Litecoin has earned its reputation as “digital silver” to Bitcoin’s gold, but that nickname doesn’t tell the whole story. Behind the scenes, the Litecoin network operates with a carefully engineered architecture that prioritizes speed, efficiency, and security in ways that set it apart from its more famous predecessor. Whether you’re a crypto trader waiting for a transaction to clear, a merchant accepting digital payments, or simply curious about how blockchain technology works in practice, understanding how Litecoin handles blocks, confirmations, and transaction speeds reveals why this cryptocurrency has remained relevant for over a decade.

The mechanics of the Litecoin network aren’t just technical details,they directly impact how quickly transactions finalize, how secure those transactions are, and how practical Litecoin is for everyday use. From the 2.5-minute block time that keeps the network humming along to the confirmation process that gradually locks transactions into permanent history, every element plays a role in delivering what users eventually care about: fast, reliable, and affordable digital money.

Key Takeaways

- The Litecoin network operates with a 2.5-minute block time, enabling transactions to confirm four times faster than Bitcoin’s 10-minute blocks.

- Most Litecoin transactions achieve sufficient security within 5–15 minutes, with low-value purchases often accepting one confirmation and high-value transfers typically requiring six confirmations.

- Litecoin’s use of the Scrypt hashing algorithm and decentralized blockchain architecture ensures transparent, secure transactions without relying on intermediaries like banks.

- Understanding Litecoin blocks and confirmations helps users choose appropriate security thresholds—two to three confirmations work for medium-value transactions, while six confirmations provide robust protection for large transfers.

- Transaction fees on the Litecoin network typically remain under a few cents, making it a practical and affordable option for everyday payments and cross-border remittances.

- The network’s fast confirmation speed and low costs position Litecoin as a payment-focused cryptocurrency ideal for merchants, traders, and users who prioritize transaction speed over purely speculative investment.

What Is the Litecoin Network?

The Litecoin network is a decentralized, peer-to-peer blockchain platform designed to help fast and efficient digital transactions without relying on banks, payment processors, or other intermediaries. Created in 2011 by Charlie Lee, Litecoin was built as a lighter, faster alternative to Bitcoin while maintaining the core principles of cryptocurrency: transparency, security, and decentralization.

At its foundation, Litecoin operates on a public ledger where every transaction is recorded transparently and permanently. This ledger is distributed across thousands of nodes worldwide, meaning no single entity controls the network. Anyone can verify transactions, and once data is written to the blockchain, it becomes virtually impossible to alter or erase.

What makes Litecoin particularly interesting is its use of the Scrypt hashing algorithm for its Proof of Work consensus mechanism. This technical choice was intentional,Scrypt requires more memory than Bitcoin’s SHA-256, which originally helped level the playing field for miners using consumer-grade hardware. While specialized mining equipment (ASICs) eventually emerged for Scrypt too, the algorithm remains a defining characteristic of Litecoin’s identity.

The network’s design prioritizes practical usability. With a maximum supply capped at 84 million coins (four times Bitcoin’s 21 million) and faster block generation, Litecoin positions itself as a medium for everyday transactions rather than just a store of value. This design philosophy permeates every aspect of how the network operates, from block times to fee structures.

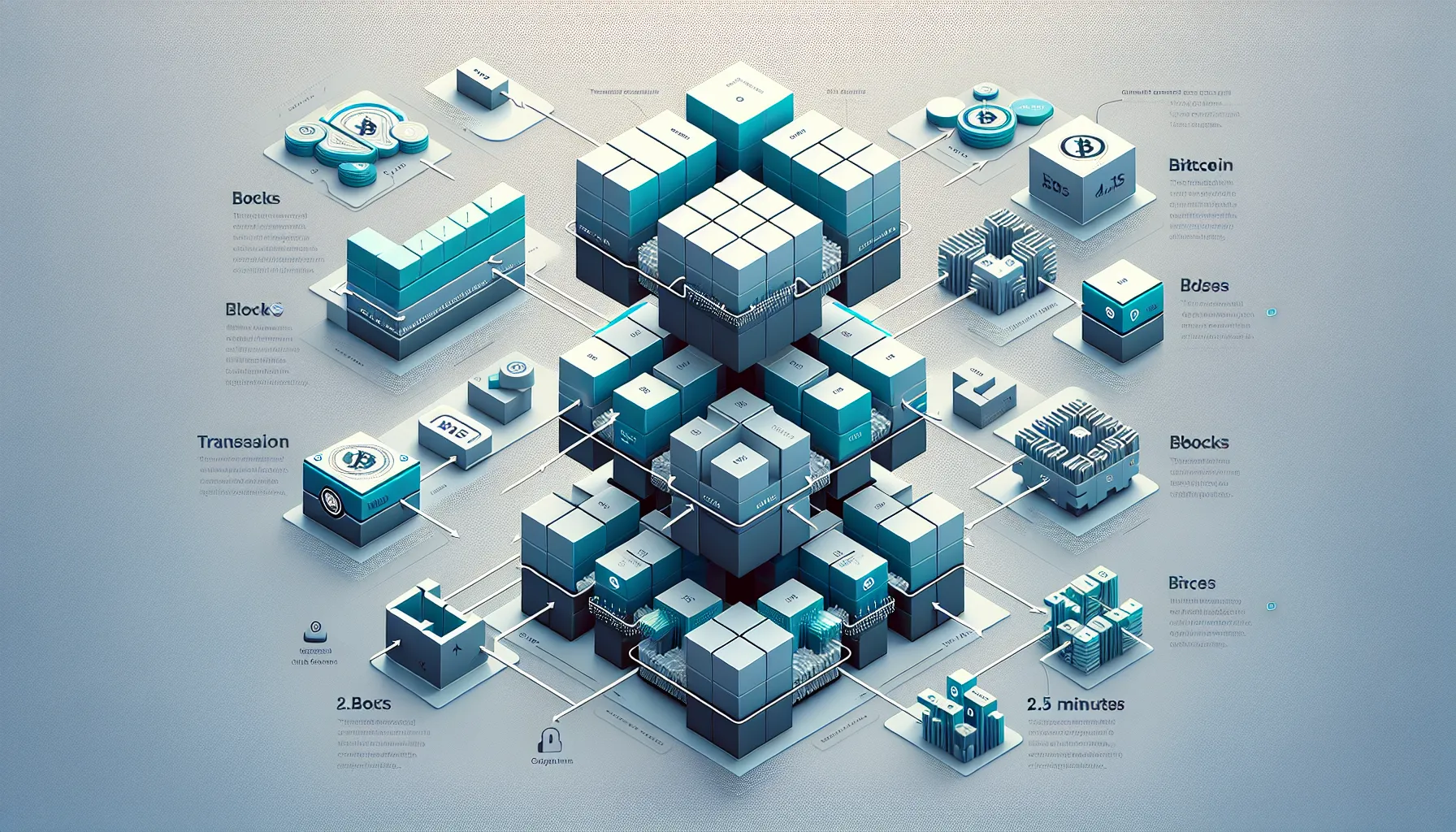

How Litecoin Blocks Work

Blocks are the fundamental building units of the Litecoin blockchain. Each block serves as a container for validated transactions, bundling them together and linking them cryptographically to the preceding block. This creates an unbroken chain stretching back to the network’s genesis block in October 2011.

When users initiate Litecoin transactions, those transactions don’t immediately become part of the permanent record. Instead, they enter a pool of unconfirmed transactions called the mempool, where miners select them for inclusion in the next block. Miners compete to solve complex mathematical puzzles using computational power, and the first to find a valid solution gets to add their block to the chain and collect the block reward plus transaction fees.

This process, known as mining, secures the Litecoin network against attacks and double-spending attempts. The computational work required makes it prohibitively expensive to rewrite history or manipulate the blockchain. Each new block builds on this security, making older transactions progressively more immutable.

Block Structure and Data

A Litecoin block contains several critical components that work together to maintain the blockchain’s integrity:

- Transaction list: The primary payload of each block, containing data about senders, receivers, and amounts for every included transaction

- Block hash: A unique cryptographic fingerprint generated from the block’s contents

- Previous block hash: A reference to the preceding block, creating the “chain” in blockchain

- Timestamp: Records when the block was mined

- Nonce: A number miners adjust while searching for a valid block hash

- Merkle root: A compact summary of all transactions in the block

This structure creates a tamper-evident system. If someone attempts to alter even a single transaction in an old block, that block’s hash changes. Since the next block references the previous block’s hash, the alteration breaks the chain’s continuity, making the fraud immediately detectable.

The cryptographic linking between blocks is what gives blockchain technology its security properties. It’s not just a database,it’s a database where any attempt to revise history leaves obvious evidence.

Block Time: Why 2.5 Minutes Matters

Litecoin’s defining characteristic is its 2.5-minute block time, exactly four times faster than Bitcoin’s 10-minute interval. This wasn’t an arbitrary choice,it represents a deliberate trade-off between speed and security.

Faster blocks mean transactions receive their first confirmation more quickly, reducing wait times for users and merchants. If you’re buying coffee with cryptocurrency, waiting 10 minutes for a Bitcoin confirmation feels impractical. With Litecoin’s 2.5-minute blocks, that first confirmation arrives much sooner, making the experience more comparable to traditional payment methods.

But, faster blocks do come with considerations. They can lead to more orphaned blocks (valid blocks that don’t make it into the main chain because another miner found a competing block at nearly the same time). They also mean the blockchain grows faster, requiring more storage over time. Litecoin’s developers determined that 2.5 minutes struck a good balance,fast enough to improve user experience significantly, but not so fast as to compromise network stability.

For practical purposes, this block time is what enables Litecoin to position itself as a payment-focused cryptocurrency. It’s the technical foundation for the network’s speed advantage, turning what could be a purely theoretical benefit into a real-world improvement in transaction finality.

Understanding Litecoin Confirmations

Confirmations are how the Litecoin network transforms tentative transactions into permanent, irreversible records. The concept is straightforward, but the security implications are profound.

What Is a Confirmation?

A confirmation occurs when a transaction is included in a block that miners have added to the blockchain. The first confirmation happens when your transaction makes it into a block for the first time. Each subsequent block added to the chain provides an additional confirmation for your transaction.

Think of it like layers of concrete poured over a footprint. The first layer captures the impression, but someone could potentially break through and alter it. Each additional layer makes tampering exponentially more difficult and expensive. By the time six blocks have been added on top of the block containing your transaction, reversing it would require an attacker to control more than half of the network’s mining power and redo all that computational work,a virtually impossible feat for a network as large as Litecoin’s.

With Litecoin’s 2.5-minute block time, confirmations accumulate quickly. A transaction gets its first confirmation in about 2.5 minutes on average, its second in roughly 5 minutes, and so on. This is where Litecoin’s speed advantage becomes tangible.

How Many Confirmations Are Needed?

The number of confirmations required depends on the transaction’s value and the recipient’s risk tolerance. There’s no universal rule, but industry standards have emerged through practice:

For low-value transactions (say, under $100), many merchants accept just one confirmation or even zero confirmations for small purchases. The risk of double-spending attacks on tiny amounts doesn’t justify making customers wait.

For medium-value transactions ($100–$10,000), two to three confirmations are common. This typically means waiting 5 to 7.5 minutes, which strikes a reasonable balance between security and convenience.

For high-value transactions (over $10,000), six confirmations are the gold standard. This takes about 15 minutes on the Litecoin network and provides robust protection against even sophisticated attacks. Cryptocurrency exchanges typically require six confirmations before crediting deposits to user accounts.

The math behind these conventions relates to the probability of a successful double-spend attack. Each additional confirmation makes such an attack exponentially more difficult. After six confirmations, the probability becomes negligible for practical purposes.

Interestingly, because Litecoin blocks come four times faster than Bitcoin blocks, six Litecoin confirmations (about 15 minutes) provide similar security to six Bitcoin confirmations (about 60 minutes) in much less time. This is one reason Litecoin has gained traction for use cases where speed matters.

Litecoin Transaction Speed Explained

Transaction speed in cryptocurrency contexts refers to finality,how long it takes before a transaction is considered irreversible. This is where Litecoin’s architectural decisions translate into real user benefits.

The journey of a Litecoin transaction involves several stages. First, you broadcast your transaction to the network, which propagates to nodes within seconds. Then, miners include it in the next block they’re working on. Once that block is mined and added to the chain, you’ve got your first confirmation. Additional blocks build on top, adding more confirmations and security.

The bottleneck isn’t the broadcast or the network propagation,it’s waiting for enough blocks to be mined. This is where Litecoin’s 2.5-minute block time shines.

Comparing Litecoin Speed to Bitcoin

The contrast between Litecoin and Bitcoin becomes clear when you map out typical transaction timelines:

| Metric | Litecoin | Bitcoin |

|---|---|---|

| Block Time | 2.5 minutes | 10 minutes |

| First Confirmation | ~2.5 minutes | ~10 minutes |

| Typical Confirmations | 2–6 | 3–6 |

| Time to 6 Confirmations | ~15 minutes | ~60 minutes |

| Finality Speed | Faster | Slower |

For a merchant waiting for six confirmations before shipping a product, that’s the difference between 15 minutes and an hour. For a user making multiple transactions throughout the day, the cumulative time savings add up significantly.

It’s worth noting that Bitcoin wasn’t necessarily designed “wrong”,its longer block time provides certain security benefits and reduces orphan rates. But for use cases prioritizing speed, Litecoin’s design choices make more sense. The networks optimized for different priorities, and both approaches have merit.

Real-World Transaction Times

In practice, most Litecoin transactions achieve sufficient security within 5 to 15 minutes, depending on the required confirmation count. Low-value purchases might clear effectively instantly (accepting zero confirmations), while high-value transfers might wait the full 15 minutes for six confirmations.

Network conditions influence these times. During periods of low activity, blocks might be found slightly faster than the 2.5-minute average due to statistical variance. During congestion, transactions with lower fees might wait in the mempool through several blocks before miners include them.

Second-layer solutions like the Lightning Network can enable virtually instant Litecoin transactions by moving small, frequent payments off the main blockchain. These channels settle final balances back to the main chain periodically, combining instant speed with blockchain security. While Lightning Network adoption on Litecoin is still developing, it represents one path toward even faster transaction experiences.

For everyday users, the practical takeaway is simple: Litecoin transactions are meaningfully faster than Bitcoin transactions when both networks are running normally. Whether that speed advantage matters depends on the use case,paying for digital goods, sending remittances, or trading on exchanges all benefit from quicker confirmation times.

Factors That Affect Litecoin Network Performance

While Litecoin’s design provides a strong foundation for fast transactions, several variable factors influence real-world performance. Understanding these helps set realistic expectations and explains why transaction experiences can vary.

Network Congestion and Fees

Network congestion occurs when transaction volume exceeds the available block space. Each Litecoin block has a maximum size limit, constraining how many transactions it can hold. When demand is high, transactions compete for inclusion, and miners typically prioritize those offering higher fees.

During congestion, several things happen. First, transactions with minimal fees might wait in the mempool for extended periods,sometimes through multiple blocks,before miners include them. Second, users who want faster confirmation may need to increase their fee to make their transaction more attractive to miners. Third, average fees across the network rise as users bid against each other for limited block space.

Historically, Litecoin has experienced lower congestion than Bitcoin, partly because its four-times-faster blocks provide four times the throughput. This means Litecoin can process more transactions per hour, reducing bottlenecks. Average Litecoin transaction fees typically remain under a few cents, even during busier periods, though they can spike during extreme demand.

For users, the practical lesson is to include a reasonable fee with transactions, especially when speed matters. Most Litecoin wallets calculate appropriate fees automatically based on current network conditions, making this largely transparent to average users.

Mining Difficulty Adjustments

Litecoin maintains its 2.5-minute average block time through a self-adjusting mechanism called difficulty adjustment. Every 2,016 blocks (approximately 3.5 days), the network recalculates how difficult it should be to find a valid block hash.

If miners have been finding blocks faster than 2.5 minutes on average,perhaps because more mining hardware joined the network,the difficulty increases proportionally. This makes the mathematical puzzle harder to solve, bringing the block time back toward the 2.5-minute target. Conversely, if blocks have been coming slower than expected, difficulty decreases to compensate.

This adjustment mechanism keeps the network stable as mining power fluctuates. When Litecoin’s price rises and mining becomes more profitable, new miners join, but difficulty rises to maintain consistent block times. When price falls and some miners shut down, difficulty drops to prevent blocks from coming too slowly.

For users, these adjustments happen automatically in the background. You might notice slightly faster or slower confirmations in the days leading up to a difficulty adjustment, but over longer timescales, the 2.5-minute average holds remarkably steady. It’s one of those elegant aspects of blockchain design that works precisely because it’s decentralized,no committee needed to adjust parameters, just mathematical rules executing automatically.

Practical Implications for Users

Understanding Litecoin’s technical characteristics helps users make informed decisions about when and how to use the cryptocurrency. The network’s speed and efficiency create specific advantages for certain use cases.

For everyday payments, Litecoin’s fast confirmation times make it practical in ways that slower blockchains struggle with. A merchant can reasonably wait 5–10 minutes for two or three confirmations on a moderate-value purchase, similar to waiting for a credit card authorization. For small purchases, accepting zero confirmations might be acceptable, especially for digital goods or services where the fraud risk is low.

For cryptocurrency trading, Litecoin’s six-confirmation standard means deposits typically credit to exchange accounts within 15–20 minutes. This is considerably faster than Bitcoin’s hour-long wait and enables more nimble trading strategies. When markets are moving quickly, that time difference can matter.

For remittances and transfers, Litecoin offers a compelling combination of speed and low fees. Sending money internationally via traditional banking might take days and cost significant fees. A Litecoin transaction, by contrast, finalizes in minutes with fees typically under $0.50. This makes it genuinely useful for cross-border payments, especially in regions with limited banking infrastructure.

For large-value storage, users should still exercise caution. While Litecoin’s security is robust, best practices like using hardware wallets, verifying addresses carefully, and waiting for sufficient confirmations remain essential. The network’s speed doesn’t diminish the importance of proper security hygiene.

The low average fees also mean Litecoin remains accessible to users in developing economies, where even small transaction costs can be prohibitive. A network that charges pennies per transaction opens possibilities that one charging dollars cannot.

One consideration is that faster isn’t always better for every purpose. Bitcoin’s longer confirmation times provide certain security advantages for extremely high-value settlements where waiting an hour is acceptable. But for the vast majority of real-world transactions,buying goods, paying for services, moving money between exchanges,Litecoin’s speed and cost profile make it more practical.

Conclusion

The Litecoin network’s architecture represents a carefully balanced set of design choices that prioritize practical usability without sacrificing security. Its 2.5-minute block time, Scrypt proof-of-work algorithm, and efficient confirmation process work together to deliver what many users actually need from cryptocurrency: fast, affordable, reliable digital payments.

Understanding how blocks, confirmations, and transaction speeds work on Litecoin isn’t just academic knowledge,it’s practical information that helps users set appropriate expectations, choose reasonable confirmation thresholds, and appreciate why certain use cases favor Litecoin over alternatives.

The network demonstrates that blockchain technology doesn’t have to be slow to be secure. By finding the right balance between confirmation speed and immutability, Litecoin carved out a distinct niche in the cryptocurrency ecosystem. Whether that niche expands or remains specialized will depend on adoption trends, technological developments, and competition from newer blockchain designs.

But more than a decade after its creation, Litecoin’s fundamentals remain sound. The blocks keep coming every 2.5 minutes, transactions continue confirming quickly and cheaply, and the network keeps delivering on its original promise: a lighter, faster alternative for digital money. For users who understand how these mechanics work, Litecoin becomes not just a speculative asset but a genuinely useful tool.

Frequently Asked Questions

How long does it take for a Litecoin transaction to confirm?

A Litecoin transaction receives its first confirmation in approximately 2.5 minutes on average. For secure transactions, most users wait for 2–6 confirmations, taking between 5 and 15 minutes depending on the transaction value and required security level.

What is the Litecoin block time and why does it matter?

Litecoin’s block time is 2.5 minutes, four times faster than Bitcoin’s 10 minutes. This faster block time means transactions confirm more quickly, making Litecoin more practical for everyday payments and significantly reducing wait times for transaction finality.

How many confirmations do I need for a Litecoin transaction?

The required confirmations depend on transaction value. Low-value purchases may need just one confirmation, medium transactions typically require 2–3 confirmations, while high-value transfers and exchange deposits usually require six confirmations for maximum security, taking about 15 minutes total.

Is Litecoin faster than Bitcoin for transactions?

Yes, Litecoin is significantly faster than Bitcoin. While Bitcoin takes approximately 60 minutes for six confirmations, Litecoin achieves the same security level in about 15 minutes due to its 2.5-minute block time versus Bitcoin’s 10-minute blocks.

Can I cancel a Litecoin transaction after sending it?

Once a Litecoin transaction is broadcast to the network, it cannot be canceled. However, if it remains unconfirmed in the mempool due to low fees, some wallets allow you to replace it with a higher-fee version before miners include it in a block.

What happens if the Litecoin network gets congested?

During network congestion, transactions with lower fees may wait longer in the mempool before miners include them in blocks. Users can increase transaction fees to prioritize faster confirmation, though Litecoin generally experiences less congestion than Bitcoin due to its higher throughput.