Cryptocurrency markets are notoriously volatile. One day your holdings are soaring: the next, they’ve plummeted by double digits. For investors entering this space, the question isn’t just what to buy, it’s how to build a portfolio that can weather the storms and capitalise on opportunities without betting everything on a single coin.

The answer lies in diversification. Rather than concentrating funds into one or two assets, a well-structured crypto portfolio spreads investments across multiple categories, sectors, and risk profiles. This approach reduces exposure to catastrophic losses whilst positioning investors to benefit from varied market movements. Whether you’re a cautious newcomer or someone ready to take calculated risks, building a diversified crypto portfolio from scratch requires understanding your goals, selecting the right assets, and maintaining discipline through market cycles.

This guide walks through the essential steps to construct a balanced, resilient crypto portfolio that aligns with your risk tolerance and investment objectives.

Key Takeaways

- A diversified crypto portfolio spreads investments across large-cap assets like Bitcoin and Ethereum, mid- and small-cap altcoins, and stablecoins to reduce risk whilst capturing growth opportunities.

- Understanding your risk tolerance and investment goals is essential before building a crypto portfolio from scratch, as it determines whether you lean towards conservative or aggressive allocation models.

- Large-cap cryptocurrencies provide stability and liquidity, whilst mid- and small-cap altcoins offer higher growth potential at increased risk, requiring careful research and selectivity.

- Dollar-cost averaging and regular rebalancing help maintain target allocations, enforce discipline, and smooth out volatility over time without emotional reactivity.

- Securing assets through reputable exchanges and cold wallets is critical, as the principle ‘not your keys, not your coins’ protects against hacks and platform insolvencies.

Understanding Crypto Portfolio Diversification

At its core, diversification means allocating capital across a range of digital assets rather than concentrating everything into a single cryptocurrency. The aim is to minimise risk whilst capturing upside potential from different market trends and asset behaviours.

A diversified crypto portfolio typically blends large-cap assets like Bitcoin and Ethereum with mid- and small-cap altcoins, plus stablecoins to anchor volatility. Each category plays a distinct role: established coins provide stability and liquidity, emerging altcoins offer growth potential, and stablecoins serve as a buffer during downturns.

This strategy mirrors traditional portfolio theory but adapts to the unique characteristics of digital assets, high volatility, rapid innovation cycles, and sector-specific trends. By spreading investments, you’re not merely hedging against poor performance in one coin: you’re building a structure that can adapt and thrive under varying market conditions.

Why Diversification Matters in Cryptocurrency

Cryptocurrency volatility is extreme. Bitcoin can swing 10% in a day: smaller altcoins can double or halve in weeks. When your entire portfolio hinges on one asset, you’re fully exposed to its worst days. A sharp downturn in that single coin can wipe out months of gains, or worse.

Diversification mitigates this. If Bitcoin stumbles whilst Ethereum rallies, or if stablecoins hold steady during a broader sell-off, your overall portfolio remains more stable. The goal isn’t to avoid losses entirely, no strategy can guarantee that, but to reduce the magnitude of drawdowns and improve risk-adjusted returns over time.

Also, different cryptocurrencies respond to different catalysts. Bitcoin often moves with macroeconomic sentiment: Ethereum reacts to developments in DeFi and smart contracts: meme coins surge on social media hype. A diversified portfolio captures multiple narratives, smoothing out the peaks and troughs that come with crypto’s inherent unpredictability.

Assessing Your Risk Tolerance and Investment Goals

Before purchasing a single token, investors need clarity on two fundamental questions: How much loss can they tolerate, and what are they trying to achieve?

Risk tolerance varies widely. Some investors can stomach 50% portfolio swings without flinching: others panic at a 10% dip. Understanding one’s emotional and financial capacity for loss is crucial. Those with lower risk tolerance should lean towards established, large-cap assets and stablecoins. Those comfortable with volatility may allocate more heavily to speculative altcoins with higher growth potential.

Investment goals also shape portfolio construction. Is the objective short-term trading profits, or long-term wealth accumulation? Are you seeking passive income through staking, or capital appreciation? A trader chasing quick gains might rotate frequently into trending altcoins: a long-term holder may build a core position in Bitcoin and Ethereum, adding smaller satellite holdings in promising projects.

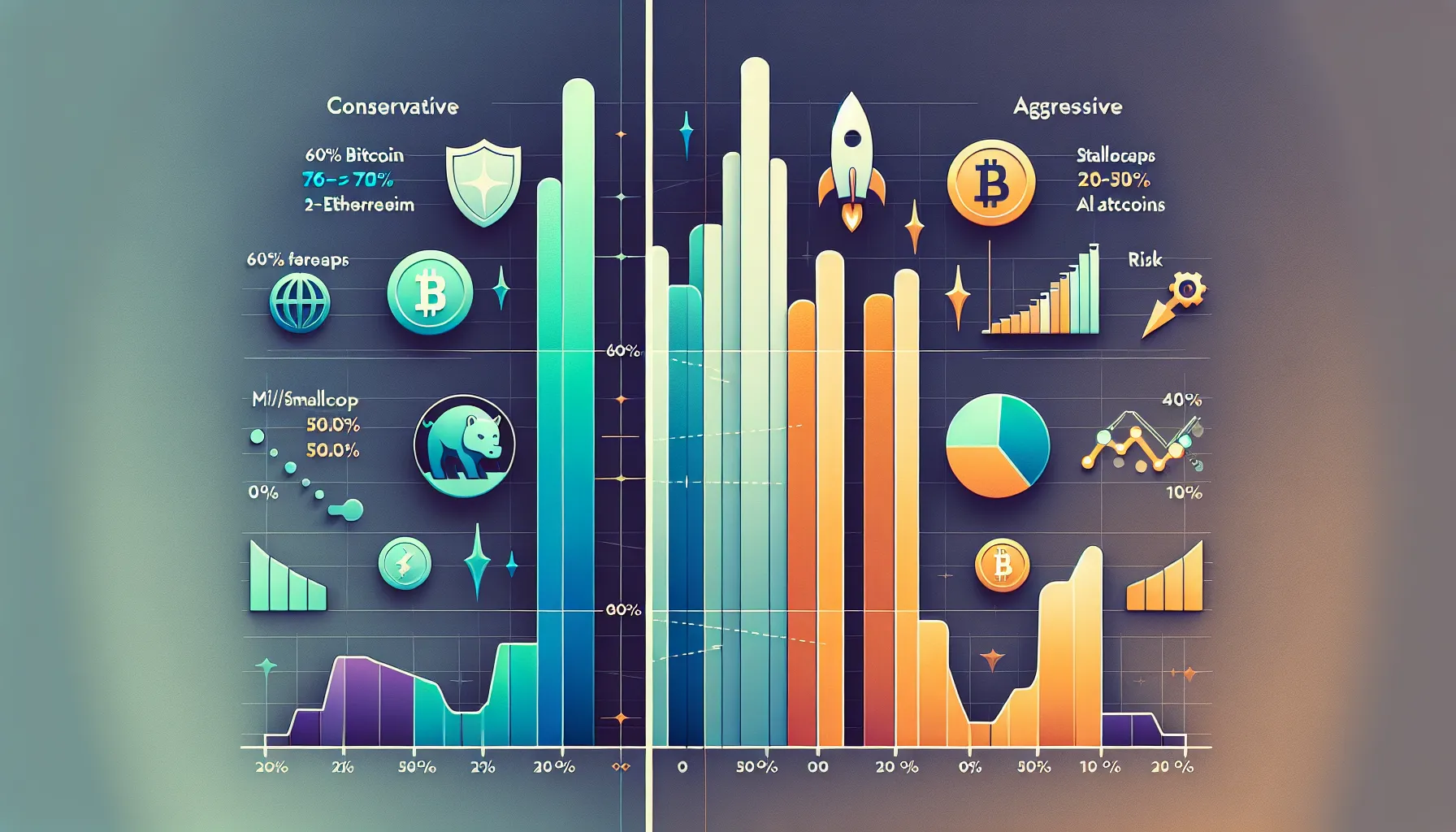

Conservative investors, perhaps those nearing retirement or with limited capital to risk, might allocate 60–70% to Bitcoin and Ethereum, 20–30% to stablecoins, and just 10% to riskier altcoins. Aggressive investors, by contrast, might hold 40% in large-caps, 50% in mid- and small-cap altcoins, and 10% in stablecoins.

There’s no universal formula. The right balance depends on personal circumstances, time horizon, and willingness to engage with market volatility. Honest self-assessment at this stage prevents costly missteps later.

Choosing the Right Asset Categories

A diversified crypto portfolio draws from several asset categories, each serving a distinct purpose and risk-return profile.

Large-Cap Cryptocurrencies

Bitcoin and Ethereum dominate this category. They’re the most established, most liquid, and least likely to vanish overnight. Bitcoin functions as digital gold, a store of value with widespread recognition and institutional adoption. Ethereum powers decentralised applications, smart contracts, and much of the DeFi ecosystem.

Large-cap assets offer relative stability (by crypto standards) and serve as the portfolio’s foundation. They’re less prone to dramatic collapse, making them suitable for conservative allocations and long-term holds. Investors often allocate 40–70% of their portfolio here, depending on risk appetite.

Mid-Cap and Small-Cap Altcoins

This category includes projects like Solana, Cardano, Polkadot, Chainlink, and various Layer 1 or Layer 2 protocols. These coins have proven technology and growing ecosystems but carry more risk than Bitcoin or Ethereum. They can deliver outsized returns during bull markets but also suffer steeper declines in downturns.

Small-cap altcoins, sometimes including meme coins or early-stage projects, offer the highest growth potential and the highest risk. A single viral moment can send prices soaring: a failed product launch can sink them. Allocations here range from 10–50%, depending on how aggressive the investor’s strategy is.

The key is selectivity. Not all altcoins are created equal. Investors should research fundamentals: active development, real-world use cases, community support, and tokenomics. Avoid chasing hype without substance.

Stablecoins for Stability

Stablecoins like USDT (Tether) and USDC (USD Coin) are pegged to fiat currencies, typically the US dollar. They provide a safe haven during market volatility and offer liquidity for quick rebalancing or opportunistic buys.

A 10–30% stablecoin allocation acts as ballast, dampening overall portfolio swings. Stablecoins also enable earning yields through lending platforms or liquidity pools, adding passive income without exposure to price volatility.

Together, these categories form a balanced structure: large-caps for stability, altcoins for growth, and stablecoins for liquidity and risk management.

Setting Up Your Portfolio Allocation Strategy

Once you’ve identified asset categories and assessed your risk profile, it’s time to define precise allocation percentages. This is where strategy transforms from theory into action.

Allocation should reflect both your risk tolerance and market outlook. A straightforward approach is to establish a baseline allocation, then adjust based on conviction and conditions.

For example:

- Conservative model: 50% Bitcoin, 20% Ethereum, 20% stablecoins, 10% altcoins.

- Balanced model: 35% Bitcoin, 25% Ethereum, 15% stablecoins, 25% altcoins.

- Aggressive model: 25% Bitcoin, 20% Ethereum, 10% stablecoins, 45% altcoins.

These are starting points, not rigid rules. Some investors prefer equal-weight strategies, spreading funds evenly across 10–15 assets. Others use a barbell approach: heavy allocations to both ultra-safe (stablecoins) and ultra-risky (small-cap altcoins) assets, with less in the middle.

Conservative vs Aggressive Allocation Models

Conservative models prioritise capital preservation. They lean heavily on Bitcoin, Ethereum, and stablecoins, accepting slower growth in exchange for reduced downside risk. This suits investors who can’t afford significant losses or who are new to crypto and prefer a cautious entry.

Aggressive models chase higher returns by allocating more to mid- and small-cap altcoins. These portfolios can double or triple during bull runs but may lose 60–80% in bear markets. Aggressive investors need strong conviction, discipline, and the ability to withstand prolonged drawdowns.

Regardless of model, write down your allocation and stick to it, at least until a scheduled review. Emotional reactions to short-term price swings lead to poor decisions. A clear allocation plan provides guardrails.

Selecting Reliable Exchanges and Wallets

Even the best portfolio allocation means little if your assets aren’t secure. Choosing reputable exchanges and wallets is a non-negotiable step.

Exchanges are where you’ll buy and sell crypto. Look for platforms with strong reputations, regulatory compliance, deep liquidity, and robust security measures. Coinbase, Binance, Kraken, and Gemini are among the most widely trusted. Check whether they support the assets you want, offer competitive fees, and provide user-friendly interfaces.

Some investors split holdings across multiple exchanges to reduce counterparty risk. If one platform faces technical issues or regulatory trouble, your entire portfolio isn’t trapped.

Wallets store your private keys, essentially, your ownership proof. There are two main types:

- Hot wallets (software-based, connected to the internet) are convenient for active trading and quick access but more vulnerable to hacks.

- Cold wallets (hardware devices, offline) offer maximum security for long-term holdings.

For most investors, a hybrid approach works best: keep a small portion in a hot wallet for liquidity and trading: store the bulk in a hardware wallet like Ledger or Trezor.

Never leave significant sums on exchanges indefinitely. Exchanges are custodians, not banks, and history is littered with hacks and insolvencies. “Not your keys, not your coins” remains sound advice.

Finally, enable two-factor authentication (2FA) on all accounts, use strong unique passwords, and be vigilant against phishing attempts. Security hygiene is as important as asset selection.

Executing Your First Purchases

With your strategy defined, exchanges chosen, and wallets set up, it’s time to execute.

Start by funding your exchange account. Most platforms accept bank transfers, debit cards, or credit cards. Bank transfers typically offer lower fees: card purchases are faster but costlier. Deposit an amount you’re comfortable investing, never more than you can afford to lose.

Once funds are available, purchase assets according to your allocation plan. If you’ve decided on 40% Bitcoin, 30% Ethereum, 20% stablecoins, and 10% altcoins, buy in those proportions. Many exchanges allow you to set limit orders (buying at a specific price) or market orders (buying immediately at current price). For beginners, market orders are simpler: limit orders offer better control.

Consider dollar-cost averaging (DCA) rather than deploying all capital at once. DCA involves buying fixed amounts at regular intervals, say, weekly or monthly, regardless of price. This reduces the risk of entering at a market peak and smooths out volatility over time.

After purchasing, transfer assets to your wallets, especially larger holdings. Leaving crypto on exchanges is convenient but risky. Moving to a hardware wallet takes a few extra steps but dramatically improves security.

Keep records of every transaction: dates, amounts, prices, and fees. This simplifies tax reporting and performance tracking later.

Monitoring and Rebalancing Your Portfolio

Building a portfolio isn’t a one-time event. Markets shift, assets outperform or underperform, and allocations drift from their targets. Regular monitoring and rebalancing keep your portfolio aligned with your strategy.

Monitoring means tracking asset prices, portfolio value, and market developments. Use portfolio trackers like CoinGecko, CoinMarketCap, or dedicated apps (Blockfolio, Delta) to consolidate holdings and visualise performance. Set aside time weekly or monthly to review, not obsessively, but systematically.

Pay attention to news, protocol updates, regulatory changes, and macroeconomic trends. Are your altcoins delivering on roadmaps? Is a new competitor threatening an existing holding? Informed adjustments beat reactive panic.

Rebalancing restores your original allocation after market movements distort it. Suppose your portfolio started 50% Bitcoin, 30% Ethereum, 20% altcoins. If Bitcoin surges and now represents 65%, you’re overexposed. Rebalancing means selling some Bitcoin and buying Ethereum or altcoins to return to target percentages.

How often? Every quarter or semi-annually is common. Rebalance too frequently and you rack up fees and taxes: too rarely and allocations drift dangerously. Set thresholds, for example, rebalance if any asset deviates more than 10% from its target.

Rebalancing also enforces discipline: it forces you to sell high (trim outperformers) and buy low (add to underperformers), counteracting the emotional urge to chase winners.

Finally, revisit your risk tolerance and goals periodically. Life circumstances change: a portfolio that suited you a year ago may not fit today. Adjust allocations accordingly.

Conclusion

Building a diversified crypto portfolio from scratch isn’t about predicting the next 100x coin or timing the market perfectly. It’s about constructing a resilient, adaptable structure that balances risk and reward across asset categories, aligns with personal goals, and withstands the inevitable volatility of digital markets.

Start by understanding diversification principles and honestly assessing your risk tolerance. Choose a mix of large-cap cryptocurrencies for stability, mid- and small-cap altcoins for growth, and stablecoins for liquidity. Define clear allocation percentages, select secure exchanges and wallets, and execute purchases methodically, preferably through dollar-cost averaging.

Once live, monitor performance regularly and rebalance to maintain target allocations. Stay informed, remain disciplined, and avoid emotional reactions to short-term swings.

Cryptocurrency investing carries risk, but a strategic, well-diversified portfolio transforms that risk from reckless speculation into calculated opportunity. By spreading exposure across technologies, sectors, and risk profiles, investors position themselves not just to survive crypto’s turbulence, but to thrive within it.

Frequently Asked Questions

How do I build a diversified crypto portfolio from scratch?

Start by assessing your risk tolerance and investment goals. Allocate funds across large-cap cryptocurrencies like Bitcoin and Ethereum, mid- and small-cap altcoins for growth, and stablecoins for stability. Define clear allocation percentages, use secure exchanges and wallets, and execute purchases systematically through dollar-cost averaging.

What percentage of my crypto portfolio should be Bitcoin and Ethereum?

Conservative investors typically allocate 60–70% to Bitcoin and Ethereum, whilst aggressive investors may hold 40–45%. A balanced approach allocates around 50–60%. These large-cap assets provide stability and liquidity, forming the foundation of a diversified crypto portfolio.

Why is diversification important in cryptocurrency investing?

Diversification reduces exposure to catastrophic losses by spreading investments across multiple assets with different risk profiles. When one cryptocurrency underperforms, others may rally or remain stable, smoothing overall portfolio volatility and improving risk-adjusted returns whilst capturing varied market movements.

What are stablecoins and why should I include them in my portfolio?

Stablecoins like USDT and USDC are cryptocurrencies pegged to fiat currencies, providing price stability during market volatility. A 10–30% stablecoin allocation acts as portfolio ballast, offers liquidity for quick rebalancing, and can generate passive income through lending platforms.

How often should I rebalance my crypto portfolio?

Rebalancing every quarter or semi-annually is common practice. You should rebalance when any asset deviates more than 10% from its target allocation. This enforces discipline by selling outperformers and buying underperformers, preventing overexposure whilst managing transaction fees and tax implications.

Is it better to use a hot wallet or cold wallet for cryptocurrency?

A hybrid approach works best: use hot wallets for small amounts needed for active trading and quick access, whilst storing the bulk of your holdings in cold wallets like Ledger or Trezor for maximum security. Never leave significant sums on exchanges indefinitely.