Crypto transactions are meant to be fast, secure, and borderless, but they don’t always go as smoothly as planned. Whether it’s a failed token transfer, a transaction stuck in limbo, or funds that seem to have vanished into thin air, these issues can be frustrating and, at times, costly.

The good news? Most transaction failures aren’t mysterious. They stem from a handful of common issues, things like insufficient gas fees, network congestion, or simple user error. Understanding why these failures happen, and more importantly, how to fix them, can save users time, money, and a lot of unnecessary stress.

This article breaks down nine of the most frequent reasons crypto transactions fail and provides clear, actionable solutions for each one. From setting the right gas price to double-checking wallet addresses, these practical tips will help anyone navigate the blockchain with confidence.

Key Takeaways

- Most crypto transactions fail due to preventable issues like insufficient gas fees, network congestion, and user error rather than mysterious technical problems.

- Setting the right gas price using real-time trackers and choosing faster transaction speeds can prevent crypto transactions from getting stuck or rejected.

- Always verify wallet addresses and ensure both sender and receiver use the same blockchain network to avoid irreversible loss of funds.

- Keep sufficient native tokens (like ETH or BNB) in your wallet to cover gas fees, as transactions will fail without enough balance for network costs.

- Updating wallet software regularly and checking exchange maintenance schedules before transacting helps avoid technical failures and withdrawal restrictions.

- Using Layer 2 solutions like Polygon or Arbitrum during peak times offers faster, cheaper alternatives to congested mainnet transactions.

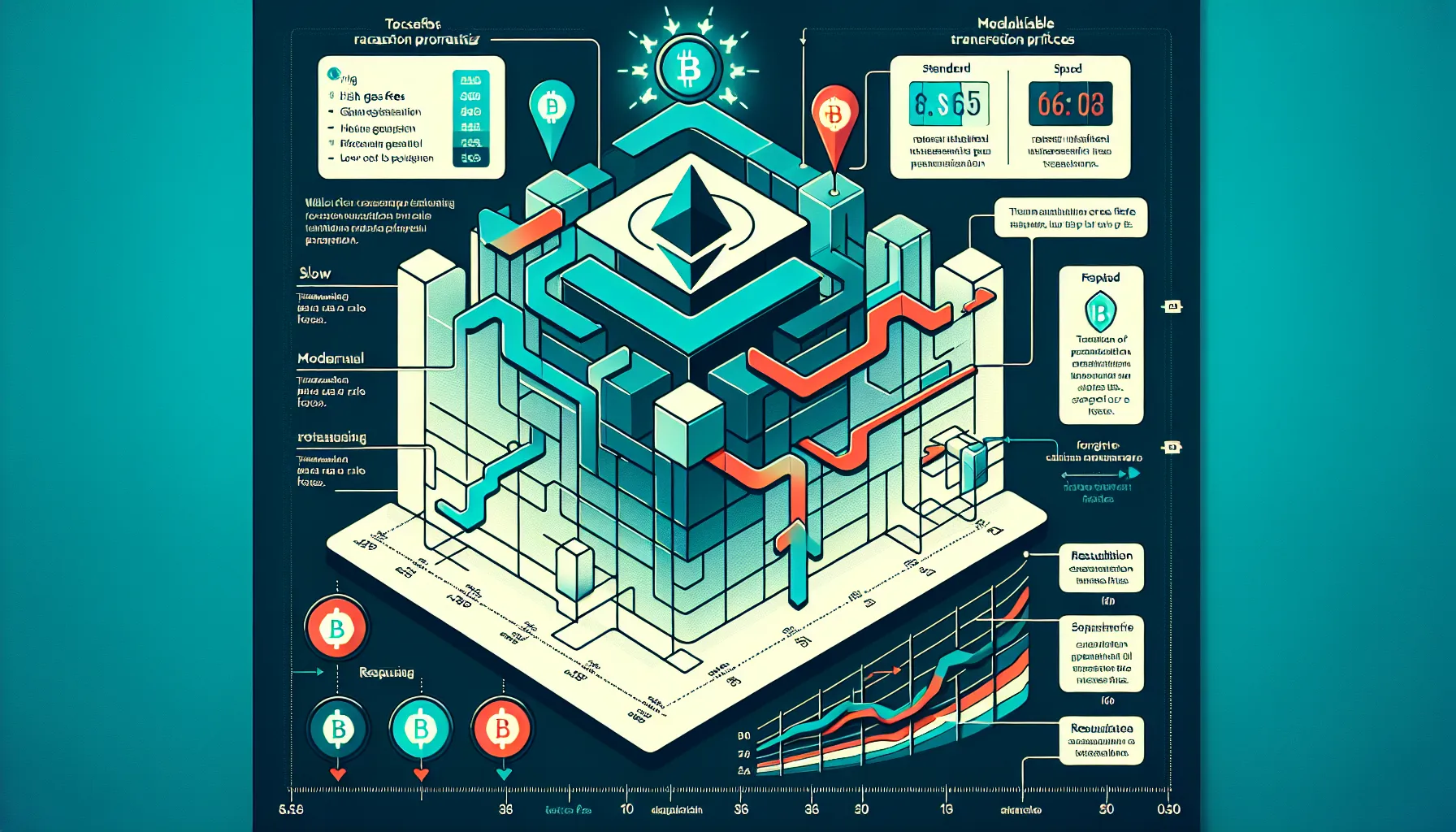

1. Insufficient Gas Fees

Gas fees are the cost users pay to validators or miners to process transactions on a blockchain. When a user sets the fee too low, especially during periods of high activity, the transaction often gets stuck or dropped entirely. Validators prioritise transactions with higher fees, leaving underpaid ones waiting indefinitely, or rejected outright.

This is particularly common on Ethereum, where gas prices fluctuate wildly depending on network demand. A transaction that might cost £2 during quiet hours could spike to £20 or more during an NFT mint or major DeFi event. Users who set static or outdated gas fees risk their transactions being ignored.

How to Set the Right Gas Price

The simplest way to avoid this issue is to check current gas prices before initiating a transaction. Tools like Etherscan’s Gas Tracker, GasNow, or built-in wallet estimators provide real-time data on what others are paying. Most wallets offer three options: slow, standard, and fast. For time-sensitive transfers, selecting “fast” ensures the transaction is picked up quickly.

Some wallets also support custom gas settings. Advanced users can manually adjust the gas price (measured in gwei on Ethereum) based on network conditions. If a transaction does get stuck, many wallets allow users to “speed up” the transfer by increasing the fee retroactively. This resubmits the transaction with a higher gas price, giving it a better chance of being processed.

It’s also worth noting that different blockchains have different fee structures. Solana and Binance Smart Chain, for instance, have much lower and more predictable fees than Ethereum. Understanding the network being used helps set realistic expectations.

2. Network Congestion

Blockchain networks aren’t immune to traffic jams. When too many users try to transact at once, say, during a popular NFT drop, a token launch, or a market-wide sell-off, the network can become congested. This slows down transaction confirmation times and drives up gas fees. In extreme cases, transactions may fail to process at all within a reasonable timeframe.

Ethereum is notorious for congestion, but it’s not alone. Even newer, faster blockchains like Solana have experienced outages or slowdowns during peak demand. The result is the same: frustrated users and failed or delayed transactions.

Timing Your Transactions Strategically

One of the easiest ways to sidestep congestion is to transact during off-peak hours. Blockchain activity tends to dip during weekends and late-night hours (in major time zones). Checking a gas tracker before sending can reveal whether the network is currently busy.

Another effective strategy is to use Layer 2 solutions. Networks like Polygon, Arbitrum, and Optimism run on top of Ethereum, offering much faster and cheaper transactions. Many exchanges and DeFi platforms now support these networks, making them a practical alternative for users who want to avoid Ethereum’s mainnet congestion.

For those who must transact during busy periods, setting a competitive gas fee and being patient is key. Some wallets also allow users to set a maximum fee they’re willing to pay, which can prevent overpaying during temporary spikes.

3. Incorrect Wallet Address

One of the most unforgiving aspects of cryptocurrency is that transactions are irreversible. Send funds to the wrong address, and there’s usually no way to get them back. Unlike traditional banking, there’s no customer service hotline to reverse a transfer. If the address is invalid, the transaction may fail, but if it’s valid but incorrect, the funds are gone for good.

This can happen in several ways: copying the address incorrectly, sending to an old address that’s no longer in use, or confusing similar-looking characters. Some users have lost significant sums by trusting autofill features or not verifying the full address.

Double-Checking Before You Send

The most important habit a crypto user can develop is verifying the recipient address before confirming a transaction. Always check the first and last few characters of the address, don’t rely solely on the middle. Some malware even changes copied addresses in the clipboard, so it’s wise to verify the address multiple times.

Many wallets now support address whitelisting, which allows users to save trusted addresses. This reduces the risk of typos and ensures that only pre-approved addresses can receive funds. For high-value transactions, some users send a small “test” amount first to confirm the address is correct before sending the full sum.

QR codes can also reduce errors, as they eliminate the need to copy and paste manually. Just ensure the QR code is generated from a trusted source.

4. Using the Wrong Network

Crypto tokens can exist on multiple blockchains. For example, USDT (Tether) can be sent via Ethereum (ERC-20), TRON (TRC-20), or Binance Smart Chain (BEP-20). Each network has its own addresses and protocols. Sending USDT on the Ethereum network to a TRON address, for instance, can result in lost funds, as the receiving wallet won’t recognise the token.

This is a surprisingly common mistake, especially among newer users or during hurried transactions. Exchanges often offer multiple network options for deposits and withdrawals, and selecting the wrong one can lead to funds being stuck or lost.

Understanding Network Compatibility

Before initiating a transfer, both the sender and receiver must confirm they’re using the same network. Most wallets and exchanges clearly label which networks they support. When withdrawing from an exchange, double-check the network dropdown menu. When depositing, ensure the wallet supports the network the exchange is using.

If a transaction is sent on the wrong network, the first step is to contact the receiving platform’s support team. Some exchanges can recover funds sent to the correct address on the wrong network, though this process can take time and may incur fees. In cases involving personal wallets, recovery depends on whether the user controls the private keys for that address on the other network.

To avoid this issue entirely, users should familiarise themselves with the networks their wallets and exchanges support, and always verify before clicking “send.”

5. Insufficient Balance to Cover Fees

Sending cryptocurrency isn’t just about having enough of the token being transferred. Users also need enough of the blockchain’s native token to pay for gas fees. On Ethereum, that’s ETH. On Binance Smart Chain, it’s BNB. Without it, the transaction simply won’t go through.

This catches many users off guard, especially if they’ve transferred all their tokens out and forgotten to leave a bit of the native currency behind. A wallet might show a balance of 100 USDC, but if there’s no ETH to cover the gas, the transaction will fail.

Calculating Total Transaction Costs

Before sending any crypto, users should check their wallet’s balance of the native token. Most wallets display an estimated gas fee before confirming a transaction, but it’s wise to keep a buffer, especially on networks like Ethereum, where fees can spike suddenly.

For example, if a wallet shows a gas fee of 0.005 ETH, the user should ensure they have at least 0.006 or 0.007 ETH available to account for fluctuations. Some wallets also allow users to preview the total cost (tokens + gas) before confirming.

If a user runs out of the native token, they’ll need to purchase or transfer more before they can continue transacting. Some exchanges and swaps allow users to buy small amounts of ETH, BNB, or other native tokens directly within their wallets, which can be a quick fix.

6. Nonce Errors and Out-of-Order Transactions

Every transaction on a blockchain is assigned a “nonce”, a sequential number that ensures transactions from a single wallet are processed in the correct order. When multiple transactions are sent in quick succession, or when a user tries to speed up or cancel a pending transaction, nonce conflicts can occur. This results in transactions getting stuck, rejected, or processed out of order.

Nonce errors are more common among advanced users who interact with DeFi protocols or send many transactions in a short time. They can be confusing to diagnose, as the wallet may display vague error messages or simply hang.

Resetting and Managing Transaction Order

If a transaction is stuck due to a nonce issue, the first option is to cancel or speed it up. Many wallets, including MetaMask, offer “cancel” or “speed up” buttons that resubmit the transaction with a higher gas fee and the correct nonce.

In more stubborn cases, users may need to manually reset the nonce. This is typically done in the wallet’s advanced settings. By clearing pending transactions and resetting the nonce to the last confirmed transaction, users can often resolve the conflict.

It’s also important to avoid sending multiple transactions at once unless necessary. Waiting for one transaction to confirm before initiating the next can prevent nonce errors altogether. For users who frequently encounter this issue, using a wallet with better nonce management or switching to a less congested network may help.

7. Smart Contract Failures

Not all crypto transactions are simple transfers. Many involve interacting with smart contracts, self-executing code that powers DeFi platforms, NFT marketplaces, and decentralised applications. These transactions are more complex and can fail for a variety of reasons: insufficient gas limits, bugs in the contract, or unmet conditions within the contract’s logic.

When a smart contract transaction fails, the gas fee is still consumed, even though the transaction didn’t complete. This can be frustrating and expensive, especially on high-fee networks like Ethereum.

Adjusting Gas Limits for Complex Transactions

Smart contract interactions require a gas limit, the maximum amount of gas the transaction is allowed to consume. If the limit is set too low, the transaction will fail partway through, and the user loses the gas fee.

Most wallets estimate the gas limit automatically, but users can manually increase it if they suspect the estimate is too low. Increasing the limit by 10–20% can provide a safety margin without significantly raising costs. It’s worth noting that unused gas is refunded, so setting a higher limit doesn’t always mean paying more.

Before interacting with a smart contract, users should also check the platform’s documentation or community forums for known issues or recommended gas settings. Testing with a small amount first can help identify potential problems without risking large sums.

8. Outdated Wallet Software

Crypto wallets are software applications, and like all software, they need regular updates. Older versions may contain bugs, security vulnerabilities, or outdated fee estimation algorithms. This can lead to failed transactions, incorrect gas calculations, or even loss of funds if a security flaw is exploited.

Even though this, many users delay updating their wallets, either out of habit or fear that an update might cause issues. In reality, running outdated software is far riskier.

Keeping Your Wallet Updated

Users should enable automatic updates if their wallet supports it, or at least check for updates regularly. Most wallets display a notification when a new version is available. Updating usually takes just a few minutes and can prevent a range of technical issues.

Before updating, it’s wise to back up the wallet’s seed phrase or private keys. This ensures that if something goes wrong during the update, funds can still be recovered. After updating, users should test the wallet with a small transaction to confirm everything is working as expected.

For mobile wallets, keeping the operating system up to date is equally important. Compatibility issues between old OS versions and new wallet updates can cause crashes or failed transactions.

9. Exchange Maintenance or Withdrawal Restrictions

Centralised exchanges occasionally undergo maintenance, upgrade their systems, or pause withdrawals for specific tokens or networks. During these periods, users may find themselves unable to send or receive crypto, even if their wallet and the blockchain itself are functioning perfectly.

Also, some exchanges impose withdrawal restrictions based on regulatory requirements, account verification levels, or suspicious activity flags. Users may be required to complete additional KYC steps or wait for a review period before withdrawals are enabled.

Checking Platform Status Before Transacting

Before initiating a withdrawal, users should check the exchange’s status page or announcements. Most platforms publish scheduled maintenance windows and real-time outage information. If a token or network is under maintenance, it’s best to wait until the issue is resolved rather than attempting the transaction and encountering errors.

For urgent transfers, users can consider moving funds to another exchange or network that isn’t affected. Some exchanges also offer status notifications via email or app alerts, which can help users plan their transactions around maintenance periods.

If a withdrawal is blocked due to account restrictions, contacting support is usually the only option. Providing requested documentation promptly and following the platform’s guidelines can speed up the resolution process.

Conclusion

Crypto transaction failures can be disheartening, but they’re rarely insurmountable. The vast majority of issues, whether it’s insufficient gas fees, network congestion, or simple user error, are preventable with a bit of knowledge and preparation. By understanding how blockchains work, double-checking addresses, keeping wallets updated, and staying informed about network conditions, users can dramatically reduce the likelihood of failed transactions.

Each of the nine issues covered here has a clear, actionable solution. Whether it’s setting a competitive gas price, using Layer 2 networks, or verifying platform status before transacting, these small steps add up to a smoother, more reliable crypto experience. As the space continues to evolve, tools and interfaces will improve, but the fundamentals remain the same: attention to detail, patience, and a willingness to learn are the keys to success in the world of cryptocurrency.

Frequently Asked Questions

Why do crypto transactions fail due to insufficient gas fees?

Crypto transactions fail when gas fees are set too low because validators prioritise transactions with higher fees. During high network activity, underpaid transactions get stuck or dropped entirely, as miners process more profitable transactions first.

How can I avoid sending crypto to the wrong wallet address?

Always verify the first and last characters of the recipient address before confirming. Use address whitelisting features, send a small test amount for high-value transfers, and consider using QR codes to eliminate copy-paste errors.

What happens if I send crypto on the wrong network?

Sending crypto on the wrong network can result in lost funds, as the receiving wallet won’t recognise the token. Contact the receiving platform’s support immediately, as some exchanges can recover funds sent to the correct address on an incorrect network.

Can I get a refund if my crypto transaction fails?

If a transaction fails due to network issues or incorrect settings, gas fees are typically still consumed and non-refundable. However, the actual crypto amount being transferred usually remains in your wallet if the transaction doesn’t complete successfully.

What are Layer 2 solutions and how do they help with failed transactions?

Layer 2 solutions like Polygon, Arbitrum, and Optimism run on top of Ethereum, offering much faster and cheaper transactions. They reduce network congestion and lower gas fees, making transactions more reliable during peak demand periods.

How do I fix a stuck crypto transaction with a nonce error?

Most wallets offer ‘cancel’ or ‘speed up’ options that resubmit the transaction with a higher gas fee and correct nonce. Alternatively, you can manually reset the nonce in your wallet’s advanced settings to resolve the conflict.