Stepping into the world of cryptocurrency can feel like standing at a crossroads. For most beginners, the first major decision is simple yet significant: should they buy Bitcoin or Ethereum first? Both assets dominate the crypto landscape, yet they serve fundamentally different purposes and carry distinct risk-reward profiles.

Choosing between Bitcoin and Ethereum isn’t about picking a winner, it’s about aligning an investment with personal goals, risk tolerance, and understanding of what each asset brings to the table. Bitcoin has established itself as ‘digital gold’, a scarce store of value designed to preserve wealth. Ethereum, on the other hand, powers a vast ecosystem of decentralised applications, smart contracts, and emerging technologies that reach far beyond payments.

This guide breaks down the core differences, evaluates investment considerations, examines market dynamics, and provides practical advice to help first-time buyers make an informed choice. Whether stability or innovation appeals more, understanding these two giants is the first step towards building a confident crypto strategy.

Key Takeaways

- Choosing between buying Bitcoin or Ethereum first depends on your investment goals, with Bitcoin serving as digital gold for wealth preservation and Ethereum powering decentralised applications and smart contracts.

- Bitcoin prioritises security and scarcity with a fixed supply of 21 million coins, making it ideal for conservative investors seeking a long-term store of value.

- Ethereum offers exposure to technological innovation through DeFi, NFTs, and Web3, appealing to risk-tolerant investors who believe in the growth potential of programmable blockchain ecosystems.

- Both cryptocurrencies are divisible, allowing investors with any budget to purchase fractions of a coin, and many adopt a diversified strategy by holding both assets.

- Ethereum’s transition to Proof-of-Stake reduced energy consumption by over 99% and improved transaction speed, whilst Bitcoin’s Proof-of-Work remains intentionally conservative for maximum security.

- Securing your cryptocurrency investment requires proper wallet management, two-factor authentication, and offline backup of recovery phrases, regardless of whether you choose Bitcoin or Ethereum first.

Understanding the Core Differences Between Bitcoin and Ethereum

Bitcoin and Ethereum often get lumped together as ‘cryptocurrencies’, but their underlying design and purpose couldn’t be more different. Grasping these distinctions is crucial for anyone deciding which to buy first.

Primary Purpose and Design Philosophy

Bitcoin was introduced in 2009 by the pseudonymous Satoshi Nakamoto with a singular vision: to create a decentralised, peer-to-peer digital currency free from central authority. Its purpose is simple yet profound, serve as a secure, scarce, and trustworthy form of money. Often called ‘digital gold’, Bitcoin prioritises being a reliable store of value over time. Its fixed supply cap of 21 million coins reinforces scarcity, mimicking precious metals and making it attractive to those seeking a hedge against inflation or currency devaluation.

Ethereum, launched in 2015 by Vitalik Buterin and a team of developers, took a different route. Rather than focusing solely on payments, Ethereum was designed as a programmable blockchain platform. Its main innovation is the smart contract, self-executing code that runs on the blockchain without intermediaries. This opens the door to decentralised applications (dApps), ranging from decentralised finance (DeFi) platforms to non-fungible tokens (NFTs) and beyond. Ethereum’s ambition is to become a global, open-source computing platform that enables innovation far beyond simple transactions.

In short, Bitcoin asks: Can we create sound, immutable money? Ethereum asks: What can we build on top of a decentralised network?

Technology and Network Capabilities

The technological backbone of each network reflects its purpose.

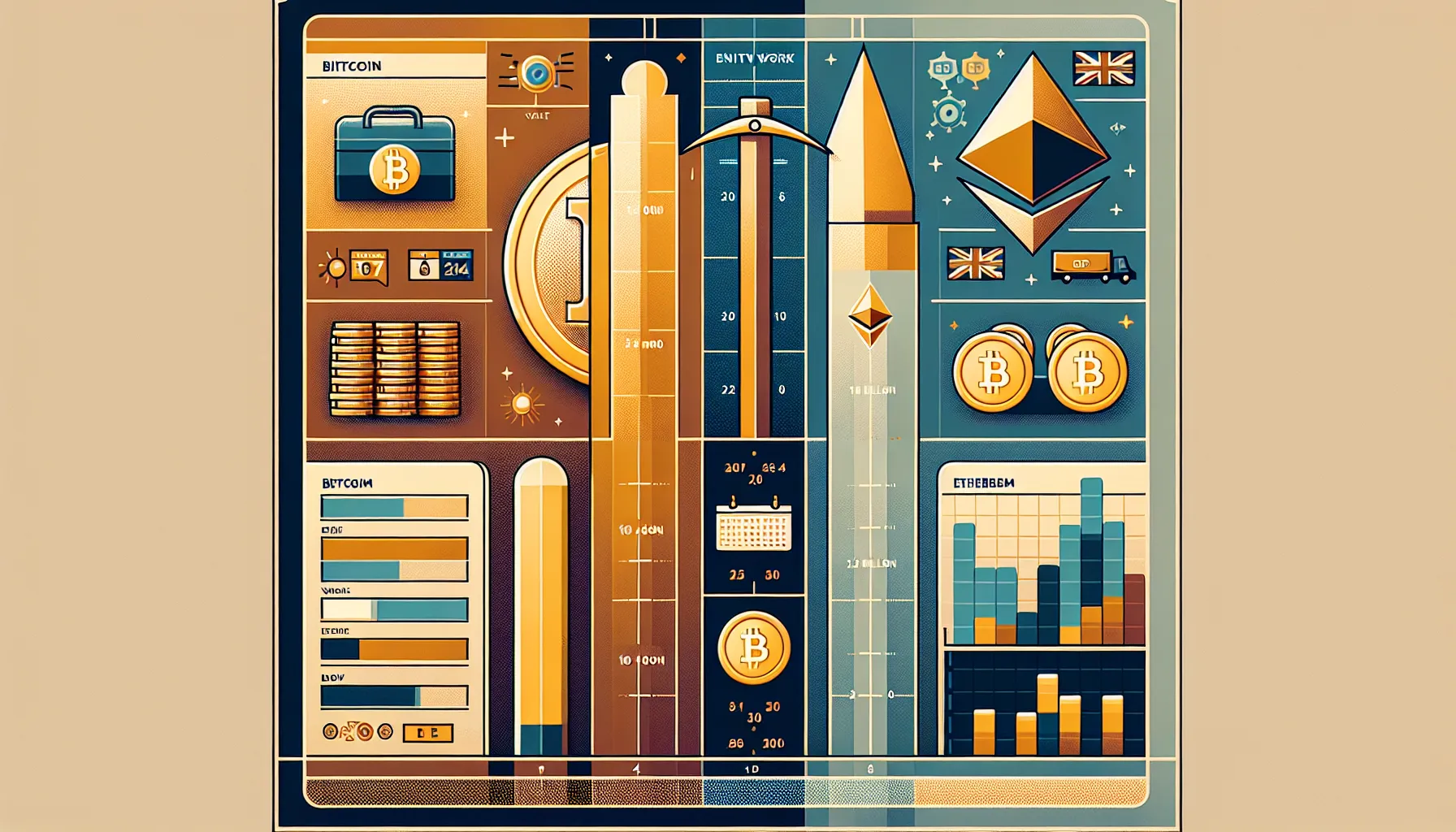

Bitcoin operates using a Proof-of-Work (PoW) consensus mechanism, where miners solve complex cryptographic puzzles to validate transactions and secure the network. This approach prioritises security and decentralisation but comes at a cost: Bitcoin’s block time averages around 10 minutes, and the network can handle roughly seven transactions per second. Also, PoW is energy-intensive, drawing criticism for its environmental impact. But, Bitcoin’s simplicity and battle-tested security have made it the most trusted cryptocurrency by market leaders and institutions.

Ethereum originally used PoW as well but transitioned to Proof-of-Stake (PoS) in September 2022 through a major upgrade known as ‘The Merge’. PoS replaces energy-hungry mining with validators who lock up (stake) their Ether to secure the network. This shift dramatically reduced Ethereum’s energy consumption, by over 99%, and improved scalability. Ethereum’s block time is roughly 12 seconds, significantly faster than Bitcoin, and the network supports a vast range of tokens and smart contracts, making it the foundation for much of the innovation happening in Web3 and decentralised finance.

While Bitcoin’s technology is intentionally conservative to maintain stability and security, Ethereum’s is dynamic and evolving, continually adding features to support its expanding ecosystem.

Evaluating Your Investment Goals and Risk Tolerance

An investor’s goals and appetite for risk should guide the choice between Bitcoin and Ethereum. Each asset serves different strategic purposes within a portfolio.

Long-Term Store of Value vs Innovation Potential

Bitcoin’s appeal lies in its scarcity and simplicity. With a hard cap of 21 million coins, it’s designed to resist inflation and act as a long-term store of value. Many investors view Bitcoin as a hedge, similar to gold, against monetary instability or geopolitical uncertainty. Its primary narrative is preservation of wealth rather than rapid innovation. For those seeking a ‘set it and forget it’ approach with an asset that has stood the test of time, Bitcoin is often the natural first choice.

Ethereum, by contrast, offers exposure to technological innovation and the growth of decentralised ecosystems. Its flexible supply model includes a mechanism where transaction fees are ‘burned’ (permanently removed from circulation), which can lead to occasional deflationary periods depending on network usage. Ethereum’s value isn’t just tied to scarcity, it’s driven by utility. As more developers build on the platform and more users interact with dApps, demand for Ether increases. Investors who believe in the long-term potential of blockchain technology beyond currency often favour Ethereum for its growth prospects.

In essence, Bitcoin appeals to those prioritising capital preservation, whilst Ethereum attracts those betting on the future of programmable finance and decentralised innovation.

Volatility Considerations for Each Asset

Volatility is part and parcel of cryptocurrency investing, but the degree varies between Bitcoin and Ethereum.

Bitcoin, as the oldest and most established cryptocurrency, tends to experience relatively lower volatility compared to altcoins, including Ethereum. Its large market capitalisation, widespread recognition, and institutional adoption provide a stabilising effect. Whilst Bitcoin’s price can still swing dramatically, especially during market cycles, it generally exhibits more predictable behaviour over the long term.

Ethereum, being slightly younger and more experimental, can be more volatile. Its price is influenced not just by macroeconomic factors but also by network upgrades, changes in DeFi activity, gas fees, and broader sentiment around blockchain utility. Major updates, such as The Merge or upcoming scaling solutions, can create sharp price movements. For risk-tolerant investors who can stomach short-term fluctuations in exchange for potentially higher returns, Ethereum’s volatility may be acceptable or even attractive.

Understanding one’s own risk tolerance is key. Conservative investors may lean towards Bitcoin: those willing to embrace higher risk for innovation upside might prefer Ethereum.

Market Position and Adoption Factors

Market dynamics and real-world adoption provide important context when deciding between Bitcoin and Ethereum. Both have carved out dominant positions, but in different ways.

Market Capitalisation and Liquidity

Bitcoin consistently holds the title of the largest cryptocurrency by market capitalisation. As of late 2025, it commands a valuation well into the hundreds of billions, attracting institutional investors, hedge funds, and even nation-states. Its liquidity, the ease with which it can be bought or sold without affecting price, is unmatched in the crypto world. This liquidity makes Bitcoin a preferred entry point for institutions and a reliable benchmark for the broader market.

Ethereum ranks second in market capitalisation and has steadily grown its share over the years. Its liquidity is robust, supported by its central role in DeFi, NFTs, and tokenised assets. Ethereum’s ecosystem generates billions in daily transaction volume, and its native token, Ether, is widely used as collateral, gas fees, and a medium of exchange within decentralised protocols. Whilst slightly less liquid than Bitcoin, Ethereum’s market depth is more than sufficient for most retail and institutional participants.

For first-time buyers, higher market cap and liquidity generally mean lower risk of extreme price manipulation and easier access to trading pairs and on-ramps.

Institutional Support and Real-World Use Cases

Bitcoin has captured the attention of institutional investors and corporations in recent years. Companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, and asset managers have launched Bitcoin ETFs, making it accessible to traditional investors. Bitcoin’s narrative as a store of value and inflation hedge resonates with institutions seeking portfolio diversification beyond equities and bonds. Its use cases remain focused on payments, remittances, and wealth preservation.

Ethereum’s institutional adoption is growing rapidly, driven by its utility. Major financial institutions are exploring Ethereum-based solutions for tokenisation, settlement, and custody. The explosion of DeFi platforms, offering lending, borrowing, and yield generation, relies almost exclusively on Ethereum’s infrastructure. NFTs, which saw massive mainstream adoption, are predominantly minted and traded on Ethereum. Stablecoins like USDC and Tether also run largely on Ethereum, cementing its role as the backbone of decentralised finance.

Whilst Bitcoin leads in brand recognition and institutional ‘safe haven’ appeal, Ethereum’s real-world applications are more diverse and fast-evolving. Buyers should consider whether they value established trust or cutting-edge utility.

Practical Considerations for First-Time Buyers

Beyond philosophy and market dynamics, practical factors, like affordability and security, play a major role in the buying decision.

Entry Price Points and Budget Allocation

One common misconception is that Bitcoin’s higher per-unit price makes it less accessible than Ethereum. In reality, both assets are divisible, meaning investors can buy fractions of a coin. Bitcoin can be purchased in increments as small as 0.00000001 BTC (known as a ‘satoshi’), whilst Ethereum can be bought in similarly tiny fractions.

That said, psychological factors matter. Some beginners prefer owning a ‘whole’ unit, which may make Ethereum, with its lower per-coin price, feel more approachable. But, what truly matters is the total amount invested and the percentage return, not the number of coins owned.

For those working with a modest budget, diversification might be the smartest approach. Allocating funds between both Bitcoin and Ethereum balances exposure to Bitcoin’s stability and Ethereum’s growth potential. A common strategy among new investors is a 60/40 or 50/50 split, adjusting based on personal conviction and risk appetite.

Storage Requirements and Security Measures

Once purchased, storing cryptocurrency securely is paramount. Both Bitcoin and Ethereum can be held in various types of wallets: hardware wallets (physical devices), software wallets (apps or desktop programmes), or custodial wallets (managed by exchanges).

Bitcoin’s storage is relatively straightforward. Most wallets support Bitcoin natively, and the network’s simplicity means fewer variables to manage. For long-term holders, hardware wallets like Ledger or Trezor offer robust security by keeping private keys offline.

Ethereum storage is slightly more complex due to its versatility. Ethereum wallets must support not only Ether but also ERC-20 tokens, NFTs, and interactions with smart contracts. Popular wallets like MetaMask combine ease of use with broad compatibility, but they require users to understand concepts like gas fees and contract approvals. For maximum security, hardware wallets that support Ethereum and its token ecosystem are recommended.

Regardless of choice, first-time buyers should prioritise security: enable two-factor authentication, back up recovery phrases offline, and never share private keys. Losing access to a wallet means losing funds permanently, there’s no customer service hotline to call.

Making Your Decision: Key Questions to Ask Yourself

Deciding between Bitcoin and Ethereum eventually comes down to self-reflection and clarity about investment priorities. Here are the essential questions every first-time buyer should consider:

Are you seeking a store of value or technological innovation? If preserving wealth and betting on scarcity appeals more, Bitcoin is the logical starting point. If excitement lies in the potential of decentralised apps, smart contracts, and Web3, Ethereum is worth prioritising.

What is your risk tolerance about volatility? Bitcoin’s established status generally means steadier performance, whilst Ethereum’s rapid evolution brings higher potential returns, and higher risk. Be honest about how much price fluctuation you can handle without panic selling.

Do you plan to participate in DeFi, NFTs, or other decentralised applications? If the answer is yes, Ethereum is essential. Many DeFi platforms, NFT marketplaces, and dApps require Ether for transactions and gas fees. Bitcoin, whilst respected, plays a limited role in these ecosystems.

How important is sustainability and transaction speed to your strategy? Ethereum’s shift to Proof-of-Stake makes it far more energy-efficient than Bitcoin’s Proof-of-Work model. If environmental impact matters to you, Ethereum has the edge. Likewise, if you value faster transactions and lower fees (especially for smaller amounts), Ethereum’s infrastructure is more flexible.

What budget can you allocate, considering current market prices? Both assets are divisible, so budget size alone shouldn’t dictate your choice. But, consider whether you’d prefer to diversify across both or go all-in on one. Many seasoned investors recommend holding both to balance risk and capture different growth narratives.

Eventually, there’s no universally ‘correct’ answer. Bitcoin prioritises stability, scarcity, and proven trust. Ethereum offers exposure to innovation, utility, and a rapidly expanding digital economy. For many, the smartest move is holding both, capturing the strengths of each whilst mitigating individual weaknesses.

Conclusion

Choosing between buying Bitcoin or Ethereum first is less about picking a winner and more about understanding what aligns with your financial goals, risk tolerance, and vision for the future of money and technology. Bitcoin offers the security of scarcity and the trust of a battle-tested network, making it ideal for those seeking a digital store of value. Ethereum, with its programmable platform and thriving ecosystem, appeals to those betting on the transformative potential of decentralised innovation.

For first-time buyers, the decision needn’t be binary. Many investors find value in holding both assets, balancing Bitcoin’s conservatism with Ethereum’s dynamism. Whichever path you choose, prioritise education, security, and a long-term perspective. Cryptocurrency markets are volatile and unpredictable, but informed decisions grounded in clear strategy tend to weather the storms better than impulse buys driven by hype.

Take the time to assess your priorities, ask the right questions, and remember: the best first cryptocurrency purchase is the one that fits your unique circumstances and conviction.

Frequently Asked Questions

Should I buy Bitcoin or Ethereum first as a beginner?

It depends on your goals. Bitcoin suits those seeking a stable store of value and capital preservation, whilst Ethereum appeals to investors interested in technological innovation and decentralised applications. Many beginners opt for both to balance stability with growth potential.

What is the main difference between Bitcoin and Ethereum?

Bitcoin was designed as digital money and a store of value, often called ‘digital gold’, with a fixed supply of 21 million coins. Ethereum is a programmable blockchain platform enabling smart contracts, decentralised finance, and applications beyond simple payments.

Is Ethereum more volatile than Bitcoin?

Yes, Ethereum typically experiences higher volatility due to its experimental nature and sensitivity to network upgrades, DeFi activity, and gas fees. Bitcoin, being more established with greater institutional adoption, generally exhibits more stable price behaviour over time.

Can I buy less than one Bitcoin or Ethereum?

Absolutely. Both cryptocurrencies are highly divisible. You can purchase fractions of Bitcoin (down to 0.00000001 BTC, called a satoshi) or Ethereum, making them accessible regardless of budget size.

Which cryptocurrency is better for long-term investment?

Bitcoin is favoured for long-term wealth preservation due to its scarcity and ‘digital gold’ status. Ethereum offers long-term growth potential through its evolving ecosystem of dApps and DeFi. Many investors hold both to diversify risk and capture different opportunities.

Do I need a special wallet to store Ethereum?

Ethereum wallets must support not only Ether but also ERC-20 tokens, NFTs, and smart contract interactions. Popular options like MetaMask offer broad compatibility, whilst hardware wallets such as Ledger provide maximum security for long-term storage.