Cryptocurrency can feel overwhelming for newcomers, especially with hundreds of coins competing for attention. Litecoin, often called the “silver” to Bitcoin’s “gold,” has carved out a unique position since its creation in 2011. But before diving in and making a purchase, beginners need to understand what they’re getting into. Litecoin isn’t just a cheaper alternative to Bitcoin,it’s a distinct digital currency with its own technology, market behaviour, and investment considerations. Whether someone’s looking to diversify a crypto portfolio or make their first purchase, knowing the fundamentals can mean the difference between a smart investment and an expensive lesson. This guide breaks down five essential things every beginner should grasp before buying Litecoin, from understanding the technology to avoiding hidden fees.

Key Takeaways

- Litecoin offers faster transaction speeds than Bitcoin with blocks generated every 2.5 minutes and consistently lower fees, making it ideal for everyday payments.

- Before buying Litecoin, beginners must prepare for significant price volatility and only invest amounts they can afford to lose completely.

- Choosing a reputable centralized exchange with strong security features and regulatory compliance is essential for safe Litecoin purchases.

- Storing Litecoin in a hardware wallet with proper backup of recovery phrases protects your investment far better than leaving funds on exchanges.

- Understanding all fees—including trading, withdrawal, and network costs—before buying Litecoin can save beginners 5-10% of their initial investment.

Understanding What Litecoin Is and How It Differs From Bitcoin

Litecoin (LTC) entered the scene in 2011, created by former Google engineer Charlie Lee. At its core, it’s a decentralized digital currency built on blockchain technology, enabling peer-to-peer payments without intermediaries like banks. While Bitcoin paved the way, Litecoin was designed to address some of Bitcoin’s limitations,specifically around transaction speed and accessibility.

Many beginners assume Litecoin is just a Bitcoin clone, but that’s not quite accurate. Yes, they share foundational principles, but Litecoin introduced technical modifications that give it distinct advantages for certain use cases. It operates independently with its own blockchain, mining community, and development roadmap. For someone new to crypto, understanding these differences isn’t just academic,it directly impacts how the coin performs as an investment and payment method.

The Technology Behind Litecoin

Litecoin’s blockchain records every transaction in an immutable, transparent ledger. Like Bitcoin, it relies on Proof-of-Work (PoW) consensus, meaning miners solve complex mathematical problems to validate transactions and secure the network. But here’s where it gets interesting: Litecoin uses the Scrypt mining algorithm instead of Bitcoin’s SHA-256.

Scrypt was deliberately chosen to make mining more accessible. Bitcoin’s mining became dominated by specialized hardware (ASICs) that put individual miners at a disadvantage. Scrypt, while eventually also mineable by ASICs, was initially more friendly to everyday computer hardware. This design choice reflected Litecoin’s philosophy of broader participation.

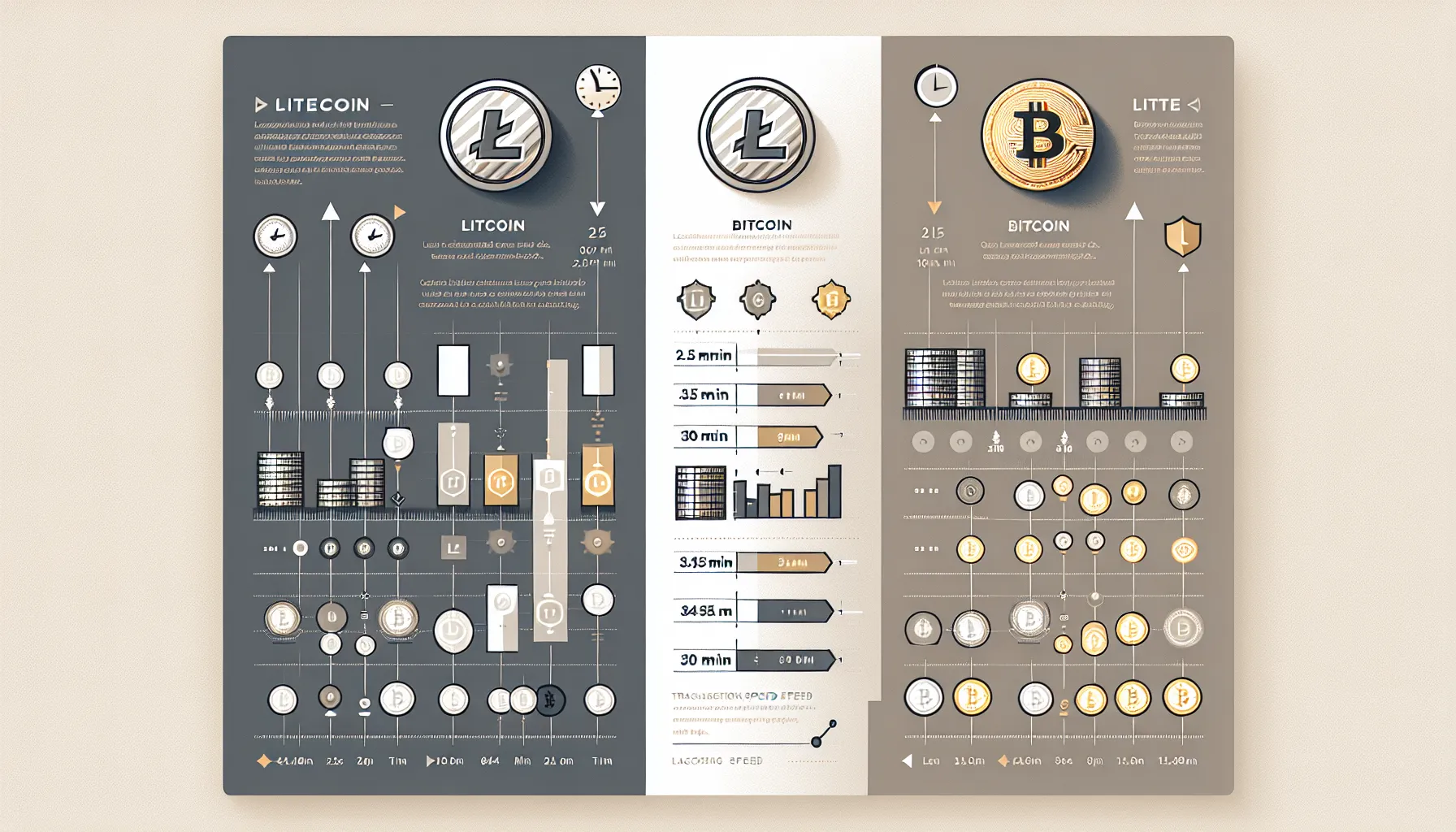

The real standout feature? Speed. Litecoin generates a new block every 2.5 minutes compared to Bitcoin’s 10 minutes. That means transactions get confirmed faster,four times faster, to be precise. For someone sending money or making a purchase, this translates to less waiting and more efficiency. This makes Litecoin particularly well-suited for micro-payments and situations where speed matters more than absolute security overkill.

Key Differences That Matter to Investors

When evaluating Litecoin as an investment, several technical differences have practical implications:

Supply cap: Bitcoin has a maximum supply of 21 million coins, while Litecoin caps at 84 million. Four times the supply doesn’t necessarily mean four times less value per coin, but it does affect scarcity dynamics. For investors, this means the supply inflation schedule differs, potentially impacting long-term price trajectories.

Transaction fees: Litecoin consistently maintains lower transaction costs than Bitcoin. During network congestion, Bitcoin fees can spike dramatically, sometimes reaching $50 or more per transaction. Litecoin fees typically remain under a dollar, often just pennies. For anyone planning to actually use their crypto (not just hold it), this difference matters.

Confirmation speed: That 2.5-minute block time isn’t just a technical detail. It means merchants can accept Litecoin payments with greater confidence in shorter timeframes. Bitcoin transactions might require 30-60 minutes for reasonable security: Litecoin can provide similar assurance in 7-15 minutes.

But, beginners should understand that speed and lower fees come with tradeoffs. Bitcoin’s slower, more expensive network also means it’s more secure against certain attacks and has established itself as the dominant store of value. Litecoin positions itself more as digital cash for everyday transactions rather than digital gold.

Volatility reality: Like all cryptocurrencies, Litecoin experiences significant price swings. Some beginners mistakenly think that because Litecoin is cheaper per coin than Bitcoin, it’s less risky. Price per coin doesn’t indicate volatility,percentage changes do, and Litecoin can swing just as wildly (sometimes more) than Bitcoin. Anyone buying Litecoin needs to prepare for that rollercoaster.

Evaluating Litecoin’s Market Position and Price Volatility

Litecoin ranks among the earliest cryptocurrencies still actively traded and developed. It’s earned the nickname “digital silver” partly because of its relationship to Bitcoin and partly due to its widespread adoption. Most major exchanges list it, hardware wallets support it, and it maintains a loyal community. But market position alone doesn’t guarantee investment success.

For beginners, understanding where Litecoin fits in the broader crypto ecosystem helps set realistic expectations. It’s not an under-the-radar altcoin with explosive growth potential, nor is it Bitcoin with its first-mover advantage and institutional adoption. Litecoin occupies a middle ground,established enough to feel relatively “safe” by crypto standards, but not dominant enough to avoid significant competition from newer, feature-rich alternatives.

Historical Price Performance

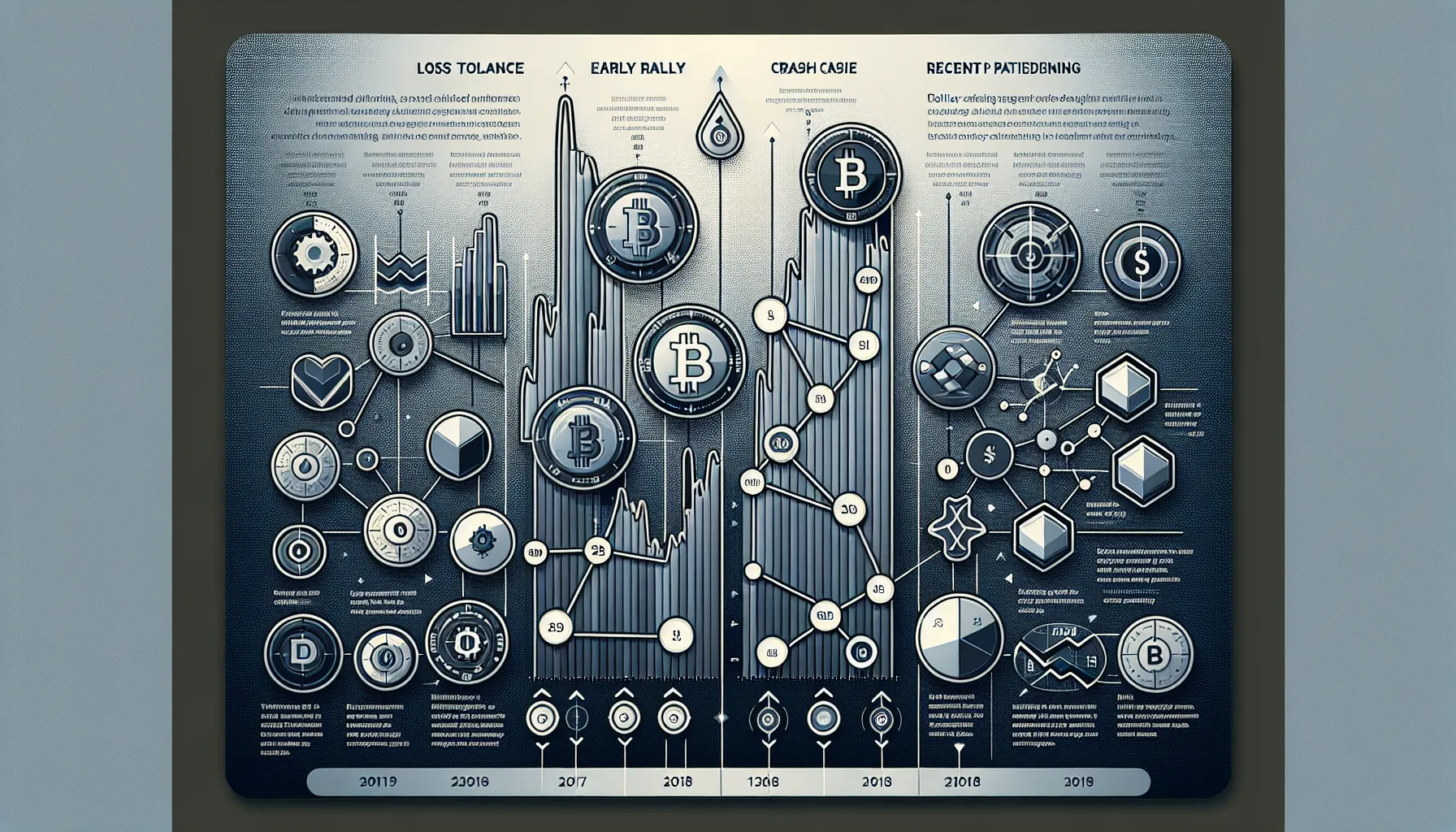

Litecoin’s price history reads like a thriller with dramatic highs and painful lows. Launched at under $5 in 2011, it experienced its first major rally during the 2013 crypto boom, reaching around $40. Then came the crash, and prices languished for years.

The 2017 cryptocurrency mania pushed Litecoin to an all-time high near $375 in December of that year. Newcomers who bought near the peak watched their investments plummet over 90% in the following year as the entire market corrected. By late 2018, LTC traded around $30.

Another rally came in 2021 alongside the broader bull market, with Litecoin reaching approximately $410 in May before Bitcoin and the entire crypto market tumbled. Since then, Litecoin has fluctuated between roughly $50 and $200, depending on market sentiment.

These swings aren’t anomalies,they’re standard in crypto. What beginners need to absorb is that buying at the wrong time can mean years of waiting just to break even. Someone who bought at $375 in late 2017 didn’t see those prices again until 2021, and then only briefly. Price volatility isn’t just a footnote: it’s the main text.

Regulatory news, macroeconomic conditions, Bitcoin’s performance, and crypto-specific events all drive Litecoin’s price. When Bitcoin rallies, Litecoin often follows (though not always proportionally). When regulators crack down on exchanges or announce unfavorable policies, Litecoin typically drops alongside other cryptocurrencies.

Managing Expectations in a Volatile Market

Here’s where theory meets reality. No matter how compelling Litecoin’s technology or market position seems, beginners must approach it with clear-eyed risk management.

Only invest what you can afford to lose. This gets repeated so often it sounds cliché, but it’s vital. The crypto market can drop 50% or more in weeks. Anyone buying Litecoin should be prepared for their investment to lose half its value without panicking or needing that money for rent or emergencies.

Diversification matters. Putting all available investment funds into Litecoin (or any single cryptocurrency) concentrates risk unnecessarily. Even crypto-enthusiastic investors typically spread holdings across multiple coins, and conservative portfolios include traditional assets too. Litecoin can be part of a balanced strategy, but probably shouldn’t be the entire strategy.

Stay informed, but don’t obsess. Following crypto news makes sense,major announcements, regulatory changes, and technological upgrades affect prices. But checking prices every hour and reacting emotionally to every dip usually leads to poor decisions. Successful crypto investors often adopt a longer time horizon, measured in years rather than days.

Timing the market is nearly impossible. Countless beginners try to buy at the absolute bottom and sell at the peak. Even professionals struggle with this. Dollar-cost averaging,buying smaller amounts regularly over time,tends to produce better outcomes than trying to nail the perfect entry point.

Litecoin’s volatility isn’t going away. Understanding that going in turns it from a shock into an expectation.

Choosing the Right Platform to Purchase Litecoin

Once someone decides to buy Litecoin, they face an immediate question: where? The platform choice affects everything from ease of use to security risks to costs. Different platforms serve different needs, and beginners need to understand the landscape before handing over personal information and funds.

Centralized Exchanges vs. Decentralized Platforms

Most beginners start with centralized exchanges like Coinbase, Binance, Kraken, or Gemini. These platforms operate much like traditional brokerages,they maintain order books, match buyers with sellers, and provide customer support. For someone coming from conventional finance, centralized exchanges feel familiar.

Advantages include:

- User-friendly interfaces designed for people who aren’t tech experts

- Higher liquidity, meaning orders fill quickly at competitive prices

- Customer support when things go wrong

- Integration with bank accounts and credit cards for easy deposits

- Regulatory compliance (at least the reputable ones), which provides some consumer protection

Downsides exist too:

- Know Your Customer (KYC) requirements mean uploading identification documents and sharing personal information

- Custodial risk,the exchange holds your crypto, so if they get hacked or go bankrupt, you might lose funds

- Geographic restrictions,not all exchanges operate in all countries or US states

- Potential for account freezes or limits based on the platform’s policies

Decentralized platforms (DEXs) offer a different approach. These help peer-to-peer trading without a central authority. No company holds your funds, and often no KYC is required. Platforms like Uniswap or decentralized exchanges built on various blockchains give users direct control.

Benefits include:

- Enhanced privacy,no need to share personal documents

- No custodial risk from the platform itself (though smart contract risks exist)

- Access regardless of geographic location

- True ownership,you control your private keys throughout

Challenges for beginners:

- Steeper learning curve,these platforms assume technical knowledge

- Lower liquidity for some trading pairs, potentially meaning worse prices

- No customer support when mistakes happen

- Higher risk of user error (sending funds to wrong addresses, approving malicious contracts)

- Often require existing cryptocurrency to get started

For most beginners, starting with a reputable centralized exchange makes sense. The convenience and safety rails justify the privacy tradeoffs early on. As someone gains experience and comfort, exploring decentralized options becomes more practical.

Security Features to Look For

Not all exchanges are created equal when it comes to security. Before depositing funds, beginners should evaluate several factors:

Regulatory compliance: Exchanges registered with financial authorities (like being licensed in the US, UK, or other major markets) must meet certain security standards. This isn’t a guarantee, but it’s a baseline filter. Unregulated exchanges operating from uncertain jurisdictions pose higher risks.

Track record: How long has the platform operated? Have they experienced major hacks or security breaches? How did they respond? Exchanges like Coinbase and Kraken have years of operation and generally strong security reputations. Newer platforms might be fine, but they lack that proven history.

Insurance and asset protection: Some exchanges maintain insurance policies or reserve funds to cover losses from hacks. Coinbase, for example, carries crime insurance. This doesn’t protect against all scenarios, but it adds a layer of security for users.

Two-factor authentication (2FA): Any legitimate platform should offer,ideally require,2FA for account access and withdrawals. This means even if someone steals a password, they can’t access the account without the second authentication factor (usually a code from an app like Google Authenticator).

Cold storage practices: Reputable exchanges keep the majority of user funds in “cold storage”,offline wallets that hackers can’t reach remotely. Only a small percentage needed for daily operations stays in “hot wallets” connected to the internet.

Withdrawal whitelists and delays: Some platforms let users whitelist specific wallet addresses for withdrawals and impose time delays on new addresses. This means if an account gets compromised, the attacker can’t immediately drain funds to their own wallet.

Beginners should research exchange security before signing up. Reading recent reviews, checking if they’ve had breaches, and verifying they’re legitimate operations takes an hour but could save thousands.

Securing Your Litecoin With the Right Wallet

Buying Litecoin is one thing: storing it safely is another. The phrase “not your keys, not your coins” captures a fundamental crypto principle: whoever controls the private keys controls the funds. When Litecoin sits on an exchange, that exchange controls the keys. For serious holders, moving crypto to a personal wallet is essential.

Hot Wallets vs. Cold Wallets

Hot wallets stay connected to the internet. They include mobile apps (like Trust Wallet or Exodus), desktop software, and web-based wallets. The main appeal is convenience,sending Litecoin or making transactions takes seconds. For someone who trades frequently or uses crypto for payments, hot wallets make sense.

The tradeoff? Security. Internet connectivity means potential vulnerability to hacking, malware, or phishing attacks. If a phone gets compromised or a computer infected, hot wallets can be drained. They’re fine for amounts someone might carry in a physical wallet,spending money rather than life savings.

Cold wallets stay offline. Hardware wallets like Ledger or Trezor are the most popular cold storage option. These physical devices store private keys isolated from internet-connected computers. To send Litecoin, users connect the device briefly, authorize the transaction on the hardware wallet itself, then disconnect.

Security is dramatically higher. Even if a computer is completely compromised by malware, the hacker can’t access private keys stored on the hardware wallet. For long-term holdings,amounts someone would keep in a safe rather than a pocket,cold storage is the standard recommendation.

Paper wallets represent another cold storage method: private keys printed on paper and stored physically. They’re free and completely offline, but come with risks too. Paper degrades, ink fades, and if that piece of paper is lost or destroyed, the Litecoin is gone forever. Plus, when it’s time to spend, the entire paper wallet usually needs to be swept (emptied), which can be technically complicated for beginners.

For most beginners, the practical approach is both: a hot wallet for small amounts and convenience, and a hardware wallet for serious holdings. Spending $50-150 on a Ledger or Trezor makes sense for anyone holding more than a few hundred dollars in crypto.

Best Practices for Wallet Security

Having the right wallet type is step one. Actually securing it requires following some non-negotiable practices:

Backup the recovery phrase,offline. When setting up any wallet, it generates a recovery phrase (usually 12 or 24 words). This phrase can restore access if the wallet is lost, broken, or stolen. Write it on paper (or metal for extra durability) and store it somewhere secure,a safe, safety deposit box, or multiple hidden locations. Never store it digitally (no photos, no cloud storage, no password managers). If someone finds that phrase, they own your crypto.

Use strong, unique passwords. Wallet apps and exchanges should have passwords that are long, random, and not used anywhere else. A password manager helps here, but remember that password manager itself needs to be secured.

Enable multi-factor authentication. For any wallet or service that offers it, turn on 2FA. App-based authentication (Google Authenticator, Authy) is more secure than SMS, which can be vulnerable to SIM-swapping attacks.

Verify addresses carefully. When sending Litecoin, always double-check the recipient address. Some malware changes copied addresses to the attacker’s wallet. Verifying at least the first and last few characters catches this. For large amounts, consider sending a small test transaction first.

Never share private keys or recovery phrases. No legitimate company, support representative, or service will ever ask for these. Anyone requesting them is attempting theft. Period.

Be wary of phishing. Fake emails, websites, and messages impersonating exchanges or wallet providers are common. Always navigate to sites directly rather than clicking links in emails. Check URLs carefully for slight misspellings.

Keep software updated. Wallet apps and hardware wallet firmware receive security updates. Installing them promptly closes vulnerabilities.

Consider multisignature wallets for large amounts. These require multiple private keys to authorize transactions (say, 2 out of 3 keys). It adds complexity but significantly increases security for substantial holdings.

Security isn’t a one-time setup,it’s an ongoing practice. The good news is that after establishing these habits, they become second nature.

Understanding the Costs and Fees Involved

One surprise for crypto beginners is how many different fees can apply to a simple transaction. Understanding the cost structure helps avoid unpleasant surprises and makes for smarter decisions about when and how to buy or move Litecoin.

Transaction Fees and Network Costs

Every time Litecoin moves on the blockchain,from one wallet to another, or from an exchange to a personal wallet,miners need to process that transaction. They get compensated through transaction fees (also called network fees or miner fees).

The good news: Litecoin’s network fees are consistently low. While Bitcoin fees can spike to $20, $30, or even higher during periods of network congestion, Litecoin typically stays well under a dollar per transaction. Often, fees are just a few cents. This is one of Litecoin’s practical advantages for actual use.

These fees aren’t set by exchanges or wallets,they’re determined by network demand. When lots of transactions compete for space in the next block, fees rise. When activity is light, fees drop. Most wallets suggest an appropriate fee automatically, though advanced users can sometimes adjust them manually (lower fees mean slower confirmation, higher fees mean priority processing).

Beginners should know that when withdrawing Litecoin from an exchange to a personal wallet, a network fee applies. It’s unavoidable and goes to miners, not the exchange (though exchanges sometimes add their own withdrawal fees on top,more on that in a moment).

Exchange Fees and Hidden Charges

Exchange fees are where things get more complicated and potentially expensive. Different platforms use different fee structures:

Trading fees: When buying Litecoin with USD (or another currency), the exchange charges for executing that trade. This might be a flat percentage (like 0.5% of the transaction) or a tiered structure where higher-volume traders pay less. Coinbase, for example, charges around 0.5% for regular trades through Coinbase Pro, but their main consumer platform has higher fees built into the simplified interface.

Some exchanges use a spread,they quote a buy price slightly higher than the market rate and a sell price slightly lower, pocketing the difference. This functions as a hidden fee. The displayed price might look good, but you’re paying more than the true market rate.

Deposit fees: Getting money onto an exchange sometimes costs money. Wire transfers might incur fees, though ACH transfers from US bank accounts are often free. Credit card purchases typically come with premium fees (3-5% or more) because of processing costs and chargeback risks.

Withdrawal fees: Moving Litecoin off an exchange to a personal wallet usually triggers a withdrawal fee set by the exchange. This is separate from and often higher than the actual network fee. Some exchanges charge $1-2 to withdraw Litecoin, others might charge $5 or more. Checking this before choosing an exchange matters, especially for people planning to withdraw regularly.

Conversion fees: If buying Litecoin with a non-USD currency (say, EUR or GBP), currency conversion fees can apply before or during the crypto purchase. These aren’t always clearly displayed.

Inactivity fees: Some platforms charge fees for accounts that stay inactive for long periods. These are less common but worth checking in the terms of service.

How to minimize fees: Shop around. Fee structures vary dramatically between platforms. Coinbase Pro, Kraken, Gemini Active Trader, and Binance generally offer lower fees than simplified consumer interfaces. Beginners might start with the easy interface, but transitioning to the pro version of the same platform usually cuts fees significantly.

Using bank transfers instead of credit cards saves money. Batching transactions,buying larger amounts less frequently rather than many small purchases,reduces the number of times fees are paid. And withdrawing only when necessary (rather than moving small amounts repeatedly) keeps withdrawal fees from adding up.

One calculation worth doing: if someone plans to buy $100 of Litecoin monthly, and the exchange charges $2.99 per transaction, that’s nearly 3% gone just to fees. Finding a platform with percentage-based fees or lower fixed fees could save substantial amounts over time.

Fees aren’t necessarily bad,they’re the cost of the service. But uninformed buyers can lose 5-10% of their investment to various fees before they even own the crypto. A little research and comparison shopping pays for itself immediately.

Conclusion

Buying Litecoin doesn’t require an advanced degree in computer science, but it does demand more attention than buying stocks through a traditional brokerage. The technology is different, the risks are higher, and the responsibility falls squarely on the buyer. There’s no FDIC insurance, no customer service hotline that can reverse fraudulent transactions, and no safety net when mistakes happen.

But with that responsibility comes opportunity. Litecoin offers a way to participate in a decentralized financial system with lower fees and faster transactions than Bitcoin. For some, it’s a speculative investment hoping for price appreciation. For others, it’s a tool for borderless payments or a hedge against traditional financial systems. Both are valid reasons, as long as they’re backed by understanding rather than hype.

The five areas covered here,understanding what Litecoin is, evaluating its market behaviour, choosing secure platforms, protecting holdings with proper wallets, and minimizing fees,form the foundation every beginner needs. None of these guarantee profits or eliminate risk, but they stack the odds in favor of making informed rather than impulsive decisions.

Anyone serious about buying Litecoin should take time on each step. Research exchanges, compare fees, invest in a hardware wallet if holdings grow, and stay educated about market developments. The crypto space moves fast, with new technologies, regulations, and competitors constantly emerging. What’s true today might shift tomorrow.

Most importantly, approach Litecoin with realistic expectations. It’s not a get-rich-quick scheme, and the volatility means losses are just as possible as gains. Treat it as a high-risk component of a broader financial strategy, not the entirety of one. With preparation, caution, and ongoing learning, beginners can navigate the Litecoin market with confidence,even if they can’t predict where the price will go next.

Frequently Asked Questions

What makes Litecoin different from Bitcoin for beginners?

Litecoin offers faster transaction speeds with blocks generated every 2.5 minutes compared to Bitcoin’s 10 minutes, and consistently lower transaction fees, often just pennies. It uses the Scrypt mining algorithm and has a maximum supply of 84 million coins versus Bitcoin’s 21 million.

How volatile is Litecoin’s price compared to other cryptocurrencies?

Litecoin experiences significant price volatility similar to other cryptocurrencies. It has dropped over 90% from its all-time high of $375 in 2017, and fluctuates between $50-$200 in recent years. Beginners should only invest what they can afford to lose.

Should I store my Litecoin on an exchange or in a personal wallet?

For long-term holdings, transferring Litecoin to a personal wallet is recommended. While exchanges offer convenience, hardware wallets like Ledger or Trezor provide significantly better security by keeping your private keys offline and under your complete control.

What fees should I expect when buying Litecoin?

Expect trading fees ranging from 0.5% to 3% depending on the platform, potential deposit fees for credit cards, and withdrawal fees when moving Litecoin to your wallet. Network transaction fees on Litecoin’s blockchain typically remain under one dollar.

Can Litecoin be used for everyday purchases like regular currency?

Yes, Litecoin’s fast confirmation times and low transaction fees make it well-suited for everyday transactions and micro-payments. Merchants can accept payments with confidence in 7-15 minutes, compared to 30-60 minutes for Bitcoin, positioning it as practical digital cash.

Is dollar-cost averaging a good strategy for buying Litecoin?

Dollar-cost averaging—buying smaller amounts regularly over time—tends to produce better outcomes than trying to time the market perfectly. This strategy helps mitigate Litecoin’s volatility and reduces the risk of investing a large sum at a market peak.