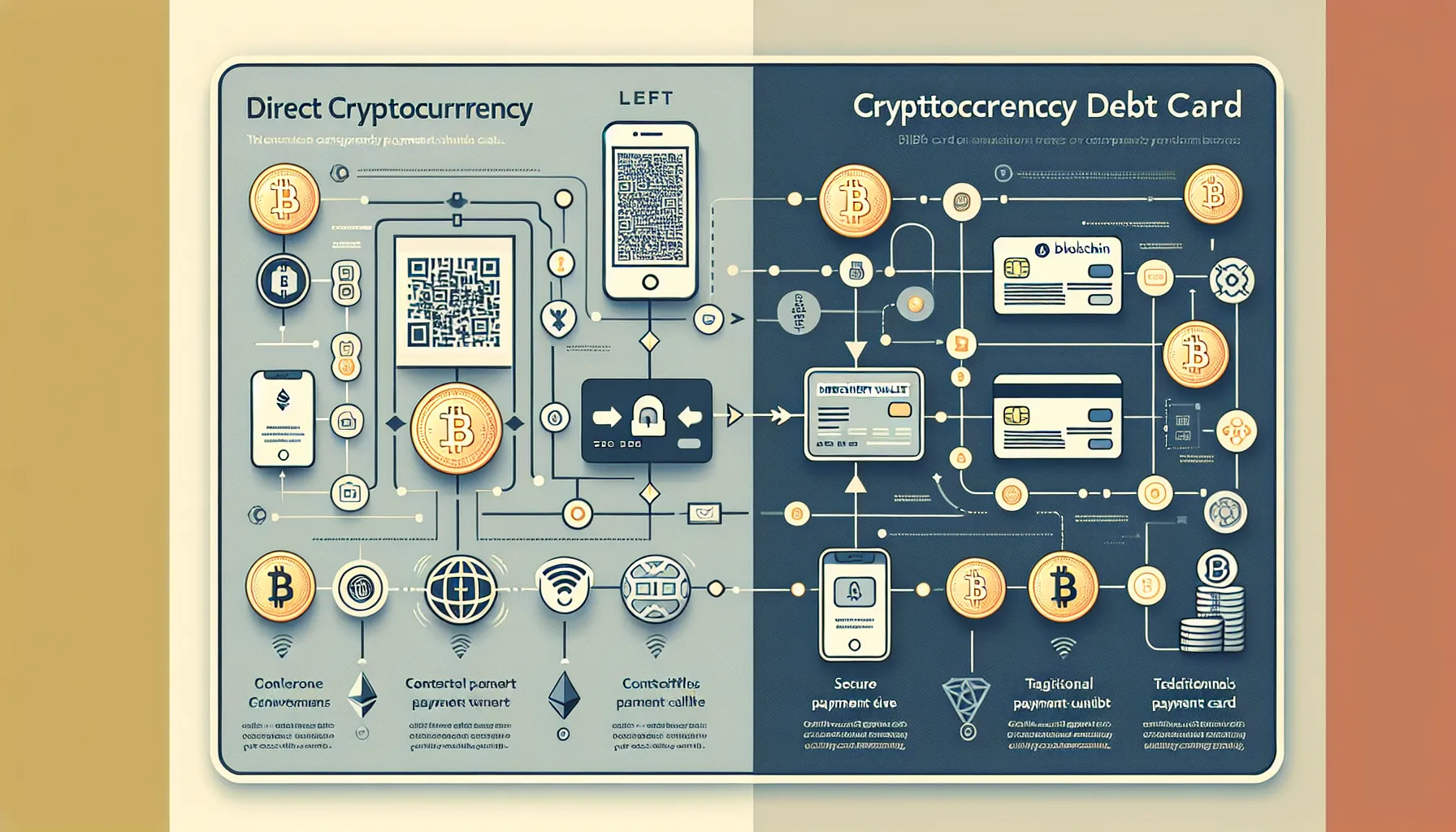

Two primary methods dominate the landscape of real-world crypto payments, each with distinct advantages depending on the user’s needs and the merchant’s capabilities.

Direct Cryptocurrency Payments

Direct payments involve sending cryptocurrency straight from a user’s wallet to a business’s wallet address. The process typically unfolds through a QR code displayed at checkout, either on a shop’s payment terminal or on a website’s payment page. The customer scans the code with their wallet app, reviews the amount and destination address, then authorises the transfer.

This method offers true peer-to-peer transactions without intermediaries, preserving the decentralised spirit of cryptocurrency. It works particularly well for Bitcoin, Ethereum, Litecoin, and other established coins. Some businesses also integrate payment gateways like BitPay or CoinGate, which streamline the process by generating payment requests and handling exchange rate conversions in real time.

But, direct payments do carry nuances. Transaction speeds vary by blockchain, Bitcoin transfers might take several minutes during network congestion, whilst faster chains like Litecoin or certain Layer-2 solutions confirm almost instantly. Users also need to account for network fees, which fluctuate based on demand and can occasionally exceed the cost of small purchases.

Cryptocurrency Debit Cards

For those seeking the convenience of traditional card payments, cryptocurrency debit cards bridge the gap between digital assets and everyday spending. Offered by major platforms such as Crypto.com, Binance, and Coinbase, these cards automatically convert cryptocurrency holdings into GBP (or other fiat currencies) at the point of sale.

The beauty of crypto cards lies in their universality. Because they’re issued through Visa or Mastercard networks, they’re accepted at virtually any merchant that takes standard debit cards, from high-street shops to online retailers to contactless terminals on public transport. The user simply loads crypto onto their card account, and the platform handles all conversion and settlement behind the scenes.

Crypto debit cards also sidestep some of the friction inherent in direct payments. There’s no waiting for blockchain confirmations, no need to verify wallet addresses, and no concern about whether a specific shop accepts cryptocurrency. The transaction feels identical to using any other debit card, making it an ideal entry point for newcomers or anyone prioritising simplicity over ideological purity.

Setting Up Your Cryptocurrency Wallet for Payments

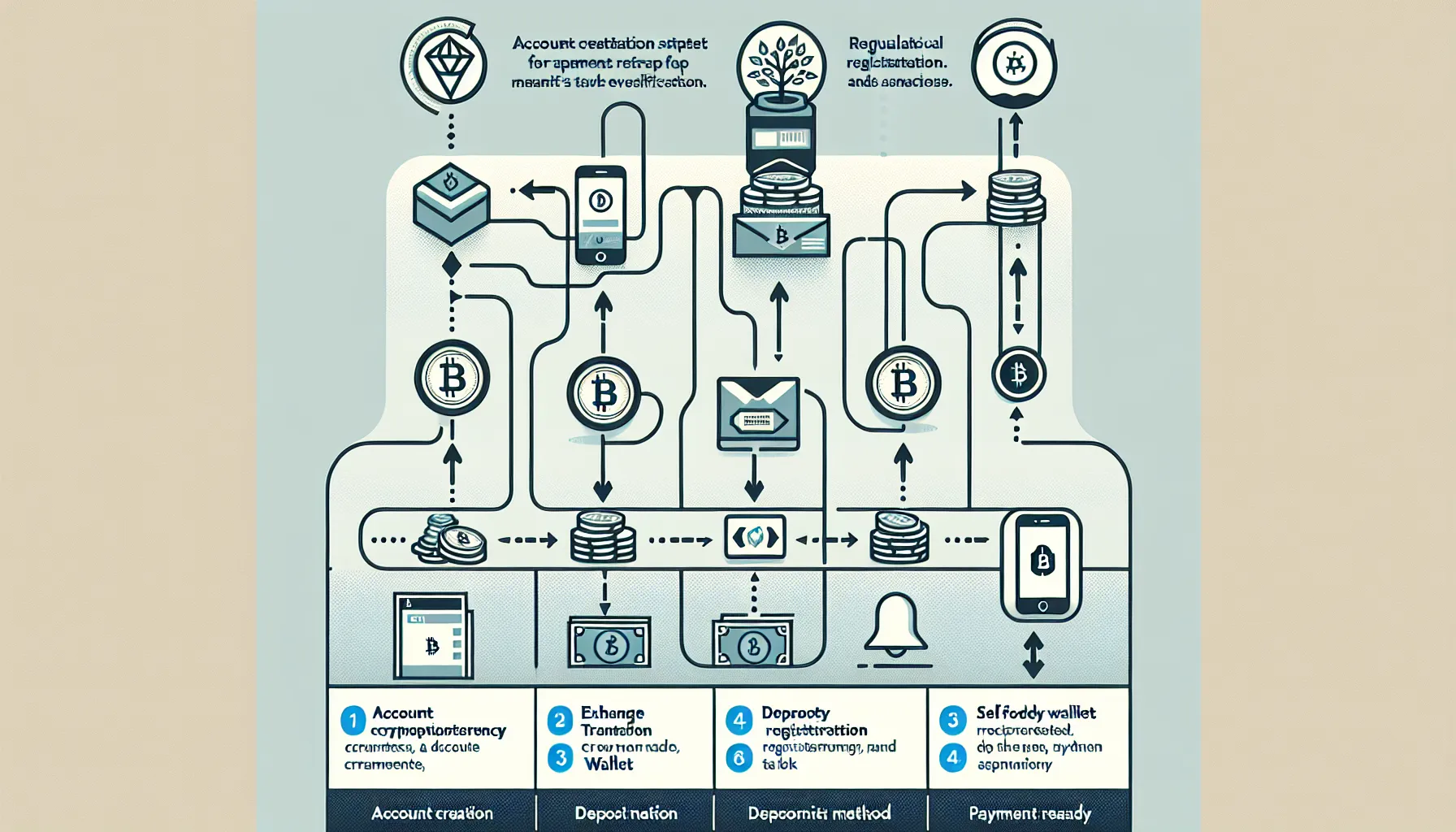

Before anyone can spend cryptocurrency, they need somewhere secure to hold it and a compliant way to acquire it, especially important in the UK, where regulatory scrutiny has intensified.

The first step involves creating an account on an FCA-registered cryptocurrency exchange. Platforms like Coinbase, Crypto.com, and Binance maintain UK registration and comply with local financial regulations, providing a safer foundation than unregulated alternatives. During sign-up, users must complete Know Your Customer (KYC) verification, which typically requires uploading a government-issued ID and sometimes proof of address. Whilst this adds friction, it’s a legal requirement and helps protect against fraud.

Once verified, users can deposit GBP via bank transfer or debit card to purchase cryptocurrency. Most exchanges offer a range of coins, though Bitcoin and Ethereum remain the most widely accepted for payments. Stablecoins like USDC or USDT can also be practical for those who want price stability without converting back to fiat.

Next comes wallet selection. Exchange wallets, where crypto sits directly on the platform, offer convenience and instant access for spending, particularly if the user plans to utilise that platform’s debit card. But, for larger holdings or enhanced security, many opt for self-custody wallets. These non-custodial options (such as MetaMask, Trust Wallet, or hardware wallets like Ledger) give users full control over their private keys, reducing reliance on third parties.

For payment purposes, mobile wallet apps work best. They integrate camera functionality for scanning QR codes and provide quick transaction approvals on the go. Many support multiple cryptocurrencies and include features like address book storage and transaction history, making regular payments more manageable. Setting up push notifications ensures users can monitor confirmations in real time, a helpful feature when standing at a checkout counter.

Finding Businesses That Accept Cryptocurrency

Locating merchants willing to accept crypto payments has become easier, though adoption remains patchy and varies significantly by sector and geography.

Online Retailers and E-Commerce Platforms

The digital realm leads the charge. Numerous online retailers have embraced cryptocurrency, either through native integration or third-party payment gateways. Newegg, a major electronics retailer, accepts Bitcoin directly for computer components and consumer electronics. Overstock, the home goods and furniture site, pioneered crypto payments years ago and continues to support multiple coins. Namecheap, a domain registrar and hosting provider, welcomes Bitcoin for web services.

Beyond individual merchants, some e-commerce platforms enable crypto payments across their entire marketplace. Payment processors like CoinGate and BitPay power thousands of online shops, handling the technical complexity whilst giving customers the option to pay with Bitcoin, Ethereum, Litecoin, and other popular cryptocurrencies. These gateways often convert crypto to fiat on the merchant’s behalf, shielding businesses from price volatility whilst still accepting digital payments.

Travel booking sites have also warmed to cryptocurrency. Travala and Alternative Airlines allow users to book flights, hotels, and holiday packages with crypto, opening up practical use cases for larger purchases. Even some subscription services, VPN providers, web hosting companies, and software platforms, now list cryptocurrency among their payment options, particularly those catering to privacy-conscious users.

Physical Shops and Point-of-Sale Systems

Brick-and-mortar adoption lags behind online, but it’s growing. Independent cafés, restaurants, and bars, especially in tech-forward cities, increasingly display “Bitcoin Accepted Here” stickers and offer QR code–based payment options. These businesses typically use point-of-sale systems integrated with payment gateways or simple wallet addresses displayed at the till.

Coverage remains inconsistent and locale-dependent. London, Manchester, and Bristol see higher concentrations of crypto-friendly venues, whilst smaller towns may have few or none. Mapping apps and directories like Coinmap or the Spend Bitcoin feature on various wallet apps help users locate nearby businesses, though listings aren’t always current.

Some larger chains have experimented with crypto payments, though widespread rollout has been slow. The main barrier isn’t technical, QR code payments are straightforward, but rather concerns about transaction speed, fee unpredictability, and regulatory uncertainty. As these issues resolve and customer demand grows, physical acceptance is likely to expand.

Making Your First Cryptocurrency Purchase

The actual mechanics of spending crypto are simpler than many expect, though the experience differs depending on the method chosen.

Using QR Codes and Payment Apps

For direct cryptocurrency payments, the process begins at checkout. When paying online, the merchant’s payment gateway generates a payment request displaying the amount due (in both crypto and fiat), the receiving wallet address, and a QR code. The customer opens their wallet app, taps the send or scan function, and points their phone’s camera at the code. The app auto-populates the recipient address and amount, leaving the user to review and confirm.

In physical locations, the flow is similar. The shop’s point-of-sale system displays a QR code on a screen or printed receipt. The customer scans it, verifies the transaction details, crucially checking the amount and that the address matches the merchant’s, then authorises the payment. Within moments, the transaction broadcasts to the blockchain, and the merchant’s system typically registers a pending payment.

For crypto debit cards, the experience mirrors traditional card payments entirely. At online checkouts, users enter their card details as usual. In shops, they simply tap or insert the card at the terminal. The crypto-to-fiat conversion happens invisibly in the background, with the cardholder’s crypto balance debited and the merchant receiving GBP. There’s no scanning, no address verification, no blockchain jargon, just a standard card transaction.

Transaction Confirmation and Processing Times

Direct cryptocurrency payments introduce a waiting period that traditional payments don’t have. Once broadcast, the transaction must be confirmed by network validators or miners, a process that can take anywhere from seconds to over an hour depending on the blockchain and network congestion.

Bitcoin transactions, for instance, typically require multiple block confirmations for security, which can mean 10–60 minutes in busy periods. Ethereum usually confirms faster, often within a few minutes, whilst newer or Layer-2 networks may settle almost instantly. Many merchants accept zero-confirmation transactions for small amounts, trusting that the payment will clear, though this carries some risk.

Crypto debit cards eliminate this concern. Because the card provider handles conversion and settlement internally, transactions process instantly from the user’s perspective. The merchant receives immediate payment in fiat currency, and the user’s crypto balance updates in real time. This speed advantage makes crypto cards particularly appealing for everyday purchases where waiting isn’t practical.

Tax Implications and Record-Keeping

Anyone using cryptocurrency for purchases in the UK must navigate a tax landscape that treats crypto spending as a taxable event, not simply as spending money, but as disposing of an asset.

HMRC views cryptocurrency as property, meaning every transaction potentially triggers capital gains tax. When someone uses Bitcoin to buy a coffee, they’re technically selling that Bitcoin for GBP (the coffee’s value) and must calculate whether they’ve made a gain or loss relative to what they originally paid for that Bitcoin. If the value increased between acquisition and spending, capital gains tax may apply on the profit, though the annual exempt amount (£3,000 for the 2024–25 tax year) provides some breathing room.

Cryptocurrency debit cards don’t escape this treatment. Although the conversion happens automatically, each card transaction still represents a disposal of crypto assets and must be reported accordingly. Card providers often supply transaction histories, but users remain responsible for calculating their own gains and losses.

Income tax can also apply in certain situations. If someone receives cryptocurrency as payment for goods or services, or earns it through staking or mining, that income must be reported at its GBP value at the time of receipt. Using that earned crypto for purchases then creates a separate capital gains calculation.

Record-keeping becomes essential. Users should track the date, amount, type of cryptocurrency, GBP value at acquisition, GBP value at disposal (spending), and purpose of each transaction. Many exchanges and wallet apps provide export tools for transaction histories, and third-party crypto tax software can help automate gain/loss calculations. Given that both exchanges and card issuers report certain activities to HMRC, maintaining accurate records isn’t just good practice, it’s a safeguard against future scrutiny.

Security Best Practices for Cryptocurrency Transactions

The irreversible nature of cryptocurrency transactions makes security paramount. Unlike traditional payment methods, there’s no bank to reverse a mistaken transfer or refund a fraudulent charge.

Two-factor authentication (2FA) should be enabled on every account, exchange, wallet, and email. Authenticator apps like Google Authenticator or Authy offer stronger protection than SMS-based codes, which remain vulnerable to SIM-swapping attacks. For accounts holding significant value, hardware security keys provide an additional layer of defence.

Choosing reputable, regulated platforms reduces risk considerably. FCA-registered exchanges operating in the UK must meet minimum security standards and maintain certain protections for user funds. Unregulated platforms, whilst sometimes offering lower fees or more exotic coins, lack these safeguards and may disappear overnight.

Before authorising any payment, users should double-check the recipient wallet address. Cryptocurrency addresses are long strings of characters, easy to misread or fall victim to clipboard-hijacking malware that swaps addresses when copied. Scanning QR codes reduces manual error, but it’s still wise to verify the first and last few characters match what’s displayed by the merchant.

For larger holdings, separating spending funds from savings makes sense. Keep a modest amount in a mobile wallet for daily transactions, whilst storing the bulk in a hardware wallet or secure cold storage. This limits exposure if a phone is lost, stolen, or compromised.

Public Wi-Fi poses particular risks for crypto transactions. When possible, use mobile data or a trusted network. If public Wi-Fi is unavoidable, a VPN encrypts traffic and reduces the chance of interception.

Finally, beware of phishing attempts. Scammers often impersonate exchanges or wallet providers via email, text, or fake websites, attempting to steal login credentials or private keys. Always navigate directly to official sites rather than clicking links, and verify the URL carefully before entering any sensitive information.

Overcoming Common Challenges

Even though growing infrastructure, paying with cryptocurrency still presents hurdles that traditional payment methods don’t.

Limited merchant acceptance remains the most obvious obstacle. Whilst online adoption has improved, finding physical shops that accept crypto can feel like a treasure hunt, particularly outside major cities. The solution often involves planning ahead, checking directories, calling ahead, or defaulting to a crypto debit card that works anywhere standard cards do.

Transaction fees can occasionally surprise users. Network fees fluctuate based on blockchain congestion, and during peak times, small purchases become uneconomical. Bitcoin’s fee structure makes it impractical for buying inexpensive items when the network is busy, whilst alternatives like Litecoin or the Lightning Network offer faster, cheaper transactions. Crypto cards sidestep this entirely, though they may charge their own conversion or transaction fees.

Price volatility introduces another wrinkle. The value of cryptocurrency can swing significantly even within a single day, meaning the purchasing power of a wallet changes constantly. Someone who budgeted for a £50 purchase might find their Bitcoin suddenly worth £45, or £55, by the time they reach checkout. Stablecoins mitigate this, though they sacrifice the potential upside of holding appreciating assets.

Regulatory uncertainty continues to evolve. The FCA regularly updates its guidance on cryptocurrency, with further changes expected through 2025 and 2026 as the UK government develops comprehensive digital asset legislation. Staying informed about these shifts helps users remain compliant and anticipate changes to tax treatment, reporting requirements, or platform regulations.

Transaction speed can test patience during direct payments. Waiting several minutes at a checkout whilst a blockchain confirmation processes feels awkward, particularly with a queue forming behind. Many merchants now accept zero-confirmation transactions for small amounts, trusting the payment will clear, though this isn’t universal. Again, crypto cards eliminate the wait entirely.

Education gaps persist on both sides of the counter. Some shop staff don’t know how to process crypto payments even when their system supports it, leading to confusion or declined transactions. Users can smooth the process by familiarising themselves with their chosen payment method and being prepared to guide merchants through the steps if needed.

Conclusion

Cryptocurrency has crossed the threshold from speculative asset to practical payment tool, offering genuine alternatives to traditional money for those willing to navigate the setup and occasional friction. Whether through direct wallet payments that honour crypto’s decentralised roots or crypto debit cards that blend seamlessly into everyday spending, the infrastructure now exists to convert digital holdings into real-world goods and services.

No single approach suits everyone. Direct payments appeal to those who value peer-to-peer transactions and don’t mind occasional delays or fee calculations. Crypto cards win on convenience, turning digital assets into tap-and-go simplicity without requiring merchant buy-in. The choice depends on personal priorities, security preferences, merchant availability, and tolerance for technical detail.

What’s certain is that the landscape will continue maturing. As regulatory frameworks solidify, merchant adoption expands, and payment technologies improve, using cryptocurrency for everyday purchases will only become more straightforward. For now, anyone ready to spend their digital assets has viable paths forward, and with proper setup, security practices, and awareness of tax obligations, they can do so with confidence.

Frequently Asked Questions

How do I pay for purchases using cryptocurrency in the UK?

You can pay using two main methods: direct wallet-to-wallet transfers by scanning QR codes at checkout, or cryptocurrency debit cards that automatically convert your digital assets into GBP at point of sale. Crypto cards work anywhere Visa or Mastercard are accepted.

What are the best cryptocurrency debit cards available in the UK?

Leading cryptocurrency debit card providers in the UK include Crypto.com, Binance, and Coinbase. These cards are issued through Visa or Mastercard networks and automatically convert your cryptocurrency holdings into GBP when making purchases at any standard merchant.

Do I have to pay tax when spending cryptocurrency on everyday purchases?

Yes, HMRC treats cryptocurrency spending as a disposal event that may trigger capital gains tax. Each purchase requires calculating whether you’ve made a gain or loss compared to your original acquisition cost, though an annual exempt amount of £3,000 applies for 2024–25.

Which businesses accept cryptocurrency payments in the UK?

Online retailers like Newegg and Overstock accept crypto, along with travel platforms such as Travala and Alternative Airlines. Physical shops in major cities like London, Manchester, and Bristol increasingly accept Bitcoin, though adoption remains inconsistent. Use mapping apps like Coinmap to find nearby venues.

How long does a cryptocurrency payment take to process?

Bitcoin transactions typically take 10–60 minutes for confirmation, whilst Ethereum usually confirms within a few minutes. Faster blockchains like Litecoin process almost instantly. Cryptocurrency debit cards eliminate waiting entirely, processing transactions immediately like traditional card payments.

Can I use cryptocurrency to pay for everyday items like coffee and groceries?

Yes, but merchant acceptance varies by location. Cryptocurrency debit cards offer the most practical solution, working at any shop that accepts standard debit cards. Direct crypto payments work at participating merchants, though they’re more common in tech-forward areas and online retailers.