Converting your Bitcoin to Ethereum has become one of the most common cryptocurrency transactions as investors diversify their digital portfolios. Whether you’re looking to take advantage of Ethereum’s smart contract capabilities or simply want to explore different blockchain opportunities, swapping between these two major cryptocurrencies is straightforward when you know the right methods.

The process involves several approaches, from using centralised exchanges to decentralised platforms, each with distinct advantages and considerations. You’ll need to understand the associated fees, security measures, and timing factors that could impact your conversion.

With Bitcoin and Ethereum representing the two largest cryptocurrencies by market capitalisation, knowing how to efficiently move between them gives you greater flexibility in managing your crypto investments. The following guide will walk you through the most reliable and cost-effective methods to convert your Bitcoin holdings into Ethereum safely.

Understanding Bitcoin to Ethereum Conversion

Bitcoin to Ethereum conversion involves exchanging your BTC holdings for ETH through various trading mechanisms. This process doesn’t represent a direct technical conversion between the two blockchain networks but rather a trade between two separate cryptocurrencies with distinct protocols and use cases.

You’re essentially selling Bitcoin and purchasing Ethereum in a single transaction sequence. The exchange rate fluctuates constantly based on market conditions, with typical spreads ranging from 0.1% to 1% depending on the platform you choose and current market liquidity.

Key Differences Between Bitcoin and Ethereum

Bitcoin operates as a digital store of value and peer-to-peer payment system, whilst Ethereum functions as a programmable blockchain platform supporting smart contracts and decentralised applications.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Primary Function | Digital currency | Smart contract platform |

| Block Time | 10 minutes | 12-15 seconds |

| Maximum Supply | 21 million BTC | No fixed cap |

| Consensus Mechanism | Proof of Work | Proof of Stake |

| Transaction Fees | $1-$50+ | $5-$100+ |

These fundamental differences affect how you approach conversion timing and strategy. Bitcoin’s longer block times mean slower transaction confirmations, whilst Ethereum’s faster processing enables quicker trade execution.

Conversion Methods Overview

Direct conversion through cryptocurrency exchanges represents the most common approach. You deposit Bitcoin to an exchange platform, execute a BTC/ETH trading pair, then withdraw your Ethereum to a personal wallet.

Peer-to-peer platforms offer another conversion route, connecting you directly with other traders. These services typically charge lower fees but require more time to find suitable trading partners.

Atomic swaps provide a decentralised conversion method that doesn’t require intermediary platforms. This technology enables direct blockchain-to-blockchain exchanges, though it’s currently limited to specific wallet implementations and requires technical knowledge.

Market Dynamics Affecting Conversion

Exchange rates between Bitcoin and Ethereum change continuously based on supply and demand dynamics across global markets. Major news events, regulatory announcements, and technological developments can cause significant price volatility affecting your conversion value.

Market depth influences the speed and efficiency of your conversion. High-volume trading pairs like BTC/ETH typically offer better liquidity and tighter spreads than smaller altcoin pairs.

Trading volume patterns show that conversion rates often fluctuate more during Asian and European trading hours when market activity peaks. Weekend trading typically experiences lower volumes and potentially wider bid-ask spreads.

Choosing the Right Exchange Platform

Your choice of exchange platform fundamentally impacts the security, cost and speed of your Bitcoin to Ethereum conversion. Three primary platforms serve different needs: centralised exchanges for simplicity, decentralised exchanges for security and peer-to-peer platforms for privacy.

Centralised Exchanges

Centralised exchanges (CEXs) operate under single entity control and hold custody of your funds and private keys throughout the conversion process. These platforms offer user-friendly interfaces with high liquidity levels and fast transaction speeds typically ranging from seconds to minutes.

CEXs like Coinbase and Binance provide streamlined conversion processes where you deposit BTC, use their trading interface to swap for ETH and withdraw to your wallet. However, these platforms present moderate security risks due to hack vulnerability and require identity verification procedures.

The trading fees on centralised exchanges typically range from 0.1% to 0.25% per transaction, with additional withdrawal fees varying by platform. CEXs excel in handling large volume conversions efficiently whilst maintaining competitive spread rates.

Decentralised Exchanges

Decentralised exchanges (DEXs) operate on distributed networks without central authority control, allowing you to retain full custody of your funds throughout the conversion process. These platforms enhance privacy and security by eliminating single points of failure but require greater technical knowledge to navigate effectively.

Popular DEXs including Uniswap and PancakeSwap enable direct on-chain swaps by connecting your wallet and exchanging BTC wrapped as WBTC or other compatible tokens for ETH. Transaction completion depends on blockchain network conditions, typically taking 1-15 minutes during standard network activity.

DEX trading involves gas fees ranging from £5-£50 depending on network congestion, plus platform fees usually between 0.05% to 0.3%. Lower liquidity levels compared to CEXs can result in higher slippage for large conversions, particularly during volatile market periods.

Peer-to-Peer Platforms

Peer-to-peer (P2P) platforms facilitate direct trades between users without intermediaries, offering maximum privacy and flexible negotiation terms. These platforms enable custom conversion rates and payment methods but require careful counterparty assessment to avoid fraudulent transactions.

P2P conversions involve agreeing terms directly with other traders through escrow services or reputation-based systems. Popular P2P platforms include LocalBitcoins and Bisq, though direct BTC-to-ETH conversions remain less common than fiat-mediated exchanges.

Transaction completion times vary significantly based on counterparty responsiveness and chosen verification methods, ranging from 30 minutes to several hours. P2P platforms typically charge fees between 0.5% to 2% whilst offering competitive rates for privacy-conscious users willing to invest additional time in the conversion process.

Step-by-Step Conversion Process

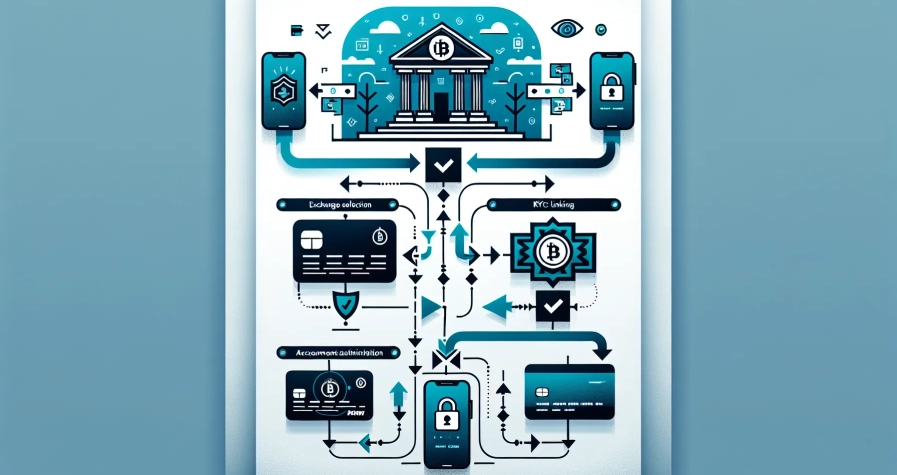

Converting Bitcoin to Ethereum involves four distinct phases that ensure secure and efficient cryptocurrency swapping. The process remains consistent across most platforms whilst specific interface elements may vary between exchanges.

Setting Up Your Exchange Account

Registration begins with selecting a reputable exchange platform that supports BTC/ETH trading pairs such as Coinbase, Binance, or Changelly. You provide your email address and create a secure password during the initial account setup process.

Identity verification (KYC) forms the cornerstone of legitimate exchange operations and enables higher transaction limits for your account. The verification process requires submitting government-issued identification documents alongside proof of address documentation. This compliance measure protects both you and the exchange from regulatory issues whilst establishing your trading capacity.

Most platforms complete verification within 24-72 hours depending on document clarity and current processing volumes. Enhanced verification levels unlock increased daily trading limits and withdrawal amounts for more substantial conversions.

Depositing Your Bitcoin

Access your exchange account and navigate to the wallet or funds management section to initiate Bitcoin deposits. Select Bitcoin (BTC) from the available cryptocurrency options and click the deposit function to generate your unique wallet address.

The platform provides a specific BTC deposit address that links directly to your exchange account. Copy this address precisely as any errors result in permanent loss of funds due to blockchain transaction irreversibility.

Transfer your Bitcoin from external wallets or storage devices by pasting the copied deposit address into your sending wallet’s recipient field. Most exchanges require 1-3 network confirmations before crediting deposited Bitcoin to your account balance, typically taking 10-30 minutes depending on network congestion.

Executing the Trade

Locate the BTC/ETH trading pair within the exchange’s trading interface and select this specific market pairing. The trading interface displays current exchange rates, order books, and price charts for informed conversion decisions.

Enter the precise amount of Bitcoin you wish to convert to Ethereum using either BTC units or equivalent fiat currency values. Review the displayed exchange rate and estimated Ethereum amount you’ll receive after deducting applicable trading fees.

Confirm the trade details including conversion rate, fee structure, and final ETH amount before executing the swap. Market orders execute immediately at current prices whilst limit orders allow you to specify desired conversion rates for future execution.

Withdrawing Your Ethereum

Navigate to your Ethereum wallet section within the exchange platform once the BTC to ETH conversion completes successfully. Your new Ethereum balance appears in the wallet dashboard alongside transaction history and current market values.

Withdraw your Ethereum to external wallets by providing your personal ETH wallet address and specifying the withdrawal amount. Double-check the recipient address format as Ethereum addresses differ from Bitcoin addresses and incorrect entries cause permanent fund loss.

Alternatively, maintain your Ethereum holdings on the exchange platform for immediate trading access or future conversions. Consider withdrawal fees ranging from 0.005-0.01 ETH depending on your chosen platform when deciding between external storage and exchange custody options.

Conversion Costs and Fees

Converting Bitcoin to Ethereum involves multiple fee types that affect your total conversion cost. Understanding these fees helps you choose the most cost-effective platform and timing for your BTC to ETH swap.

Trading Fees

Trading fees represent the charges platforms apply for facilitating your Bitcoin to Ethereum conversion. Exchanges typically structure these fees as percentages of your transaction value, ranging from 0.05% to 1.5% depending on the platform and your trading volume.

Centralised exchanges like Binance charge maker fees of 0.1% and taker fees of 0.1% for standard users, whilst premium users with higher monthly volumes receive discounts down to 0.02%. Coinbase applies a spread of approximately 0.50% plus a flat fee that varies by region and payment method.

Decentralised exchanges calculate fees differently, with Uniswap charging a 0.3% fee for each swap that goes to liquidity providers. These DEX fees remain constant regardless of your trading volume or user status.

| Platform Type | Fee Range | Volume Discounts |

|---|---|---|

| Centralised Exchanges | 0.05% – 0.5% | Available for high-volume traders |

| Decentralised Exchanges | 0.3% – 1.0% | Fixed rates regardless of volume |

| P2P Platforms | 0% – 2.0% | Varies by individual agreements |

Network Transaction Fees

Network transaction fees cover the blockchain processing costs for moving your Bitcoin and receiving Ethereum. Bitcoin network fees depend on transaction byte size and current network congestion, typically ranging from £2 to £50 during peak periods.

Bitcoin miners prioritise transactions with higher fees per byte, meaning you can reduce costs by choosing lower-priority processing during off-peak hours. Transaction confirmation times range from 10 minutes to several hours based on the fee rate you select.

Ethereum network fees, called gas fees, fluctuate based on network demand and can range from £5 to £100 for standard transactions. These fees include a base fee that gets burned and an optional tip for miners to prioritise your transaction.

Gas fees spike during high-demand periods, particularly when popular DeFi applications or NFT launches create network congestion. You can monitor gas prices using tools like GasTracker to time your conversions during lower-cost periods.

Spread Considerations

Spread represents the difference between the buying and selling prices for Bitcoin and Ethereum on exchanges. This spread affects your effective conversion rate and can add 0.1% to 2% to your conversion costs depending on market liquidity and platform efficiency.

Larger exchanges typically maintain tighter spreads due to higher trading volumes and more active market makers. During volatile market conditions, spreads widen significantly as liquidity providers adjust their risk exposure.

Market makers on centralised exchanges compete to provide the best prices, resulting in spreads as low as 0.05% during normal conditions. Decentralised exchanges rely on automated market makers (AMMs) that can produce wider spreads, particularly for large transactions that significantly impact pool ratios.

You can minimise spread impact by splitting large conversions into smaller transactions, using limit orders instead of market orders, and choosing high-liquidity trading pairs during active market hours. Comparing rates across multiple platforms before executing your conversion ensures you receive the most favourable exchange rate.

Security Best Practices

Converting Bitcoin to Ethereum requires robust security measures to protect your digital assets from potential threats and fraud. Implementing proper security protocols safeguards your cryptocurrency throughout the conversion process and prevents costly losses.

Wallet Security

Hardware wallets provide the highest level of security for your Bitcoin and Ethereum holdings by storing private keys offline. Cold storage devices like Ledger and Trezor protect your assets from online hacks and malware attacks, making them essential for serious cryptocurrency investors.

Strong passwords combined with multi-factor authentication (MFA) create multiple security layers for your wallet access. Enable two-factor authentication (2FA) using apps like Google Authenticator or Authy to prevent unauthorised access even if your password becomes compromised.

Regular wallet software updates patch security vulnerabilities and improve protection against emerging threats. Download updates only from official sources to avoid malicious software that could compromise your private keys.

Address verification prevents costly mistakes during Bitcoin to Ethereum conversions. Double-check recipient wallet addresses character by character before confirming transactions, as blockchain transfers remain irreversible once processed.

Exchange Safety Measures

Reputable exchanges with regulatory compliance offer enhanced security for your Bitcoin to Ethereum conversions. Choose platforms like Coinbase Pro, Binance, or Kraken that maintain strong security protocols and positive user feedback whilst operating under proper licensing.

Two-factor authentication (2FA) combined with withdrawal whitelists provides additional protection for your exchange account. Configure IP address restrictions to limit access from unauthorised locations and enable withdrawal confirmations via email or SMS.

Know Your Customer (KYC) verification strengthens account security whilst ensuring regulatory compliance. Complete identity verification processes to unlock higher transaction limits and access enhanced security features offered by regulated exchanges.

Cryptographic protection measures including SSL encryption, firewalls, and intrusion detection systems safeguard your transactions and personal data. Select exchanges that implement advanced network security protocols to protect against cyberattacks and data breaches.

Anti-money laundering (AML) procedures help legitimate exchanges maintain security standards and regulatory compliance. These measures protect users from fraudulent activities and ensure the platform operates within legal frameworks.

Tax Implications of Cryptocurrency Conversions

HMRC treats Bitcoin to Ethereum conversions as taxable events under Capital Gains Tax (CGT) regulations. Converting BTC to ETH constitutes a disposal for tax purposes even though you’re exchanging one cryptocurrency for another rather than selling for fiat currency.

Capital Gains Tax Requirements

You must calculate gains or losses by comparing the sterling value of your disposed Bitcoin at conversion time against its original acquisition cost. Record the GBP equivalent value of both the Bitcoin you’re disposing of and the Ethereum you’re receiving at the exact moment of exchange.

Capital gains calculations require you to:

- Document transaction dates with precise timestamps for each conversion

- Record exchange rates in GBP at the time of swap completion

- Track acquisition costs of the original Bitcoin including purchase fees

- Calculate disposal proceeds based on the Ethereum value received

- Account for exchange fees which reduce your disposal proceeds

Record-Keeping Obligations

Maintain comprehensive records for each Bitcoin to Ethereum conversion throughout the tax year. Your documentation must include transaction hash numbers, exchange platform names, wallet addresses used, and market values in pounds sterling at transaction completion.

HMRC requires records covering:

| Required Information | Details |

|---|---|

| Transaction dates | Complete timestamps including time zones |

| Cryptocurrency amounts | Exact BTC disposed and ETH received |

| Sterling values | Market rates at conversion moment |

| Platform fees | All charges deducted during exchange |

| Wallet addresses | Both sending and receiving addresses |

Annual Allowance and Reporting

Report capital gains exceeding the annual tax-free allowance to HMRC through your Self Assessment return. The capital gains allowance for 2023-24 stands at £6,000 per individual, with gains above this threshold subject to CGT rates of 10% for basic rate taxpayers or 20% for higher rate taxpayers.

You don’t need to report conversions if your total disposals remain below four times the annual allowance (£24,000 for 2023-24) and your gains stay within the tax-free threshold.

Income Tax Considerations

Bitcoin acquired through mining or staking activities faces different tax treatment when converted to Ethereum. HMRC classifies crypto earned through mining as income rather than capital assets, meaning you pay Income Tax on the sterling value at receipt before calculating any subsequent capital gains from conversion.

Trading activities involving frequent Bitcoin to Ethereum swaps may trigger Income Tax rather than CGT if HMRC determines your conversions constitute a trading business rather than investment activity.

Conclusion

Converting Bitcoin to Ethereum offers you strategic advantages for portfolio diversification and access to Ethereum’s innovative ecosystem. You’ll need to weigh the benefits of centralised exchanges’ simplicity against decentralised platforms’ enhanced privacy and security.

Success depends on your careful selection of conversion methods that align with your technical expertise and risk tolerance. Remember to factor in all associated costs including trading fees network charges and spreads when planning your conversion strategy.

Don’t overlook the critical importance of maintaining detailed records for tax compliance and implementing robust security measures throughout the process. By following best practices and staying informed about market conditions you’ll be well-positioned to execute efficient and secure Bitcoin-to-Ethereum conversions that support your cryptocurrency investment goals.

Frequently Asked Questions

What is Bitcoin to Ethereum conversion?

Bitcoin to Ethereum conversion involves exchanging BTC for ETH through trading mechanisms rather than a direct technical conversion between blockchain networks. The process uses market-based exchange rates that fluctuate based on supply and demand, with spreads typically ranging from 0.1% to 1%.

What are the main methods to convert Bitcoin to Ethereum?

There are three primary methods: centralised exchanges (CEXs) like Coinbase and Binance offering user-friendly interfaces, decentralised exchanges (DEXs) such as Uniswap providing enhanced privacy, and peer-to-peer (P2P) platforms enabling direct trades between users with maximum privacy and flexible terms.

What fees should I expect when converting Bitcoin to Ethereum?

Trading fees typically range from 0.05% to 1.5% depending on the platform. Additional costs include Bitcoin network transaction fees, Ethereum gas fees, and spreads (difference between buying and selling prices). Total costs can vary significantly based on network congestion and chosen platform.

Is converting Bitcoin to Ethereum a taxable event in the UK?

Yes, HMRC treats Bitcoin to Ethereum conversions as taxable events under Capital Gains Tax (CGT) regulations. You must calculate gains or losses and maintain comprehensive records including transaction dates, amounts, and sterling values. The annual CGT allowance is £6,000 for 2023-24.

What security measures should I follow during conversion?

Use reputable exchanges with regulatory compliance, enable two-factor authentication, and complete KYC verification. Store cryptocurrencies in hardware wallets when possible, use strong passwords, verify recipient addresses carefully, and keep wallet software updated to protect against potential threats and fraud.

How long does it take to convert Bitcoin to Ethereum?

Conversion times vary by platform and method. Centralised exchanges typically process trades instantly, but Bitcoin deposits may take 30-60 minutes for confirmation. Ethereum withdrawals usually take 5-15 minutes. Decentralised exchanges and P2P platforms may take longer depending on network congestion and transaction complexity.