If you’ve ever sent money through traditional banking, you’re familiar with waiting days for clearance, dealing with hefty fees, and navigating a labyrinth of middlemen. Cryptocurrencies promised a better way,but even Bitcoin, the pioneer, can be slow and expensive for everyday transactions. Enter Litecoin, often dubbed the “silver to Bitcoin’s gold.” Created in 2011 by former Google engineer Charlie Lee, Litecoin was designed from the ground up to be faster, cheaper, and more practical for daily use.

But how do Litecoin transactions actually work? What happens when someone hits “send” in their wallet? And what makes this cryptocurrency different from the others flooding the market? In this guide, readers will get a clear, jargon-free breakdown of how Litecoin moves value across the internet,from the basics of wallet addresses and private keys to the miners who verify each transaction. Whether someone is considering their first crypto purchase or just curious about blockchain mechanics, understanding Litecoin’s transaction process reveals why this digital currency has maintained relevance for over a decade.

Key Takeaways

- Litecoin transactions process approximately four times faster than Bitcoin, with an average confirmation time of just 2.5 minutes, making them ideal for everyday payments.

- Transaction fees on Litecoin remain consistently low—often just fractions of a cent—because fees are based on data size rather than transaction value.

- How Litecoin transactions work involves wallet addresses for receiving, private keys for authorizing spending, and miners who verify transactions using the Scrypt hashing algorithm.

- Once confirmed, Litecoin transactions become effectively irreversible due to proof-of-work consensus, which makes altering the blockchain astronomically expensive.

- Litecoin’s input-output structure creates a transparent chain of ownership where every coin can be traced back through the blockchain to its origin.

- Understanding how Litecoin transactions work reveals why this cryptocurrency has maintained practical relevance for over a decade as a medium of exchange.

What Is Litecoin and Why Does It Matter?

Litecoin (LTC) is a decentralized, peer-to-peer cryptocurrency,essentially, digital money that operates without banks, governments, or payment processors acting as gatekeepers. Launched in October 2011, it was one of the earliest cryptocurrencies to spin off from Bitcoin’s codebase, but with deliberate improvements aimed at making it more practical for real-world transactions.

Charlie Lee, Litecoin’s creator, envisioned a cryptocurrency that could handle the kind of small, frequent payments people make every day,buying coffee, splitting a dinner bill, paying for online services. Bitcoin was proving too slow and expensive for that. Litecoin addressed those pain points by processing transactions roughly four times faster than Bitcoin and maintaining consistently lower fees.

Today, Litecoin matters because it occupies a sweet spot in the cryptocurrency ecosystem. It’s established enough to be widely supported by exchanges and payment processors, yet nimble enough to serve as an actual medium of exchange rather than just a store of value. For anyone learning about cryptocurrency, Litecoin offers a practical case study in how blockchain-based transactions work without the complexity or cost barriers associated with some other networks.

The Basic Components of a Litecoin Transaction

Before diving into the mechanics of how transactions flow through the network, it helps to understand the essential building blocks. Every Litecoin transaction relies on three core components: wallet addresses, private keys, and the inputs and outputs that define where coins come from and where they’re going.

Wallet Addresses and Keys

Think of a Litecoin wallet address as a public mailbox,anyone can send coins to it, and the address itself is safe to share openly. These addresses are long strings of letters and numbers (often starting with an “L” or “M” for Litecoin) that identify where coins should be delivered.

But having a mailbox isn’t enough. To actually access and spend the coins inside, someone needs the corresponding private key,a secret cryptographic code that proves ownership. If the wallet address is the mailbox, the private key is the key that unlocks it. Lose the private key, and those coins are locked away forever. Share it with someone else, and they can take everything. This asymmetric key system is the foundation of cryptocurrency security: public addresses for receiving, private keys for authorizing spending.

Transaction Inputs and Outputs

When someone sends Litecoin, they’re not transferring a single, indivisible coin. Instead, transactions reference previous transactions where the sender received coins,these are called inputs. An input is essentially a pointer saying, “I’m spending coins that were sent to me in transaction X.”

Outputs, meanwhile, specify where those coins should go next. Each output includes a recipient’s wallet address and the amount they’re receiving. If someone receives 10 LTC in one transaction and wants to send 3 LTC to a friend, the transaction will have one input (the original 10 LTC) and two outputs: 3 LTC to the friend and 7 LTC back to the sender’s own wallet as change.

This input-output structure creates a transparent chain of ownership. Every Litecoin can be traced back through the blockchain to where it was first mined, forming an unbroken record of transactions that makes the system both transparent and tamper-resistant.

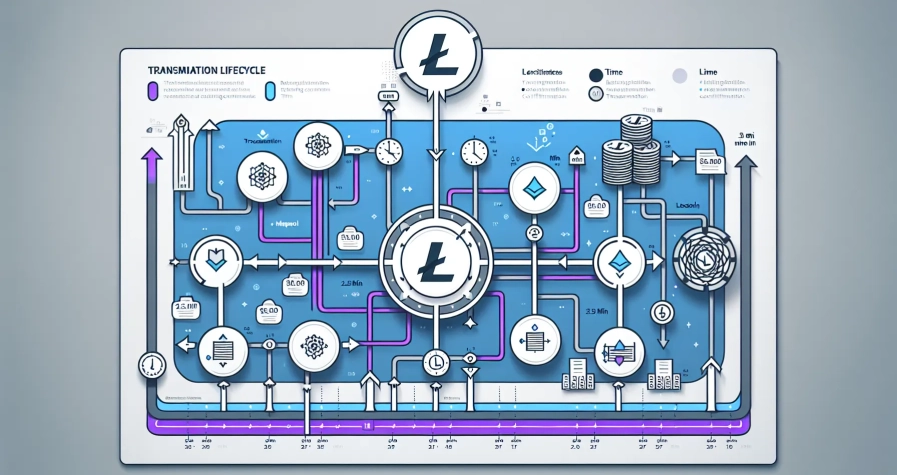

Step-by-Step: How a Litecoin Transaction Happens

When someone sends Litecoin, several things happen behind the scenes. The process might take just a few minutes, but each step involves sophisticated cryptography and network coordination. Here’s how it unfolds from start to finish.

Initiating the Transaction

Everything begins when the sender opens their Litecoin wallet software and enters the recipient’s address along with the amount to send. Once they confirm, the wallet software constructs a transaction message that includes the inputs (where the coins are coming from), the outputs (where they’re going), and the transaction amount.

Crucially, the wallet uses the sender’s private key to create a digital signature,a cryptographic proof that they actually control the coins being spent. This signature is unique to this specific transaction and can’t be copied or reused. It’s the equivalent of signing a check, but mathematically unbreakable. Without the private key, no one can create a valid signature, which is why safeguarding that key is paramount.

Broadcasting to the Network

Once signed, the transaction isn’t sent directly to the recipient. Instead, it’s broadcast to the entire Litecoin network,a sprawling collection of nodes (computers running Litecoin software) scattered around the world. Each node receives the transaction and performs preliminary checks: Does the signature match? Do the inputs actually exist? Has this coin already been spent elsewhere?

If everything checks out, nodes relay the transaction to their peers, spreading it across the network within seconds. At this point, the transaction sits in what’s called the mempool,a waiting area of unconfirmed transactions that miners will soon process.

Verification by Miners

Miners are the workhorses of the Litecoin network. These participants collect pending transactions from the mempool and bundle them into a candidate block,a package of transactions waiting to be added to the blockchain.

To add their block to the chain, miners must solve a complex cryptographic puzzle using Litecoin’s Scrypt hashing algorithm. This algorithm requires significant computational effort, making it difficult and resource-intensive to find a valid solution. The first miner to solve the puzzle gets to add their block to the blockchain and receives a reward in newly minted Litecoin plus any transaction fees from the included transactions.

Scrypt was specifically chosen over Bitcoin’s SHA-256 algorithm to make mining more accessible and harder to dominate with specialized hardware. This design choice reflects Litecoin’s emphasis on decentralization and broader participation.

Confirmation and Block Addition

Once a miner successfully solves the puzzle, the new block is broadcast to the network. Other nodes verify the solution, check all the transactions inside, and add the block to their copy of the blockchain. The transaction is now confirmed,it’s permanently recorded in Litecoin’s public ledger.

Most exchanges and merchants consider a transaction secure after one confirmation, though some wait for several blocks (multiple confirmations) to be absolutely certain. Each subsequent block makes the transaction exponentially harder to reverse or tamper with, cementing it into the blockchain’s history.

From the moment someone hits “send” to full confirmation typically takes about 2.5 minutes,the average time it takes for Litecoin to generate a new block.

What Makes Litecoin Transactions Different from Bitcoin?

Litecoin and Bitcoin share a common ancestor,Litecoin was forked from Bitcoin’s codebase,but Charlie Lee made several key adjustments that fundamentally change the user experience.

The most immediately noticeable difference is speed. Bitcoin generates a new block roughly every 10 minutes, meaning a transaction might wait that long before its first confirmation. Litecoin, by contrast, produces blocks every 2.5 minutes. That four-fold speed increase makes Litecoin far more practical for point-of-sale transactions or any situation where waiting 10-plus minutes isn’t acceptable.

Fees tell a similar story. Bitcoin’s network can become congested during high-demand periods, driving transaction fees into the double digits,sometimes $10, $20, or more. Litecoin’s fees remain consistently low, often just a few cents regardless of network activity. This makes Litecoin viable for small payments where Bitcoin’s fees would exceed the transaction value itself.

Under the hood, the mining algorithm differs too. Bitcoin uses SHA-256, which led to the development of specialized ASIC miners,expensive, purpose-built machines that dominate the mining landscape. Litecoin’s Scrypt algorithm was designed to be more memory-intensive, initially favoring GPU mining and making it harder for any single entity to monopolize the network. While Scrypt ASICs do exist now, the barrier to entry remains lower than Bitcoin’s.

These differences don’t make one cryptocurrency “better” than the other,they serve different purposes. Bitcoin has positioned itself as digital gold, a store of value. Litecoin aims to be digital silver, a practical medium of exchange for everyday transactions.

Transaction Fees and How They’re Calculated

Litecoin transaction fees are typically measured in fractions of a cent,a stark contrast to many other cryptocurrencies. But how are these fees determined, and why are they necessary at all?

Unlike credit card fees that take a percentage of the transaction value, Litecoin fees are based on the size of the transaction data measured in bytes. A transaction that consolidates multiple inputs or sends to many outputs requires more data, and hence incurs a slightly higher fee. The actual amount being sent,whether it’s 1 LTC or 1,000 LTC,doesn’t directly affect the fee.

These fees serve two purposes. First, they compensate miners for the computational resources spent verifying transactions and maintaining the blockchain. Second, they act as a spam prevention mechanism,requiring even a tiny fee makes it prohibitively expensive to flood the network with junk transactions.

Most Litecoin wallet software automatically calculates an appropriate fee based on current network conditions. During normal operations, this fee is often less than a cent. Users can manually adjust fees if they want faster confirmation (higher fee) or don’t mind waiting a bit longer (lower fee), though the difference is usually negligible given Litecoin’s already-fast block times.

The predictability and affordability of Litecoin’s fees are among its strongest selling points for real-world use. No one wants to pay $5 to send $10, but a fraction of a cent? That’s the kind of fee structure that makes digital payments practical.

How Long Do Litecoin Transactions Take?

Speed is one of Litecoin’s defining characteristics. On average, a transaction receives its first confirmation in about 2.5 minutes,the time it takes for a new block to be mined and added to the blockchain.

For most purposes, one confirmation is sufficient. Someone buying a coffee or paying for an online service will see their transaction clear in roughly the same time it takes to make small talk with a barista. That’s a dramatic improvement over Bitcoin’s 10-minute average and light-years ahead of traditional bank transfers that can take days.

For larger transactions or situations requiring extra security, recipients might wait for multiple confirmations. Three confirmations (about 7.5 minutes) provide strong assurance that the transaction is permanent. Six confirmations (around 15 minutes) are considered extremely secure, even for high-value transfers.

Several factors can affect transaction speed. Network congestion, though rare on Litecoin, can delay confirmation times slightly. The fee attached to a transaction also matters,miners prioritize transactions with higher fees when assembling blocks. But, given Litecoin’s consistently low network load and fast block generation, these variables have minimal impact compared to other cryptocurrencies.

In practical terms, Litecoin transactions occupy a sweet spot: fast enough for everyday use, yet secure enough to trust. That balance is precisely what Charlie Lee aimed for when designing the system over a decade ago.

Security and Irreversibility of Litecoin Transactions

Once a Litecoin transaction is confirmed and added to a block, it becomes effectively irreversible. There’s no “undo” button, no customer service department to call for a refund. This permanence is both a feature and a responsibility.

The security underlying this irreversibility comes from Litecoin’s proof-of-work consensus mechanism. Miners compete to solve cryptographic puzzles, and the computational effort required to do so makes it astronomically expensive to alter past transactions. To reverse a confirmed transaction, an attacker would need to control more than 50% of the network’s total mining power,a feat that becomes more prohibitively expensive with each passing block.

Each new block added to the chain further cements previous transactions. After just a few confirmations, the computational work required to rewrite history exceeds the resources of even well-funded adversaries. This is why exchanges and merchants feel comfortable accepting Litecoin payments after just a handful of confirmations.

The decentralized nature of the blockchain adds another layer of security. There’s no central database to hack, no single point of failure. The blockchain is replicated across thousands of nodes worldwide, each independently verifying transactions and maintaining their own copy of the ledger. Compromising one node,or even many nodes,doesn’t threaten the integrity of the network as a whole.

Of course, this security model places responsibility squarely on users. Since transactions can’t be reversed, sending Litecoin to the wrong address means those coins are gone. There’s no bank to file a dispute with, no fraud protection built into the system. Users must double-check recipient addresses, safeguard their private keys, and understand that with great decentralization comes great personal accountability.

For those who value financial sovereignty and censorship resistance, this trade-off is worth it. Litecoin’s security guarantees that no government, corporation, or intermediary can freeze accounts or reverse legitimate transactions,a level of autonomy traditional payment systems simply can’t offer.

Conclusion

Litecoin transactions aren’t magic,they’re the result of clever cryptography, distributed consensus, and a network of miners working around the clock to maintain a shared ledger. From the moment someone initiates a transaction with their private key to the final confirmation on the blockchain, every step is designed to be fast, affordable, and secure.

What sets Litecoin apart is its pragmatic approach. Faster block times, lower fees, and a proven track record make it more than just another Bitcoin clone. It’s a cryptocurrency purpose-built for the transactions people actually want to make,quick, cheap, and reliable.

Understanding how Litecoin transactions work demystifies the technology and highlights why this decade-old cryptocurrency continues to matter. In a space crowded with thousands of competitors, Litecoin’s straightforward, effective design keeps it relevant. Whether someone is sending their first cryptocurrency or they’re a veteran looking for a practical payment solution, knowing what happens behind the scenes builds confidence in the technology,and shows why peer-to-peer digital money isn’t just a theoretical concept, but a working reality.

Frequently Asked Questions

How long does a Litecoin transaction take to confirm?

A Litecoin transaction typically receives its first confirmation in about 2.5 minutes, which is the average block generation time. For higher security on larger transactions, most users wait for 3-6 confirmations, taking approximately 7.5 to 15 minutes total.

What makes Litecoin transactions faster than Bitcoin?

Litecoin generates new blocks every 2.5 minutes compared to Bitcoin’s 10-minute average, making it four times faster. This speed improvement, combined with consistently lower fees, makes Litecoin more practical for everyday transactions like purchases and payments.

How much does it cost to send a Litecoin transaction?

Litecoin transaction fees are typically just a few cents, often less than one cent. Unlike credit cards, fees are based on transaction data size in bytes rather than the amount sent, making Litecoin ideal for small, frequent payments.

Can you reverse a Litecoin transaction after it’s confirmed?

No, Litecoin transactions are irreversible once confirmed on the blockchain. The proof-of-work consensus mechanism makes it computationally impossible to alter past transactions, which is why users must carefully verify recipient addresses before sending.

What is the Scrypt algorithm used in Litecoin mining?

Scrypt is Litecoin’s memory-intensive hashing algorithm that miners use to verify transactions and add blocks to the blockchain. It was chosen over Bitcoin’s SHA-256 to make mining more accessible and prevent specialized hardware from dominating the network.

Do I need special software to send Litecoin?

You need a Litecoin wallet application that stores your private keys and wallet addresses. The wallet software handles transaction creation, digital signatures, and broadcasting to the network. Many options exist including desktop, mobile, and hardware wallets.