The promise of earning whilst you sleep has captivated investors for generations, but cryptocurrency has brought this dream into sharper focus. Unlike traditional passive income avenues that often require substantial capital or property ownership, crypto offers accessible entry points for those willing to navigate its unique landscape. From staking coins on proof-of-stake networks to providing liquidity on decentralised exchanges, the opportunities are diverse, and they’re growing.

Building passive income streams with crypto isn’t simply about buying tokens and hoping for appreciation. It involves active participation in blockchain ecosystems, lending protocols, and decentralised finance (DeFi) mechanisms that reward users for contributing capital or resources. Each strategy carries its own risk-reward profile, time commitment, and technical complexity. Some approaches, like staking established cryptocurrencies, offer relatively predictable returns with moderate risk. Others, such as yield farming on experimental protocols, promise higher yields but demand constant vigilance and a tolerance for volatility.

What makes crypto passive income particularly compelling is the elimination of traditional intermediaries. Smart contracts automate payments, blockchain transparency provides real-time verification, and global accessibility means anyone with an internet connection can participate. But, this same decentralisation places greater responsibility on individuals to assess risks, verify platform security, and manage their holdings wisely. Understanding the fundamental mechanisms behind each income strategy is the first step toward building a sustainable crypto portfolio that generates consistent returns.

Key Takeaways

- Building passive income streams using crypto offers accessible entry points through staking, lending, and liquidity provision without requiring substantial capital or property ownership.

- Staking established cryptocurrencies on proof-of-stake networks typically yields 2–15% APY with moderate risk and minimal technical complexity for beginners.

- Decentralised finance (DeFi) lending and yield farming can deliver higher returns but demand constant monitoring and carry elevated smart contract vulnerabilities.

- Liquidity providers earn trading fees by supplying token pairs to decentralised exchanges, though they face impermanent loss when paired assets diverge in price.

- Effective risk management—including platform vetting, diversification across strategies, and disciplined security practices—is essential for sustainable passive income in crypto’s volatile landscape.

Understanding Crypto Passive Income Opportunities

Crypto passive income revolves around putting digital assets to work rather than letting them sit idle in a wallet. Unlike traditional savings accounts that offer minimal returns, cryptocurrency ecosystems reward users who contribute to network security, provide liquidity, or help lending.

Staking has emerged as one of the most straightforward methods. By locking coins on proof-of-stake (PoS) networks, holders help validate transactions and maintain blockchain integrity. In return, they receive newly minted tokens or transaction fees as rewards. The process typically involves delegating coins to validators or running a validator node oneself, the former being far more accessible for everyday investors.

Lending platforms allow crypto owners to deposit their holdings into protocols where borrowers can access loans. Interest rates fluctuate based on supply and demand dynamics, with stablecoins generally offering lower but more predictable yields whilst volatile altcoins command higher rates to compensate lenders for added risk.

Yield farming takes a more active approach, involving the strategic deployment of capital across multiple DeFi protocols to maximise returns. Farmers often move assets between platforms, chase promotional APY rates, and compound earnings by reinvesting rewards. This strategy demands more attention and carries elevated smart contract risk.

Liquidity provision serves decentralised exchanges (DEXs) by supplying token pairs to pools that help trading. Providers earn a portion of trading fees proportional to their share of the pool. But, they face impermanent loss, a phenomenon where price divergence between paired assets can erode profits compared to simply holding.

Dividend-paying tokens represent another avenue, particularly exchange tokens or real-world asset (RWA) coins that distribute periodic rewards from platform revenues or transaction fees. These function similarly to dividend stocks but operate within crypto’s regulatory grey zones.

Each opportunity presents distinct trade-offs between effort, risk, and potential reward. Beginners often start with staking established coins before exploring more complex DeFi strategies as their confidence and knowledge expand.

Staking Your Cryptocurrency Holdings

Staking has become the cornerstone of passive crypto income for those seeking relatively stable returns without excessive complexity. The mechanism relies on proof-of-stake consensus, where validators lock coins as collateral to process transactions and secure the network. Unlike proof-of-work mining that demands expensive hardware and electricity, staking simply requires holding and delegating tokens.

The process varies slightly across networks, but the fundamentals remain consistent. Users commit their coins for a specified period, either by running a validator node (which typically requires technical knowledge and substantial holdings) or by delegating to existing validators through staking pools. The latter option democratises access, allowing even small holders to participate and earn proportional rewards.

Rewards generally range from 2–15% annual percentage yield (APY), depending on the blockchain, total staked supply, and network inflation rate. Ethereum staking, for example, has historically offered 3–5% returns, whilst newer or smaller networks may promise double-digit yields to attract early participants. But, higher advertised rates often correlate with increased risk, either from token volatility or questionable project fundamentals.

Most staking arrangements involve lock-up periods during which coins cannot be accessed or sold. These timeframes range from flexible (withdraw anytime with minimal delay) to rigid (weeks or months before unstaking completes). Some networks impose slashing penalties if validators misbehave or experience extended downtime, though delegators typically face minimal risk in this regard when choosing reputable validators.

Choosing the Right Staking Platforms

Platform selection can make or break a staking strategy. Centralised exchanges like Coinbase, Binance, and Kraken offer user-friendly interfaces and handle technical complexities behind the scenes. They support popular staking assets such as Ethereum, Cardano, Polkadot, and Solana, making it easy for newcomers to begin earning without understanding validator operations.

But, exchange staking introduces custodial risk, users must trust the platform to secure funds and distribute rewards fairly. Exchange outages, regulatory issues, or security breaches can freeze access to staked assets. For those comfortable with self-custody, native wallets and dedicated staking platforms provide more control whilst connecting directly to blockchain validators.

Key evaluation criteria include:

- Security track record: Has the platform experienced hacks or fund losses?

- Supported assets: Does it offer the coins you wish to stake?

- Fee structure: Some platforms charge commissions on staking rewards (typically 5–25%).

- Minimum requirements: Certain coins demand minimum stakes (Ethereum requires 32 ETH to run a solo validator, though pooled options exist with lower thresholds).

- Reputation and reviews: Community feedback often reveals hidden issues or superior alternatives.

Diversifying across multiple platforms can reduce single-point-of-failure risk, though managing numerous accounts adds administrative overhead.

Expected Returns and Lock-Up Periods

Realistic expectations prevent disappointment and poor decision-making. Stablecoin staking usually yields 2–8% APY, modest but relatively safe given reduced price volatility. Major cryptocurrencies like Ethereum or Cardano fall into similar ranges, reflecting their established networks and large staking participation.

Smaller or emerging projects frequently advertise 10–20% returns, sometimes higher during promotional phases. Whilst tempting, these rates may prove unsustainable once token emissions slow or if price depreciation outpaces staking rewards. A 15% APY means little if the underlying asset loses 40% of its value during the lock-up period.

Lock-up durations significantly impact liquidity and risk exposure. Flexible staking allows withdrawals within hours or days, providing an escape route if market conditions deteriorate. Fixed-term staking locks funds for weeks to months, often offering slightly higher rewards to compensate for reduced liquidity. Some networks impose unbonding periods, transitional phases where coins are neither staked (earning rewards) nor fully accessible, leaving them vulnerable to price swings without generating income.

Before committing, investors should assess their liquidity needs, risk tolerance, and conviction in the staked asset. Locking up funds during a bull market might seem prudent, but sudden bear trends can trap capital at unfavourable valuations.

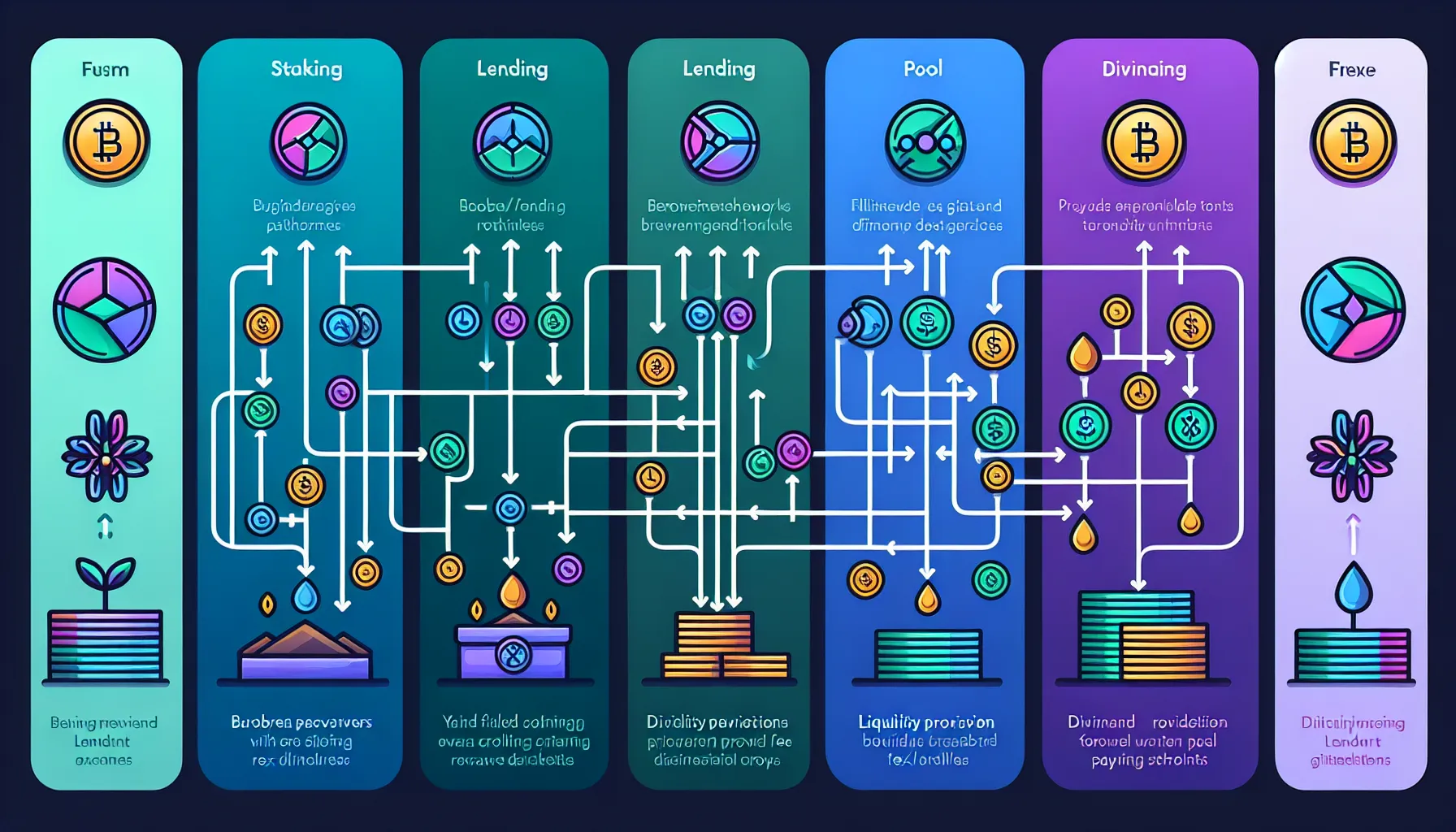

Lending and Yield Farming Strategies

Lending and yield farming occupy the more adventurous end of crypto passive income, promising higher returns in exchange for elevated risk and complexity. Both strategies leverage decentralised finance protocols, but they differ in approach and intensity.

Crypto lending mirrors traditional finance but removes intermediaries. Lenders deposit assets into platforms where borrowers can take loans by providing overcollateralised positions. Interest accrues automatically, with rates fluctuating based on supply-demand dynamics within each lending pool. Platforms like Aave, Compound, and Nexo have popularised this model, offering yields ranging from 3–12% on stablecoins and higher on volatile altcoins.

Yield farming, by contrast, involves actively moving capital between protocols to chase the highest available returns. Farmers provide liquidity, stake LP (liquidity provider) tokens, compound rewards, and sometimes employ leverage to amplify gains. The strategy requires constant monitoring as APY rates can plummet when incentives expire or new participants flood popular pools.

Both approaches generate income through interest payments, protocol incentive tokens, or trading fees. But, they demand careful platform selection and risk assessment, as smart contract vulnerabilities or protocol insolvencies can result in total capital loss.

Decentralised Finance Lending Platforms

Decentralised lending platforms operate via smart contracts deployed on blockchains like Ethereum, Binance Smart Chain, or Polygon. Unlike centralised services where a company controls funds, DeFi protocols execute transactions autonomously based on predetermined code logic.

Aave and Compound stand as industry leaders, offering transparent, audited smart contracts and broad asset support. Users deposit crypto into liquidity pools and receive interest-bearing tokens (like aTokens or cTokens) that automatically accrue value. Borrowers must overcollateralise loans, typically depositing $150 worth of assets to borrow $100, which protects lenders from default risk through automatic liquidation mechanisms.

Interest rates adjust algorithmically. High utilisation (most pooled assets borrowed) pushes rates up to attract more lenders and discourage borrowing: low utilisation reduces rates. This dynamic pricing ensures market equilibrium without centralised rate-setting.

Nexo and similar platforms blend centralised and decentralised elements, offering custodial services with regulatory compliance whilst paying competitive interest. They appeal to users prioritising convenience and customer support over pure decentralisation.

Risk management in DeFi lending centres on smart contract security and protocol solvency. Established platforms undergo multiple audits and maintain bug bounty programmes, yet vulnerabilities occasionally emerge. Lenders should diversify across protocols, avoid unaudited projects, and never deposit more than they can afford to lose.

Managing Risks in Yield Farming

Yield farming amplifies both returns and risks. The most lucrative opportunities often exist on new or experimental protocols offering unsustainable incentive rates to bootstrap liquidity. These “degen” farms can deliver 100%+ APY for brief periods before collapsing when incentives end or exploits drain funds.

Smart contract risk tops the danger list. Even audited code can contain hidden vulnerabilities that hackers exploit, resulting in total fund loss. High-profile DeFi hacks have drained hundreds of millions, with limited recourse for affected users since transactions are irreversible and protocols often lack insurance.

Impermanent loss affects liquidity providers who deposit token pairs into automated market maker (AMM) pools. If one asset appreciates significantly relative to its pair, the pool’s rebalancing mechanism leaves providers with less value than if they’d simply held both tokens. Trading fees may offset this loss, but volatile markets can erode profits quickly.

Market volatility compounds every other risk. A sudden price crash can liquidate leveraged positions, trigger cascading liquidations across DeFi, or cause stablecoin de-pegging that devastates yield farming strategies built on perceived safety.

Platform insolvency remains a threat, particularly with centralised lending services. Regulatory crackdowns, mismanagement, or fraud can freeze withdrawals, as seen in several high-profile collapses.

Mitigation strategies include:

- Using audited, established protocols with proven track records.

- Diversifying holdings across platforms and strategies to avoid concentrated exposure.

- Starting small whilst learning mechanics and assessing risk tolerance.

- Monitoring positions regularly rather than treating yield farming as truly passive.

- Avoiding leverage until thoroughly comfortable with DeFi mechanics.

Yield farming suits experienced users willing to trade time and attention for potentially superior returns. Beginners should gain experience with simpler strategies before venturing into this high-stakes arena.

Earning Through Liquidity Provision

Liquidity provision represents a middle ground between staking’s simplicity and yield farming’s complexity. By depositing token pairs into decentralised exchange pools, providers enable trading whilst earning a share of transaction fees. This mechanism underpins the entire DEX ecosystem, allowing platforms like Uniswap, Curve, and PancakeSwap to function without centralised order books.

The concept is straightforward: traders need liquidity to swap tokens efficiently, and liquidity providers (LPs) supply that liquidity in exchange for compensation. When someone trades on a DEX, a small fee (typically 0.25–0.3%) is distributed proportionally among all LPs in the relevant pool. High-volume pools generate substantial fee income, whilst low-volume pairs may barely cover the opportunity cost of locked capital.

Many protocols sweeten the deal with additional incentive tokens, temporarily boosting APY to attract liquidity. These “liquidity mining” programmes can push total returns into double or triple digits during launch phases, though rates inevitably decline as more providers join and incentives taper.

The strategy appeals to holders of multiple assets who want to put idle coins to work without committing to single-token staking. But, liquidity provision introduces unique risks, particularly impermanent loss, that require careful consideration.

How Liquidity Pools Generate Income

Liquidity pools operate through automated market makers (AMMs), which use mathematical formulas to price assets rather than relying on buyer-seller matching. The most common formula, constant product (x × y = k), maintains balance by adjusting prices as traders swap tokens.

When a user deposits equal values of two tokens (e.g., £500 of ETH and £500 of USDC), they receive LP tokens representing their share of the pool. As trades occur, the pool collects fees and distributes them to LP token holders. Many platforms allow staking these LP tokens in additional farms for extra rewards, creating layered yield opportunities.

Income sources include:

- Trading fees: Direct share of every transaction in the pool.

- Incentive tokens: Protocol-issued rewards for providing liquidity during promotional periods.

- Boosted rewards: Some platforms offer enhanced returns for locking LP tokens or holding governance tokens.

Profitability depends heavily on trading volume. Stablecoin pairs (like USDC-USDT) generate consistent but modest fees with minimal impermanent loss. Volatile pairs (like ETH-LINK) may produce higher fee income during price swings but expose providers to significant impermanent loss if one asset outperforms the other.

Calculating real returns requires accounting for all variables: trading fees earned, incentive tokens received (and their value), impermanent loss incurred, and gas fees paid for deposits and withdrawals. In bull markets with high trading activity, liquidity provision can outperform simple holding strategies. During quiet periods or one-directional price movements, LPs may underperform.

Successful liquidity providers choose pools strategically, monitor positions regularly, and withdraw when risk-reward ratios deteriorate. Tools like Impermanent Loss calculators help assess potential scenarios before committing capital.

Dividend-Paying Crypto Assets

Dividend-paying crypto assets offer perhaps the most familiar passive income model for those transitioning from traditional finance. These tokens distribute periodic rewards to holders, derived from project revenues, transaction fees, or staking mechanisms built into tokenomics.

Exchange tokens exemplify this category. Platforms like Binance (BNB) or KuCoin (KCS) share portions of trading fee revenue with token holders, either through direct distributions or buyback-and-burn programmes that reduce supply and theoretically increase value. Some exchanges offer enhanced benefits, reduced trading fees, access to token sales, or higher staking yields, for users holding native tokens.

Real-world asset (RWA) tokens represent another emerging class. These digitalise ownership of income-generating assets like real estate, bonds, or commodities, passing through rental income, interest, or other yields to token holders. Whilst promising, RWA tokens navigate complex regulatory landscapes and depend on trustworthy intermediaries to manage underlying assets.

Proof-of-stake network tokens sometimes function as dividend assets when staking rewards effectively distribute network revenues. But, these differ from traditional dividends since rewards typically come from inflation rather than external revenue, making sustainability a key consideration.

Before investing, scrutinise project fundamentals: How are “dividends” funded? Are revenues sustainable or dependent on unsustainable growth? What regulatory risks might affect distributions? Does the token provide genuine utility beyond speculation? Legitimate dividend tokens usually have transparent revenue models, audited financials, and regulatory compliance efforts. Projects promising unrealistic returns often collapse once new capital stops flowing.

Dividend strategies work best as portfolio complements rather than core holdings. Diversifying across multiple dividend tokens, combined with other passive income streams, creates more resilient overall returns whilst managing individual project risk.

Essential Risk Management Practices

Risk management separates sustainable crypto passive income from reckless speculation. The decentralised, largely unregulated nature of cryptocurrency amplifies both opportunities and dangers, making disciplined practices essential for long-term success.

Platform vetting forms the first defence. Only use established, audited platforms with transparent teams and proven security records. Research recent audits, check for bug bounty programmes, and review community sentiment before depositing funds. New protocols offering astronomical yields often hide catastrophic risks, if returns seem too good to be true, they probably are.

Never invest more than one can afford to lose. This timeless advice applies doubly to crypto, where entire protocols can disappear overnight through hacks, rug pulls, or regulatory shutdowns. Passive income strategies should employ capital earmarked for higher-risk investments, not emergency funds or money needed for near-term expenses.

Diversification spreads risk across assets, strategies, and platforms. Rather than concentrating holdings in a single high-yield farm, allocate capital between staking, lending, and liquidity provision across multiple protocols. If one platform fails or a strategy underperforms, others may compensate, smoothing overall returns and reducing catastrophic loss potential.

Staying informed about protocol changes, security updates, and market conditions enables proactive adjustments. Follow project announcements, monitor DeFi safety trackers, and maintain awareness of broader crypto market trends. Smart contract upgrades, governance votes, or regulatory developments can dramatically impact returns or risk profiles, sometimes with little warning.

Withdrawal strategies matter as much as entry plans. Set clear targets for when to claim rewards, compound earnings, or exit positions entirely. Regular profit-taking locks in gains and reduces exposure, whilst stop-loss thinking (knowing when to cut losses on underperforming strategies) prevents emotional decision-making during market turmoil.

Security hygiene protects against personal vulnerabilities. Use hardware wallets for significant holdings, enable two-factor authentication on all accounts, bookmark official URLs to avoid phishing sites, and never share private keys or seed phrases. The irreversibility of blockchain transactions means stolen crypto rarely gets recovered.

Risk management isn’t about eliminating uncertainty, that’s impossible in crypto. Instead, it’s about taking calculated risks whilst ensuring that inevitable setbacks don’t derail long-term wealth-building goals.

Conclusion

Building passive income streams with crypto offers unprecedented accessibility to wealth-generating strategies once reserved for institutions or high-net-worth individuals. From straightforward staking on established networks to sophisticated DeFi yield farming, the spectrum of opportunities accommodates diverse risk appetites, technical skill levels, and capital commitments.

Yet accessibility shouldn’t be mistaken for simplicity. Each strategy demands due diligence, understanding mechanisms, evaluating platforms, and continuously managing risks in an environment where regulatory frameworks remain nascent and technical vulnerabilities persist. The investors who thrive are those who treat crypto passive income as an active learning process rather than a set-and-forget solution.

Success often begins modestly. Starting with small positions in reputable staking platforms builds confidence and practical knowledge before venturing into higher-risk, higher-reward territories like yield farming or liquidity provision. As understanding deepens, portfolios can evolve to incorporate multiple strategies, creating diversified income streams that weather individual setbacks.

The crypto landscape will continue evolving, new protocols will emerge, regulations will tighten or clarify, and yields will fluctuate with market cycles. Those who stay informed, adapt strategies thoughtfully, and maintain disciplined risk management position themselves to benefit from this financial innovation whilst avoiding the pitfalls that trap less cautious participants. Passive income in crypto may not be entirely passive, but for those willing to invest time alongside capital, the rewards can be substantial.

Frequently Asked Questions

How can I build passive income streams using crypto?

You can build crypto passive income through staking on proof-of-stake networks, lending digital assets on DeFi platforms, providing liquidity to decentralised exchanges, yield farming across protocols, or holding dividend-paying tokens. Each strategy offers different risk-reward profiles and technical requirements.

What is cryptocurrency staking and how much can I earn?

Staking involves locking coins on proof-of-stake networks to help validate transactions and secure the blockchain. In return, you earn rewards typically ranging from 2–15% annual yield, depending on the network, total staked supply, and inflation rate.

What is impermanent loss in crypto liquidity provision?

Impermanent loss occurs when the price of tokens in a liquidity pool diverges significantly. The automated rebalancing mechanism can leave providers with less value than if they’d simply held the tokens separately, potentially eroding profits from trading fees.

Is crypto passive income actually passive?

Whilst termed ‘passive’, most crypto income strategies require active monitoring, platform evaluation, and risk management. Simple staking approaches demand minimal attention, but strategies like yield farming require constant vigilance to maximise returns and avoid smart contract vulnerabilities.

Do I need to pay tax on crypto staking rewards?

In most jurisdictions, including the UK, staking rewards are taxable as income when received, with their value calculated at the time of receipt. Additionally, any subsequent gains when selling staked tokens may incur capital gains tax obligations.

What are the biggest risks of DeFi lending platforms?

Major risks include smart contract vulnerabilities that hackers can exploit, platform insolvency, market volatility causing liquidations, and impermanent loss for liquidity providers. Always use audited platforms, diversify holdings, and never invest more than you can afford to lose.