The cryptocurrency world revolves around a simple yet powerful principle: “Not your keys, not your crypto.” For many, the journey into digital assets begins with a custodial wallet, convenient, user-friendly platforms where a third party manages the technical complexity. But as your understanding deepens and your holdings grow, the appeal of true ownership becomes impossible to ignore.

Moving from a custodial wallet to a non-custodial wallet represents more than a technical migration. It’s a declaration of financial sovereignty, a conscious choice to take responsibility for your assets rather than trust an intermediary. Whilst custodial wallets offer simplicity and recovery mechanisms, they come with inherent risks: counterparty failures, regulatory seizures, and the nagging reality that you’re borrowing access to your own money.

This guide walks through the practical steps needed to reclaim control of your cryptocurrency. Whether you’re motivated by security concerns, privacy considerations, or simply the desire for autonomy, the transition doesn’t have to be intimidating. With proper preparation and an understanding of the key differences between wallet types, anyone can make the move safely and confidently.

Key Takeaways

- Moving from a custodial wallet to a non-custodial wallet grants you full control over your private keys and eliminates dependence on third-party platforms.

- Non-custodial wallets enhance security by distributing risk and allowing pseudonymous transactions without intermediaries collecting personal data.

- Choose between hardware wallets like Ledger for maximum security or software wallets like MetaMask for convenience based on your holdings and technical comfort.

- Always conduct a small test transaction before transferring significant funds to verify addresses and understand the process correctly.

- Secure your recovery phrase by writing it on paper or metal, storing multiple copies in separate physical locations, and never saving it digitally.

- Common mistakes include losing recovery phrases, sending to incorrect addresses, neglecting network selection for tokens, and falling for phishing attempts.

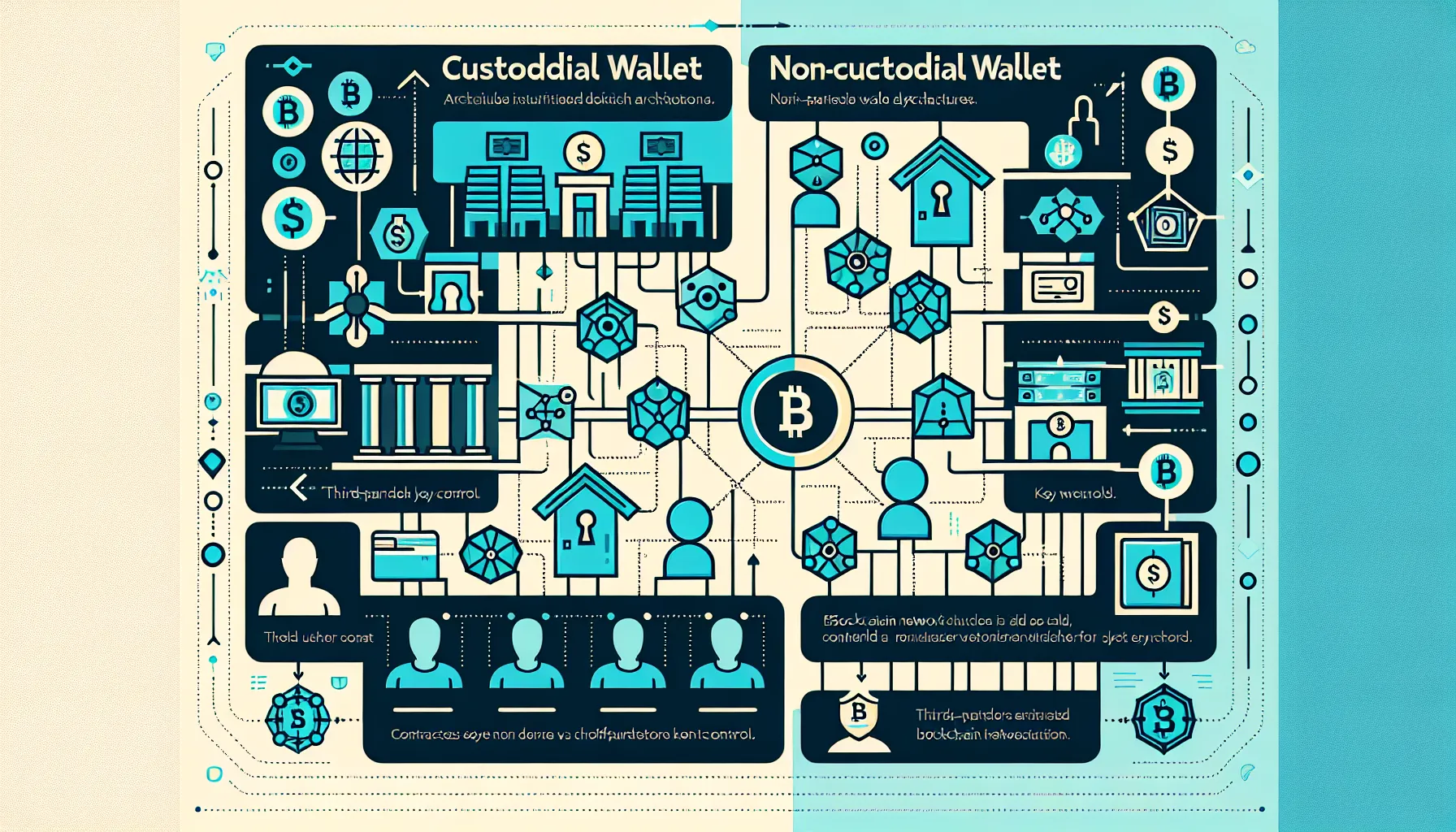

Understanding the Difference Between Custodial and Non-Custodial Wallets

Before initiating any transfer, it’s essential to grasp what separates these two wallet architectures, and why that distinction matters.

Custodial wallets operate much like traditional banking. When you create an account on a centralised exchange or wallet service, that platform generates and stores your private keys on your behalf. You access your funds through login credentials, but the service provider maintains ultimate control over the cryptographic keys that authorise transactions. This arrangement offers undeniable convenience: password resets, customer support, and streamlined recovery processes if you forget your details.

But, this convenience comes at a cost. You’re trusting the custodian’s security practices, regulatory compliance, and financial stability. If the platform suffers a hack, goes bankrupt, or faces government seizure, your assets could become inaccessible or lost entirely. Recent history has provided stark reminders of these risks, with several prominent exchanges collapsing and taking user funds with them.

Non-custodial wallets flip this model entirely. Here, you generate and control your own private keys, the cryptographic credentials that prove ownership and authorise transactions. No intermediary can freeze your account, impose withdrawal limits, or restrict access to your holdings. You interact directly with the blockchain, maintaining complete autonomy over your cryptocurrency.

This independence requires accepting full responsibility for security and recovery. There’s no customer service helpline if you lose your recovery phrase, no password reset option if you forget your credentials. The phrase “be your own bank” captures both the empowerment and the burden of non-custodial storage.

The fundamental trade-off is straightforward: custodial wallets exchange control for convenience, whilst non-custodial wallets offer sovereignty in return for personal accountability. Understanding where you stand on this spectrum helps clarify whether the transition makes sense for your situation.

Why You Should Consider Moving to a Non-Custodial Wallet

The decision to migrate away from custodial storage isn’t purely ideological. It rests on tangible benefits that become increasingly relevant as you deepen your engagement with cryptocurrency.

Full Control Over Your Private Keys

Ownership in the digital realm reduces to a simple technical reality: whoever holds the private keys controls the assets. When a third party manages those keys, your ownership is conditional, dependent on that entity’s continued operation, goodwill, and regulatory status.

By moving to a non-custodial wallet, you eliminate this dependency. Your cryptocurrency becomes genuinely yours in the most fundamental sense. You decide when to transact, where to send funds, and how to secure your holdings. There are no withdrawal limits, no mandatory identity verification for basic transactions, and no risk of your account being frozen during a platform’s liquidity crisis.

This control extends to how you interact with the broader cryptocurrency ecosystem. Non-custodial wallets enable direct participation in decentralised finance (DeFi) protocols, peer-to-peer transactions, and other applications that custodial platforms often restrict. You’re no longer limited by an intermediary’s supported features or permitted activities.

Enhanced Security and Privacy

Custodial platforms present attractive targets for attackers. A single successful breach can compromise thousands or millions of users simultaneously. Non-custodial wallets distribute this risk: each wallet operates independently, so compromising one doesn’t automatically threaten others. An attacker would need to target you specifically, rather than exploiting a central point of failure.

Privacy considerations also favour non-custodial storage. Custodial platforms typically require extensive identity verification, monitor transaction patterns, and may share data with regulators or other parties. Non-custodial wallets interact directly with the blockchain, allowing for pseudonymous transactions without an intermediary collecting personal information.

That said, security in a non-custodial environment depends entirely on your practices. A hardware wallet stored properly offers exceptional security. A mobile wallet with a weak password on a malware-infected device does not. The shift places both the power and the responsibility squarely in your hands.

Preparing for the Transition

Successful migration requires thoughtful preparation. Rushing the process or skipping foundational steps can lead to costly mistakes.

Choosing the Right Non-Custodial Wallet

The non-custodial wallet landscape offers numerous options, each with distinct advantages. Your choice should reflect your security requirements, technical comfort level, and the specific cryptocurrencies you hold.

Hardware wallets like Ledger and Trezor represent the gold standard for security-conscious users. These physical devices store private keys offline, immune to remote hacking attempts. They’re ideal for significant holdings or long-term storage, though they require an upfront purchase and slightly more complex setup procedures.

Software wallets like MetaMask, Trust Wallet, and Exodus provide convenience and accessibility. Mobile versions allow for on-the-go transactions, whilst desktop implementations often offer more features and larger screen interfaces. These wallets expose you to online risks if your device is compromised, but they’re perfectly suitable for moderate holdings and frequent transactions.

When evaluating options, prioritise wallets with strong reputations, active development communities, and transparent security practices. Check whether the wallet supports all the cryptocurrencies you need to transfer, not every wallet handles every blockchain. Read recent user reviews and security audits where available.

Open-source wallets deserve special consideration. Their code can be independently verified, reducing the risk of hidden vulnerabilities or malicious functions. This transparency doesn’t guarantee security, but it allows the broader community to scrutinise the implementation.

Backing Up Your Custodial Wallet Information

Before initiating any transfers, document your current custodial wallet completely. This might seem overly cautious, but it provides a safety net if something goes wrong during the transition.

Record all account details, including your holdings of each cryptocurrency, recent transaction history, and any pending operations. Take screenshots or export statements that show your balances at a specific date and time. This documentation proves invaluable if you need to verify transactions or reconcile discrepancies later.

Ensure you can access all relevant two-factor authentication devices and that your withdrawal permissions are properly configured. Some custodial platforms carry out security delays or additional verification for large withdrawals. Understanding these requirements beforehand prevents frustrating surprises mid-transfer.

Finally, check for any locked, staked, or otherwise restricted assets. You’ll need to unstake or unlock these before transferring them to your non-custodial wallet. Review the timing requirements and any associated fees for these operations.

Step-by-Step Guide to Moving Your Assets

With preparation complete, you’re ready to execute the actual migration. Follow these steps methodically, and resist the urge to rush.

Setting Up Your Non-Custodial Wallet

Begin by obtaining your chosen wallet through official channels only. For hardware wallets, purchase directly from the manufacturer or authorised retailers, never from third-party marketplaces where devices might be tampered with. For software wallets, download exclusively from official websites or verified app stores.

During initial setup, you’ll create a password or PIN. Make this genuinely strong, a random mix of characters, not a memorable phrase. But here’s the critical point: this password merely locks the wallet interface. It doesn’t control access to your funds if someone obtains your recovery phrase.

The wallet will generate a recovery phrase, typically consisting of 12 or 24 words drawn from a standardised list. This phrase represents the master key to your cryptocurrency. Anyone possessing it can recreate your wallet on any compatible device and control all associated funds. Its importance cannot be overstated.

Securing Your Recovery Phrase

How you handle your recovery phrase will largely determine your long-term security. Poor practices here undermine every other precaution.

Write the phrase down on paper, not on any device connected to the internet. Many prefer specialised metal plates designed to withstand fire and water damage. Whatever medium you choose, create multiple copies and store them in separate physical locations. A single copy in your home becomes vulnerable to fire, theft, or natural disaster.

Never photograph your recovery phrase, store it in cloud services, email it to yourself, or save it in password managers. Digital storage creates opportunities for remote compromise. Similarly, never share your recovery phrase with anyone, regardless of their claimed authority or technical expertise. Legitimate services will never ask for it.

Some users split their recovery phrase between multiple locations or use cryptographic secret-sharing schemes for added security. Whilst these approaches can work, they introduce complexity. For most people, straightforward physical storage in multiple secure locations provides the best balance of security and recoverability.

Transferring Your Cryptocurrency

With your non-custodial wallet secured, you’re ready to begin the actual transfer. Start conservatively with a small test transaction, the equivalent of £10 or £20 in value. This proves you’ve correctly noted your receiving address and understand the process without risking significant funds.

In your non-custodial wallet, locate the receiving address for the appropriate cryptocurrency. Addresses are typically long alphanumeric strings, sometimes accompanied by a QR code. Double-check that you’re viewing the address for the correct blockchain, sending Bitcoin to an Ethereum address won’t work.

Copy this address carefully. Many users verify the first and last several characters after pasting to ensure no clipboard malware has substituted a different address. Some prefer typing addresses manually for small amounts, though this introduces risk of transcription errors for long strings.

In your custodial wallet, initiate a withdrawal to your new non-custodial address. Most platforms will ask you to confirm the address and amount, possibly with two-factor authentication. After submitting, you’ll receive a transaction ID that allows you to track the transfer on the blockchain.

Blockchain confirmations take varying amounts of time depending on network congestion and the cryptocurrency involved. Bitcoin might require 30 minutes to an hour for several confirmations. Ethereum and other networks often move faster. Don’t panic if the transfer isn’t instant, this is normal.

Once your test transaction arrives successfully, proceed with larger amounts. Some prefer transferring their entire balance at once: others feel more comfortable with several medium-sized transactions. There’s no single right answer, choose what matches your risk tolerance, keeping in mind that multiple transactions incur multiple network fees.

Common Mistakes to Avoid During the Transfer

Even with careful planning, certain pitfalls catch users during migration. Awareness helps you steer clear.

Losing the recovery phrase tops the list of catastrophic errors. Users sometimes treat the phrase casually during initial setup, intending to secure it properly “later.” Then life intervenes, and the phrase disappears. Without it, your funds become permanently inaccessible if anything happens to the device hosting your wallet. Secure the phrase immediately, before transferring any significant value.

Sending to incorrect addresses represents another common disaster. Cryptocurrency transactions are irreversible, there’s no “undo” button, no bank to reverse an erroneous transfer. Always verify addresses carefully, use the test transaction approach, and understand the difference between address formats for different blockchains. Sending Bitcoin Cash to a Bitcoin address, for instance, might result in lost funds depending on the specific circumstances.

Neglecting network selection causes particular confusion with tokens built on multiple blockchains. USDT exists on Ethereum, Tron, Binance Smart Chain, and other networks. Your non-custodial wallet might support USDT on one network but not others. Sending via an unsupported network can make your tokens unrecoverable. Confirm that both your custodial and non-custodial wallets are using the same network for the transfer.

Ignoring transaction fees can lead to unpleasant surprises. Network fees vary dramatically based on congestion and blockchain architecture. Ethereum gas fees occasionally spike to dozens of pounds for a single transaction. Factor these costs into your migration planning, and consider timing transfers during lower-activity periods when fees typically decrease.

Skipping software updates leaves your wallet vulnerable to known exploits. Before transferring funds, ensure your wallet software is current. After the migration, maintain this practice, updates often include critical security patches.

Falling for phishing attempts becomes more dangerous once you control your own keys. Attackers create fake wallet websites, send fraudulent emails claiming issues with your wallet, or distribute malicious browser extensions. Bookmark your wallet’s official website, verify URLs carefully, and treat any unsolicited contact with extreme scepticism.

Best Practices for Managing Your Non-Custodial Wallet

Migration marks the beginning, not the end, of responsible self-custody. Ongoing security requires sustained attention.

Regular backups extend beyond the initial recovery phrase. If your wallet allows you to add new addresses or accounts, ensure you understand whether your original recovery phrase covers these additions. Some wallet architectures generate all future addresses from the initial seed: others require additional backups for certain features.

Layered security significantly improves protection. For software wallets on mobile devices, enable biometric authentication if available. For desktop wallets, consider running them on dedicated devices used solely for cryptocurrency management, not the same computer you use for general web browsing and email. For hardware wallets, store the device itself securely when not in use, separate from your recovery phrase backups.

Two-factor authentication presents an interesting consideration for non-custodial wallets. Unlike custodial platforms, the wallet itself doesn’t offer 2FA, control reduces to possession of the private keys. But, if you use a wallet with optional cloud backup or social recovery features, apply 2FA to those supplementary services.

Transaction verification should become habitual. Before approving any transaction, carefully review the destination address and amount. Hardware wallets excel here, displaying transaction details on the device screen where malware can’t tamper with them. For software wallets, develop the discipline to manually verify even though the tedium.

Software maintenance includes monitoring for updates from your wallet provider. Subscribe to official announcements or follow their verified social media accounts. Be cautious, though, verify that update notifications are legitimate before downloading anything.

Phishing vigilance needs to become second nature. Legitimate wallet providers will never ask for your recovery phrase. They won’t send unsolicited links asking you to “verify” your wallet. They don’t randomly contact users about security problems requiring immediate action. When in doubt, independently navigate to the official website rather than clicking any provided link.

Periodic testing of your recovery phrase provides peace of mind. Some users annually verify they can restore their wallet from the backup phrase using a test device or wallet software. This confirms the phrase was recorded accurately and remains legible. If attempting this, exercise extreme caution to avoid exposing your phrase to online devices or creating additional security risks.

Finally, stay educated. The cryptocurrency security landscape evolves constantly. New attack vectors emerge, wallet software improves, and best practices adapt. Occasional reading about recent security incidents and recommended precautions helps you stay ahead of threats rather than learning about them through painful experience.

Conclusion

Transitioning from custodial to non-custodial storage represents a significant milestone in your cryptocurrency journey. You’re exchanging the convenience and safety nets of intermediated services for the autonomy and responsibility of true ownership. It’s not a decision to make lightly, nor a process to rush through carelessly.

The technical steps themselves, setting up the wallet, securing the recovery phrase, executing the transfer, are eventually straightforward. What matters most is the mindset shift. You’re becoming the sole guarantor of your asset security. There’s no customer service to rescue you from mistakes, no insurance to compensate you for losses due to negligence.

But there’s also no third party who can freeze your funds, no platform that might collapse and take your holdings with it, no intermediary collecting data about your financial activities. You gain privacy, security from counterparty risk, and the freedom to interact with the cryptocurrency ecosystem without permission or restriction.

For those prepared to accept the responsibility, non-custodial storage offers the closest approximation to the original vision of cryptocurrency: peer-to-peer, permissionless, and genuinely owned by individuals rather than institutions. Take your time with the migration, follow security best practices rigorously, and you’ll establish a foundation for long-term, sovereign control of your digital assets.

Frequently Asked Questions

What is the main difference between custodial and non-custodial wallets?

Custodial wallets store your private keys on your behalf, similar to traditional banking, whilst non-custodial wallets allow you to generate and control your own private keys. With non-custodial wallets, you have complete autonomy over your cryptocurrency without intermediary control or restrictions.

How do I safely store my recovery phrase when moving to a non-custodial wallet?

Write your recovery phrase on paper or metal plates, never digitally. Create multiple copies and store them in separate physical locations. Never photograph, email, or save it in cloud services, as this creates opportunities for remote compromise and theft.

Can I recover my cryptocurrency if I lose access to my non-custodial wallet?

Yes, but only if you’ve securely stored your recovery phrase. This 12 or 24-word phrase can recreate your wallet on any compatible device. However, without it, your funds become permanently inaccessible—there’s no customer service or password reset option available.

What are the best hardware wallets for storing cryptocurrency?

Ledger and Trezor are considered the gold standard for secure cryptocurrency storage. These physical devices store private keys offline, making them immune to remote hacking attempts. They’re ideal for significant holdings and long-term storage, though they require an upfront purchase.

Why should I do a test transaction before transferring all my cryptocurrency?

A small test transaction verifies you’ve correctly noted your receiving address and understand the process without risking significant funds. Since cryptocurrency transactions are irreversible, this precaution helps prevent costly mistakes like sending to incorrect addresses or wrong networks.

What happens if I send cryptocurrency to the wrong blockchain network?

Sending tokens to an unsupported network can make them unrecoverable. Many tokens like USDT exist on multiple blockchains (Ethereum, Tron, Binance Smart Chain). You must confirm that both your custodial and non-custodial wallets use the same network for the transfer.