Buying cryptocurrency for the first time should be exciting, not financially draining. Yet many newcomers to the crypto world lose more money than they realise, not from market volatility, but from fees they didn’t know existed. Hidden charges, confusing fee structures, and opaque pricing can quickly erode the value of an initial investment before a single coin is even held in a wallet.

Understanding where these costs lurk and how to avoid them is crucial for anyone entering the crypto market. From trading fees and withdrawal charges to spread markups and conversion costs, exchanges have multiple ways to monetise transactions. For first-time buyers unfamiliar with the terrain, these fees can add up to surprising amounts, sometimes exceeding 2% or more per transaction.

The good news? With a bit of knowledge and strategic planning, it’s entirely possible to minimise or sidestep many of these costs. This guide walks through the most common types of crypto exchange fees, how to compare platforms effectively, and practical strategies to keep more money in the investment rather than in the exchange’s coffers.

Key Takeaways

- Hidden exchange fees can erode over 2% of your initial crypto investment through trading charges, spread markups, and conversion costs that first-time buyers often overlook.

- Using limit orders instead of market orders reduces trading fees significantly, as maker fees are typically 0.1–0.3% lower than taker fees on most exchanges.

- Depositing funds via bank transfer rather than debit or credit card can save 2–4% in fees, making it the most cost-effective payment method for first-time crypto buyers.

- Comparing fee schedules across multiple exchanges before purchasing reveals total transaction costs, helping buyers avoid platforms with opaque pricing and excessive withdrawal charges.

- Timing crypto withdrawals during off-peak hours, such as weekends or late evenings, can reduce blockchain network fees from £10 to £3 or less.

- Regulatory transparency matters—FCA-registered exchanges in the UK are more likely to disclose fees clearly and adhere to accountability standards that protect buyers from hidden costs.

Understanding the Common Types of Crypto Exchange Fees

Before anyone can avoid hidden fees, they need to know what they’re looking for. Crypto exchanges employ several fee structures, some transparent and others less so. Recognising these different charges is the first step towards making informed decisions.

Trading Fees and Maker-Taker Models

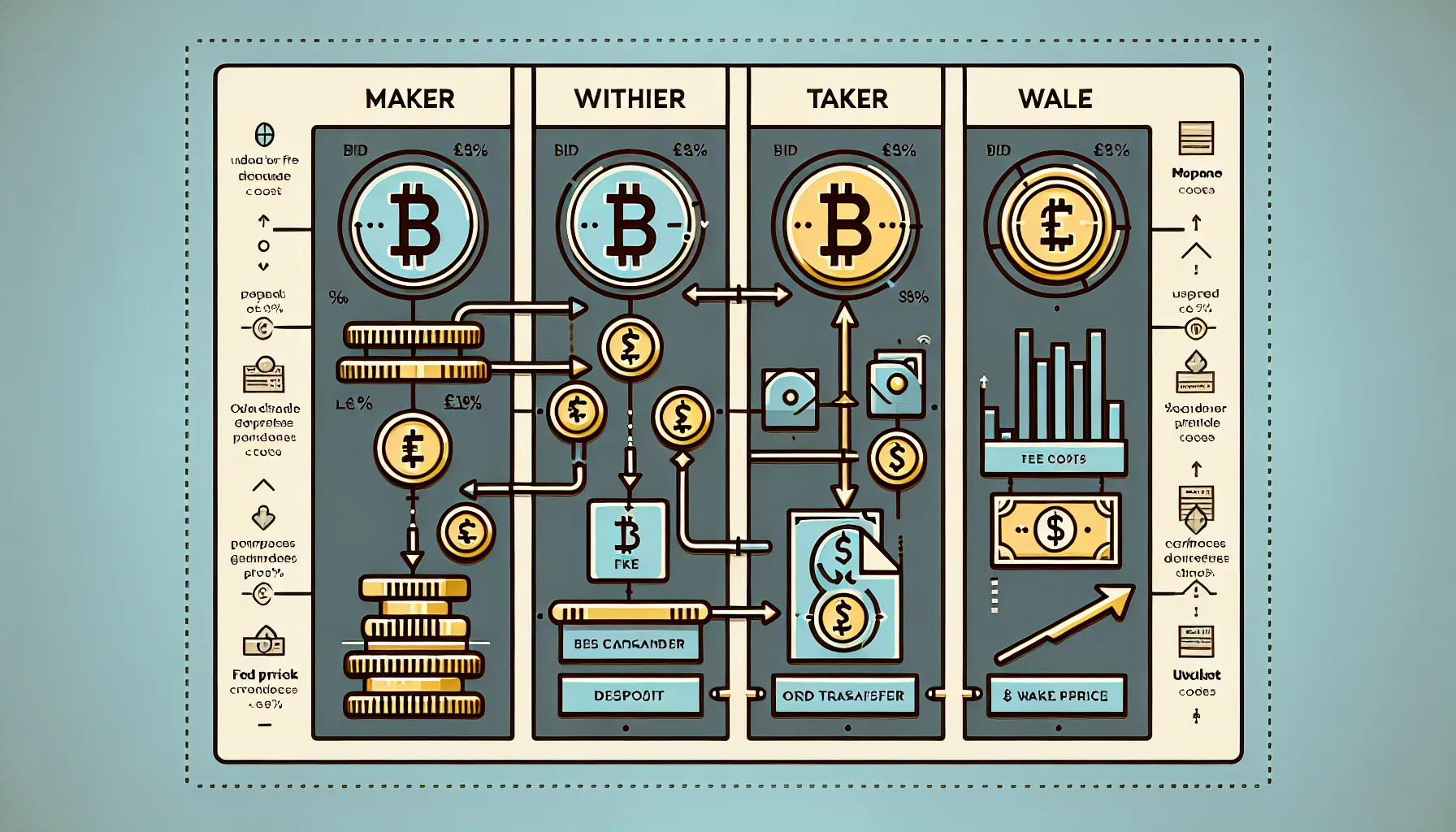

Trading fees are the most visible charges on most platforms, applied each time a user buys or sells cryptocurrency. The majority of exchanges use what’s called a maker-taker model to determine how much they charge.

In this system, ‘makers’ are traders who place limit orders that add liquidity to the order book, essentially, they’re offering to buy or sell at a specific price and waiting for someone to match it. ‘Takers’, on the other hand, execute market orders that immediately match existing orders, removing liquidity from the market. Because makers help build the market, exchanges typically reward them with lower fees, whilst takers pay slightly more.

Fees under this model can vary dramatically. Some exchanges charge as little as 0.12% per trade for high-volume users or those holding native tokens, whilst others levy fees exceeding 2%, particularly for small transactions or users on basic plans. The difference might seem minor on a single purchase, but over multiple trades or larger amounts, it compounds significantly.

For a first-time buyer making a £500 purchase, the difference between a 0.25% fee (£1.25) and a 1.5% fee (£7.50) is immediately noticeable. Factor in multiple transactions over months, and the gap widens further.

Deposit and Withdrawal Fees

Getting money onto an exchange and moving cryptocurrency off it can also incur charges, and these vary widely depending on the platform and payment method chosen.

Many exchanges offer free deposits via bank transfer or certain payment methods, making it cost-effective to fund an account initially. But, using a debit or credit card often attracts additional fees, sometimes as much as 3-4% of the deposit amount. This can represent a substantial hidden cost for buyers who don’t compare payment options beforehand.

Withdrawal fees are where things get trickier. Moving cryptocurrency from an exchange to a personal wallet usually involves paying network fees (the cost of processing the transaction on the blockchain) plus potential platform fees. Some exchanges pass on network fees at cost, whilst others mark them up or charge flat fees that can be disproportionately high for smaller withdrawals.

For example, withdrawing Bitcoin might cost a fixed fee of £15 on one platform and £5 on another, even though the underlying network fee is the same. For someone withdrawing a modest amount, this difference can eat into the investment significantly.

Spread Markups and Hidden Conversion Costs

Perhaps the least transparent fees are spread markups and currency conversion charges. These don’t appear as line items on a receipt but are baked into the price itself.

The spread is the difference between the price at which an exchange will sell cryptocurrency (the ‘ask’ price) and the price at which it will buy it back (the ‘bid’ price). A wider spread means the exchange is effectively charging more, even if the advertised trading fee looks competitive.

Some platforms with seemingly low or zero trading fees compensate by widening the spread. A buyer might see a Bitcoin price that’s 1-2% higher than the market rate on other exchanges, which functions as a hidden fee. Over time or on larger purchases, this adds up considerably.

Currency conversion fees are another hidden cost. If a user deposits funds in one currency (say, pounds) but the exchange operates primarily in another (like US dollars or euros), conversion fees may apply. These are often not disclosed upfront and can range from 0.5% to 2% or more, depending on the platform and payment provider.

How to Compare Fee Structures Before Choosing an Exchange

Choosing the right exchange isn’t just about user interface or coin selection, fee structures should be a primary consideration. Taking time to compare platforms can save significant amounts over the long term.

Reading the Fee Schedule Thoroughly

Every reputable exchange publishes a fee schedule, typically found in the help centre or footer of the website. But, not all fee schedules are created equal. Some are clear and comprehensive, whilst others bury critical details in footnotes or separate pages.

A thorough fee schedule should include:

- Trading fees, broken down by maker and taker rates

- Any volume-based discounts or tiered pricing

- Deposit fees for all supported payment methods (bank transfer, card, etc.)

- Withdrawal fees for each cryptocurrency and fiat currency

- Spread or exchange rate markup policies

- Any inactivity, account maintenance, or subscription fees

If an exchange doesn’t provide this information clearly and accessibly, it’s a warning sign. Transparency matters, and platforms that hide or obscure their fee structures are more likely to surprise users with unexpected charges.

First-time buyers should make a habit of reviewing fee schedules for at least three to five exchanges before committing. This comparative approach quickly reveals which platforms offer competitive pricing and which rely on hidden costs.

Calculating Total Transaction Costs

Understanding individual fees is useful, but the real measure of cost-effectiveness is the total expense of a complete transaction, from depositing funds to buying crypto and eventually withdrawing it.

To calculate this, consider a hypothetical scenario: depositing £500 via bank transfer, buying Bitcoin, and then withdrawing it to a personal wallet.

- Deposit fee: Some exchanges charge nothing: others might charge 1-2% for card payments.

- Trading fee: A 0.5% maker fee on £500 equals £2.50: a 1.5% taker fee equals £7.50.

- Withdrawal fee: Might be a flat £5 or a percentage, depending on the platform and cryptocurrency.

Adding these together gives a realistic picture of what the transaction actually costs. On one exchange, the total might be £7.50. On another, it could easily exceed £20.

Using example trades like this across multiple platforms helps first-time buyers identify the best value. It’s also worth considering future transactions, if someone plans to buy regularly, even small percentage differences accumulate over time.

Many exchanges also offer calculators or preview screens that show estimated fees before confirming a trade. These tools are invaluable for avoiding surprises and should always be consulted before proceeding.

Strategies to Minimise Fees When Buying Cryptocurrency

Once a buyer understands the fee landscape and has compared platforms, the next step is adopting strategies that actively reduce costs. Small adjustments to how and when purchases are made can lead to meaningful savings.

Using Limit Orders Instead of Market Orders

One of the simplest ways to cut trading fees is to use limit orders rather than market orders. As mentioned earlier, makers (those placing limit orders) typically enjoy lower fees than takers (those executing market orders immediately).

A limit order lets a buyer specify the exact price they’re willing to pay. The trade only executes if the market reaches that price. Whilst this requires a bit more patience, the fee savings can be substantial, often 0.1% to 0.3% lower per transaction.

For a first-time buyer, this might mean setting a limit order slightly below the current market price and waiting a few minutes or hours for it to fill. In stable or declining markets, this approach not only saves on fees but can also result in a better purchase price.

Market orders, whilst convenient, should generally be reserved for situations where speed is essential. For most routine purchases, the fee penalty isn’t worth the immediacy.

Choosing the Right Payment Method

Payment method selection has a surprisingly large impact on overall costs. Bank transfers (such as Faster Payments or SEPA in Europe) are almost always the cheapest option, with many exchanges offering zero or minimal fees for these deposits.

Debit and credit cards, whilst faster and more convenient, often come with additional charges, sometimes 2-4% of the deposit amount. Payment processors and card networks levy their own fees, which exchanges pass on to users. For a £500 deposit, this could mean an extra £10-£20 in costs.

Some platforms also support alternative payment methods like e-wallets or direct bank connections (open banking). These can sometimes split the difference, offering faster processing than traditional transfers without the steep fees of cards.

First-time buyers should prioritise bank transfers wherever possible, planning ahead to account for any processing delays (usually a few hours to a day). The savings are well worth the minor inconvenience.

Timing Your Purchases to Reduce Network Fees

Blockchain network fees fluctuate based on congestion. When many people are transacting simultaneously, fees rise as users compete to have their transactions processed quickly. Conversely, during quieter periods, fees drop.

Whilst buyers can’t control when they deposit or trade on an exchange (those are internal operations), they can time their withdrawals to avoid peak congestion. Network fees for Bitcoin and Ethereum, for example, tend to be lower during weekends or late evenings (UK time), when fewer people are transacting.

Several online tools and websites track real-time network fee estimates, allowing users to choose optimal moments for withdrawing crypto to personal wallets. Waiting a few hours for fees to drop from £10 to £3 can make a noticeable difference, especially for smaller transactions.

This strategy requires a bit of monitoring but becomes second nature with experience. For first-time buyers making their initial withdrawal, it’s worth checking network conditions beforehand to avoid unnecessarily high costs.

Red Flags That Indicate Excessive or Hidden Fees

Not all exchanges are created equal, and some actively obscure their fee structures to extract more money from users. Recognising warning signs can help first-time buyers avoid platforms that prioritise profit over transparency.

One of the most glaring red flags is the absence of a clear, publicly accessible fee schedule. If an exchange requires users to sign up or contact support to learn about fees, it’s a strong indication that costs are either high or inconsistent. Reputable platforms publish detailed fee information upfront.

Another warning sign is an unusually large spread between buy and sell prices. If the price to buy Bitcoin is significantly higher than the market rate on other exchanges, say, 2% or more, the platform is likely inflating prices to compensate for low advertised trading fees. This is a hidden cost that can be just as damaging as a direct fee.

Mandatory fees that aren’t disclosed during account setup are also problematic. Some exchanges charge inactivity fees if an account isn’t used for a certain period, or levy monthly subscription fees for access to basic features. These should be clearly stated before a user commits to the platform.

Withdrawal fees that seem disproportionately high compared to competitors are another red flag. Whilst network fees vary, platform markups should be reasonable. If one exchange charges £20 to withdraw Bitcoin whilst others charge £5, the first platform is likely adding excessive fees.

Finally, a lack of regulatory oversight or unclear company information is a broader concern. In the UK, for example, crypto exchanges must be registered with the Financial Conduct Authority (FCA) for anti-money laundering purposes. Platforms that aren’t registered or don’t disclose their regulatory status may not adhere to transparency standards, increasing the risk of hidden fees and other issues.

Questions to Ask Before Making Your First Purchase

Armed with knowledge about fees and red flags, first-time buyers should approach their first transaction with a clear checklist of questions. Asking these before committing to an exchange can prevent costly mistakes and ensure a seamless process.

What are the exchange’s maker and taker fees? This is fundamental. Knowing the exact percentages and how they apply based on order type allows buyers to estimate costs accurately and choose the most economical trading method.

Are there deposit or withdrawal fees for my preferred payment method? Not all payment methods are treated equally. Confirming costs upfront prevents surprises when funding an account or moving crypto to a wallet.

Is there a markup on the crypto price (spread)? Some platforms advertise zero trading fees but inflate the purchase price. Comparing the displayed price to real-time market rates on other exchanges or aggregators reveals whether a spread markup is in play.

How are network fees calculated, and are they passed on at cost or marked up? Understanding whether an exchange charges network fees transparently or adds a platform fee on top is essential for budgeting withdrawals.

Is the platform FCA-registered and transparent about risks? Regulatory registration provides a baseline level of accountability. FCA registration doesn’t guarantee low fees, but it does indicate the platform meets certain standards for transparency and compliance. Also, reputable exchanges clearly communicate the risks of crypto investing, including volatility and the potential for loss.

Asking these questions, either through the platform’s help centre, fee schedule, or customer support, ensures a buyer is fully informed before making their first purchase. It also helps identify exchanges that prioritise transparency and customer value over hidden charges.

Conclusion

Hidden fees are one of the most overlooked pitfalls for first-time crypto buyers, but they’re entirely avoidable with the right approach. By understanding the common types of charges, trading fees, deposit and withdrawal costs, spread markups, and conversion fees, buyers can enter the market with eyes wide open.

Comparing exchanges methodically, reading fee schedules in detail, and calculating total transaction costs provide a clear picture of where money is actually going. Adopting practical strategies like using limit orders, choosing cost-effective payment methods, and timing withdrawals during low-congestion periods further reduces expenses.

Recognising red flags such as opaque fee structures, excessive spreads, and undisclosed charges helps buyers steer clear of platforms that prioritise profit over transparency. And asking the right questions before making a first purchase ensures that no unpleasant surprises await.

Eventually, avoiding hidden exchange fees isn’t about finding a perfect platform with zero costs, such a thing doesn’t exist. It’s about making informed decisions, comparing options, and staying vigilant. With diligent research and a strategic mindset, first-time buyers can keep more of their money invested in cryptocurrency and less of it lining the pockets of exchanges. That’s a foundation worth building on.

Frequently Asked Questions

What are the most common hidden exchange fees when buying cryptocurrency for the first time?

The most common hidden fees include spread markups (inflated buy/sell prices), currency conversion charges, card payment fees (often 3–4%), and excessive withdrawal fees. These costs aren’t always disclosed upfront and can add 2% or more to your transaction.

How can I avoid high fees when buying crypto as a beginner?

Use bank transfers instead of cards for deposits, place limit orders rather than market orders to benefit from lower maker fees, compare fee schedules across multiple exchanges, and time withdrawals during low network congestion periods to minimise costs.

What is the difference between maker and taker fees on crypto exchanges?

Makers place limit orders that add liquidity to the order book and typically pay lower fees. Takers execute market orders that immediately match existing orders, removing liquidity, and usually pay higher fees. The difference can be 0.1–0.3% per transaction.

Are crypto exchanges in the UK regulated?

Yes, crypto exchanges operating in the UK must register with the Financial Conduct Authority (FCA) for anti-money laundering purposes. Whilst FCA registration doesn’t guarantee low fees, it indicates the platform meets transparency and compliance standards.

Why do some crypto exchanges show different Bitcoin prices?

Price differences often result from spread markups, where exchanges inflate the buying price and deflate the selling price to generate revenue. Some platforms with ‘zero fees’ compensate through wider spreads, effectively creating hidden charges of 1–2% or more.

Can I get charged fees for not using my crypto exchange account?

Yes, some exchanges charge inactivity fees if your account remains unused for a certain period, or levy monthly subscription fees for basic features. Always check the fee schedule for these charges before signing up to avoid unexpected costs.