Crypto trading offers incredible opportunities, but it also comes with substantial risks,especially for newcomers. Without a solid risk management strategy, you can quickly watch your capital vanish, even on a secure and well-regulated platform like OrangeX. The difference between traders who thrive long-term and those who burn out in weeks often boils down to one thing: how well they manage risk.

OrangeX provides a reliable environment for crypto trading with tier-1 regulation, robust security measures, and powerful risk management tools. But having the right platform is only half the battle. You need to understand how to use these tools effectively, set appropriate limits, and build sustainable trading habits. Whether you’re making your first trade or refining your approach, mastering risk management on OrangeX will help you protect your capital, minimize losses, and trade with confidence.

Key Takeaways

- Effective risk management on OrangeX is essential for protecting your capital in volatile crypto markets and requires using stop-loss orders, proper position sizing, and disciplined trading habits.

- New traders should risk no more than 1-2% of their total trading capital per trade to survive losing streaks and maintain long-term sustainability.

- OrangeX provides tier-1 regulation, cold and hot wallet segregation, and automated risk management tools like stop-loss and take-profit orders to support secure trading.

- Diversification across multiple crypto assets—including large-cap, mid-cap, and selective altcoins—reduces portfolio risk and prevents overexposure to any single asset.

- Avoid common mistakes like overleveraging, emotional trading, and neglecting daily risk limits, which can quickly erode your account even on a secure platform.

- A sustainable trading plan with clear entry and exit rules, consistent position sizing, and daily risk limits is the foundation for long-term success managing risk on OrangeX.

Understanding Risk Management in Crypto Trading

Risk management is the process of identifying, analyzing, and mitigating your exposure to potential losses while protecting your trading capital. In crypto markets,known for their extreme volatility,effective risk management isn’t optional: it’s essential for survival.

At its core, risk management involves making deliberate decisions about how much capital you’re willing to put at risk on each trade, which tools you’ll use to limit downside exposure, and how you’ll respond when markets move against you. It’s not about avoiding risk entirely (that’s impossible in trading), but about controlling it so that no single trade or bad day can wipe out your account.

Key risk management strategies include diversification (spreading capital across multiple assets), position sizing (determining how much to invest per trade), and using protective orders like stop-losses to automatically exit losing positions. When combined with discipline and a clear trading plan, these strategies help you stay in the game long enough to refine your skills and capitalize on winning trades.

Why Risk Management Matters on OrangeX

OrangeX stands out as a secure and compliant platform, which makes it an excellent choice for new traders serious about risk management. The exchange is tier-1 regulated and implements strict Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, evaluated by leading compliance firms like LexisNexis and SlowMist. This regulatory framework ensures investor protection and reduces the risk of fraud or security breaches.

Beyond regulatory compliance, OrangeX employs robust security measures including cold and hot wallet segregation, multi-signature technology, and advanced risk control systems. These protections safeguard your funds from external threats, but they don’t protect you from poor trading decisions,that’s where personal risk management comes in.

By combining OrangeX’s secure infrastructure with disciplined risk management practices, you create a powerful foundation for sustainable trading. You’re not just relying on the platform’s protections: you’re actively managing your exposure, controlling your emotions, and making informed decisions that protect your capital over the long haul.

Setting Up Your Risk Management Foundation

Before you place your first trade on OrangeX, you need to build a solid risk management foundation. This starts with honest self-assessment and clear planning,not with jumping into trades because a coin is trending on social media.

First, take stock of your personal financial situation. How much capital can you realistically afford to allocate to trading without affecting your day-to-day expenses, emergency fund, or long-term savings? Only trade with money you can afford to lose. This might sound dramatic, but crypto markets can be unforgiving, and preserving your financial stability should always come first.

Next, familiarize yourself with OrangeX’s risk controls and compliance standards. Understand the platform’s security features, explore the available trading tools (like stop-loss and take-profit orders), and review any limits or requirements related to withdrawals or leverage. Knowing how the platform works will help you make smarter decisions under pressure.

Finally, commit to a systematic approach. Decide in advance how much you’re willing to risk per trade, what percentage of your portfolio you’ll allocate to each asset, and what rules you’ll follow when things go wrong. Having a plan before emotions kick in is the hallmark of disciplined trading.

Determining Your Risk Tolerance

Risk tolerance is highly personal,it depends on your financial situation, experience level, personality, and how much volatility you can stomach without panicking. Some traders are comfortable risking 2-3% of their capital per trade, while others prefer a more conservative 0.5-1%.

To determine your risk tolerance, start by reviewing your financial situation. Ask yourself: How much capital do I have available for trading? What percentage of that capital am I comfortable potentially losing on a single trade? If you lost 5% of your account in one day, would you be able to sleep at night,or would you make impulsive decisions to “win it back”?

A common guideline for new traders is to risk no more than 1-2% of your total trading capital on any single trade. This means if you have $5,000 in your OrangeX account, you’d risk $50-$100 per trade. This approach allows you to survive a string of losses without depleting your account, giving you the breathing room to learn and improve.

As you gain experience and refine your strategy, you can adjust your risk tolerance based on market conditions and your confidence level. But when you’re starting out, err on the side of caution,protect your capital first, chase profits second.

Calculating Position Sizes

Position sizing is one of the most critical,and most overlooked,aspects of risk management. It’s not enough to say, “I’ll risk 1% per trade.” You need to calculate exactly how much of an asset to buy based on that risk percentage and where you’ll place your stop-loss.

The formula for calculating position size is:

Position Size = (Account Balance × Risk Percentage) / Trade Risk (in price units)

Let’s break this down with an example. Say you have a $5,000 account and you’re willing to risk 1% ($50) on a trade. You’re planning to buy Bitcoin at $30,000 with a stop-loss at $29,500,meaning your trade risk is $500 per BTC.

Using the formula:

Position Size = ($5,000 × 0.01) / $500 = $50 / $500 = 0.1 BTC

So you’d buy 0.1 BTC, which costs $3,000 at current price. If the stop-loss triggers, you lose $50 (1% of your account), not $3,000.

This approach keeps your risk consistent regardless of where you set your stop-loss or which asset you trade. Avoid overleveraging,just because OrangeX might offer leverage doesn’t mean you should use it aggressively. Keeping risk per trade within 1-2% of total funds helps you survive losing streaks and compound gains over time.

Essential Risk Management Tools on OrangeX

OrangeX offers a suite of tools designed to help you manage risk effectively and trade with confidence. From automated orders that protect your positions to advanced security features that safeguard your funds, these tools form the backbone of a disciplined trading strategy.

One of the most valuable features is the ability to set stop-loss and take-profit orders. These automated orders execute trades on your behalf when certain price levels are reached, removing emotion from the equation and ensuring you stick to your plan even when you’re not watching the charts.

OrangeX also provides robust security infrastructure, including cold and hot wallet segregation and sophisticated risk control systems. While these protections focus on platform-level security, they complement your personal risk management by ensuring your funds are safe from hacks or breaches.

For more advanced users, OrangeX supports trading bots that can automate strategies and maintain consistent risk management even when you’re away from your screen. These bots follow pre-set rules for entry, exit, and position sizing, helping you avoid impulsive decisions driven by fear or greed.

Stop-Loss Orders and How to Use Them

A stop-loss order is your safety net,it automatically sells your asset when the price drops to a predetermined level, limiting your potential loss. Without a stop-loss, you’re relying on willpower and constant monitoring to exit losing trades, which is a recipe for disaster.

Here’s how to use stop-loss orders effectively on OrangeX: When you enter a trade, immediately decide where you’ll exit if the market moves against you. This level should be based on technical analysis (like a key support level) or your risk tolerance (the maximum loss you’re willing to accept).

For example, if you buy Ethereum at $2,000 and set a stop-loss at $1,900, you’ll automatically exit the trade if ETH drops to $1,900, locking in a $100 loss per coin. It’s not fun to take a loss, but it’s far better than watching your position drop 20, 30, or 50% because you didn’t have an exit plan.

One common mistake is setting stop-losses too tight,placing them just below your entry point often results in getting stopped out by normal market noise before the trade has a chance to work. Give your trades room to breathe, but always have a stop-loss in place.

Take-Profit Orders for Securing Gains

While stop-losses protect you from excessive losses, take-profit orders help you lock in gains before the market reverses. A take-profit order automatically sells your position when the price reaches your target level, ensuring you don’t give back profits by holding too long.

Let’s say you buy Solana at $100, expecting it to rise to $120. You set a take-profit order at $120, so when SOL hits that price, your position automatically closes and you secure a $20 gain per coin. Without a take-profit order, you might get greedy and hold for $130, only to watch the price crash back to $105.

Using take-profit orders enforces discipline and helps you stick to your trading plan. It’s easy to say, “I’ll sell when it hits my target,” but when the price is soaring and everyone’s talking about how much higher it could go, emotions take over. Automation removes that temptation.

On OrangeX, you can set both stop-loss and take-profit orders simultaneously, creating a “bracket” around your position. This approach defines your risk and reward upfront, letting you manage multiple trades without constant supervision.

Diversification Strategies for New Traders

Diversification is one of the oldest and most reliable risk management strategies: don’t put all your eggs in one basket. In crypto trading, this means spreading your capital across multiple assets so that poor performance in one position doesn’t devastate your entire portfolio.

Crypto markets are notoriously correlated,when Bitcoin drops sharply, most altcoins follow. But that correlation isn’t perfect, and different assets respond differently to news, technical levels, and market sentiment. By diversifying, you reduce the impact of any single asset’s volatility on your overall account.

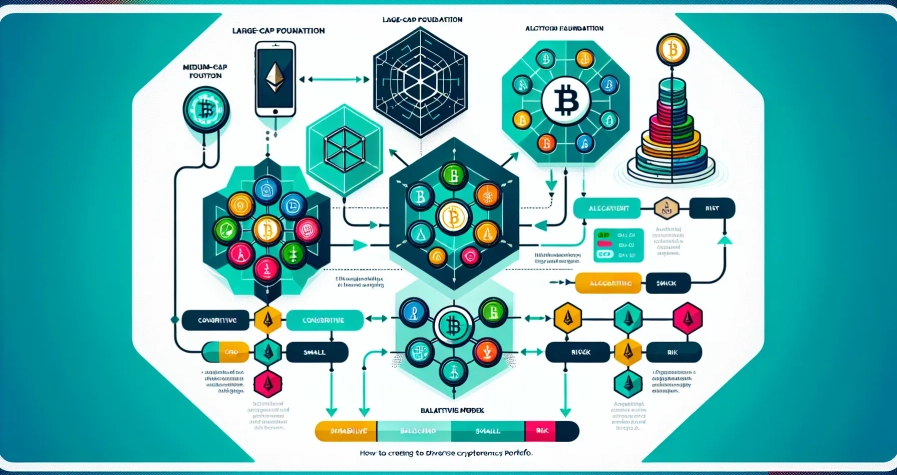

Diversification doesn’t mean buying every coin listed on OrangeX. Instead, focus on building a balanced portfolio that includes a mix of large-cap cryptocurrencies (like Bitcoin and Ethereum), mid-cap projects with strong fundamentals, and perhaps a smaller allocation to higher-risk, higher-reward altcoins.

For new traders, a simple diversification strategy might be allocating 50% to Bitcoin and Ethereum, 30% to a few promising mid-cap coins, and 20% to smaller, speculative positions. Adjust these percentages based on your risk tolerance, but the key principle remains: never allocate all your capital to a single asset.

Spreading Risk Across Multiple Assets

Spreading risk across multiple assets is practical diversification in action. If you have $5,000 to trade, don’t put it all into one coin, no matter how bullish you are. Instead, build positions in several assets that aren’t perfectly correlated.

For example, you might allocate $2,000 to Bitcoin, $1,500 to Ethereum, $1,000 to a DeFi project like Uniswap, and $500 to a layer-1 blockchain like Avalanche. If Bitcoin underperforms but DeFi tokens rally, your portfolio remains balanced and you’re not relying on a single trade to succeed.

You can also diversify across sectors within crypto: infrastructure projects (Ethereum, Polkadot), decentralized finance (Aave, Compound), gaming and NFTs (Axie Infinity, The Sandbox), and layer-2 solutions (Polygon, Optimism). This sector-based approach reduces your exposure to any single narrative or market trend.

Remember, diversification isn’t about eliminating risk,it’s about managing it. You’ll still experience losses, but you’ll reduce the likelihood that one bad trade wipes out your account. And on a secure, compliant platform like OrangeX, you can diversify with confidence knowing your funds are protected by robust security measures.

Common Risk Management Mistakes to Avoid

Even with the best tools and intentions, new traders often fall into predictable risk management traps. Recognizing these mistakes early can save you a lot of pain and capital.

One of the biggest errors is overleveraging,using too much leverage or risking too much of your account on a single trade. Leverage amplifies gains, but it also amplifies losses, and many traders blow up their accounts chasing big wins without understanding the downside.

Another common mistake is emotional trading. Markets move fast, fear and greed kick in, and suddenly you’re making impulsive decisions,doubling down on a losing position, exiting a winner too early, or revenge-trading after a loss. Emotional trading destroys discipline and leads to inconsistent results.

Neglecting position sizing is another pitfall. Some traders pick arbitrary position sizes without calculating risk properly, which leads to outsized losses when trades go wrong. Similarly, failing to set stop-losses leaves you vulnerable to catastrophic drawdowns.

Finally, many new traders lack a clear trading plan. They enter trades based on tips or hunches, without defined entry, exit, or risk parameters. Without a plan, you’re just gambling,and the house always wins eventually.

Overleveraging and Emotional Trading

Overleveraging happens when you take on more risk than your account can handle, often because leverage makes it easy to control large positions with small amounts of capital. OrangeX, like many crypto platforms, offers leverage,but just because it’s available doesn’t mean you should max it out.

Imagine you have $1,000 and use 10x leverage to control a $10,000 position. A 10% move against you wipes out your entire account. Even experienced traders struggle with high leverage, so as a new trader, keep leverage low or avoid it altogether until you’ve proven consistent profitability.

Emotional trading is equally dangerous. After a losing trade, you might feel the urge to immediately jump into another position to “make back” your loss. Or after a big win, you might feel invincible and take on more risk than your plan allows. Both scenarios lead to poor decision-making.

The antidote to emotional trading is discipline: stick to your trading plan, risk the same percentage per trade regardless of recent results, and take breaks when you notice emotions clouding your judgement. Remember, trading is a marathon, not a sprint. Protecting your capital matters more than any single win or loss.

Developing a Sustainable Trading Plan

A sustainable trading plan is your roadmap for long-term success on OrangeX. It defines how you’ll approach the markets, manage risk, and measure progress,taking the guesswork and emotion out of trading.

Your plan should include several key components: entry criteria (what conditions must be met before you enter a trade), exit rules (both stop-loss and take-profit levels), position sizing guidelines (how much you’ll risk per trade), and daily risk limits (how much you’re willing to lose in a single day before you stop trading).

Consistency is crucial. Your plan won’t work if you only follow it when it’s convenient. Treat your trading like a business: track every trade, review your performance regularly, and adjust your strategy based on data, not feelings.

Many successful traders also incorporate routines into their plans,pre-market analysis, post-trade reviews, and regular breaks to maintain mental clarity. On OrangeX, you have access to tools like trading bots that can help execute your plan consistently, especially if you struggle with discipline.

Finally, remember that a sustainable trading plan prioritizes capital preservation over massive gains. You’re not trying to double your account overnight: you’re trying to grow it steadily while protecting against catastrophic losses.

Creating Daily Risk Limits

Daily risk limits are one of the most effective,and underutilized,risk management tools for new traders. The concept is simple: decide in advance the maximum percentage of your account you’re willing to lose in a single day, and stop trading if you hit that limit.

For example, you might set a daily risk limit of 3%. If your account is $5,000, that’s $150. Once you’ve lost $150 in a day (whether from one trade or several), you close your laptop and walk away. No exceptions, no revenge trading, no “just one more trade to get it back.”

Daily risk limits protect you from the worst consequences of emotional trading and bad days. Markets can be unpredictable, and sometimes everything goes wrong at once. Without a daily limit, a bad day can spiral into a catastrophic loss that takes weeks or months to recover from.

Implementing daily risk limits requires discipline and honesty. You need to track your results in real-time and have the self-control to stop when you hit your limit, even if you’re convinced the next trade will be a winner.

On OrangeX, you can support your daily risk limits with automated tools and alerts. Some traders even use separate accounts,risking only a predetermined amount each day by transferring it from a main holding account. Find a system that works for you, but always have a daily limit in place.

Conclusion

Risk management isn’t the most exciting part of crypto trading, but it’s the foundation of everything else. Without it, even the best trading strategies will eventually lead to losses. On OrangeX, you have a secure, regulated platform with robust tools,but those tools only work if you use them consistently and intelligently.

Start by understanding your risk tolerance and calculating proper position sizes. Use stop-loss and take-profit orders to automate your risk management and remove emotion from the equation. Diversify your portfolio to spread risk, avoid common mistakes like overleveraging and emotional trading, and build a sustainable trading plan with clear daily limits.

Successful trading on OrangeX isn’t about taking big risks and hoping for the best. It’s about protecting your capital, making informed decisions, and staying disciplined even when markets get chaotic. Master these risk management fundamentals, and you’ll give yourself the best possible chance of long-term success in the volatile world of crypto trading.

Frequently Asked Questions

What is risk management in crypto trading and why is it important?

Risk management is the process of identifying, analyzing, and mitigating exposure to potential losses while protecting trading capital. In volatile crypto markets, it’s essential for survival, helping traders control risk so no single trade can wipe out their account.

How much should a new trader risk per trade on OrangeX?

New traders should risk no more than 1-2% of their total trading capital on any single trade. For example, with a $5,000 account, you’d risk $50-$100 per trade, allowing you to survive losing streaks while learning and improving.

How do stop-loss orders work on OrangeX?

A stop-loss order automatically sells your asset when the price drops to a predetermined level, limiting potential losses. It removes emotion from trading decisions and ensures you exit losing positions according to your plan without constant monitoring.

What are the best diversification strategies for crypto portfolios?

Effective diversification involves spreading capital across multiple assets and sectors. A balanced approach might allocate 50% to major coins like Bitcoin and Ethereum, 30% to mid-cap projects, and 20% to smaller speculative positions, reducing single-asset risk.

What is overleveraging and how can traders avoid it?

Overleveraging occurs when traders use excessive leverage or risk too much capital on single trades. A 10% adverse move with 10x leverage can wipe out an entire account. New traders should keep leverage low or avoid it until consistently profitable.

How do you calculate proper position size for crypto trades?

Position size equals account balance times risk percentage divided by trade risk in price units. For a $5,000 account risking 1% with a $500 stop-loss distance, you’d buy 0.1 BTC, ensuring consistent risk management regardless of asset or stop-loss placement.