Litecoin has established itself as one of the most reliable and widely-used cryptocurrencies since its launch in 2011. Whether someone bought in early, received LTC as payment, or simply wants to diversify their holdings, there comes a time when converting Litecoin to cash or swapping it for other digital assets becomes necessary. The good news? Converting Litecoin is straightforward,provided they understand the available methods and choose the right approach for their needs.

From centralized exchanges and peer-to-peer platforms to Bitcoin ATMs and decentralized swaps, multiple pathways exist to turn LTC into fiat currency or trade it for Bitcoin, Ethereum, and beyond. Each method comes with its own set of trade-offs involving speed, fees, privacy, and security. This guide walks through the most practical conversion options, outlines step-by-step processes, and highlights important considerations like costs, safety measures, and tax obligations,so anyone holding Litecoin can make informed decisions about cashing out or swapping with confidence.

Key Takeaways

- Converting Litecoin to cash can be done through centralized exchanges, peer-to-peer platforms, or Bitcoin ATMs, each offering different trade-offs in speed, fees, and privacy.

- Centralized exchanges like Kraken, Coinbase, and BitPay provide the most user-friendly method to convert Litecoin to cash, with withdrawal options including bank transfers, debit cards, and digital wallets like PayPal.

- Trading fees typically range from 0.1% to 1% on exchanges, while Bitcoin ATMs charge the highest fees at 5% to 10% or more per transaction.

- Swapping Litecoin for other cryptocurrencies like Bitcoin, Ethereum, or stablecoins through centralized exchanges is often faster and cheaper than cashing out to fiat currency.

- Always enable two-factor authentication, verify withdrawal details carefully, and use reputable platforms to protect your funds during the conversion process.

- Converting Litecoin is a taxable event in most jurisdictions, with capital gains tax applied to profits whether you sell for fiat or trade for another cryptocurrency.

Understanding Your Conversion Options

Before diving into the mechanics of conversion, it helps to get a clear picture of the landscape. Converting Litecoin isn’t a one-size-fits-all process,different methods suit different priorities, whether that’s speed, lower fees, enhanced privacy, or ease of use.

Cryptocurrency exchanges remain the most popular choice. Platforms like Coinbase, Kraken, BitPay, and MoonPay let users sell Litecoin for fiat currencies such as USD or EUR, then withdraw funds directly to bank accounts, debit cards, or digital wallets like PayPal. These services are regulated, user-friendly, and support a wide range of withdrawal methods.

Peer-to-peer (P2P) platforms offer a more direct route. Here, users can sell LTC to other individuals without relying on a centralized exchange to help the transaction. The platform acts as an escrow service, holding the coins until the buyer completes payment. P2P can mean lower fees and more flexible payment options, but it requires extra vigilance.

Bitcoin ATMs that support Litecoin provide a physical, cash-based option. Though less common than exchanges, these ATMs let users send LTC and receive cash vouchers or direct withdrawals on the spot,ideal for those who prefer tangible currency and want to avoid linking bank accounts.

For those not looking to cash out but instead wanting to swap Litecoin for other cryptocurrencies, both centralized and decentralized exchanges offer quick conversion paths. Whether it’s moving into Bitcoin, Ethereum, stablecoins like USDT, or exploring altcoins, the crypto-to-crypto conversion process is often faster and cheaper than cashing out entirely.

Each option balances speed, cost, privacy, and regulatory compliance differently. Understanding these trade-offs upfront helps users pick the method that aligns best with their goals and comfort level.

Converting Litecoin to Cash

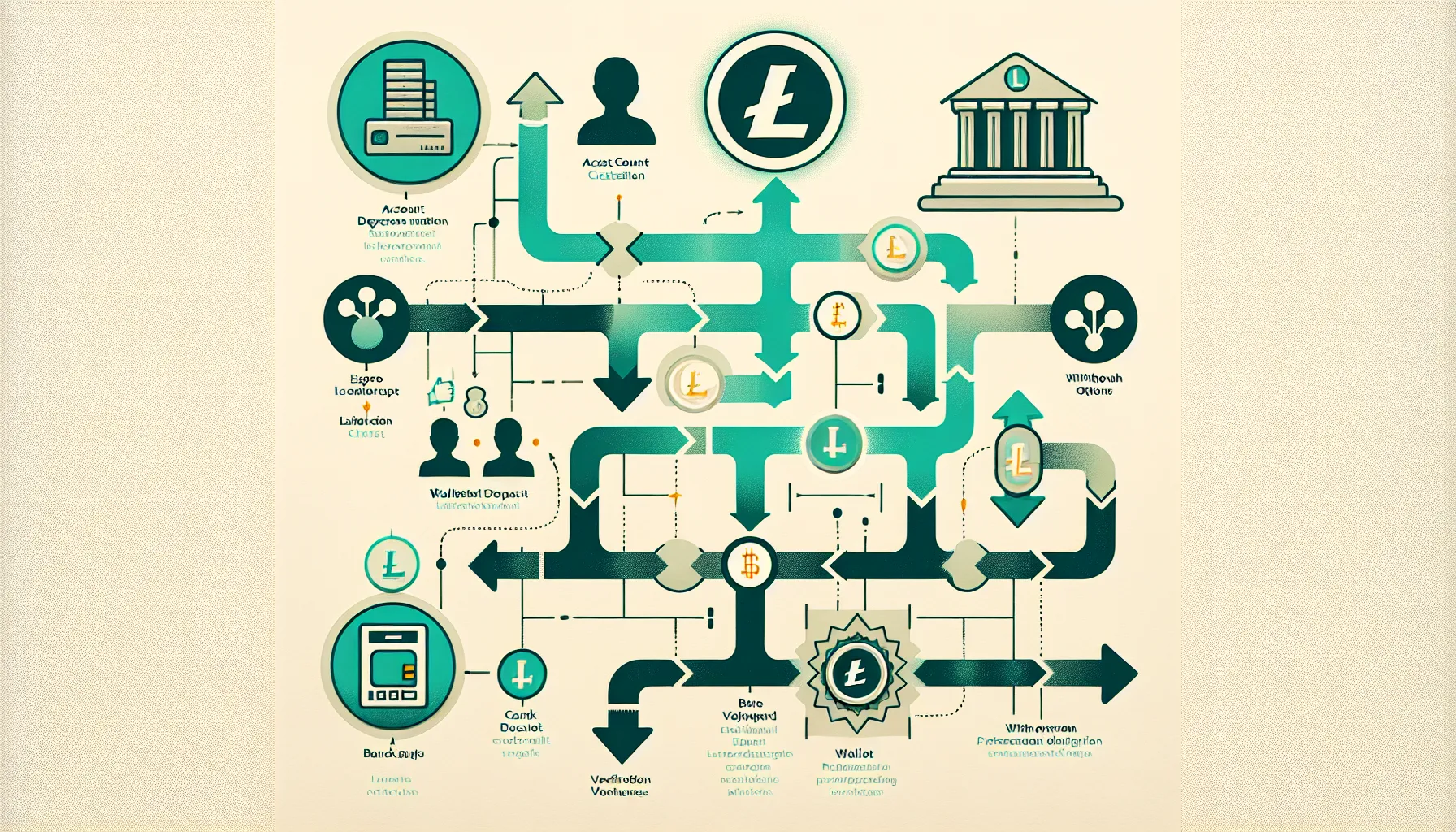

When it’s time to turn Litecoin into spendable fiat currency, three primary methods stand out: using a cryptocurrency exchange, engaging in peer-to-peer trades, or visiting a Bitcoin ATM that supports LTC.

Using Cryptocurrency Exchanges

Cryptocurrency exchanges are the go-to solution for most users converting Litecoin to cash. The process is reliable, relatively fast, and backed by customer support and regulatory frameworks.

To get started, users need a verified account on a platform like Kraken, BitPay, or MoonPay. Verification typically involves completing Know Your Customer (KYC) procedures,submitting ID documents and sometimes proof of address. Once verified, they deposit their Litecoin into the exchange wallet by sending it from their personal wallet to the provided LTC address.

After the deposit confirms (usually within minutes), the next step is selling. Users navigate to the trading or sell section, select Litecoin, and choose the fiat currency they want to receive,USD, EUR, GBP, and others depending on the platform. The exchange executes the sale at the current market rate, converting LTC into fiat that now sits in the user’s account balance.

Withdrawal options vary by platform but commonly include bank transfers (ACH or wire), debit or credit card deposits, and digital wallets like PayPal or Venmo. Bank transfers are usually the cheapest but can take one to three business days. Card withdrawals and PayPal options tend to be faster,sometimes within minutes,but may carry higher fees.

Exchanges like Kraken are known for competitive fees and robust security, while services like BitPay and MoonPay emphasize speed and integrate smoothly with external wallets and apps. Withdrawal times range from a few minutes to several business days depending on the method and the user’s location.

Peer-to-Peer (P2P) Platforms

For those seeking more control over the transaction or looking to avoid some exchange fees, peer-to-peer platforms offer a viable alternative. Platforms like Cryptomus and LocalBitcoins (which supports multiple cryptos including LTC) connect sellers directly with buyers.

The process works like this: a user lists their Litecoin for sale, often specifying the payment method they’ll accept,bank transfer, cash deposit, PayPal, or even gift cards. Interested buyers respond, and the platform holds the LTC in escrow until the seller confirms they’ve received payment. Once confirmed, the escrow releases the coins to the buyer.

P2P trades can mean lower fees since there’s no intermediary taking a cut beyond the platform’s escrow service charge. They also offer more payment flexibility and can provide faster access to cash in some cases. But, they require extra caution. Users need to verify the legitimacy of their trading partner, watch for scam attempts, and ensure payment is genuinely received before releasing the coins. Reputation systems and user reviews on these platforms help, but diligence is essential.

Bitcoin ATMs That Support Litecoin

Bitcoin ATMs,some of which also support Litecoin,offer a physical, in-person way to convert LTC to cash. These machines are less common than online exchanges but can be found in urban areas, convenience stores, and shopping centers.

The process is straightforward. Users select the option to sell Litecoin, scan a QR code displayed by the ATM with their wallet app, and send the specified amount of LTC to the machine’s address. Once the transaction confirms on the blockchain, the ATM dispenses cash or prints a voucher redeemable for cash.

Bitcoin ATMs are convenient for those who prefer not to link bank accounts or go through lengthy verification processes. But, fees can be steep,often 5% to 10% or more per transaction,and daily limits may apply. They’re best suited for smaller, immediate cash needs rather than large conversions.

Converting Litecoin to Other Cryptocurrencies

Not everyone looking to convert Litecoin wants to exit the crypto space entirely. Many users prefer to swap LTC for other digital assets,whether to diversify, take advantage of market opportunities, or move into stablecoins for safer storage. Two main pathways exist for crypto-to-crypto conversions: centralized exchange swaps and decentralized exchanges.

Direct Exchange Swaps

Centralized exchanges make swapping Litecoin for other cryptocurrencies quick and seamless. Platforms like Coinbase, Kraken, Binance, and others support direct trading pairs between LTC and major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and many altcoins.

The process mirrors selling for fiat but skips the withdrawal step. Users deposit Litecoin into their exchange wallet, navigate to the trade or swap interface, select the target cryptocurrency, and execute the trade. The exchange handles the conversion at the current market rate, and the new crypto appears in the user’s wallet within seconds or minutes.

Direct swaps on centralized exchanges are generally fast, reliable, and come with the backing of customer support. Trading fees are typically low,ranging from 0.1% to 1% per trade depending on the platform and user’s trading volume. For users who already have accounts on these exchanges, it’s often the most straightforward option.

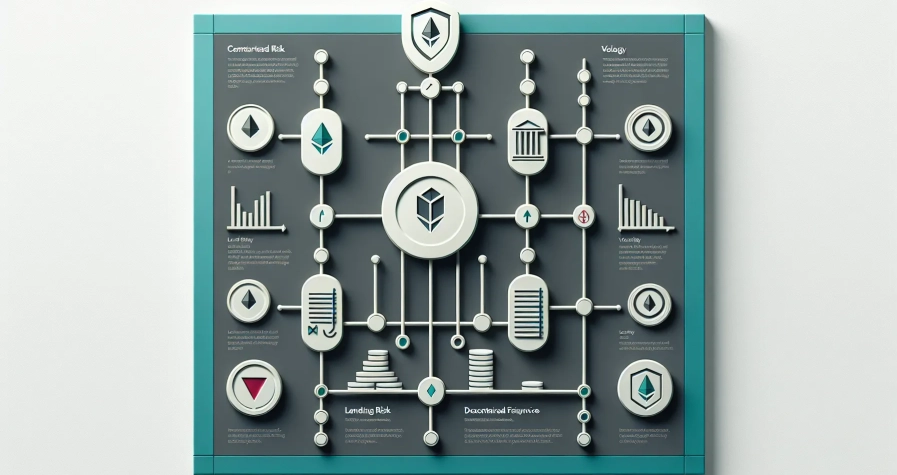

Decentralized Exchanges (DEXs)

Decentralized exchanges offer a non-custodial alternative, meaning users retain full control of their funds throughout the transaction. Platforms like Uniswap, PancakeSwap, and others allow peer-to-peer swaps without a centralized intermediary.

But, there’s a catch: Litecoin operates on its own blockchain, which isn’t natively compatible with many DEXs that run on Ethereum or Binance Smart Chain. To use a DEX, users often need to first convert Litecoin into a wrapped or bridged version compatible with the target blockchain, or use a cross-chain bridge service. This adds complexity and potential fees.

Even though the extra steps, DEXs appeal to users prioritizing privacy, decentralization, and avoiding KYC requirements. They’re also useful for accessing niche tokens not listed on major centralized exchanges. Fees vary,users pay network gas fees plus to any swap fees,but the trade-off is greater control and reduced reliance on centralized entities.

For most users, centralized exchange swaps remain the simplest and most cost-effective route for converting Litecoin to other cryptocurrencies. DEXs are better suited for experienced users comfortable with wallet management and blockchain mechanics.

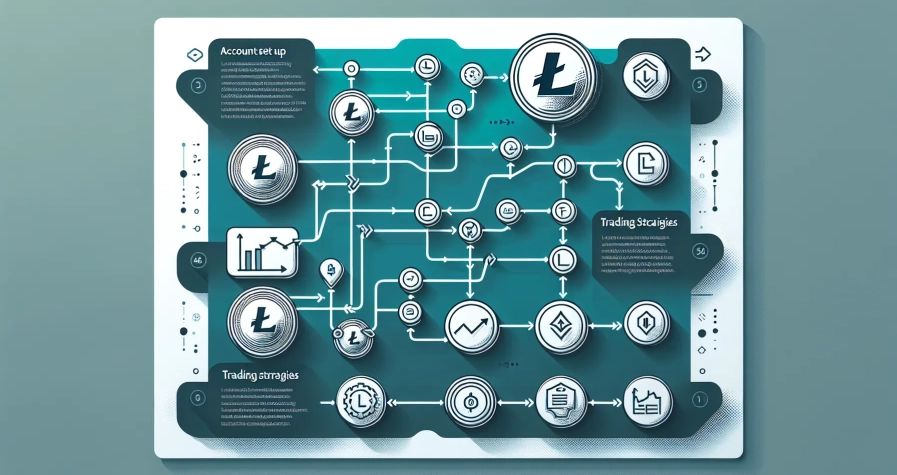

Step-by-Step Guide to Converting on a Centralized Exchange

For those new to the process or looking for a clear roadmap, here’s a step-by-step walkthrough of converting Litecoin to cash (or another cryptocurrency) using a centralized exchange. This example applies to most major platforms like Kraken, Coinbase, or Binance.

Step 1: Create and Verify Your Account

If the user doesn’t already have an account, they’ll need to sign up on the chosen exchange. Registration usually requires an email address and password. After signing up, they must complete identity verification (KYC). This involves uploading a government-issued ID,passport, driver’s license, or national ID card,and sometimes a selfie or proof of address. Verification can take anywhere from a few minutes to a couple of days, depending on the platform and volume of requests.

Step 2: Deposit Litecoin to the Exchange Wallet

Once verified, the user navigates to the deposit section of the exchange, selects Litecoin, and copies the deposit address (or scans the QR code). They then open their personal Litecoin wallet,whether it’s a hardware wallet, mobile app, or desktop client,and send the desired amount of LTC to the exchange’s address. It’s critical to double-check the address before confirming the transaction, as cryptocurrency transfers are irreversible.

Litecoin transactions typically confirm within a few minutes, and the exchange will credit the account once the required number of network confirmations is met (usually between 6 and 12 confirmations).

Step 3: Navigate to the Sell or Trade Section

After the deposit is confirmed, the user heads to the “Sell” or “Trade” section of the exchange. They select Litecoin as the asset to sell and choose what they want in return,fiat currency like USD or EUR, or another cryptocurrency like Bitcoin or Ethereum. The platform displays the current exchange rate and calculates the amount they’ll receive after fees.

Step 4: Select Withdrawal Method and Enter Details

If converting to fiat, the next step is choosing a withdrawal method. Options typically include bank transfer (ACH, SEPA, or wire), debit/credit card, PayPal, or Venmo. The user enters the necessary details,bank account number, card information, or PayPal email,and specifies the amount to withdraw.

Some platforms require users to add and verify withdrawal methods in advance, which might involve a small test deposit or additional verification steps.

Step 5: Confirm and Complete the Transaction

Before finalizing, the exchange displays a summary showing the amount being sold, applicable fees, and the net amount to be received. After reviewing and confirming, the transaction processes. Fiat withdrawals can take anywhere from a few minutes (for PayPal or card) to one to three business days (for bank transfers). Crypto-to-crypto swaps are usually instant or near-instant.

Users receive a confirmation email and can track the status of their withdrawal in the exchange’s transaction history. Once complete, the funds appear in the designated bank account, card, or wallet.

Following these steps ensures a smooth, secure conversion process with minimal risk of errors or delays.

Fees and Costs to Consider

Understanding the fee structure is crucial for anyone converting Litecoin, as costs can add up quickly and eat into profits,especially for smaller transactions.

Trading Fees

Most exchanges charge a trading or conversion fee when selling Litecoin for fiat or swapping it for another cryptocurrency. These fees typically range from 0.1% to 1% per transaction. High-volume traders often benefit from tiered fee structures that reduce costs, while casual users pay standard rates. For example, Kraken’s fees start at 0.26% for makers and 0.16% for takers, while Coinbase charges around 0.5% to 1% depending on the transaction type.

Withdrawal Fees

Withdrawal fees vary widely based on the method and region. Bank transfers (ACH in the US, SEPA in Europe) are usually the cheapest, costing anywhere from free to around $5. Wire transfers can be more expensive, ranging from $10 to $25. Debit or credit card withdrawals might incur flat fees of $1 to $5 or a percentage-based charge. PayPal and Venmo withdrawals sometimes come with higher fees or unfavorable exchange rates.

Bitcoin ATMs, as mentioned earlier, charge some of the steepest fees,often 5% to 10% or more,making them less economical for large conversions.

Network Fees

When sending Litecoin to an exchange, users pay a small network fee to miners who process and confirm the transaction. Litecoin’s fees are generally low,often just a few cents,but they can fluctuate based on network congestion.

Currency Conversion and Spread

Some platforms add a spread,a markup on the exchange rate,plus to explicit fees. This means the rate at which users sell Litecoin may be slightly lower than the market rate, with the difference going to the platform. It’s worth comparing rates across multiple exchanges to find the best deal.

Additional Costs

Certain services offer expedited processing for an extra fee, useful when users need cash urgently. Cross-border transfers may also incur additional charges or unfavorable currency conversion rates.

To minimize costs, users should compare fee structures across platforms, choose withdrawal methods wisely, and avoid unnecessary expedited services unless speed is essential. Even small differences in fees can matter, especially when converting large amounts of Litecoin.

Security Best Practices During Conversion

Converting Litecoin involves moving assets through wallets, exchanges, and bank accounts,each step presenting potential security risks. Following best practices can protect users from theft, scams, and costly mistakes.

Use Reputable, Regulated Platforms

Stick to well-established exchanges and services with strong reputations and regulatory compliance. Platforms that adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are generally safer and offer better recourse in case of issues. Kraken, Coinbase, and Binance are examples of platforms with solid track records.

Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring a second form of verification,usually a code from an authenticator app like Google Authenticator or Authy,plus to a password. Enabling 2FA on exchange accounts, email accounts, and any linked bank or payment accounts significantly reduces the risk of unauthorized access.

Double-Check Withdrawal Details

Before confirming any transaction, users should carefully verify all withdrawal details,bank account numbers, wallet addresses, payment emails,character by character. Cryptocurrency transactions are irreversible, and a single typo can result in permanent loss of funds. Some users take screenshots or use saved templates to reduce the risk of errors.

Beware of Phishing and Scams

Phishing attacks are common in the crypto space. Scammers impersonate exchanges, send fake emails, or create look-alike websites to steal login credentials and funds. Users should never click on suspicious links, always navigate to exchange websites by typing the URL directly, and verify the authenticity of any communication claiming to be from their exchange.

On P2P platforms, watch for buyers or sellers with little to no reputation, offers that seem too good to be true, or requests to complete transactions outside the platform’s escrow system.

Use Hardware Wallets for Storage

Before converting, if users hold Litecoin in an exchange wallet, they expose themselves to exchange hacks and platform insolvency. Storing LTC in a hardware wallet (like Ledger or Trezor) until ready to convert ensures control over private keys and reduces risk.

Keep Software Updated

Regularly update wallet software, exchange apps, and device operating systems to patch security vulnerabilities.

By prioritizing security at every stage,from choosing platforms to verifying transactions,users can convert Litecoin with confidence and minimize exposure to threats.

Tax Implications of Converting Litecoin

Many people overlook the tax side of converting cryptocurrency, but it’s a critical consideration. In most jurisdictions, converting Litecoin,whether to fiat or another cryptocurrency,is a taxable event.

Capital Gains Tax

When someone sells or trades Litecoin, they’re disposing of an asset, and any profit made since acquiring it is subject to capital gains tax. For example, if a user bought Litecoin at $50 and later sold it at $100, the $50 gain per coin is taxable. The tax rate depends on how long they held the asset. In the United States, holding for more than a year qualifies for long-term capital gains rates (generally 0%, 15%, or 20% depending on income), while shorter holding periods are taxed as ordinary income at higher rates.

Crypto-to-Crypto Trades

Swapping Litecoin for Bitcoin, Ethereum, or another cryptocurrency is also a taxable event in many countries, including the US. The fair market value of the received cryptocurrency at the time of the trade determines the gain or loss. This can get complicated quickly, especially for active traders making multiple swaps.

Record Keeping

Tax authorities require detailed records of each transaction, including dates, amounts, values at the time of acquisition and disposal, and the nature of the transaction. Many exchanges provide transaction history exports, but users should also keep their own records,especially if they use multiple platforms or P2P trades.

Cryptocurrency tax software like CoinTracker, Koinly, or TurboTax’s crypto features can help automate calculations and generate reports for tax filing.

Losses and Offsets

If a user sells Litecoin at a loss, they can often offset those losses against other capital gains, reducing their overall tax liability. In some cases, losses can even be carried forward to future tax years.

Consult a Tax Professional

Tax laws around cryptocurrency are complex and vary significantly by country and even by state or province. Consulting a tax professional familiar with crypto transactions is wise, especially for larger conversions or frequent trading activity.

Ignoring tax obligations can result in penalties, interest, and audits. Staying compliant not only avoids legal trouble but also provides peace of mind when converting and using cryptocurrency.

Conclusion

Converting Litecoin to cash or other cryptocurrencies doesn’t have to be daunting. With a clear understanding of the available methods,centralized exchanges, P2P platforms, Bitcoin ATMs, and decentralized swaps,users can choose the approach that best fits their priorities, whether that’s speed, cost, privacy, or convenience.

Centralized exchanges remain the most reliable and user-friendly option for most people, offering straightforward processes, regulatory protections, and a variety of withdrawal methods. P2P platforms and Bitcoin ATMs provide alternatives for those seeking more control or preferring cash transactions, though they come with trade-offs in fees and complexity. Swapping Litecoin for other cryptocurrencies opens doors to diversification and market opportunities without leaving the crypto ecosystem.

Understanding fees, securing accounts with strong authentication, double-checking transaction details, and staying compliant with tax obligations are all essential to a smooth and safe conversion experience. The crypto landscape continues to evolve, with new platforms, features, and regulations emerging regularly,but the fundamentals remain the same: choose reputable services, prioritize security, and keep good records.

Whether cashing out for a major purchase, diversifying into other digital assets, or simply realizing gains, Litecoin holders have more options than ever to move their funds where they need them. Armed with the right knowledge and a bit of caution, converting Litecoin becomes just another routine step in managing digital wealth.

Frequently Asked Questions

What is the fastest way to convert Litecoin to cash?

Using a centralized cryptocurrency exchange with card or PayPal withdrawal is typically the fastest method, often completing within minutes. Bitcoin ATMs supporting Litecoin also provide instant cash but charge significantly higher fees, usually 5-10% per transaction.

How much does it cost to convert Litecoin to USD?

Costs vary by method. Centralized exchanges typically charge 0.1-1% trading fees plus withdrawal fees. Bank transfers are cheapest at $0-5, while card and PayPal withdrawals may cost more. Bitcoin ATMs charge the highest fees at 5-10% or more.

Do I need to pay taxes when converting Litecoin to cash?

Yes, in most jurisdictions including the US, converting Litecoin to cash is a taxable event subject to capital gains tax. You’ll owe taxes on any profit made since acquiring the LTC, with rates depending on your holding period and income level.

Can I convert Litecoin to Bitcoin without using an exchange?

Yes, decentralized exchanges (DEXs) allow direct peer-to-peer swaps without centralized intermediaries. However, Litecoin may require bridging to compatible blockchains first. For most users, centralized exchange swaps remain simpler, faster, and more cost-effective for LTC-to-BTC conversions.

Is converting Litecoin on a peer-to-peer platform safe?

P2P platforms can be safe when using reputable services with escrow systems, but they require extra vigilance. Always verify trading partner reputations, confirm payment receipt before releasing coins, and avoid completing transactions outside the platform’s protection mechanisms.

What is the difference between wrapped Litecoin and regular Litecoin?

Wrapped Litecoin is a tokenized version of LTC that operates on other blockchains like Ethereum, enabling compatibility with DeFi protocols and decentralized exchanges. Regular Litecoin runs on its native blockchain. Wrapping involves locking LTC to mint an equivalent token elsewhere.