Cryptocurrency has evolved far beyond Bitcoin’s initial breakthrough, and Litecoin stands as one of the earliest alternatives designed to address real-world transaction challenges. Since its launch in 2011, Litecoin has carved out a reputation as “digital silver” to Bitcoin’s “digital gold,” prioritizing speed, affordability, and accessibility. For anyone new to cryptocurrency, understanding Litecoin offers valuable insight into how blockchain technology can be adapted for different use cases,especially when it comes to everyday transactions. This guide explores what Litecoin is, how it works, what sets it apart from Bitcoin, and whether it’s worth considering for newcomers navigating the crypto space.

Key Takeaways

- Litecoin is a peer-to-peer cryptocurrency launched in 2011 that offers faster transaction times and lower fees than Bitcoin, making it ideal for everyday payments.

- With a 2.5-minute block time compared to Bitcoin’s 10 minutes, Litecoin confirms transactions four times faster, improving its practicality for point-of-sale purchases.

- Litecoin uses the Scrypt mining algorithm, which allows more accessible mining with consumer-grade hardware compared to Bitcoin’s specialized ASIC requirements.

- The cryptocurrency has a maximum supply of 84 million coins—four times Bitcoin’s 21 million cap—and undergoes halving events to maintain scarcity.

- Litecoin serves as a testing ground for blockchain innovations like SegWit and the Lightning Network before they’re adopted by Bitcoin’s network.

- While Litecoin excels at fast, low-cost transactions and cross-border payments, it faces challenges from lower adoption rates and competition from newer cryptocurrencies.

What Is Litecoin?

Litecoin (LTC) is a peer-to-peer cryptocurrency that operates on decentralized blockchain technology, enabling direct transactions between users without relying on banks, payment processors, or other intermediaries. It was designed as a digital currency for quick and low-cost payments, making it particularly well-suited for smaller transactions that might not be practical with Bitcoin’s slower processing times and higher fees.

Like Bitcoin, Litecoin uses a public ledger to record all transactions transparently and securely. But, Litecoin prioritizes efficiency and accessibility, aiming to provide a more practical solution for real-world use cases where speed matters. Transactions are verified by a network of miners who use computational power to solve complex mathematical problems, securing the blockchain while earning newly minted Litecoin as a reward.

While Bitcoin remains the dominant cryptocurrency by market cap and adoption, Litecoin offers an alternative that’s faster and cheaper,positioning itself as a complementary asset rather than a direct competitor. For beginners, Litecoin represents an approachable entry point into understanding how digital currencies function and how blockchain networks can be optimized for specific purposes.

The History of Litecoin

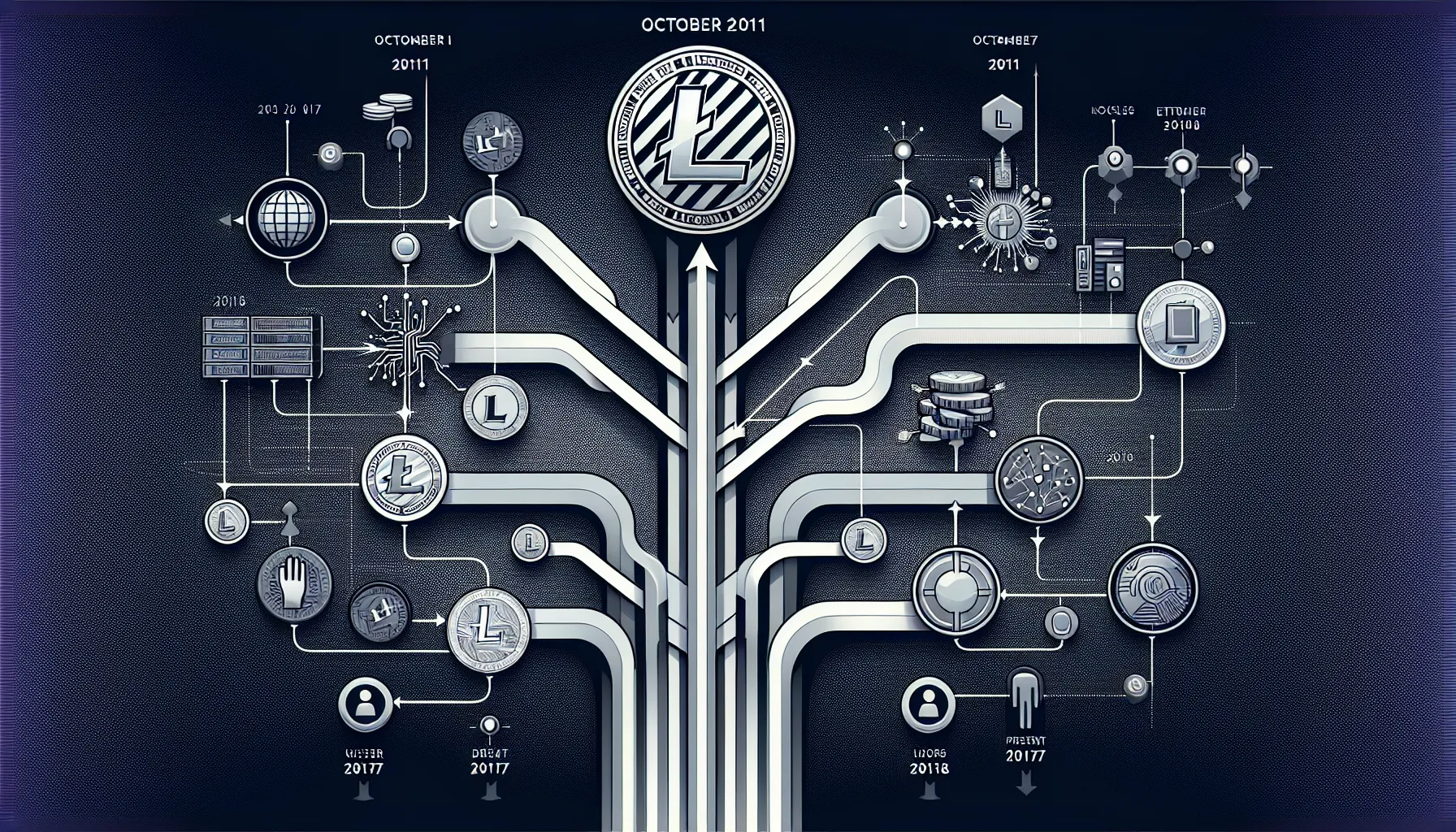

Litecoin was launched on October 13, 2011, by Charlie Lee, a former Google engineer who sought to create a “lite” version of Bitcoin that addressed some of Bitcoin’s limitations. Lee openly described Litecoin as the “silver to Bitcoin’s gold,” emphasizing that it wasn’t meant to replace Bitcoin but to complement it by offering faster transaction times and lower fees.

Charlie Lee based Litecoin on Bitcoin’s open-source code, making targeted modifications to improve speed and accessibility. His vision was to create a cryptocurrency that ordinary people could mine using consumer-grade hardware, rather than the expensive, specialized equipment increasingly required for Bitcoin mining. This democratization of mining was central to Litecoin’s early appeal.

Litecoin gained traction quickly, becoming one of the top cryptocurrencies by market capitalization within its first few years. In 2017, Litecoin became one of the first major cryptocurrencies to adopt the Lightning Network and carry out Segregated Witness (SegWit), both technologies designed to improve transaction capacity and speed. These upgrades reinforced Litecoin’s role as a testing ground for innovations that Bitcoin would later adopt.

Charlie Lee famously sold or donated all of his Litecoin holdings in December 2017, citing a desire to avoid conflicts of interest. Even though this controversial move, he remained actively involved in the project’s development and promotion. Over a decade later, Litecoin continues to maintain relevance in a crowded cryptocurrency market, benefiting from its established network, active community, and reputation as a reliable, efficient payment system.

How Does Litecoin Work?

Litecoin operates on a decentralized, open-source blockchain,a distributed ledger that records every transaction across a network of computers. This structure ensures that no single entity controls the currency, and all transaction data remains transparent and immutable once confirmed.

Transactions on the Litecoin network follow a straightforward process. When someone sends Litecoin to another user, the transaction is broadcast to the network and placed in a pool of unconfirmed transactions. Miners then compete to bundle these transactions into a new block by solving complex cryptographic puzzles,a process known as Proof-of-Work. The first miner to solve the puzzle adds the block to the blockchain and receives a reward in newly created Litecoin, along with transaction fees paid by users.

Litecoin’s block time,the interval between new blocks being added to the blockchain,is 2.5 minutes, compared to Bitcoin’s 10 minutes. This faster block generation means transactions are confirmed more quickly, making Litecoin more practical for everyday purchases where speed matters.

The Proof-of-Work consensus mechanism ensures network security. Because altering the blockchain would require redoing the computational work for all subsequent blocks, malicious attacks become prohibitively expensive and impractical. Miners’ collective computational power effectively protects the network from fraud and double-spending.

Litecoin’s open-source nature allows developers to propose improvements and innovations, ensuring the network can evolve over time. Its architecture closely mirrors Bitcoin’s, which means many technological advancements developed for Bitcoin can be adapted for Litecoin,often serving as a “testnet” for new features before they’re implemented on Bitcoin’s larger, more conservative network.

Litecoin vs Bitcoin: Key Differences

While Litecoin and Bitcoin share foundational similarities,both use Proof-of-Work consensus, operate on decentralized blockchains, and have capped supplies,several key differences set them apart.

| Feature | Bitcoin | Litecoin |

|---|---|---|

| Block Time | 10 minutes | 2.5 minutes |

| Algorithm | SHA-256 | Scrypt |

| Max Supply | 21 million | 84 million |

| Transaction Speed | Slower | Faster |

| Fees | Higher | Lower |

| Adoption | Wider | Niche (faster tx) |

Transaction Speed and Block Time

Litecoin processes new blocks every 2.5 minutes, which is four times faster than Bitcoin’s 10-minute block time. This translates to quicker transaction confirmations, making Litecoin more practical for point-of-sale purchases and situations where waiting isn’t ideal. For users sending payments or merchants accepting crypto, Litecoin’s speed advantage reduces the risk of transaction delays and provides a smoother experience overall.

Mining Algorithm

Litecoin uses the Scrypt hashing algorithm, which is more memory-intensive than Bitcoin’s SHA-256. This design choice was intentional: Scrypt makes mining more accessible by allowing users to mine Litecoin with consumer-grade CPUs and GPUs, rather than the expensive ASIC (Application-Specific Integrated Circuit) hardware required for Bitcoin mining. While ASICs for Scrypt have since been developed, Litecoin’s mining landscape remains more decentralized and accessible compared to Bitcoin’s.

Supply and Scarcity

Bitcoin’s maximum supply is capped at 21 million coins, whereas Litecoin’s cap is set at 84 million,exactly four times higher. Both cryptocurrencies undergo “halving” events roughly every four years, where the mining reward is cut in half to control inflation and increase scarcity over time. Even though having a larger total supply, Litecoin’s halving mechanism ensures that it remains deflationary, with the last coin expected to be mined around 2142,similar to Bitcoin’s timeline.

What Makes Litecoin Unique?

Litecoin’s uniqueness stems from its intentional design as a faster, more affordable alternative to Bitcoin without straying too far from Bitcoin’s proven security model. Its primary advantages lie in transaction speed, lower fees, and mining accessibility.

Faster transactions mean Litecoin can handle everyday payments more efficiently. Whether purchasing goods online, tipping content creators, or transferring funds between wallets, Litecoin’s 2.5-minute block time reduces wait times significantly. This makes it a practical choice for merchants and users who need near-instant confirmation without paying premium fees.

Lower transaction costs are another compelling feature. While Bitcoin fees can spike during periods of high network congestion, Litecoin’s fees typically remain low, making it economical even for microtransactions. This affordability opens the door for use cases that wouldn’t make sense with Bitcoin’s higher fee structure.

Litecoin has also served as a proving ground for new blockchain technologies. Features like Segregated Witness (SegWit) and the Lightning Network were tested on Litecoin before being adopted by Bitcoin. This “testnet” role highlights Litecoin’s willingness to innovate while maintaining a close relationship with Bitcoin’s development community.

Finally, Litecoin benefits from longevity and brand recognition. As one of the oldest cryptocurrencies still actively traded and developed, it has weathered multiple market cycles, regulatory scrutiny, and technological shifts. This resilience gives users and developers confidence in its staying power, even as newer projects emerge with flashier features.

How to Buy and Store Litecoin

Buying Litecoin is straightforward and accessible through major cryptocurrency exchanges. Popular platforms like Coinbase, Binance, Kraken, and Gemini all support Litecoin trading. To get started, users typically need to create an account, complete identity verification (due to regulatory requirements), and deposit funds via bank transfer, credit card, or other supported payment methods. Once funded, purchasing Litecoin is as simple as placing a buy order at the current market price or setting a limit order at a desired price point.

After purchasing Litecoin, the next critical step is secure storage. Keeping funds on an exchange is convenient for active trading but comes with risks,exchanges can be hacked, go bankrupt, or freeze accounts. For long-term holders, transferring Litecoin to a personal wallet is the safer choice.

Wallets come in several forms. Software wallets, also called hot wallets, are applications that run on computers or smartphones. They offer convenience and quick access but remain connected to the internet, making them more vulnerable to hacking. Examples include Exodus, Electrum-LTC, and the official Litecoin Core wallet.

Hardware wallets, or cold wallets, are physical devices that store cryptocurrency offline, providing the highest level of security. Devices like Ledger Nano X and Trezor are popular choices among serious investors. They protect private keys from online threats while still allowing users to send and receive funds when needed.

Paper wallets,printed QR codes representing public and private keys,are another cold storage option, though they require careful handling to avoid physical damage or loss. Regardless of the wallet type chosen, users must safeguard their private keys and recovery phrases. Losing access to these means losing access to funds permanently, with no customer service or password reset option available.

Litecoin Use Cases and Advantages

Litecoin’s design makes it particularly well-suited for fast payments and microtransactions. Its low fees and quick confirmation times are ideal for everyday purchases like buying coffee, tipping online content creators, or paying for digital services. Merchants who accept cryptocurrency often prefer Litecoin for point-of-sale transactions because customers don’t have to wait long for payment confirmation.

Cross-border payments are another strong use case. Traditional international transfers can take days and incur significant fees, especially when dealing with banks or remittance services. Litecoin enables near-instant transfers anywhere in the world at a fraction of the cost, making it an attractive option for freelancers, expatriates, and businesses operating globally.

Litecoin has also played an important role as a technological testing ground. Because its codebase closely mirrors Bitcoin’s but with a smaller market cap and less conservative community, developers often use Litecoin to trial new features before proposing them for Bitcoin. This “canary in the coal mine” function has accelerated innovation across the broader cryptocurrency ecosystem.

The cryptocurrency’s longevity and established network also provide reliability. Unlike newer projects that may fail or lose momentum, Litecoin has maintained consistent development and community support for over a decade. This track record reassures users and merchants that the network will remain operational and secure for the foreseeable future.

Litecoin’s widespread availability on exchanges and payment processors further enhances its utility. It’s supported by most major platforms, making it easy to buy, sell, trade, or spend. This accessibility lowers the barrier to entry for newcomers while providing liquidity for traders and investors.

Risks and Limitations of Litecoin

Even though its strengths, Litecoin faces several challenges that potential users and investors should consider. One significant limitation is its lower adoption rate compared to Bitcoin. While Litecoin is accepted by many merchants and supported by major exchanges, Bitcoin remains the dominant cryptocurrency by far. This disparity means fewer use cases, less liquidity, and reduced network effects for Litecoin.

Market capitalization is another concern. Litecoin consistently ranks among the top cryptocurrencies by market cap, but it’s dwarfed by Bitcoin and Ethereum. A smaller market cap can lead to higher volatility and makes Litecoin more susceptible to price manipulation or sudden market swings. For investors, this translates to increased risk, especially during broader market downturns.

Competition from newer cryptocurrencies poses an ongoing threat. Projects like Bitcoin Cash, Dash, and privacy-focused coins like Monero offer similar or superior features,whether it’s faster transactions, enhanced privacy, or more advanced smart contract capabilities. Also, Bitcoin’s adoption of technologies like the Lightning Network has reduced Litecoin’s speed advantage, potentially eroding one of its core value propositions.

Litecoin also lacks the “digital gold” narrative that has driven much of Bitcoin’s institutional adoption. While Bitcoin is increasingly viewed as a store of value and hedge against inflation, Litecoin’s identity as a transactional currency hasn’t captured the same level of mainstream interest or investment. This limits its appeal to institutional investors and could constrain long-term price appreciation.

Regulatory uncertainty affects all cryptocurrencies, but smaller-cap assets like Litecoin may be more vulnerable to sudden regulatory changes. If governments impose stricter rules on cryptocurrency trading or usage, Litecoin’s relatively smaller ecosystem could struggle more than Bitcoin’s to adapt and maintain relevance.

Conclusion

Litecoin has earned its place in the cryptocurrency landscape by delivering on its promise of faster, more affordable transactions. For beginners exploring digital currencies, Litecoin offers a practical introduction to how blockchain technology can be optimized for everyday use rather than just speculation or long-term holding. Its speed, low fees, and accessibility make it especially suitable for payments, cross-border transfers, and microtransactions,use cases where Bitcoin’s limitations become more apparent.

That said, Litecoin operates in Bitcoin’s shadow. While it provides technical advantages in transaction speed and cost, it hasn’t achieved the same level of adoption, market dominance, or cultural significance. Newer cryptocurrencies continue to emerge with innovative features, and Bitcoin itself is evolving to address some of the gaps Litecoin was designed to fill.

For those interested in Litecoin, the key is understanding its role: it’s not trying to replace Bitcoin but to complement it. Whether as a transactional currency, a testing ground for blockchain innovation, or a diversification option within a crypto portfolio, Litecoin remains relevant more than a decade after its launch. As the cryptocurrency market matures, Litecoin’s longevity and proven track record may prove to be its greatest assets.

Frequently Asked Questions

What is Litecoin and how does it differ from Bitcoin?

Litecoin is a peer-to-peer cryptocurrency designed as a faster, more affordable alternative to Bitcoin. It processes transactions in 2.5 minutes compared to Bitcoin’s 10 minutes, uses the Scrypt mining algorithm, and has a maximum supply of 84 million coins versus Bitcoin’s 21 million.

How long does a Litecoin transaction take to confirm?

Litecoin transactions are confirmed approximately every 2.5 minutes, which is four times faster than Bitcoin’s 10-minute block time. This makes Litecoin ideal for everyday purchases and point-of-sale transactions where speed matters.

Who created Litecoin and why?

Charlie Lee, a former Google engineer, created Litecoin in October 2011. He designed it as the ‘silver to Bitcoin’s gold’ to provide faster transaction times, lower fees, and more accessible mining using consumer-grade hardware.

Is Litecoin a good investment for beginners?

Litecoin can serve as an approachable entry point for beginners due to its established track record and practical use cases. However, it faces competition from newer cryptocurrencies and has lower adoption than Bitcoin, which may affect long-term price potential and requires careful consideration.

Can you mine Litecoin with a regular computer?

While Litecoin originally used the Scrypt algorithm to enable mining with consumer CPUs and GPUs, dedicated ASIC miners have since been developed. Regular computers can technically mine Litecoin but are no longer profitable due to increased network difficulty and specialized hardware competition.

What are the main advantages of using Litecoin for payments?

Litecoin offers fast transaction confirmations, low fees, and widespread exchange support, making it ideal for everyday purchases, cross-border payments, and microtransactions. Its lower costs compared to Bitcoin make it economical even for small-value transfers.