The cryptocurrency landscape has evolved far beyond Bitcoin, with thousands of altcoins now competing for investor attention. Yet only a handful possess the fundamentals necessary for sustained long-term growth. Identifying these standout projects requires more than tracking price charts, it demands understanding the technology, teams, and real-world problems each altcoin aims to solve.

For investors looking beyond short-term speculation, 2025 presents compelling opportunities in altcoins that have proven their resilience through market cycles whilst continuing to innovate. Ethereum, Solana, Cardano, Polkadot, and Chainlink consistently emerge as top contenders, each addressing distinct challenges within blockchain infrastructure. These projects combine strong use cases with active development and robust communities, positioning them favourably for the years ahead.

This guide examines what separates viable long-term altcoin investments from fleeting trends, explores the leading candidates worth considering, and outlines the practical factors that should inform any investment decision in this notoriously volatile market.

Key Takeaways

- The best altcoins to invest in for long-term growth include Ethereum, Solana, Cardano, Polkadot, and Chainlink, each addressing distinct blockchain infrastructure challenges.

- Successful long-term altcoin investments require strong use cases, active development teams, engaged communities, and real-world applications rather than speculative hype.

- Ethereum remains the dominant smart contract platform with the largest developer ecosystem, whilst Solana offers high-speed scalability for consumer-facing applications.

- Chainlink provides essential oracle infrastructure connecting smart contracts to real-world data, positioning it as foundational technology across multiple blockchain platforms.

- Altcoin investing carries substantial risks including extreme price volatility, technological vulnerabilities, and regulatory uncertainty, making diversification and careful position sizing critical.

- Building a diversified altcoin portfolio with allocations of 5-15% per project and regular rebalancing helps manage risk whilst maintaining exposure to cryptocurrency’s growth potential.

What Makes an Altcoin Suitable for Long-Term Investment?

Not all altcoins are created equal. Whilst thousands of projects promise revolutionary technology, most will fade into obscurity. The altcoins that survive, and thrive, share specific characteristics that set them apart from speculative tokens chasing hype cycles.

Strong Use Cases and Real-World Applications

The foundation of any worthwhile long-term altcoin investment is a genuine use case that addresses tangible problems. Projects built on solid utility rather than marketing narratives tend to weather market downturns and attract sustained development interest.

Ethereum, for instance, pioneered smart contracts, self-executing agreements that power decentralised applications across finance, gaming, and digital identity. This wasn’t theoretical innovation: it created an entire ecosystem of decentralised finance (DeFi) protocols and non-fungible tokens (NFTs) that now process billions in value. Similarly, Solana tackled blockchain scalability by enabling high-speed, low-cost transactions that make consumer-facing applications practical. Polkadot’s focus on interoperability solves the fragmentation problem plaguing blockchain networks, allowing different chains to communicate and share data seamlessly.

Altcoins with clear, defensible use cases attract developers, businesses, and users, creating network effects that compound over time. The question investors should ask isn’t whether a project sounds innovative, but whether it solves a problem people actually face and whether adoption is demonstrably growing.

Development Team and Community Support

Technology alone doesn’t guarantee success. Behind every enduring altcoin stands a reputable development team and an engaged community capable of navigating the inevitable challenges of blockchain development.

Projects led by experienced developers with transparent roadmaps and consistent delivery inspire confidence. Cardano’s research-driven approach, featuring peer-reviewed academic papers before implementation, exemplifies methodical development prioritising security and sustainability over rushed launches. The team’s credentials and methodology signal long-term commitment rather than quick profit extraction.

Equally vital is community strength. Active communities contribute code, build applications on the platform, provide support, and advocate for adoption. They also hold development teams accountable and help projects adapt to changing market conditions. Ethereum’s vast developer ecosystem, for example, has enabled it to maintain dominance even though emerging competitors because thousands of contributors continuously improve the protocol and expand its capabilities.

Investors should scrutinise team backgrounds, development activity on repositories like GitHub, community engagement across forums and social channels, and how projects handle setbacks. Altcoins that transparently communicate challenges whilst maintaining steady progress demonstrate the resilience necessary for long-term viability.

Top Altcoins With Long-Term Growth Potential

Whilst the cryptocurrency market offers countless options, several altcoins have distinguished themselves through consistent innovation, growing adoption, and battle-tested infrastructure. These projects represent different approaches to blockchain technology, each carving out distinct niches within the ecosystem.

Ethereum: The Smart Contract Pioneer

Ethereum remains the undisputed leader in smart contract platforms and decentralised applications. As the first blockchain to enable programmable transactions, it established the template that most competitors now follow. Its first-mover advantage has translated into the largest ecosystem of developers, applications, and users in the crypto space.

What sets Ethereum apart isn’t just historical dominance, it’s continued evolution. The transition to proof-of-stake consensus through Ethereum 2.0 addressed longstanding concerns about energy consumption and scalability. Layer-2 solutions like Optimism and Arbitrum now handle transaction overflow, dramatically reducing costs whilst maintaining security guarantees from the main chain.

Ethereum hosts the overwhelming majority of DeFi protocols, NFT marketplaces, and decentralised autonomous organisations (DAOs). This entrenched ecosystem creates powerful network effects: developers build on Ethereum because users are there, and users stay because applications are there. For long-term investors, Ethereum represents relatively lower risk within the volatile altcoin space, combining established infrastructure with ongoing innovation.

Solana: High-Speed Blockchain for Scalability

Solana emerged as a serious Ethereum challenger by tackling blockchain’s most persistent problem: scalability without sacrificing decentralisation. Its innovative proof-of-history consensus mechanism enables transaction throughput that dwarfs most competitors, processing thousands of transactions per second at minimal cost.

This technical advantage has attracted projects requiring high performance, decentralised exchanges, gaming platforms, and consumer applications that would be impractical on slower chains. Solana’s ecosystem has grown rapidly, particularly in NFTs and DeFi, establishing it as more than a theoretical improvement but a functioning alternative with real adoption.

The network has faced challenges, including several outages that raised questions about decentralisation and reliability. But, the development team’s transparent response and continued improvements demonstrate commitment to addressing these issues. For investors, Solana represents higher risk than Ethereum but potentially greater upside if it can maintain momentum whilst improving stability. Its strong developer community and venture capital backing provide resources to sustain long-term development.

Cardano: Research-Driven Development

Cardano takes a distinctly academic approach to blockchain development, prioritising peer-reviewed research and methodical implementation over rapid deployment. Founded by Ethereum co-founder Charles Hoskinson, the project emphasises sustainability, scalability, and interoperability through rigorous scientific methodology.

This cautious approach has drawn criticism for slower feature rollout compared to competitors. Yet it also positions Cardano for long-term stability, with each upgrade thoroughly vetted before implementation. The platform’s proof-of-stake consensus mechanism, Ouroboros, was the first to be mathematically proven secure, reflecting the project’s commitment to foundational soundness.

Cardano’s focus on developing-world applications, particularly in Africa for identity management and financial inclusion, could unlock adoption in underserved markets. Its treasury system, which allocates ongoing funding for development through community voting, creates a sustainable model for continued innovation. For investors willing to accept slower progress in exchange for potentially greater long-term security and sustainability, Cardano presents a compelling option.

Polkadot: Connecting Multiple Blockchains

Polkadot addresses blockchain fragmentation through an ambitious vision: enabling different blockchains to communicate and share data seamlessly. Rather than competing directly with platforms like Ethereum, Polkadot positions itself as infrastructure connecting disparate networks into a cohesive “internet of blockchains.”

The platform’s parachain architecture allows specialised blockchains to operate independently whilst benefiting from Polkadot’s shared security and interoperability. This modular approach enables developers to optimise chains for specific use cases, privacy, speed, or smart contracts, without compromising on other dimensions.

Polkadot’s parachain auctions, where projects bid for slots on the network, have demonstrated strong demand and created a unique economic model. The platform also offers attractive staking rewards, providing income opportunities for long-term holders. As blockchain adoption expands across industries and use cases, Polkadot’s interoperability focus could become increasingly valuable, making it a strategic long-term holding for investors betting on a multi-chain future.

Chainlink: Decentralised Oracle Network

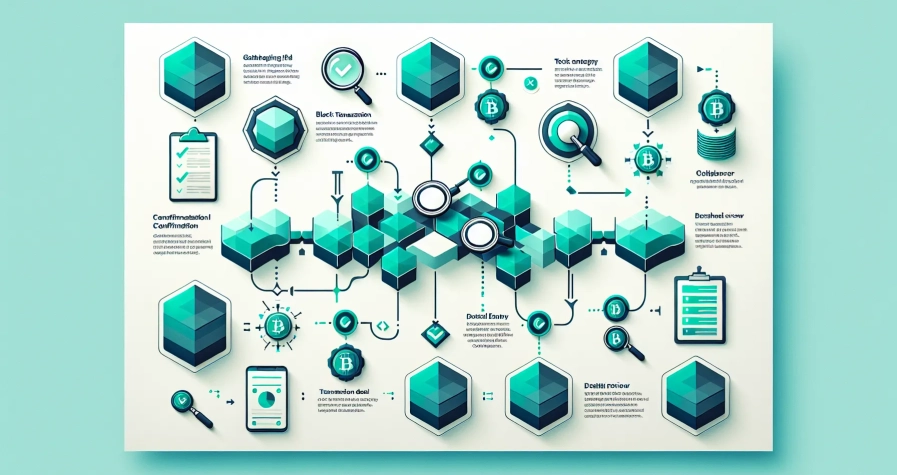

Chainlink occupies a unique niche within the crypto ecosystem: connecting smart contracts with real-world data. Whilst other altcoins focus on transaction processing or application hosting, Chainlink provides the critical infrastructure that enables blockchain applications to interact with external information, price feeds, weather data, sports results, and more.

This oracle functionality is essential for countless applications. DeFi protocols rely on Chainlink price feeds to determine collateral values, insurance products use it to verify claims, and supply chain platforms depend on it for tracking goods. Chainlink’s decentralised approach prevents any single point of failure, a critical feature for applications handling significant value.

The project has established partnerships across industries, from traditional finance institutions to tech companies exploring blockchain integration. Its technology-agnostic design allows it to serve multiple blockchains, positioning Chainlink as foundational infrastructure regardless of which smart contract platforms eventually dominate. For investors, Chainlink represents a bet on blockchain adoption broadly rather than any specific platform, offering diversified exposure within a single asset.

Key Factors to Consider Before Investing

Selecting promising altcoins is only part of the investment equation. Understanding the broader context that affects their value and viability helps investors make more informed decisions and manage expectations appropriately.

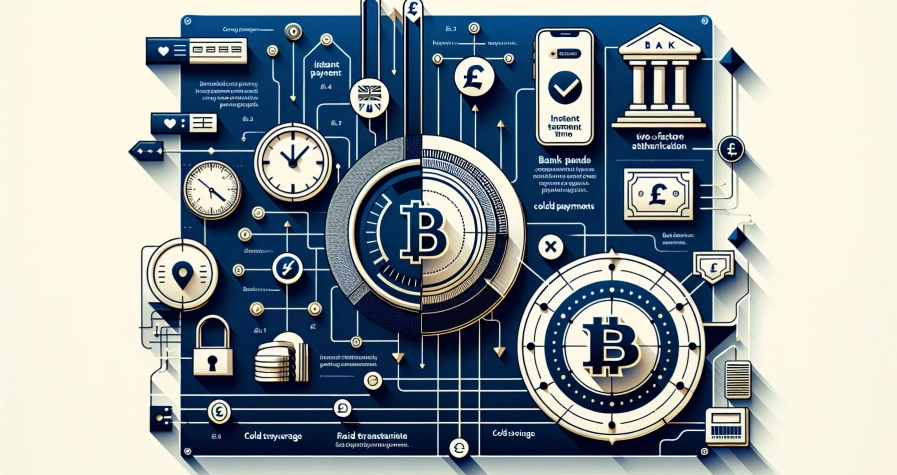

Market Capitalisation and Liquidity

Market capitalisation, the total value of all coins in circulation, provides important context about an altcoin’s maturity and potential. Larger market caps generally indicate greater stability, as moving the price requires significantly more capital. Ethereum’s market cap in the hundreds of billions makes it far less volatile than coins valued in the millions, where relatively small trades can cause dramatic price swings.

Liquidity, measured by daily trading volume, determines how easily investors can enter or exit positions without affecting price. High liquidity means tighter bid-ask spreads and the ability to execute larger trades without slippage. Altcoins with low liquidity might appear attractively priced but can be difficult to sell during downturns, potentially trapping investors in losing positions.

For long-term investors, higher market cap and liquidity often matter more than for speculators. Whilst smaller projects might offer greater percentage gains, they also carry substantially higher risk of failure or illiquidity. Balancing potential returns against these practical considerations helps create more resilient portfolios.

Regulatory Environment and Compliance

Regulatory uncertainty remains one of the cryptocurrency market’s most significant risks. Different jurisdictions are developing varied approaches to crypto regulation, from outright bans to progressive frameworks encouraging innovation. These regulatory decisions can dramatically impact altcoin values and accessibility.

Projects that proactively engage with regulators and design compliance features may be better positioned as frameworks crystallise. Conversely, altcoins that explicitly circumvent regulations or operate in legal grey areas face existential risks if authorities decide to act. The classification of tokens, whether they’re securities, commodities, or something else, carries significant implications for their legal status and investor protections.

Investors should consider where projects are based, how they interact with regulatory bodies, and whether their design might attract scrutiny. Geographic diversification can help mitigate jurisdiction-specific regulatory risks, though no cryptocurrency is entirely immune from legal developments. Staying informed about evolving regulations in major markets provides context for understanding potential headwinds or tailwinds facing specific altcoins.

Risks Associated With Altcoin Investments

For all their potential, altcoins remain among the highest-risk investments available. Understanding these risks doesn’t necessarily preclude investment, but it should inform position sizing and portfolio allocation.

Price volatility in cryptocurrency markets dramatically exceeds traditional assets. Altcoins can lose 50% or more of their value in days during market downturns, with no circuit breakers or trading halts to slow declines. This volatility works both directions, spectacular gains are possible, but the psychological and financial impact of severe drawdowns challenges even experienced investors.

Technological risks are substantial. Smart contract bugs can lead to catastrophic losses, as numerous DeFi hacks have demonstrated. Network outages, consensus failures, or successful attacks on blockchain infrastructure can undermine confidence and value. Even well-designed projects face risks from unforeseen technical challenges or competition from superior technology.

Operational risks include exchange failures, custody issues, and the potential for loss through user error. Unlike traditional finance, cryptocurrency transactions are typically irreversible, and lost private keys mean permanently inaccessible funds. The relatively young infrastructure supporting crypto trading lacks the regulatory protections and insurance that traditional investors take for granted.

Market manipulation, whilst difficult to quantify, likely affects prices, particularly for smaller altcoins with limited liquidity. Coordinated buying or selling, false information, and other manipulative tactics can create artificial price movements that trap unsuspecting investors.

Perhaps most importantly, the vast majority of altcoins will eventually fail. Even promising projects with solid technology and reputable teams can be displaced by competitors, lose community support, or simply fail to achieve sufficient adoption. Long-term altcoin investment requires accepting that some positions will likely go to zero, making diversification and position sizing critical risk management tools.

How to Build a Diversified Altcoin Portfolio

Given the high risk and uncertainty inherent in altcoin investing, diversification becomes particularly important. A thoughtfully constructed portfolio can provide exposure to cryptocurrency’s upside potential whilst managing the risk of individual project failures.

Begin by allocating across altcoins with different use cases and technological approaches. Rather than concentrating in multiple smart contract platforms that directly compete, consider combining a dominant platform like Ethereum with infrastructure plays like Chainlink and interoperability solutions like Polkadot. This approach provides exposure to various aspects of blockchain development rather than betting entirely on one category.

Position sizing should reflect both conviction and risk tolerance. Even strong altcoins warrant limited allocations given their volatility. Many experienced crypto investors cap individual altcoin positions at 5-15% of their crypto portfolio, with larger allocations reserved for more established projects and smaller positions for higher-risk opportunities. The fundamental rule remains: invest only what you can afford to lose entirely without affecting your financial wellbeing.

Regular rebalancing helps manage risk as market values fluctuate. An altcoin that appreciates significantly may grow to dominate a portfolio, concentrating risk. Periodically trimming winners and potentially adding to underperformers (if fundamentals remain sound) maintains intended diversification. But, rebalancing should consider tax implications and be approached thoughtfully rather than mechanically.

Staying informed about technological developments, partnership announcements, and competitive dynamics helps investors adjust portfolios as circumstances change. The cryptocurrency landscape evolves rapidly, projects that appear dominant can be displaced, whilst overlooked technologies can suddenly gain traction. Regular portfolio reviews, perhaps quarterly, provide opportunities to reassess whether holdings still align with investment thesis and risk tolerance.

Finally, consider how cryptocurrency fits within a broader investment strategy. Even a diversified altcoin portfolio represents high-risk allocation. Most financial advisors suggest limiting crypto exposure to a small percentage of overall investments, ensuring that more stable assets form the foundation of long-term financial security.

Conclusion

The search for altcoins with genuine long-term growth potential requires looking beyond price momentum to fundamental factors: solving real problems, maintaining active development, and building sustainable communities. Ethereum, Solana, Cardano, Polkadot, and Chainlink each demonstrate these qualities whilst addressing different aspects of blockchain infrastructure, making them worth considering for patient investors.

Yet even the strongest altcoins carry substantial risks. Market volatility, regulatory uncertainty, technological challenges, and fierce competition mean that outcomes remain highly uncertain. Success in this space demands thorough research, realistic expectations, disciplined risk management, and the emotional fortitude to withstand inevitable downturns.

For those willing to accept these risks, altcoins offer exposure to potentially transformative technology at relatively early stages of development. The key is approaching them as high-risk, high-reward holdings within a diversified portfolio rather than as shortcuts to wealth. By combining careful project selection with prudent position sizing and ongoing monitoring, investors can participate in cryptocurrency’s potential whilst protecting themselves from its very real dangers.

Frequently Asked Questions

What are the best altcoins to invest in for long-term growth?

Ethereum, Solana, Cardano, Polkadot, and Chainlink consistently rank as top long-term altcoin investments. Each addresses distinct blockchain challenges whilst demonstrating strong use cases, active development, and resilient communities that have weathered multiple market cycles.

How do you identify an altcoin suitable for long-term investment?

Look for altcoins with genuine real-world use cases, reputable development teams with transparent roadmaps, active community support, and demonstrated resilience through market downturns. Projects solving tangible problems with measurable adoption growth typically outperform speculative tokens.

Why is Ethereum considered a strong long-term altcoin investment?

Ethereum dominates smart contract platforms with the largest developer ecosystem and established infrastructure. Its transition to proof-of-stake, Layer-2 scaling solutions, and hosting of most DeFi and NFT applications create powerful network effects that reinforce long-term viability.

What percentage of your portfolio should be allocated to altcoins?

Most financial advisors recommend limiting cryptocurrency exposure to a small percentage of overall investments. Within crypto portfolios, experienced investors typically cap individual altcoin positions at 5–15%, with larger allocations for established projects and smaller positions for higher-risk opportunities.

Can altcoins outperform Bitcoin in the long term?

Some altcoins have historically outperformed Bitcoin during specific periods, particularly those with strong fundamentals and growing adoption. However, altcoins carry substantially higher risk, and most will eventually fail. Diversification across quality projects helps balance potential upside with downside protection.

What is the biggest risk when investing in altcoins for the long term?

Price volatility and project failure represent the primary risks. Altcoins can lose 50% or more of value rapidly, and the vast majority will eventually fail despite promising technology. Regulatory uncertainty, technological vulnerabilities, and market manipulation further compound these risks.