Ethereum has become one of the most talked-about cryptocurrencies in recent years, powering everything from decentralised finance to digital art. For beginners in the UK looking to invest, the world of crypto can feel daunting, filled with technical jargon, security concerns, and a seemingly endless choice of platforms. But buying Ethereum doesn’t have to be complicated or risky.

With the right approach, anyone can purchase Ethereum safely and confidently. The key lies in choosing a reputable exchange, understanding the basics of how Ethereum works, and taking sensible precautions to protect investments. This guide walks through the entire process step by step, covering everything from setting a budget to storing Ethereum securely. Whether one is investing a modest amount or planning a larger purchase, these principles apply across the board.

Key Takeaways

- Buying Ethereum safely starts with choosing an FCA-registered exchange like Coinbase, eToro, or Crypto.com to ensure regulatory protection.

- Never invest more than you can afford to lose, as cryptocurrency prices are highly volatile and can fluctuate dramatically.

- Enable two-factor authentication and use strong, unique passwords to secure your exchange account against hackers.

- Store larger amounts of Ethereum in a cold wallet (hardware wallet) for maximum security, rather than leaving funds on the exchange.

- Always verify wallet addresses before sending Ethereum, as crypto transactions are irreversible and cannot be undone.

- Avoid phishing scams and never share your private keys or recovery phrases with anyone, as legitimate platforms will never request them.

What You Need to Know Before Buying Ethereum

Before diving into a purchase, it’s essential to understand what Ethereum is and how it fits into a broader investment strategy. Crypto isn’t like a traditional savings account, it comes with real risks and requires a clear-headed approach.

Understanding Ethereum and Its Uses

Ethereum is much more than just another digital currency. It’s a decentralised blockchain platform that allows developers to build and run smart contracts and decentralised applications (dApps). Unlike Bitcoin, which primarily functions as digital money, Ethereum serves as the backbone for thousands of projects spanning decentralised finance (DeFi), gaming, non-fungible tokens (NFTs), and more.

The native cryptocurrency of this network is Ether (ETH), which users need to interact with the Ethereum blockchain. People buy ETH for various reasons: some see it as a long-term investment, others use it to participate in DeFi protocols, and many hold it to access emerging blockchain applications. Understanding these uses helps investors grasp why Ethereum has value and what might influence its price over time.

It’s also worth noting that Ethereum is legal to buy, sell, and hold in the UK, provided transactions occur through Financial Conduct Authority (FCA)-registered platforms and all tax obligations are met.

Setting a Budget and Investment Strategy

Cryptocurrencies are notoriously volatile. Prices can swing dramatically within hours, and what goes up can come down just as quickly. That’s why the golden rule for any beginner is straightforward: never invest more than one can afford to lose.

Before making a purchase, it’s wise to assess one’s broader financial position. Are there emergency savings in place? Are debts under control? Only once these fundamentals are covered should someone consider allocating money to crypto.

Setting clear limits is crucial. Decide on a specific amount to invest, whether that’s £50, £500, or more, and stick to it. Some investors prefer a lump-sum approach, whilst others drip-feed smaller amounts over time to smooth out price fluctuations (a strategy known as pound-cost averaging). Either way, having a plan prevents emotional decision-making when markets get choppy.

Choosing a Safe and Reliable Crypto Exchange

The exchange one chooses can make or break the buying experience. A reputable platform offers security, ease of use, and fair pricing, whilst a dodgy one might expose investors to hacks, hidden fees, or regulatory trouble.

For beginners in the UK, several platforms stand out: eToro, Coinbase, Uphold, Crypto.com, and Bitpanda all cater well to newcomers and offer user-friendly interfaces. More importantly, they’re FCA-registered, which means they comply with UK regulations designed to protect consumers.

Choosing an FCA-registered exchange isn’t just a bureaucratic box to tick, it provides a layer of accountability and reduces the risk of dealing with unregulated operators who might vanish overnight.

Evaluating Security Features and Reputation

Security should be non-negotiable. A platform’s track record matters: has it suffered major breaches? How transparent is it about its security measures? Established exchanges like Coinbase and eToro have built strong reputations over the years, with robust security protocols and, in some cases, insurance coverage for digital assets held on the platform.

Look for features such as cold storage of funds (keeping the majority of assets offline), encryption, and a clear history of compliance. Reading user reviews and checking whether the platform has had any significant security incidents can provide valuable insight. A platform that’s been around for years without major problems is generally a safer bet than a brand-new, untested service.

Comparing Fees and Payment Methods

Fees can eat into returns quickly, so it’s worth comparing costs before committing. Exchanges typically charge a combination of deposit fees, withdrawal fees, and trading fees. Some also apply a ‘spread’, the difference between the buying and selling price, which can be less transparent than a straightforward commission.

Bank transfers (often called faster payments in the UK) usually incur the lowest fees, whilst debit card deposits may carry a small charge. E-wallets like PayPal are supported by some platforms, though they can come with higher costs. Credit cards should generally be avoided, not only do they attract hefty fees, but many UK card issuers treat crypto purchases as cash advances, which come with additional interest charges.

Take the time to review the fee structure on a few platforms. Even a 1% difference in fees can add up, especially if one plans to buy and sell regularly.

Creating and Securing Your Exchange Account

Once a platform has been chosen, the next step is setting up an account. This process is usually straightforward, but there are a few important security steps that shouldn’t be skipped.

Start by registering with an email address and creating a strong, unique password. Avoid reusing passwords from other accounts, if one service gets compromised, hackers often try the same credentials elsewhere. A password manager can help generate and store complex passwords securely.

Completing Identity Verification

To comply with anti-money laundering (AML) regulations, all reputable exchanges require identity verification, commonly known as Know Your Customer (KYC). This typically involves uploading a government-issued ID, such as a passport or driving licence, and sometimes proof of address, like a recent utility bill or bank statement.

Whilst some might find this step tedious, it’s a sign that the platform takes compliance seriously. KYC also protects users by making it harder for fraudsters to open accounts and conduct illegal activity.

Verification usually takes anywhere from a few minutes to a couple of days, depending on the platform and current demand. It’s worth completing this step early to avoid delays when one is ready to buy.

Enabling Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification beyond just a password. This might be a code sent via SMS or, more securely, generated by an authenticator app like Google Authenticator or Authy.

Enabling 2FA is one of the simplest and most effective ways to protect an account. Even if someone manages to steal a password, they won’t be able to log in without access to the second factor. Most exchanges make this optional, but it should be considered essential for anyone serious about security.

Step-by-Step: Making Your First Ethereum Purchase

With the account set up and secured, it’s time to make that first purchase. The process is surprisingly simple once everything is in place.

Depositing Funds into Your Account

Before buying Ethereum, funds need to be deposited into the exchange account. Most platforms allow deposits in GBP via bank transfer, which is typically the cheapest option. Some also accept debit card payments, though these may come with higher fees.

To deposit via bank transfer, navigate to the deposit section of the platform, select GBP (or the relevant fiat currency), and follow the instructions. The exchange will provide bank details and a reference number. Use these exactly as shown to ensure the deposit is credited correctly.

Bank transfers in the UK are usually processed within minutes thanks to the Faster Payments system, though occasionally they can take longer. Once the funds appear in the account, it’s time to buy.

Placing Your Ethereum Order

Most exchanges offer two main types of orders: market orders and limit orders.

A market order buys Ethereum immediately at the current market price. It’s the quickest and easiest option, ideal for beginners who simply want to purchase ETH without worrying about timing.

A limit order, on the other hand, allows buyers to set a specific price at which they’re willing to purchase Ethereum. The order only executes if the market reaches that price. This gives more control but requires patience and a bit more understanding of market movements.

For a first purchase, a market order is usually the way to go. Simply enter the amount of Ethereum to buy (or the amount of GBP to spend), review the transaction details, including any fees, and confirm the purchase.

Once the order goes through, the Ethereum should appear in the exchange wallet within seconds. It’s worth double-checking the balance to ensure everything processed correctly.

Storing Your Ethereum Securely

Buying Ethereum is only half the story, storing it safely is just as important. Where one keeps their ETH depends on how they plan to use it and how much security they need.

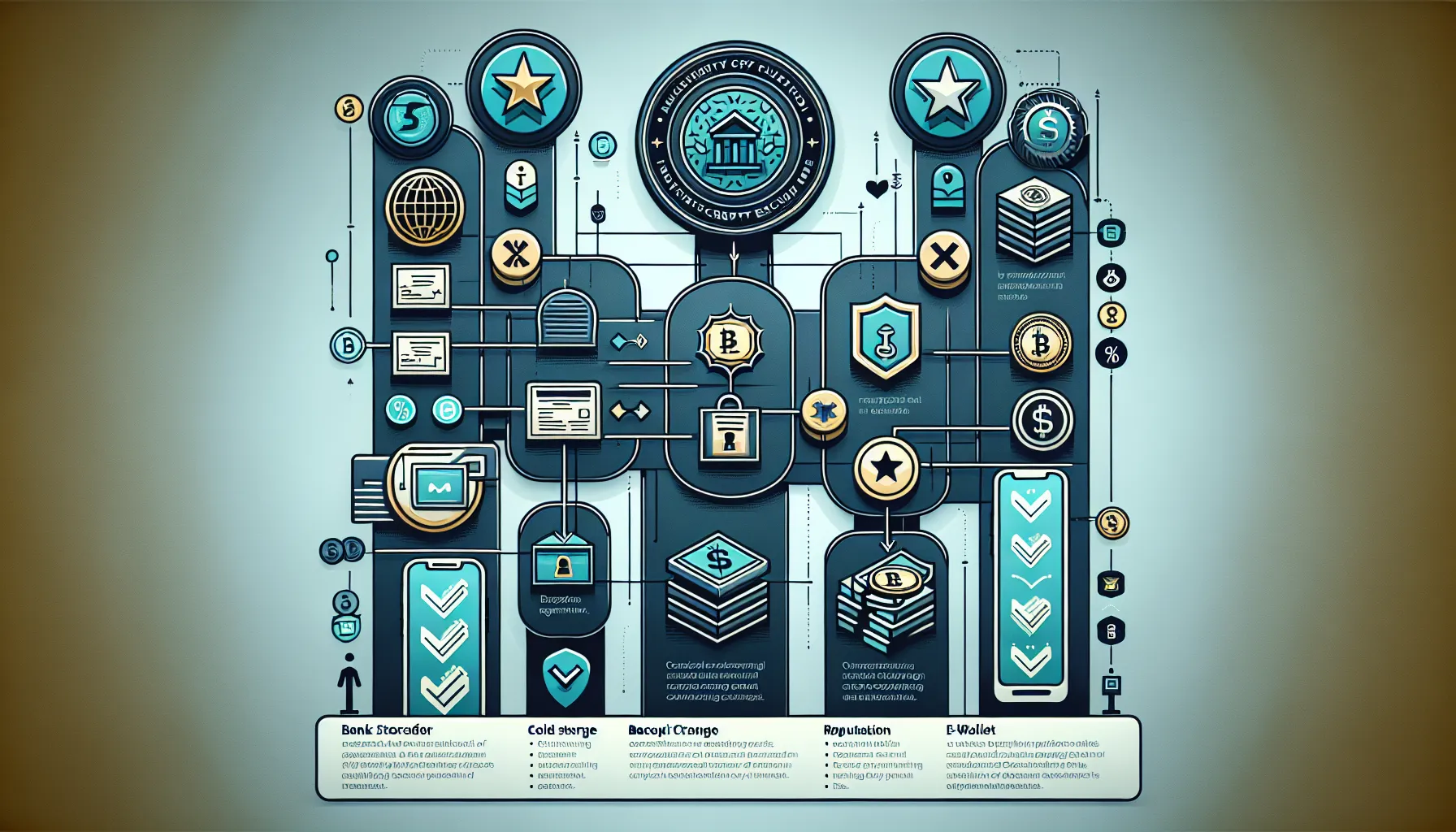

Exchange Wallets vs Personal Wallets

When Ethereum is purchased on an exchange, it’s automatically held in the platform’s wallet. This is convenient, especially for beginners or those planning to trade frequently. But, exchange wallets come with a significant risk: if the platform is hacked or goes out of business, users could lose their funds.

A personal wallet, also known as a self-custody wallet, gives users full control over their Ethereum. These wallets store private keys (the passwords that control access to the crypto) on the user’s device rather than on the exchange’s servers. Popular options include software wallets like MetaMask, Trust Wallet, and Exodus.

The trade-off is responsibility. With a personal wallet, there’s no customer support to reset a password if it’s forgotten, and losing access to the wallet means losing the funds permanently.

Choosing Between Hot and Cold Storage

Personal wallets come in two main forms: hot wallets and cold wallets.

Hot wallets are software-based and connected to the internet. They’re easy to use and ideal for smaller amounts or regular transactions. But, because they’re online, they’re more vulnerable to hacking.

Cold wallets (also called hardware wallets) are physical devices that store Ethereum offline. Brands like Ledger and Trezor are popular choices. Cold storage is the most secure option and best suited for larger holdings or long-term investment.

Here’s a quick comparison:

| Storage Type | Security Level | Best Used For |

|---|---|---|

| Exchange Wallet | Low–Moderate | Active trading |

| Hot Wallet | Moderate | Small/regular use |

| Cold Wallet | High | Large/long-term hold |

For beginners holding modest amounts, an exchange wallet or hot wallet may suffice initially. But as holdings grow, moving funds into cold storage becomes a sensible step.

Avoiding Common Scams and Mistakes

The crypto space, unfortunately, attracts its share of scammers. Being aware of common pitfalls can save a lot of heartache.

First, always use official websites. Phishing attacks, where fake sites mimic legitimate exchanges, are widespread. Double-check URLs before logging in, and consider bookmarking the official site to avoid typos that could land one on a fraudulent page.

Never share private keys or recovery phrases with anyone. Legitimate exchanges and wallet providers will never ask for these. If someone does, it’s a scam. Private keys are like the keys to a safe, once someone else has them, they can take everything.

Be wary of offers that sound too good to be true. Promises of guaranteed returns, ‘double your crypto’ schemes, or celebrity endorsements (often deepfakes) are red flags. Scammers prey on inexperience and greed, so a healthy dose of scepticism goes a long way.

When withdrawing Ethereum, always double-check the wallet address. Crypto transactions are irreversible, and sending funds to the wrong address means they’re gone for good. Some malware even changes copied addresses in the clipboard, so it’s worth verifying character by character.

Finally, ongoing safety means sticking with registered, reputable platforms and moving significant amounts of ETH off exchanges into secure personal wallets. Exchanges are convenient, but they’re also high-value targets for hackers.

Conclusion

Buying Ethereum safely as a beginner isn’t as complicated as it might first appear. By choosing an FCA-registered exchange, securing an account properly, and understanding the basics of how Ethereum works, anyone can make their first purchase with confidence.

The most important takeaways? Never invest more than one can afford to lose, take security seriously from the start, and store Ethereum in a way that matches one’s needs and risk tolerance. Whether that means leaving it on a trusted exchange for convenience or moving it into cold storage for maximum security, the choice should be informed and deliberate.

Scams and mistakes are avoidable with vigilance and common sense. Stick to official platforms, protect private keys, and treat any offer that seems too good to be true with suspicion.

Ethereum offers exciting opportunities, but it’s a long game. Patience, careful planning, and a commitment to security will serve any beginner well as they navigate the world of cryptocurrency.

Frequently Asked Questions

How do I buy Ethereum safely as a beginner in the UK?

Choose an FCA-registered exchange like Coinbase or eToro, complete identity verification, enable two-factor authentication, and deposit funds via bank transfer. Then place a market order to purchase Ethereum and store it securely in a personal wallet for added protection.

What is the difference between Ethereum and Bitcoin?

Whilst Bitcoin primarily functions as digital money, Ethereum is a decentralised blockchain platform that supports smart contracts and decentralised applications (dApps). Ether (ETH) is Ethereum’s native cryptocurrency, used to power transactions and interactions across its network.

Should I store my Ethereum on an exchange or in a personal wallet?

Exchange wallets are convenient for active trading but carry security risks if the platform is compromised. Personal wallets, especially cold storage hardware wallets like Ledger or Trezor, offer greater security and full control, making them ideal for long-term holdings.

How much money should I invest in Ethereum as a beginner?

Never invest more than you can afford to lose. Ensure you have emergency savings and manageable debts first. Start with a modest amount, such as £50 to £500, and consider pound-cost averaging to reduce the impact of price volatility.

What are the fees for buying Ethereum in the UK?

Fees vary by platform and payment method. Bank transfers typically have the lowest fees, whilst debit cards may incur small charges. Exchanges also charge trading fees and spreads. Compare fee structures across platforms to minimise costs and maximise returns.

Can I lose money investing in Ethereum?

Yes, Ethereum is highly volatile and prices can fluctuate dramatically within hours. Unlike traditional savings accounts, cryptocurrency investments carry real risks. It’s essential to invest responsibly, set clear budgets, and be prepared for potential losses alongside gains.