Cryptocurrency investing doesn’t have to feel like navigating a minefield. For newcomers looking beyond Bitcoin, Litecoin offers a compelling entry point,faster transactions, lower fees, and a track record stretching back over a decade. Yet the promise of digital silver comes with its own set of challenges, especially when it comes to making that first purchase without stumbling into common security pitfalls.

Buying Litecoin safely involves more than just clicking a “buy” button on the first platform that pops up. From selecting a trustworthy exchange to securing a digital wallet and avoiding rookie mistakes that could compromise holdings, each step matters. This guide walks through the entire process, breaking down what beginners need to know to purchase Litecoin with confidence and store it securely. Whether someone’s drawn to Litecoin’s technical advantages or simply wants to diversify their crypto portfolio, understanding the fundamentals of safe acquisition is the first step toward smart investing.

Key Takeaways

- Buying Litecoin safely requires choosing a reputable centralized exchange, completing identity verification, and understanding fee structures before making your first purchase.

- Setting up a secure digital wallet—preferably a hardware wallet for significant holdings—and backing up your recovery phrase is essential before purchasing Litecoin.

- Litecoin offers faster transaction times (2.5 minutes vs. Bitcoin’s 10 minutes) and lower fees, making it ideal for beginners seeking practical cryptocurrency investments.

- Always transfer purchased Litecoin from exchanges to a private wallet and enable two-factor authentication on all accounts to protect against hacks and unauthorized access.

- Avoid common security mistakes like leaving funds on exchanges long-term, reusing passwords, and clicking suspicious links to ensure your Litecoin investment remains secure.

What Is Litecoin and Why Invest in It?

Litecoin entered the cryptocurrency scene in 2011, developed by Charlie Lee as a lighter, faster alternative to Bitcoin. Often described as “digital silver” to Bitcoin’s “digital gold,” Litecoin was engineered with practical, everyday transactions in mind rather than purely serving as a store of value. This positioning has earned it a loyal following among investors seeking assets with real-world utility.

The appeal of Litecoin centers on a few core strengths. Transaction confirmation times clock in at roughly 2.5 minutes per block compared to Bitcoin’s 10-minute intervals, meaning transfers settle much faster. This speed advantage matters when someone’s trying to make a quick payment or needs funds to arrive promptly. Add in generally lower transaction fees, and Litecoin becomes an attractive option for smaller, more frequent transfers that would rack up costs on other networks.

Beyond technical specs, Litecoin benefits from stability and longevity in a market notorious for volatility and vaporware. It’s weathered multiple crypto winters, maintained an active development community, and secured listings on virtually every major exchange. For investors, this established track record offers a degree of reassurance that newer altcoins can’t match. While no cryptocurrency investment is risk-free, Litecoin’s sustained presence suggests staying power that appeals to those taking a measured approach to digital assets.

Key Differences Between Litecoin and Bitcoin

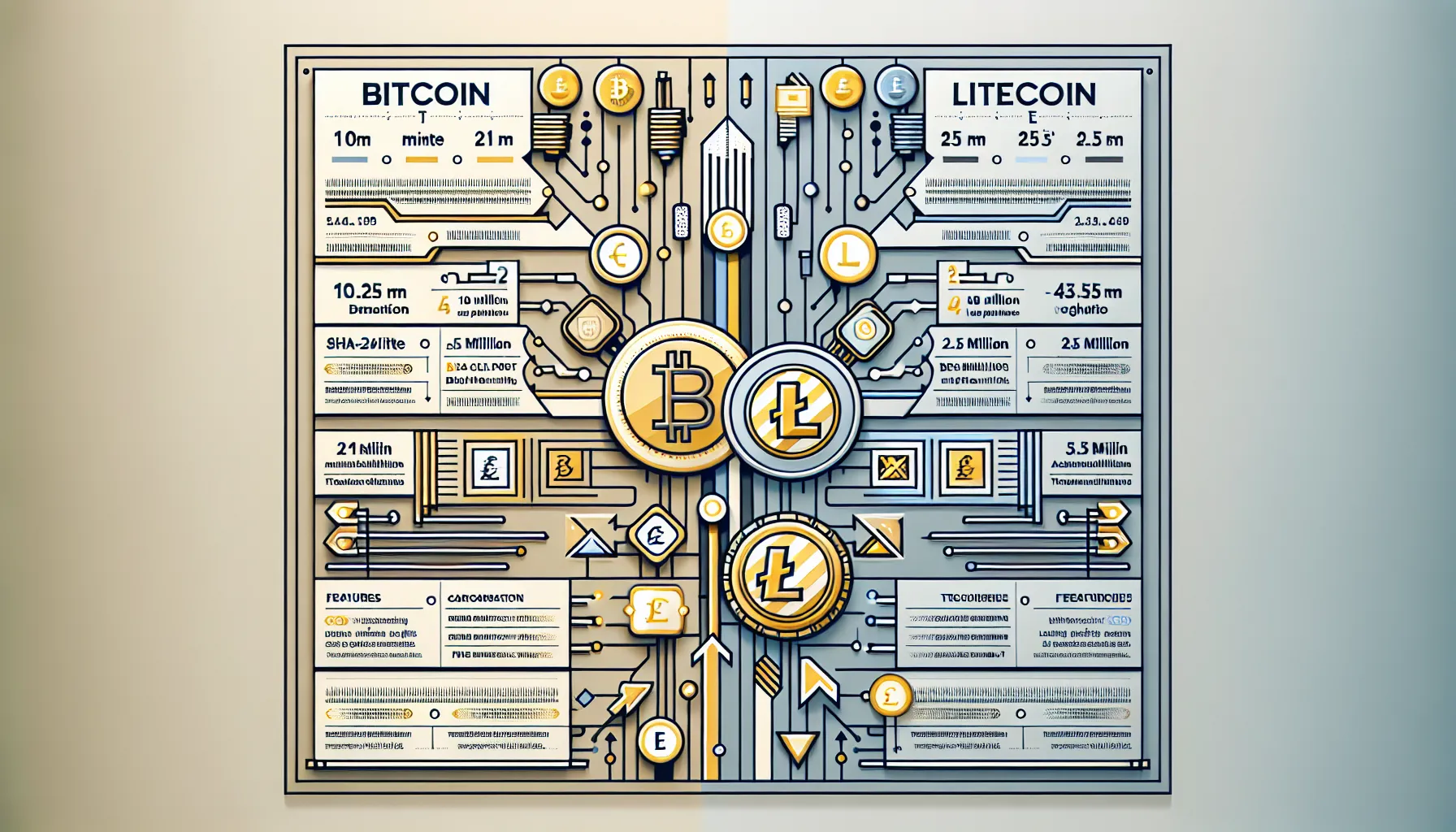

Understanding what sets Litecoin apart from Bitcoin helps clarify why someone might choose one over the other. Though they share similar DNA,Litecoin is a fork of Bitcoin’s code,several technical differences create distinct use cases.

| Feature | Bitcoin | Litecoin |

|---|---|---|

| Block Time | 10 minutes | 2.5 minutes |

| Algorithm | SHA-256 (ASIC mining) | Scrypt (more accessible) |

| Maximum Supply | 21 million | 84 million |

| Transaction Speed | Slower (fewer TPS) | Faster (higher TPS) |

| Typical Fees | Higher | Lower |

The block time difference directly impacts how quickly transactions confirm. Bitcoin’s 10-minute blocks mean users often wait through multiple confirmations for security, while Litecoin’s 2.5-minute blocks speed up the process considerably. This makes Litecoin more practical for point-of-sale situations or when time-sensitive transfers matter.

Litecoin’s Scrypt algorithm was chosen specifically to resist the ASIC mining dominance that took over Bitcoin, though specialized Scrypt miners eventually emerged anyway. The algorithm difference doesn’t affect end users much, but it shaped Litecoin’s mining landscape and early adoption.

The supply cap tells another part of the story. Bitcoin’s famous 21 million coin limit creates scarcity, while Litecoin’s 84 million cap,exactly four times Bitcoin’s,maintains proportional scarcity while allowing for wider distribution. This doesn’t necessarily make one more valuable than the other, but it affects price psychology and accessibility for smaller investors.

Transaction fees tend to run lower on Litecoin, though both networks experience fee spikes during periods of heavy congestion. For everyday users making modest transfers, those fee differences can add up over time, making Litecoin the more economical choice for regular activity rather than long-term holding.

Preparing to Buy Litecoin: What You Need

Before diving into a purchase, gathering the right tools and information makes the process smoother and safer. The requirements aren’t overly burdensome, but missing even one piece can stall progress or create security gaps down the line.

At minimum, buyers need personal identification documents,a passport or driver’s license typically suffices. Regulated exchanges must verify identity as part of KYC compliance, so having clear photos or scans ready speeds things along. An email address and phone number are also essential for account creation and security measures like two-factor authentication.

Payment methods matter too. A linked bank account offers the most cost-effective way to fund purchases, though transfers can take a few days to clear. Debit and credit cards provide instant funding but usually come with higher fees, sometimes 3-5% of the transaction amount. Wire transfers sit somewhere in between, offering relatively fast settlement with moderate costs. Understanding these tradeoffs helps buyers choose the funding method that matches their timeline and budget.

The final essential piece is a digital wallet to store purchased Litecoin. While exchanges offer built-in wallets, leaving significant amounts on an exchange long-term increases risk. Having a personal wallet ready before buying means Litecoin can be transferred to secure storage immediately after purchase, reducing exposure to exchange hacks or other platform issues.

Setting Up a Digital Wallet

Choosing and configuring a wallet represents one of the most important security decisions in the buying process. Wallets come in several flavors, each with distinct tradeoffs between convenience and security.

Software wallets run on computers or smartphones, offering a balance of accessibility and control. Options like Exodus or the official Litecoin Core wallet provide full custody of private keys while maintaining user-friendly interfaces. They’re convenient for regular transactions but remain vulnerable to malware or device theft if proper precautions aren’t taken.

Hardware wallets like Ledger or Trezor provide the strongest security for significant holdings. These physical devices store private keys offline, making them nearly immune to remote hacking attempts. The initial cost,typically $50-200,pays for itself in peace of mind for anyone holding more than a few hundred dollars worth of crypto. Setup involves installing companion software, initializing the device, and carefully recording the recovery phrase.

Mobile wallets prioritize convenience, perfect for keeping small amounts accessible for spending. Trust Wallet and others in this category work well for day-to-day use but shouldn’t hold the bulk of someone’s investment.

Regardless of wallet type, the setup process includes one critical step: backing up the recovery phrase. This 12-24 word sequence is the master key to recovering funds if the wallet is lost or damaged. It should be written on paper,never stored digitally,and kept in a secure location separate from the device. Losing this phrase means losing access to the Litecoin forever, with no customer service department able to help.

Verifying Your Identity for Compliance

KYC verification feels bureaucratic, but it’s a necessary gateway to using regulated exchanges. These requirements stem from anti-money laundering regulations that require financial platforms to verify customer identities.

The verification process typically unfolds in tiers. Basic verification might require just an email and phone number, allowing limited trading. Higher limits demand government-issued ID,passport, driver’s license, or national identity card. Some exchanges add a third tier requiring proof of address through a recent utility bill or bank statement.

Submission usually happens through an automated system that scans uploaded documents. The process might complete in minutes or take several days depending on the exchange’s backlog and the document quality. Clear, well-lit photos with all text readable help avoid rejections and resubmissions.

Privacy-conscious users sometimes balk at these requirements, and fair enough,sharing personal documents with a tech platform isn’t without risk. But, reputable exchanges carry out strong data protection measures and face regulatory oversight that smaller, unverified platforms don’t. The tradeoff between privacy and using established, liquid exchanges is one each buyer must weigh for themselves. For beginners prioritizing safety and ease of use, verified accounts on major platforms generally offer the best experience.

Choosing a Secure Platform to Purchase Litecoin

The platform decision shapes the entire buying experience, affecting everything from fees and security to available features and customer support. Not all exchanges are created equal, and choosing poorly can lead to unnecessary costs or security risks.

Location matters,some platforms serve global markets while others restrict access based on region. Before investing time in account creation, verifying that a platform operates in the buyer’s jurisdiction prevents wasted effort. Beyond availability, factors like trading volume, fee structures, supported payment methods, and security track record all deserve consideration.

Large, established exchanges offer advantages for beginners. Higher liquidity means orders fill at expected prices without significant slippage. Regulatory compliance provides some legal recourse if problems arise. Customer support, while often criticized in the crypto space, at least exists on major platforms, unlike many smaller alternatives.

Fees deserve close scrutiny. Trading fees typically range from 0.1% to 1.5% depending on the platform and trading volume. Deposit and withdrawal fees vary even more widely,some platforms charge nothing for bank transfers while others impose flat fees or percentages. Calculating total costs across the full transaction cycle (deposit, trade, withdrawal) reveals the true expense.

Centralized Exchanges vs. Peer-to-Peer Platforms

The choice between centralized exchanges (CEX) and peer-to-peer (P2P) platforms represents fundamentally different approaches to buying cryptocurrency.

Centralized exchanges like Coinbase, Binance, or Kraken act as intermediaries, matching buyers with sellers and holding funds during transactions. They offer familiar interfaces, high liquidity, and straightforward purchasing flows. For beginners, this model provides the smoothest experience,create an account, deposit funds, click buy, and receive Litecoin. The exchange handles price discovery, order matching, and settlement details behind the scenes.

The centralization comes with tradeoffs. Users must trust the exchange to secure their funds and execute trades fairly. Exchange hacks, though less common than in crypto’s early days, still occur. Regulatory actions can freeze accounts or halt withdrawals. Privacy is limited since KYC creates detailed records of purchases tied to real identities.

P2P platforms like LocalBitcoins or Paxful connect buyers directly with sellers, cutting out the middleman. Buyers choose from listings posted by individuals, negotiate terms, and complete trades through the platform’s escrow system. This model offers more privacy and often supports payment methods that centralized exchanges don’t accept.

But, P2P trading demands more caution. Scam risks increase when dealing with individual sellers rather than a platform. Prices can be less competitive due to lower liquidity. The process takes more time and attention, requiring buyers to evaluate seller reputations and complete more manual steps. For first-time buyers, P2P platforms generally present more complexity than necessary.

Most beginners find centralized exchanges strike the right balance, offering security, liquidity, and user protection that outweigh the privacy and payment flexibility of P2P options. Once someone’s comfortable with the basics, exploring alternative platforms makes more sense.

Evaluating Security Features and Reputation

Distinguishing secure platforms from risky ones requires looking beyond marketing claims to examine actual security practices and track records.

Two-factor authentication should be standard, not optional. This adds a second verification layer,typically a code from an authenticator app or SMS,making unauthorized access far more difficult even if a password leaks. Platforms that don’t offer or actively encourage 2FA show a concerning lack of security awareness.

Cold storage practices indicate how seriously an exchange protects customer funds. Reputable platforms keep the majority of holdings in offline cold storage, with only a small percentage in hot wallets for immediate withdrawals. This limits damage from potential breaches. Exchanges that openly discuss their cold storage percentages,often 95% or higher,demonstrate transparency about security priorities.

Insurance coverage provides an additional safety net. Some exchanges maintain insurance policies covering losses from hacks or platform failures. While not universal, this coverage offers meaningful protection for customers and signals that a platform stands behind its security measures.

Reputation research takes some legwork but pays dividends. Reading user reviews across multiple sources,Reddit, Trustpilot, Twitter,reveals patterns in customer experiences. A few complaints are inevitable for any large platform, but recurring themes around frozen accounts, unresponsive support, or withdrawal problems should raise red flags. Longevity matters too: platforms operating successfully for years have weathered market cycles and proven their operational stability.

Regulatory compliance serves as another trust signal. Exchanges registered with financial regulators, holding money transmitter licenses, or partnering with established financial institutions face oversight that unregulated platforms avoid. This doesn’t guarantee perfection, but it creates accountability and legal frameworks for addressing problems.

Step-by-Step Guide to Buying Your First Litecoin

With preparation complete and a platform selected, the actual purchase process unfolds in a series of straightforward steps. Taking these methodically reduces errors and ensures security throughout the transaction.

Creating and Verifying Your Exchange Account

Account creation begins with basic information,email address, password, and often a phone number. Choosing a strong, unique password matters more than convenience here. Password managers help generate and store complex passwords without the burden of memorization.

After initial signup, the exchange sends a verification email. Clicking the link confirms email ownership and activates the account. At this stage, enabling two-factor authentication should be the immediate next step, before adding any payment methods or personal information. Authenticator apps like Google Authenticator or Authy provide more security than SMS-based 2FA, which remains vulnerable to SIM-swapping attacks.

KYC verification follows, with requirements varying by platform and desired limits. Basic verification might need only name and date of birth. Higher tiers require uploading ID documents and sometimes proof of address. Following the platform’s instructions carefully and submitting clear, legible photos helps avoid processing delays.

Verification times range from near-instant to several business days. During busy periods or for complex cases, patience becomes necessary. Some platforms allow limited trading during pending verification, while others restrict all activity until approval completes.

Funding Your Account Safely

Once verified, depositing funds becomes the next hurdle. The safest funding methods depend on available options and individual circumstances, but some general principles apply.

Bank transfers typically offer the best combination of low fees and security. ACH transfers in the US or SEPA transfers in Europe move money directly from a verified bank account to the exchange. Processing takes 1-5 business days but costs little or nothing. For buyers not in a rush, this method maximizes value.

Debit and credit cards provide instant funding but at a premium. Transaction fees often reach 3-5%, and credit card purchases might also incur cash advance fees from the card issuer. These methods make sense for small, time-sensitive purchases but become expensive for larger amounts.

Wire transfers split the difference, settling in 1-2 business days with moderate fees. They work well for larger purchases where ACH limits prove restrictive but the buyer doesn’t want to pay card processing premiums.

Security during funding requires vigilance. Double-checking account numbers and ensuring connections use secure HTTPS protocols prevents costly errors. Avoiding public WiFi when entering banking information protects against man-in-the-middle attacks. Legitimate exchanges never ask for banking passwords or direct account access,only routing and account numbers for standard transfers.

Placing Your Litecoin Purchase Order

With funds in the account, the actual purchase becomes surprisingly simple. Most exchanges offer multiple order types, but beginners typically start with market orders,buying at current market prices for immediate execution.

Navigating to the trading interface, buyers select Litecoin (ticker symbol LTC) from the list of available cryptocurrencies. The platform displays the current price and options for how much to purchase, either by specifying dollar amount or quantity of LTC desired.

Entering the desired amount, the platform calculates the other side of the transaction,spending $100 might yield approximately 1.2 LTC at current prices, for example. A review screen shows the final amounts including any fees. Double-checking these figures catches input errors before they become expensive mistakes.

Confirming the purchase executes the order, typically within seconds for market orders. The exchange debits the funding currency and credits Litecoin to the account’s wallet. A confirmation message and email provide records of the transaction.

Some platforms offer limit orders, which execute only if Litecoin reaches a specified price. These provide more control but risk the order never filling if the market doesn’t reach the target price. For first purchases, the simplicity of market orders usually outweighs the price optimization potential of limit orders.

After purchase completion, the Litecoin appears in the exchange wallet, visible in the account dashboard. At this point, the coins exist on the exchange’s platform rather than in personal custody. For security-conscious holders, the next step,transferring to a private wallet,shouldn’t be delayed.

Securing Your Litecoin After Purchase

The purchase may be complete, but the security work isn’t. Litecoin sitting on an exchange remains vulnerable to platform hacks, regulatory seizures, or account compromises. Taking control through private storage and robust security measures protects the investment.

Transferring to a Private Wallet

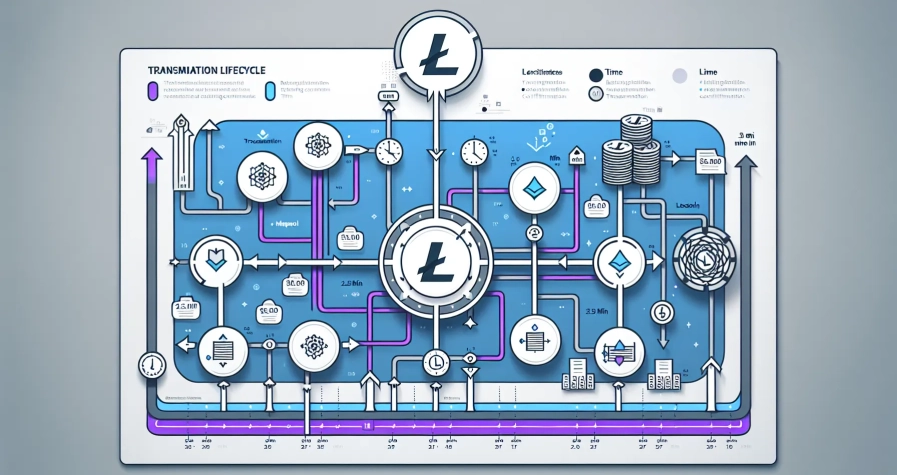

Moving Litecoin from exchange custody to a personal wallet shifts control,and responsibility,to the owner. This transfer requires careful execution to avoid sending funds to the wrong address or losing access.

The process starts in the personal wallet, which generates a receiving address,a long string of letters and numbers starting with “L” or “M” for Litecoin. Copying this address exactly is crucial: even a single character error sends funds into an irretrievable void. Using copy-paste rather than manual typing eliminates transcription errors, but verifying the first and last several characters after pasting catches clipboard malware that swaps addresses.

Many hardware wallets display the receiving address on their physical screens, allowing verification that the address shown on the computer matches the device. This confirms the connection hasn’t been compromised by malware attempting to redirect funds.

On the exchange, navigating to the withdrawal section and selecting Litecoin brings up a form requesting the destination address and amount to transfer. Pasting the wallet’s receiving address and specifying the amount,usually “withdraw all” minus any withdrawal fees,prepares the transaction.

Exchanges typically impose withdrawal fees, often fixed amounts like 0.001 LTC. These fees cover network transaction costs and platform processing. While frustrating, they’re far less concerning than the risks of leaving funds on the exchange long-term.

Before confirming, double-checking the destination address one final time prevents expensive mistakes. Some exchanges require 2FA confirmation or email verification for withdrawals, adding security layers that prevent unauthorized transfers.

After confirmation, the transaction enters the Litecoin network for processing. Blockchain confirmation times vary based on network congestion and the fee paid, but most transfers appear in the destination wallet within 15-30 minutes. The personal wallet shows the pending transaction, which becomes spendable after sufficient confirmations,usually 6 blocks, or about 15 minutes for Litecoin.

Enabling Two-Factor Authentication

Two-factor authentication deserves emphasis beyond just exchange accounts. Enabling 2FA on every account and service touching the Litecoin investment creates overlapping security layers that dramatically reduce compromise risk.

For software wallets supporting 2FA, enabling it prevents unauthorized access even if someone gains the device password. The configuration process mirrors exchange 2FA,installing an authenticator app, scanning a QR code, and confirming the connection with a verification code.

Hardware wallets provide inherent 2FA through physical device confirmation. Every transaction requires button presses on the hardware wallet itself, making remote theft virtually impossible even if a computer is fully compromised.

Email accounts linked to exchange and wallet accounts need 2FA protection too. Hackers often target email as the weakest link, using access to reset passwords and bypass other security measures. Securing email with strong 2FA closes this vulnerability.

Authenticator apps are preferable to SMS for 2FA codes. SIM-swapping attacks, where attackers convince mobile carriers to transfer phone numbers to new SIM cards, can defeat SMS-based 2FA. Authenticator apps generate codes locally on the device, eliminating this attack vector.

Backing up 2FA recovery codes during setup provides a way to regain access if the authentication device is lost. These codes should be stored securely,written on paper in a safe location or encrypted in a password manager,but never saved in plain text on connected devices.

The recovery phrase generated during wallet setup remains the ultimate key. This 12-24 word sequence must be protected with extreme care. Writing it on paper and storing it in a secure physical location,a safe, safety deposit box, or other protected space,keeps it away from digital threats. Splitting it across multiple secure locations adds redundancy without significantly increasing risk, as long as no single location contains the complete phrase.

Never photographing the recovery phrase, storing it in cloud services, or sharing it with anyone ensures it remains secure. No legitimate service ever needs this phrase, and anyone requesting it is attempting theft.

Common Security Mistakes to Avoid

Even with good intentions, beginners often stumble into preventable security pitfalls. Recognizing these common mistakes helps avoid painful lessons learned through lost funds.

Leaving large amounts of Litecoin on exchanges long-term represents perhaps the most widespread error. Exchanges make tempting targets for hackers due to the concentrated value they hold. While major platforms have improved security substantially, breaches still occur. The crypto mantra “not your keys, not your coins” exists for good reason. Keeping only what’s needed for active trading on exchanges, and moving everything else to private wallets, dramatically reduces exposure.

Weak passwords and password reuse create easy entry points for attackers. Using the same password across multiple sites means a breach at one service compromises all accounts sharing that password. Each crypto-related account should have a unique, complex password. Password managers make this practical by generating and storing strong passwords without memorization requirements.

Neglecting wallet backups sets up potential disaster. Hardware wallets fail, phones get lost, computers die. Without proper backups,primarily the recovery phrase,these failures mean permanent loss of access to funds. Taking a few minutes to properly record and secure backup information prevents devastating losses later.

Phishing attempts grow increasingly sophisticated, mimicking legitimate exchanges and wallet providers with impressive accuracy. Common tactics include fake customer service emails requesting account information, lookalike websites harvesting login credentials, and urgent security warnings pressuring quick action.

Protection requires skepticism and verification. Always accessing exchange and wallet sites by typing URLs directly or using bookmarked links prevents landing on phishing sites from search results or emails. Checking for HTTPS and correct domain spelling before entering credentials catches many attempts. Legitimate services never ask for passwords, 2FA codes, or recovery phrases via email or social media.

Ignoring software updates leaves known vulnerabilities unpatched. Wallet software, authenticator apps, and device operating systems regularly receive security updates addressing discovered weaknesses. Enabling automatic updates or regularly checking for and installing updates manually maintains protection against emerging threats.

Public WiFi networks pose risks when accessing crypto accounts. Open networks allow tech-savvy attackers to intercept traffic and potentially harvest credentials or session data. Using VPNs on public networks encrypts traffic, making interception useless. Better still, avoiding accessing crypto accounts on public networks entirely eliminates the risk.

Social engineering attacks exploit human psychology rather than technical vulnerabilities. Attackers might impersonate exchange support staff, create urgency around fake security issues, or pose as fellow investors offering help. Maintaining healthy skepticism about unsolicited contact, verifying identities through official channels before sharing information, and remembering that legitimate support never initiates contact requesting credentials provides protection.

Small test transactions before large transfers seem tedious but prevent costly errors. Sending a tiny amount first, verifying it arrives correctly, then sending the remaining balance catches address errors or technical issues before they affect significant funds. The small fee for an extra transaction is negligible compared to the risk of sending a large amount to the wrong destination.

Conclusion

Buying Litecoin safely isn’t particularly complicated, but it does require attention to detail and a willingness to prioritize security over convenience at key moments. From selecting a reputable exchange and setting up secure wallets to executing the purchase and transferring funds to private storage, each step builds on the previous one to create a robust security foundation.

The principles outlined here,strong authentication, private wallet storage, careful verification of addresses and platforms, and awareness of common threats,apply beyond just Litecoin. They form good practices for any cryptocurrency investment, providing a framework that serves beginners well as they expand their crypto activities.

New buyers should resist the temptation to rush. Taking time to properly set up wallets, research platforms, and understand security measures pays dividends in avoided losses and peace of mind. The crypto space rewards those who approach it thoughtfully, and the learning invested in a first Litecoin purchase builds knowledge applicable to future investments.

Litecoin’s combination of speed, low fees, and established track record makes it an accessible entry point for crypto investing. Following the steps outlined here helps ensure that first purchase experience is positive and secure, setting the stage for confident participation in the broader cryptocurrency ecosystem. The technology may be cutting edge, but safe investing practices remain timeless,due diligence, security consciousness, and measured decision-making never go out of style.

Frequently Asked Questions

How do I buy Litecoin safely as a beginner?

To buy Litecoin safely, start by choosing a reputable centralized exchange like Coinbase or Kraken, complete KYC verification, fund your account via bank transfer, and enable two-factor authentication. After purchasing, immediately transfer your Litecoin to a private wallet rather than leaving it on the exchange.

What is the best wallet to store Litecoin securely?

Hardware wallets like Ledger or Trezor offer the strongest security for significant Litecoin holdings by storing private keys offline. For smaller amounts or regular transactions, software wallets like Exodus or the official Litecoin Core wallet provide a good balance of accessibility and control.

What are the main differences between Litecoin and Bitcoin?

Litecoin processes transactions much faster than Bitcoin, with 2.5-minute block times versus Bitcoin’s 10 minutes. It also typically has lower transaction fees, a maximum supply of 84 million coins compared to Bitcoin’s 21 million, and uses the Scrypt algorithm instead of SHA-256.

Can I buy Litecoin without completing identity verification?

Most reputable centralized exchanges require KYC identity verification due to anti-money laundering regulations. While peer-to-peer platforms may offer more privacy and less stringent verification, they carry higher scam risks and are generally not recommended for beginners prioritizing safety.

How long does it take for a Litecoin transaction to confirm?

Litecoin transactions typically appear in your wallet within 15-30 minutes. The network processes blocks every 2.5 minutes, and most transactions become fully spendable after 6 block confirmations, which takes approximately 15 minutes under normal network conditions.

Is it safe to leave my Litecoin on an exchange after buying?

Leaving large amounts of Litecoin on an exchange long-term is not recommended due to risks like platform hacks, regulatory seizures, or account compromises. Exchanges are attractive targets for hackers. Transfer your holdings to a private wallet where you control the keys for maximum security.