The cryptocurrency world offers exciting opportunities, but it’s also rife with scams that can wipe out unsuspecting investors overnight. Rug pulls and exit scams have cost victims billions, leaving countless traders holding worthless tokens whilst developers vanish with their funds. From the infamous Squid Game token collapse to the Thodex exchange disappearance, these schemes share common patterns that savvy investors can learn to spot.

Understanding how to identify these fraudulent projects before investing isn’t just wise, it’s essential. The good news? Scammers often leave telltale signs in their smart contracts, tokenomics, and marketing materials. With the right knowledge and tools, anyone can dramatically reduce their risk of falling victim to these devastating schemes. This guide breaks down the warning signals every crypto investor should watch for and provides actionable steps to protect hard-earned capital in an increasingly complex digital asset landscape.

Key Takeaways

- Rug pulls and exit scams have cost crypto investors billions, but learning to detect common warning patterns can dramatically reduce your risk.

- Always verify that liquidity is locked for extended periods and check smart contracts for hidden mint functions or backdoors before investing.

- Anonymous teams, unrealistic profit promises, and excessive marketing hype are major red flags when evaluating crypto projects.

- Use free tools like Token Sniffer, DexTools, and blockchain explorers to systematically analyse smart contracts and token distribution patterns.

- Start with small test investments and never commit funds you cannot afford to lose, especially in newer or unaudited projects.

- Detecting rug pulls requires combining multiple verification methods—from team background checks to audit confirmations—rather than relying on a single indicator.

Understanding Rug Pulls and Exit Scams

Before diving into detection methods, it’s crucial to understand exactly what these schemes entail and how they differ.

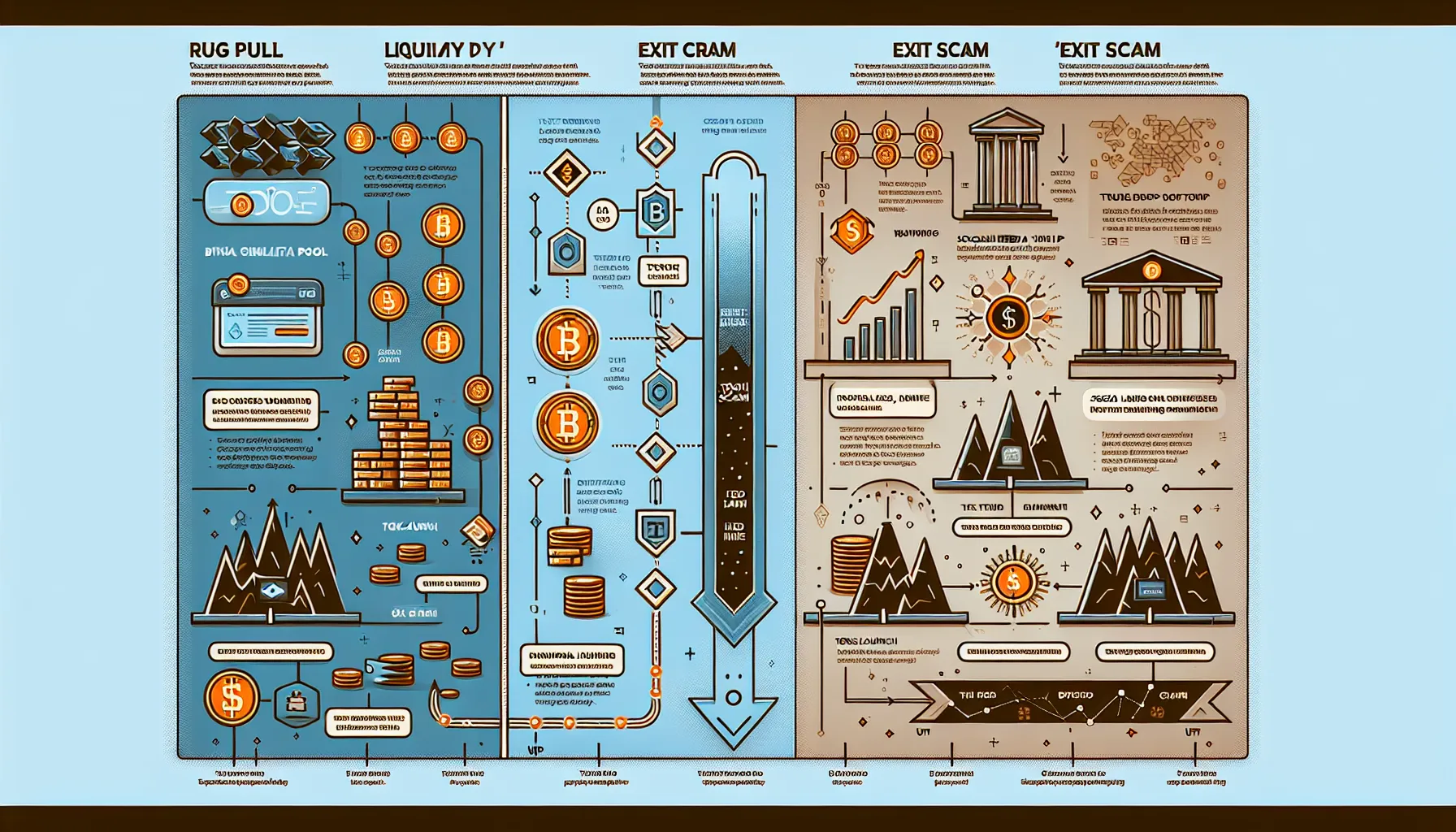

What Is a Rug Pull?

A rug pull is a type of crypto scam where developers suddenly withdraw all funds from a project’s liquidity pool, leaving investors unable to sell their tokens. The name comes from the expression “pulling the rug out from under someone”, an apt description of what happens to unsuspecting holders.

These scams typically unfold in decentralised finance (DeFi) environments where projects can launch tokens with minimal oversight. Developers create a new token, generate hype through social media and marketing, attract investors, then drain the liquidity pool in a single transaction. What remains are worthless tokens that can’t be traded because there’s no liquidity to help sales.

Rug pulls can be “soft” or “hard.” Soft rug pulls involve developers slowly selling off their massive token holdings, gradually draining value whilst technically keeping the project alive. Hard rug pulls are more dramatic, developers use backdoors in smart contracts to instantly drain all funds, often disappearing without a trace.

What Is an Exit Scam?

An exit scam operates on a similar principle but often involves a longer timeframe and more elaborate deception. These schemes may run legitimately for weeks, months, or even years, building trust and attracting substantial investment before operators disappear with user funds.

The key difference lies in the approach: exit scams typically involve more sophisticated operations that mimic legitimate businesses. They might operate exchanges, offer investment platforms, or provide services that appear functional until the eventual exit. The Thodex exchange case exemplifies this, it operated as what seemed like a normal crypto exchange before its founder allegedly fled with approximately $2 billion in user assets.

Exit scams exploit the trust built over time. By delivering small returns initially or maintaining normal operations, scammers lull investors into a false sense of security, often encouraging them to deposit more funds just before the exit. Whilst rug pulls tend to be quick hits on newly launched tokens, exit scams are the long con of the crypto world.

Red Flags in Smart Contracts and Tokenomics

The code doesn’t lie. Smart contracts and token economics reveal a project’s true intentions if you know what to look for.

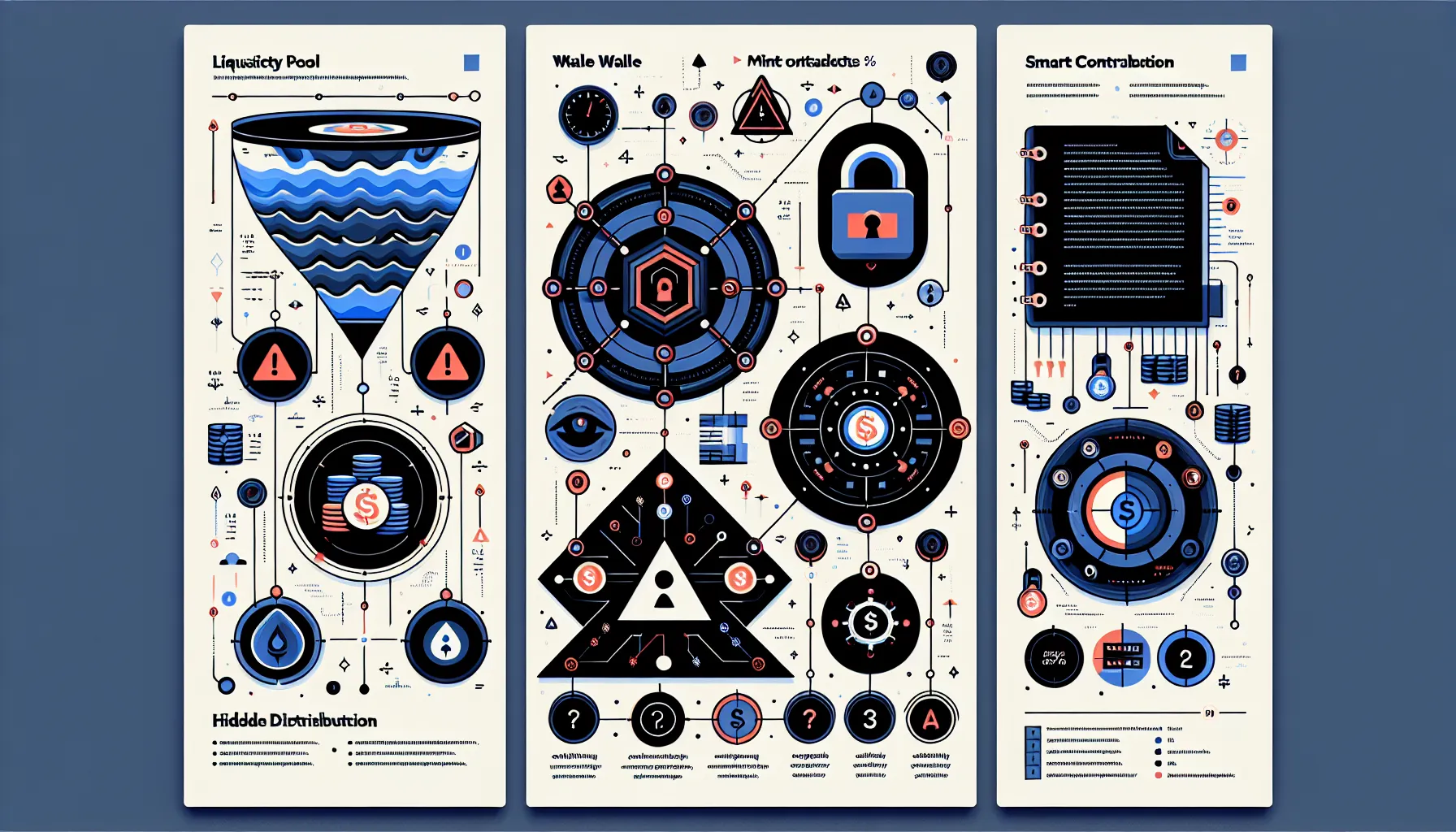

Unlocked or Excessive Liquidity Control

Liquidity is the lifeblood of any token, it’s what allows investors to buy and sell. When developers retain control over liquidity pools without locking them, they hold an exit button that can be pressed at any moment.

Legitimate projects lock their liquidity for extended periods (typically months or years) through time-lock smart contracts. This proves developers can’t simply drain funds and disappear. If liquidity isn’t locked, or worse, if it’s locked for an absurdly short period like a few days, it’s a glaring warning sign.

Investors should also be wary of projects where developers control excessive portions of the liquidity pool. Even with some locking mechanisms in place, maintaining too much control gives bad actors the ability to manipulate markets or execute partial rug pulls that might fly under the radar.

Hidden Mint Functions and Backdoors

Smart contract code can contain hidden functions that give developers god-like powers over tokens and user funds. Malicious mint functions allow creators to generate unlimited new tokens from thin air, instantly diluting everyone else’s holdings and tanking the price.

Backdoors are even more insidious. These hidden code snippets might allow developers to transfer tokens from user wallets without permission, pause trading to prevent selling, or change fundamental token rules after launch. The Squid Game token infamously included code that prevented most holders from selling, a textbook example of a hidden backdoor.

Unaudited contracts are particularly dangerous because these malicious functions can be disguised within thousands of lines of code. Even experienced developers sometimes miss them without proper security audits. Projects that refuse to publish their contract code or get independent audits should be treated with extreme suspicion.

Suspicious Token Distribution

How tokens are distributed tells a powerful story about a project’s intentions. When a tiny number of wallets control the vast majority of a token’s supply, price manipulation becomes trivial.

Legitimate projects typically have distributed holdings across many wallets, with clear explanations for any large allocations (team tokens, development funds, etc.). Red flags appear when developers hold 50%, 70%, or even 90% of the supply in just a few addresses. These “whale” wallets can dump their holdings at any moment, crashing the price whilst retail investors are left holding the bag.

Smart scammers sometimes try to hide this by spreading tokens across multiple wallets, but blockchain analysis tools can identify patterns that reveal connected addresses. Sudden transfers between wallets shortly after launch, identical transaction patterns, or coordinated selling behaviour all point to centralised control disguised as distribution.

Warning Signs in Project Teams and Communication

Beyond the code, the people and promises behind a project reveal critical information about legitimacy.

Anonymous or Unverified Teams

Whilst privacy has value in crypto culture, legitimate projects building serious financial infrastructure typically don’t hide their identities. Anonymous teams make exit scams consequence-free, developers can disappear without facing legal repercussions or reputational damage.

Red flags include stock photos used for team member profiles, LinkedIn accounts created days before the project launch, fabricated credentials, or team members who can’t be found anywhere else online. Some scammers even steal real people’s photos and credentials, so verification goes beyond just checking if profiles exist.

Legitimate projects have teams with verifiable histories: previous projects, professional experience, conference appearances, or established reputations in the crypto space. When team members put their real identities and professional standing behind a project, they have skin in the game beyond just the token they’re promoting.

Unrealistic Promises and Marketing Hype

If something sounds too good to be true in crypto, it almost certainly is. Scam projects often promise daily returns that defy economic reality, 10% per day, 1000% APY, guaranteed profits with zero risk.

Vague roadmaps filled with buzzwords but lacking technical substance are another warning sign. Phrases like “revolutionary technology,” “guaranteed moon shot,” or “next Bitcoin” without explaining actual innovation or use cases should trigger scepticism.

Heavy reliance on influencer marketing, especially when those promotions lack technical discussion, often indicates a project built on hype rather than fundamentals. Legitimate projects invest in detailed whitepapers, technical documentation, and community education. Scams invest in flashy websites, celebrity endorsements, and aggressive social media campaigns designed to create FOMO (fear of missing out) rather than well-informed choice-making.

Essential Tools and Resources for Due Diligence

The right tools transform due diligence from guesswork into systematic analysis. Several platforms have emerged specifically to help investors identify risky projects before committing funds.

Smart Contract Analysers like Token Sniffer and SolidityScan automatically audit code for common vulnerabilities and malicious functions. These tools scan for hidden mint functions, suspicious permissions, and other red flags that might take human auditors hours to identify. They’re not perfect, sophisticated scams can sometimes slip through, but they catch the majority of amateur fraud attempts.

Liquidity Scanners such as GeckoTerminal and DexTools provide real-time visibility into liquidity pools. They reveal whether liquidity is locked, for how long, and what percentage of total liquidity developers control. These platforms also display token holder distribution, making it easy to spot suspicious wallet concentration.

Blockchain Explorers like Etherscan and BscScan offer transparent views into every transaction and smart contract interaction. Investors can review a token’s complete history: when it was created, how it’s been traded, which wallets hold it, and what functions have been called in the contract. This transparency is crypto’s superpower, use it.

Audit Verifications from reputable security firms add a crucial layer of confidence. Companies like CertiK, Hacken, and Trail of Bits specialise in comprehensive smart contract audits. But, it’s important to verify that audits are real (scammers sometimes fake them) and to actually read the audit reports. Even audited projects can have identified risks that auditors disclosed but couldn’t force developers to fix.

Combining multiple tools creates a comprehensive picture. No single tool is foolproof, but together they dramatically reduce the chance of missing critical warning signs.

Practical Steps to Protect Yourself

Knowledge means little without action. These practical steps transform awareness into protection.

Research team backgrounds thoroughly. Don’t just glance at profiles, dig deeper. Search team members’ names with terms like “scam” or “fraud.” Check their LinkedIn connections, GitHub contributions, and involvement in previous projects. If team members have abandoned multiple projects or have connections to known scams, that’s your cue to walk away.

Start with small test investments. Never commit significant capital to a new or unfamiliar project immediately. Make a small initial investment to test how the token behaves: Can you actually sell it? Are there unexpected fees? Does liquidity seem adequate? This approach limits potential losses whilst providing real-world data.

Confirm liquidity locks and audit reports. Don’t take anyone’s word for it, verify directly. Check the blockchain to confirm liquidity lock contracts are real and have adequate time remaining. Visit audit companies’ official websites to verify reports rather than trusting PDFs on a project’s site.

Engage with community discussions critically. Communities can provide valuable insights, but they’re also easily manipulated. Be wary of channels where dissent is suppressed or critical questions go unanswered. Genuine projects welcome scrutiny and respond to concerns with substance, not deflection.

Use reputable exchanges with vetting processes. Major exchanges like Coinbase, Binance, and Kraken conduct their own due diligence before listing tokens. Whilst not infallible, their vetting adds a layer of protection. Tokens only available on decentralised exchanges or obscure platforms carry higher risk.

Never invest more than you can afford to lose. This advice applies to all crypto investing but becomes critical when exploring newer projects. The potential for complete loss is real, and mental or financial health should never depend on a single investment’s success.

Stay current with security news. Follow trusted crypto security researchers, subscribe to scam alert services, and join communities focused on security rather than hype. Scam tactics evolve, and yesterday’s detection methods may not catch tomorrow’s schemes.

Conclusion

Rug pulls and exit scams represent the dark side of crypto’s permissionless innovation, but they needn’t be inevitable losses. The vast majority of these schemes share identifiable patterns: unlocked liquidity, suspicious smart contract code, anonymous teams, unrealistic promises, and marketing that prioritises hype over substance.

Protection comes from combining healthy scepticism with systematic due diligence. The tools exist, smart contract analysers, liquidity scanners, blockchain explorers, and most are freely available. What separates victims from survivors is usually the willingness to use these resources before investing, not after.

The crypto space rewards boldness, but it punishes recklessness even more severely. Projects that can’t withstand scrutiny don’t deserve investment, regardless of how persuasive their marketing might be. Legitimate developers welcome questions, publish transparent code, lock their liquidity, and build reputations on delivering value rather than promises.

In an industry where transactions are irreversible and regulations remain limited, personal responsibility for security isn’t just advisable, it’s mandatory. Investors who treat due diligence as a process rather than an inconvenience dramatically improve their odds of avoiding the devastating losses that continue to plague less cautious participants. The knowledge to protect oneself exists: applying it consistently makes all the difference.

Frequently Asked Questions

What are the main warning signs of a crypto rug pull?

Key indicators include unlocked liquidity pools, anonymous development teams, hidden mint functions in smart contracts, and suspicious token distribution where few wallets control most supply. Projects with unrealistic profit promises and unaudited code also pose significant risks.

How can I verify if a crypto project’s liquidity is locked?

Use blockchain explorers like Etherscan or BscScan to examine liquidity lock contracts directly. Tools such as GeckoTerminal and DexTools also display liquidity lock information, showing whether funds are secured and for how long.

What is the difference between a rug pull and an exit scam?

Rug pulls typically happen quickly, with developers draining liquidity pools from newly launched tokens. Exit scams operate longer, building trust over weeks or months through seemingly legitimate services before operators disappear with user funds.

Are audited crypto projects safe from rug pulls?

Whilst smart contract audits from reputable firms like CertiK add security, they don’t guarantee safety. Scammers sometimes fabricate audits, and even legitimate audits may identify risks that developers choose not to fix. Always verify audits directly with the auditing company.

Which tools can help detect exit scams in crypto before investing?

Token Sniffer and SolidityScan analyse smart contracts for malicious code, whilst DexTools and GeckoTerminal examine liquidity. Blockchain explorers provide transaction transparency, and combining multiple tools offers comprehensive protection against fraudulent projects.

Can you recover funds after falling victim to a crypto rug pull?

Recovery is extremely difficult due to blockchain’s irreversible transactions and scammers’ anonymity. Whilst some victims report to authorities or blockchain analysis firms, successful fund recovery remains rare. Prevention through thorough due diligence is essential.