The cryptocurrency landscape is undergoing transformations that few could have imagined even a couple of years ago. From Bitcoin’s relentless march towards unprecedented valuations to the quiet revolution of tokenised real-world assets, the industry stands at a crossroads where speculation meets genuine utility. Institutional giants who once dismissed digital currencies are now scrambling for exposure, whilst regulators worldwide are finally crafting frameworks that could legitimise, or constrain, the sector’s ambitions. Meanwhile, technological innovations in Layer 2 solutions, artificial intelligence integration, and cross-chain interoperability promise to address longstanding limitations that have kept mainstream adoption just out of reach. These aren’t merely the musings of enthusiasts in online forums: they represent consensus views amongst analysts, executives, and policymakers shaping the future of finance. What follows is a comprehensive examination of the twelve predictions dominating industry discourse right now, some backed by concrete data, others speculative yet plausible, all worthy of attention from anyone invested in crypto’s trajectory.

Bitcoin’s Path to New All-Time Highs

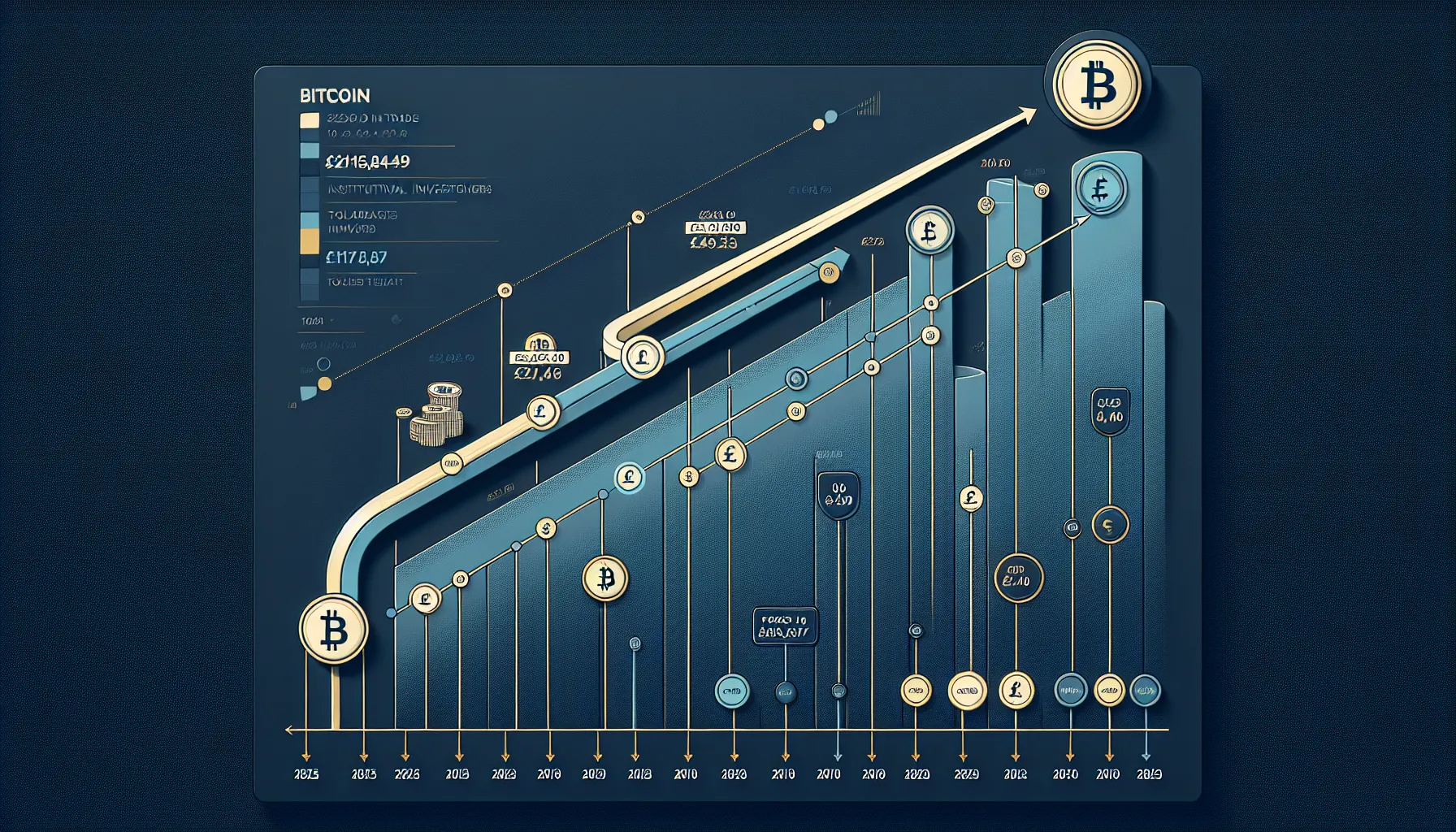

Bitcoin predictions for 2025 remain predominantly bullish amongst analysts, with forecasts suggesting the flagship cryptocurrency will continue its upward trajectory even though inevitable volatility. Experts anticipate Bitcoin will trade between a maximum of £121,440.85 and a minimum of £45,871.41 throughout 2025, representing a substantial range that accounts for market cycles and macroeconomic pressures.

Notable forecasters have staked their reputations on even more optimistic targets. Anthony Scaramucci of SkyBridge Capital predicts Bitcoin could peak at £170,000 within the next year, whilst Marshall Beard, CEO of Gemini Exchange, and Tom Lee of Fundstrat Global Advisors both project a £150,000 target by year-end. These aren’t fringe voices, they’re institutional leaders whose predictions carry weight with investors.

Digital Coin Price takes an even more ambitious stance, suggesting an average price of £210,644.67 for 2025, with peaks potentially reaching £230,617.59. Such projections reflect confidence in Bitcoin’s growing acceptance as both a store of value and an increasingly legitimate asset class. Looking further ahead, analysts anticipate Bitcoin could reach a maximum price of £500,000 by 2030, driven by continued scarcity dynamics as halvings reduce supply and demand from institutional and sovereign buyers accelerates. Whether these predictions materialise depends on factors ranging from regulatory developments to macroeconomic conditions, but the consensus clearly leans bullish.

Ethereum’s Evolution and Layer 2 Dominance

Ethereum’s roadmap continues to focus on scalability solutions that could fundamentally reshape how the network operates. Layer 2 solutions, including rollups, sidechains, and state channels, have emerged as the primary strategy for addressing Ethereum’s persistent congestion and high transaction fees. Projects like Arbitrum, Optimism, and Polygon are processing millions of transactions whilst settling security on Ethereum’s base layer, effectively multiplying the network’s capacity without compromising decentralisation.

Industry observers predict Layer 2 adoption will reach critical mass in the coming years, with most users interacting with Ethereum indirectly through these scaling solutions rather than the mainnet itself. This shift represents a maturation of Ethereum’s architecture, moving from a monolithic structure to a modular design where the base layer provides security whilst execution happens elsewhere. The implications extend beyond mere throughput, lower fees could unlock use cases previously rendered impractical by cost, from microtransactions to complex DeFi strategies.

Ethereum’s transition to proof-of-stake has also positioned the network favourably for environmental, social, and governance considerations, reducing energy consumption by approximately 99.95% compared to its previous proof-of-work model. As developers continue refining the user experience and abstracting away the complexity of Layer 2 interactions, Ethereum’s dominance in smart contract platforms appears secure, though competition from alternative Layer 1 blockchains ensures complacency remains a luxury the ecosystem cannot afford.

The Rise of Real-World Asset Tokenisation

Real-world asset tokenisation represents one of cryptocurrency’s most pragmatic applications, bridging traditional finance with blockchain infrastructure in ways that unlock liquidity and accessibility. The premise is straightforward: convert ownership rights to physical or financial assets, property, commodities, bonds, equity, into digital tokens that can be traded, fractionalized, and programmed with smart contract logic.

Predictions suggest tokenised assets could reach trillions in market value over the next decade as institutional adoption accelerates. Major financial institutions, including BlackRock and JPMorgan, have already begun experimenting with tokenised funds and securities, lending credibility to a concept once relegated to speculative whitepapers. The advantages are compelling: 24/7 trading, reduced intermediary costs, programmable compliance, and fractional ownership that democratises access to assets historically available only to wealthy investors.

Regulatory frameworks remain the primary bottleneck. Tokenising a commercial property or corporate bond requires navigating complex legal structures that vary by jurisdiction, and clarity on how securities laws apply to digital tokens is still emerging. Nevertheless, pilot programmes and sandbox environments are proliferating, suggesting regulators recognise the potential whilst working to mitigate risks. Should legal and technical infrastructure mature as predicted, real-world asset tokenisation could become one of blockchain’s most significant mainstream applications, finally delivering tangible utility beyond speculative trading.

Central Bank Digital Currencies Gain Momentum

Central bank digital currencies are transitioning from theoretical frameworks to active pilots and implementations across dozens of countries. China’s digital yuan has already processed billions in transactions, whilst the European Central Bank continues developing the digital euro with trials expected in the coming years. Even traditionally cautious institutions like the Bank of England are exploring CBDCs as potential complements or alternatives to physical cash.

Proponents argue CBDCs could enhance monetary policy transmission, reduce payment system costs, and provide financial inclusion for unbanked populations. Critics, but, warn of privacy implications and the potential for unprecedented government surveillance of financial transactions. The technology could theoretically enable programmable money, currency with embedded rules about how and where it can be spent, raising questions about individual autonomy that extend well beyond finance.

Predictions suggest multiple major economies will launch CBDCs within the next five years, fundamentally altering the relationship between citizens, commercial banks, and central authorities. For the cryptocurrency industry, CBDCs represent both validation of blockchain principles and potential competition for stablecoins and payment-focused cryptocurrencies. The extent to which CBDCs adopt genuinely decentralised architectures versus centralised databases remains an open question, one that will significantly influence their reception amongst privacy-conscious users and crypto advocates.

Institutional Adoption Reaches Critical Mass

Institutional adoption is accelerating at a pace that has caught even optimists by surprise. In the United States, spot Bitcoin exchange-traded funds have driven substantial demand from institutional investors, particularly following political developments that created a more favourable regulatory environment. Within the UK, the Financial Conduct Authority opened retail access to crypto exchange-traded products in October 2025, marking a significant shift in regulatory posture.

Current statistics illustrate the growing mainstream acceptance: 12% of UK adults now own cryptocurrency, up from 10% in previous research. The UK cryptocurrency market generated £334.3 million in revenue during 2024 and is projected to reach £619.0 million by 2030, representing an 11.1% compound annual growth rate. These figures reflect not merely speculative interest but sustained engagement from individuals and institutions treating cryptocurrency as a legitimate asset class.

Pension funds, endowments, and corporate treasuries are increasingly allocating small percentages to Bitcoin and other digital assets as portfolio diversifiers. The infrastructure supporting institutional participation, custody solutions, prime brokerage services, derivatives markets, has matured substantially, removing technical barriers that once deterred conservative investors. As institutional capital flows into the sector, predictions suggest market volatility may moderate whilst total capitalisation continues expanding, creating a feedback loop that attracts additional mainstream participants seeking exposure to what was recently considered fringe technology.

AI and Blockchain Convergence Accelerates

The convergence of artificial intelligence and blockchain technology represents a fusion of two transformative forces that could amplify each other’s strengths whilst mitigating respective weaknesses. AI’s hunger for data and computational resources intersects with blockchain’s capacity for secure, verifiable data sharing and decentralised computation. Predictions suggest this intersection will spawn entirely new categories of applications over the next several years.

Blockchain could address AI’s transparency and accountability challenges by providing immutable audit trails for training data, model decisions, and algorithmic updates. Conversely, AI could enhance blockchain networks through optimised consensus mechanisms, predictive analytics for market dynamics, and automated smart contract security audits. Projects exploring AI-driven decentralised autonomous organisations and blockchain-verified AI models are moving from theoretical papers to working prototypes.

The economic implications are substantial. Decentralised AI marketplaces could democratise access to machine learning capabilities, whilst tokenised compute resources might create liquid markets for GPU power and data sets. Challenges remain, integrating AI’s typically centralised, computationally intensive processes with blockchain’s distributed architecture requires architectural innovations that are still emerging. Nevertheless, industry observers increasingly view AI-blockchain convergence not as a distant possibility but as an inevitable evolution that will reshape both domains, with predictions suggesting significant commercial applications emerging within the next three to five years.

DeFi 2.0 Transforms Traditional Finance

Decentralised finance has evolved beyond its initial incarnation of yield farming and liquidity mining into something more sustainable and genuinely useful. Growth in decentralised finance platforms continues, with increasing interest driving market expansion beyond the speculative frenzy that characterised DeFi’s first wave. What industry insiders call DeFi 2.0 emphasises protocol-owned liquidity, sustainable tokenomics, and integration with real-world financial infrastructure.

Predictions suggest DeFi protocols will increasingly compete directly with traditional financial services, lending, derivatives, asset management, by offering superior efficiency, transparency, and accessibility. The total value locked in DeFi protocols, whilst volatile, has demonstrated resilience through multiple market cycles, indicating that genuine utility underpins at least a portion of the sector. Innovations in undercollateralised lending, algorithmic stablecoins (lessons learned from previous failures despite), and cross-chain liquidity aggregation promise to address limitations that have constrained mainstream adoption.

Regulatory scrutiny represents both challenge and opportunity for DeFi’s maturation. Whilst anonymity and permissionlessness remain core values for purists, pragmatic projects are implementing compliance layers and identity solutions that could satisfy regulators without entirely compromising decentralisation. Should DeFi protocols successfully navigate this balance, predictions of traditional finance institutions adopting blockchain-based settlement and smart contract automation could materialise faster than the incumbents themselves anticipate, disrupting business models that have remained largely unchanged for decades.

Regulatory Clarity Reshapes the Industry

Regulatory developments are fundamentally reshaping the cryptocurrency landscape, with 2025 marking a potential inflection point between uncertainty and framework establishment. The FCA’s decision to open retail access to crypto exchange-traded products in October 2025 demonstrates increasing regulatory acceptance within the UK, reflecting a broader global trend towards accommodation rather than outright hostility.

But, challenges persist. Evolving anti-money laundering and Know Your Customer laws continue presenting operational headaches for exchanges and DeFi protocols alike. The tension between blockchain’s pseudonymous architecture and regulators’ demands for transaction transparency remains unresolved in many jurisdictions. Different regulatory approaches across regions, from Singapore’s progressive framework to China’s outright bans, create compliance complexities for global projects and arbitrage opportunities for jurisdictional shopping.

Predictions suggest the next several years will see increased harmonisation of cryptocurrency regulations amongst major economies, potentially through international coordination bodies. This clarity, whilst potentially constraining certain activities, would likely accelerate institutional adoption by removing legal ambiguity that currently prevents conservative investors from participating. The industry faces a philosophical crossroads: embrace regulatory legitimacy and mainstream acceptance, or maintain ideological purity at the cost of remaining niche. Market dynamics and capital flows suggest the former path will prevail for most projects, though a vibrant ecosystem of privacy-focused alternatives will persist for users prioritising censorship resistance above regulatory compliance.

NFT Utility Expands Beyond Digital Art

Non-fungible tokens have weathered the collapse of speculative excess and are emerging with genuine utility cases that extend far beyond overpriced profile pictures. The NFT market’s maturation involves shifting focus from collectibles towards practical applications in identity, credentials, membership, and intellectual property rights management.

Predictions suggest NFTs will become infrastructure for digital ownership across multiple domains. Event ticketing represents one obvious application, NFTs eliminate counterfeiting, enable programmable resale markets with artist royalties, and provide verifiable attendance records. Academic credentials and professional certifications stored as NFTs could create portable, tamper-proof records that individuals control rather than institutions. Gaming items and virtual world assets represent another growth area, with interoperability between platforms potentially enabled by standardised NFT protocols.

The technology’s ability to embed programmable royalties has particular significance for creators, ensuring they capture value from secondary market transactions in ways impossible with traditional media. Music rights, film distribution, and publishing could all be disrupted by NFT-based models that align creator incentives with long-term asset appreciation. Whilst the speculative bubble has deflated, the underlying technology’s capacity to tokenise unique digital and physical items suggests NFTs will persist as fundamental blockchain infrastructure, even if most projects from the 2021-2022 boom fade into obscurity. The prediction isn’t a return to previous valuations but rather a steady expansion of practical applications that quietly become standard practice.

Stablecoin Innovation and Market Growth

Stablecoins have emerged as cryptocurrency’s killer application, providing the price stability necessary for everyday transactions whilst maintaining blockchain’s advantages. The stablecoin market has grown to hundreds of billions in capitalisation, with USDT and USDC dominating but newer entrants challenging their hegemony with innovative collateralisation models and regulatory compliance features.

Predictions suggest stablecoin usage will expand dramatically as payment rails, particularly in remittances and cross-border commerce where traditional banking infrastructure remains slow and expensive. Major payment processors and financial institutions are launching proprietary stablecoins, recognising the technology’s potential to streamline settlement and reduce costs. The speed and low fees of blockchain-based transfers compared to correspondent banking networks provide compelling advantages that are difficult to dismiss.

Regulatory attention on stablecoins has intensified, with authorities concerned about systemic risk if poorly collateralised stablecoins achieve widespread adoption. Proposals for reserve audits, capital requirements, and banking charters for stablecoin issuers suggest the regulatory framework will resemble traditional banking more than the permissionless ideal that initially inspired cryptocurrency. Algorithmic stablecoins, which maintain pegs through supply adjustments rather than collateral, have faced scepticism following high-profile failures, though research continues into designs that might prove more resilient. The prediction is that fiat-backed stablecoins will dominate the market, becoming increasingly regulated and mainstream, whilst more experimental approaches remain niche but continue attracting developers seeking elegance and true decentralisation.

Environmental Sustainability Becomes Standard

Environmental concerns have dogged cryptocurrency since Bitcoin’s energy consumption became a mainstream talking point. Bitcoin’s energy usage continues drawing criticism, with estimates suggesting the network consumes electricity comparable to medium-sized countries. This criticism has prompted soul-searching within the industry and spurred innovations aimed at reducing blockchain’s environmental footprint.

Predictions suggest environmental sustainability will transition from differentiator to expectation as ESG considerations influence institutional investment decisions. Ethereum’s transition to proof-of-stake, which reduced its energy consumption by approximately 99.95%, demonstrates that dramatic efficiency improvements are technically feasible. Newer blockchain architectures prioritise energy efficiency from inception, whilst Bitcoin proponents argue that renewable energy adoption amongst miners is accelerating and that the network’s energy use secures unprecedented monetary infrastructure.

The debate extends beyond mere energy consumption to questions about e-waste from mining hardware, the carbon intensity of electricity sources, and whether blockchain’s benefits justify its environmental costs. Carbon offset initiatives, renewable energy commitments, and alternative consensus mechanisms represent the industry’s responses to criticism. Regulators in some jurisdictions have proposed or implemented restrictions on energy-intensive mining operations, adding urgency to sustainability efforts. The prediction is that environmental considerations will increasingly influence which blockchain networks attract capital and adoption, with projects demonstrating credible sustainability commitments gaining competitive advantages as climate consciousness permeates investment decisions and consumer preferences.

Interoperability Solutions Connect Ecosystems

Blockchain’s fragmented landscape, dozens of incompatible networks each with distinct ecosystems, has long hindered user experience and capital efficiency. Interoperability solutions promise to connect these isolated islands into an interconnected archipelago where assets and data flow seamlessly across chains. Predictions suggest the next several years will see dramatic improvements in cross-chain infrastructure, fundamentally changing how users interact with blockchain technology.

Bridge protocols, wrapped assets, and cross-chain messaging systems have proliferated, though security vulnerabilities in bridges have resulted in billions in losses, highlighting the technical challenges involved. Newer approaches emphasise cryptographic verification rather than trusted intermediaries, potentially offering security guarantees closer to the underlying blockchains themselves. Projects like Cosmos, Polkadot, and LayerZero represent different architectural philosophies for achieving interoperability, from hub-and-spoke models to generalised messaging layers.

The implications extend beyond convenience. True interoperability could enable liquidity aggregation across chains, allowing DeFi protocols to tap into assets regardless of their native blockchain. Developers could build applications that leverage the specific strengths of different networks, Ethereum’s security, Solana’s speed, Bitcoin’s liquidity, within a single user experience. Predictions suggest successful interoperability solutions will command significant value capture as essential infrastructure, whilst networks that remain isolated may struggle to retain users and developers as the ecosystem consolidates around interoperable standards. The vision of a seamlessly connected blockchain ecosystem remains partially realised, but momentum and investment suggest it’s a question of when rather than if.

Conclusion

The cryptocurrency industry stands at a peculiar juncture where maturation and experimentation coexist. Bitcoin’s trajectory towards potential six-figure valuations reflects growing institutional confidence, whilst emerging technologies like real-world asset tokenisation and AI-blockchain convergence promise utility beyond speculative trading. Regulatory frameworks are crystallising, bringing both legitimacy and constraints that will shape which projects thrive and which fade.

These twelve predictions represent more than educated guesses, they reflect capital allocation decisions, development priorities, and regulatory initiatives already in motion. Not all will materialise as forecast: the cryptocurrency space has humbled plenty of confident predictors. Yet the directional trends seem clear: greater institutional involvement, improved infrastructure, expanding use cases, and increasing integration with traditional finance and technology sectors.

What’s perhaps most significant is that these predictions are being discussed not merely in crypto-native circles but in boardrooms, regulatory agencies, and mainstream financial media. The conversation has shifted from whether blockchain technology matters to how it will reshape existing systems. That shift alone suggests the industry has crossed a threshold from which retreat seems unlikely, regardless of short-term price volatility or regulatory turbulence. The coming years will test these predictions, and reality will undoubtedly surprise in ways no forecast anticipates, but the trajectory points unmistakably towards cryptocurrency’s continued evolution from fringe experiment to financial infrastructure.

Frequently Asked Questions

What are the most bullish Bitcoin predictions for 2025 and beyond?

Analysts predict Bitcoin could trade between £45,871 and £121,441 throughout 2025, with notable forecasters like Anthony Scaramucci projecting peaks of £170,000. Looking further ahead, Bitcoin could potentially reach £500,000 by 2030, driven by scarcity dynamics and accelerating institutional demand.

How are Layer 2 solutions transforming Ethereum’s scalability?

Layer 2 solutions like Arbitrum, Optimism, and Polygon are processing millions of transactions whilst settling security on Ethereum’s base layer. Industry observers predict most users will soon interact with Ethereum indirectly through these scaling solutions, significantly reducing fees and unlocking previously impractical use cases.

What is real-world asset tokenisation in cryptocurrency?

Real-world asset tokenisation converts ownership rights to physical or financial assets—such as property, commodities, or bonds—into digital tokens tradeable on blockchain. Major institutions like BlackRock and JPMorgan are experimenting with tokenised funds, with predictions suggesting this market could reach trillions in value.

Will central bank digital currencies replace traditional cryptocurrencies?

CBDCs represent both validation of blockchain principles and potential competition for stablecoins. Whilst multiple major economies will likely launch CBDCs within five years, they’ll probably coexist with cryptocurrencies rather than replace them, serving different purposes within the broader digital finance ecosystem.

How is institutional adoption changing the cryptocurrency market?

Institutional adoption is accelerating dramatically, with 12% of UK adults now owning cryptocurrency and the UK market projected to reach £619 million by 2030. Spot Bitcoin ETFs, improved custody solutions, and regulatory clarity are driving pension funds and corporate treasuries to allocate capital to digital assets.

Why is blockchain interoperability important for crypto’s future?

Interoperability solutions connect fragmented blockchain networks, enabling seamless asset and data flow across chains. This allows liquidity aggregation, improved user experience, and applications that leverage multiple networks’ strengths simultaneously, addressing a longstanding limitation preventing mainstream adoption and capital efficiency.