Cryptocurrency has become a mainstream investment option across the United States, with millions of Americans now holding digital assets in their portfolios. Whether you’re drawn to Bitcoin’s stability or excited about emerging altcoins, the US crypto market offers extensive opportunities for both beginners and seasoned investors.

Getting started with cryptocurrency purchases doesn’t have to be overwhelming. The American market provides numerous regulated platforms and exchanges that make buying crypto straightforward and secure. From centralised exchanges like Coinbase to peer-to-peer platforms, you’ll find options that suit your experience level and investment goals.

Understanding the basics before you dive in will save you time and money whilst ensuring you’re making informed decisions. This guide will walk you through everything you need to know about purchasing cryptocurrency in the US, from choosing the right platform to securing your digital assets properly.

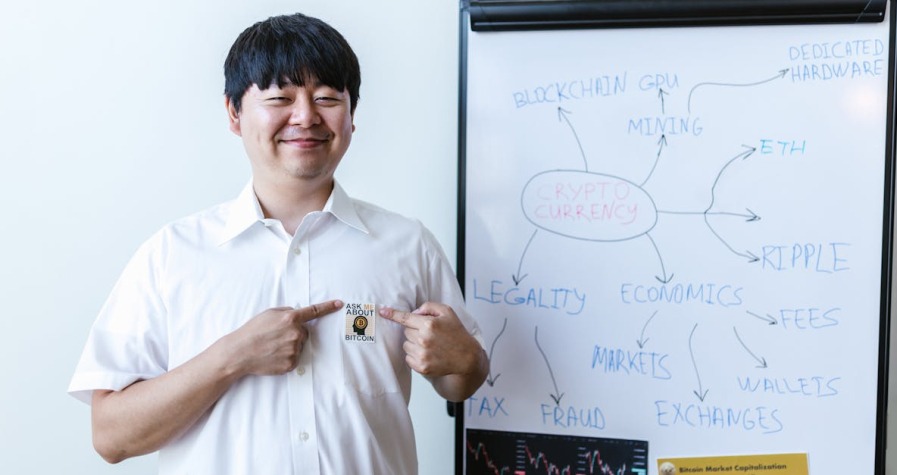

Understanding Cryptocurrency Basics

Cryptocurrency represents a digital form of currency that operates through blockchain technology and cryptographic security. You can think of crypto as electronic money that exists independently of traditional banking systems and government control. Bitcoin launched in 2009 as the first cryptocurrency and remains the most recognisable digital asset with a market capitalisation exceeding $500 billion.

What Makes Crypto Different from Traditional Currency

Decentralisation sets cryptocurrency apart from conventional currencies like the US dollar or British pound. Traditional currencies rely on central banks and government institutions for regulation and control whilst crypto operates on distributed networks of computers called nodes. These networks validate transactions through consensus mechanisms without requiring intermediary approval.

Transparency defines another key difference as blockchain technology records every transaction on a public ledger. You can verify any transaction history through blockchain explorers like Etherscan or Blockchain.info. Traditional banking systems keep transaction records private and limit access to account holders and financial institutions.

Key Components of the Crypto Ecosystem

Blockchain technology serves as the foundation for all cryptocurrency operations. This distributed ledger system creates immutable records by linking transaction blocks through cryptographic hashes. Each block contains transaction data, timestamps, and references to previous blocks, creating an unalterable chain of information.

Mining or validation processes secure blockchain networks and process new transactions. Miners use computational power to solve complex mathematical problems and add new blocks to the chain. Proof-of-work systems like Bitcoin require significant energy consumption whilst proof-of-stake networks like Ethereum 2.0 use validator selection based on token ownership.

Wallets store your cryptocurrency holdings and enable transaction capabilities. Hardware wallets like Ledger and Trezor provide offline storage for maximum security. Software wallets including MetaMask and Trust Wallet offer convenient access through mobile applications and browser extensions.

Popular Cryptocurrency Types

| Cryptocurrency | Symbol | Primary Use Case | Market Cap Rank |

|---|---|---|---|

| Bitcoin | BTC | Digital gold/store of value | 1 |

| Ethereum | ETH | Smart contracts platform | 2 |

| Tether | USDT | Stablecoin pegged to USD | 3 |

| BNB | BNB | Binance exchange token | 4 |

| Solana | SOL | High-speed blockchain platform | 5 |

Altcoins encompass all cryptocurrencies other than Bitcoin and include thousands of different projects. Major categories include payment tokens, platform tokens, utility tokens, and governance tokens. Each category serves specific functions within the broader crypto ecosystem.

Stablecoins maintain price stability by pegging their value to traditional assets like the US dollar or gold. Popular stablecoins include USDC, USDT, and DAI, which provide price stability for trading and storing value without cryptocurrency volatility.

How Crypto Transactions Work

Transaction initiation begins when you send cryptocurrency from your wallet to another address. Your wallet creates a digital signature using your private key to authorise the transaction. This signature proves ownership without revealing your private key information.

Network validation occurs when miners or validators receive your transaction and verify its authenticity. They check your account balance, validate the digital signature, and ensure you’re not double-spending the same coins. Valid transactions enter a pool awaiting inclusion in the next block.

Block confirmation happens when miners successfully add your transaction to a new block on the blockchain. Bitcoin transactions typically require 1-6 confirmations for full security whilst Ethereum transactions confirm in seconds to minutes. Higher-value transactions often require multiple confirmations for increased security.

Choosing the Right Cryptocurrency Exchange

Selecting the right cryptocurrency exchange forms the foundation of your crypto purchasing journey in the US. You must evaluate exchanges based on factors such as ease of use, fees, security measures, supported cryptocurrencies, and available payment methods.

Centralised vs Decentralised Exchanges

Centralised exchanges (CEX) and decentralised exchanges (DEX) offer distinct approaches to crypto trading, each with specific advantages and limitations for US buyers.

| Feature | Centralised Exchanges (CEX) | Decentralised Exchanges (DEX) |

|---|---|---|

| Control over funds | Exchange holds private keys (custodial) | User retains private keys (non-custodial) |

| Security | Vulnerable to hacks, but may have insurance | Avoid central hacks, but smart contract risks exist |

| Ease of use | More user friendly, regulated, customer support available | Less intuitive, requires more user responsibility |

| Fees | Usually lower trading fees, may charge withdrawal fees | Fees vary depending on network gas costs |

| Speed & Regulation | Instant trades, regulated | Speed depends on blockchain, less regulated |

| Popular examples | Coinbase, Crypto.com | Uniswap, PancakeSwap |

Centralised exchanges suit beginners due to their user-friendly interfaces and regulatory safeguards. Most platforms accept fiat deposits in USD via bank transfers, credit cards, or digital payment services. Decentralised exchanges appeal to users wanting complete control of assets and enhanced privacy, though they require greater technical knowledge and involve varying transaction costs.

Popular US Cryptocurrency Exchanges

Leading cryptocurrency exchanges in the US provide regulated environments for purchasing digital assets with comprehensive KYC verification processes.

Coinbase offers beginner-friendly features with strong regulatory compliance across all US states. The platform supports fiat deposits and provides access to a wide range of cryptocurrencies including Bitcoin and Ethereum.

Kraken maintains a reputation for robust security measures and regulatory compliance whilst supporting numerous cryptocurrencies. The exchange caters to both novice and experienced traders with advanced trading tools.

Gemini operates as a regulated US exchange offering insurance on crypto holdings stored in their custody. The platform provides straightforward account opening processes suitable for cryptocurrency newcomers.

Crypto.com delivers user-friendly interfaces with multiple payment options and rewards programmes. The exchange facilitates direct purchasing of various cryptocurrencies through streamlined verification procedures.

These exchanges enable account creation with mandatory identity verification, support US dollar deposits, and offer direct cryptocurrency purchasing options for popular digital assets.

Setting Up Your Account

Establishing your cryptocurrency account represents the first practical step towards purchasing digital assets in the US. Most regulated exchanges require comprehensive verification processes to ensure compliance with federal regulations.

Identity Verification Requirements

US crypto platforms implement strict identity verification procedures to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) laws. You must provide a valid government-issued identification document for identity confirmation during the registration process.

The verification process typically involves uploading clear photographs of your ID document alongside your personal information including:

- Legal name exactly as it appears on government documents

- Date of birth for age verification

- Current state of residence for regulatory compliance

- Valid email address for account communications

- Social Security number for tax reporting purposes

Many platforms also require facial recognition verification through selfie uploads to match your appearance with your submitted identification. This verification process protects user funds and ensures platform security by preventing fraudulent account creation.

Complete the verification process carefully and follow each platform’s specific instructions to avoid delays in account approval. Verification typically takes 24-48 hours but can extend longer during periods of high demand.

Securing Your Account

Account security measures form the foundation of safe cryptocurrency trading and storage. You must implement multiple security layers to protect your digital assets from unauthorised access and potential threats.

Create strong unique passwords using a combination of uppercase letters lowercase letters numbers and special characters. Password managers provide secure storage for complex passwords whilst eliminating the risk of password reuse across multiple platforms.

Enable two-factor authentication (2FA) on your account to add an extra security layer beyond your password. Authenticator apps like Google Authenticator or Authy offer more security than SMS codes which can be intercepted through SIM swapping attacks.

Protect yourself against phishing attempts by:

- Accessing your exchange only through official websites or verified mobile applications

- Verifying website URLs contain HTTPS encryption and correct spelling

- Never sharing private keys passwords or authentication codes with anyone

- Ignoring unsolicited emails or messages requesting account information

Review your account security settings regularly and update passwords every 90 days. Many exchanges offer security alerts for login attempts withdrawal requests and account changes to help monitor suspicious activity on your account.

Funding Your Cryptocurrency Purchase

Once you’ve set up and secured your cryptocurrency account, you can fund your purchase using several reliable payment methods. Each funding option offers distinct advantages in terms of cost, speed and transaction limits.

Bank Transfer Options

Bank transfers provide the most cost-effective method for purchasing cryptocurrency in the US. ACH (Automated Clearing House) transfers typically charge fees between 0.5% and 1.5%, significantly lower than card payment fees. Wire transfers offer even higher purchase limits, allowing transactions up to $250,000 daily on major exchanges like Coinbase and Kraken.

Processing times for bank transfers range from 1-5 business days depending on your bank and the exchange platform. BitPay and established exchanges such as Gemini accept direct bank account funding with enhanced security protocols. You’ll experience slightly slower transaction times compared to instant payment methods, but the substantial cost savings make bank transfers ideal for larger cryptocurrency purchases.

Some banks may require additional verification for substantial transfers or charge international wire fees ranging from $15-50 per transaction. Major US banks including Chase, Bank of America and Wells Fargo support cryptocurrency exchange transfers without restrictions.

Debit and Credit Card Payments

Debit and credit cards deliver immediate cryptocurrency purchases with instant settlement times. Your digital assets appear in your exchange wallet within minutes of completing the transaction. This speed comes with higher fees, typically ranging from 3% to 5% per transaction, making cards suitable for smaller purchases under $1,000.

Visa and Mastercard payments are accepted across all major US exchanges including Coinbase, Crypto.com and eToro. Daily purchase limits for card payments typically range from $2,500 to $25,000 depending on your verification level and exchange platform. Credit card purchases may trigger cash advance fees from your card issuer, adding 3-5% to your total cost.

Card payments offer excellent convenience for beginners making their first cryptocurrency purchase. The instant processing eliminates waiting periods associated with bank transfers, allowing you to capitalise on market opportunities immediately.

Alternative Payment Methods

Peer-to-peer (P2P) platforms such as LocalBitcoins and Paxful enable cryptocurrency purchases using cash, gift cards and prepaid vouchers. These methods often carry premiums of 5-15% above market rates but provide enhanced privacy for your transactions. Bitcoin ATMs across the US accept cash payments with fees ranging from 8-20% per transaction.

PayPal and Apple Pay integration on select exchanges offers additional convenience for US buyers. Robinhood and eToro support these digital wallet options with competitive fee structures. Gift cards from major retailers including Amazon, Walmart and Target can be converted to cryptocurrency through specialised platforms.

In-person transactions facilitate high-value purchases whilst maintaining privacy and security. Cash transactions combined with VPN usage or Tor browsers increase anonymity but require careful attention to safety protocols. These alternative methods suit experienced users who prioritise privacy over convenience and cost-effectiveness.

Making Your First Cryptocurrency Purchase

After funding your account, you’re ready to execute your first cryptocurrency transaction. Understanding different order types and investment strategies helps optimise your entry into the crypto market.

Market Orders vs Limit Orders

Market orders execute immediately at the current market price, providing instant purchase confirmation but potentially at less favourable rates during periods of high volatility. You receive your cryptocurrency within seconds, making this option ideal when you want immediate exposure to a specific digital asset regardless of minor price fluctuations.

Limit orders allow you to specify the exact price at which you want to purchase cryptocurrency, executing only when the market reaches your predetermined target. This approach offers precise control over your entry point but may result in delayed or unfulfilled transactions if the price doesn’t reach your specified level.

Consider using market orders when purchasing established cryptocurrencies like Bitcoin or Ethereum during stable market conditions. Choose limit orders when targeting specific price points or when market volatility creates opportunities for strategic entries at preferred rates.

Dollar-Cost Averaging Strategy

Dollar-cost averaging (DCA) involves investing fixed amounts at regular intervals—weekly, fortnightly, or monthly—regardless of cryptocurrency prices. This systematic approach reduces the impact of market timing and smooths out price volatility over extended periods.

For example, investing £100 monthly in Bitcoin across different price points potentially lowers your average cost basis compared to a single lump sum purchase. Research indicates that DCA strategies often outperform lump sum investments in volatile markets, particularly over 12-month periods or longer.

Benefits of DCA implementation:

- Reduces emotional decision-making during market fluctuations

- Minimises the risk of purchasing at peak prices

- Creates disciplined investment habits through automated purchases

- Allows gradual portfolio building within your risk tolerance

Limit your cryptocurrency exposure to 5-10% of your total investment portfolio initially, using only funds you can afford to lose completely. Set up recurring purchases through your chosen exchange’s automated DCA features to maintain consistency regardless of market conditions.

Storing Your Cryptocurrency Safely

Cryptocurrency storage represents one of your most critical decisions after purchasing digital assets. You control your security through wallet selection, which determines both access convenience and protection levels.

Exchange Wallets vs Personal Wallets

Exchange wallets store your cryptocurrency directly on the platform where you purchased it, offering immediate trading access without additional setup. These wallets maintain custody of your private keys, meaning the exchange controls your assets whilst providing security measures like two-factor authentication and insurance coverage.

Personal wallets grant you complete control over your private keys through self-custody arrangements. You download wallet software or purchase hardware devices that generate and store your keys independently from any exchange platform.

| Feature | Exchange Wallet | Personal Wallet |

|---|---|---|

| Private key control | Exchange maintains custody | You control keys directly |

| Security vulnerability | Susceptible to platform hacks | Protected from exchange failures |

| Trading convenience | Instant buying and selling | Requires transfer for trading |

| Setup complexity | Automatic upon registration | Manual installation required |

| Recovery options | Platform support available | Your responsibility entirely |

Exchange wallets expose your assets to platform risks including hacking attempts, regulatory shutdowns, and technical failures that have affected major platforms throughout crypto history. Personal wallets eliminate these third-party risks but require careful management of your recovery phrases and private keys.

Moving your cryptocurrency to personal wallets after purchasing provides enhanced security for long-term storage, particularly when holding substantial amounts exceeding your typical trading requirements.

Hardware Wallet Options

Hardware wallets store your private keys on dedicated physical devices that remain offline, providing maximum protection from online threats and malware attacks. These devices require physical confirmation for transactions whilst keeping your keys isolated from internet-connected computers.

Ledger hardware wallets include the Nano S Plus (£79) and Nano X (£149), supporting over 5,500 cryptocurrencies with Bluetooth connectivity on the premium model. Ledger devices feature secure chip technology and companion mobile applications for portfolio management.

Trezor offers the Model One (£69) and Model T (£219), providing open-source firmware and colour touchscreen interfaces on the advanced model. Trezor wallets support major cryptocurrencies including Bitcoin, Ethereum, and numerous altcoins with third-party wallet integration.

Coldcard specialises exclusively in Bitcoin storage, offering advanced security features including duress PINs, brick-me PINs, and air-gapped transaction signing. Coldcard devices cost approximately £120 and target experienced Bitcoin users requiring maximum security protocols.

Hardware wallets require one-time purchase costs but eliminate ongoing subscription fees whilst providing superior protection compared to software alternatives. You connect these devices to computers only when initiating transactions, maintaining offline storage during regular periods.

Setting up hardware wallets involves generating seed phrases containing 12-24 words that restore access if your device becomes lost or damaged. Store these recovery phrases in secure physical locations separate from your hardware device to ensure complete asset protection.

Tax Implications and Legal Considerations

Understanding cryptocurrency taxation requirements is crucial before purchasing digital assets in the US. The IRS classifies crypto as a digital asset, treating it similarly to stocks and other capital assets for tax purposes. You face tax obligations only on realised gains—when you sell, trade, or spend cryptocurrency—whilst simply buying and holding crypto remains non-taxable.

Taxable Cryptocurrency Events

Several activities trigger tax obligations when dealing with cryptocurrency. Selling crypto for USD creates a taxable event requiring you to report capital gains or losses. Trading one cryptocurrency for another (like Bitcoin for Ethereum) also generates taxable consequences, as does using crypto to purchase goods and services.

Non-taxable events include gifting cryptocurrency within IRS annual limits, donating digital assets to qualified charities, or transferring crypto between wallets you own. These activities don’t require immediate tax reporting, though maintaining detailed records remains essential for future reference.

Legal Framework for US Crypto Purchases

Purchasing and holding cryptocurrency is completely legal in the US, provided you comply with federal reporting requirements. All cryptocurrency exchanges operating in the US must follow regulatory guidelines, including implementing Know Your Customer (KYC) verification processes for account opening.

US-licensed exchanges like Binance.US, Coinbase, and Kraken operate under federal oversight, ensuring compliance with anti-money laundering (AML) regulations. These platforms require identity verification through government-issued documents and maintain transaction records for regulatory reporting purposes.

International Investor Considerations

Non-US investors using American cryptocurrency platforms face unique regulatory challenges. Regular trading activity on US exchanges may trigger US tax obligations, potentially classifying profits as income effectively connected to US trade or business activities.

International users must navigate both their home country’s cryptocurrency regulations and US compliance requirements. This dual regulatory framework often necessitates professional tax advice to ensure proper reporting across jurisdictions.

| Tax Aspect | Taxable Events | Non-Taxable Events |

|---|---|---|

| Selling crypto | Capital gains/losses apply | Holding crypto |

| Trading crypto | Each trade creates tax event | Wallet transfers |

| Spending crypto | Transaction value taxable | Gifting within limits |

| Receiving payments | Income tax applies | Charitable donations |

Maintaining comprehensive records of all cryptocurrency transactions enables accurate tax reporting and legal compliance. Document purchase dates, amounts, prices, and transaction purposes for each crypto activity throughout the tax year.

Common Mistakes to Avoid When Buying Crypto

Using insecure platforms represents the most significant risk you face when entering the cryptocurrency market. Platforms lacking strong security features expose your investments to hacks and potential loss of funds. You must select reputable exchanges like Binance.US, Coinbase, or Kraken that implement two-factor authentication and cold storage solutions. These established platforms maintain regulatory compliance whilst providing comprehensive security measures that protect your digital assets from unauthorised access.

Ignoring fees and hidden costs creates a substantial drain on your investment returns over time. Transaction fees, network charges, and spread costs vary dramatically between platforms and can consume significant portions of your profits. You should compare fee structures across multiple exchanges before making purchases, as high fees compound with each transaction. ACH transfers typically offer the lowest-cost deposit option at 0.5-1.5%, whilst credit card purchases often carry fees exceeding 3%.

Failing to develop a trading plan leads to impulsive decisions that result in substantial losses. Buying assets without clear objectives or chasing market hype creates emotional investment patterns that destroy long-term wealth. You must establish defined entry and exit strategies before purchasing any cryptocurrency. Setting specific price targets and risk tolerance levels prevents emotional trading decisions that occur during market volatility.

Neglecting to secure your investments properly exposes you to unnecessary risks beyond platform security. Leaving funds long-term on exchanges that don’t offer insured custody creates vulnerability to platform failures or regulatory changes. You should transfer purchased cryptocurrency to private wallets with proper backup procedures and enable two-factor authentication on all accounts. Hardware wallets like Ledger or Trezor provide enhanced protection for larger holdings.

Overtrading or emotional trading patterns increase both fees and risk exposure whilst reducing overall returns. Excessive transactions generate unnecessary costs and create tax complications for your annual reporting. You must stick to your predetermined investment strategy regardless of short-term market movements. Dollar-cost averaging at regular intervals eliminates the need for timing decisions and reduces emotional involvement in purchase decisions.

Falling victim to cryptocurrency scams destroys investments through fraudulent schemes targeting inexperienced investors. Fake tokens, phishing websites, and social media promotions frequently target newcomers to the space. You should verify the legitimacy of all tokens and platforms through official channels before investing. Regulatory bodies like the SEC provide resources for identifying registered platforms and warning lists for known scams.

| Common Mistake | Financial Impact | Prevention Method |

|---|---|---|

| Using insecure platforms | Total loss of funds | Choose regulated exchanges with cold storage |

| Ignoring fee structures | 3-5% reduction in returns | Compare platform fees before purchasing |

| Lack of trading plan | 20-40% higher losses | Establish clear entry/exit strategies |

| Poor security practices | Risk of account compromise | Enable 2FA and use hardware wallets |

| Overtrading activities | Increased fees and taxes | Implement dollar-cost averaging |

| Falling for scams | Complete investment loss | Verify legitimacy through official sources |

Choosing trusted US exchanges with proper security measures, understanding comprehensive fee structures, and maintaining disciplined investment approaches enable you to safely navigate the cryptocurrency market whilst avoiding these costly mistakes.

Conclusion

You’re now equipped with the knowledge and tools needed to confidently enter the cryptocurrency market. From selecting the right exchange to securing your digital assets and understanding tax obligations you have all the essential information at your fingertips.

Remember to start small and stick to your investment strategy. The crypto market can be volatile but with proper security measures and disciplined approach you’ll be well-positioned to navigate this exciting digital landscape.

Take your time choosing the platform that best suits your needs and always prioritise security over convenience. Your journey into cryptocurrency investing starts with that first purchase but success comes from consistent education and responsible trading practices.

Frequently Asked Questions

What is cryptocurrency and how does it work?

Cryptocurrency is a digital form of currency that operates through blockchain technology and cryptographic security. Unlike traditional currencies controlled by central banks, crypto is decentralised and operates on a public ledger. Transactions are recorded transparently on the blockchain, verified through network validation, and secured using digital signatures. Bitcoin was the first and remains the most recognisable digital asset.

Which cryptocurrency exchanges are best for US buyers?

Popular regulated exchanges for US buyers include Coinbase, Kraken, Gemini, and Crypto.com. These platforms offer user-friendly interfaces, comprehensive identity verification, and regulatory safeguards. Centralised exchanges (CEX) are ideal for beginners, whilst decentralised exchanges (DEX) offer greater control and privacy but require more technical knowledge. Choose based on your experience level and security preferences.

What are the different payment methods for buying cryptocurrency?

Bank transfers are the most cost-effective option with fees between 0.5-1.5%, though processing takes longer. Debit and credit cards offer immediate purchases but incur higher fees. Alternative methods include peer-to-peer platforms, Bitcoin ATMs, and digital wallets like PayPal and Apple Pay. Each method varies in terms of fees, processing times, and privacy considerations.

How should I store my cryptocurrency safely?

You can store crypto in exchange wallets for immediate access or personal wallets for greater control. Hardware wallets like Ledger and Trezor offer enhanced protection against online threats. Exchange wallets are convenient but expose assets to platform risks. Personal wallets require careful management but provide superior security. Always securely store recovery phrases for hardware wallets.

What are the tax implications of cryptocurrency in the US?

The IRS classifies cryptocurrency as a digital asset similar to stocks. You owe taxes on realised gains from selling or trading crypto. Non-taxable events include holding crypto or gifting within limits. Maintain comprehensive records of all transactions for accurate tax reporting. Purchasing and holding cryptocurrency is legal in the US with proper federal compliance.

What common mistakes should I avoid when buying cryptocurrency?

Avoid using insecure platforms, ignoring fee structures, and lacking a proper trading plan. Don’t neglect security practices like two-factor authentication and strong passwords. Resist overtrading and be cautious of scams. Choose trusted exchanges, understand costs, maintain disciplined investment approaches, and limit crypto exposure to 5-10% of your total investment portfolio.

What investment strategies work best for cryptocurrency?

Dollar-cost averaging (DCA) involves investing fixed amounts at regular intervals to reduce market volatility impact. Use market orders for immediate execution or limit orders for precise price control. Set up automated DCA purchases for consistency and limit cryptocurrency exposure to 5-10% of your total portfolio for balanced risk management.