The blockchain world has evolved far beyond Bitcoin and Ethereum operating in isolation. Today, hundreds of distinct blockchains host thousands of tokens, each with unique features and ecosystems. But what happens when a user wants to swap Bitcoin for an Ethereum-based token, or move assets from Solana to Binance Smart Chain? Traditionally, this meant relying on centralised exchanges, handing over control of funds to a third party, creating accounts, and navigating withdrawal limits. Enter cross-chain swaps: a mechanism that allows users to exchange tokens directly across different blockchain networks, bypassing intermediaries and unlocking a more flexible, secure crypto experience. As the crypto ecosystem fragments and diversifies, understanding how cross-chain swaps work, and how to use them safely, has become essential for anyone serious about navigating digital assets.

Key Takeaways

- Cross-chain swaps enable users to exchange tokens across different blockchains without centralised intermediaries, maintaining control of private keys throughout the process.

- Atomic swaps use hash time-locked contracts (HTLCs) to ensure trustless, all-or-nothing exchanges, eliminating counterparty risk entirely.

- Bridge protocols and wrapped tokens offer accessible cross-chain swaps but introduce security risks, with several high-profile bridge hacks highlighting the importance of using audited platforms.

- Cross-chain aggregators scan multiple DEXs and bridges to find optimal routes, making token exchanges across blockchains simple whilst preserving decentralisation benefits.

- Always verify contract addresses, start with small test transactions, and choose reputable platforms with proven security records to safely navigate cross-chain swaps.

- Transaction fees and speeds vary significantly depending on network congestion and swap method, with users needing to balance cost, security, and settlement time based on their priorities.

What Are Cross-Chain Swaps?

At their core, cross-chain swaps are methods for exchanging cryptocurrencies between different blockchain networks without requiring a centralised intermediary. Imagine swapping Bitcoin (BTC) for Ether (ETH) directly, two assets that live on entirely separate blockchains, without creating an account on Coinbase or Binance. That’s the promise of cross-chain swaps.

Unlike traditional exchanges where users deposit funds, place orders, and wait for matches, cross-chain swaps help peer-to-peer or protocol-mediated exchanges. The key innovation is the ability to move value across chains that don’t natively communicate with each other. Blockchains are, by design, isolated systems with their own consensus rules, smart contract languages, and transaction formats. Cross-chain swaps bridge this divide using cryptographic protocols, smart contracts, and sometimes intermediary assets.

The result? Users retain control of their private keys and assets throughout the process, accessing liquidity and trading opportunities across multiple chains without surrendering custody. For traders, investors, and developers, this represents a fundamental shift in how digital assets can be managed and exchanged.

Why Cross-Chain Swaps Matter in Today’s Crypto Ecosystem

Interoperability is one of the biggest challenges facing blockchain technology. Each blockchain operates as its own walled garden, with native tokens, dApps, and user communities. As the number of chains multiplies, Ethereum, Solana, Avalanche, Polkadot, Cosmos, and dozens more, users face increasing friction when trying to move value or access opportunities across these networks.

Cross-chain swaps address this fragmentation head-on. They allow users to trade assets and tap into liquidity pools on blockchains they might not even have wallets for, all without leaving the decentralised ecosystem. This is crucial as DeFi protocols, NFT marketplaces, and Web3 applications spread across multiple chains. A user staking on Ethereum might want to participate in a yield farm on Polygon, or someone holding Solana tokens might need to swap into Bitcoin. Without cross-chain swaps, every such move would require a centralised exchange, adding cost, time, and counterparty risk.

Beyond convenience, cross-chain swaps promote a freer, more dynamic crypto market. Liquidity isn’t trapped on a single chain: it flows where demand is highest. Users can respond quickly to price differences, new project launches, or shifting market conditions. In essence, cross-chain swaps unlock the full potential of a multi-chain future, making the crypto ecosystem more resilient and interconnected.

How Cross-Chain Swaps Work: The Technology Behind Token Exchanges

Understanding cross-chain swaps requires a peek under the bonnet at the cryptographic and protocol-level mechanisms that make them possible. At a high level, cross-chain swaps rely on smart contracts and cryptographic protocols to coordinate token exchanges across blockchains that don’t natively interact.

When a user initiates a cross-chain swap, the wallet or protocol first detects available liquidity on the destination chain and calculates the optimal route. This might involve bridging assets, wrapping tokens, or routing through decentralised exchanges on both the source and destination chains. Once the route is determined, the swap is executed using one of several underlying technologies, most commonly atomic swaps or bridge protocols.

The settlement happens on the destination chain, with the user receiving their desired token in their wallet. Throughout this process, the user’s assets are either locked in smart contracts or secured by cryptographic guarantees, ensuring that funds can’t be lost or stolen mid-swap. Let’s break down the two main technological approaches.

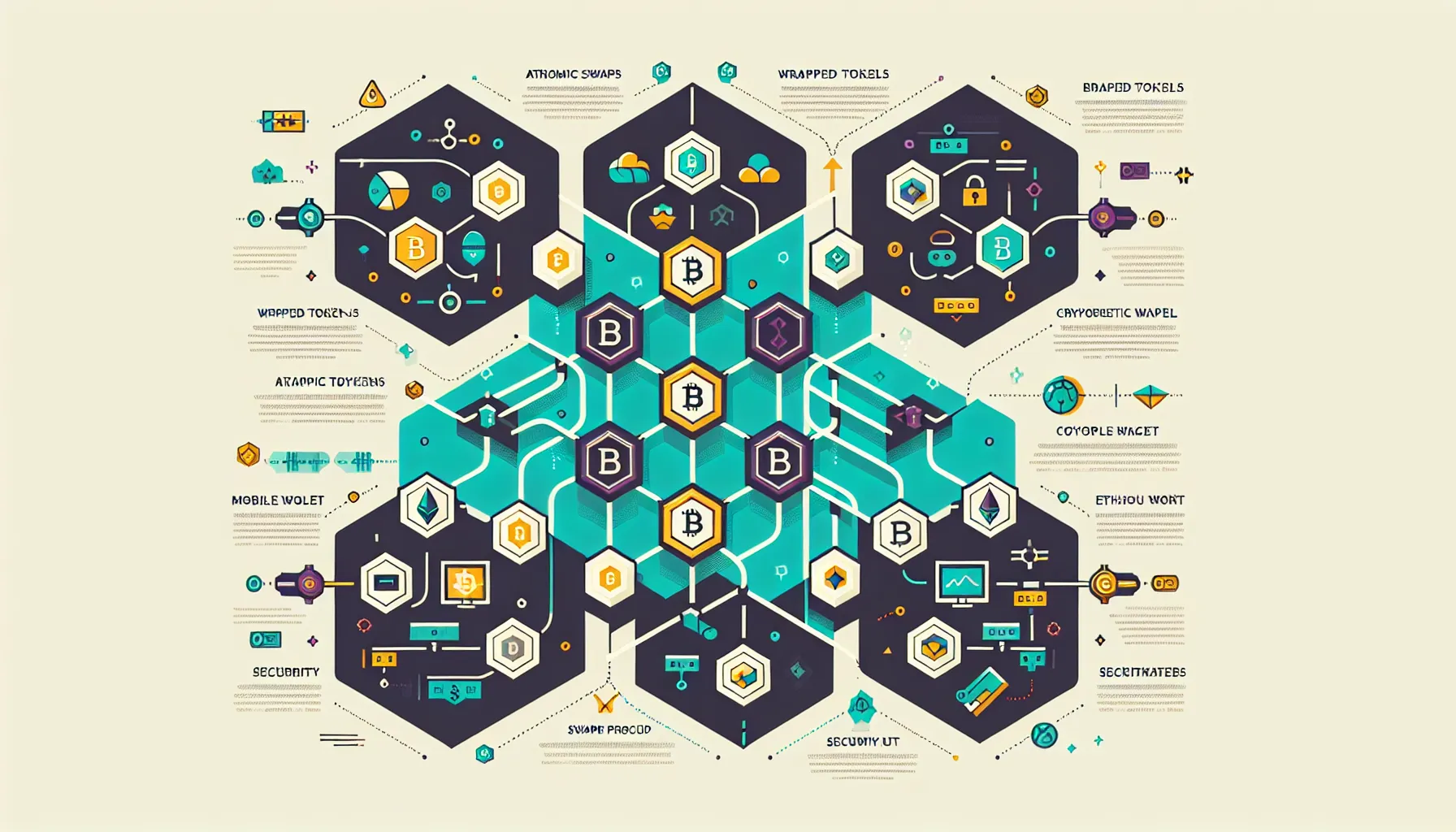

Atomic Swaps

Atomic swaps represent the purest form of cross-chain exchange. They use hash time-locked contracts (HTLCs), a type of smart contract that locks funds based on cryptographic hash functions and time constraints. The beauty of HTLCs is their all-or-nothing nature: either both parties in the swap receive their tokens, or neither does. There’s no middle ground where one party walks away with both assets.

Here’s how it works. Alice wants to swap Bitcoin for Bob’s Ether. Alice creates an HTLC on the Bitcoin blockchain, locking her BTC and generating a cryptographic hash. Bob then creates a corresponding HTLC on the Ethereum blockchain, locking his ETH and referencing the same hash. Alice reveals the secret key (preimage) to claim Bob’s ETH, and in doing so, Bob can use that same key to unlock Alice’s BTC. If either party fails to act within the time limit, the contracts expire and funds return to their original owners.

Atomic swaps remove counterparty risk entirely, there’s no need to trust a third party or even the other user. They also don’t require wrapped tokens or bridge infrastructure, making them a lean, trustless solution. But, atomic swaps can be complex to set up and are less common in user-facing applications due to technical barriers and limited wallet support.

Wrapped Tokens and Bridge Protocols

Wrapped tokens and bridges offer a more accessible, albeit slightly more trust-dependent, approach to cross-chain swaps. A wrapped token is a representation of an asset from one blockchain issued on another. For example, Wrapped Bitcoin (WBTC) is an ERC-20 token on Ethereum that represents Bitcoin. Each WBTC is backed 1:1 by actual BTC held in reserve by a custodian.

Bridge protocols help this wrapping process. When a user wants to move Bitcoin to Ethereum, they send BTC to a bridge protocol, which locks the Bitcoin on its native chain and mints an equivalent amount of WBTC on Ethereum. The user can then trade, lend, or use WBTC within Ethereum’s DeFi ecosystem. To reverse the process, the user sends WBTC back to the bridge, which burns the token and releases the original BTC.

Bridges vary in their architecture, some are custodial (requiring trust in a central entity), while others use decentralised validators or multi-signature schemes to manage locked assets. Bridges have become the backbone of cross-chain liquidity, enabling seamless token movement across chains. But, they introduce new attack vectors: if a bridge’s smart contracts are exploited or its validators compromised, users’ funds are at risk. This has led to several high-profile bridge hacks in recent years, underscoring the importance of choosing battle-tested, audited protocols.

The Easiest Methods to Exchange Tokens Across Blockchains

For users who want to perform cross-chain swaps without diving into the technical weeds, several accessible methods have emerged. These range from fully decentralised platforms to hybrid solutions that balance ease of use with security.

Decentralised Cross-Chain Exchanges

Decentralised exchanges (DEXs) with cross-chain functionality bring the peer-to-peer ethos of DeFi to multi-chain swaps. Platforms like Komodo pioneered atomic swap technology, allowing users to exchange tokens directly from their wallets without custodians or intermediaries. These DEXs aggregate liquidity across chains and use smart contracts to help trustless trades.

The advantage? Users retain full control of their private keys and assets throughout the swap. There’s no account creation, no KYC, and no risk of exchange insolvency. DEXs with cross-chain support are ideal for privacy-conscious users and those who prioritise decentralisation. But, they may have steeper learning curves and less liquidity than centralised alternatives, which can result in higher slippage on large trades.

Cross-Chain Aggregators

Cross-chain aggregators are the Swiss Army knives of token swapping. These platforms scan multiple DEXs, bridges, and liquidity sources across blockchains to find the best rates and routes for a given swap. Rather than being tied to a single protocol, aggregators dynamically route transactions through whichever path offers optimal liquidity, lowest fees, or fastest settlement.

Wallet-integrated aggregators, such as those found in Zypto or Trust Wallet, make cross-chain swaps as simple as selecting two tokens and clicking “swap.” Behind the scenes, the aggregator handles liquidity detection, route optimisation, and execution across multiple chains. This abstraction makes cross-chain swaps accessible to everyday users without sacrificing the benefits of decentralisation.

Aggregators are particularly useful in volatile markets where liquidity and prices shift rapidly. By comparing options in real time, they help users avoid overpaying in fees or getting stuck with poor exchange rates.

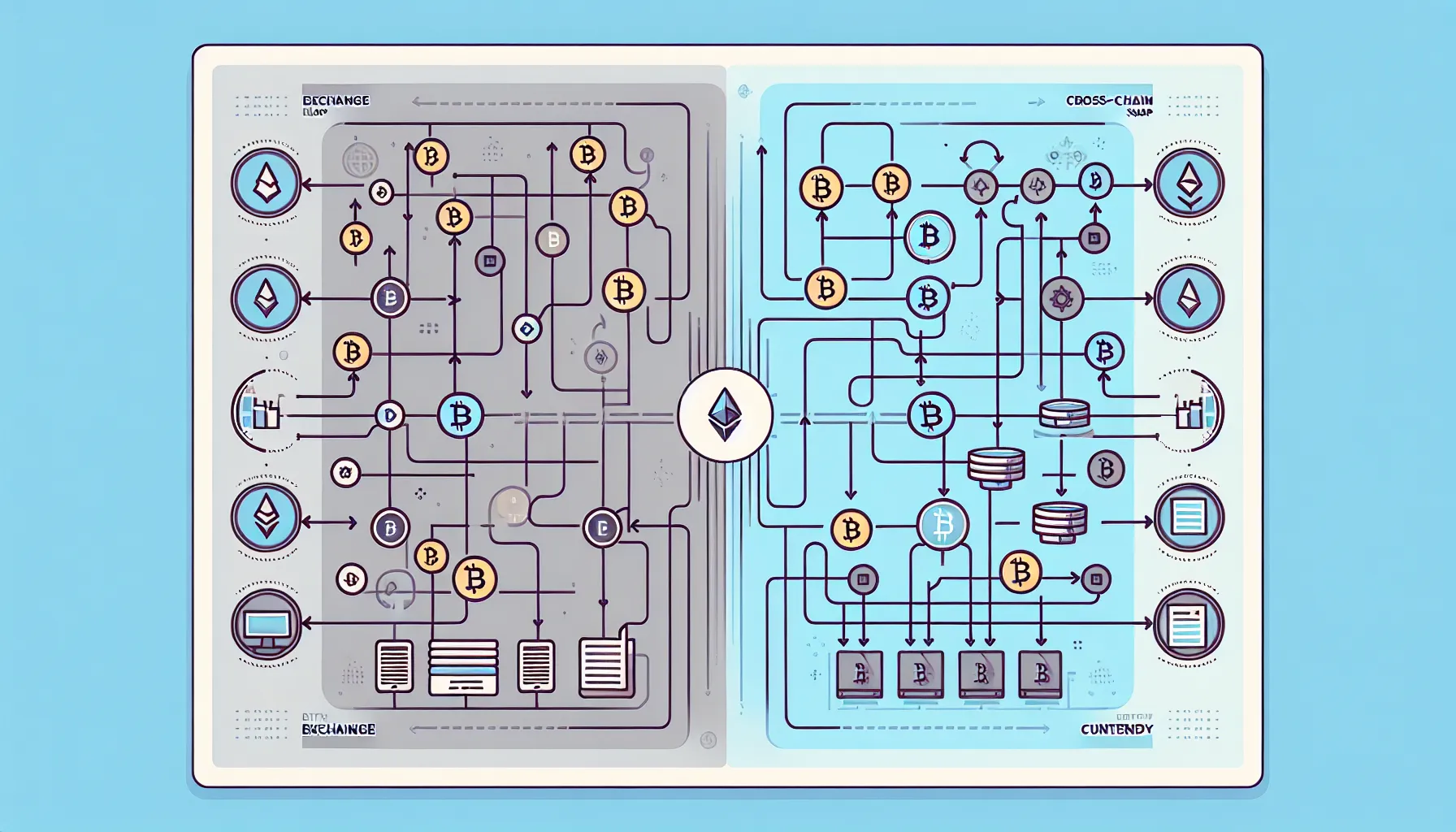

Centralised Exchanges With Multi-Chain Support

For users prioritising speed and simplicity over decentralisation, centralised exchanges (CEXs) with multi-chain support offer a familiar solution. Platforms like Binance, Coinbase, and Kraken support deposits and withdrawals across multiple blockchains, allowing users to trade assets that exist on different chains within a single interface.

The process is straightforward: deposit tokens on one chain, trade them for another asset (potentially on a different chain), and withdraw to the desired blockchain. CEXs handle all the bridging and liquidity sourcing in the background, abstracting away complexity.

But, this convenience comes at a cost. Users must trust the exchange with custody of their funds, exposing themselves to risks like exchange hacks, insolvency, or withdrawal freezes. Regulatory pressures can also limit access or impose restrictions. For casual traders or those moving large sums, CEXs remain a practical option, but they sacrifice the trustless, self-sovereign ethos that defines decentralised swaps.

Security Considerations When Making Cross-Chain Swaps

Cross-chain swaps unlock incredible flexibility, but they also introduce new security risks. From smart contract vulnerabilities to phishing attacks, users need to navigate a minefield of potential threats. Understanding these risks, and how to mitigate them, is essential for safe token exchanges.

Smart contract vulnerabilities top the list. Cross-chain protocols rely heavily on code to lock, mint, burn, and transfer assets. A single bug or oversight can be catastrophic, as seen in numerous bridge exploits where hackers drained hundreds of millions in user funds. Even audited contracts aren’t foolproof: sophisticated attackers constantly probe for weaknesses.

Bridge exploits deserve special mention. Because bridges manage large reserves of locked assets, they’re high-value targets. Attackers have exploited flaws in validator logic, cross-chain messaging, and token minting mechanisms. Users should favour bridges with strong security track records, transparent operations, and ideally, insurance or compensation mechanisms.

Phishing and scam tokens also plague the cross-chain space. Malicious actors create fake tokens with names similar to legitimate projects, tricking users into swapping for worthless assets. Unverified platforms or aggregators might steal funds outright or redirect swaps to fraudulent contracts.

Common Risks and How to Avoid Them

Bridge hacks remain the most prevalent risk. To minimise exposure, users should stick to well-established bridges with proven security records and multiple audits. Avoiding new or unproven protocols, especially those with large total value locked (TVL) but limited operational history, can prevent costly losses.

Poor liquidity is another pitfall. Low-liquidity swaps can result in significant slippage, where the final exchange rate is far worse than quoted. Before executing a swap, users should check trading volumes and liquidity depth on the route their aggregator or DEX selects. Starting with smaller test transactions can reveal liquidity issues without risking large sums.

Scam tokens are easily avoided with diligence. Always verify contract addresses against official sources, project websites, verified social media accounts, or trusted token lists like those on CoinGecko or CoinMarketCap. If a token isn’t listed or verified, proceed with extreme caution or avoid it entirely.

Best Practices for Safe Token Exchanges

Security starts with platform selection. Use reputable, audited platforms, whether DEXs, aggregators, or bridges. Check for third-party security audits from firms like CertiK, Trail of Bits, or ConsenSys Diligence. A transparent team and active community support are also positive signals.

Keep wallets updated and private keys secure. Hardware wallets offer the best protection against phishing and malware. Never share seed phrases or private keys, and be wary of unsolicited messages or emails asking for wallet information.

Start with small transactions to test. Before swapping large amounts, execute a small test swap to verify the route, fees, and destination address. This minimises potential losses if something goes wrong and builds confidence in the process.

Comparing Fees and Transaction Speeds

Fees and transaction speeds vary widely across cross-chain swap methods, influenced by blockchain congestion, protocol design, and whether the swap involves bridges or direct atomic swaps.

Decentralised protocols and aggregators often offer lower fees than centralised exchanges, especially for smaller swaps. But, users must account for gas fees on both the source and destination blockchains. During periods of high network activity, particularly on Ethereum, gas fees can spike, making even small swaps prohibitively expensive. Layer-2 solutions and alternative chains like Polygon or Arbitrum can mitigate costs.

Centralised exchanges typically charge fixed or percentage-based trading fees, which can be competitive for large trades but may include hidden costs like withdrawal fees or unfavourable exchange rates. CEXs generally process swaps faster than decentralised alternatives because they don’t wait for blockchain confirmations, they simply update internal ledgers.

Transaction speeds also depend on the bridging mechanism. Atomic swaps can be slower because they require confirmation on both blockchains. Wrapped token bridges vary: some offer near-instant swaps by relying on liquidity pools, while others require validators to confirm cross-chain messages, adding minutes or even hours to the process.

Users should weigh cost against speed and security. For time-sensitive trades, a CEX or fast bridge might justify higher fees. For cost-conscious users or those prioritising decentralisation, DEXs and aggregators with flexible route options offer better value, provided they’re willing to tolerate longer settlement times.

Conclusion

Cross-chain swaps are no longer a niche experiment, they’re a critical infrastructure layer for a truly interconnected crypto ecosystem. By enabling users to exchange tokens across blockchains without intermediaries, they unlock liquidity, enhance flexibility, and empower individuals to move seamlessly between diverse blockchain environments.

Yet with this power comes responsibility. The technology is still maturing, and risks, from bridge exploits to smart contract vulnerabilities, remain real. Users must approach cross-chain swaps with a combination of enthusiasm and caution: choosing reputable platforms, verifying contracts, and starting with small transactions.

Whether through atomic swaps, wrapped tokens, decentralised exchanges, aggregators, or centralised platforms, the tools for safe and efficient cross-chain swaps are more accessible than ever. As blockchain interoperability continues to evolve, those who master these methods will be best positioned to capitalise on the opportunities of a multi-chain future, without sacrificing security or control.

Frequently Asked Questions

What are cross-chain swaps and how do they work?

Cross-chain swaps allow users to exchange cryptocurrencies between different blockchain networks without centralised intermediaries. They use cryptographic protocols like atomic swaps or bridge protocols to coordinate token exchanges, enabling direct swaps between assets on separate blockchains whilst users retain control of their private keys throughout the process.

Are cross-chain swaps safe to use?

Cross-chain swaps can be safe when using reputable, audited platforms, but they carry risks including bridge exploits, smart contract vulnerabilities, and phishing attacks. To minimise risk, users should verify contract addresses, start with small test transactions, use established protocols with proven security records, and keep wallets secure with hardware devices.

What is the difference between atomic swaps and wrapped tokens?

Atomic swaps use hash time-locked contracts for direct peer-to-peer exchanges with no intermediaries, offering complete trustlessness but limited wallet support. Wrapped tokens rely on bridge protocols that lock assets on one chain and mint equivalent tokens on another, providing easier access but introducing custodial risks and potential bridge vulnerabilities.

Which cross-chain swap method has the lowest fees?

Decentralised protocols and aggregators typically offer lower trading fees than centralised exchanges, especially for smaller swaps. However, users must account for gas fees on both source and destination blockchains. Layer-2 solutions like Polygon or Arbitrum can significantly reduce costs during periods of high network congestion on Ethereum.

Can I swap Bitcoin for Ethereum tokens without using a centralised exchange?

Yes, decentralised cross-chain exchanges and aggregators enable direct Bitcoin-to-Ethereum token swaps without centralised platforms. These use atomic swap technology or bridge protocols to facilitate trustless exchanges, allowing users to retain control of their private keys whilst accessing liquidity across multiple blockchains without creating exchange accounts.

How long do cross-chain transactions typically take to complete?

Cross-chain transaction speeds vary by method. Centralised exchanges process swaps fastest by updating internal ledgers instantly. Atomic swaps require confirmations on both blockchains, taking longer. Bridge protocols range from near-instant swaps using liquidity pools to several minutes or hours when validators must confirm cross-chain messages.