Crypto staking has emerged as one of the most accessible ways for investors to generate passive income in the digital asset space. Unlike traditional trading strategies that require constant monitoring and market timing, staking allows individuals to earn rewards simply by locking up their cryptocurrencies on proof-of-stake (PoS) blockchains. By participating in network validation, stakers support blockchain operations whilst receiving regular payouts, typically in the same cryptocurrency they’ve committed. With annual percentage yields often far exceeding conventional savings accounts, staking presents an attractive proposition for both seasoned crypto enthusiasts and newcomers seeking to put their dormant holdings to work. But, the landscape of staking platforms has grown increasingly diverse, ranging from centralised exchanges to decentralised protocols and specialised services, each offering distinct features, security measures, and yield structures. Selecting the right platform requires careful evaluation of multiple factors, including security track records, APY rates, supported assets, and lock-up terms. This guide examines the best staking platforms available in 2025, highlighting what makes each option stand out and providing practical insights for those ready to start earning passive income through crypto staking.

Key Takeaways

- Crypto staking allows investors to earn passive income by locking cryptocurrencies on proof-of-stake blockchains, with yields often exceeding traditional savings accounts.

- The best staking platforms range from centralised exchanges like Binance and Coinbase to decentralised protocols such as Lido and Rocket Pool, each offering distinct security features and APY rates.

- Security reputation and robust measures like cold storage are critical when selecting staking platforms to protect digital assets from hacks and platform failures.

- Lock-up periods and market volatility present key risks, as staked assets may remain illiquid during price downturns or require extended unbonding periods.

- Starting with staking requires selecting a trustworthy platform, acquiring eligible cryptocurrency, and carefully reviewing terms including APY rates and withdrawal conditions.

- Diversifying across multiple staking platforms and conducting thorough due diligence helps mitigate risks whilst maximising passive income opportunities.

What Is Crypto Staking and How Does It Generate Passive Income?

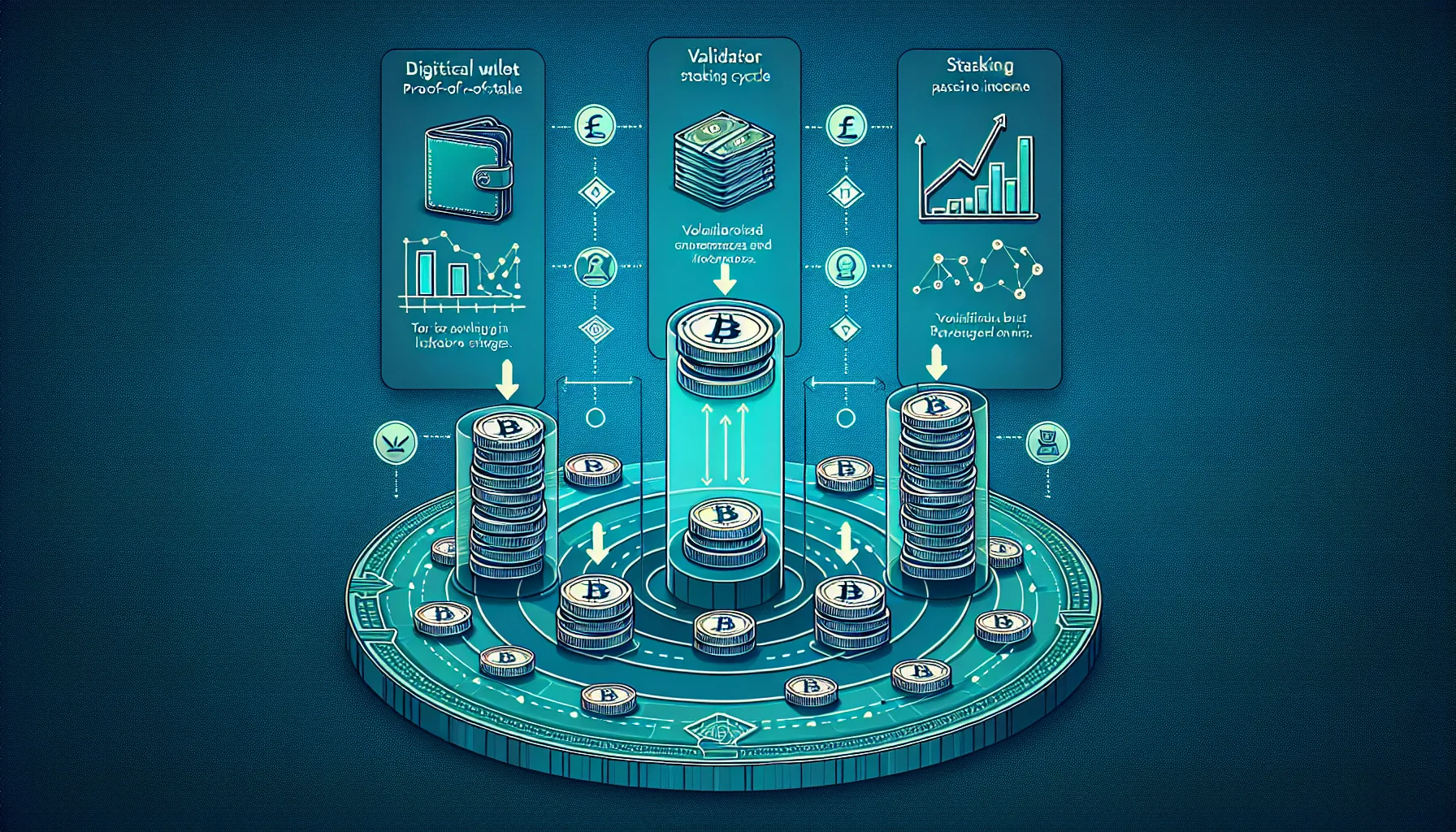

At its core, crypto staking involves storing digital assets in a designated wallet or platform to participate in the validation and security mechanisms of a blockchain network. Unlike proof-of-work systems that rely on energy-intensive mining, proof-of-stake blockchains select validators based on the amount of cryptocurrency they’ve “staked” or committed to the network. By locking up these funds, participants help verify transactions, maintain network integrity, and secure the blockchain against malicious activity.

In return for this contribution, stakers receive reward payouts distributed over time, usually denominated in the same cryptocurrency they’ve staked. These rewards function much like interest payments in traditional finance, yet often deliver significantly higher returns. Where conventional savings accounts might offer 1–2% annually, staking yields can range anywhere from modest single-digit percentages to double-digit APYs, depending on the asset, platform, and market conditions.

The beauty of staking lies in its passivity. Once an investor has committed their tokens, the platform or protocol handles the technical requirements of validation. There’s no need to actively trade, time market movements, or execute complex strategies. Rewards accumulate automatically, creating a steady stream of income that compounds if reinvested. This makes staking particularly appealing for long-term holders, those who believe in a project’s fundamentals and prefer to earn whilst they wait for potential price appreciation, rather than leaving their assets idle.

Key Factors to Consider When Choosing a Staking Platform

Selecting the right staking platform isn’t a one-size-fits-all decision. The ideal choice depends on an individual’s risk tolerance, investment goals, and the specific cryptocurrencies they wish to stake. Several critical factors should guide this evaluation.

Security and Reputation

Security stands as the foremost consideration when entrusting a platform with digital assets. The history of cryptocurrency is littered with exchange hacks, protocol exploits, and platform failures that have cost users millions. Hence, prioritising platforms with robust security measures, such as cold storage for the majority of funds, two-factor authentication, and regular security audits, is non-negotiable.

Reputation matters equally. Established platforms with transparent operating histories and positive user feedback demonstrate reliability over time. Look for services that carry insurance coverage for staked assets, offer clear communication during incidents, and maintain regulatory compliance in their operating jurisdictions. A platform’s track record can often predict its future behaviour, especially during periods of market stress or technical challenges.

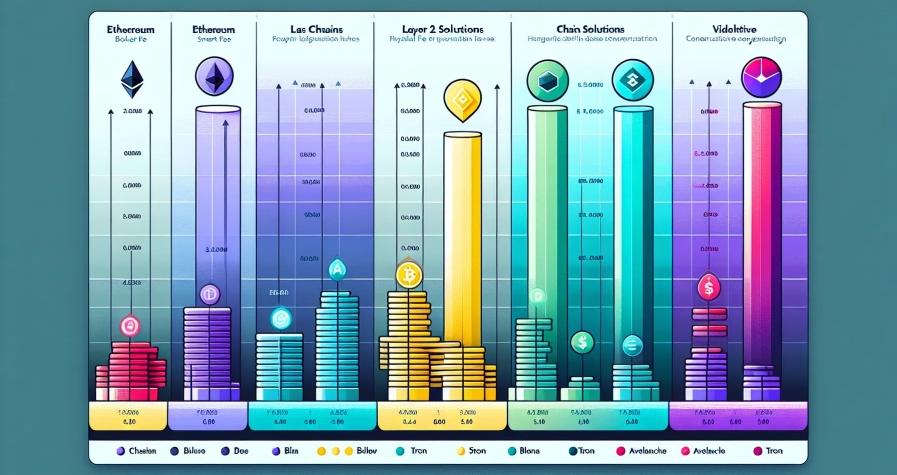

Annual Percentage Yield (APY) Rates

Whilst security protects capital, APY rates determine how quickly that capital grows. Yields vary dramatically across platforms and assets, with some offering conservative 3–5% returns on established cryptocurrencies like Ethereum, whilst others advertise rates exceeding 24% on stablecoins or emerging tokens.

But, higher yields don’t always translate to better opportunities. Exceptionally high APYs often signal elevated risk, whether from token inflation, platform sustainability concerns, or market volatility. Savvy investors compare rates across multiple platforms for the same asset, questioning why one might offer substantially more than competitors. Sometimes the difference reflects genuine efficiency or innovative protocol design: other times, it masks underlying risks that could erode both rewards and principal.

Supported Cryptocurrencies and Lock-Up Periods

Not all platforms support the same range of assets. Some focus exclusively on major cryptocurrencies like Ethereum, Cardano, or Solana, whilst others provide access to dozens of smaller tokens. Investors should ensure their chosen platform supports the specific coins they wish to stake, with sufficient liquidity and trading pairs if they later decide to exit.

Lock-up periods represent another crucial dimension. Certain staking arrangements require tokens to remain locked for fixed durations, sometimes weeks or months, during which they cannot be withdrawn or traded. This illiquidity poses challenges if market conditions shift suddenly or personal circumstances demand quick access to funds. Other platforms offer flexible staking with no lock-up, allowing withdrawals at any time, though often at slightly reduced APY rates. Understanding these terms upfront helps align staking strategies with liquidity needs and risk management preferences.

Top Staking Platforms for 2025

The staking ecosystem has matured considerably, offering investors multiple pathways to earn passive income. Each category of platform presents distinct advantages depending on user priorities.

Centralised Exchange Platforms

Centralised exchanges such as Binance, Coinbase, and Crypto.com have emerged as popular entry points for staking, particularly amongst newer participants. These platforms provide intuitive interfaces that simplify the entire process, often requiring just a few clicks to start earning rewards. Assets held on reputable exchanges typically benefit from insurance schemes and regulatory oversight, adding layers of protection against certain types of loss.

Binance, for instance, offers an extensive selection of stakeable assets with competitive rates and both flexible and locked staking options. Coinbase appeals to users prioritising regulatory compliance and ease of use, especially in markets like the United States and United Kingdom. Crypto.com distinguishes itself through integrated ecosystem benefits, linking staking rewards to its broader suite of financial products.

The trade-off with centralised platforms involves surrendering some degree of control. Users don’t hold private keys directly, meaning they rely on the exchange’s security and solvency. Also, centralised services may impose higher fees or offer slightly lower yields compared to alternatives, reflecting the convenience and infrastructure they provide.

Decentralised Staking Protocols

Decentralised protocols such as Lido, Rocket Pool, and Ankr represent the alternative approach, emphasising user control, transparency, and often innovation in staking mechanics. These platforms operate through smart contracts on blockchain networks, eliminating intermediaries and distributing trust across decentralised infrastructure.

Lido has gained significant traction by enabling liquid staking, users stake Ethereum and receive stETH tokens in return, which represent their staked position but remain tradeable. This liquidity solves one of staking’s primary drawbacks, allowing participants to earn rewards without sacrificing flexibility. Rocket Pool offers similar functionality whilst maintaining a more decentralised validator network, appealing to those who prioritise protocol-level decentralisation.

Decentralised protocols frequently deliver higher yields than centralised exchanges because they eliminate middleman fees and operate with leaner cost structures. But, they also demand greater technical understanding and expose users to smart contract risks, bugs or exploits in the underlying code could result in losses. For those comfortable navigating DeFi ecosystems, these platforms often represent the most efficient staking solutions available.

Dedicated Staking Services

Beyond exchanges and DeFi protocols, dedicated staking services like Figment and MyCointainer cater to users seeking specialised tools, analytics, and optimisation strategies. These platforms focus exclusively on staking, often providing enhanced reporting, portfolio management features, and access to a broader range of tokens than general-purpose exchanges.

Figment, for example, serves both retail and institutional clients with enterprise-grade infrastructure and detailed performance metrics. MyCointainer offers a diverse catalogue of stakeable assets, including many smaller-cap tokens not available on major exchanges, alongside auto-compounding features that maximise returns over time.

Dedicated services occupy a middle ground between the simplicity of centralised exchanges and the autonomy of decentralised protocols. They typically provide better customer support and educational resources than DeFi platforms, whilst offering more specialised features than general exchanges. For investors who prioritise maximising returns across multiple assets or require sophisticated tracking tools, dedicated staking services often deliver the best balance of functionality and support.

Risks and Challenges of Staking

Whilst staking offers compelling income potential, it’s far from risk-free. Understanding the primary challenges helps investors make informed decisions and carry out appropriate safeguards.

Market volatility presents the most obvious threat. Staking rewards are denominated in the same cryptocurrency being staked, meaning their value in fiat terms fluctuates with market prices. An investor might earn a 10% annual return in token terms, yet find the value of both principal and rewards diminished if the underlying asset drops 30% in price. This price risk affects all crypto investments, but it becomes particularly relevant in staking scenarios where assets are locked and can’t be sold quickly during downturns.

Lock-up risks compound this volatility challenge. Many staking arrangements require tokens to remain committed for specified periods, preventing withdrawals even when market conditions deteriorate. Some networks impose unbonding periods that delay access to funds by weeks after initiating a withdrawal. This illiquidity can prove costly when timing matters, forcing investors to either accept losses or miss alternative opportunities.

Platform risk encompasses the various ways staking services themselves might fail. Centralised exchanges can be hacked, mismanage funds, or face regulatory shutdowns. Decentralised protocols might contain undiscovered smart contract vulnerabilities that malicious actors exploit. Even well-intentioned platforms can succumb to operational challenges, liquidity crunches, or economic attacks that compromise user funds.

Insolvency concerns are particularly acute with smaller or newer platforms offering unsustainably high yields. If a service promises returns that vastly exceed network-level rewards, it likely relies on unsustainable token inflation, new user deposits (Ponzi-like structures), or risky lending strategies. When these models collapse, stakers often lose significant portions of their holdings.

Due diligence remains essential. Investors should research platform histories, audit reports, insurance arrangements, and community feedback before committing substantial capital. Diversifying across multiple platforms and assets can mitigate single-point failures, whilst limiting stake sizes to amounts one can afford to lose provides an additional safety margin.

How to Get Started With Staking

Beginning a staking journey requires methodical preparation rather than rushed decisions. The process generally unfolds across several straightforward stages.

First, research and select both a trustworthy platform and an eligible cryptocurrency. Consider the factors outlined earlier, security, yields, supported assets, and lock-up terms, matching them against personal investment goals and risk tolerance. New stakers often benefit from starting with established platforms and major cryptocurrencies before exploring more exotic options.

Second, acquire the chosen cryptocurrency if not already held. This might involve purchasing through an exchange, transferring from another wallet, or converting existing holdings. Ensure sufficient quantities to meet any minimum staking requirements the platform might impose, whilst also accounting for transaction fees during transfers.

Third, transfer the coins to the staking account or wallet. For centralised platforms, this typically means moving assets to the exchange and navigating to the staking section. Decentralised protocols require connecting a compatible Web3 wallet like MetaMask and interacting with the protocol’s interface. Follow platform-specific instructions carefully, double-checking wallet addresses to avoid irreversible transfer errors.

Fourth, select the staking amount and confirm participation. Most platforms allow choosing between flexible and locked staking, with corresponding APY differences. Review all terms, including lock-up durations, withdrawal conditions, and fee structures, before finalising the commitment. Once confirmed, the platform begins allocating rewards according to its payout schedule, which might be daily, weekly, or based on blockchain epochs.

Finally, track rewards and adjust positions as needed. Regularly monitor staking performance through the platform’s dashboard, checking that rewards arrive as expected. Market conditions and network parameters change over time, potentially warranting position adjustments, reinvesting rewards for compound growth, reallocating to higher-yielding opportunities, or unstaking if circumstances shift. Active management, even within a passive income strategy, helps optimise returns and respond to evolving risks.

Conclusion

Staking has established itself as a compelling method for earning passive cryptocurrency income whilst simultaneously supporting blockchain network security. The diversity of platforms available in 2025, from user-friendly centralised exchanges to innovative decentralised protocols and specialised staking services, ensures investors can find options aligned with their specific needs, technical comfort levels, and risk appetites.

Yet success in staking demands more than simply parking assets and collecting rewards. The best outcomes emerge from careful platform vetting, realistic yield expectations, and clear-eyed acknowledgement of risks ranging from market volatility to platform failures. Lock-up periods, smart contract vulnerabilities, and token price fluctuations all require consideration within broader portfolio strategies.

For those willing to conduct proper due diligence and maintain regular oversight, staking offers a relatively straightforward path to putting dormant crypto holdings to productive use. The rewards can significantly exceed traditional savings vehicles, potentially compounding into substantial gains over time. As the staking ecosystem continues maturing and protocols carry out increasingly sophisticated mechanisms, opportunities for passive income generation will likely expand further, making now an opportune moment to explore what staking can offer within a diversified investment approach.

Frequently Asked Questions

What is crypto staking and how does it generate passive income?

Crypto staking involves locking digital assets on proof-of-stake blockchains to help validate transactions and secure the network. In return, stakers receive regular reward payouts in the same cryptocurrency, functioning like interest payments but often delivering significantly higher returns than traditional savings accounts.

Which staking platforms offer the best APY rates in 2025?

APY rates vary considerably across platforms and assets, ranging from 3–5% on established cryptocurrencies like Ethereum to over 20% on certain stablecoins or emerging tokens. Decentralised protocols like Lido and Rocket Pool often deliver higher yields than centralised exchanges by eliminating middleman fees.

Are there lock-up periods when staking cryptocurrency?

Yes, many staking arrangements require tokens to remain locked for fixed durations, sometimes weeks or months, preventing withdrawals during that time. However, some platforms offer flexible staking with no lock-up periods, allowing withdrawals at any time, typically at slightly reduced APY rates.

Can you lose money staking crypto?

Yes, staking carries risks including market volatility, where token price drops can diminish the fiat value of both principal and rewards. Additional risks include platform failures, smart contract vulnerabilities, lock-up illiquidity during downturns, and potential insolvency of platforms offering unsustainably high yields.

What is liquid staking and why is it beneficial?

Liquid staking allows users to stake cryptocurrencies and receive tradeable tokens representing their staked position, such as stETH from Lido. This solves staking’s primary liquidity drawback, enabling participants to earn rewards whilst maintaining flexibility to trade or use their assets elsewhere.

Is staking better than keeping crypto in a savings account?

Crypto staking typically offers substantially higher returns than traditional savings accounts, with yields often ranging from 5–20% annually compared to 1–2% from conventional banks. However, staking carries additional risks including price volatility, platform security concerns, and potential lock-up periods.