Choosing the right cryptocurrency exchange can be the difference between a seamless trading experience and a frustrating one. With hundreds of platforms vying for attention, traders need clarity on which exchanges truly deliver on security, features, and user satisfaction.

This ranking of the 10 most popular crypto exchanges is based on real user preferences, trading volumes, and platform reputation. Whether one is a complete beginner or a seasoned trader hunting for advanced derivatives, there’s an exchange tailored to every need. From global giants with millions of users to innovative platforms pushing the boundaries of Web3 integration, these exchanges represent the cream of the crop in today’s digital asset landscape.

Each platform brings something unique to the table, be it regulatory compliance, extensive altcoin listings, or institutional-grade security. Let’s explore what makes these exchanges stand out and why users keep coming back to them.

Key Takeaways

- Binance leads as the world’s largest crypto exchange by trading volume, offering over 350 cryptocurrencies and competitive fees starting at just 0.1%.

- Coinbase remains the top choice for beginners, combining a user-friendly interface with regulatory compliance and 98% of funds stored in secure offline cold storage.

- The 10 most popular crypto exchanges each serve distinct trader needs, from Kraken’s security-focused approach to Bybit’s derivatives specialisation and KuCoin’s extensive altcoin selection.

- Professional traders gravitate towards platforms like Bitfinex and OKX for advanced charting tools, deep liquidity, and sophisticated trading features including futures and margin trading.

- Selecting the right crypto exchange depends on individual priorities such as regulatory compliance, fee structures, available cryptocurrencies, and whether one requires beginner-friendly features or institutional-grade tools.

- Diversifying across multiple crypto exchanges allows traders to access different token selections, benefit from varying fee structures, and reduce concentration risk whilst maintaining security.

1. Binance: The Global Market Leader

Binance consistently ranks as the world’s largest cryptocurrency exchange by trading volume, processing billions of dollars in transactions daily. Founded in 2017 by Changpeng Zhao, the platform has grown exponentially to serve over 150 million users across more than 180 countries.

Why Users Choose Binance

Users flock to Binance for its unmatched liquidity and competitive fee structure. The platform charges just 0.1% per spot trade, with further reductions available through its BNB token discount programme. This cost efficiency matters tremendously for active traders who execute multiple transactions daily.

The exchange’s global reach means traders can access markets 24/7 with minimal slippage, even during volatile periods. Binance supports over 350 cryptocurrencies and more than 1,500 trading pairs, giving users exposure to everything from established coins to emerging altcoins. The platform’s mobile app receives particular praise for its intuitive interface and full feature parity with the desktop version.

Key Features and Trading Options

Binance offers an impressive suite of products beyond basic spot trading. Users can access futures contracts, margin trading, staking services, savings accounts, and even an NFT marketplace, all from a single account. The Binance Earn programme allows passive income generation through flexible and locked staking options.

For those interested in decentralised finance, Binance Smart Chain provides an ecosystem of DeFi applications with significantly lower gas fees than Ethereum. The exchange also operates Binance Academy, a free educational resource that helps newcomers understand blockchain technology and trading strategies. Security features include two-factor authentication, anti-phishing codes, and a Secure Asset Fund for Users (SAFU) that protects against potential breaches.

2. Coinbase: The Beginner-Friendly Platform

Coinbase has become synonymous with cryptocurrency adoption in Western markets, particularly in the United States. As a publicly traded company on the NASDAQ, it offers a level of transparency and legitimacy that appeals to cautious newcomers and institutional investors alike.

User Experience and Security

The platform’s clean, uncluttered interface makes it remarkably easy for first-time buyers to purchase their first Bitcoin or Ethereum. Coinbase walks users through each step of the verification process and offers straightforward payment options including bank transfers, debit cards, and PayPal in select regions.

Security remains a cornerstone of Coinbase’s offering. The exchange stores 98% of customer funds in offline cold storage, protecting assets from online threats. Insurance coverage extends to the remaining 2% held in hot wallets, providing an additional safety net. Users also benefit from biometric authentication options and the ability to whitelist withdrawal addresses.

Regulatory Compliance Advantages

Coinbase’s commitment to regulatory compliance sets it apart in an industry often characterised by legal grey areas. The exchange holds licences across multiple jurisdictions and works closely with financial regulators to ensure adherence to anti-money laundering (AML) and know-your-customer (KYC) requirements.

This regulatory standing makes Coinbase particularly attractive to institutional investors and those who prioritise legitimacy over bleeding-edge features. The platform’s Coinbase Pro service (now integrated into the main platform as Advanced Trade) offers lower fees and more sophisticated tools for experienced traders, whilst maintaining the same rigorous security standards. Educational initiatives like Coinbase Earn allow users to learn about different cryptocurrencies whilst earning small amounts of tokens, a clever onboarding strategy that reduces the financial barrier to exploration.

3. Kraken: Trusted for Security and Reliability

Founded in 2011, Kraken is one of the oldest cryptocurrency exchanges still operating, having weathered multiple market cycles without a major security breach. This track record has earned it a reputation as one of the most trustworthy platforms in the industry.

Kraken serves users in over 190 countries and offers more than 200 cryptocurrencies for trading. The exchange is particularly popular in Europe and North America, where its regulatory compliance and banking partnerships help smooth fiat currency transactions. Kraken’s fee structure starts at 0.26% for makers and 0.16% for takers, decreasing with higher trading volumes.

What distinguishes Kraken is its commitment to transparency and user education. The company publishes regular proof-of-reserves audits, allowing users to verify that customer funds are fully backed. This level of openness remains rare in the cryptocurrency space and builds significant trust with security-conscious traders.

Advanced Trading Tools

Kraken Pro (formerly known as Cryptowatch) provides professional-grade charting tools, multiple order types, and algorithmic trading capabilities. Traders can execute market, limit, stop-loss, and take-profit orders with precision, whilst accessing real-time data across multiple timeframes.

The platform supports margin trading with up to 5x leverage on select pairs, allowing experienced traders to amplify their positions. Kraken also offers futures contracts, staking services with competitive yields, and OTC trading desks for large-volume transactions. Customer support receives consistently high marks, with 24/7 live chat available even for basic account holders, a rarity among major exchanges. The exchange’s API documentation is comprehensive, making it a favourite among algorithmic traders and developers building trading bots.

4. Bybit: Rising Star for Derivatives Trading

Bybit has rapidly ascended the ranks since its 2018 launch, now serving over 20 million users worldwide. The exchange specialises in derivatives trading, offering perpetual contracts and futures on major cryptocurrencies with leverage up to 100x on select pairs.

The platform’s growth stems from its focus on user experience in the derivatives market, a segment often perceived as complex and intimidating. Bybit’s interface strikes a balance between sophistication and accessibility, making advanced trading strategies approachable for intermediate users whilst satisfying professional traders’ needs.

Bybit’s fee structure is competitive, with maker fees as low as 0.01% and taker fees at 0.06%. The exchange uses a dual-price mechanism and insurance fund to prevent unfair liquidations during volatile market conditions, a feature that protects traders from cascading liquidation events that plagued earlier derivatives platforms.

User-Friendly Perpetual Contracts

Perpetual contracts, futures without expiry dates, represent Bybit’s core offering. These instruments allow traders to maintain long or short positions indefinitely, paying or receiving funding rates based on market conditions. Bybit’s funding rate calculations are transparent and updated in real-time, helping traders make informed decisions about position management.

The platform offers both linear contracts (settled in USDT) and inverse contracts (settled in the underlying cryptocurrency), giving traders flexibility in how they manage collateral and profit. Demo trading accounts let newcomers practise with virtual funds before risking real capital, an invaluable learning tool for those new to leveraged trading.

Bybit has also expanded into spot trading, NFTs, and copy trading services, where users can automatically replicate the trades of successful traders. The exchange’s mobile app is particularly well-optimised for derivatives trading, with responsive order execution and comprehensive portfolio management tools.

5. OKX: Comprehensive Crypto Ecosystem

OKX (formerly OKEx) serves millions of users across over 180 countries, offering one of the most comprehensive cryptocurrency ecosystems available. The exchange provides spot trading, derivatives, DeFi services, NFT marketplaces, and even a learning platform, all integrated into a unified experience.

The platform supports over 300 cryptocurrencies and tokens, with deep liquidity across major trading pairs. OKX’s fee structure is competitive, starting at 0.08% for makers and 0.1% for takers, with substantial discounts available through the exchange’s native OKB token.

What sets OKX apart is its commitment to bridging centralised and decentralised finance. The exchange has invested heavily in tools that allow users to seamlessly transition between CeFi and DeFi applications, recognising that the future of cryptocurrency likely involves both paradigms.

Web3 Wallet Integration

OKX’s Web3 wallet represents a significant innovation in exchange offerings. This non-custodial wallet integrates directly with the exchange platform, allowing users to interact with decentralised applications (dApps), NFT marketplaces, and DeFi protocols across multiple blockchains, including Ethereum, Polygon, BNB Chain, and Solana.

The wallet supports cross-chain swaps, enabling users to exchange tokens across different blockchains without leaving the interface. This eliminates the need for multiple bridge services and simplifies what has traditionally been a fragmented user experience. Built-in dApp discovery features help users find promising DeFi opportunities, complete with security ratings and audit information.

OKX also offers on-chain earning opportunities through its DeFi section, where users can access yield farming and liquidity provision directly from the exchange interface. The platform’s trading bots provide automation options for both spot and futures markets, with customisable strategies for grid trading, dollar-cost averaging, and arbitrage. Educational resources and demo trading accounts help users build confidence before committing significant capital.

6. KuCoin: The People’s Exchange

KuCoin has earned its nickname as “the people’s exchange” through its commitment to listing emerging cryptocurrencies before they appear on larger platforms. Founded in 2017, the exchange serves over 30 million users across 200+ countries and territories.

The platform’s appeal lies in its early adoption of promising projects. Many tokens that eventually gained mainstream attention first appeared on KuCoin, giving early adopters significant advantages. This strategy has cultivated a loyal community of users who appreciate the opportunity to discover projects before they explode in value.

KuCoin’s fee structure is reasonable at 0.1% for both makers and takers, with further reductions available through holding the exchange’s native KCS token. The platform offers an extensive range of services including spot trading, futures contracts, margin trading, staking, and a peer-to-peer marketplace.

Extensive Altcoin Selection

KuCoin supports over 700 cryptocurrencies, one of the broadest selections available on any centralised exchange. This vast catalogue includes everything from established projects to micro-cap tokens with considerable risk and reward potential. The exchange conducts due diligence before listings, but the sheer volume means users must still conduct their own research.

The platform’s trading terminal offers advanced features like TradingView chart integration, multiple order types, and portfolio tracking tools. KuCoin Earn provides various passive income opportunities through flexible staking, locked staking, and liquidity provision with competitive annual percentage yields.

KuCoin’s trading bot marketplace allows users to deploy automated strategies without coding knowledge. Pre-configured bots handle grid trading, rebalancing, and arbitrage opportunities across the platform’s extensive token selection. The exchange also operates a launchpad for new token sales, giving users early access to projects before they hit the open market. Community features include social trading elements where users can follow successful traders and participate in trading competitions with substantial prize pools.

7. Gemini: Premium Security and Compliance

Founded by Cameron and Tyler Winklevoss in 2014, Gemini positions itself as a premium cryptocurrency exchange focused on security, compliance, and institutional-grade infrastructure. The platform operates primarily in the United States and select international markets, holding licences from the New York State Department of Financial Services and other regulatory bodies.

Gemini’s approach prioritises regulatory compliance and user protection over rapid expansion. This conservative strategy has earned trust from institutional investors and high-net-worth individuals who require bulletproof security and legal clarity. The exchange supports around 100 cryptocurrencies, fewer than some competitors, but each undergoes rigorous evaluation before listing.

Fees are higher than industry averages, reflecting Gemini’s premium positioning. The platform offers both a simplified interface for beginners (Gemini) and an advanced trading platform (ActiveTrader) with lower fees and sophisticated tools for experienced users.

Institutional-Grade Protection

Gemini’s security infrastructure rivals that of traditional financial institutions. All customer fiat and cryptocurrency funds are held in FDIC-insured accounts and cold storage, respectively. The exchange carries comprehensive insurance coverage for digital assets held in hot storage, protecting against potential breaches.

The platform was the first cryptocurrency exchange to achieve SOC 2 Type 2 certification, demonstrating adherence to strict security standards set by the American Institute of Certified Public Accountants. Regular security audits and penetration testing ensure vulnerabilities are identified and addressed proactively.

Gemini’s commitment to transparency extends to its custody services, which serve institutional clients requiring segregated storage and additional security measures. The exchange operates as a qualified custodian under New York banking law, a distinction that matters significantly for regulated entities like pension funds and endowments. Educational initiatives through the Gemini Cryptopedia provide thoroughly researched content about blockchain technology, investment strategies, and regulatory developments. Customer support is notably responsive, with phone support available during business hours, a rarity in the cryptocurrency space.

8. Crypto.com: All-in-One Crypto Platform

Crypto.com has built a comprehensive cryptocurrency ecosystem that extends far beyond traditional exchange services. The Singapore-based platform serves over 80 million users worldwide and has invested heavily in mainstream marketing, including stadium naming rights and celebrity partnerships.

The company’s vision centres on accelerating cryptocurrency adoption through everyday use cases. Beyond trading, Crypto.com offers a Visa debit card that allows users to spend cryptocurrency at millions of merchants worldwide, a DeFi wallet, NFT marketplace, and even cryptocurrency payment processing for businesses.

The exchange supports over 250 cryptocurrencies with competitive trading fees starting at 0.4% and decreasing substantially with volume or through staking the platform’s native CRO token. Zero-fee trading is available on select pairs, making it attractive for beginners testing the waters.

Rewards and Cashback Benefits

Crypto.com’s Visa card programme represents one of the most compelling value propositions in cryptocurrency. Card holders earn cashback on everyday purchases ranging from 1% to 5%, depending on the amount of CRO tokens staked. Higher tiers unlock additional benefits including Spotify and Netflix rebates, airport lounge access, and higher earning rates on staked assets.

The platform’s staking services offer competitive yields across dozens of cryptocurrencies, with both flexible and fixed-term options. Crypto Earn allows users to generate passive income on idle holdings, with rates varying based on lock-up periods and loyalty tiers.

Crypto.com has also developed a robust DeFi ecosystem centred on its Cronos blockchain, which supports decentralised applications with low transaction costs. The platform’s NFT marketplace features drops from major artists and brands, bridging the gap between traditional entertainment and digital collectables. Mobile-first design philosophy ensures all features function seamlessly on smartphones, recognising that many users primarily access cryptocurrency services via mobile devices. Educational content through Crypto.com University helps newcomers understand both basic concepts and advanced trading strategies.

9. Bitfinex: Professional Trader’s Choice

Bitfinex caters to professional traders and institutions seeking advanced functionality and deep liquidity. Established in 2012, the exchange has weathered numerous controversies but maintains a loyal user base drawn to its sophisticated trading tools and extensive cryptocurrency offerings.

The platform supports over 150 cryptocurrencies with more than 400 trading pairs, including numerous obscure tokens rarely found elsewhere. Bitfinex’s liquidity is particularly strong for major pairs like BTC/USD, making it attractive for large-volume traders who require minimal slippage.

Fees follow a maker-taker model, starting at 0.1% for makers and 0.2% for takers, with aggressive discounts for high-volume traders. The platform offers margin trading with leverage up to 10x and peer-to-peer lending where users can provide liquidity to margin traders in exchange for interest payments.

Advanced Charting and Liquidity

Bitfinex’s trading terminal is among the most powerful available, featuring comprehensive charting tools powered by TradingView, dozens of order types, and algorithmic trading capabilities. Professional traders appreciate features like hidden orders, iceberg orders, and time-weighted average price (TWAP) execution, tools typically found only on institutional platforms.

The exchange offers derivatives trading through its sister platform, allowing users to trade perpetual swaps and futures contracts with up to 100x leverage. Order book depth provides transparency that sophisticated traders require for large position entries and exits.

Bitfinex Pulse functions as a social network for cryptocurrency traders, allowing users to share insights, analysis, and trading ideas. The platform’s API is exceptionally well-documented and stable, making it a favourite among quantitative traders and algorithmic trading firms. Mobile applications provide full trading functionality, though the interface complexity can overwhelm newcomers. OTC trading desks help large block trades with personalised service and competitive pricing. Even though past controversies, Bitfinex has implemented robust security measures including multi-signature wallets, advanced account monitoring, and two-factor authentication across all critical functions.

10. Gate.io: Innovative Features and Deep Markets

Gate.io rounds out this list as an exchange that consistently pushes boundaries with innovative features and an enormous selection of trading pairs. Founded in 2013, the platform serves users in over 190 countries and supports more than 1,700 cryptocurrencies, one of the largest selections available.

The exchange’s philosophy centres on providing access to emerging projects and niche markets that larger platforms ignore. This approach attracts adventurous traders seeking high-risk, high-reward opportunities in micro-cap tokens and newly launched projects. Gate.io’s vetting process attempts to balance opportunity with due diligence, though users must still exercise caution.

Fees are competitive at 0.2% for makers and takers, with substantial discounts available through trading volume or holding the exchange’s native GT token. The platform offers comprehensive services including spot trading, futures contracts, options, copy trading, and even quantitative trading strategies.

Unique Trading Opportunities

Gate.io’s startup platform hosts initial exchange offerings (IEOs) that give users early access to tokens before public trading begins. Whilst risky, these opportunities have occasionally delivered substantial returns for early participants. The platform also operates prediction markets where users can bet on future events, from cryptocurrency price movements to real-world outcomes.

The exchange’s copy trading feature allows less experienced traders to automatically replicate the strategies of successful traders, complete with performance statistics and risk ratings. Over 10,000 traders offer copyable strategies across various risk profiles and trading styles.

Gate.io offers both perpetual and quarterly futures contracts with leverage up to 100x, alongside options contracts for sophisticated hedging strategies. The platform’s liquidity mining programmes incentivise users to provide liquidity to trading pairs in exchange for token rewards. Margin lending allows users to earn interest on idle cryptocurrency holdings by lending to margin traders. Gate.io’s mobile app provides full functionality with a surprisingly intuitive interface given the platform’s complexity. Educational resources help users navigate the platform’s extensive features, though the learning curve remains steep for beginners. The exchange maintains a strong presence in Asian markets whilst gradually expanding its Western user base through improved English-language support and regulatory compliance efforts.

Conclusion

The cryptocurrency exchange landscape offers remarkable diversity, with each platform carving out distinct niches to serve different trader profiles. From Binance’s comprehensive ecosystem and Coinbase’s beginner-friendly approach to Bitfinex’s professional-grade tools and KuCoin’s altcoin abundance, traders have more quality options than ever before.

Selecting the right exchange depends on individual priorities, whether that’s regulatory compliance, fee structures, available cryptocurrencies, or advanced trading features. Beginners typically find the most value in user-friendly platforms like Coinbase or Crypto.com, which prioritise education and straightforward interfaces. Experienced traders gravitate towards Binance, Bybit, or Bitfinex for sophisticated tools and deep liquidity.

Security should remain a primary consideration regardless of experience level. Exchanges with strong track records, transparent operations, and robust protection measures, like Kraken, Gemini, and Coinbase, provide peace of mind that matters tremendously in an industry still maturing its security standards.

Diversification across multiple exchanges often makes practical sense, allowing traders to access different token selections, take advantage of varying fee structures, and reduce concentration risk. The cryptocurrency market continues evolving rapidly, and these leading exchanges are adapting by expanding services, improving user experiences, and building bridges between traditional finance and digital assets. Whatever one’s trading goals, this list provides a solid starting point for finding a platform that aligns with specific needs and risk tolerance.

Frequently Asked Questions

Which crypto exchange is best for beginners in the UK?

Coinbase is widely regarded as the most beginner-friendly platform, offering a clean interface, straightforward verification, and educational resources like Coinbase Earn. Its regulatory compliance and 98% cold storage provide additional security for newcomers.

What is the largest cryptocurrency exchange by trading volume?

Binance consistently ranks as the world’s largest crypto exchange by trading volume, processing billions of dollars daily. It serves over 150 million users across 180+ countries with over 350 cryptocurrencies and 1,500 trading pairs.

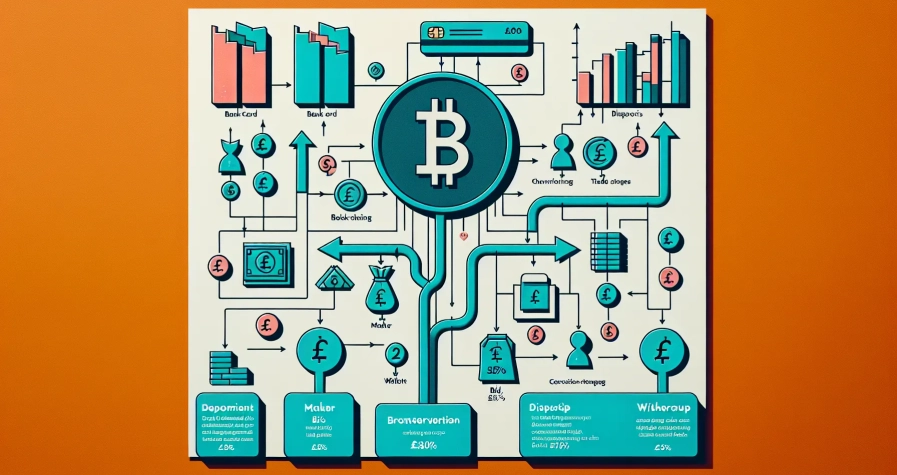

How do crypto exchange fees compare across popular platforms?

Fees vary significantly: Binance charges 0.1% per spot trade, Kraken starts at 0.16-0.26%, whilst Coinbase’s standard fees are higher but offset by stronger regulatory protection. Volume discounts and native token holdings can reduce costs further.

Are cryptocurrency exchanges safe to use?

Security varies by platform. Established exchanges like Kraken, Gemini, and Coinbase employ cold storage, insurance coverage, and regular audits. However, no exchange is entirely risk-free; users should enable two-factor authentication and consider hardware wallets for long-term holdings.

What is the difference between spot trading and derivatives on crypto exchanges?

Spot trading involves directly buying and owning cryptocurrency at current market prices. Derivatives like futures and perpetual contracts allow traders to speculate on price movements with leverage, without owning the underlying asset, offering higher risk and reward potential.

Can I use multiple crypto exchanges simultaneously?

Yes, using multiple exchanges is common and advisable. It provides access to different token selections, allows comparison of fee structures, and reduces concentration risk. Many experienced traders diversify across platforms to optimise their trading strategies and security.