For anyone who’s sent a transaction on Ethereum, gas fees can come as an unwelcome surprise. One moment the network feels affordable, the next, a simple swap or NFT mint costs the equivalent of a meal out. These fees, payments made in ETH to compensate validators, are essential for keeping the network secure and operational. But they’re also notoriously volatile, rising sharply during periods of high demand or when interacting with complex smart contracts.

The good news? Users don’t have to accept inflated costs as inevitable. By understanding how gas works, recognising the factors that drive prices up, and employing a handful of practical strategies, it’s possible to cut expenses significantly. From timing transactions during quieter periods to exploring Layer 2 networks and fine-tuning wallet settings, there are multiple levers to pull. This guide walks through proven methods for avoiding overpayment and making Ethereum transactions more economical, without sacrificing reliability or security.

Key Takeaways

- Gas fees on Ethereum can be reduced significantly by timing transactions during off-peak hours, such as weekends and late-night UTC periods when network demand is lower.

- Using real-time gas tracking tools like Etherscan Gas Tracker helps users identify optimal moments to transact and avoid overpaying for gas fees.

- Adjusting wallet settings by setting custom gas limits and choosing slower transaction speeds for non-urgent operations can yield substantial cost savings.

- Layer 2 solutions like Arbitrum, Optimism, and zkSync offer drastically lower fees, often just a few pence per transaction, making them ideal for routine activity.

- Batching multiple operations into a single transaction and selecting gas-efficient wallets and platforms can further reduce cumulative gas costs.

- Understanding how Ethereum gas fees work and combining multiple cost-saving strategies enables users to participate in the network more economically without compromising security.

Understanding Ethereum Gas Fees

Before diving into cost-saving tactics, it helps to grasp what gas fees actually represent and why they exist in the first place. Ethereum operates as a decentralised computer, and every operation, whether transferring tokens, minting an NFT, or executing a smart contract, consumes computational resources. Gas fees are the mechanism that compensates validators (formerly miners) for processing these operations and adding them to the blockchain.

Without fees, the network would be wide open to spam attacks: bad actors could flood Ethereum with worthless transactions at no cost, grinding activity to a halt. Gas fees act as both a spam deterrent and a prioritisation tool, ensuring that users who value speed and certainty can pay a bit more to jump the queue, while those willing to wait can opt for lower rates.

What Gas Fees Are and Why They Matter

In practical terms, gas fees are measured in gwei, a tiny fraction of ETH (one gwei equals 0.000000001 ETH). When someone initiates a transaction, they propose a maximum fee they’re willing to pay per unit of gas, along with an optional priority fee (or tip) to incentivise validators to include the transaction quickly.

This system matters because it aligns the interests of users and validators. Validators earn revenue from fees, motivating them to process transactions efficiently. Users, meanwhile, gain a way to signal urgency: pay more to confirm faster, or pay less and accept a delay. The result is a dynamic marketplace for block space, where prices shift minute by minute based on network activity.

For everyday users, this means gas fees directly affect the cost of participation. A DeFi trade that might cost £2 during quiet hours can balloon to £20 or more during a market frenzy. Understanding this variability is the first step towards avoiding unnecessary expense.

Factors That Influence Gas Prices

Several forces drive gas prices up and down. The most significant is network demand. When many users want to transact simultaneously, perhaps during a popular NFT drop or a sudden market swing, competition for limited block space intensifies, pushing fees higher. Conversely, when activity drops off, fees decline.

Another factor is transaction complexity. Simple ETH transfers require relatively little computation and hence less gas. Interacting with a DeFi protocol, on the other hand, might involve multiple smart contract calls, token approvals, and state changes, all of which consume more gas. The more intricate the operation, the higher the baseline cost.

Finally, Ethereum’s block size and block time impose constraints on supply. Blocks are produced roughly every 12 seconds, and each block has a maximum gas capacity. When demand exceeds this capacity, users must bid against one another, and prices rise accordingly. It’s a classic supply-and-demand dynamic, with block space as the scarce resource.

Timing Your Transactions Strategically

One of the simplest yet most effective ways to save on gas is to transact when the network is less congested. Because Ethereum is global, activity ebbs and flows with the rhythms of different time zones and working weeks. By choosing the right moment, users can often slash their fees by half or more, without changing anything else about the transaction.

The challenge, of course, is knowing when those low-fee windows occur. Gas prices aren’t static: they can spike within minutes and settle just as quickly. But patterns do emerge, and with the help of real-time data, it’s possible to identify opportune moments.

Identifying Off-Peak Hours

Historically, Ethereum gas fees tend to be lower during weekends and late-night hours in UTC. This makes sense: much of the network’s activity is driven by traders, DeFi users, and NFT collectors concentrated in North America, Europe, and parts of Asia. When these regions are asleep or offline for the weekend, demand softens and fees drop.

For instance, executing a transaction at 2 AM UTC on a Sunday morning often yields noticeably lower costs than doing the same thing at 3 PM UTC on a Wednesday afternoon. The difference can be substantial, sometimes as much as 50% or more, depending on broader market conditions.

Of course, these patterns aren’t set in stone. Major events, a highly anticipated token launch, a protocol exploit, or a sharp market move, can trigger surges at any hour. But as a general rule, off-peak timing is a reliable lever for cost reduction.

Using Real-Time Gas Tracking Tools

Rather than guessing, users can consult real-time gas tracking tools to see current fee levels and make informed decisions. Etherscan Gas Tracker is one of the most popular, displaying live estimates for slow, standard, and fast transaction speeds. GasNow and ETH Gas Station offer similar functionality, often with additional historical charts and alerts.

Many modern wallets, MetaMask, Rainbow, and Argent among them, also integrate gas analytics directly into the transaction flow. Before confirming a transfer or swap, users can see the current fee and compare it against recent averages. Some wallets even allow setting alerts: “notify me when gas drops below 20 gwei.”

By checking these tools before hitting send, users can decide whether to proceed immediately or wait a few hours. It’s a small habit that can yield significant savings over time, especially for those who transact frequently.

Optimising Transaction Settings

Beyond timing, users have direct control over the parameters of each transaction. Most wallets default to “recommended” settings that prioritise speed and certainty, but these aren’t always the most economical. By adjusting gas limits, prices, and transaction speeds manually, it’s possible to fine-tune costs without meaningfully compromising performance.

This requires a bit of care, setting values too low can result in failed transactions, wasting gas, but the trade-off is usually worth it for anyone looking to keep expenses in check.

Setting Custom Gas Limits and Prices

Every transaction includes a gas limit: the maximum amount of gas the sender is willing to consume. Wallets typically estimate this automatically, adding a small buffer to ensure the transaction completes. But sometimes the estimate is overly generous, especially for straightforward operations like token transfers.

Users can override the default and set a custom gas limit closer to the minimum required. For a basic ETH send, 21,000 gas is usually sufficient. For interacting with a smart contract, consulting a block explorer or the DApp’s documentation can provide guidance. The key is not to cut it too close, underfunding the limit means the transaction fails mid-execution, and the gas spent up to that point is lost.

Similarly, the gas price (or max fee) determines how much users are willing to pay per unit of gas. During low-congestion periods, setting a lower gas price can still result in timely confirmation. Wallets often present options like “slow,” “standard,” and “fast,” but advanced users can input a custom value in gwei. Monitoring tools like Etherscan help identify the current floor price for inclusion in the next block.

Choosing the Right Transaction Speed

Most wallets present transaction speed as a slider or dropdown: slow, standard, or fast. Slow transactions pay the minimum necessary fee and may take several minutes, or longer during busy times, to confirm. Fast transactions pay a premium to be included in the very next block.

For non-urgent activities, claiming rewards, consolidating tokens, or routine transfers, choosing the “slow” or “economy” option is a straightforward way to save. The delay is often negligible, and the cost difference can be substantial. On the other hand, time-sensitive operations, such as liquidation protection in DeFi, or minting a limited-supply NFT, may justify paying for speed.

The trick is to match the urgency of the task to the fee tier. There’s no need to pay for fast confirmation if there’s no deadline, and conversely, skimping on fees during critical moments can backfire. A bit of situational judgment goes a long way.

Leveraging Layer 2 Solutions

For users who transact frequently or work with smaller amounts, mainnet Ethereum fees can quickly become prohibitive. Enter Layer 2 solutions: networks built on top of Ethereum that process transactions off-chain, then settle batches of them back to the main chain. The result is drastically lower fees, often just a few pence per transaction, while retaining much of Ethereum’s security.

Layer 2 has matured significantly in recent years. What was once an experimental corner of the ecosystem is now home to thriving DeFi protocols, NFT marketplaces, and payment applications. For anyone looking to minimise costs, exploring Layer 2 is no longer optional: it’s essential.

Popular Layer 2 Networks to Consider

Several Layer 2 networks have gained traction, each with its own trade-offs and ecosystems. Arbitrum and Optimism are optimistic rollups: they assume transactions are valid by default and only run computations if someone challenges them. Both offer fees a fraction of mainnet’s, alongside broad DApp support and relatively seamless bridging.

zkSync and StarkNet use zero-knowledge rollups, which bundle transactions with cryptographic proofs of validity. This approach can be even cheaper and faster, though the technology is still evolving and DApp adoption lags slightly behind optimistic rollups.

Polygon (formerly Matic) is technically a sidechain rather than a true Layer 2, but it offers similarly low fees and a rich ecosystem. It’s particularly popular for gaming and NFTs.

Each network requires bridging assets from Ethereum mainnet, a process that incurs a one-time gas fee. But once funds are on Layer 2, subsequent transactions are cheap enough to make the upfront cost worthwhile for active users.

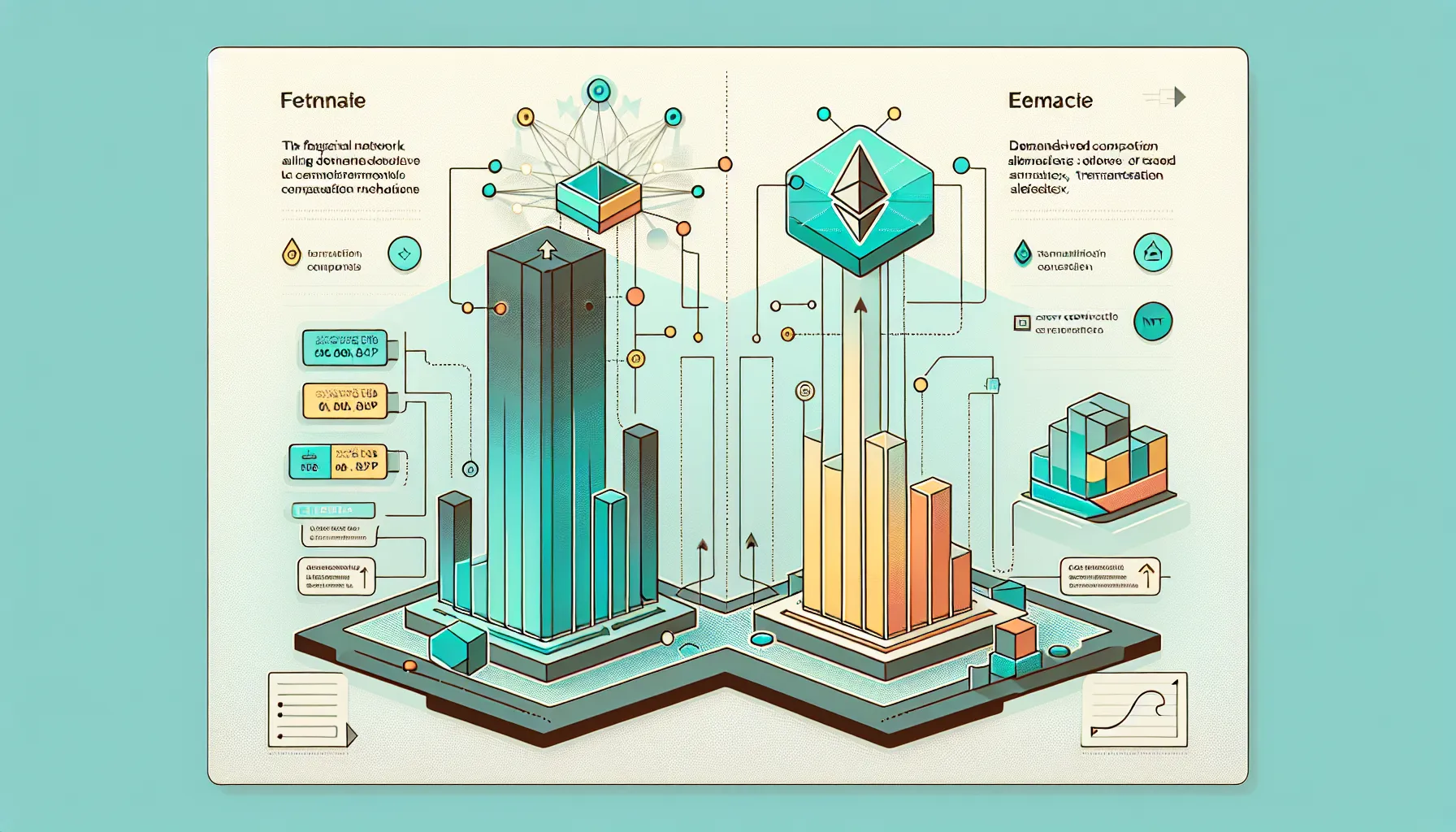

When to Use Layer 2 Over Mainnet

Choosing between mainnet and Layer 2 comes down to transaction size, frequency, and purpose. For large, one-off transfers, especially those involving significant sums or where maximum security is paramount, mainnet remains the safest bet. The higher fee is a reasonable trade-off for the assurance that comes with Ethereum’s base layer.

For routine activity, trading on a DEX, participating in a DAO vote, minting NFTs, or sending small payments, Layer 2 is almost always the better choice. The table below summarises the trade-offs:

| Mainnet (Layer 1) | Layer 2 |

|---|---|

| Higher fees, maximum security | Lower fees, slightly higher latency |

| Best for critical or large transfers | Best for routine or smaller transactions |

| Slower, more expensive | Faster, more economical |

As Layer 2 infrastructure improves and more protocols migrate or offer multi-chain support, the case for staying exclusively on mainnet weakens. Users who haven’t yet explored these networks are leaving savings on the table.

Additional Cost-Saving Strategies

Beyond timing, settings, and Layer 2, a handful of other tactics can further reduce gas expenses. These strategies won’t apply to every user or every transaction, but they’re worth keeping in mind, especially for those who interact with Ethereum regularly.

Batching Multiple Transactions

If someone needs to execute several operations, say, sending tokens to multiple recipients, or approving and then swapping tokens, doing them separately incurs a gas fee for each. Batching those operations into a single transaction can reduce the cumulative cost.

Some wallets and DApps support batching natively. For example, certain DeFi aggregators allow users to approve and swap in one go, rather than two separate steps. Similarly, multisend tools let users distribute tokens to dozens of addresses in a single transaction, paying one base fee instead of many.

Batching isn’t always possible, it depends on the DApp and the nature of the operations, but when it is, the savings can be significant. Even combining just two or three actions can cut costs by 30% or more.

Selecting Gas-Efficient Wallets and Platforms

Not all wallets and platforms are created equal when it comes to gas efficiency. Some wallets, MetaMask, Argent, and Rainbow, for instance, offer features like gas estimation, fee alerts, and integration with Layer 2 networks, making it easier to transact economically.

On the DApp side, certain platforms optimise their smart contracts to consume less gas. DEX aggregators like 1inch and Matcha scan multiple liquidity sources and routing paths to find not only the best price, but also the most gas-efficient route. Choosing these platforms over less-optimised alternatives can shave a noticeable amount off each trade.

It’s also worth noting that some wallets default to higher gas estimates to avoid failed transactions. While this is user-friendly, it can lead to overpayment. Advanced users may prefer wallets that allow granular control and manual overrides, giving them the flexibility to optimise further.

Conclusion

Ethereum gas fees can feel like an unpredictable tax on participation, but they don’t have to be. By understanding the mechanics behind fees, timing transactions thoughtfully, adjusting wallet settings, and embracing Layer 2 solutions, users can dramatically reduce what they pay, without sacrificing security or reliability.

The strategies outlined here aren’t mutually exclusive. In fact, they work best in combination: check a gas tracker to identify a low-fee window, set a custom gas limit to avoid overpaying, and consider bridging to a Layer 2 network for routine activity. Small adjustments compound into meaningful savings, especially over time.

As Ethereum continues to evolve and Layer 2 adoption grows, the landscape will keep shifting. But the principles remain the same: stay informed, be intentional about when and how transactions are executed, and leverage the tools and networks designed to make participation more affordable. With a bit of effort and awareness, avoiding overpayment becomes second nature.

Frequently Asked Questions

What are Ethereum gas fees and why do they fluctuate?

Ethereum gas fees are payments made in ETH to validators for processing transactions on the network. They fluctuate based on network demand, transaction complexity, and competition for limited block space, with prices rising during peak activity periods and dropping during quieter times.

How can I avoid overpaying for gas fees on Ethereum?

You can avoid overpaying by timing transactions during off-peak hours, using real-time gas tracking tools like Etherscan, setting custom gas limits, choosing slower transaction speeds for non-urgent operations, and leveraging Layer 2 networks like Arbitrum or Optimism for routine transactions.

When are the cheapest times to make Ethereum transactions?

Gas fees tend to be lowest during weekends and late-night hours in UTC, particularly around 2 AM UTC on Sunday mornings. Network activity drops when major regions like North America and Europe are offline, reducing demand and driving costs down significantly.

What are Layer 2 solutions and should I use them?

Layer 2 solutions are networks built atop Ethereum that process transactions off-chain before settling batches to mainnet. They offer drastically lower fees, often just pence per transaction, making them ideal for routine activities like trading, NFT minting, and small payments.

Can a transaction fail if I set the gas limit too low?

Yes, setting the gas limit too low causes transactions to fail mid-execution, and the gas spent up to that point is lost. It’s important to estimate limits carefully, using 21,000 gas for basic ETH transfers and consulting documentation for smart contract interactions.

What is the difference between gas price and gas limit?

The gas limit is the maximum amount of computational work you’re willing to pay for, whilst the gas price (measured in gwei) determines how much you’ll pay per unit of gas. Together, they calculate your total transaction fee on Ethereum.