Trading Litecoin can be exciting and potentially profitable, but it’s also riddled with pitfalls that catch even experienced traders off guard. As one of the oldest and most established cryptocurrencies, Litecoin offers unique opportunities,yet many traders sabotage their own success by repeating the same avoidable mistakes. Whether it’s diving in without a plan, letting emotions hijack decisions, or ignoring basic security, these errors can quickly erode capital and confidence.

The difference between traders who consistently profit and those who watch their portfolios shrink often comes down to discipline, preparation, and understanding what not to do. This article walks through ten of the most common mistakes Litecoin traders make and shows how to sidestep them. By recognizing these traps early, traders can protect their investments, make smarter decisions, and build a sustainable approach to navigating Litecoin’s dynamic market.

Key Takeaways

- Trading Litecoin successfully requires a clear strategy with predefined entry and exit points, risk management rules, and disciplined execution.

- Stop-loss orders are essential protection against sudden market swings, preventing emotional decisions and limiting losses on every trade.

- Emotional trading driven by fear and FOMO leads to buying high and selling low—successful traders separate feelings from analysis.

- Security best practices like hardware wallets, two-factor authentication, and vigilance against phishing are critical to protecting your Litecoin holdings.

- Understanding Litecoin’s unique characteristics—including its faster block time, higher supply cap, and role as a Bitcoin testbed—gives traders a strategic edge.

- Avoiding common mistakes like overtrading, chasing hype, neglecting taxes, and using unreliable exchanges dramatically improves long-term trading outcomes.

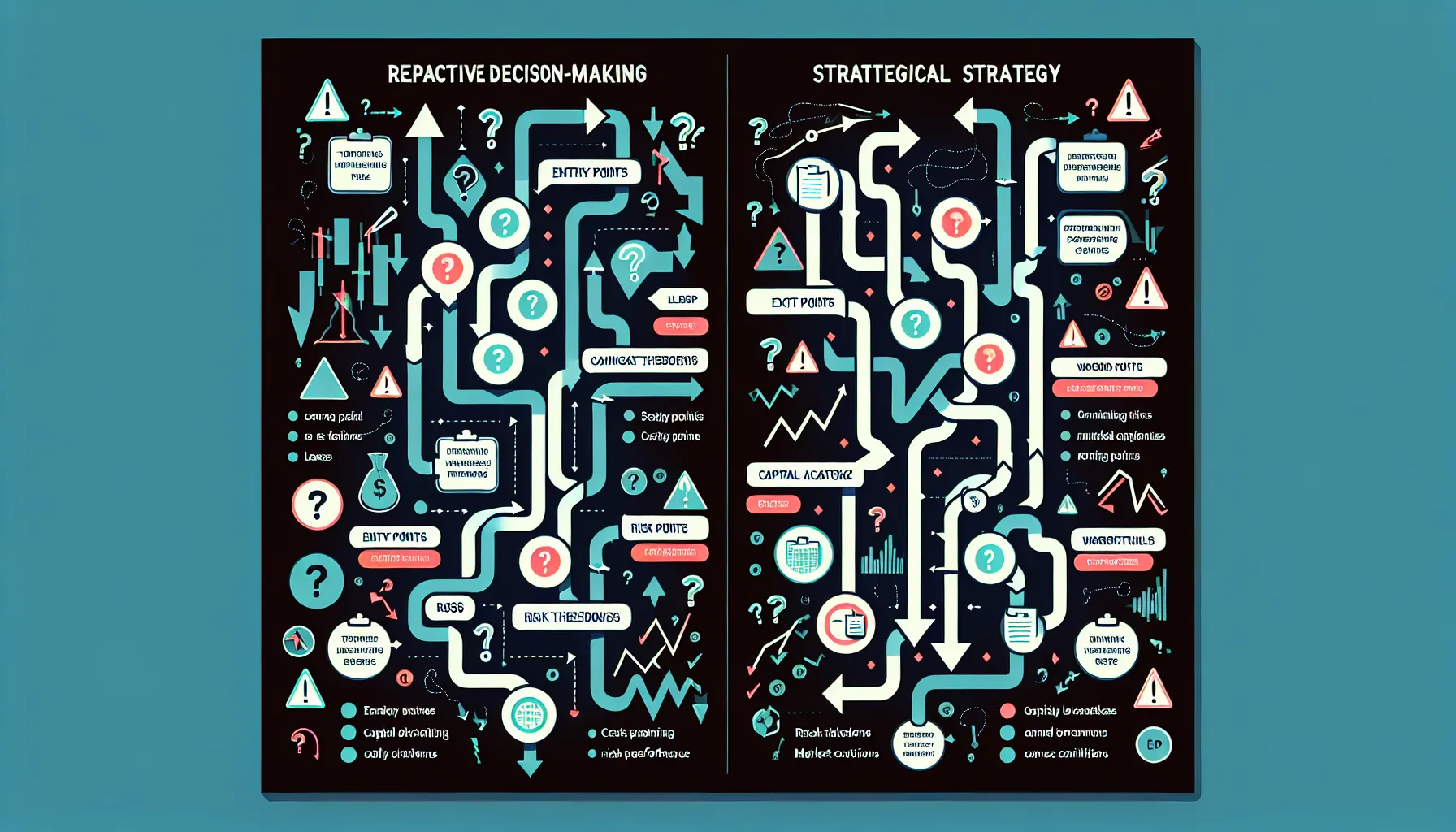

Trading Without a Clear Strategy

Jumping into Litecoin trading without a defined plan is one of the fastest ways to burn through capital. Yet it’s surprisingly common. Many traders open positions based on gut feelings, price movements they happened to notice, or vague notions of “getting in before it’s too late.” Without a structured strategy, every decision becomes reactive rather than intentional.

A solid trading strategy answers critical questions before a trade is ever placed: What are your entry and exit points? How much capital will you allocate to each position? What’s your acceptable risk per trade? What market conditions favor your approach? These aren’t optional considerations,they’re the foundation of consistent performance.

Traders without a plan tend to make impulsive decisions. They hold losing positions too long, hoping for a reversal, or exit winning trades prematurely out of fear. They chase price movements without understanding context. Over time, this randomness leads to inconsistent results and mounting losses. Successful traders, by contrast, follow a repeatable process that removes guesswork and keeps emotions in check. If you’re trading Litecoin seriously, develop a written strategy and stick to it, adjusting only after deliberate review,not in the heat of the moment.

Ignoring Market Research and Analysis

Relying on social media buzz, influencer tips, or casual Reddit threads might feel like research, but it’s a dangerous shortcut. Real market analysis involves digging into both fundamental and technical factors that drive Litecoin’s price. Skipping this step leaves traders vulnerable to hype cycles, misinformation, and poorly timed entries.

Technical analysis looks at price charts, volume trends, support and resistance levels, and indicators like moving averages or RSI. These tools help identify potential entry and exit points based on historical patterns. Fundamental analysis considers Litecoin’s position in the broader crypto ecosystem, its network activity, development updates, and macroeconomic factors like Bitcoin’s performance or regulatory news.

Many beginners bypass this assignments entirely, preferring to follow the crowd. They buy because “everyone’s talking about it” or sell because panic spreads on Twitter. This reactive approach exposes them to getting in at local tops or exiting near bottoms. Before placing any trade, spend time understanding why Litecoin is moving the way it is. Check trading volume, review recent news, analyze the chart, and consider how external factors might influence price. Informed decisions consistently outperform guesses.

Failing to Use Stop-Loss Orders

Not setting stop-loss orders is one of the most reckless risks traders take, yet it happens constantly. A stop-loss is a predetermined price level at which your position automatically closes, capping your loss on a trade. It’s essential protection against sudden market swings, flash crashes, or unexpected news that sends prices plummeting.

Without stop-losses, traders rely on manually monitoring positions and making real-time decisions under pressure. This rarely goes well. When prices drop sharply, panic sets in. Traders either freeze, hoping for a recovery that may never come, or sell impulsively at the worst possible moment. Meanwhile, losses grow larger than originally planned.

Professional traders set stop-losses before entering a trade, not after. They decide in advance how much they’re willing to lose and place the stop accordingly. This discipline preserves capital for future opportunities and prevents a single bad trade from wiping out weeks of gains. Stop-losses aren’t admissions of failure,they’re intelligent risk management. If you’re trading Litecoin without them, you’re gambling with your portfolio every time the market moves against you.

Letting Emotions Drive Trading Decisions

Emotional trading kills profitability faster than almost anything else. When prices drop, fear takes over. Traders panic-sell at losses, convinced the market will keep falling. Hours or days later, prices rebound,and they’ve locked in unnecessary losses. When prices surge, FOMO kicks in. Traders buy late in a rally, right before a correction, then watch their positions bleed red.

This cycle of fear and greed is exhausting and expensive. It leads to buying high, selling low, and second-guessing every decision. Emotional traders make impulsive moves based on how they feel about the market rather than what the data actually shows. They abandon their strategies during drawdowns and chase gains during rallies, always one step behind.

Breaking this pattern requires discipline and structure. Set rules for when you’ll enter and exit trades, then follow them regardless of short-term emotions. Use pre-determined stop-losses and profit targets so decisions are made before emotions cloud judgement. Review trades objectively after they close, learning from both wins and losses. Over time, separating feelings from analysis becomes easier,and results improve dramatically. Litecoin’s volatility will always trigger emotional reactions, but successful traders don’t let those reactions dictate their actions.

Overtrading and Excessive Position Sizing

Making too many trades in rapid succession might feel productive, but it’s often counterproductive. Overtrading leads to decision fatigue, mounting transaction fees, and a higher probability of poor-quality setups. Add excessive position sizing,risking too much capital on individual trades,and losses compound quickly.

Traders who overtrade are usually chasing action rather than waiting for high-probability opportunities. They enter marginal setups because sitting on the sidelines feels uncomfortable. Each additional trade increases exposure to risk, and not every market condition favors trading. Sometimes the best move is patience.

Excessive position sizing amplifies this problem. Risking 10%, 20%, or more of a portfolio on a single trade might generate impressive gains when it works,but a few losses in a row can devastate an account. Professional traders typically risk 1-2% of their capital per trade, ensuring that even a string of losses won’t knock them out of the game.

Set daily or weekly trade limits. Focus on quality over quantity. Wait for setups that meet your strategy’s criteria rather than forcing trades out of boredom or impatience. Protect your capital by sizing positions conservatively. Trading isn’t about constant activity,it’s about making smart decisions when the odds are in your favor.

Neglecting Security Best Practices

All the trading skill in the world won’t matter if your Litecoin gets stolen. Yet many traders treat security as an afterthought, leaving themselves vulnerable to hacks, phishing, and scams. Protecting your assets requires deliberate effort and multiple layers of defence.

Start with hardware wallets. Storing Litecoin on exchanges is convenient for active trading, but keeping large holdings there is risky. Hardware wallets store private keys offline, making them virtually immune to online attacks. For long-term holdings, this is non-negotiable.

Enable two-factor authentication (2FA) on every account,exchanges, wallets, email. Use authenticator apps rather than SMS when possible, since phone numbers can be hijacked. Be vigilant against phishing emails and fake apps designed to steal credentials. Always verify URLs and app sources before entering sensitive information.

Never share your private keys with anyone, for any reason. Legitimate services will never ask for them. Avoid discussing holdings publicly or posting screenshots that reveal wallet addresses or balances. Security isn’t glamorous, but losing access to your Litecoin,or having it stolen,can erase months or years of gains in an instant. Treat protection as seriously as you treat trading strategy.

Not Understanding Litecoin’s Unique Characteristics

Too many traders treat Litecoin as just another altcoin, ignoring what makes it distinct. While it shares similarities with Bitcoin, Litecoin has unique features that influence how it trades and where it fits in the crypto ecosystem. Understanding these differences is essential for making informed decisions.

Litecoin’s block time is roughly 2.5 minutes,four times faster than Bitcoin’s 10 minutes. This makes transactions quicker and gives the network different dynamics. Its total supply cap is 84 million coins, compared to Bitcoin’s 21 million. These supply mechanics affect scarcity perception and price behaviour.

Litecoin often acts as a testing ground for features later adopted by Bitcoin, like Segregated Witness (SegWit) and the Lightning Network. It’s also positioned as a “digital silver” to Bitcoin’s “digital gold,” emphasizing everyday transactions over store-of-value narratives. These characteristics influence how the market perceives and prices Litecoin relative to other cryptocurrencies.

Traders who understand these nuances can better anticipate how Litecoin will react to broader market trends, Bitcoin movements, or specific news events. They can identify when Litecoin is undervalued or overextended relative to its fundamentals. Generic altcoin strategies don’t always translate,knowing what sets Litecoin apart sharpens your edge.

Chasing Pumps and Following Hype

When Litecoin starts trending on Twitter, Reddit, or crypto news sites, it’s tempting to jump in. The price is surging, everyone’s talking about it, and FOMO whispers that you’re missing out. But chasing pumps is a reliable way to buy high and suffer through corrections.

By the time mainstream attention peaks, early investors have already accumulated positions at lower prices. They’re often taking profits as latecomers pile in, creating selling pressure right when enthusiasm is highest. The result? Newcomers buy near the top, then watch prices drop as hype fades.

Hype-driven trading ignores fundamentals. It’s based on emotion, social proof, and fear of missing gains rather than sound analysis. Prices disconnected from underlying value eventually correct, and those who bought based on excitement rather than research get caught holding losing positions.

Successful traders do the opposite. They build positions quietly before hype cycles begin, based on research and conviction. They view extreme attention as a potential exit signal rather than an entry opportunity. If you’re only noticing Litecoin because everyone’s suddenly talking about it, you’re probably late. Focus on fundamentals, identify value before the crowd does, and ignore the noise.

Overlooking Tax Implications and Record-Keeping

Tax obligations aren’t exciting, but ignoring them can lead to serious consequences. Many traders fail to track their Litecoin transactions properly, leaving them scrambling when tax season arrives,or worse, facing penalties for inaccurate reporting.

In most jurisdictions, cryptocurrency trades are taxable events. Selling Litecoin for fiat, trading it for another crypto, or even using it to purchase goods can trigger capital gains taxes. Accurately reporting these transactions requires detailed records: dates, amounts, prices, gains, and losses for every trade.

Without proper record-keeping, reconstructing months or years of trading activity becomes a nightmare. Missing or incomplete records lead to guesswork, which increases audit risk and potential penalties. Some traders simply don’t report crypto at all, hoping to fly under the radar,a risky gamble as tax authorities worldwide improve their crypto tracking capabilities.

Use portfolio tracking tools that automatically log transactions and calculate gains and losses. Maintain records of all trades, transfers, and wallet addresses. Consult with tax professionals who understand cryptocurrency regulations in your jurisdiction. Compliance might feel tedious, but it’s far less painful than dealing with audits, fines, or legal trouble down the road. Treat taxes as a cost of doing business, not an optional afterthought.

Trading on Unreliable or Unregulated Exchanges

Not all exchanges are created equal, and choosing the wrong platform can expose traders to unnecessary risk. Low-volume, unregulated exchanges might advertise lower fees or unique features, but they often lack the security, liquidity, and oversight that protect traders.

Unreliable exchanges are more vulnerable to hacks. They may have weaker security infrastructure, making them attractive targets for attackers. If the exchange gets compromised, your Litecoin could disappear with little recourse. Some platforms have simply shut down unexpectedly, locking users out of their funds.

Low liquidity is another problem. On small exchanges, wide bid-ask spreads increase trading costs, and large orders can move prices dramatically, making it difficult to execute trades at fair prices. Price manipulation is also more common on low-volume platforms, where coordinated buying or selling can create artificial movements.

Regulated, established exchanges offer stronger protections. They carry out robust security measures, maintain insurance funds, comply with legal standards, and provide higher liquidity for better execution. Yes, fees might be slightly higher,but that’s a small price for peace of mind and asset security. Before trading Litecoin on any platform, research its reputation, security track record, regulatory status, and trading volume. Your choice of exchange is as important as your choice of trades.

Conclusion

Avoiding these ten mistakes won’t guarantee profits, but it will dramatically improve the odds. Successful Litecoin trading isn’t about finding secret strategies or predicting every price movement,it’s about discipline, preparation, and consistently making smart decisions while avoiding costly errors.

Develop a clear trading strategy and follow it. Do your assignments before every trade, using both technical and fundamental analysis. Protect your capital with stop-losses and conservative position sizing. Keep emotions in check by relying on predetermined rules rather than gut reactions. Secure your assets with hardware wallets and strong authentication. Understand what makes Litecoin unique and trade accordingly. Ignore hype and focus on fundamentals. Track every transaction for tax purposes. And choose reliable, regulated exchanges that prioritize security and liquidity.

These aren’t revolutionary insights,they’re foundational practices that separate traders who last from those who don’t. Litecoin’s market will always be volatile and unpredictable, but building a disciplined, informed approach gives traders the resilience to navigate uncertainty and capitalize on opportunities as they arise. Start by identifying which of these mistakes you’re currently making, then commit to fixing them one at a time. Your portfolio will thank you.

Frequently Asked Questions

What is the biggest mistake beginners make when trading Litecoin?

Trading without a clear strategy is the most common mistake. Beginners often make impulsive decisions based on gut feelings rather than following a structured plan with defined entry/exit points, risk management rules, and capital allocation guidelines.

How much of my portfolio should I risk on a single Litecoin trade?

Professional traders typically risk only 1-2% of their total capital per trade. This conservative position sizing ensures that even multiple consecutive losses won’t devastate your account, protecting your ability to continue trading long-term.

Why should I use stop-loss orders when trading Litecoin?

Stop-loss orders automatically close your position at a predetermined price, capping losses during sudden market swings or crashes. They prevent emotional decision-making under pressure and preserve capital by limiting how much a single bad trade can cost.

What makes Litecoin different from Bitcoin for trading purposes?

Litecoin has a 2.5-minute block time versus Bitcoin’s 10 minutes, making transactions faster. It has an 84 million coin supply cap compared to Bitcoin’s 21 million and often serves as a testing ground for features later adopted by Bitcoin.

Are cryptocurrency trades taxable events?

Yes, in most jurisdictions selling Litecoin for fiat, trading it for another cryptocurrency, or using it to purchase goods triggers capital gains taxes. Proper record-keeping of all transactions, including dates, amounts, and prices, is essential for accurate tax reporting.

Is it safe to store Litecoin on cryptocurrency exchanges long-term?

No, storing large Litecoin holdings on exchanges long-term is risky due to potential hacks. Hardware wallets that store private keys offline provide much stronger security and are recommended for any significant amounts you’re not actively trading.