Buying Dogecoin has become increasingly popular amongst cryptocurrency enthusiasts, but navigating the digital currency landscape safely requires careful planning and knowledge. Whether you’re drawn to this meme-inspired cryptocurrency for its community appeal or investment potential, protecting yourself from scams and security breaches should be your top priority.

The cryptocurrency market can feel overwhelming for newcomers, with countless platforms, wallets and payment methods to choose from. Making the wrong choice could expose your personal information or result in significant financial losses. Understanding the essential security measures and choosing reputable exchanges will help you avoid common pitfalls that catch many first-time buyers off guard.

This comprehensive guide will walk you through the safest methods to purchase Dogecoin, from selecting trusted exchanges to securing your digital assets properly. You’ll learn how to verify platforms, protect your investments and avoid the costly mistakes that can derail your cryptocurrency journey before it even begins.

Understanding Dogecoin and Its Risks

Understanding Dogecoin’s fundamentals gives you the knowledge to make informed investment decisions. Dogecoin operates as a decentralised cryptocurrency that Billy Markus and Jackson Palmer created in 2013 as a parody of Bitcoin. The digital currency features the Shiba Inu dog meme as its mascot and uses a proof-of-work consensus mechanism similar to Litecoin.

The Nature of Dogecoin

Dogecoin differs from Bitcoin through its unlimited supply cap and faster block generation times. The cryptocurrency produces new blocks every minute compared to Bitcoin’s 10-minute intervals. This faster processing allows for quicker transaction confirmations but creates inflationary pressure due to the continuous coin creation.

The currency’s value relies heavily on community sentiment and social media influence rather than technological innovations or institutional adoption. Elon Musk’s tweets about Dogecoin have historically caused significant price fluctuations, demonstrating the asset’s volatility and speculative nature.

Market Volatility Risks

Dogecoin’s price exhibits extreme volatility that can result in substantial financial losses. The cryptocurrency’s value has experienced swings exceeding 50% within single trading days during periods of high market activity. Your investment can lose significant value rapidly due to market sentiment changes, regulatory announcements, or social media trends.

Historical data shows Dogecoin reached an all-time high of approximately $0.73 in May 2021 before declining over 90% in subsequent months. These dramatic price movements highlight the speculative risks associated with Dogecoin investments.

Security and Scam Risks

Cryptocurrency investments expose you to various security threats including exchange hacks, phishing attacks, and fraudulent schemes. Scammers frequently target Dogecoin investors through fake giveaways, Ponzi schemes, and impersonation attacks on social media platforms.

Common Dogecoin scams include:

- Fake celebrity endorsement giveaways promising doubled returns

- Phishing websites mimicking legitimate exchanges

- Pump-and-dump schemes coordinated through social media groups

- Fake wallet applications designed to steal private keys

Your digital assets remain vulnerable to theft if you store them on compromised exchanges or fall victim to social engineering attacks. The irreversible nature of cryptocurrency transactions means stolen funds typically cannot be recovered.

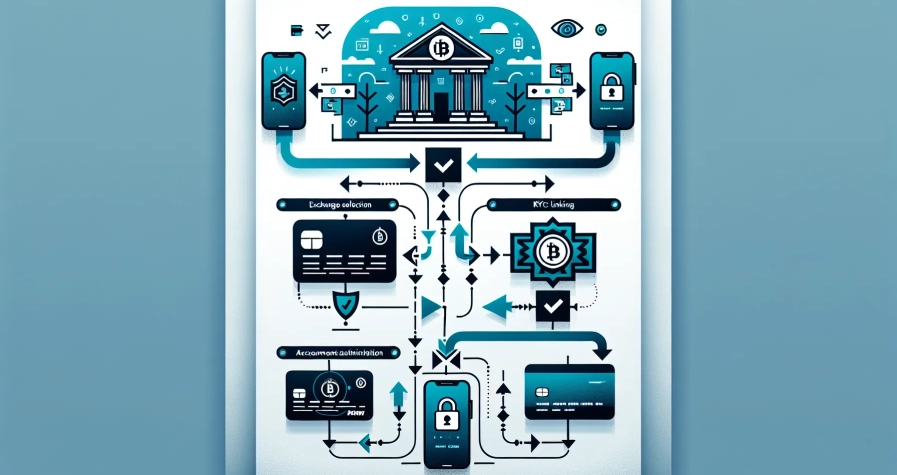

Choosing a Reputable Cryptocurrency Exchange

Selecting a trustworthy cryptocurrency exchange forms the foundation of safe Dogecoin purchasing. Your choice determines both the security of your transactions and the protection of your digital assets.

Researching Exchange Security Features

Security features distinguish reliable exchanges from vulnerable platforms that expose your investments to unnecessary risks. Look for exchanges implementing two-factor authentication (2FA) across all account access points, as this security layer prevents unauthorised access even if your password becomes compromised.

Cold storage capabilities represent another critical security measure you must verify before selecting an exchange. Reputable platforms like Kraken store the majority of user funds offline in cold wallets, protecting your Dogecoin from online hacking attempts and cyber attacks. This storage method keeps your digital assets physically disconnected from internet networks.

Insurance policies provide additional protection against potential losses from security breaches or platform failures. Leading exchanges maintain comprehensive insurance coverage that compensates users for losses resulting from exchange-related security incidents rather than individual account compromises.

Regular security audits demonstrate an exchange’s commitment to maintaining robust protective measures. Transparent exchanges publish audit results and security reports, allowing you to evaluate their defensive capabilities against evolving cyber threats.

Customer support responsiveness contributes significantly to overall platform security by providing immediate assistance during suspicious account activity or technical issues. Exchanges offering 24/7 support through multiple channels ensure you can quickly address security concerns.

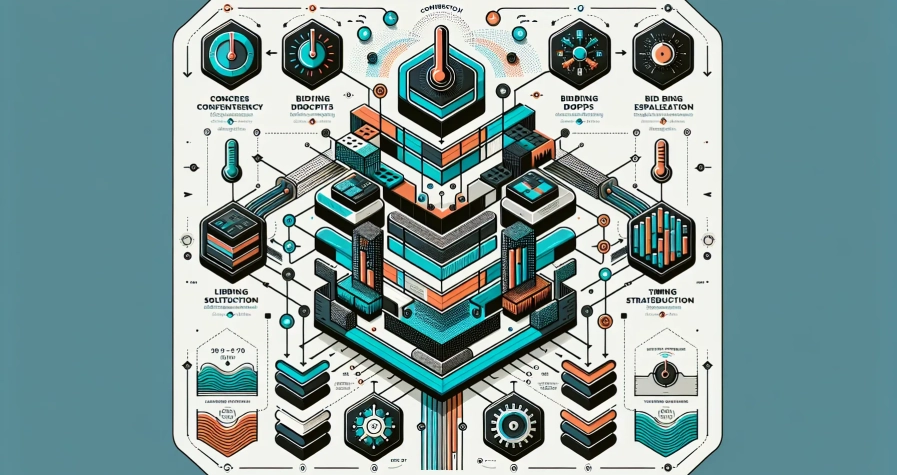

Comparing Fees and Trading Options

Fee structures vary significantly between exchanges and directly impact your Dogecoin purchasing costs. Maker-taker fee models, utilised by exchanges like Kraken, charge different rates depending on whether you add liquidity to the order book (maker) or remove it (taker), with makers typically receiving lower fees.

| Exchange Type | Typical Fee Range | Volume Discounts |

|---|---|---|

| Major Exchanges | 0.1% – 0.5% | Available for high-volume traders |

| Beginner-Friendly | 0.5% – 1.5% | Limited discount tiers |

| Advanced Trading | 0.05% – 0.25% | Comprehensive tier system |

Trading volume discounts reduce your transaction costs as your monthly trading activity increases. Exchanges implement tiered fee structures that reward frequent traders with progressively lower rates, making regular Dogecoin transactions more economical.

Payment method compatibility affects both convenience and additional costs associated with funding your account. Bank transfers typically offer the lowest fees but require longer processing times, whilst debit card purchases provide immediate access but carry higher transaction costs.

Deposit and withdrawal options determine how easily you can move funds in and out of the exchange. Consider supported currencies, processing timeframes, and associated fees for each funding method to optimise your overall trading experience.

Advanced trading features like margin trading, futures contracts, and stop-loss orders provide sophisticated tools for experienced investors. However, beginners benefit more from exchanges offering simple buy/sell interfaces with educational resources rather than complex trading mechanisms.

Setting Up Secure Account Verification

Establishing secure account verification forms the foundation of safe Dogecoin purchases through reputable cryptocurrency exchanges. Your account security directly determines the protection level for your digital assets and personal information.

Two-Factor Authentication Requirements

Two-factor authentication (2FA) creates an essential security barrier beyond your standard password protection. Most reputable exchanges including Binance, Coinbase and Kraken require 2FA activation immediately after account creation.

Authenticator apps like Google Authenticator and Authy provide the most secure 2FA method for cryptocurrency exchanges. These applications generate time-sensitive codes that change every 30 seconds, creating a dynamic verification layer that significantly reduces unauthorised access risks.

SMS-based 2FA options exist but offer lower security levels compared to authenticator apps:

- Authenticator apps work offline and resist SIM swapping attacks

- SMS codes remain vulnerable to phone number hijacking

- Hardware security keys provide the highest protection level for substantial investments

Enable 2FA before making any deposits or purchases on your chosen exchange. This security measure protects against phishing attacks and password theft attempts that commonly target cryptocurrency investors.

Identity Verification Process

Know Your Customer (KYC) verification ensures compliance with UK financial regulations and protects your account from fraudulent activities. Every legitimate cryptocurrency exchange requires identity verification before allowing fiat currency deposits or withdrawals.

The verification process typically involves submitting official government-issued documents such as:

- Valid UK passport or driving licence

- Proof of address documents (utility bills, bank statements dated within 90 days)

- Clear photographs showing your face alongside the identification document

Verification levels vary across different exchanges:

| Verification Level | Requirements | Transaction Limits |

|---|---|---|

| Basic | Email and phone number | Limited cryptocurrency trading |

| Standard | Government ID and address proof | Full fiat deposits up to £10,000 daily |

| Enhanced | Additional income verification | Unlimited trading capabilities |

Complete the highest verification tier available on your chosen platform to ensure maximum deposit limits and withdrawal flexibility. The verification process typically takes 24-72 hours for approval, though complex cases may require additional documentation review.

Document quality affects verification approval speed – ensure photographs display clear text, proper lighting and complete document visibility. Rejected submissions create delays that postpone your ability to purchase Dogecoin safely through the platform.

Safe Payment Methods for Purchasing Dogecoin

Selecting the right payment method significantly impacts your Dogecoin purchase security and overall transaction experience. Understanding the advantages and risks of different payment options helps you make informed decisions whilst protecting your funds.

Bank Transfers vs Debit Cards

Bank transfers provide the most secure payment method for purchasing Dogecoin on reputable exchanges. These transactions create a direct connection between your bank account and the exchange, offering enhanced fraud protection and lower associated fees. Processing times typically range from 1-3 business days for standard transfers, though some exchanges offer faster processing for verified accounts.

Debit card payments deliver instant access to Dogecoin purchases with immediate transaction confirmation. You can complete your purchase within minutes and start trading immediately after payment verification. Transaction fees for debit cards range between 3-5% of the purchase amount, making them more expensive than bank transfers but suitable for urgent purchases or smaller amounts.

Both payment methods offer strong consumer protection under UK financial regulations. Bank transfers provide additional security through established banking protocols, whilst debit cards offer chargeback protection for unauthorised transactions. Consider bank transfers for larger purchases exceeding £1,000, and debit cards for amounts under £500 where speed matters more than fees.

Avoiding High-Risk Payment Options

Credit card purchases expose you to higher fees and potential debt accumulation, particularly when purchasing volatile assets like Dogecoin. Many exchanges charge premium rates between 5-8% for credit card transactions, and your card provider may classify cryptocurrency purchases as cash advances with additional interest charges.

Peer-to-peer payment services without escrow protection create significant fraud risks. Platforms like PayPal Friends & Family, direct wire transfers to individuals, and cash transactions lack dispute resolution mechanisms. Scammers frequently target these payment methods because transactions are irreversible once completed.

Cryptocurrency ATMs often charge excessive fees ranging from 10-20% above market rates whilst offering limited consumer protection. These machines frequently operate without proper regulatory oversight and may not verify the legitimacy of transactions. Anonymous payment methods including prepaid cards and gift cards should be avoided entirely, as they provide no recourse for fraudulent activities.

Third-party payment processors claiming to offer “instant” or “guaranteed” Dogecoin purchases through unconventional methods typically operate scam schemes. Legitimate exchanges never request payment through Western Union, MoneyGram, or similar money transfer services for cryptocurrency purchases.

Storing Your Dogecoin Securely

Once you’ve purchased Dogecoin through a reputable exchange, your next priority involves securing your digital assets. Proper storage protects your investment from exchange hacks, theft and technical failures that could result in permanent loss.

Hardware Wallets vs Software Wallets

Hardware wallets provide the highest security level for storing your Dogecoin by keeping your private keys offline in cold storage. These physical devices isolate your keys from internet-connected devices, protecting against hacking, malware and phishing attacks. When you make transactions, the signing occurs inside the device itself, ensuring your private keys never leave the hardware wallet even when connected to a potentially compromised computer.

Software wallets operate as applications on your desktop or mobile device, offering convenience and ease of access for frequent Dogecoin transactions. They provide real-time balance updates, QR code scanning capabilities and user-friendly interfaces that make trading straightforward. However, software wallets connect to the internet, creating higher security risks compared to hardware alternatives. They’re better suited for smaller holdings or active trading rather than long-term storage.

Exchange wallets offer maximum convenience but minimum security since third parties control your private keys. This arrangement exposes you to risks including exchange hacks, insolvencies and potential regulatory seizures. Major exchange breaches have resulted in millions of pounds worth of cryptocurrency losses, making exchange storage unsuitable for significant Dogecoin holdings or long-term investment strategies.

Private Key Management

Your private key controls complete access to your Dogecoin, making its protection absolutely critical for maintaining ownership of your digital assets. Never share your private key with anyone, as possession of this information grants full control over your cryptocurrency funds. Store backup copies of your seed phrases offline in multiple secure locations, preferably written on paper or metal storage devices rather than digital formats.

Hardware wallets excel at private key management by never exposing your keys externally, even during transaction signing processes. Consider using reputable hardware wallet manufacturers like Ledger or Trezor that implement robust security protocols and regular firmware updates. Set strong PINs for your devices and store recovery phrases in fireproof, waterproof containers separate from your hardware wallet location.

Software wallet security depends on your device’s protection and your own security practices. Use updated antivirus software, avoid suspicious downloads and never enter your private keys on untrusted websites. Enable additional security features like biometric authentication where available and regularly backup your wallet files to secure offline storage.

Essential Security Practices

Implementing robust security measures protects your Dogecoin investments from theft and unauthorised access. These practices form the foundation of safe cryptocurrency trading and storage.

Recognising and Avoiding Scams

Phishing attacks target Dogecoin investors through fraudulent emails and websites that mimic legitimate cryptocurrency services. Always access exchanges and wallets by typing official URLs directly into your browser or using bookmarked links rather than clicking email links.

Investment scams promise guaranteed returns or “risk-free” Dogecoin profits through fake trading platforms or pyramid schemes. Legitimate cryptocurrency investments never guarantee specific returns, and any platform claiming otherwise operates as a scam.

Social media fraud spreads through fake celebrity endorsements and giveaway schemes that request Dogecoin deposits for larger returns. Verify all communications claiming to be from cryptocurrency services, as legitimate platforms never request your private keys or seed phrases via email or social media.

Fake wallet applications appear in app stores and websites, designed to steal your Dogecoin once you deposit funds. Download wallets only from official websites or verified app store listings, and check developer credentials before installation.

| Common Dogecoin Scams | Warning Signs | Protection Method |

|---|---|---|

| Phishing emails | Urgent language, suspicious links | Access sites directly |

| Fake giveaways | “Send X to receive 2X” promises | Never send Dogecoin first |

| Ponzi schemes | Guaranteed high returns | Research investment legitimacy |

| Fake exchanges | Unlicensed operations | Use regulated platforms only |

Regular Security Audits

Account monitoring involves checking your exchange and wallet activity weekly for unauthorised transactions or login attempts. Set up email alerts for all account activities, including logins, trades, and withdrawals to detect suspicious behaviour immediately.

Password management requires updating your passwords every 90 days and using unique, complex combinations for each cryptocurrency platform. Enable two-factor authentication (2FA) on all accounts, preferring authenticator apps over SMS for enhanced security.

Software updates patch security vulnerabilities in wallets, browsers, and operating systems that cybercriminals exploit to access Dogecoin holdings. Configure automatic updates for critical security software and manually update cryptocurrency applications within 48 hours of new releases.

Backup verification ensures your wallet recovery phrases remain accessible and secure in offline storage locations. Test your backup phrases quarterly by restoring a small test wallet, and store multiple copies in separate physical locations such as safe deposit boxes or fireproof safes.

Network security protects your Dogecoin transactions from interception during online activities. Avoid public Wi-Fi networks for cryptocurrency transactions, and use VPN services when accessing accounts from unfamiliar networks or locations.

Conclusion

Your journey into Dogecoin investment doesn’t have to be fraught with unnecessary risks. By following the security practices and purchasing strategies outlined above you’ll be well-equipped to protect your digital assets whilst participating in this dynamic market.

Remember that successful Dogecoin ownership extends far beyond the initial purchase. Your ongoing commitment to security updates wallet maintenance and staying informed about emerging threats will determine the long-term safety of your investment.

The cryptocurrency landscape continues to evolve rapidly but the fundamental principles of safe trading remain constant. Take your time research thoroughly and never compromise on security measures regardless of market excitement or pressure to act quickly.

Start small build your confidence gradually and always prioritise the protection of your funds over potential quick gains. With the right approach you can enjoy the benefits of Dogecoin whilst keeping your investment secure.

Frequently Asked Questions

What is Dogecoin and how did it originate?

Dogecoin is a cryptocurrency created in 2013 as a parody of Bitcoin, featuring the popular Shiba Inu dog meme as its mascot. Unlike Bitcoin, it has an unlimited supply cap and faster block generation times. Its value is heavily influenced by community sentiment and social media, particularly through endorsements from figures like Elon Musk, making it extremely volatile.

Is it safe to buy Dogecoin?

Buying Dogecoin can be safe if you follow proper security practices. Choose reputable exchanges with strong security features, use secure storage methods, and be aware of common scams. However, Dogecoin investments carry significant risks due to extreme price volatility and the potential for substantial financial losses.

What should I look for in a cryptocurrency exchange?

Choose exchanges with essential security features including two-factor authentication, cold storage capabilities, insurance policies, and regular security audits. Also consider responsive customer support, competitive fee structures, payment method compatibility, and whether the platform offers advanced trading features suitable for your experience level.

Should I store Dogecoin on an exchange?

No, storing significant amounts of Dogecoin on exchanges is not recommended due to vulnerability to hacks and potential insolvencies. For maximum security, use hardware wallets that keep private keys offline. Software wallets offer convenience but carry higher security risks than hardware alternatives.

How can I protect my Dogecoin from scams?

Be wary of fake giveaways, phishing attacks, and Ponzi schemes. Never share your private keys, access sites directly rather than through links, and research investment opportunities thoroughly. Implement strong security practices including regular software updates, secure password management, and enabling two-factor authentication wherever possible.

What are the main risks of investing in Dogecoin?

Dogecoin investments carry significant risks including extreme price volatility, potential for substantial financial losses, and exposure to various security threats. The cryptocurrency’s value fluctuates dramatically based on social media sentiment and community hype, making it a highly speculative investment unsuitable for risk-averse investors.

How should I manage my Dogecoin private keys?

Never share your private keys with anyone and store backup phrases securely offline. Use reputable hardware wallet manufacturers and implement strong security practices for software wallets. Regularly verify your backups work properly and consider using multiple secure storage locations for redundancy.

What security practices should I follow for Dogecoin investments?

Conduct regular security audits of your accounts, use strong password management, keep all software updated, and verify backup integrity regularly. Ensure network security when accessing accounts, enable biometric authentication where available, and use updated antivirus software to protect against malware and unauthorised access.