The cryptocurrency world offers unprecedented financial freedom, but with that freedom comes responsibility. Every year, billions of pounds worth of digital assets vanish into thin air, stolen by hackers, lost to phishing scams, or locked away forever when exchanges collapse. For anyone holding cryptocurrency, especially those planning to keep it long-term, security isn’t optional. It’s everything.

Cold storage has emerged as the gold standard for protecting digital assets, offering a fortress-like defence against the ever-evolving landscape of online threats. By keeping private keys completely offline, cold storage solutions eliminate the most common attack vectors that plague cryptocurrency holders. Yet even though its importance, many investors still rely on vulnerable hot wallets or leave their assets on exchanges, unaware of the risks they’re taking. Understanding how to properly carry out cold storage isn’t just about following best practices, it’s about ensuring that the crypto you’ve worked hard to acquire remains yours, safe from both digital thieves and human error.

Key Takeaways

- Cold storage solutions keep your private keys completely offline, eliminating the most common attack vectors and providing the strongest defence against cryptocurrency theft.

- Hardware wallets like Ledger Nano X and Trezor Model T offer the best balance of security and usability for most users, combining institutional-grade protection with convenient access.

- Steel backup devices protect your recovery phrase from fire, water, and physical damage, ensuring you can always restore access even if your hardware wallet is destroyed.

- Never store your recovery phrase digitally or share it with anyone—it’s the master key to your cryptocurrency and must exist only in physical form.

- A complete cold storage setup combining a hardware wallet with steel backups typically costs under £200, a modest investment compared to the value of the digital assets it protects.

- Regular security audits every six months help verify that your hardware wallets function correctly, recovery phrases remain legible, and storage locations are still secure.

Understanding Cold Storage and Why It Matters

Cold storage represents a fundamental shift in how cryptocurrency owners approach security. Rather than keeping private keys on devices connected to the internet, cold storage keeps them entirely offline, creating an air gap between your assets and potential attackers. This offline approach drastically reduces exposure to the digital threats that have cost the cryptocurrency community dearly over the years.

The importance of cold storage becomes clear when you consider that your private keys are everything in the crypto world. Unlike traditional banking, where multiple layers of institutional protection exist, cryptocurrency places full responsibility on the holder. Lose your keys or have them stolen, and there’s no bank manager to call, no fraud department to reverse the transaction. The blockchain doesn’t recognise theft or mistakes, it only recognises valid signatures. Cold storage ensures those signatures remain under your exclusive control.

For long-term holders and anyone managing substantial amounts of cryptocurrency, cold storage isn’t merely advisable, it’s essential. The temporary inconvenience of accessing funds stored offline pales in comparison to the permanent loss that can result from a single security breach. Think of it as the difference between keeping cash in your pocket versus storing it in a safe deposit box. The safe requires more effort to access, but your money won’t disappear if someone picks your pocket.

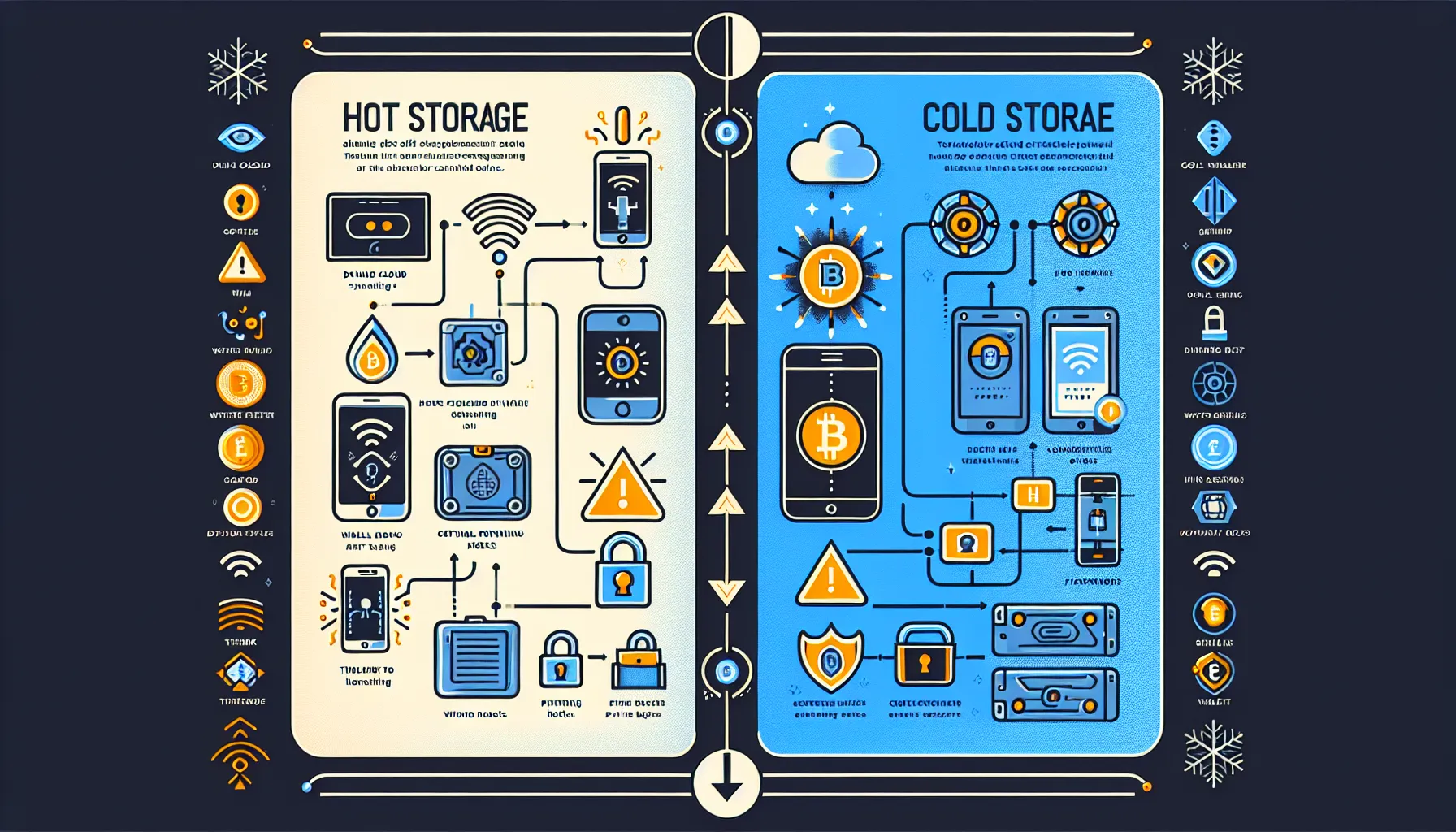

The Difference Between Hot and Cold Wallets

The terms “hot” and “cold” in cryptocurrency storage refer to internet connectivity, and that distinction makes all the difference. Hot wallets maintain a constant or regular connection to the internet, allowing for quick transactions and easy access to funds. They’re convenient for daily trading, making purchases, or managing active portfolios. Mobile wallet apps, desktop software wallets, and exchange accounts all fall into the hot wallet category.

This convenience, but, comes at a steep price: vulnerability. Every moment a hot wallet spends online represents potential exposure to threats. Malware can intercept transactions, keyloggers can capture passwords, and sophisticated phishing attacks can trick users into revealing sensitive information. Even well-secured hot wallets face risks from the platforms they run on, mobile phones get lost, computers crash, and software can contain hidden vulnerabilities.

Cold wallets, by contrast, store private keys on devices or media that never touch the internet. Hardware wallets, paper wallets, and steel backup devices all qualify as cold storage. When you need to make a transaction, you briefly connect the device or import the keys, sign the transaction, then return to offline status. This minimal exposure window dramatically reduces risk whilst still allowing full control over your assets.

The choice between hot and cold storage often comes down to use case. Active traders might keep a small operational balance in a hot wallet whilst securing the bulk of their holdings in cold storage. It’s similar to carrying spending money in your wallet whilst keeping savings in a bank vault, you balance accessibility with security based on your needs.

Common Threats to Cryptocurrency Security

The threat landscape for cryptocurrency holders is both diverse and constantly evolving. Online threats dominate the headlines, and for good reason. Hacking remains the most prevalent danger, with attackers targeting everything from individual wallets to major exchanges. The infamous Mt. Gox collapse, numerous exchange breaches, and countless individual wallet compromises demonstrate that internet-connected storage presents an attractive target for criminals.

Malware specifically designed to target cryptocurrency has become increasingly sophisticated. Some variants monitor clipboard activity, swapping wallet addresses when users copy and paste, sending funds to attackers instead of intended recipients. Others lie dormant, waiting for users to access their wallets before capturing passwords or private keys. Keyloggers record every keystroke, potentially exposing seed phrases or passwords typed on compromised devices.

Phishing attacks exploit human psychology rather than technical vulnerabilities. Fraudulent emails mimicking exchanges, fake wallet apps in app stores, and convincing replica websites all aim to trick users into voluntarily handing over their credentials. These social engineering attacks can bypass even robust technical security if users aren’t vigilant.

Exchange breaches represent another significant threat. Whilst exchanges have improved security substantially, they remain high-value targets. Funds held on exchanges aren’t truly under your control, you’re trusting a third party to safeguard them. History has repeatedly shown this trust can be misplaced, whether through hacking, insider theft, or simple mismanagement.

Offline risks, though less common, shouldn’t be ignored. Physical theft of hardware wallets or paper wallets can occur, particularly if storage locations aren’t properly secured. Natural disasters like fires or floods can destroy paper wallets unless properly protected. Even simple loss, misplacing a hardware device or forgetting where you stored a backup, can permanently lock you out of your holdings. Cold storage addresses the online threats comprehensively, but users must still consider physical security to achieve complete protection.

Types of Cold Storage Solutions

Cold storage solutions come in several forms, each with distinct advantages and trade-offs. Choosing the right type depends on your specific security needs, technical comfort level, and how you plan to manage your cryptocurrency holdings.

Hardware Wallets

Hardware wallets represent the most popular and user-friendly cold storage option for most cryptocurrency holders. These purpose-built physical devices store private keys in a secure chip, isolated from internet-connected computers. Popular models include the Ledger Nano X, Trezor Model T, and various other devices from established manufacturers.

The appeal of hardware wallets lies in their balance of security and usability. When you need to make a transaction, you connect the device to a computer or smartphone via USB or Bluetooth, but the private keys never leave the secure element within the device. Transactions are signed internally, with only the signed transaction (not the keys themselves) transmitted to the connected device. This architecture protects against malware on the host computer, even a completely compromised machine can’t extract your private keys.

Modern hardware wallets support hundreds of cryptocurrencies, feature intuitive interfaces, and include additional security measures like PIN protection and optional passphrases. The Ledger Nano X offers Bluetooth connectivity for mobile use, whilst the Trezor Model T provides a touchscreen interface that eliminates the need to enter sensitive information on a potentially compromised computer.

The main disadvantage is cost, quality hardware wallets typically range from £50 to £200. They also require careful handling and storage, as physical loss or damage can create access problems (though recovery phrases provide a backup). Even though these considerations, hardware wallets strike an excellent balance for most users, offering institutional-grade security in a consumer-friendly package.

Paper Wallets

Paper wallets represent the original cold storage solution: private keys and public addresses printed on physical paper, often as QR codes for easy scanning. This completely offline approach eliminates all digital attack vectors, there’s no device to hack, no firmware to exploit, and no electronic components to fail.

Creating a paper wallet involves using a wallet generator (ideally run offline on a clean computer) to create a new key pair, then printing it out. The paper contains everything needed to access the funds: the public address for receiving cryptocurrency and the private key for spending it. Some users laminate their paper wallets or store them in protective sleeves to guard against physical degradation.

The simplicity of paper wallets is both their strength and weakness. They’re inexpensive, don’t require batteries or updates, and remain completely immune to electronic attacks. But, they’re extremely vulnerable to physical damage. Fire, water, or simple wear can destroy a paper wallet, and the ink can fade over time. They’re also less convenient for regular transactions, using funds from a paper wallet typically requires importing the private key into a software wallet, at which point the paper wallet should be considered compromised and no longer used.

Paper wallets suit specific use cases: gifting small amounts of cryptocurrency, creating long-term storage for assets you don’t plan to touch for years, or serving as a backup to other methods. They’re less ideal as a primary storage solution for most users, given the physical fragility and usability limitations.

Steel Wallets and Backup Devices

Steel wallets and backup devices address the primary weakness of paper wallets: durability. These solutions involve engraving, stamping, or otherwise recording recovery phrases or private keys on metal plates or devices specifically designed to survive extreme conditions. Products like Billfodl, Cryptosteel, and various steel plate solutions provide protection against fire, water, crushing, and corrosion.

The concept is straightforward: your recovery phrase, the 12 or 24 words that can restore access to your cryptocurrency, is permanently preserved in a medium that can survive disasters that would destroy paper or electronic devices. Most steel backup solutions use tiles, plates, or mechanisms where you stamp or arrange letters to spell out your recovery phrase. The result is a backup that can withstand house fires (typically resistant to temperatures exceeding 1,000°C), flooding, and physical damage.

Steel backups work brilliantly in combination with hardware wallets. The hardware wallet provides convenient, secure access for regular use, whilst the steel backup ensures you’ll never permanently lose access even if the hardware device is destroyed, lost, or fails. This redundancy creates a robust security architecture, you’d need to lose both the hardware wallet and all steel backups to permanently lose access to your funds.

The investment in a quality steel backup device ranges from £30 to over £100, depending on capacity and design. Some accommodate full 24-word recovery phrases, whilst others handle 12 words. Certain designs allow for multiple backups on a single device, useful for managing several wallets. The cost is modest compared to the value of the cryptocurrency it protects, making steel backups an essential component of any serious cold storage setup.

The main consideration with steel backups is secure storage location. These devices must be kept as safe as the cryptocurrency itself, anyone who finds your steel backup can access your funds. Fireproof safes, safety deposit boxes, or secure locations known only to you (and perhaps trusted family members) are appropriate storage sites. Some users create multiple steel backups stored in different geographical locations, providing redundancy against localised disasters whilst increasing the complexity of securing multiple sites.

Setting Up Your Cold Storage Wallet

Properly setting up cold storage determines whether it will effectively protect your cryptocurrency or become a source of frustration and potential loss. The process requires careful attention to detail and following security best practices from the start.

Choosing the Right Solution for Your Needs

Selecting the appropriate cold storage solution begins with honest assessment of your situation. How much cryptocurrency are you protecting? If you’re holding significant value, whether that’s hundreds or hundreds of thousands of pounds, a hardware wallet combined with steel backups makes sense. The investment in quality security devices becomes negligible compared to the assets at stake.

Consider how frequently you’ll need to access your funds. If you’re a long-term holder who rarely transacts, maximum security should take priority over convenience. If you occasionally need to move funds or check balances, a hardware wallet offers better usability than paper wallets. Active traders might maintain cold storage for the bulk of holdings whilst keeping a smaller amount in a hot wallet for liquidity.

Cryptocurrency diversity matters too. If you hold multiple altcoins beyond Bitcoin and Ethereum, verify that your chosen solution supports them. Most major hardware wallets support hundreds of cryptocurrencies, but niche coins might require specific solutions. Check compatibility before purchasing.

Budget plays a role, though it shouldn’t be the primary factor when significant assets are at stake. That said, solutions exist at various price points. A Ledger Nano S Plus provides excellent security at the lower end of hardware wallet pricing, whilst the Nano X offers additional features for slightly more. Adding a steel backup device increases the total investment but dramatically improves recovery security.

Finally, consider your technical comfort level. Hardware wallets from established manufacturers offer user-friendly interfaces suitable for newcomers. Paper wallets require more technical knowledge to generate safely. Steel backups are straightforward but require careful attention to detail when recording recovery phrases. Choose a solution you’ll carry out correctly rather than the theoretically most secure option you might misconfigure.

Initialising and Securing Your Device

Once you’ve acquired your cold storage solution, initialisation is critical. For hardware wallets, always purchase directly from the manufacturer or authorised retailers. Never buy pre-owned devices or purchase from unofficial sellers, tampered devices could compromise your security from the start. Reputable manufacturers include security seals and tamper-evident packaging: verify these before use.

When initialising a hardware wallet, the device generates your recovery phrase during setup. This process should occur in a private, secure environment. Don’t set up your wallet in public spaces or anywhere you might be observed or recorded. Close any unnecessary software on connected computers to minimise malware risk.

Set a strong PIN immediately, eight digits provide better protection than the minimum four that some devices allow. Avoid obvious patterns like birth dates or repeated digits. This PIN prevents unauthorised use if someone gains physical access to your device. Some hardware wallets offer additional security features like a passphrase (sometimes called the “25th word”), which adds another layer of protection to your recovery phrase. Whilst optional, this feature significantly enhances security for high-value holdings.

Firmware updates deserve immediate attention. Before transferring any cryptocurrency to your new wallet, check for and install the latest firmware from the manufacturer. These updates often contain security improvements and bug fixes. Establish a habit of checking for updates regularly, manufacturers release them for good reasons.

For paper wallets, generation must occur on a clean, offline computer. Download the wallet generator software, disconnect from the internet, run the generator, print the wallet, then securely delete any digital traces before reconnecting. This air-gapped approach prevents malware from compromising the keys during generation.

Creating and Storing Your Recovery Phrase

The recovery phrase (also called a seed phrase or mnemonic phrase) is the master key to your cryptocurrency. It’s typically 12 or 24 words selected from a standardised list, and it can recreate your wallet on any compatible device. This makes it both incredibly powerful and potentially dangerous, anyone with access to your recovery phrase can access your funds, regardless of PINs or other device security.

When your hardware wallet displays the recovery phrase during setup, write it down carefully on the provided recovery sheet or directly onto your steel backup device. Double-check each word for accuracy, a single error makes the entire phrase useless. Some words look similar (like “board” and “broad”): pay close attention to spelling.

Never photograph your recovery phrase, never type it into a computer or phone, never store it in cloud services, and never share it with anyone. Digital storage exposes it to hacking, whilst sharing it eliminates the security benefits of cold storage entirely. The phrase should exist only in physical form, secured offline.

Once written, immediately transfer the recovery phrase to your steel backup device if you’re using one. Store the steel backup in a secure location, a home safe, safety deposit box, or other controlled-access location. Some users create multiple copies stored in different locations, balancing redundancy against the increased risk of discovery. If you do create multiple copies, ensure each location offers genuine security.

Consider whether trusted family members need access in emergency situations. If so, decide whether to give them direct access to the recovery phrase or use a system like Shamir’s Secret Sharing, which splits the phrase into multiple parts that require a threshold number to reconstruct. This prevents any single person from accessing your funds whilst ensuring recovery remains possible if something happens to you.

Test your recovery phrase whilst the wallet is still empty or contains only a small test amount. Some hardware wallets offer a recovery check feature that verifies you’ve recorded the phrase correctly without requiring a full device reset. If not available, you can perform a test recovery on a separate device or after resetting your primary device, confirming that the phrase successfully restores access before transferring significant funds.

Best Practices for Cold Storage Security

Setting up cold storage correctly establishes the foundation for security, but maintaining that security requires ongoing attention to best practices. These habits distinguish those who successfully protect their cryptocurrency long-term from those who suffer losses even though using cold storage solutions.

Strong, unique PINs and passphrases form the first line of defence if someone gains physical access to your hardware wallet. Don’t reuse PINs from other devices or services. Consider using the optional passphrase feature, this creates an entirely separate wallet even if someone obtains your recovery phrase. Store the passphrase separately from the recovery phrase itself, ensuring that compromising one doesn’t compromise your entire security architecture.

Regular firmware updates keep your devices protected against newly discovered vulnerabilities. Manufacturers continuously improve security, and delaying updates leaves known weaknesses unpatched. Check for updates monthly at minimum, and apply them promptly. Always update firmware through official channels, never install firmware from third-party sources or suspicious links, as malicious firmware can compromise security completely.

Verify addresses carefully every single time you transact. Before sending cryptocurrency, confirm the entire receiving address on your hardware wallet’s screen, not just on the computer display. Malware can modify addresses shown on compromised computers, but it cannot alter what your hardware wallet’s secure display shows. Take the extra seconds to verify, it’s far easier than trying to recover misdirected funds.

Physical Security Measures

Physical security matters as much as digital security for cold storage solutions. Your hardware wallet and steel backups should be stored with the same care you’d give to large amounts of cash or valuable jewellery. A quality home safe provides excellent protection, particularly models that offer both fire and water resistance. Bolt floor or wall safes to structural elements, they’re useless if a thief can simply carry them away.

Safety deposit boxes at banks offer another layer of security, particularly for backup devices. Storing your steel backup in a safety deposit box whilst keeping your hardware wallet in a home safe creates geographical separation, a disaster at home won’t destroy both. The bank’s security and controlled access provide protection you can’t easily replicate at home.

Avoid discussing your cryptocurrency holdings or storage methods publicly or on social media. The “£5 wrench attack” isn’t theoretical, people have been robbed after revealing that they hold cryptocurrency. Discretion is its own form of security. Keep your involvement in cryptocurrency private, and never share details about where you store devices or backups.

Consider environmental factors in storage locations. Whilst steel backups can survive fire and water, hardware wallets cannot. Store devices in dry locations away from temperature extremes. Some users place hardware wallets in waterproof containers within their safes for additional protection. Moisture, heat, and physical shock can damage electronic components, potentially making device access difficult even though recovery phrases can restore funds to new devices.

Regular Security Audits and Updates

Periodic security audits help identify vulnerabilities before they become problems. Every six months, review your entire cold storage setup. Check that hardware wallets still function correctly by connecting them and verifying they power on and display properly. Test that you can access the device with your PIN, if you’ve forgotten it, you’ll need to restore from your recovery phrase, and it’s better to discover this during a planned audit than during an emergency.

Verify that recovery phrases and backups remain legible and accessible. Check steel backups to ensure they haven’t corroded or been damaged. If you’ve stored paper wallets, inspect them for fading or physical deterioration. Update storage methods if you discover degradation, transfer fading paper wallets to fresh paper or upgrade to steel backups.

Review who has access to your storage locations. Have you moved house, changed banks, or experienced relationship changes that affect who might access your security devices? Update access controls accordingly. Change safe combinations if others might know them. Consider relocating backups if necessary.

Periodically research whether your hardware wallet manufacturer remains reputable and actively supported. The cryptocurrency industry evolves rapidly, and manufacturers occasionally exit the market or face security scandals. If your device is no longer supported or the manufacturer faces serious issues, consider migrating to a current, well-supported device. The migration process itself must be done carefully, set up the new device, transfer funds, then securely wipe or destroy the old device only after confirming the new setup works correctly.

Common Mistakes to Avoid

Even with cold storage, certain mistakes can compromise security or lead to loss of access. Learning from others’ errors costs nothing and can save you significant grief.

Storing recovery phrases digitally ranks as the most common and dangerous mistake. Taking a photo “just as a backup” or typing the phrase into a notes app defeats the entire purpose of cold storage. Digital copies can be hacked, backed up to cloud services without your knowledge, or accessed by malware. If you wouldn’t write your banking password on a photograph and store it online, don’t do it with your recovery phrase either.

Using untrusted third-party devices or services introduces risk that cold storage is meant to eliminate. Stick with hardware wallets from established manufacturers with strong security track records. Avoid unbranded devices found on marketplaces, even if they’re cheaper. The same applies to wallet generator software for paper wallets, use only well-known, open-source tools that have been audited by the security community.

Neglecting firmware updates leaves known vulnerabilities unpatched. Manufacturers discover and fix security issues regularly, and failing to update means you’re protected only against threats that were known when you bought the device. Set a recurring reminder to check for updates, and treat them as mandatory rather than optional maintenance.

Storing devices and recovery phrases together defeats the redundancy that protects you. If your house burns down and both your hardware wallet and recovery phrase are in it, you’ve lost everything. Separate storage locations ensure that no single incident compromises both your primary access method and your recovery option.

Forgetting to test recovery procedures before loading significant funds onto a wallet causes panic during actual recovery situations. It’s too late to discover you’ve recorded your recovery phrase incorrectly after you’ve transferred your life savings and the hardware wallet has failed. Test the recovery process with small amounts or empty wallets first.

Sharing seeds of doubt by discussing holdings or security methods with untrustworthy individuals creates risk. You don’t need to be secretive with close family, but broadcasting your cryptocurrency wealth or storage methods to acquaintances, online forums, or social media invites unwanted attention. The less others know about what you have and how you store it, the safer you are.

Rushing through setup leads to errors that haunt you later. Take time during initialisation to carefully record recovery phrases, verify everything twice, and understand each security feature before dismissing it as unnecessary. The hour you invest in careful setup could prevent permanent loss of access or theft.

Conclusion

Cold storage represents the most effective defence against the myriad threats facing cryptocurrency holders. By keeping private keys offline, these solutions eliminate the vast majority of attack vectors that have cost the cryptocurrency community billions. The inconvenience of slightly reduced accessibility is negligible compared to the security gained and the peace of mind that comes with knowing your digital assets are properly protected.

The right cold storage approach depends on individual circumstances, but for most holders, a quality hardware wallet combined with a steel backup device provides an excellent balance of security, usability, and resilience. This combination protects against both online attacks and physical disasters, whilst remaining accessible enough for occasional transactions. For those holding substantial value, the investment in proper cold storage, typically under £200 for a complete setup, is a small fraction of the assets protected.

Implementation matters as much as the solution itself. Carefully chosen devices poorly configured offer little real protection, whilst even basic cold storage properly set up dramatically improves security. Follow manufacturer instructions meticulously during setup, establish strong physical security for devices and backups, maintain firmware updates, and periodically audit your security posture. These practices transform cold storage from a theoretical concept into practical protection.

The cryptocurrency landscape will continue evolving, with new threats emerging and security solutions advancing. Cold storage provides a foundation that adapts to this evolution, the fundamental principle of offline key storage remains sound regardless of how specific threats develop. By committing to cold storage and the best practices that maximise its effectiveness, cryptocurrency holders take full responsibility for their financial sovereignty, securing their digital assets against both present dangers and future uncertainties.

Frequently Asked Questions

What is cold storage for cryptocurrency and why is it important?

Cold storage keeps private keys completely offline, creating an air gap between your crypto assets and potential attackers. It’s essential because it eliminates the most common attack vectors, protecting your cryptocurrency from hacking, malware, and online threats that have cost billions in losses.

How does a hardware wallet protect my crypto better than an exchange?

Hardware wallets store private keys in a secure chip isolated from the internet, meaning keys never leave the device even during transactions. Unlike exchanges where you trust a third party, hardware wallets give you exclusive control, protecting against exchange breaches and hacking.

What should I do if I lose my hardware wallet?

If you’ve properly recorded your recovery phrase, losing your hardware wallet doesn’t mean losing your crypto. Simply purchase a new compatible device and restore your wallet using the 12 or 24-word recovery phrase you securely stored during initial setup.

Can cold storage be hacked if stored offline?

Properly implemented cold storage cannot be hacked remotely because private keys never connect to the internet. However, physical theft of the device or recovery phrase, or compromise during the brief moment you connect to make transactions, remains theoretically possible though highly unlikely.

How much does it cost to set up cold storage solutions?

Quality hardware wallets typically cost between £50 and £200, whilst steel backup devices range from £30 to £100. A complete cold storage setup with a hardware wallet and steel backup generally costs under £200, a modest investment compared to the crypto value protected.

Should I store my recovery phrase in multiple locations?

Yes, storing recovery phrases in multiple secure locations provides redundancy against localised disasters like fire or theft. Keep your hardware wallet and steel backup separated geographically, such as one in a home safe and another in a bank safety deposit box, ensuring no single incident compromises both.