The cryptocurrency market has always moved in cycles, and anyone who’s been paying attention knows that the next bull run isn’t just a matter of if, it’s a matter of when. But what will drive it this time? The landscape has changed dramatically. Institutional players have entered the arena with serious capital, regulatory frameworks are finally taking shape, and technological innovations are maturing at an impressive pace. Analysts across the industry have identified several key trends that could serve as the catalysts for the next major rally. From Bitcoin ETF expansion to AI-blockchain integration, these aren’t wild speculations, they’re grounded in real developments happening right now. Understanding these trends isn’t just academically interesting: it’s essential for anyone looking to position themselves ahead of the curve. Here are eight crypto trends that analysts believe could fundamentally shape the next bull run.

Key Takeaways

- Institutional adoption through Bitcoin ETFs has reached unprecedented levels, with cumulative inflows exceeding $60 billion by November 2025, potentially forming the foundation for the next bull run.

- Real-world asset tokenisation is bridging traditional finance and crypto markets by enabling fractional ownership and 24/7 trading of properties, bonds, and commodities on blockchain networks.

- Regulatory clarity in 2025, including the GENIUS Act and streamlined SEC approval processes, has dramatically increased market confidence and removed barriers to mainstream adoption.

- Layer-2 scaling solutions are delivering exponential improvements in transaction speeds and cost reductions, creating the essential infrastructure needed to support mass crypto adoption.

- The 2028 Bitcoin halving could create unprecedented supply-demand dynamics as institutional participation coincides with a 50% reduction in new Bitcoin entering circulation.

- DeFi 2.0 focuses on sustainable yield mechanisms derived from real economic activity rather than inflationary token emissions, positioning decentralised finance for long-term viability.

Institutional Adoption and Bitcoin ETF Expansion

The institutional floodgates have well and truly opened. What was once a retail-dominated market has transformed into something far more sophisticated, and the numbers tell a compelling story. By November 2025, Bitcoin ETF net inflows had surged by $25.18 billion year-to-date, pushing cumulative totals to an impressive $60.42 billion. This isn’t speculative money from retail traders, it’s institutional capital flowing through regulated products.

BlackRock’s iShares Bitcoin Trust (IBIT) has become the poster child for this transformation. The fund has grown to somewhere between $70.7 billion and $97.8 billion in assets, making it the most successful crypto ETF launch in history. The revenue figures are equally staggering: $218 million for 2025 alone. When the world’s largest asset manager commits this aggressively to Bitcoin, others take notice.

But the institutional adoption story doesn’t end with ETFs. Retirement account integration is quietly revolutionising access to crypto exposure. Fidelity and BlackRock now offer Bitcoin ETF options within 401(k) plans, and investment consultants are recommending allocations between 2% and 5%. That might sound modest, but when applied across trillions in retirement assets, the potential capital inflow becomes enormous.

Corporate treasuries have joined the party as well. MicroStrategy’s aggressive accumulation of 257,000 BTC in 2024 alone set a precedent that other corporations are beginning to follow. The SEC’s approval of spot Bitcoin and Ethereum ETFs eliminated much of the regulatory friction that had previously kept institutions on the sidelines. With clearer pathways and established products, the institutional adoption trend shows no signs of slowing down, and analysts believe this sustained capital inflow could provide the foundation for the next sustained bull run.

The Rise of Real-World Asset Tokenisation

Real-world asset (RWA) tokenisation represents one of the most practical and potentially transformative applications of blockchain technology. The premise is straightforward: take traditional assets, property, bonds, commodities, art, and represent them as digital tokens on a blockchain. The implications, but, are profound.

Tokenisation solves several fundamental problems with traditional asset markets. It dramatically increases liquidity by allowing fractional ownership. A property worth millions can be divided into thousands of tokens, making it accessible to investors who couldn’t otherwise participate. It reduces intermediaries, cutting costs and settlement times from days to minutes. And it creates 24/7 markets that don’t depend on traditional banking hours or geographic boundaries.

Major financial institutions are taking RWA tokenisation seriously. Banks and asset managers are exploring tokenised bonds, treasury products, and private equity vehicles. The technology allows for programmable compliance, where regulatory requirements are embedded directly into the token’s smart contract code. This makes cross-border transactions far more efficient whilst maintaining necessary oversight.

Analysts view RWA tokenisation as a bridge between traditional finance and crypto markets. It brings trillions in existing assets onto blockchain infrastructure, creating deeper liquidity pools and more sophisticated financial products. As regulatory frameworks mature and technical standards emerge, tokenised assets could become a significant driver of blockchain adoption, and by extension, demand for the underlying cryptocurrencies that power these networks. The trend is still in its early stages, but the trajectory is clear, and the potential market size is enormous.

AI and Blockchain Integration

The convergence of artificial intelligence and blockchain technology is creating opportunities that neither field could achieve alone. This isn’t just about hype, it’s about solving real problems that exist at the intersection of data, computation, and trust.

AI models require massive amounts of data and computational power. Blockchain can provide decentralised infrastructure for both. Distributed computing networks can aggregate processing power across thousands of nodes, making AI training more accessible and less dependent on centralised cloud providers. Blockchain’s transparency also addresses one of AI’s biggest challenges: provenance and authenticity. When AI-generated content or decisions are recorded on-chain, users can verify their origin and the data used to create them.

Several projects are exploring AI-powered trading algorithms that operate on-chain, autonomous agents that execute smart contracts based on real-world data, and decentralised AI marketplaces where users can buy and sell model training or inference services. The tokenisation of AI services creates new economic models where contributors are directly compensated for providing data or computational resources.

From a market perspective, AI-blockchain integration projects are attracting significant venture capital and developer attention. Analysts believe that successful implementations could create entirely new categories of crypto assets and use cases. The technology is still maturing, and many projects remain experimental, but the combination of AI’s analytical power with blockchain’s trustless infrastructure could unlock applications that fundamentally change how decentralised networks operate. As both technologies continue to advance, their integration may well become one of the defining characteristics of the next crypto market cycle.

Regulatory Clarity Driving Market Confidence

Regulatory uncertainty has long been the dark cloud hanging over the crypto market. But 2025 marked a turning point. The regulatory landscape transformed significantly, and the change in tone from enforcement to enablement has had a measurable impact on market confidence.

The SEC reduced crypto ETF approval timelines from 270 days to just 75 days following streamlined standards introduced in September 2025. That’s not a minor administrative tweak, it’s a fundamental shift in how quickly new products can reach market. The GENIUS Act established the first federal stablecoin framework, providing much-needed clarity for one of crypto’s most important use cases. Meanwhile, the CLARITY Act advanced through Congress, promising comprehensive regulatory standards.

The Trump administration’s executive orders in January 2025 represented perhaps the most dramatic policy reversal. Declaring the US the ‘crypto capital’ wasn’t just rhetoric, it came with concrete measures. Plans for a Strategic Bitcoin Reserve and prohibitions on Federal Reserve CBDC development signalled a fundamental shift in how the US government views digital assets. Bitcoin gained over 35% following Trump’s inauguration, suggesting markets responded enthusiastically to the regulatory clarity.

This policy environment has catalysed institutional adoption in ways that regulatory hostility never could. When firms know the rules of the game, they can participate with confidence. Legal departments can assess risk. Compliance teams can build frameworks. Product development can proceed without existential uncertainty. Analysts believe that regulatory clarity, particularly in the world’s largest economy, removes one of the biggest barriers to mainstream adoption. With that obstacle diminishing, capital that was sitting on the sidelines now has permission to enter the market. The psychological impact of this shift shouldn’t be underestimated.

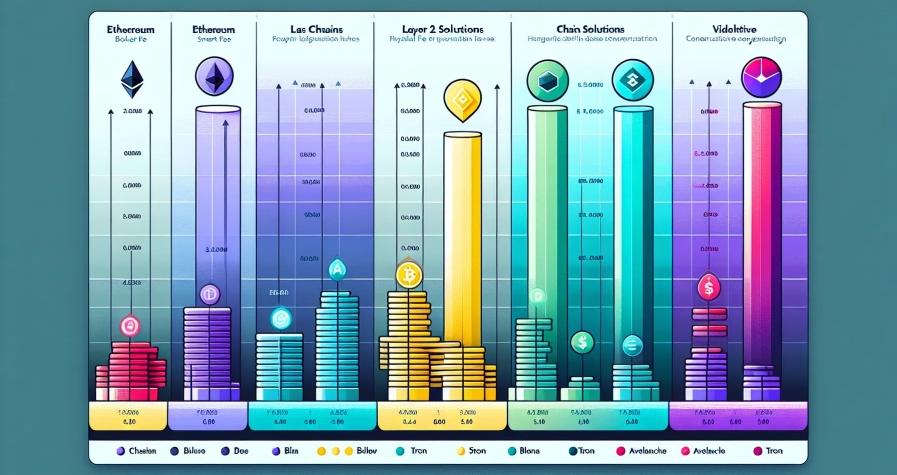

Layer-2 Scaling Solutions Gaining Momentum

Scalability has been blockchain’s Achilles heel since the beginning. Layer-2 solutions promise to solve this problem without compromising the security and decentralisation of base layers like Ethereum and Bitcoin. The progress in this area is accelerating, and analysts see it as critical infrastructure for the next bull run.

Layer-2 networks process transactions off the main blockchain, then batch and settle them on the base layer. This dramatically increases throughput and reduces costs. Technologies like optimistic rollups, zero-knowledge rollups, and state channels each take different approaches, but they share a common goal: making blockchain usable for everyday applications.

The numbers are compelling. Layer-2 solutions can increase transaction speeds by orders of magnitude whilst reducing fees to fractions of a penny. This makes applications like decentralised social media, gaming, and micropayments actually viable. Users won’t tolerate paying pounds in fees for routine transactions, Layer-2 solutions eliminate that barrier.

Major projects are gaining significant traction. Ecosystem development is thriving, with developers building applications specifically designed for Layer-2 environments. Total value locked in Layer-2 protocols has grown substantially, indicating real economic activity migrating to these networks. Bridges between Layer-1 and Layer-2, and between different Layer-2 solutions, are becoming more sophisticated and secure.

Analysts view Layer-2 scaling as essential infrastructure for mass adoption. Without it, blockchain networks simply can’t handle the transaction volumes that would come with mainstream use. As these solutions mature and user experience improves, they remove yet another barrier to widespread crypto adoption. The next bull run won’t just be about speculation, it will need infrastructure that can actually support millions of active users. Layer-2 solutions are building that infrastructure now.

Ethereum’s Evolution and Staking Growth

Ethereum’s transition to proof-of-stake fundamentally changed the network’s economic model, and the implications continue to unfold. Staking has become a major force in the crypto ecosystem, affecting both supply dynamics and investor behaviour in ways that could significantly influence the next market cycle.

The shift to proof-of-stake eliminated energy-intensive mining and introduced staking rewards as the mechanism for securing the network. Holders can now earn yields by locking their ETH, typically ranging from 3% to 6% annually depending on network conditions. This creates a different kind of holder, one who has economic incentive to lock up assets long-term rather than trade them actively.

The amount of ETH locked in staking contracts has grown substantially since the merge. This represents a significant portion of the circulating supply that’s effectively removed from liquid markets. When demand increases during a bull run, this reduced liquid supply could amplify price movements. Staking also introduces opportunity cost calculations that didn’t exist under proof-of-work. Selling staked ETH means giving up future yield, which can dampen selling pressure during volatile periods.

Beyond staking, Ethereum’s ongoing development continues to improve the network. Upgrades focused on scalability, security, and user experience are rolling out on regular schedules. The ecosystem of applications built on Ethereum, from DeFi protocols to NFT platforms to DAOs, continues to innovate and attract users.

Analysts view Ethereum’s evolution as a maturing of the second-largest crypto network. The combination of staking yields, supply dynamics, and continuous technical improvement creates a more robust foundation for sustained value. As institutional products around Ethereum staking emerge and the network handles increasing transaction volumes via Layer-2 solutions, Ethereum’s role in the next bull run could be even more significant than in previous cycles.

DeFi 2.0 and Sustainable Yield Mechanisms

The first wave of decentralised finance promised to remake financial services. It delivered impressive innovation but also revealed serious limitations, unsustainable yields, protocol vulnerabilities, and user experiences that alienated all but the most dedicated enthusiasts. DeFi 2.0 represents the industry’s attempt to learn from those lessons and build something more durable.

Sustainable yield mechanisms are at the heart of this evolution. Early DeFi often relied on inflationary token emissions to attract liquidity, creating yield rates that looked impressive but couldn’t last. When emissions decreased or prices fell, liquidity evaporated. DeFi 2.0 projects are focusing on yield that comes from actual economic activity, trading fees, lending interest, and real-world revenue streams, rather than simply printing tokens.

Protocol-owned liquidity is another key innovation. Instead of renting liquidity through unsustainable incentives, protocols are acquiring their own liquidity through mechanisms like bonds and treasury management. This creates more stable markets and reduces dependence on mercenary capital that disappears at the first sign of trouble.

Improved security practices are also defining DeFi 2.0. Multiple audits, bug bounties, insurance protocols, and formal verification are becoming standard rather than optional. The industry learned expensive lessons from hacks and exploits, collectively losing billions, and is building accordingly.

User experience improvements are making DeFi accessible beyond the crypto-native crowd. Better interfaces, abstracted complexity, and integration with familiar tools are lowering barriers to entry. Analysts believe that DeFi 2.0’s focus on sustainability and usability could drive the next wave of adoption. If decentralised finance can deliver competitive yields with acceptable risk and genuinely better user experiences, it could capture meaningful market share from traditional finance. That would represent not just a bull market, but a fundamental shift in how financial services operate.

Bitcoin Halving Cycles and Supply Dynamics

Bitcoin’s four-year halving cycle has been the metronome of crypto markets since the beginning. Every 210,000 blocks, roughly every four years, the reward for mining new blocks cuts in half. This systematic reduction in new supply has historically preceded major bull runs, and analysts are watching the approach of the 2028 halving with considerable interest.

The mechanics are straightforward but powerful. When the halving occurs, new Bitcoin entering circulation drops by 50% overnight. If demand remains constant, reduced supply should push prices higher. But the 2028 halving presents a unique situation. It will occur during a period when institutional adoption may reach unprecedented levels. The combination of dramatically reduced new supply and potentially intense institutional FOMO could create supply-demand dynamics unlike previous cycles.

Some analysts project that Bitcoin could rise two times higher from current levels following the 2028 halving. That’s not guaranteed, of course, markets are complex and multiple factors interact, but the supply shock combined with maturing infrastructure and institutional participation creates conditions that haven’t existed in previous halvings.

Historically, Bitcoin has entered bull markets roughly 12 to 18 months after each halving. The pattern has held remarkably consistent across three previous cycles. Whilst past performance doesn’t guarantee future results, the supply schedule is mathematically certain. Barring changes to Bitcoin’s core protocol, which the community has shown little appetite for, the 2028 halving will happen exactly as programmed.

The halving cycle also affects miner economics, potentially forcing less efficient operations out of the market and concentrating hash power amongst the most sophisticated operators. This maturation of the mining industry parallels the broader professionalisation of crypto markets. Together, these supply dynamics create a compelling case for Bitcoin’s continued role as the cornerstone of any crypto bull run.

Conclusion

The next crypto bull run won’t look like the last one. The market has matured considerably, the participants have changed, and the infrastructure is far more sophisticated. These eight trends, from institutional ETF adoption to Bitcoin’s supply dynamics, represent fundamental shifts rather than speculative frenzies. Analysts emphasise that whilst timing markets remains notoriously difficult, understanding the structural changes underway provides a clearer picture of where opportunities might emerge. Regulatory clarity has removed uncertainty. Technological improvements have addressed scalability. Institutional capital has validated the asset class. Real-world applications are moving beyond theory into practice. None of this guarantees a bull run, but it does suggest that the crypto market of 2025 and beyond operates on a fundamentally different foundation than previous cycles. For investors, developers, and institutions watching these trends unfold, the message is clear: the next chapter of crypto’s story is being written right now, and those paying attention have the chance to position themselves accordingly.

Frequently Asked Questions

What crypto trends could shape the next bull run?

Analysts identify eight key trends: institutional adoption through Bitcoin ETFs, real-world asset tokenisation, AI-blockchain integration, regulatory clarity, Layer-2 scaling solutions, Ethereum staking growth, DeFi 2.0 innovations, and Bitcoin halving cycles. These represent fundamental structural changes rather than speculative movements.

How has institutional adoption changed the crypto market?

Bitcoin ETF net inflows reached $60.42 billion cumulatively by November 2025, with BlackRock’s iShares Bitcoin Trust growing to between $70.7–97.8 billion in assets. Institutions now offer Bitcoin exposure in 401(k) retirement plans, with recommended allocations of 2–5%, representing a major shift from retail-dominated markets.

What is real-world asset tokenisation and why does it matter?

Real-world asset tokenisation converts traditional assets like property, bonds, and commodities into digital blockchain tokens. It increases liquidity through fractional ownership, reduces intermediaries, cuts settlement times from days to minutes, and creates 24/7 markets, bridging traditional finance with crypto infrastructure.

How has regulatory clarity affected cryptocurrency markets?

The SEC reduced crypto ETF approval timelines from 270 to 75 days in 2025, whilst the GENIUS Act established the first federal stablecoin framework. Trump administration policies declaring the US the ‘crypto capital’ helped Bitcoin gain over 35% following inauguration, significantly boosting market confidence.

When is the next Bitcoin halving and how might it impact prices?

The 2028 Bitcoin halving will reduce new supply by 50% during a period of unprecedented institutional adoption. Historically, Bitcoin enters bull markets 12–18 months after each halving. Analysts project Bitcoin could potentially rise two times higher from current levels, though outcomes depend on multiple factors.

What are Layer-2 solutions in cryptocurrency?

Layer-2 solutions process transactions off the main blockchain, then batch and settle them on the base layer, dramatically increasing speeds and reducing fees to fractions of a penny. Technologies like optimistic rollups and zero-knowledge rollups make blockchain viable for everyday applications like gaming and social media.