The cryptocurrency market never sleeps, and neither should your tracking tools. With digital assets fluctuating wildly across hundreds of exchanges and wallets, keeping tabs on your portfolio manually isn’t just impractical, it’s a recipe for missed opportunities and late reactions to market shifts. That’s where dedicated crypto portfolio tracking apps come into play, offering real-time monitoring, instant alerts, and the peace of mind that comes from having all your holdings visible in one place.

In 2025, the best crypto tracking apps have evolved far beyond simple price tickers. They integrate with dozens of exchanges, support DeFi protocols and NFTs, deliver customisable alerts straight to your phone, and provide analytics that rival professional trading platforms. Whether you’re a casual holder checking your Bitcoin balance once a week or an active trader juggling positions across multiple chains, the right app can transform how you manage your digital wealth. This guide explores what separates the best from the rest and helps you choose the tracker that fits your investment style.

What to Look for in a Crypto Portfolio Tracking App

Not all portfolio trackers are created equal. The app that works brilliantly for a Bitcoin-only hodler might frustrate someone managing a complex DeFi portfolio across five chains. Before downloading yet another app, it’s worth understanding the key features that separate genuinely useful tools from glorified price widgets.

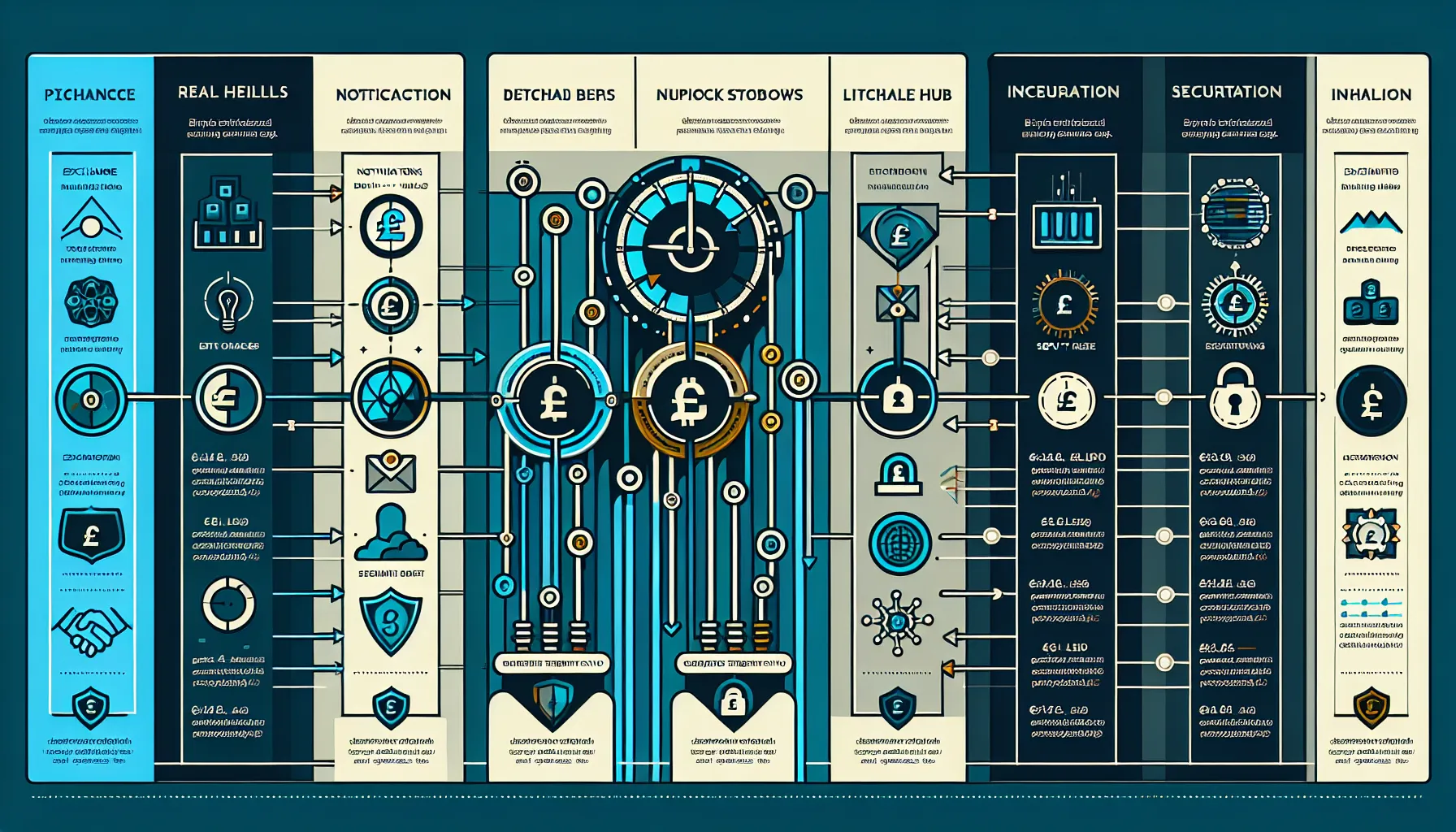

Real-Time Price Updates and Alert Features

Speed matters in crypto. A price update that arrives five minutes late is essentially useless when markets can swing 10% in that time. The best tracking apps deliver real-time price data with minimal lag, pulling information from multiple sources to ensure accuracy even during periods of high volatility.

But real-time prices are only half the equation. What truly sets excellent apps apart is their alert system. Look for platforms that offer custom alerts triggered by specific conditions: price thresholds (“notify me when Bitcoin hits £40,000”), percentage movements (“alert if my portfolio drops 5% in an hour”), or even wallet activity (“tell me when funds move from this address”). The most sophisticated apps support multiple notification channels, push notifications, SMS, and email, so critical alerts reach you regardless of where you are or what you’re doing.

Flexibility in alert customisation is crucial. Different trading strategies demand different alert structures. A day trader needs tight, frequent notifications about small price movements, whilst a long-term investor might only want alerts for major market events. Apps that force you into rigid notification templates quickly become more annoying than helpful.

Multi-Exchange Integration and API Support

If you’re like most crypto investors, your holdings aren’t sitting in one tidy location. You’ve got Bitcoin on one exchange, some altcoins on another, a bit of staked Ethereum in a wallet, and perhaps some tokens locked in a DeFi protocol. Manually entering and updating all these positions is tedious and error-prone.

Top-tier tracking apps solve this through extensive integration. The best platforms connect with hundreds of exchanges and wallets through API support or automatic syncing. Once you’ve linked your accounts (using read-only API keys that can’t execute trades), the app automatically imports your balances and transaction history. Updates happen in real time, so your portfolio view is always current without lifting a finger.

When evaluating integration capabilities, consider both breadth and depth. An app might boast “300+ exchange integrations” but if it doesn’t support the three you actually use, that number is meaningless. Check whether your specific exchanges, wallets, and DeFi protocols are supported. Also look for apps that handle the full spectrum of assets, not just major coins but also smaller altcoins, DeFi LP tokens, NFTs, and staked assets.

Security and Privacy Considerations

Here’s an uncomfortable truth: when you connect a portfolio tracker to your exchanges, you’re granting access to information about your holdings. In the wrong hands, that data becomes a target. Security can’t be an afterthought.

The gold standard is read-only API access. When linking exchanges, ensure the API keys you create have view-only permissions, no withdrawal, trading, or transfer rights. A legitimate portfolio tracker never needs the ability to move your funds. If an app requests full API access, that’s a massive red flag.

Beyond API permissions, examine the platform’s overall security posture. Strong encryption for stored data, two-factor authentication for account access, and transparent privacy policies about data collection and sharing should all be baseline requirements. The best apps also minimise data collection, storing only what’s necessary for functionality and avoiding practices like selling user information to third parties.

Privacy-conscious investors might also consider apps that allow local tracking without cloud synchronisation or those that offer anonymous usage without account creation. The trade-off is usually reduced functionality (no cross-device sync, for instance), but for users holding significant assets, that compromise might be worthwhile.

Top Crypto Portfolio Tracking Apps in 2025

With dozens of portfolio trackers vying for attention, which ones actually deliver? These four platforms represent the best options for different investor profiles, each bringing distinct strengths to the table.

CoinGecko: Comprehensive Tracking with Community Features

CoinGecko has built its reputation on breadth and accessibility. Tracking over 14,000 coins and tokens, it provides one of the most comprehensive asset databases available, a crucial advantage if you venture beyond the top 100 cryptocurrencies. The platform aggregates data from hundreds of exchanges, giving you accurate pricing even for obscure altcoins that larger trackers might miss.

What makes CoinGecko particularly appealing is its robust free tier. Unlike competitors that lock essential features behind paywalls, CoinGecko offers genuine utility without spending a penny. Portfolio tracking, price alerts, market data, and even event calendars and news feeds are all available to free users. The community elements, including user-submitted reviews, developer updates, and governance tracking, add context that pure price data can’t provide.

For users who want to eliminate adverts and access enhanced analytics, CoinGecko offers premium tiers. But frankly, most individual investors will find the free version more than adequate. It’s an excellent choice for casual investors, long-term holders, or anyone wanting comprehensive tracking without subscription costs.

Delta: Advanced Analytics for Serious Traders

Delta caters to users who need more than basic balance tracking. Its interface, whilst clean and modern, packs in serious analytical depth. Multiple portfolio views, detailed performance charts, asset allocation breakdowns, and historical tracking give active traders the insights they need to make informed decisions.

The app supports over 300 exchanges and allows manual transaction entry for wallets and DeFi positions, making it flexible enough to handle complex, multi-platform portfolios. Delta also excels at tracking cost basis and profit/loss calculations across different time periods, essential for tax purposes and performance evaluation.

Delta’s free version is generous, offering core tracking and analytics without payment. Premium tiers unlock additional notification types, deeper analytics, and more granular data exports. It’s the sweet spot for intermediate to advanced investors who want professional-grade tools without professional-grade complexity.

Blockfolio by FTX: User-Friendly Interface with Social Elements

Blockfolio built its early reputation on simplicity and ease of use, making portfolio tracking accessible even to complete crypto beginners. The interface is intuitive, onboarding is straightforward, and the learning curve is minimal. For new investors potentially overwhelmed by crypto’s complexity, that approachability is invaluable.

The app also pioneered social features in crypto tracking, allowing users to follow coins, receive news updates, and even interact with project teams through in-app messaging. These community elements help investors stay informed about developments affecting their holdings without leaving the app.

But, there’s an elephant in the room: FTX’s collapse in late 2022 cast uncertainty over Blockfolio’s future. Whilst the app continues to function and the core tracking features remain solid, the premium tier has seen limited development, and long-term support remains somewhat unclear. It’s still a viable option, particularly for beginners, but potential users should be aware of the platform’s complicated recent history.

CoinStats: All-in-One Solution with DeFi Support

CoinStats positions itself as the comprehensive solution, and in 2025, it largely delivers on that promise. The platform excels at integration, connecting with exchanges, wallets, and, critically, DeFi protocols and NFT platforms. For investors with holdings spread across centralised exchanges, hardware wallets, and DeFi protocols, CoinStats provides a unified view that few competitors match.

The alert system is particularly robust, offering customisation by price levels, percentage changes, all-time highs and lows, and even specific wallet activity. Multi-device synchronisation means your portfolio view stays consistent whether you’re checking your phone, tablet, or computer.

CoinStats’ free tier covers the basics: real-time tracking, device sync for up to two devices, and standard alerts. For serious users, the Pro version unlocks advanced analytics, syncing across up to five devices, multiple portfolio support, enhanced alerts, and priority customer support. The pricing is reasonable given the feature set, making it one of the best value propositions for active investors managing diverse holdings.

Coinstats Pro vs Free: Which Is Right for You?

Deciding between CoinStats’ free and paid tiers comes down to portfolio complexity and usage patterns. The free version handles single-portfolio tracking across basic exchanges and wallets adequately. If you’re a casual investor with holdings on one or two platforms and you check your balance occasionally, free will likely suffice.

Upgrading to Pro makes sense in several scenarios: you manage multiple distinct portfolios (perhaps separating long-term holds from trading positions), you need synchronisation across more than two devices (useful for households where partners share investment oversight), you require detailed analytics for tax reporting or performance analysis, or you’re active in DeFi and need comprehensive protocol integration.

The Pro tier also provides more sophisticated alert customisation and priority support, valuable if you rely on timely notifications for trading decisions or if you’ve encountered technical issues that free-tier support hasn’t resolved quickly. For professional traders or anyone managing a six-figure portfolio, the modest subscription cost is easily justified by the time savings and peace of mind.

Setting Up Effective Price Alerts

Price alerts can be your greatest asset or your biggest annoyance. The difference lies entirely in how you configure them. A well-designed alert system keeps you informed about genuinely important events without drowning you in noise.

Customising Alert Types for Different Trading Strategies

Your alert strategy should mirror your investment approach. Day traders and swing traders need tight, responsive alerts because they’re capitalising on short-term price movements. Set alerts for relatively small percentage changes, perhaps 3-5% movements, and consider time-bound alerts that notify you if a coin moves a certain amount within a specific period (“alert me if Bitcoin moves 2% in one hour”).

Long-term investors, conversely, shouldn’t care about every 5% wiggle. Focus alerts on significant events: major percentage swings (perhaps 15-20% or more), breaches of important psychological price levels (like Bitcoin crossing £50,000), or new all-time highs or lows. You might also set alerts for fundamental events affecting coins you hold, governance votes, protocol upgrades, major partnership announcements.

For portfolio-level alerts, consider percentage-based notifications about your total holdings. An alert when your entire portfolio gains or loses 10% in a day gives you actionable information without obsessing over individual coin movements. Some apps also support alerts based on profit/loss thresholds (“notify when my unrealised gains hit £10,000”), which can be useful for planning exit strategies or rebalancing.

Don’t forget wallet activity alerts if your tracker supports them. Being notified immediately when funds move out of an address you control is both a security feature (alerting you to potential unauthorised access) and a transaction confirmation tool.

Avoiding Alert Fatigue

Here’s a scenario every crypto investor has experienced: you excitedly set up alerts for twelve different coins, each with multiple triggers. Within days, your phone buzzes constantly. By week two, you’re ignoring notifications entirely, potentially missing the few genuinely important ones buried in the noise. You’ve achieved alert fatigue.

The solution is ruthless selectivity. Only enable alerts for events that require action or meaningful attention. If you’re holding for years, you don’t need alerts every time a coin moves 5%. If you’re not planning to trade a particular holding regardless of price, why have alerts for it at all?

Group minor notifications and check them on your schedule rather than receiving instant alerts. Many apps allow digest-style notifications, perhaps a summary email each morning rather than real-time pushes throughout the night. This batching preserves sleep whilst keeping you informed.

Also consider using different notification channels for different alert priorities. Reserve push notifications for critical alerts (major portfolio movements, significant price breaches), use email for moderate-importance updates (daily summaries, weekly performance reports), and check in-app notifications for everything else when you happen to open the app anyway.

Finally, review and prune your alerts regularly. That obscure altcoin you set alerts for three months ago might no longer be in your portfolio, or your trading strategy might have evolved. Quarterly alert audits take minutes but dramatically improve the signal-to-noise ratio of your notifications.

Comparing Free vs Premium Portfolio Tracking Features

The free-versus-paid question looms over every portfolio tracker decision. Understanding exactly what you gain (and lose) with each tier helps you avoid both overpaying for features you’ll never use and frustratingly hitting limitations of free plans.

Free tiers typically cover the fundamentals admirably. Real-time price updates, basic portfolio tracking with manual entry or limited exchange connections, simple price alerts, and fundamental charts usually come without charge. For new investors or those with straightforward portfolios, Bitcoin, Ethereum, and perhaps a few major altcoins held on one exchange, free versions often prove entirely sufficient.

The limitations emerge as complexity grows. Free tiers usually restrict the number of portfolios you can create (often just one), limit exchange integrations or API connections, cap the number of custom alerts, and reduce or eliminate device synchronisation. Analytics tend to be basic, current balance and simple profit/loss, without the detailed breakdowns, historical performance tracking, or tax reporting tools that premium tiers provide.

Premium subscriptions unlock features that matter most to active or serious investors. Multiple portfolio support lets you separate different investment strategies or household accounts. Unlimited or expanded exchange integrations mean comprehensive coverage regardless of where you hold assets. Advanced analytics provide the insights needed for well-informed choice-making: detailed cost basis tracking, performance attribution by asset or time period, correlation analysis, and portfolio rebalancing suggestions.

Tax reporting features alone can justify premium subscriptions for anyone in jurisdictions requiring detailed crypto tax accounting. Rather than manually combing through thousands of transactions across multiple platforms, premium apps generate transaction reports compatible with tax software, potentially saving hours of frustration and reducing errors.

Priority customer support, whilst often overlooked when choosing apps, becomes invaluable when something breaks. If an exchange integration fails during tax season or a syncing error misrepresents your holdings, waiting days for free-tier support to respond is aggravating. Premium users typically get faster, more comprehensive assistance.

DeFi and NFT support increasingly separates free from paid tiers as well. Tracking LP tokens, staked positions, and NFT collections requires more sophisticated integration than simple exchange balances. If you’re active in DeFi, you’ll likely need a premium tracker to get accurate portfolio visibility.

The decision point? Free tiers work brilliantly for simple, infrequent tracking. If you check your portfolio weekly, hold assets in one or two locations, and aren’t concerned with detailed analytics or tax reporting, save your money. Upgrade when your portfolio complexity, trading frequency, or need for insights outgrows what free versions offer. And remember, you can always start free and upgrade later, no need to pay for features you’re not yet ready to use.

Conclusion

The cryptocurrency landscape in 2025 demands more than casual attention. With thousands of assets trading across countless platforms, keeping accurate track of holdings isn’t a luxury, it’s a necessity for anyone serious about digital asset investing. The right portfolio tracking app transforms what could be hours of manual calculation and monitoring into a streamlined, automated view of your entire crypto position.

For most investors, CoinStats offers the best balance of comprehensive integration, robust alerts, and DeFi support, particularly at the Pro tier. Those prioritising free options whilst maintaining broad asset coverage will find CoinGecko’s offering unbeatable, especially given its community features and extensive coin database. Active traders requiring deep analytics should lean towards Delta, whilst beginners might appreciate Blockfolio’s approachable interface even though its uncertain development trajectory.

Eventually, the “best” app depends entirely on your specific situation, your portfolio complexity, trading style, feature priorities, and budget. Many investors find value in testing multiple apps (most offer free versions) before committing to a premium subscription. The time invested in finding the right tracker pays dividends in better portfolio visibility, timely responses to market movements, and the confidence that comes from truly understanding where your digital wealth stands at any given moment.

Frequently Asked Questions

What features should I look for in the best crypto portfolio tracking app?

The best crypto apps offer real-time price updates, customisable alerts, multi-exchange integration via API support, comprehensive asset coverage including DeFi and NFTs, and robust security with read-only access. Advanced analytics and tax reporting features are also valuable for serious investors.

How do crypto portfolio tracking apps keep my funds secure?

Reputable crypto tracking apps use read-only API keys that can view your balances but cannot execute trades or withdraw funds. They should also employ strong encryption, two-factor authentication, and transparent privacy policies to protect your data from unauthorised access.

Can I track DeFi investments and NFTs with crypto portfolio apps?

Yes, advanced crypto apps like CoinStats support DeFi protocol integration and NFT tracking. However, this functionality is often limited in free tiers, with premium subscriptions providing comprehensive coverage of LP tokens, staked positions, and NFT collections across multiple chains.

Are free crypto portfolio trackers sufficient for beginners?

Free crypto tracking apps are excellent for beginners with straightforward portfolios. They typically offer real-time prices, basic portfolio tracking, simple alerts, and manual entry. CoinGecko’s free tier is particularly generous, providing comprehensive tracking without subscription costs for casual investors.

How do I avoid alert fatigue from crypto price notifications?

Avoid alert fatigue by setting notifications only for actionable events aligned with your investment strategy. Long-term holders should focus on major movements (15-20%), whilst day traders need tighter thresholds. Use digest-style summaries for less critical updates and regularly review your alerts.

Do crypto portfolio apps support automatic transaction imports for tax reporting?

Premium crypto tracking apps typically offer automatic transaction imports via exchange API connections and generate tax reports compatible with accounting software. This feature saves considerable time during tax season by consolidating transactions across multiple platforms into exportable formats.