The blockchain landscape has evolved rapidly over the past few years, with layer-2 solutions emerging as one of the most promising developments for investors seeking passive income. These networks, built atop established layer-1 blockchains like Ethereum, offer a compelling proposition: enhanced scalability, dramatically reduced transaction costs, and new opportunities to earn rewards through staking. For those tired of high gas fees and slow confirmation times on mainnet protocols, layer-2 staking presents a modern alternative that balances efficiency with earning potential.

But whilst the rewards can be attractive, navigating this space safely requires more than just locking up tokens and hoping for the best. The intersection of cutting-edge technology and financial opportunity brings with it a unique set of considerations, from smart contract vulnerabilities to platform selection and security best practices. Understanding how layer-2 staking differs from traditional layer-1 approaches, knowing which platforms have proven track records, and implementing proper risk management strategies can mean the difference between steady passive income and costly mistakes.

This guide walks through the essentials of earning passive income through layer-2 staking whilst prioritising safety at every step. Whether someone’s new to staking or looking to expand beyond layer-1 protocols, the following sections break down everything needed to make informed decisions in this dynamic sector of decentralised finance.

Key Takeaways

- Layer-2 staking offers passive income with dramatically lower transaction fees and faster processing compared to layer-1 protocols, making it economically viable for investors of all sizes.

- Prioritise platforms with strong security audits, proven track records, and transparent community engagement when selecting layer-2 staking options to minimise smart contract risks.

- Diversifying your staking portfolio across multiple layer-2 networks with different technical architectures protects against single points of failure and platform-specific vulnerabilities.

- Established networks like Optimism, Arbitrum, and Polygon provide safer entry points for earning passive income through staking, whilst newer platforms may offer higher yields with increased risk.

- Hardware wallets and robust security practices are essential for protecting private keys, as compromised credentials can lead to irreversible loss of staked funds.

- Regular monitoring of staking returns, timely reward claiming, and staying informed about platform developments ensure optimal performance and early detection of potential issues.

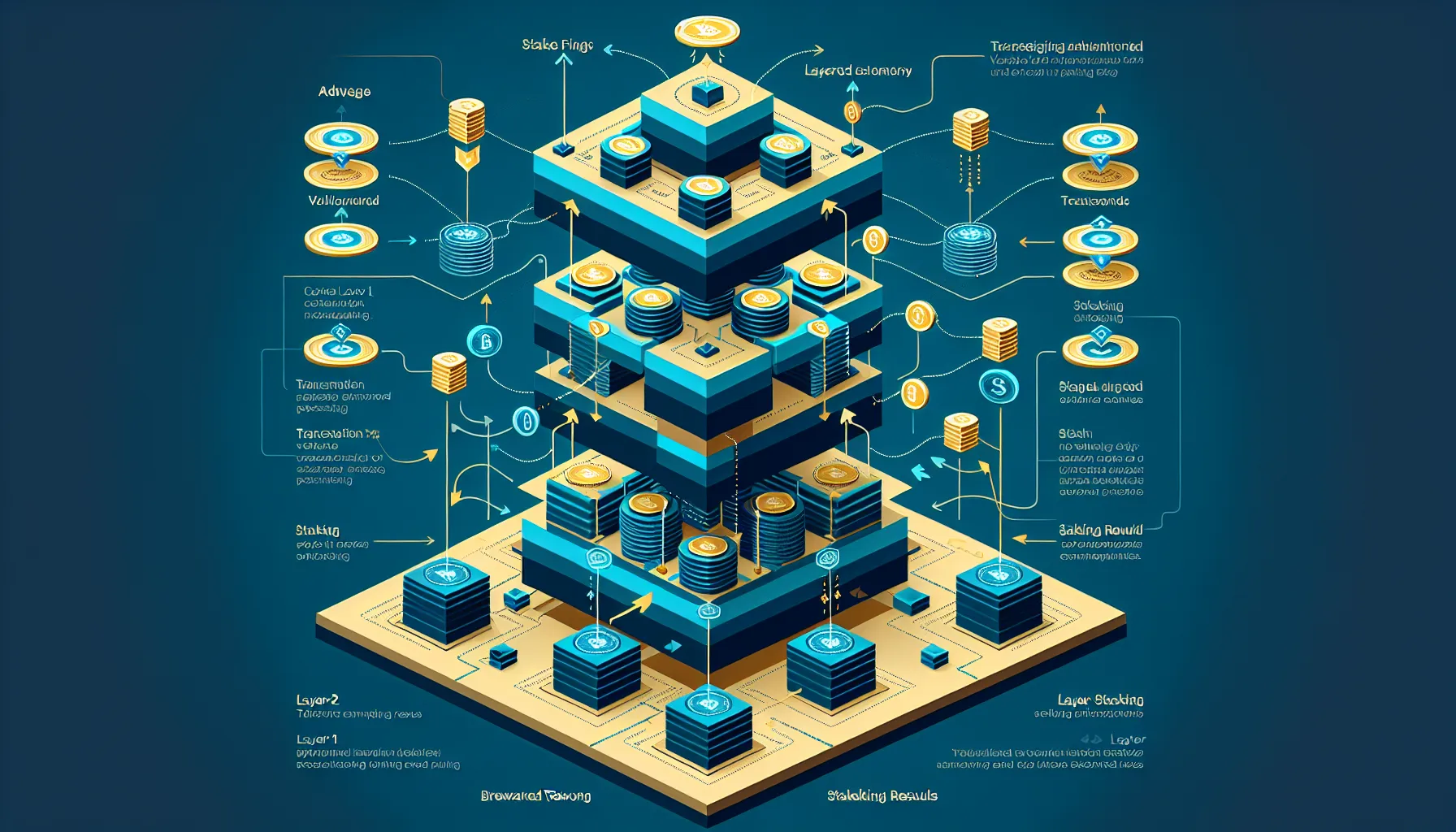

Understanding Layer-2 Staking and Its Advantages

Layer-2 networks represent a fundamental shift in how blockchain scalability challenges are addressed. Rather than competing directly with layer-1 protocols, these solutions work in tandem with them, processing transactions off-chain before settling the final results on the base layer. This architecture creates an ecosystem where users can benefit from both the security of established blockchains and the efficiency of newer scaling technologies.

When someone stakes on a layer-2 network, they’re essentially locking their tokens to support the network’s operations, validating transactions, maintaining security, and contributing to consensus mechanisms. In return, stakers earn rewards, typically distributed in the network’s native tokens or other supported assets. Unlike active trading, which requires constant monitoring and decision-making, staking generates returns passively once the initial setup is complete.

The appeal goes beyond simple convenience, though. Layer-2 staking taps into networks specifically designed to handle higher volumes of activity without the bottlenecks that often plague layer-1 systems during periods of peak demand. This efficiency translates directly into practical benefits for stakers, from lower entry barriers to more attractive reward structures.

What Makes Layer-2 Staking Different From Layer-1

The distinction between layer-1 and layer-2 staking isn’t just technical jargon, it shapes the entire staking experience and risk profile. Layer-1 blockchains like Ethereum or Cardano handle transaction settlement directly on their main chains, prioritising decentralisation and security above all else. Every transaction, every state change, gets recorded and validated by the network’s full set of validators. It’s secure, but it’s also slower and more expensive.

Layer-2 solutions take a different approach. They process transactions in batches or bundles off the main chain, handling the computational heavy lifting away from layer-1 before periodically settling the results back to the base layer. Think of it like a busy restaurant that takes orders at multiple stations (layer-2) but eventually processes all payments through one central till (layer-1). The result? Dramatically faster transaction speeds, significantly lower fees, and the ability to handle far more users simultaneously.

For stakers, these architectural differences manifest in several ways. Layer-2 platforms often introduce wrapped versions of tokens, enabling greater interoperability across different networks. They may employ different consensus mechanisms or reward structures compared to their layer-1 counterparts. And because layer-2 networks are inherently more complex, involving bridges, smart contracts, and multiple layers of interaction, they require stakers to understand an additional layer of technical nuance.

But complexity brings opportunity. Layer-2 staking can offer more flexible options, from liquid staking derivatives that allow users to stake without locking funds indefinitely to auto-compounding mechanisms that maximise returns without manual intervention.

Key Benefits of Layer-2 Staking for Passive Income

The primary draw of layer-2 staking lies in its economic efficiency. Transaction fees on layer-1 networks can eat significantly into returns, especially for smaller stakers. When gas fees spike on Ethereum, for instance, it might cost more to stake or claim rewards than the rewards themselves are worth. Layer-2 networks largely eliminate this problem, processing transactions at a fraction of the cost and making staking economically viable for participants of all sizes.

Higher transaction throughput creates another advantage: network capacity that can accommodate growth without degrading user experience. As more participants join a layer-2 network, the infrastructure can scale to meet demand, maintaining low fees and fast confirmation times. This scalability can translate to more stable and potentially growing reward rates as networks mature and attract more activity.

Many layer-2 staking platforms also offer what traditional finance would call “set it and forget it” options. Auto-compounding features reinvest rewards automatically, allowing stakers to benefit from compound interest without needing to manually claim and restake. Some exchange-traded products built on layer-2 technology even provide instant liquidity, removing the lock-up periods that can make layer-1 staking feel like a long-term commitment.

Perhaps most importantly, the relatively lower barriers to entry make layer-2 staking accessible. Someone doesn’t need to run their own validator node or meet minimum staking thresholds that can run into tens of thousands of pounds. Delegation options and staking pools allow even modest holders to participate and earn proportional rewards, democratising access to passive income opportunities that were once reserved for larger players.

Evaluating the Safety of Layer-2 Staking Platforms

Not all layer-2 networks are created equal, and safety should always take precedence over promised returns. The blockchain space has seen its share of exploits, rug pulls, and technical failures, many of which could have been avoided with proper due diligence. Before committing funds to any layer-2 staking platform, investors need to assess several critical factors that indicate reliability and security.

Reputation matters enormously in this space. Established projects like Optimism, Arbitrum, and Polygon have built track records over time, weathering market cycles and demonstrating technical competence. These platforms have attracted significant developer activity, secured partnerships with major protocols, and maintained transparent communication with their communities. Whilst past performance doesn’t guarantee future results, it does provide evidence that a project can handle real-world pressures.

The size of a network’s total value locked (TVL) offers another useful signal. Higher TVL generally indicates greater trust from the broader market and provides a cushion of liquidity that can stabilise the network during volatile periods. But, TVL alone shouldn’t be the deciding factor, newer networks might offer compelling opportunities even with smaller locked values, provided they demonstrate solid fundamentals in other areas.

Community engagement and developer activity also reveal a lot about a platform’s health. Active GitHub repositories, regular updates, responsive teams, and vibrant community discussions all suggest a project that’s being actively maintained and improved rather than abandoned or neglected.

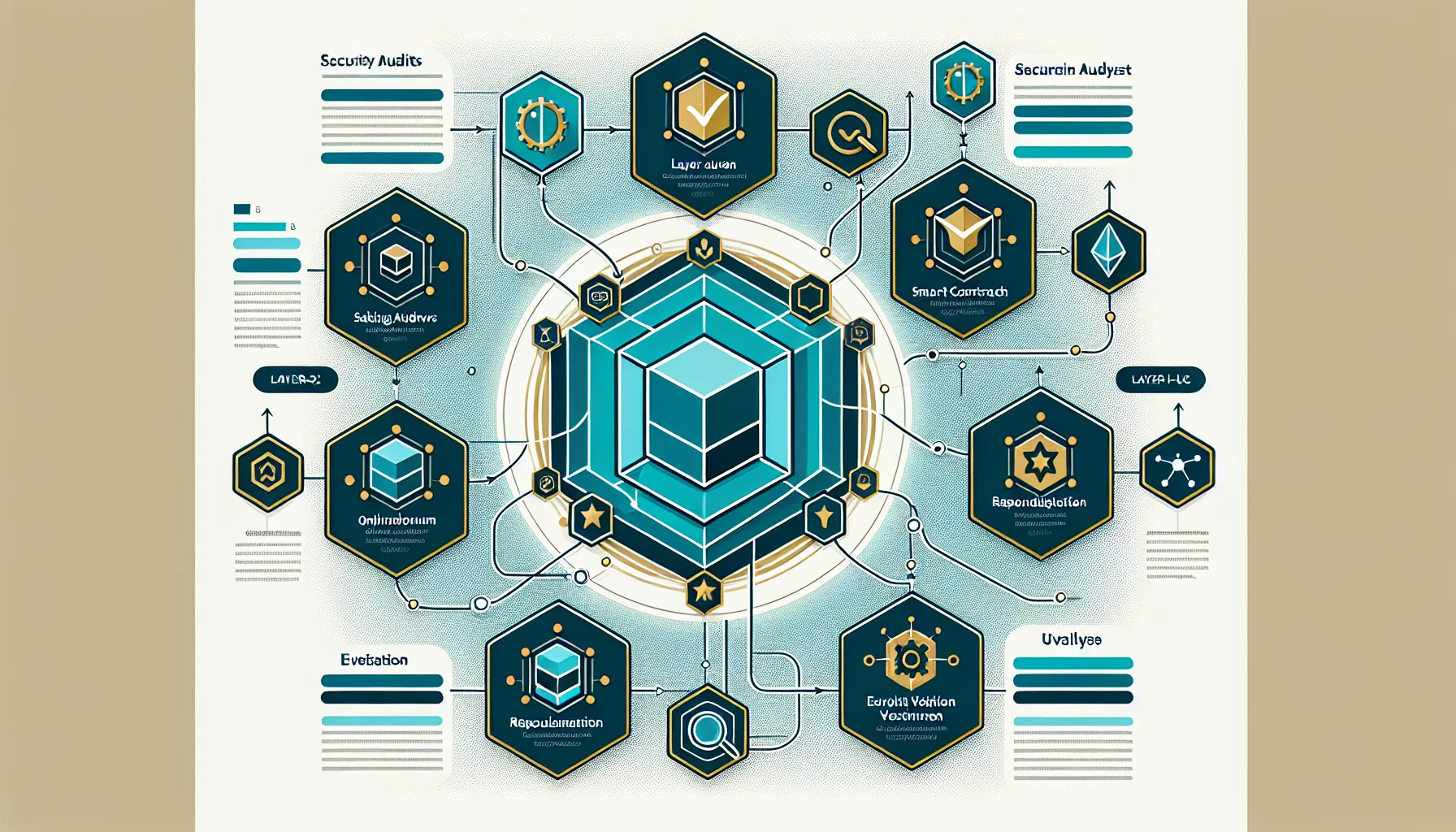

Security Audits and Protocol Track Records

Security audits serve as the first line of defence against technical vulnerabilities. Reputable layer-2 platforms commission independent security firms to review their code, identify potential weaknesses, and verify that smart contracts function as intended. These audits aren’t just box-ticking exercises, they’re thorough examinations by specialists who probe for the kinds of flaws that have led to multi-million-pound exploits in the past.

When evaluating a platform, stakers should look for recent audits from well-known firms such as Trail of Bits, CertiK, or OpenZeppelin. The audit reports themselves should be publicly available, allowing anyone to review the findings and see how (or if) identified issues were addressed. A single audit is good: multiple audits from different firms is better, as it brings diverse perspectives and methodologies to the security assessment.

But audits aren’t infallible. Even audited code can contain undiscovered vulnerabilities, and audits only reflect the state of the code at a specific point in time. That’s why a platform’s track record matters just as much. Has the network suffered any security incidents? If so, how did the team respond? A transparent post-mortem and swift remediation demonstrate maturity: silence or deflection raises red flags.

Look also for bug bounty programmes, which incentivise white-hat hackers to find and report vulnerabilities before malicious actors can exploit them. Platforms that offer substantial rewards for critical bug discoveries signal confidence in their security whilst actively working to uncover potential issues.

Understanding Smart Contract Risks

Layer-2 solutions are inherently more complex than their layer-1 counterparts, relying on intricate smart contracts to handle bridging, transaction batching, fraud proofs (in optimistic rollups), and state management. Each additional component introduces potential points of failure, and smart contracts, once deployed, are typically immutable, meaning bugs can’t simply be patched like traditional software.

Smart contract risk manifests in several forms. Logic errors might allow unintended behaviours, such as incorrect reward calculations or unauthorised fund withdrawals. Reentrancy attacks could enable malicious actors to drain funds before state updates complete. Oracle failures might provide incorrect price feeds, affecting reward distributions or collateralisation ratios.

The composability of DeFi, where protocols interact and build upon each other, amplifies these risks. A vulnerability in one protocol can cascade through others that depend on it, creating systemic risks that aren’t immediately obvious. When a layer-2 staking platform integrates with multiple DeFi protocols, each integration point becomes another potential vulnerability.

Stakers can mitigate smart contract risks by prioritising platforms with longer operational histories (more time to discover and fix issues), formal verification processes (mathematical proofs of contract correctness), and insurance options through protocols like Nexus Mutual or InsurAce. Staying informed about any disclosed vulnerabilities and monitoring security-focused community channels helps users respond quickly if issues arise.

It’s also worth remembering that layer-2 networks inherit certain risks from their underlying layer-1 chains. If Ethereum experiences a critical bug or consensus failure, layer-2 solutions built on top of it will be affected as well. Defence in depth, diversification across platforms, awareness of interconnected risks, and never investing more than one can afford to lose, remains essential.

Top Layer-2 Staking Options to Consider

The layer-2 ecosystem has matured significantly, with several platforms emerging as leaders in terms of security, adoption, and staking opportunities. Whilst the space continues to evolve rapidly, a few networks have demonstrated the combination of technical capability and market confidence that makes them worth serious consideration for passive income strategies.

Choosing amongst these options depends on individual priorities, whether that’s maximising yield, minimising risk, accessing specific DeFi ecosystems, or supporting particular technological approaches. Each of the major layer-2 networks brings something different to the table, and understanding their respective strengths helps stakers make informed allocation decisions.

Optimism and Arbitrum Staking Opportunities

Optimism and Arbitrum represent the vanguard of optimistic rollup technology, an approach that assumes transactions are valid by default and only runs fraud proofs when challenged. Both networks have become integral to Ethereum’s scaling roadmap, attracting billions in total value locked and hosting thriving DeFi ecosystems.

Optimism launched its OP token in 2022, creating governance and staking opportunities for participants. The network emphasises simplicity and Ethereum equivalence, making it relatively straightforward for developers to port existing Ethereum applications. For stakers, this means access to familiar protocols and staking mechanisms with the added benefits of lower fees and faster finality. Optimism’s governance model also allows token holders to participate in protocol decisions, adding a layer of influence beyond simple yield generation.

Arbitrum, meanwhile, has gained significant traction through its high performance and strong developer support. Its ARB token enables governance participation and various staking mechanisms through protocols built on the network. Arbitrum’s ecosystem includes numerous DeFi platforms offering liquid staking, yield farming, and lending opportunities that allow users to put their assets to work whilst maintaining exposure to the network’s growth.

Both networks benefit from being Ethereum layer-2s, inheriting Ethereum’s security guarantees whilst offering substantially improved efficiency. For risk-conscious stakers, this combination of proven technology and established ecosystems makes them attractive entry points into layer-2 staking. The main consideration is that optimistic rollups involve a withdrawal period (typically seven days) when moving funds back to layer-1, which affects liquidity planning.

Polygon and Other Established Layer-2 Networks

Polygon (formerly Matic Network) stands out for its maturity and versatility. Originally launched as a Plasma-based sidechain, Polygon has evolved into a multi-faceted scaling platform supporting various layer-2 technologies, including sidechains, rollups, and more. This technological diversity provides stakers with multiple avenues for earning passive income.

The MATIC token (being transitioned to POL) has long offered staking opportunities, with validators and delegators earning rewards for securing the network. Polygon’s proof-of-stake mechanism is well-established, with thousands of validators and a strong track record. Staking returns vary based on network conditions and total staked amount, but Polygon generally offers competitive yields alongside one of the most active ecosystems in the space.

What distinguishes Polygon is its adoption by mainstream applications and enterprises. Major brands and platforms have built on Polygon, creating genuine usage beyond speculative DeFi activity. This real-world adoption provides a foundation of network activity that can support sustainable staking rewards rather than relying solely on token emissions.

Beyond these three major players, other layer-2 networks worth monitoring include zkSync, which uses zero-knowledge rollups for enhanced privacy and efficiency, and Starknet, another ZK-rollup platform with growing developer interest. These newer networks may offer higher potential returns as they bootstrap their ecosystems, but they also carry higher risks given their shorter track records.

The key is matching platform choice with risk tolerance and investment timeline. Established networks provide more stability and liquidity: emerging platforms offer potentially higher yields with correspondingly higher risk. Many experienced stakers split allocations across multiple layer-2 networks to balance these trade-offs.

Best Practices for Minimising Risk While Staking

Earning passive income through layer-2 staking doesn’t mean setting and forgetting indefinitely. The dynamic nature of blockchain networks, technical upgrades, changing market conditions, evolving security landscapes, demands ongoing attention and proactive risk management. Fortunately, a few core practices can significantly reduce exposure to the most common pitfalls.

Risk management in crypto often comes down to avoiding concentration and maintaining security fundamentals. The same principles that protect traditional investment portfolios apply here, adapted for the unique characteristics of decentralised networks. Whilst it’s tempting to chase the highest yields or go all-in on a single promising platform, discipline and diversification typically produce better long-term outcomes.

Diversifying Your Staking Portfolio

Concentration risk, putting too many eggs in one basket, has probably caused more losses in crypto than any other factor. When a single platform suffers a security breach, regulatory action, or technical failure, users with their entire stake on that platform face total or near-total loss. Diversification doesn’t eliminate risk, but it does prevent any single event from becoming catastrophic.

A sensible approach involves spreading stakes across multiple layer-2 networks with different technical architectures. For instance, combining exposure to optimistic rollups (Optimism, Arbitrum) with ZK-rollups (zkSync, Starknet) and sidechains (Polygon) ensures that a vulnerability affecting one technology type doesn’t compromise the entire portfolio. These different approaches to scaling have distinct security models and potential failure points, making them genuinely diversifying.

Within each network, further diversification across different staking mechanisms or protocols adds another layer of protection. Rather than staking everything through a single validator or liquid staking protocol, splitting across several reputable options reduces the impact of any single provider’s failure. The trade-off is slightly more complexity in managing multiple positions, but modern portfolio tracking tools make this increasingly manageable.

It’s also worth maintaining some allocation to layer-1 staking even though layer-2’s advantages. Ethereum staking, for example, offers direct participation in the most established smart contract platform with battle-tested security. Balancing layer-2 opportunities with layer-1 stability creates a portfolio that can weather different types of market conditions.

Diversification extends to not putting all crypto holdings into staking full stop. Maintaining liquid reserves, funds readily available without unstaking delays or withdrawal queues, ensures the ability to respond to opportunities or emergencies without being forced to exit positions at inopportune times.

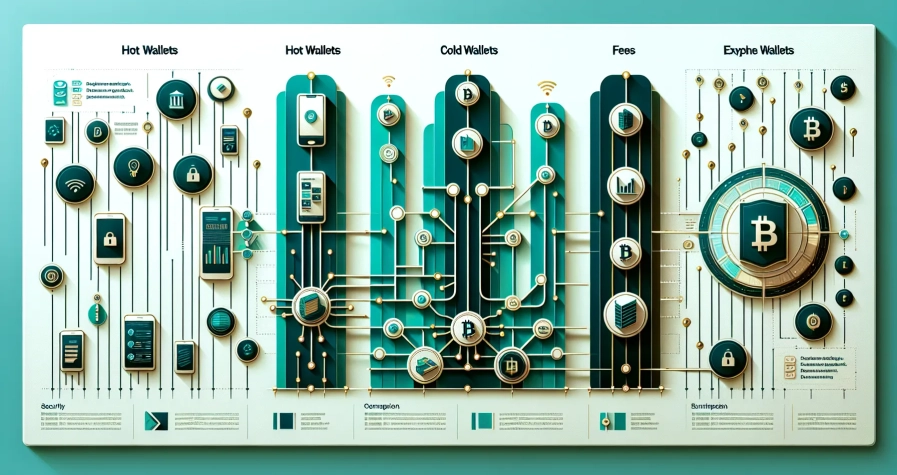

Securing Your Wallet and Private Keys

All the due diligence in the world means nothing if private keys end up compromised. The decentralised nature of blockchain means there’s no customer service number to call, no bank to reverse fraudulent transactions. Once funds leave a wallet, they’re generally gone for good, making security practices absolutely critical.

Hardware wallets, physical devices that store private keys offline, represent the gold standard for crypto security. Devices from reputable manufacturers like Ledger or Trezor keep keys isolated from internet-connected devices, drastically reducing the attack surface. Whilst they require a modest upfront investment, the protection they offer far exceeds the cost for anyone holding significant value.

For those using software wallets, keeping them on dedicated devices separate from daily-use computers or phones reduces exposure to malware and phishing attempts. Never installing wallet software on devices used for general web browsing, opening email attachments, or downloading files from untrusted sources helps maintain a clean environment.

Phishing remains one of the most common attack vectors. Malicious websites that mimic legitimate staking platforms trick users into connecting wallets and signing transactions that drain funds. Always verify URLs carefully, bookmark legitimate sites, and be sceptical of unexpected links even from seemingly trusted sources. No legitimate platform will ever ask for private keys or seed phrases, these should never be entered anywhere except directly into the hardware wallet or original wallet software.

Regular security hygiene matters too. Enabling two-factor authentication wherever supported, using unique passwords for different services, and keeping software updated all contribute to overall security posture. For larger holdings, consider multi-signature wallets that require multiple approvals before funds can move, adding a layer of protection against both external attacks and personal errors.

Finally, secure backup procedures ensure that access isn’t lost if devices fail. Seed phrases should be written down (never stored digitally) and kept in secure physical locations, ideally multiple locations in case of fire, flood, or other disasters. Some users employ metal backup solutions that can withstand extreme conditions, providing ultimate peace of mind for recovery phrases.

Getting Started With Layer-2 Staking

Understanding the theory behind layer-2 staking is one thing: actually putting funds to work is another. The practical steps of getting started can feel daunting, especially for those new to DeFi or layer-2 ecosystems. Breaking the process down into manageable steps helps build confidence whilst avoiding costly mistakes that often come from rushing in unprepared.

Choosing the Right Amount to Stake

The question of how much to stake doesn’t have a universal answer, it depends on individual financial circumstances, risk tolerance, and investment goals. But, several principles can guide the decision for most people.

Starting small makes sense, particularly when venturing into layer-2 staking for the first time. Allocating a modest amount allows someone to learn how the platform works, understand the claiming and compounding process, and develop a feel for the ecosystem without exposing significant capital to unfamiliar risks. Think of the initial stake as tuition fees for hands-on education. Once comfortable with the mechanics and confident in the platform’s reliability, gradually increasing the stake becomes less anxiety-inducing.

The amount should also align with liquidity needs. Funds locked in staking, especially on platforms with withdrawal delays or unstaking periods, aren’t available for emergencies or other opportunities. A general rule from traditional finance applies here too: never invest money that might be needed in the short to medium term. Layer-2 staking works best as part of a broader financial strategy that includes emergency funds, diverse investments, and liquid reserves.

Risk-adjusted position sizing considers the uncertainty inherent in each platform. A well-established network with years of operation might warrant a larger allocation than a brand-new layer-2 just launching mainnet. The potential returns should be weighed against the probability and potential magnitude of loss. Higher yields often signal higher risk, whether from newer technology, smaller network effects, or less proven security.

For those with larger portfolios, the diversification strategies mentioned earlier become especially important. Rather than staking everything on one platform, spreading across three to five different layer-2 networks with varying allocations based on confidence level creates a more resilient overall position.

Monitoring Your Staking Returns and Performance

Once staked, the work isn’t quite done. Passive income still benefits from periodic monitoring to ensure everything’s performing as expected and to identify any issues before they become serious problems.

Most layer-2 staking platforms provide dashboards showing current stake amounts, accumulated rewards, annual percentage yields, and other relevant metrics. Checking these periodically, monthly or quarterly, depending on preference, helps track whether returns are meeting expectations. Significant deviations from projected yields might signal changes in network conditions, validator performance, or other factors worth investigating.

Reward claiming and compounding strategies affect overall returns substantially. Some platforms auto-compound rewards, reinvesting them automatically to benefit from compound growth. Others require manual claiming, which then presents a choice: withdraw the rewards as income, or restake them to increase future earnings. The right approach depends on whether the goal is generating current income or maximising long-term growth.

For platforms requiring manual claiming, setting regular reminders prevents rewards from sitting idle when they could be compounding. The frequency of compounding should balance gas fees against the benefits of more frequent reinvestment, on low-fee layer-2 networks, claiming and restaking more frequently makes economic sense compared to high-fee layer-1 environments.

Staying informed about platform developments proves equally important. Following official channels, joining community discussions, and monitoring security updates ensures awareness of any issues, planned upgrades, or changing conditions. Networks evolve constantly, with governance proposals that might affect reward structures, security changes that impact risk profiles, or new features that create additional opportunities.

Portfolio rebalancing deserves consideration as well. As different staking positions grow at different rates and market values fluctuate, the allocation might drift from its intended balance. Periodic rebalancing, perhaps quarterly or semi-annually, maintains the desired risk profile and can enhance returns by systematically taking profits from outperformers and adding to positions that have lagged.

Tax implications shouldn’t be overlooked either. In most jurisdictions, staking rewards constitute taxable income, and proper record-keeping from the start makes year-end accounting far less painful. Many portfolio tracking tools now include tax reporting features specifically designed for crypto staking, automating much of the documentation process.

Conclusion

Layer-2 staking represents a meaningful evolution in how individuals can earn passive income from blockchain networks. The combination of lower fees, higher efficiency, and growing ecosystems makes these platforms increasingly attractive compared to traditional layer-1 staking alone. But the opportunity comes with responsibility, the same technological sophistication that enables better returns also introduces complexities that demand careful navigation.

Safety in layer-2 staking isn’t about eliminating risk entirely: that’s impossible in any investment, especially in crypto. Rather, it’s about understanding the risks, managing them intelligently, and building positions that can withstand the inevitable bumps along the way. Platforms with proven security track records, diversified allocations across networks and mechanisms, robust wallet security, and ongoing monitoring form the foundation of a sustainable passive income strategy.

The landscape will continue evolving. New layer-2 solutions will emerge, existing platforms will upgrade and expand, and the broader ecosystem will mature. Those who approach layer-2 staking with a learning mindset, starting conservatively, building knowledge through experience, and adapting to changing conditions, position themselves to benefit from these developments whilst avoiding the pitfalls that catch less prepared participants.

For anyone looking to generate passive income in crypto, layer-2 staking deserves serious consideration. The technology has moved beyond experimental stages into genuine utility and adoption. With proper due diligence, sensible risk management, and a commitment to ongoing security, it offers a compelling way to put digital assets to work in one of the most dynamic sectors of modern finance.

Frequently Asked Questions

What is layer-2 staking and how does it differ from traditional staking?

Layer-2 staking involves locking tokens on networks built atop layer-1 blockchains like Ethereum to earn rewards. Unlike layer-1 staking, it offers dramatically lower transaction fees, faster processing speeds, and often more flexible staking options through enhanced scalability without compromising the base layer’s security.

How can I safely earn passive income with layer-2 staking options?

Prioritise platforms with proven security audits, established track records, and transparent operations like Optimism, Arbitrum, or Polygon. Diversify across multiple networks, secure your wallet with hardware devices, start with modest amounts, and regularly monitor your staking positions to minimise risk.

What are the main benefits of layer-2 staking for passive income?

Layer-2 staking offers significantly lower transaction fees, making it economically viable for smaller participants. It provides faster confirmation times, auto-compounding options, improved scalability, and lower entry barriers compared to layer-1 networks, whilst maintaining robust security through the underlying blockchain.

Which layer-2 networks are best for staking in 2025?

Established layer-2 networks like Optimism, Arbitrum, and Polygon offer reliable staking opportunities with proven track records. Emerging platforms like zkSync and Starknet may provide higher yields but carry greater risk. Diversifying across multiple networks with different technical architectures helps balance returns and safety.

Can you lose money with layer-2 staking?

Yes, layer-2 staking carries risks including smart contract vulnerabilities, platform security breaches, token price volatility, and technical failures. However, these risks can be mitigated through thorough due diligence, diversification, using audited platforms, secure wallet practices, and never investing more than you can afford to lose.

How much should I invest when starting with layer-2 staking?

Begin with a modest amount you’re comfortable potentially losing whilst learning the platform mechanics. Never stake funds needed for short-term expenses or emergencies. Once familiar with the process and confident in the platform’s reliability, you can gradually increase your stake based on your risk tolerance and financial circumstances.