Swapping tokens on Uniswap has become one of the most popular ways to trade cryptocurrencies without using traditional exchanges. This decentralised platform lets you exchange thousands of different tokens directly from your wallet whilst maintaining complete control over your funds.

Whether you’re new to DeFi or looking to expand your trading options, understanding how Uniswap works can open up a world of possibilities. The platform’s automated market maker system means you can trade 24/7 without waiting for buyers or sellers to match your orders.

In this guide, you’ll learn the step-by-step process of swapping tokens on Uniswap, from connecting your wallet to completing your first trade. We’ll also cover essential tips about slippage, gas fees, and security considerations to help you navigate the platform confidently and avoid common mistakes that could cost you money.

What Is Uniswap and How Does It Work

Uniswap operates as a decentralised exchange (DEX) protocol built on the Ethereum blockchain that enables direct peer-to-peer cryptocurrency trading without intermediaries. You interact with smart contracts rather than order books when swapping tokens on this platform.

The protocol functions through an Automated Market Maker (AMM) system that replaces traditional market makers with algorithmic price discovery. Liquidity providers deposit equal values of two tokens into liquidity pools, creating trading pairs like ETH/USDC or DAI/WETH that facilitate swaps.

Liquidity Pools and Price Mechanics

Liquidity pools contain paired tokens that determine exchange rates through a mathematical formula. The constant product formula (x × y = k) maintains balance between token quantities in each pool, where price adjustments occur automatically based on supply and demand.

Trading volume affects token prices inversely – purchasing Token A from a pool reduces its quantity and increases Token B’s quantity, making Token A more expensive relative to Token B. This mechanism ensures continuous price discovery without requiring centralised order matching.

Smart Contract Automation

Smart contracts execute all trades automatically when you submit swap transactions to the Uniswap protocol. These contracts verify token balances, calculate exchange rates, process transfers, and distribute fees to liquidity providers without human intervention.

Version 3 of Uniswap introduced concentrated liquidity features that allow liquidity providers to specify price ranges for their deposits. This enhancement increases capital efficiency by up to 4,000× compared to traditional AMM models, reducing slippage for traders.

Key Protocol Features

| Feature | Description | Benefit |

|---|---|---|

| Permissionless Trading | Anyone can create trading pairs | Access to new tokens immediately |

| 24/7 Availability | Protocol operates continuously | Trade anytime without exchange downtime |

| Non-Custodial Design | Tokens remain in your wallet | Full control over funds during trades |

| Transparent Fees | 0.05% to 1% depending on pair | Predictable trading costs |

The protocol supports ERC-20 tokens exclusively and requires ETH for transaction fees. Your trades settle instantly on-chain once miners confirm the transaction, typically within 15 seconds to 5 minutes depending on network congestion.

Setting Up Your Wallet for Uniswap

Setting up your wallet correctly ensures seamless token swapping on Uniswap’s decentralised platform. You’ll need a compatible wallet funded with ETH to cover gas fees and transaction costs.

Connecting MetaMask to Uniswap

MetaMask serves as the most popular wallet choice for Uniswap users across Ethereum and supported blockchain networks. Install MetaMask as a browser extension or mobile app by creating a new account or importing an existing one through your recovery phrase.

Fund your MetaMask wallet with sufficient ETH to cover both swap amounts and gas fees before connecting to Uniswap. Navigate to app.uniswap.org and locate the Connect Wallet button positioned at the top right corner of the interface.

Select MetaMask from the displayed wallet options to trigger a connection prompt. MetaMask displays your available accounts – choose your preferred account and click Next followed by Connect to establish the connection.

Your connected wallet address appears in the top right corner once the connection succeeds. This connection enables token swapping and liquidity provision across all supported networks within your MetaMask configuration.

Alternative Wallet Options

WalletConnect provides mobile wallet connectivity for users preferring smartphone-based crypto management. Popular mobile wallets including Trust Wallet, Rainbow, and Argent connect through WalletConnect’s scanning protocol.

Coinbase Wallet offers built-in DeFi integration with simplified connection processes for mainstream users. Hardware wallet owners can connect Ledger and Trezor devices through compatible wallet interfaces like MetaMask or WalletConnect.

Each wallet follows identical connection steps: access app.uniswap.org, click Connect Wallet, select your wallet provider, and approve the connection request within your chosen wallet application. Web3 wallets like Brave Wallet and Opera Wallet integrate directly with their respective browsers for streamlined access.

Mobile-first wallets provide enhanced security through biometric authentication and offline private key storage. Desktop users benefit from browser extension wallets offering quick access and transaction signing capabilities across multiple DeFi protocols.

Step-by-Step Guide to Swapping Tokens

Once you’ve connected your wallet to Uniswap, you can execute token swaps through a straightforward process. The interface guides you through each stage to complete your trade securely.

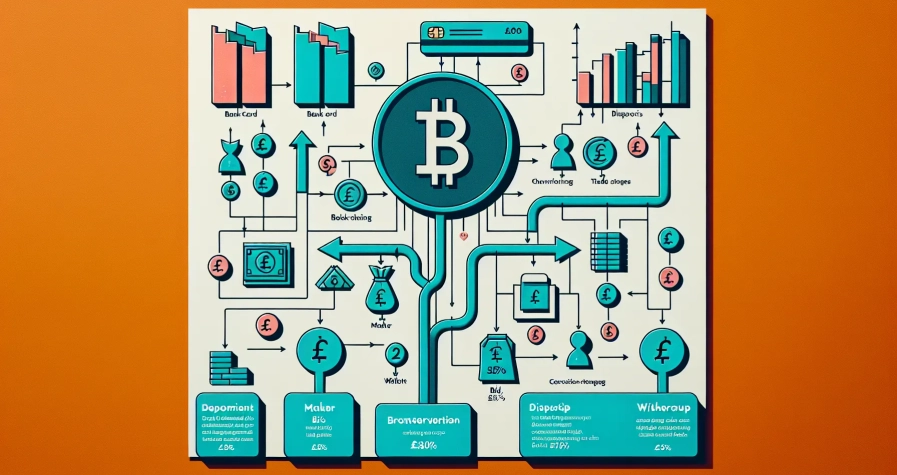

Accessing the Uniswap Interface

Navigate to app.uniswap.org through your browser to access the main trading interface. The platform automatically detects your connected wallet and displays your available token balances. Click the “Swap” tab if you’re not already on the main trading page to begin your transaction.

The interface presents two main fields: the “From” field for the token you’re selling and the “To” field for the token you’re purchasing. Your wallet balance appears next to each compatible token, enabling you to verify sufficient funds before proceeding with the swap.

Selecting Your Tokens

Choose your input token from the “From” dropdown menu by scrolling through popular tokens or using the search function to find specific assets. Enter the token contract address directly if you can’t locate the desired token through browsing. Popular tokens like USDC, WETH, and DAI appear prominently in the selection interface.

Select your output token from the “To” dropdown using the same method. The platform automatically calculates exchange rates based on current liquidity pool prices once you’ve chosen both tokens. Enter the amount you want to swap in the “From” field, or click “Max” to use your entire balance whilst reserving ETH for gas fees.

Setting Slippage Tolerance

Access the slippage settings through the gear icon located near the swap interface. Slippage tolerance represents the maximum price difference you’ll accept between quote time and execution time. Standard slippage ranges from 0.1% for stablecoin pairs to 1-3% for volatile token pairs.

Higher slippage percentages increase your transaction success rate during periods of high market volatility but may result in less favourable execution prices. Lower slippage settings protect against unfavourable price movements but increase the risk of failed transactions during volatile market conditions.

Confirming Your Transaction

Review the transaction summary displaying the exchange rate, estimated gas fees, and minimum tokens you’ll receive after slippage. Click “Swap” to initiate the transaction approval process through your connected wallet. First-time token approvals require two separate transactions: one to approve token spending and another to execute the swap.

Confirm both transactions in your wallet interface, paying the associated gas fees for each step. The blockchain typically processes Uniswap transactions within 15 seconds to 5 minutes, depending on network congestion and your selected gas price. Monitor your transaction status through the provided transaction hash on Etherscan or similar blockchain explorers.

Understanding Fees and Gas Costs

Uniswap transactions involve multiple fees that directly impact your trading costs. Understanding these fee structures enables you to make informed decisions and optimise your swap transactions effectively.

Network Fees Explained

Network fees represent the primary cost component when swapping tokens on Uniswap. You pay these fees to Ethereum miners who process and confirm your transactions on the blockchain.

Trading fees on Uniswap V2 charge a fixed 0.3% on each swap transaction. The protocol collects this fee from the token amount you exchange, with no additional protocol fees currently active.

Gas costs fluctuate based on network congestion and transaction complexity. These fees compensate miners for validating your swap and adding it to the blockchain. During periods of high network activity, gas prices increase significantly.

Gasless swaps through UniswapX eliminate direct gas payments by having third parties execute transactions on your behalf. You pay indirectly through adjusted swap prices, removing the requirement to hold native tokens for gas fees.

| Fee Type | Cost Structure | Payment Method |

|---|---|---|

| Trading Fee | Fixed 0.3% | Deducted from swap amount |

| Gas Fees | Variable | Paid in ETH |

| Gasless Swaps | Indirect via price adjustment | Built into swap rate |

Minimising Transaction Costs

Strategic timing reduces your overall transaction expenses when swapping tokens on Uniswap. Execute swaps during off-peak hours when network congestion decreases and gas prices drop accordingly.

Consolidate multiple transactions by combining several small swaps into single larger operations. This approach reduces the total gas spent per token amount and maximises efficiency.

Adjust slippage tolerance carefully to prevent failed transactions that waste gas fees. Setting appropriate slippage parameters based on market volatility protects against unnecessary transaction failures.

Use layer-2 networks where Uniswap operates to benefit from significantly lower gas fees. These alternative blockchains maintain security whilst reducing transaction costs substantially.

Monitor gas price trackers before executing swaps to identify optimal timing windows. Gas prices typically decrease during weekends and late evening hours in major time zones.

Enable gasless swap options through UniswapX when available to eliminate direct gas payments. This feature streamlines the swapping process without requiring additional wallet steps or native token holdings.

Common Issues and Troubleshooting

Understanding potential problems before they occur helps you navigate Uniswap’s trading platform more effectively. These common issues can prevent successful token swaps but remain easily solvable with the right troubleshooting approach.

Transaction Failures

Transaction failures occur when your swap doesn’t execute successfully on the blockchain, typically due to three main factors. Slippage exceeding your maximum tolerance causes the most frequent failures when token prices move beyond your set parameters during the transaction processing time.

Insufficient gas fees prevent your transaction from being processed by miners, leaving it stuck or rejected entirely. You must maintain adequate ETH in your wallet to cover both approval and swap transaction costs, with approval fees ranging from £5-20 and swap fees varying from £10-100 depending on network congestion.

Extended confirmation times trigger automatic transaction failures when network congestion delays processing beyond acceptable timeframes. Ethereum network congestion during peak trading hours increases both gas costs and processing delays significantly.

| Issue Type | Common Cause | Solution |

|---|---|---|

| Slippage exceeded | Price movement during processing | Increase slippage tolerance to 1-3% |

| Low gas fees | Insufficient ETH for transaction | Add more ETH to cover gas costs |

| Network delays | High congestion periods | Wait for off-peak hours or increase gas price |

Adjusting slippage tolerance in Uniswap’s settings resolves most transaction failures. Navigate to the settings icon, increase your slippage from the default 0.5% to 1-2% for standard tokens, or 3-5% for volatile assets with limited liquidity.

Insufficient Liquidity Warnings

Insufficient liquidity warnings appear when the available tokens in a liquidity pool can’t accommodate your trade size without significant price impact. Large trades relative to pool size create excessive slippage, making your swap economically unfavourable or impossible to execute.

Pool depth limitations restrict the maximum trade size you can execute at reasonable prices. Trading 10% or more of a pool’s total liquidity typically generates warnings and substantial price impacts exceeding 5-15%.

Token verification errors occur when you select incorrect contract addresses or similar token names, attempting to swap tokens with minimal or non-existent liquidity pools. Always verify token contracts through official sources like CoinGecko or the project’s website before initiating swaps.

Reducing trade size provides the most effective solution for liquidity warnings. Split large trades into smaller portions executed over time, or reduce your swap amount to match available pool liquidity more appropriately.

Increasing slippage tolerance allows trades to proceed despite higher price impacts, though this approach increases your costs significantly. Consider whether the increased slippage cost justifies completing your trade immediately versus waiting or reducing size.

Alternative solutions include checking different trading pairs that might offer better liquidity, or using aggregators that split your trade across multiple pools automatically. Some tokens maintain better liquidity when paired with USDC rather than ETH, reducing your overall price impact.

Best Practices for Safe Token Swapping

Safe token swapping on Uniswap protects your assets whilst maximising trading efficiency. Implementing these security measures prevents costly mistakes and reduces exposure to fraudulent tokens.

Verify token contract addresses meticulously before executing any swap. Many fake tokens appear with similar names to legitimate cryptocurrencies, potentially causing significant losses. Copy contract addresses directly from official project websites or verified token databases like CoinGecko rather than relying on search results within the interface.

Access Uniswap exclusively through official channels to avoid phishing attempts. Bookmark the legitimate Uniswap app URL (app.uniswap.org) and double-check the web address before connecting your wallet. Scammers frequently create convincing replicas that steal private keys and drain wallets.

Configure slippage settings appropriately to account for market volatility during your transaction. Standard slippage tolerance ranges from 0.1% to 1% for established tokens, whilst new or low-liquidity tokens may require 3% to 5% tolerance. Higher slippage increases your transaction’s success rate but exposes you to greater price variation.

Maintain sufficient native network tokens in your wallet to cover gas fees throughout the swap process. Ethereum network requires ETH for transaction costs, meaning you cannot swap your entire token balance if fees exceed your remaining ETH holdings. Reserve 0.01 to 0.05 ETH for standard swaps depending on network congestion.

Review transaction details comprehensively before confirming each swap. Examine the output amount, estimated gas costs, and total transaction value to ensure accuracy. Price impact indicators show how your trade affects the token’s market price, with impacts above 5% signalling potential slippage concerns.

Research unfamiliar tokens thoroughly before trading to avoid scams or worthless assets. Check project websites, community discussions, and trading volumes across multiple exchanges. New tokens without established track records pose higher risks of manipulation or abandonment by developers.

Split large transactions into smaller increments to minimise slippage impact and reduce failed transaction risks. Multiple smaller swaps often achieve better overall pricing than single large trades, particularly for tokens with limited liquidity pools.

Utilise hardware wallets for transaction approvals when possible to enhance private key security. Hardware devices like Ledger or Trezor require physical confirmation for each transaction, preventing unauthorised access even if your computer becomes compromised.

| Security Measure | Risk Reduction | Implementation Difficulty |

|---|---|---|

| Contract verification | High | Easy |

| Official platform access | High | Easy |

| Slippage configuration | Medium | Medium |

| Gas fee reserves | Medium | Easy |

| Transaction review | High | Easy |

| Token research | High | Medium |

| Trade splitting | Medium | Medium |

| Hardware wallet use | Very High | Hard |

These practices enable secure and efficient token swapping whilst protecting your cryptocurrency investments from common threats and technical failures.

Conclusion

You’re now equipped with the knowledge to confidently swap tokens on Uniswap while minimising risks and costs. Remember that successful trading on this decentralised platform comes down to preparation and attention to detail.

Keep your wallet funded with sufficient ETH for gas fees and always verify token contracts before trading. By following the security practices and troubleshooting tips you’ve learnt you’ll be able to navigate Uniswap’s interface efficiently and avoid common pitfalls.

Start with smaller trades to familiarise yourself with the platform’s mechanics before executing larger swaps. With practice you’ll develop the confidence to take full advantage of Uniswap’s 24/7 trading capabilities and competitive rates.

The decentralised finance space continues to evolve rapidly so stay informed about platform updates and new features that could enhance your trading experience.

Frequently Asked Questions

What is Uniswap and how does it work?

Uniswap is a decentralised exchange (DEX) protocol built on the Ethereum blockchain that enables direct peer-to-peer cryptocurrency trading through smart contracts. It uses an Automated Market Maker (AMM) system where liquidity providers deposit tokens into pools to facilitate swaps. Token prices are determined through a constant product formula, and trades execute automatically without human intervention, typically settling within 15 seconds to 5 minutes.

Which wallet should I use for Uniswap?

MetaMask is the most popular choice for Uniswap users, offering easy installation and seamless connection. Alternative options include WalletConnect for mobile wallets, Coinbase Wallet for mainstream users, and hardware wallets like Ledger and Trezor for enhanced security. All wallets require ETH to cover gas fees and must be compatible with ERC-20 tokens to function properly on the platform.

What fees do I need to pay when using Uniswap?

Uniswap charges a 0.3% trading fee on V2 swaps, plus variable gas fees that depend on Ethereum network congestion. Gas costs can range from a few pounds to over £50 during peak times. UniswapX offers gasless swaps by adjusting swap prices instead of charging direct gas fees. Consider timing trades during off-peak hours and using layer-2 networks to minimise costs.

How do I avoid common Uniswap trading problems?

Prevent transaction failures by setting appropriate slippage tolerance (typically 0.5-3%), ensuring sufficient ETH for gas fees, and timing trades during off-peak hours. For insufficient liquidity warnings, reduce trade size or check alternative trading pairs. Always verify token contract addresses, use official Uniswap channels, and review transaction details carefully before confirming to avoid scams and errors.

What is slippage and how should I set it?

Slippage is the difference between expected and actual trade prices due to market movement during transaction processing. Set slippage tolerance between 0.5-3% for most trades – lower for stable pairs, higher for volatile tokens. If transactions fail due to slippage, gradually increase tolerance. Higher slippage settings complete trades faster but may result in less favourable prices.

How long do Uniswap transactions take to complete?

Uniswap transactions typically settle on-chain within 15 seconds to 5 minutes, depending on Ethereum network congestion and gas fees paid. Higher gas fees result in faster processing. During peak network activity, transactions may take longer. Monitor transaction status using blockchain explorers and ensure adequate gas fees to avoid extended delays or failed transactions.

Can I use Uniswap on mobile devices?

Yes, Uniswap works on mobile devices through mobile wallets like Trust Wallet, Rainbow, or the Coinbase Wallet app. You can also access the web interface through mobile browsers connected to WalletConnect-compatible wallets. Mobile wallets often provide enhanced security features and convenient access to DeFi protocols, making them suitable for regular Uniswap users who prefer trading on-the-go.

What tokens can I trade on Uniswap?

Uniswap exclusively supports ERC-20 tokens that exist on the Ethereum blockchain and compatible layer-2 networks. Popular tokens include ETH, USDC, DAI, WBTC, and thousands of other ERC-20 tokens. Always verify token contract addresses before trading to avoid scams. Some tokens may have low liquidity, resulting in higher slippage, so research unfamiliar tokens thoroughly before swapping.