Bank transfers have emerged as one of the most trusted and cost-effective methods for purchasing cryptocurrency in the UK. Unlike card payments, which often carry higher transaction fees and additional friction, bank transfers provide a direct, familiar route from a user’s bank account to their chosen exchange. For many, the appeal lies in the simplicity: no intermediaries, no foreign payment processors, and, crucially, fewer opportunities for unexpected charges to creep in.\n\nBut familiarity doesn’t eliminate risk. As the crypto market continues to mature and attract regulatory oversight, understanding how to navigate bank transfers safely has never been more important. From selecting a reputable, FCA-registered platform to recognising phishing attempts and managing processing times, there’s a careful balance to strike between convenience and security. This guide walks through everything one needs to know to buy crypto via bank transfer with confidence, covering the types of transfers available, step-by-step instructions, essential security practices, and the common pitfalls to avoid.

Key Takeaways

- Bank transfers are one of the most cost-effective and secure methods to buy crypto in the UK, typically carrying lower fees than card payments.

- Always choose an FCA-registered exchange like Coinbase, Kraken, or Gemini to ensure legal protection and regulatory compliance when buying crypto using a bank transfer.

- Domestic Faster Payments transfers usually arrive within minutes to a few hours at little to no cost, making them ideal for UK crypto purchases.

- Enable two-factor authentication and verify exchange legitimacy before initiating any transfer to protect against phishing scams and fraudulent platforms.

- Complete identity verification (KYC) and ensure your bank account name matches your exchange registration to avoid payment delays or rejections.

- Be aware of phishing attempts: never click links in unsolicited emails and always navigate directly to the exchange’s official website to buy crypto safely.

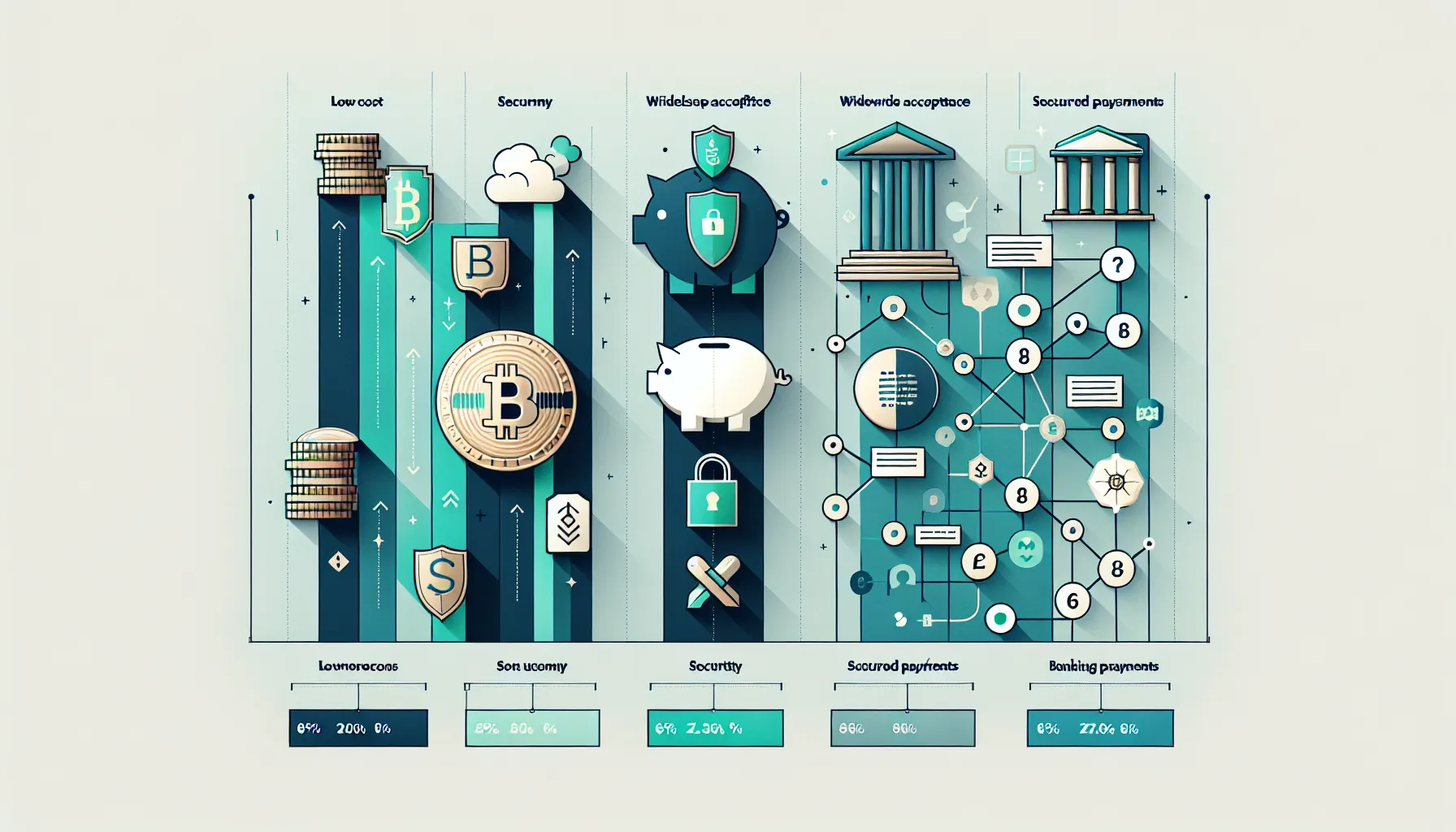

Why Bank Transfers Are a Popular Method for Buying Crypto

Bank transfers have carved out a dominant position in the UK crypto buying landscape, and for good reason. They tick several boxes that matter to both newcomers and experienced investors alike.

First, there’s the cost advantage. Compared to debit or credit card payments, which can attract fees ranging from 2% to 4%, bank transfers are typically free or carry minimal charges, especially for domestic payments. This makes them particularly appealing for larger purchases, where even a 2% fee can add up quickly.

Second, bank transfers offer a sense of security and legitimacy. Most people have been using online banking for years: it’s a known entity. When funds move directly from a user’s own bank account to a regulated exchange, there’s a clear audit trail. That transparency matters, both for personal record-keeping and in the unlikely event that something goes wrong.

There’s also the matter of acceptance. Nearly every reputable, FCA-registered crypto exchange in the UK supports bank transfers. Platforms like Coinbase, Kraken, and Gemini all recognise that UK users expect this option, and they’ve built their onboarding flows around it. This widespread support means users aren’t forced into less familiar, or less secure, payment methods simply because their preferred exchange doesn’t accept cards.

Finally, bank transfers provide an additional layer of payment security. Because they’re processed through established banking infrastructure, they’re subject to rigorous fraud prevention and anti-money laundering protocols. Whilst this does mean more identity checks upfront, it also reduces the risk of unauthorised transactions slipping through.

Understanding the Types of Bank Transfers for Crypto Purchases

Not all bank transfers work the same way. Depending on where the exchange is based and which payment rails are used, the speed, cost, and experience can vary considerably. Here’s a breakdown of the main types.

Domestic Bank Transfers

For UK-based buyers using UK-registered exchanges, domestic bank transfers are the go-to option. The Faster Payments system, introduced in 2008, has become the backbone of instant banking in the UK. Transfers made via Faster Payments typically land in the recipient account within seconds to a few hours, and crucially, they’re usually free of charge.

This makes them ideal for crypto purchases. A user can initiate a transfer from their online banking app, and within minutes, the funds appear in their exchange account, ready to be deployed. It’s fast, it’s familiar, and it doesn’t eat into the amount they’re planning to invest.

International Wire Transfers

Sometimes, a user might want to buy crypto from an exchange that isn’t based in the UK, perhaps to access a wider range of coins or take advantage of specific features. In these cases, international wire transfers come into play.

These transfers use networks like SWIFT (for global payments) or SEPA (for euro-denominated transfers within Europe). Whilst they’re reliable and widely supported, they do come with trade-offs. Fees can be higher, often charged by both the sending bank and the receiving institution, and processing times are slower, sometimes taking several business days.

For smaller purchases, the fees and delays can make international wires impractical. But for larger investments or when a specific exchange is required, they remain a viable option.

Instant Payment Systems

Beyond traditional banking rails, a new generation of instant payment systems has emerged. Open Banking, for instance, allows exchanges to connect directly to a user’s bank account with explicit permission, enabling real-time transfers without manual input of bank details.

Similarly, digital banks like Revolut and Monzo have integrated crypto purchasing directly into their apps. Users can buy crypto without leaving the app, using funds that are already held in their account. These systems offer speed and convenience, though it’s worth noting that they may come with their own fee structures or limitations on withdrawal and storage.

Step-by-Step Guide to Buying Crypto via Bank Transfer

Buying crypto via bank transfer isn’t complicated, but it does require attention to detail. Here’s how to do it safely, from start to finish.

Choose a Reputable Crypto Exchange

The foundation of a safe crypto purchase is the exchange itself. In the UK, the Financial Conduct Authority (FCA) requires crypto firms to register and comply with anti-money laundering regulations. Choosing an FCA-registered exchange, such as Coinbase, Kraken, or Gemini, provides legal protection and a degree of consumer recourse if something goes wrong.

Beyond regulatory status, it’s worth considering factors like the range of supported cryptocurrencies, user reviews, customer support quality, and fee structures. A reputable exchange should be transparent about its fees, have a strong track record of security, and offer responsive support channels.

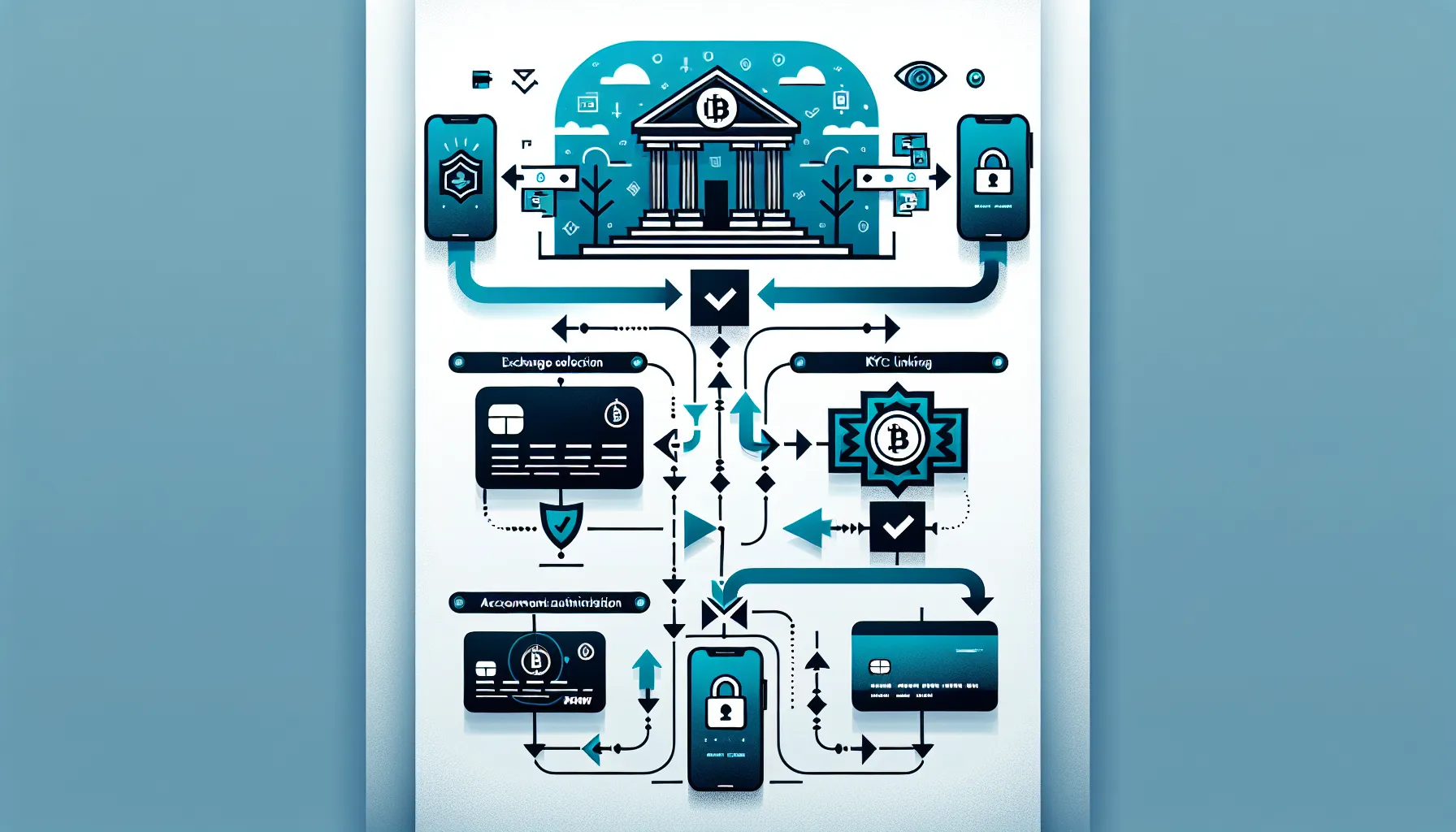

Complete Identity Verification

Once an exchange is selected, the next step is identity verification, commonly known as KYC (Know Your Customer). This process is mandatory for regulated exchanges and typically involves submitting a photo ID, such as a passport or driving licence, and sometimes a selfie or live video scan.

Whilst the process can feel intrusive, it’s a legal requirement designed to prevent money laundering and fraud. Most exchanges process KYC applications within minutes to a few hours, though during periods of high demand, it can take longer.

It’s important to ensure that the name on the bank account matches the name registered on the exchange. Mismatches can trigger delays or even rejections, as exchanges are obliged to verify that the person sending funds is the same person who owns the account.

Link Your Bank Account

With identity verification complete, the next step is linking a bank account. This usually involves entering bank account details, sort code and account number, into the exchange’s deposit settings.

Some exchanges may require a small test deposit to confirm ownership, whilst others use Open Banking to verify the account instantly. Either way, it’s crucial to double-check that the details entered are correct. A single-digit error can result in funds being sent to the wrong account, with little recourse for recovery.

Initiate and Confirm Your Transfer

Once the bank account is linked, the user can initiate a deposit. This is typically done by navigating to the “Deposit” or “Add Funds” section of the exchange, selecting bank transfer as the payment method, and following the on-screen instructions.

The exchange will provide details such as a reference number or unique code, which must be included in the transfer. This reference ensures that the funds are credited to the correct user account.

After initiating the transfer via online banking, it’s important to wait for confirmation that the funds have been received by the exchange before attempting to buy crypto. Most exchanges send an email or in-app notification once the deposit has cleared. Trying to purchase before the funds are available can lead to failed transactions or confusion.

Essential Security Measures When Using Bank Transfers

Even when using a reputable exchange and following best practices, security can’t be taken for granted. Here are the key measures every crypto buyer should carry out.

Verify Exchange Legitimacy and Licensing

Before transferring any funds, it’s essential to confirm that the exchange is legitimate and properly licensed. In the UK, this means checking the FCA’s register of approved crypto firms. A quick search on the FCA website can verify whether an exchange is registered and compliant.

Scammers often create fake websites that mimic legitimate exchanges, complete with convincing logos and layouts. Always access an exchange by typing the URL directly into the browser or using a verified bookmark, never via a link in an email or social media post.

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds a critical layer of security to an exchange account. Even if a password is compromised, 2FA requires a second form of verification, usually a code generated by an app like Google Authenticator or sent via SMS, before login or withdrawal is permitted.

Most exchanges make 2FA optional, but it should be considered mandatory. Without it, an account is significantly more vulnerable to unauthorised access, especially if the same password has been used elsewhere.

Use Secure Networks and Devices

Crypto transactions should only be conducted on secure, private networks. Public Wi-Fi, such as in cafés, airports, or hotels, can be intercepted by malicious actors, potentially exposing login credentials or bank details.

Similarly, it’s wise to use a trusted, up-to-date device with antivirus software installed. Avoid using shared or public computers for anything involving financial transactions, and ensure that the device’s operating system and browser are regularly updated to patch known vulnerabilities.

Common Risks and How to Avoid Them

Even though the relative safety of bank transfers, risks remain. Being aware of them, and knowing how to mitigate them, can make all the difference.

Phishing Scams and Fraudulent Platforms

Phishing remains one of the most common threats in the crypto space. Fraudsters send emails or text messages that appear to come from legitimate exchanges, urging users to log in, update details, or confirm a transaction. These messages often include links to fake websites designed to steal login credentials or banking information.

The best defence is scepticism. Always verify the sender’s email address, check for spelling mistakes or awkward phrasing, and never click links in unsolicited messages. If in doubt, navigate directly to the exchange’s website and log in from there.

It’s also worth enabling email or SMS alerts from the exchange for account activity. If a login or withdrawal attempt is flagged that the user didn’t initiate, they can act immediately to secure the account.

Payment Reversals and Chargebacks

Whilst bank transfers are generally irreversible, there are scenarios where a bank might reverse a payment, particularly if it flags the transaction as suspicious or unauthorised. This can create problems if the crypto has already been purchased and moved off the exchange.

To minimise this risk, users should only transact with trusted, regulated exchanges and ensure that all account details are accurate and up to date. It’s also wise to keep records of all transactions, including screenshots and email confirmations, in case a dispute arises.

Some banks in the UK have been known to block or delay payments to crypto exchanges, citing fraud prevention. If this happens, contacting the bank directly and confirming that the transaction is legitimate can usually resolve the issue.

Fees and Processing Times to Expect

Understanding the cost and speed of bank transfers is essential for planning a crypto purchase effectively.

For domestic transfers using the Faster Payments system, the process is typically free or carries a negligible fee, and funds usually arrive within minutes to a few hours. This makes it the most attractive option for UK buyers using UK-based exchanges. Some exchanges may charge a small deposit fee, often a flat rate or a small percentage, but this is far lower than card payment fees.

International wire transfers, on the other hand, are slower and more expensive. Banks often charge a fee for sending international payments, and the receiving exchange may also deduct a processing fee. On top of this, currency conversion fees can apply if the transfer involves changing pounds to euros or dollars. Processing times can range from one to five business days, depending on the banks and networks involved.

It’s also worth noting that some exchanges impose minimum deposit amounts or withdrawal limits, particularly for international transfers. Checking these details in advance can prevent frustration and ensure that the intended purchase amount is feasible.

For users who value speed and convenience, instant payment systems and Open Banking integrations offer near-instantaneous transfers with transparent fee structures. But, these services may not be available on all exchanges, so it’s worth confirming compatibility before committing.

Conclusion

Buying cryptocurrency via bank transfer in the UK is one of the safest, most cost-effective methods available, provided the right precautions are taken. By selecting a regulated, FCA-registered exchange, completing identity verification, and enabling robust security measures like two-factor authentication, users can significantly reduce their exposure to fraud and technical mishaps.

Understanding the different types of bank transfers, and their associated fees and processing times, also helps set realistic expectations and ensures a smoother experience. Domestic transfers via Faster Payments offer speed and convenience, whilst international wires provide access to a broader range of exchanges, albeit with higher costs.

Above all, vigilance is key. Phishing scams, fraudulent platforms, and payment reversals remain real threats, but they can be avoided with careful attention to detail and a healthy dose of scepticism. Sticking to trusted exchanges, secure networks, and verified payment methods will go a long way toward ensuring that every crypto purchase is both safe and successful.

Frequently Asked Questions

How long does a bank transfer take when buying crypto in the UK?

Domestic bank transfers using the UK’s Faster Payments system typically arrive within seconds to a few hours and are usually free. International wire transfers via SWIFT or SEPA can take one to five business days and involve higher fees.

Is it safe to buy crypto using a bank transfer?

Yes, bank transfers are amongst the safest methods for buying crypto, especially when using FCA-registered exchanges. They provide a clear audit trail, are subject to anti-money laundering protocols, and carry lower fraud risk than card payments when proper security measures are followed.

What are the fees for buying crypto via bank transfer?

Domestic UK bank transfers are typically free or carry minimal charges, making them far more cost-effective than card payments, which can incur 2–4% fees. International wire transfers involve higher fees from both sending and receiving banks, plus potential currency conversion costs.

Can I buy crypto with a bank transfer if my bank blocks crypto transactions?

Some UK banks may block or delay payments to crypto exchanges due to fraud prevention policies. If this occurs, contact your bank directly to confirm the transaction is legitimate. Alternatively, consider using a crypto-friendly digital bank like Revolut or Monzo.

Why do crypto exchanges require identity verification for bank transfers?

Identity verification (KYC) is a legal requirement for FCA-registered exchanges to comply with anti-money laundering regulations. It ensures the person sending funds matches the account holder, preventing fraud and providing consumer protection in case issues arise.

What is Open Banking and how does it work for crypto purchases?

Open Banking allows crypto exchanges to connect directly to your bank account with your permission, enabling real-time transfers without manually entering bank details. This provides instant payment processing with transparent fees, though availability varies by exchange and bank.