The allure of cryptocurrency draws thousands of new investors daily, all hoping to capitalise on the next Bitcoin or Ethereum. Yet for every success story, countless others watch their investments evaporate, not through market downturns, but through preventable mistakes. The decentralised nature of cryptocurrency offers unprecedented financial freedom, but it also means there’s no safety net when things go wrong. No customer service department can reverse a transaction sent to the wrong address, and no insurance scheme covers losses from poor security practices. Understanding where new investors typically stumble can mean the difference between building wealth and losing everything. This article examines the most common, and costly, errors that drain crypto portfolios, along with practical strategies to avoid them.

Key Takeaways

- New investors accidentally lose money in crypto primarily through preventable mistakes like phishing scams, emotional trading, and inadequate security practices.

- Always enable two-factor authentication and use hardware wallets for long-term storage, as exchanges remain vulnerable to hacking and operational failures.

- Emotional decision-making destroys portfolios—establish clear entry and exit criteria based on research rather than reacting to market volatility.

- Never share private keys or seed phrases with anyone, as legitimate crypto services will never request this information through any communication channel.

- Transaction fees and gas costs can significantly erode returns, so calculate total costs before executing trades and time transactions during lower network activity.

- Proper tax record-keeping is essential, as HMRC requires reporting cryptocurrency gains and non-compliance can result in substantial penalties and legal consequences.

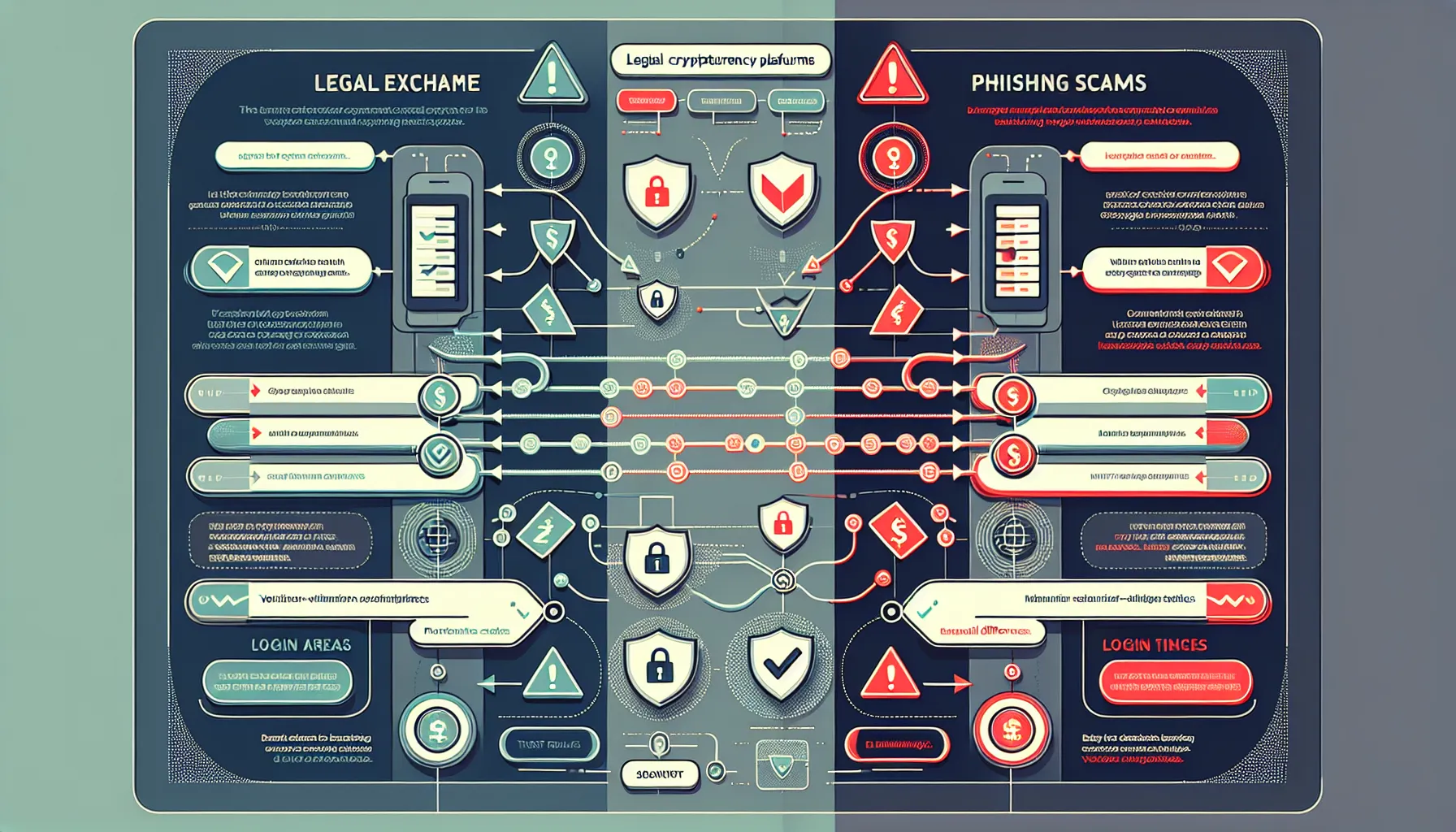

Falling for Phishing Scams and Fake Websites

Phishing scams remain one of the most dangerous threats facing cryptocurrency holders, precisely because they’re devastatingly effective. Scammers craft fraudulent emails, text messages, and entire websites that mimic legitimate cryptocurrency exchanges, wallet providers, and blockchain services with alarming accuracy. These counterfeit platforms often look virtually identical to the real thing, same logos, similar URLs (often differing by just one character), and professionally designed interfaces that inspire false confidence.

The mechanics are simple but ruthless. An investor receives what appears to be an urgent email from their exchange warning of suspicious account activity. They click the provided link, landing on a page that looks exactly like their exchange’s login portal. Once they enter their credentials or, worse, their private keys, the attackers capture this information and drain the account within minutes.

Protecting yourself requires vigilance at every step. Always manually type exchange URLs into your browser rather than clicking email links. Check for HTTPS security indicators in the address bar, though be aware that even phishing sites can have SSL certificates. Examine URLs carefully for subtle misspellings or unusual domain extensions. If you receive an unexpected message claiming to be from your exchange or wallet provider, contact them directly through official channels you’ve independently verified. Legitimate cryptocurrency services will never ask for your private keys, seed phrases, or passwords via email or text message. The moment someone requests this information, you’re almost certainly dealing with a scammer.

Trading Based on Emotion Rather Than Strategy

Emotional decision-making destroys more crypto portfolios than almost any other factor. New investors frequently buy cryptocurrencies because they’ve seen dramatic price increases, experienced fear of missing out, or heard friends discussing their gains. This reactive approach, buying high during periods of hype and panic-selling during downturns, represents the exact opposite of profitable trading.

The cryptocurrency market’s extreme volatility amplifies emotional responses. A 20% drop in a single day can trigger panic that would be unthinkable in traditional markets. Investors who lack a predetermined strategy find themselves making desperate decisions in these moments, often selling at a loss only to watch prices recover days later. Similarly, the euphoria of a rapid price increase can lead to overleveraged positions or purchases at unsustainable peaks.

Successful cryptocurrency investing requires discipline grounded in research and fundamentals, not market sentiment. Before purchasing any asset, investors should establish clear entry and exit criteria based on their analysis, risk tolerance, and investment timeline. This might include setting specific price targets for taking profits or cutting losses, regardless of emotional impulses in the moment. When emotions run high, whether fear or greed, the best course is often to do nothing, allowing your predetermined strategy to guide decisions rather than temporary market movements. Those who master their emotional responses dramatically improve their chances of long-term success.

Neglecting Proper Wallet Security

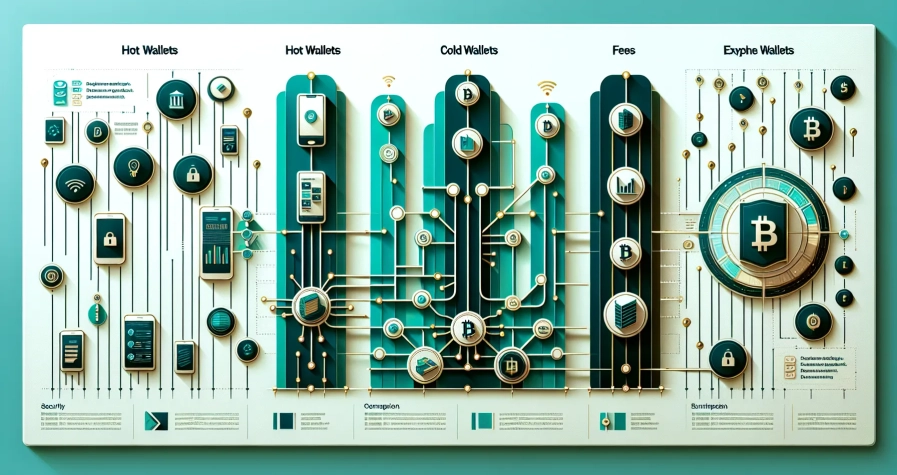

Inadequate wallet security represents one of the fastest ways to lose cryptocurrency holdings. Unlike traditional banking, where institutions carry out security measures on your behalf, crypto investors bear full responsibility for protecting their assets. This responsibility begins with the fundamentals and extends to advanced security practices.

Weak passwords remain surprisingly common. Using simple, easily guessed passwords or reusing passwords across multiple platforms creates vulnerabilities that hackers exploit routinely. A strong password should be lengthy, complex, and unique to each platform. Password managers can generate and store these securely, removing the burden of remembering dozens of complex strings.

The type of wallet matters immensely. Hot wallets (connected to the internet) offer convenience but expose holdings to online threats. For significant amounts, cold storage solutions like hardware wallets provide far superior protection. These physical devices keep private keys offline, making remote theft virtually impossible. The initial investment in a quality hardware wallet pales compared to the potential loss from a compromised hot wallet.

Network security deserves equal attention. Accessing crypto accounts over public Wi-Fi networks or unsecured connections invites attacks. Cybercriminals can intercept data transmitted over these networks, potentially capturing sensitive information. Always use secure, private internet connections when managing cryptocurrency holdings.

Not Using Two-Factor Authentication

Two-factor authentication (2FA) adds an essential security layer that dramatically reduces unauthorised access risks. Without 2FA, anyone who obtains your password, through phishing, data breaches, or keyloggers, can immediately access your account and transfer your funds. With 2FA enabled, they’d also need access to your second authentication factor, typically a code generated by an app on your mobile device or sent via SMS.

Enabling 2FA takes minutes but provides exponential security improvements. Authentication apps like Google Authenticator or Authy generate time-sensitive codes that change every 30 seconds. Even if someone steals your password, they can’t access your account without this constantly changing code. Whilst SMS-based 2FA offers less security than app-based methods (due to SIM-swapping attacks), it’s still vastly better than password-only protection. Every exchange and wallet service that offers 2FA should have it enabled immediately.

Sharing Private Keys or Seed Phrases

Private keys and seed phrases function as the master keys to cryptocurrency holdings. Anyone with access to these can control and transfer your assets, permanently and irreversibly. This makes them the most sensitive information in cryptocurrency investment, yet new investors sometimes share them with alarming casualness.

Legitimate cryptocurrency companies, exchanges, and wallet providers will never ask for your private keys or seed phrases. Not via email, not through text messages, not on social media, and not over the phone. Any request for this information, regardless of how official it appears, is a scam. Customer support teams don’t need this information to help you: they have other methods to verify identity and assist with account issues.

Your seed phrase should be written down and stored securely offline, ideally in multiple physical locations. Some investors use fireproof safes or safe deposit boxes. Never store seed phrases in digital formats like photographs, cloud storage, or password managers, as these can be hacked. Treat your private keys and seed phrases with the same security you’d give to large amounts of cash, because that’s exactly what they represent.

Investing More Than You Can Afford to Lose

The cryptocurrency market’s spectacular gains tempt investors to stake more than prudent amounts, sometimes their entire savings or borrowed funds. This approach courts financial disaster. Unlike traditional bank deposits protected by government insurance schemes, cryptocurrency holdings carry no such safeguards. If you lose your crypto through theft, scams, exchange failures, or market crashes, there’s no institution that will make you whole.

The principle of only investing money you can afford to lose isn’t pessimism, it’s risk management. Total loss remains a realistic possibility in cryptocurrency investment. Projects fail, exchanges get hacked, regulations change, and markets crash. When investors commit funds essential for living expenses, debt payments, or emergency reserves, they place themselves in precarious positions where they might be forced to sell at the worst possible times.

This conservative approach also improves decision-making. Investors who’ve committed only discretionary funds can weather volatility without panic. They’re not checking prices obsessively, losing sleep, or making desperate moves to recover losses. This emotional stability translates directly into better investment outcomes, as they can stick to long-term strategies rather than reacting to every market fluctuation. Before investing a single pound in cryptocurrency, honestly assess your financial situation and commit only amounts whose complete loss wouldn’t materially affect your quality of life.

Ignoring Transaction Fees and Gas Costs

Transaction fees and gas costs represent hidden erosions of cryptocurrency returns that new investors frequently overlook. These expenses vary dramatically depending on the blockchain, network congestion, and transaction complexity. What seems like a profitable trade can quickly become marginal or even unprofitable once fees are properly accounted for.

Ethereum’s gas fees provide a particularly instructive example. During periods of high network activity, simple transactions can cost £30, £50, or even more. For smaller investors making modest purchases, these fees can consume a significant percentage of their investment. Someone investing £200 who pays £40 in gas fees has immediately lost 20% of their capital before the asset has moved a penny in either direction.

Different blockchains have vastly different fee structures. Some newer networks offer transactions for fractions of a penny, whilst established networks like Bitcoin and Ethereum charge substantially more. Exchange withdrawal fees add another layer of cost. Moving cryptocurrency from an exchange to your personal wallet might incur fixed fees that make small transfers economically irrational.

Savvy investors calculate total costs before executing transactions. They monitor network congestion and time transactions for periods of lower activity when possible. They consolidate smaller transactions into larger ones to spread fixed costs across bigger amounts. They compare fee structures across different exchanges and blockchains. Most importantly, they include all fees when calculating investment returns, ensuring they have a realistic picture of actual performance rather than an inflated one that ignores these very real costs.

Chasing Pumps and Following Hype

The crypto space thrives on hype, and new investors often find themselves caught in pump-and-dump schemes or simply buying assets at unsustainable peaks. These schemes involve coordinated groups artificially inflating a cryptocurrency’s price through misleading statements, coordinated buying, and social media campaigns. Once the price reaches a target level, the orchestrators sell their holdings, leaving latecomers with worthless or dramatically devalued assets.

The pattern repeats with predictable regularity. An obscure token suddenly appears across social media, with influencers and anonymous accounts proclaiming it the “next big thing.” Charts show dramatic upward movement. FOMO (fear of missing out) sets in. New investors pile in, driving prices even higher and seemingly validating the hype. Then, just as quickly, the bottom falls out as early buyers cash out, leaving recent purchasers holding bags of coins that have lost 70%, 80%, or 90% of their value.

Even without deliberate manipulation, hype cycles create terrible entry points. Buying during periods of maximum enthusiasm means purchasing at inflated prices from sellers who bought much lower. The subsequent correction is inevitable: only its timing is uncertain.

Protecting yourself requires scepticism and patience. Be especially wary of investments promising quick, guaranteed returns or creating artificial urgency. Research the project’s fundamentals rather than its social media buzz. Ask yourself whether you’d want to hold this asset for months or years, not just days. Most importantly, develop the discipline to sit out opportunities that seem too good to be true, because they almost always are.

Failing to Research Projects Thoroughly

Insufficient research leaves investors vulnerable to fraudulent schemes, failed projects, and fundamentally flawed investments. The cryptocurrency space is littered with abandoned projects, outright scams, and well-intentioned ideas that simply didn’t work. Without proper due diligence, distinguishing between legitimate opportunities and expensive mistakes becomes impossible.

Thorough research examines multiple dimensions. The technology itself: Does the project solve a real problem? Is the technical approach sound? Does it offer genuine advantages over existing solutions? The team: Who’s building this? What’s their track record? Are they transparent and accessible, or anonymous and evasive? The tokenomics: How is the token distributed? What percentage do the founders hold? Is there a clear use case for the token, or is it unnecessary?

New investors often rely on single sources of information, frequently from parties with financial interests in promoting the project. This creates echo chambers where genuine scrutiny is absent. Credible research draws from multiple independent sources, including critical perspectives and technical analyses. White papers should be read and understood, not simply skimmed for exciting promises.

Scepticism is particularly warranted for opportunities promising unusually high returns with minimal risk. In investing, risk and return are correlated: claims of guaranteed high returns with low risk are nearly always fraudulent. Similarly, pressure tactics, “invest now or miss out forever”, signal scams rather than legitimate opportunities. Quality projects don’t need artificial urgency because their fundamentals speak for themselves. The hours spent researching before investing can prevent losses that years of gains couldn’t recover.

Leaving Crypto on Exchanges Long-Term

Storing cryptocurrency on exchanges long-term significantly increases exposure to hacking, theft, and platform failures. Whilst exchanges offer convenience, easy trading, quick access, familiar interfaces, they also concentrate vast amounts of cryptocurrency in single locations, making them attractive targets for sophisticated cybercriminals.

Exchange hacks have resulted in billions of pounds in losses. Mt. Gox, once the world’s largest Bitcoin exchange, collapsed after hackers stole approximately 850,000 Bitcoin. More recently, platforms like Bitfinex, Binance, and Coincheck have all experienced significant security breaches. Whilst some exchanges have compensated affected users, others have simply shut down, leaving investors with total losses.

Beyond hacking, exchanges can fail operationally. They may become insolvent, face regulatory shutdowns, or experience technical issues that prevent withdrawals. When your cryptocurrency sits in an exchange wallet, you don’t actually control it, the exchange does. You’re trusting them to maintain security, remain solvent, and honour withdrawal requests. This trust is sometimes misplaced.

The solution is straightforward: use exchanges for their intended purpose, exchanging, then transfer holdings to secure personal wallets. Hardware wallets provide the highest security for long-term storage. The slight inconvenience of transferring funds back to an exchange when you want to trade is a small price for dramatically improved security. The cryptocurrency saying “not your keys, not your coins” exists precisely because of the risks inherent in leaving assets under someone else’s control. Treat exchanges as you would a currency exchange booth when travelling: use them for transactions, but don’t store your wealth there.

Making Impulsive Decisions During Market Volatility

Market volatility triggers some of the costliest investment mistakes. Cryptocurrency prices can swing 10%, 20%, or even 50% in short periods, creating psychological pressure that overwhelms rational decision-making. New investors watching their portfolio value plummet often panic-sell at the bottom, locking in losses. Conversely, sharp upward movements trigger FOMO-driven purchases at unsustainable peaks.

These impulsive reactions typically follow predictable patterns. A cryptocurrency drops 30% in two days. Fear intensifies with each price update. The investor imagines the asset going to zero and sells everything to “stop the bleeding.” Days or weeks later, prices recover, and they’ve crystallised unnecessary losses. The opposite occurs during rapid rises: euphoria replaces analysis, and they buy at prices that can’t be sustained, only to watch subsequent corrections erase their gains.

The antidote is a predetermined investment strategy that operates independently of emotional states. This strategy should define position sizes, entry criteria, profit-taking levels, and stop-loss points before emotional pressure arrives. When volatility strikes, the investor consults their strategy rather than their feelings. If the strategy says hold, they hold, even if it’s uncomfortable. If it says sell a portion at certain profit levels, they execute that plan regardless of whether the asset might go higher.

Reducing exposure to volatility also helps. Checking prices constantly amplifies emotional responses to every fluctuation. Investors with long-term strategies often benefit from checking less frequently, allowing short-term noise to fade in importance. The most successful cryptocurrency investors often aren’t those who react quickest to volatility, but those who react least, maintaining discipline when everyone else is panicking or celebrating.

Overlooking Tax Obligations and Record-Keeping

Tax obligations represent one of the most commonly overlooked aspects of cryptocurrency investing. Many new investors operate under the mistaken belief that cryptocurrency transactions are anonymous or tax-exempt. In reality, most jurisdictions treat cryptocurrency as property or assets subject to capital gains taxes, and tax authorities have increasingly sophisticated methods for tracking crypto activity.

In the UK, HMRC requires reporting of cryptocurrency gains, and transactions can trigger taxable events in multiple scenarios: selling crypto for fiat currency, trading one cryptocurrency for another, using crypto to purchase goods or services, and even receiving crypto as payment. Each of these transactions may generate capital gains or losses that must be calculated and reported.

The complexity multiplies for active traders making numerous transactions across multiple platforms. Calculating cost basis, tracking individual trades, and determining gain or loss for each transaction becomes genuinely challenging without meticulous record-keeping. Some investors only discover this burden when preparing tax returns, by which point reconstructing transaction histories from incomplete exchange records becomes nightmarish.

Proactive record-keeping prevents this scenario. Document every transaction with dates, amounts, values in your local currency at the time of transaction, and the purpose. Many cryptocurrency tax software solutions can import exchange data and calculate obligations automatically. Beyond avoiding penalties, proper record-keeping allows you to offset gains with losses, potentially reducing tax liability substantially.

Ignoring tax obligations doesn’t make them disappear. Tax authorities have access to exchange transaction data and are increasingly focused on cryptocurrency compliance. The consequences of non-compliance, penalties, interest, and potential legal action, far exceed the inconvenience of proper reporting. Understanding and meeting tax obligations from the beginning prevents costly complications later.

Conclusion

The cryptocurrency landscape offers genuine opportunities for investors willing to navigate its complexities thoughtfully. Yet the path is littered with preventable losses that claim new investors who underestimate the risks or overestimate their knowledge. The mistakes outlined here, from phishing scams and emotional trading to inadequate security and tax negligence, share a common thread: they’re entirely avoidable with proper preparation and discipline.

Success in cryptocurrency investment requires a dual approach. Technical security measures, strong passwords, two-factor authentication, hardware wallets, and verified platforms, protect against external threats. Equally important are the internal disciplines: research-based decision-making, emotional control, realistic risk assessment, and systematic record-keeping. Neither dimension suffices alone: both must work together.

The decentralised nature of cryptocurrency means there’s no safety net for mistakes. No institution will reverse your transaction to a scammer. No insurance covers losses from poor security. No customer service department can retrieve forgotten passwords or seed phrases. This unforgiving environment demands higher standards of personal responsibility than traditional finance.

Yet this same characteristic, personal sovereignty over your assets, represents cryptocurrency’s revolutionary potential. By understanding common pitfalls and implementing protective strategies, investors can harness this potential whilst managing its risks. The question isn’t whether cryptocurrency investing is risky, but whether you’re prepared to take responsibility for managing those risks effectively. Those who are will find the landscape far less treacherous than it first appears.

Frequently Asked Questions

What are the most common ways new investors accidentally lose money in crypto?

New investors typically lose money through phishing scams, emotional trading decisions, inadequate wallet security, sharing private keys, leaving funds on exchanges, and neglecting to research projects thoroughly. These preventable mistakes account for more losses than market downturns.

How can I protect myself from crypto phishing scams?

Always manually type exchange URLs rather than clicking email links, verify HTTPS security, examine URLs for subtle misspellings, and never share private keys or seed phrases. Legitimate crypto services will never request this sensitive information via email or text.

Should I keep my cryptocurrency on an exchange or in a personal wallet?

For long-term holdings, transfer crypto to a secure personal wallet, preferably a hardware wallet. Exchanges are vulnerable to hacks and operational failures. Use exchanges for transactions only, as you don’t truly control assets stored there.

Is two-factor authentication really necessary for crypto accounts?

Yes, two-factor authentication is essential. It prevents unauthorised access even if someone steals your password. Authentication apps like Google Authenticator provide superior protection by generating time-sensitive codes that change every 30 seconds, dramatically reducing account breach risks.

How much should I invest in cryptocurrency as a beginner?

Only invest money you can afford to lose completely. Unlike traditional banks, crypto holdings have no government insurance. Investing discretionary funds rather than essential savings allows you to weather volatility without panic-selling and improves long-term decision-making.

Do I need to pay taxes on cryptocurrency transactions in the UK?

Yes, HMRC treats cryptocurrency as property subject to capital gains tax. Taxable events include selling crypto for fiat, trading between cryptocurrencies, and using crypto for purchases. Maintain detailed transaction records to calculate obligations accurately and avoid penalties.