The world of cryptocurrency can feel like learning a new language. With terms like “blockchain,” “DeFi,” and “gas fees” thrown around constantly, it’s easy to feel overwhelmed before even making a first investment. Yet understanding these fundamental concepts isn’t just helpful, it’s essential for anyone considering entering the crypto space.

Cryptocurrency represents one of the most significant financial innovations of the 21st century, but diving in without proper knowledge can lead to costly mistakes. Whether someone is planning to invest in Bitcoin, explore altcoins, or simply wants to understand what all the fuss is about, grasping these core terms will provide a solid foundation.

This guide breaks down 15 crucial crypto terms every investor should know. From the technology that powers cryptocurrencies to the psychological forces that drive market movements, these concepts will help demystify the digital asset landscape and enable more informed investment decisions.

Key Takeaways

- Understanding crypto terms like blockchain, wallets, and gas fees is essential before investing in digital assets.

- Bitcoin remains the largest cryptocurrency by market capitalisation, whilst altcoins offer diverse alternatives with varying risk levels.

- Private keys prove ownership of cryptocurrency, and losing them means permanently losing access to your funds.

- Cryptocurrency markets exhibit extreme volatility, with prices capable of double-digit percentage swings within a single day.

- FOMO and FUD are psychological forces that drive emotional decision-making and often lead investors to buy high and sell low.

- Staking allows cryptocurrency holders to earn passive income by locking up coins to support blockchain network operations.

1. Blockchain

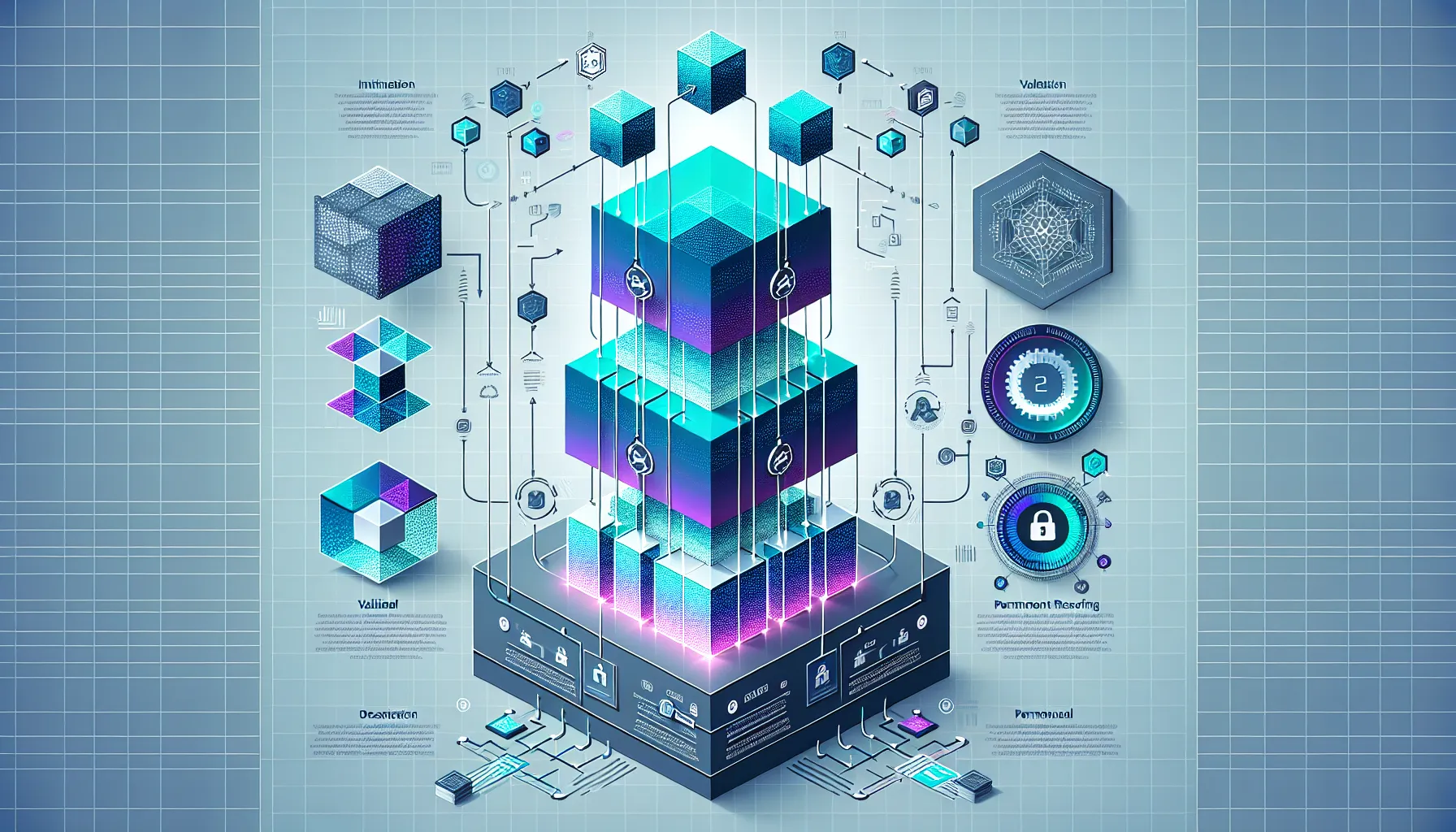

Blockchain is the foundational technology that makes cryptocurrencies possible. At its core, it’s a distributed digital ledger that records transactions across multiple computers in a way that makes the data extremely difficult to alter or hack.

Think of it as a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block contains transaction data, a timestamp, and a cryptographic link to the previous block, creating an unbreakable chain of information.

What makes blockchain revolutionary is its decentralised nature, no single entity controls the entire network. Instead, all participants maintain copies of the ledger, making the system transparent and resistant to fraud. When someone initiates a transaction, it’s broadcast to all nodes in the network, verified, and then permanently added to the blockchain.

How Blockchain Technology Works

The blockchain process follows several key steps. When a transaction occurs, it’s grouped with other pending transactions into a block. Network participants, called nodes, then validate these transactions using complex algorithms. Once verified, the block receives a unique code called a hash and is added to the chain.

This verification process varies depending on the blockchain. Some use Proof of Work (requiring computational power to solve mathematical puzzles), whilst others employ Proof of Stake (where validators are chosen based on their cryptocurrency holdings). The result is a permanent, tamper-proof record that anyone can view but no one can unilaterally change.

Blockchain’s applications extend far beyond cryptocurrency, with potential uses in supply chain management, healthcare records, voting systems, and more.

2. Cryptocurrency

Cryptocurrency is digital or virtual currency that uses cryptography for security and operates on blockchain technology. Unlike traditional currencies issued by governments (known as fiat currencies), cryptocurrencies are typically decentralised and exist purely in digital form.

The “crypto” prefix refers to the various encryption techniques used to secure transactions and control the creation of new units. These digital assets can be transferred directly between parties without requiring intermediaries like banks, which is why many view them as a disruptive force in traditional finance.

Cryptocurrencies serve multiple functions: they can act as a medium of exchange (like cash), a store of value (like gold), or provide access to specific blockchain-based services. Their value is determined by supply and demand in the market rather than by government decree.

Key characteristics include transparency (all transactions are recorded on the blockchain), pseudonymity (users are identified by addresses rather than names), and immutability (confirmed transactions cannot be reversed). But, these features also mean that if someone loses access to their cryptocurrency, there’s typically no central authority that can restore it.

Today, thousands of cryptocurrencies exist, each with different purposes, technologies, and communities supporting them.

3. Bitcoin

Bitcoin is the first and most well-known cryptocurrency, created in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto. It introduced the world to blockchain technology and remains the largest cryptocurrency by market capitalisation.

Bitcoin was designed as a peer-to-peer electronic cash system that would allow online payments to be sent directly between parties without going through financial institutions. The Bitcoin network has a fixed supply cap of 21 million coins, making it inherently deflationary, a stark contrast to fiat currencies that central banks can print at will.

Transactions on the Bitcoin network are verified by miners who use computational power to solve complex mathematical problems. As a reward, they receive newly minted bitcoins and transaction fees. This process, known as Proof of Work, secures the network but has drawn criticism for its energy consumption.

Bitcoin’s price has experienced dramatic swings since its inception, from being virtually worthless to reaching tens of thousands of pounds per coin. These price movements attract both investors seeking returns and critics warning of speculation.

Why Bitcoin Matters to Investors

Bitcoin has earned the nickname “digital gold” due to its scarcity and its perceived role as a store of value. Many investors view it as a hedge against inflation and currency debasement, particularly in times of economic uncertainty.

Institutional adoption has grown significantly, with major corporations adding Bitcoin to their balance sheets and financial institutions offering Bitcoin-related products. This mainstream acceptance has lent legitimacy to the cryptocurrency space, though it remains controversial amongst traditional finance professionals.

For investors, Bitcoin often serves as an entry point into cryptocurrency and can represent a significant portion of a diversified crypto portfolio. Its established network, widespread recognition, and relative stability compared to other cryptocurrencies make it a benchmark for the entire digital asset market.

4. Altcoin

Altcoin is a term that refers to any cryptocurrency other than Bitcoin. The name derives from “alternative coin,” as these digital assets emerged as alternatives to Bitcoin, each attempting to improve upon or differentiate itself from the original cryptocurrency.

There are thousands of altcoins in existence, ranging from well-established projects like Ethereum, Ripple (XRP), and Litecoin to countless smaller, more speculative tokens. Each altcoin typically aims to solve specific problems or serve particular use cases that Bitcoin doesn’t address.

Some altcoins focus on faster transaction speeds, others on enhanced privacy, and many provide platforms for building decentralised applications or smart contracts. The diversity within the altcoin space means that investors have numerous options beyond Bitcoin, though this also increases complexity and risk.

Altcoins are generally categorised into several types:

- Platform coins: Like Ethereum, which enables developers to build applications

- Stablecoins: Designed to maintain a stable value, often pegged to fiat currencies

- Privacy coins: Such as Monero, which emphasise transaction anonymity

- Utility tokens: Grant access to specific services within a blockchain ecosystem

- Meme coins: Created as jokes or social experiments, though some have gained significant value

Whilst altcoins offer potential for higher returns than Bitcoin, they typically carry greater risk due to lower liquidity, less proven technology, and in some cases, questionable fundamentals. Investors should thoroughly research any altcoin before investing.

5. Wallet

A cryptocurrency wallet is a digital tool that allows users to store, send, and receive digital assets. Even though the name, wallets don’t actually store cryptocurrency itself, they store the private keys needed to access and manage crypto holdings on the blockchain.

Wallets come in various forms, from software applications on computers and smartphones to physical hardware devices and even paper. Each wallet has a public address (similar to an account number) that others can use to send cryptocurrency, and a private key that proves ownership and authorises transactions.

The security of a crypto wallet depends largely on how the private keys are managed. If someone gains access to another person’s private keys, they can control those funds entirely. This is why the crypto community emphasises the phrase “not your keys, not your coins”, holding cryptocurrency on an exchange means trusting that platform to safeguard those assets.

Choosing the right wallet depends on an investor’s priorities: convenience, security, the types of cryptocurrencies they hold, and how frequently they transact. Many experienced investors use multiple wallet types for different purposes.

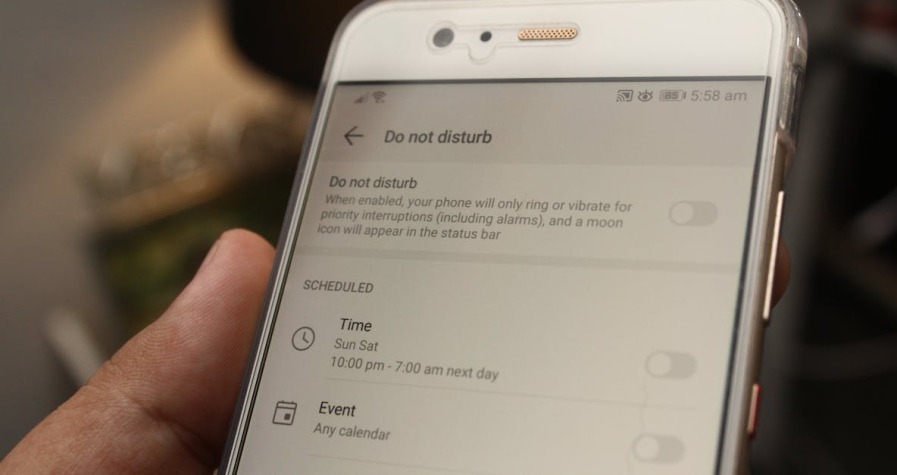

Hot Wallets vs Cold Wallets

Hot wallets are connected to the internet, making them convenient for regular transactions but potentially vulnerable to hacking. These include mobile apps, desktop software, and web-based wallets. They’re ideal for holding smaller amounts that someone might need quick access to, much like keeping cash in a physical wallet for daily expenses.

Cold wallets, by contrast, remain offline and provide enhanced security for long-term storage. Hardware wallets (physical devices resembling USB drives) and paper wallets (printed private keys) fall into this category. Though less convenient for frequent transactions, cold wallets are significantly more resistant to cyber attacks and are recommended for storing substantial cryptocurrency holdings.

Many investors adopt a balanced approach: using hot wallets for trading and everyday transactions whilst keeping the majority of their holdings in cold storage. This strategy balances accessibility with security, reducing exposure to potential theft whilst maintaining practical functionality.

6. Private Key and Public Key

Private keys and public keys are cryptographic elements that form the foundation of cryptocurrency ownership and transactions. Understanding how these work is crucial for anyone handling digital assets.

A public key functions like an email address or bank account number, it’s a string of characters that can be shared freely with others who want to send cryptocurrency. It’s derived from the private key through complex mathematical algorithms but cannot be used to work backwards and discover the private key.

A private key, on the other hand, is like a password combined with a signature. It’s a secret alphanumeric code that proves ownership of the cryptocurrency associated with a particular public address. Anyone with access to a private key can authorise transactions and effectively control those funds.

The relationship between these keys relies on asymmetric cryptography. When someone sends cryptocurrency, they sign the transaction with their private key. The network can verify this signature using the corresponding public key, confirming the transaction’s authenticity without ever revealing the private key itself.

This system enables secure, trustless transactions, two parties can exchange value without needing to trust each other or rely on a third party to mediate. But, it also places enormous responsibility on users. If a private key is lost, the cryptocurrency becomes permanently inaccessible. If it’s stolen or compromised, the funds can be taken without recourse.

Most wallet software generates and manages these keys automatically, often representing the private key as a “seed phrase”, a series of 12 to 24 random words that can restore access to a wallet. Safeguarding this seed phrase with the same vigilance as the private key itself is absolutely essential.

7. Exchange

A cryptocurrency exchange is a digital marketplace where users can buy, sell, and trade cryptocurrencies. These platforms serve as the primary gateway for most people entering the crypto space, converting fiat currency into digital assets and vice versa.

Exchanges function similarly to stock market platforms, matching buyers with sellers and facilitating transactions. They typically charge fees for their services, which can vary considerably between platforms and transaction types. Some exchanges support dozens or even hundreds of different cryptocurrencies, whilst others focus on major coins like Bitcoin and Ethereum.

When selecting an exchange, investors should consider several factors: security measures, available cryptocurrencies, fee structures, user interface, regulatory compliance, and geographic availability. Reputation matters significantly in this space, as exchange hacks and failures have resulted in substantial losses for users.

Most exchanges require identity verification (a process called Know Your Customer or KYC) to comply with anti-money laundering regulations. This typically involves submitting identification documents and sometimes proof of address.

Centralised vs Decentralised Exchanges

Centralised exchanges (CEXs) like Coinbase, Binance, and Kraken operate as intermediaries, holding users’ funds in custody and managing order books. They offer user-friendly interfaces, high liquidity, customer support, and often function as on-ramps from traditional finance. But, they require users to trust the platform with their assets and personal information, contradicting cryptocurrency’s ethos of decentralisation.

Centralised exchanges are also vulnerable to hacking, regulatory action, and operational failures. The collapse of exchanges like FTX in 2022 demonstrated the risks of leaving substantial funds on these platforms.

Decentralised exchanges (DEXs) like Uniswap and PancakeSwap operate without a central authority, instead using smart contracts to help peer-to-peer trading directly from users’ wallets. This approach offers enhanced privacy, user control, and resistance to censorship. Users maintain custody of their funds until the moment of exchange.

But, DEXs typically have steeper learning curves, less liquidity for some trading pairs, and limited fiat currency support. They also offer no customer service if something goes wrong. For many investors, using both types of exchanges for different purposes represents a pragmatic approach.

8. Mining

Mining is the process by which new cryptocurrency units are created and transactions are verified on certain blockchain networks, most notably Bitcoin. Miners use powerful computers to solve complex mathematical puzzles that secure the network and validate transactions.

When a miner successfully solves a puzzle, they earn the right to add a new block of transactions to the blockchain. As a reward for this work and the computational resources expended, they receive newly minted cryptocurrency plus transaction fees from the transactions included in that block.

This process, known as Proof of Work, serves multiple purposes: it distributes new coins in a decentralised manner, secures the network against attacks (as altering the blockchain would require redoing all that computational work), and creates consensus about the state of the ledger without requiring a central authority.

Mining has become increasingly competitive and specialised. In Bitcoin’s early days, individuals could mine using ordinary computers. Today, industrial-scale operations use specialised hardware called ASICs (Application-Specific Integrated Circuits) in warehouses located in regions with cheap electricity.

The environmental impact of mining, particularly Bitcoin mining, has become controversial due to the enormous amounts of electricity consumed. This has prompted some cryptocurrencies to adopt alternative consensus mechanisms like Proof of Stake, which Ethereum transitioned to in 2022.

For most individual investors, mining is no longer a practical way to acquire cryptocurrency due to equipment costs, electricity expenses, and technical complexity. But, understanding mining helps explain how blockchain networks maintain security and how new coins enter circulation.

9. Market Capitalisation (Market Cap)

Market capitalisation, often shortened to market cap, is a key metric used to evaluate the relative size and value of a cryptocurrency. It’s calculated by multiplying the current price of a single coin by the total number of coins in circulation.

For example, if a cryptocurrency has 10 million coins in circulation and each coin trades at £50, its market cap would be £500 million. This figure provides a snapshot of the cryptocurrency’s total value and helps investors compare different digital assets.

Market cap is typically categorised into three tiers:

- Large-cap cryptocurrencies: Generally above £10 billion, including Bitcoin and Ethereum. These are considered relatively more stable and established, though still volatile compared to traditional assets.

- Mid-cap cryptocurrencies: Ranging from £1 billion to £10 billion. These often represent projects with proven concepts but more growth potential and risk than large-caps.

- Small-cap cryptocurrencies: Below £1 billion. These carry the highest risk but also offer potential for substantial returns if the project succeeds.

Market cap provides more meaningful context than price alone. A coin trading at £0.01 might seem cheap, but if trillions of coins exist, its market cap could be enormous. Conversely, a coin priced at £1,000 with limited circulation might have a relatively small market cap.

Investors should note that market cap doesn’t tell the whole story. It doesn’t account for liquidity (how easily a cryptocurrency can be bought or sold), development activity, real-world adoption, or the amount of cryptocurrency locked in staking or lost forever. Nevertheless, it remains one of the most useful metrics for quickly assessing a cryptocurrency’s position in the market.

Websites like CoinMarketCap and CoinGecko rank cryptocurrencies by market cap, providing an overview of the digital asset landscape that helps investors identify major players and track market trends.

10. Volatility

Volatility refers to the degree of price fluctuation in an asset over time. Cryptocurrency markets are notoriously volatile, with prices capable of swinging dramatically, sometimes by double-digit percentages, within a single day.

This extreme volatility stems from several factors. Cryptocurrency markets operate 24/7 without circuit breakers that halt trading during extreme movements. The market is relatively young and less mature than traditional financial markets, with lower overall liquidity. Regulatory uncertainty, technological developments, market sentiment, and influential figures can all trigger significant price movements.

News events, whether positive (institutional adoption, favourable regulations) or negative (exchange hacks, government crackdowns), can cause rapid price changes. Social media and influential personalities can also impact prices, particularly for smaller-cap cryptocurrencies.

For investors, volatility presents both opportunity and risk. Traders may profit from price swings, whilst long-term investors can purchase assets at lower prices during downturns. But, volatility also means that substantial losses can occur quickly, and emotional decision-making during turbulent periods often leads to poor outcomes.

Compared to traditional assets like stocks or bonds, cryptocurrencies exhibit significantly higher volatility. Bitcoin, the largest and relatively most stable cryptocurrency, still experiences price movements that would be considered extraordinary in conventional markets.

Understanding and accepting this volatility is essential before investing in cryptocurrency. Investors should only allocate funds they can afford to lose and should avoid checking prices obsessively, which can lead to impulsive decisions. Many successful crypto investors adopt a long-term perspective, viewing short-term volatility as noise rather than signal.

Some cryptocurrencies, called stablecoins, are specifically designed to minimise volatility by pegging their value to stable assets like the US dollar, though these come with their own risks and considerations.

11. FOMO and FUD

FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, and Doubt) are psychological phenomena that significantly influence cryptocurrency markets and investor behaviour. Understanding these concepts can help investors make more rational decisions.

FOMO occurs when investors see prices rapidly increasing and feel compelled to buy in, fearing they’ll miss out on potential gains. This emotion often drives buying at market peaks when assets are overvalued. FOMO is particularly powerful in cryptocurrency due to stories of early Bitcoin adopters becoming millionaires and rapid price increases that seem to justify impulsive decisions.

Social media amplifies FOMO, as investors see others discussing their gains and feel pressure to participate. This can create feedback loops where buying pressure pushes prices higher, attracting more FOMO buyers, until the trend eventually reverses, often leaving latecomers holding assets that quickly decline in value.

FUD refers to the spreading of negative, often misleading information to create fear and drive prices down. This might include exaggerated concerns about regulation, security, or a project’s viability. FUD can be spread intentionally by those who benefit from lower prices or unintentionally by media outlets seeking attention-grabbing headlines.

FUD can trigger panic selling, where investors dump their holdings at losses, fearing further declines. In reality, some negative news is legitimate and worth heeding, whilst other FUD is baseless or overblown.

How Emotions Impact Investment Decisions

Both FOMO and FUD represent emotional decision-making that often contradicts sound investment strategy. They can cause investors to buy high and sell low, precisely the opposite of profitable investing.

Recognising these emotions in oneself is the first step toward overcoming them. When feeling an urgent need to buy because prices are rising, it’s worth pausing to assess whether the investment makes sense based on fundamentals rather than fear of missing out. Similarly, when negative news creates panic, evaluating the information’s credibility and relevance can prevent hasty decisions.

Successful crypto investors typically develop strategies to counteract these emotions: setting clear investment criteria before entering positions, using dollar-cost averaging to reduce the impact of timing, establishing stop-losses to limit downside risk, and maintaining a long-term perspective that views short-term price movements as temporary noise.

The cryptocurrency community has even developed terms like “HODL” (a misspelling of “hold” that became a rallying cry for maintaining positions through volatility) and “diamond hands” (refusing to sell even though downturns) as cultural responses to FOMO and FUD. Whilst these concepts can promote resilience, they should complement, not replace, thoughtful analysis and risk management.

12. DeFi (Decentralised Finance)

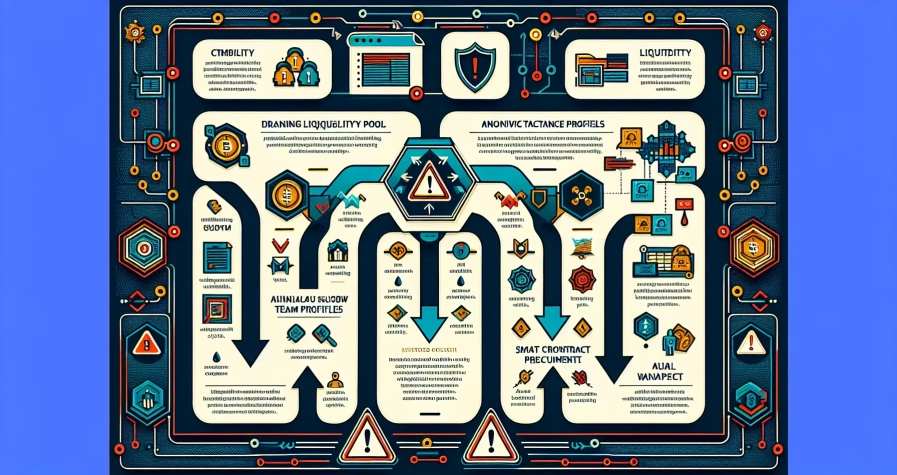

DeFi, short for Decentralised Finance, refers to a movement that aims to recreate traditional financial services, lending, borrowing, trading, insurance, and more, using blockchain technology and smart contracts, without intermediaries like banks or brokerages.

The core promise of DeFi is to make financial services more accessible, transparent, and efficient. Anyone with an internet connection can access DeFi platforms without requiring permission from centralised authorities, credit checks, or minimum balances. Transactions are executed automatically by code rather than by institutions, theoretically reducing costs and eliminating human bias or error.

DeFi applications, often called “dApps” (decentralised applications), run primarily on blockchain platforms that support smart contracts, with Ethereum being the most prominent. These platforms enable developers to create financial protocols where users can:

- Lend and borrow cryptocurrency, earning interest or accessing liquidity without traditional banks

- Trade assets directly with others using decentralised exchanges

- Earn yield by providing liquidity to trading pools

- Access derivatives and synthetic assets that mirror real-world prices

- Obtain insurance against smart contract failures or other risks

The DeFi ecosystem grew explosively in 2020 and 2021, with billions of pounds locked in various protocols. Yield farming and liquidity mining became popular strategies where users earned tokens as rewards for participating in DeFi platforms.

But, DeFi carries significant risks. Smart contracts can contain bugs that hackers exploit, leading to substantial losses. The lack of regulation means no consumer protections exist if something goes wrong. Many DeFi projects have proven to be scams or poorly designed, collapsing and taking investors’ funds with them.

Also, DeFi platforms often have complex interfaces and mechanisms that can confuse newcomers, leading to costly mistakes. Regulatory scrutiny is increasing as authorities grapple with how to oversee these systems.

Even though these challenges, DeFi represents one of the most innovative applications of blockchain technology, potentially transforming how financial services operate. For investors willing to navigate its complexities and risks, DeFi offers novel opportunities that didn’t exist in traditional finance.

13. NFT (Non-Fungible Token)

NFT stands for Non-Fungible Token, a unique digital asset that represents ownership of a specific item or piece of content on the blockchain. Unlike cryptocurrencies such as Bitcoin, where each unit is interchangeable (fungible), each NFT is distinct and cannot be replicated or substituted.

The concept of fungibility is key here: a £10 note is fungible because it can be exchanged for any other £10 note with no difference in value. NFTs, but, are like individual pieces of art, each has unique properties that make it different from all others.

NFTs can represent various types of digital content:

- Digital art: Images, animations, or generative art pieces

- Collectables: Trading cards, virtual pets, or limited-edition items

- Music and audio: Songs, albums, or sound clips

- Virtual real estate: Land or property in metaverse platforms

- Gaming items: Characters, weapons, or skins in blockchain games

- Domain names: Blockchain-based web addresses

- Membership passes: Access tokens for exclusive communities or events

NFTs exploded in popularity in 2021, with some selling for millions of pounds and attracting celebrities, artists, and major brands. The technology enables creators to sell digital work directly to collectors, often including royalties on future resales, something impossible with traditional digital files that can be copied infinitely.

Ownership and transaction history are recorded on the blockchain, providing provable authenticity and scarcity. But, it’s important to understand that owning an NFT typically means owning a token that points to the digital content rather than the content itself, and copyright usually remains with the original creator unless explicitly transferred.

Critics argue that NFTs are speculative bubbles with little intrinsic value, pointing to environmental concerns (due to energy-intensive blockchains), copyright issues, and market manipulation. The NFT market has also experienced significant downturns, with many tokens losing most of their value.

Nevertheless, NFTs demonstrate how blockchain can establish ownership and scarcity for digital items, potentially transforming industries from art and entertainment to real estate and identity verification. Whether they represent a lasting innovation or a passing trend remains hotly debated.

14. Staking

Staking is a process where cryptocurrency holders lock up their coins to support a blockchain network’s operations and, in return, earn rewards. It’s conceptually similar to earning interest on a savings account, though the mechanisms and risks differ significantly.

Staking is specifically associated with blockchains that use Proof of Stake (PoS) or similar consensus mechanisms, rather than Proof of Work mining. In these systems, validators are chosen to create new blocks and verify transactions based partly on how much cryptocurrency they’ve staked as collateral.

When someone stakes their cryptocurrency, they’re essentially pledging those coins to help secure and operate the network. In exchange for this service and for locking up their assets, they receive staking rewards, typically newly minted coins or a share of transaction fees.

The process varies by blockchain:

- Some require substantial minimum amounts to become a validator

- Others allow participation with any amount through staking pools where multiple users combine their holdings

- Lock-up periods can range from flexible (unstake anytime) to fixed terms of weeks or months

- Rewards vary based on factors like the amount staked, lock-up duration, and overall network participation

Major cryptocurrencies that support staking include Ethereum (after its 2022 transition to Proof of Stake), Cardano, Polkadot, and Solana, among many others.

Benefits of Staking Cryptocurrencies

Staking offers several advantages for cryptocurrency holders. It provides a way to generate passive income from holdings rather than simply holding them idle. Staking rewards can be substantial, sometimes offering annual percentage yields in the double digits, though these rates fluctuate based on network conditions and participation levels.

From a network perspective, staking incentivises long-term holding and aligns participants’ interests with the blockchain’s health and security. Validators who act maliciously risk losing their staked coins through a process called “slashing.”

Staking is also more environmentally friendly than Proof of Work mining, requiring minimal energy consumption whilst still securing the network. This has become increasingly important as environmental concerns about cryptocurrency gain prominence.

But, staking carries risks that potential participants should understand. Staked coins are typically locked and cannot be sold or transferred during the staking period, meaning holders miss the opportunity to sell if prices drop. If the staked cryptocurrency’s value declines, rewards may not compensate for the loss.

Also, technical risks exist: if running one’s own validator node, technical failures or downtime can result in penalties. Even when using reputable staking services or exchanges, smart contract vulnerabilities or platform failures could jeopardise staked assets.

Even though these considerations, staking has become a popular strategy for crypto investors seeking to earn returns on their holdings whilst contributing to network security.

15. Gas Fees

Gas fees are transaction costs paid by users to execute operations on blockchain networks, most commonly associated with Ethereum and similar platforms. These fees compensate validators or miners for the computational resources required to process and validate transactions.

The term “gas” refers to the unit that measures the computational effort needed for operations. Simple transactions require less gas than complex ones, such as executing smart contracts or minting NFTs. The total fee is calculated by multiplying the gas used by the gas price (set by users based on how quickly they want their transaction processed).

Gas fees fluctuate based on network congestion. When many users are attempting transactions simultaneously, they compete by offering higher fees to prioritise their transactions. During periods of intense activity, fees can become extremely expensive, sometimes costing more than the value being transferred, particularly for small transactions.

This creates practical limitations for blockchain usage. High gas fees can make certain applications economically unviable, especially for smaller transactions, microtransactions, or use cases involving frequent interactions with the blockchain.

Users typically have options when setting gas fees:

- Low fees: Transactions may take longer or potentially fail during busy periods

- Medium fees: Balanced approach with reasonable processing times

- High fees: Priority processing, useful for time-sensitive transactions

Most wallet software provides estimates and recommendations, though predicting exact costs can be challenging due to rapidly changing network conditions.

Gas fees serve important purposes beyond compensating validators. They prevent spam by making it expensive to flood the network with frivolous transactions and allocate limited blockchain resources to those willing to pay for them.

But, high fees remain one of the biggest criticisms of certain blockchain networks. They create barriers to adoption and make these systems less accessible to users in developing countries or those making smaller transactions.

This has spurred innovation in several directions: Layer 2 solutions (like Ethereum’s Optimism and Arbitrum) process transactions off the main chain to reduce costs, alternative blockchains with different architectures offer lower fees, and Ethereum’s ongoing upgrades aim to improve scalability and reduce gas costs.

For investors and users, understanding gas fees is crucial for budgeting and timing transactions. Monitoring network activity and choosing optimal times to transact can result in substantial savings, whilst failing to account for fees can make certain activities unprofitable or unexpectedly expensive.

Conclusion

Mastering these 15 fundamental cryptocurrency terms provides a solid foundation for anyone considering investment in digital assets. From understanding the blockchain technology that underpins the entire ecosystem to grasping the psychological forces like FOMO and FUD that drive market movements, each concept plays a crucial role in navigating the crypto landscape.

The cryptocurrency space continues to evolve rapidly, with new innovations, regulations, and use cases emerging regularly. Technologies like DeFi and NFTs are reshaping what’s possible with blockchain, whilst established cryptocurrencies like Bitcoin and Ethereum mature and gain broader acceptance.

But, knowledge of these terms is just the beginning. Successful cryptocurrency investment requires ongoing education, careful research into specific projects, robust security practices, and disciplined risk management. The volatility and complexity of crypto markets mean that even well-informed investors can experience significant losses.

Before investing, individuals should assess their risk tolerance, investment timeframe, and financial situation. Many experts recommend allocating only a small percentage of one’s overall portfolio to cryptocurrency due to its speculative nature and volatility.

As with any investment, there are no guarantees. Yet by understanding these core concepts, from the technical infrastructure like wallets and private keys to market dynamics such as market capitalisation and gas fees, investors position themselves to make more informed decisions and avoid common pitfalls that trap newcomers.

The journey into cryptocurrency can be rewarding, but it requires patience, scepticism, and a commitment to continuous learning. Armed with this foundational knowledge, investors can approach the crypto market with greater confidence and clarity.

Frequently Asked Questions

What is the difference between a hot wallet and a cold wallet?

Hot wallets are connected to the internet, making them convenient for frequent transactions but more vulnerable to hacking. Cold wallets remain offline, providing enhanced security for long-term storage, though they’re less convenient for regular use.

How is cryptocurrency market capitalisation calculated?

Market capitalisation is calculated by multiplying the current price of a single coin by the total number of coins in circulation. It provides a snapshot of the cryptocurrency’s total value and helps investors compare different digital assets.

Why are gas fees so high on Ethereum?

Gas fees increase during network congestion when many users attempt transactions simultaneously. They compete by offering higher fees to prioritise their transactions. Layer 2 solutions and blockchain upgrades aim to reduce these costs.

What is the best crypto term for beginners to learn first before investing?

Understanding blockchain is essential, as it’s the foundational technology behind cryptocurrencies. Knowing how wallets and private keys work is equally crucial for safely storing and managing digital assets before making any investment.

Can you lose money through staking cryptocurrency?

Yes, whilst staking generates rewards, you face risks including price declines during lock-up periods, technical penalties for validator failures, and potential platform vulnerabilities. Staking rewards may not compensate for cryptocurrency value losses.

How does DeFi differ from traditional banking?

DeFi uses blockchain technology and smart contracts to provide financial services without intermediaries like banks. It offers greater accessibility and transparency but lacks consumer protections, regulatory oversight, and can expose users to smart contract vulnerabilities.