If you’ve ever wondered what sets Bitcoin apart from the thousands of other cryptocurrencies out there, you’re not alone. Bitcoin stands as the original cryptocurrency,the one that started it all back in 2009,but since then, a vast universe of alternative coins (or “altcoins”) has emerged, each claiming to offer something unique. While Bitcoin holds its crown as the most recognized digital asset, altcoins are constantly pushing boundaries with innovative features, faster transactions, and specialized use cases.

Understanding the key differences between Bitcoin and altcoins isn’t just academic,it’s essential for making informed investment decisions and grasping how the crypto ecosystem actually works. From market dominance to consensus mechanisms, energy consumption to investment risk, these differences shape how each cryptocurrency functions and what role it plays in your portfolio. Let’s break down the ten most important distinctions in plain English, so you can navigate the crypto landscape with confidence.

Key Takeaways

- Bitcoin commands 40-60% of the crypto market and serves as the most recognized and secure digital asset, making it the foundation for most cryptocurrency portfolios.

- The key differences between Bitcoin and altcoins include market dominance, blockchain architecture, consensus mechanisms, transaction speed, and specialized use cases.

- Bitcoin uses energy-intensive Proof-of-Work for maximum security, while many altcoins employ Proof-of-Stake and other mechanisms that reduce energy consumption by over 99%.

- Altcoins offer faster transactions, lower fees, and smart contract functionality for specialized applications like DeFi and NFTs that Bitcoin wasn’t designed to support.

- Bitcoin’s fixed supply of 21 million coins creates absolute scarcity, whereas altcoins use diverse supply models ranging from fixed caps to inflationary or algorithmic mechanisms.

- Understanding the differences between Bitcoin and altcoins is essential for managing investment risk, as Bitcoin offers relative stability while altcoins provide higher potential returns with significantly greater volatility.

1. Market Dominance and Recognition

Bitcoin commands a dominant position in the cryptocurrency market that no altcoin has come close to matching. At any given time, Bitcoin typically captures between 40–60% of the entire crypto market capitalization, dwarfing individual altcoins that usually represent only single-digit percentages. This massive market share translates into unparalleled liquidity, meaning you can buy or sell Bitcoin quickly without dramatically affecting its price.

As the first cryptocurrency, Bitcoin enjoys near-universal recognition,even people who’ve never invested in crypto have heard of Bitcoin. This name recognition extends to institutional investors, major corporations, and governments worldwide, making Bitcoin the gateway asset for most newcomers to cryptocurrency investing. When mainstream financial institutions dip their toes into crypto, they almost always start with Bitcoin.

Bitcoin’s First-Mover Advantage

Bitcoin’s first-mover advantage isn’t just about being first,it’s about being battle-tested over more than fifteen years. While thousands of altcoins have launched, failed, or faded into obscurity, Bitcoin has weathered market crashes, regulatory scrutiny, technological challenges, and countless predictions of its demise. This track record builds trust that newer altcoins simply can’t replicate overnight.

The network effect works powerfully in Bitcoin’s favor. More users, more developers, more merchants accepting it, more mining infrastructure,each element reinforces the others, creating a virtuous cycle that’s incredibly difficult for altcoins to break. Even technically superior altcoins struggle to overcome Bitcoin’s entrenched position as the default crypto asset. For most investors, Bitcoin serves as the foundation of a crypto portfolio precisely because of this established dominance and recognition.

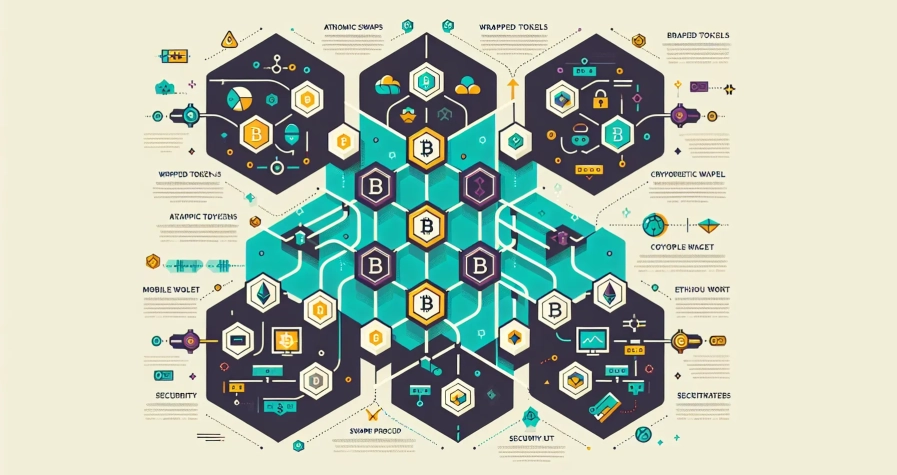

2. Technology and Blockchain Architecture

Bitcoin’s blockchain architecture is deliberately straightforward: it’s designed as a peer-to-peer electronic cash system focused on secure, transparent transactions. The Bitcoin protocol prioritizes simplicity and security over fancy features, creating a trustless system where you don’t need intermediaries to transfer value. This intentional minimalism is both Bitcoin’s strength and its limitation.

Altcoins, on the other hand, often build upon or completely reimagine blockchain architecture to expand functionality far beyond simple transactions. Many altcoins introduce complex features that Bitcoin was never designed to handle, positioning themselves as solutions to problems Bitcoin doesn’t attempt to solve.

How Altcoins Innovate Beyond Bitcoin’s Framework

Ethereum represents perhaps the most significant architectural departure from Bitcoin. It introduced smart contracts,self-executing programs with predefined conditions that automatically trigger when those conditions are met. This seemingly simple innovation unlocked entire categories of applications: decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and countless other use cases that simply can’t exist on Bitcoin’s network.

Other altcoins have pursued different architectural innovations. Cardano emphasizes a research-driven, peer-reviewed approach to blockchain design. Solana optimizes for high throughput and low latency, processing thousands of transactions per second. Privacy-focused altcoins like Monero and Zcash incorporate cryptographic techniques that obscure transaction details in ways Bitcoin doesn’t.

These architectural differences aren’t just technical trivia,they fundamentally determine what each cryptocurrency can do. Bitcoin excels at being money: many altcoins aim to be platforms, tools, or specialized solutions for specific industries like supply chain management, healthcare data, gaming, or decentralized identity. The tradeoff? Added complexity often means more potential vulnerabilities and less time-tested security.

3. Supply Limits and Scarcity

Bitcoin’s monetary policy is coded directly into its protocol: there will only ever be 21 million bitcoins. This fixed maximum supply creates absolute scarcity,one of Bitcoin’s most compelling economic features and a cornerstone of its “digital gold” narrative. Unlike fiat currencies that governments can print endlessly, Bitcoin’s supply cap is mathematically enforced and impossible to change without consensus from the entire network.

Besides, Bitcoin’s issuance rate decreases over time through “halving” events that occur roughly every four years (every 210,000 blocks). Each halving cuts the reward miners receive for validating new blocks in half, gradually reducing the flow of new bitcoins entering circulation. The last bitcoin won’t be mined until around 2140, creating a predictable, transparent supply schedule that supports long-term scarcity.

Fixed vs. Variable Supply Models

Altcoins take wildly different approaches to supply economics. Some mimic Bitcoin’s fixed-cap model,Litecoin, for instance, has a maximum supply of 84 million coins. Others deliberately choose inflationary models with no hard cap, like Ethereum post-merge, which has an indefinite supply that can expand over time (though mechanisms like fee burning can create deflationary pressure).

Still other altcoins employ algorithmic supply mechanisms that dynamically adjust based on network conditions. Stablecoins like USDC or DAI expand and contract supply to maintain a peg to the US dollar. Some DeFi tokens carry out complex tokenomics with burning mechanisms, staking rewards, and governance-driven supply changes that can significantly affect circulating supply.

This diversity means you need to understand each cryptocurrency’s supply model before investing. Fixed supply supports the scarcity value proposition but may not suit all use cases. Inflationary models can fund ongoing development and network security but risk diluting value. Variable or algorithmic supplies introduce complexity and sometimes unpredictability. Bitcoin’s approach is simple and transparent,you always know exactly how many bitcoins exist and how many will exist,which is part of its appeal as a store of value.

4. Transaction Speed and Scalability

Bitcoin processes transactions relatively slowly compared to traditional payment networks and many altcoins. The Bitcoin network generates a new block approximately every 10 minutes, and conservative practices recommend waiting for six confirmations (about an hour) before considering a transaction fully settled. While this might seem frustratingly slow in our instant-gratification world, it’s a deliberate design choice that prioritizes security and decentralization over speed.

Bitcoin’s base layer can handle roughly 7 transactions per second,nowhere near Visa’s capacity of thousands per second. This limitation has sparked ongoing debates about scalability and led to the development of second-layer solutions like the Lightning Network, which enables faster, cheaper transactions by settling them off-chain and only recording final balances on Bitcoin’s main blockchain.

Why Some Altcoins Process Transactions Faster

Many altcoins were specifically designed to address Bitcoin’s speed limitations. Solana, for example, can process thousands of transactions per second with confirmation times measured in seconds rather than minutes. Ripple (XRP) settles transactions in 3-5 seconds. Even Ethereum, before its various upgrades, processed transactions faster than Bitcoin.

These speed improvements typically come from different architectural choices and consensus mechanisms. Altcoins using Proof-of-Stake can validate blocks more quickly than Bitcoin’s Proof-of-Work system. Some altcoins sacrifice decentralization by using fewer validators, enabling faster consensus but potentially compromising security. Others employ innovative approaches like sharding (splitting the blockchain into parallel chains) or unique consensus algorithms optimized for throughput.

The catch? Faster isn’t always better. Bitcoin’s slower speed reflects its uncompromising approach to security and decentralization. Every speed improvement involves tradeoffs,whether it’s reduced decentralization, newer and less battle-tested technology, or different security assumptions. For small everyday transactions, altcoin speed advantages matter significantly. For large-value transfers where security is paramount, Bitcoin’s cautious approach often makes more sense.

5. Consensus Mechanisms

Bitcoin pioneered Proof-of-Work (PoW), the consensus mechanism that allows a decentralized network to agree on transaction validity without a central authority. In PoW, miners compete to solve complex cryptographic puzzles, and the first to find a solution gets to add the next block to the blockchain and receives newly minted bitcoins as a reward. This process requires enormous computational power, making it extremely difficult and expensive to attack the network.

Proof-of-Work has proven remarkably secure and resilient over Bitcoin’s 15+ year history. The amount of energy and hardware required to execute a 51% attack on Bitcoin’s network is prohibitively expensive, essentially making the network tamper-proof at scale. But, PoW’s energy intensity and relatively slow transaction processing have led altcoins to explore alternative approaches.

Proof-of-Work vs. Proof-of-Stake and Beyond

Proof-of-Stake (PoS) represents the most popular alternative consensus mechanism among altcoins. Instead of miners competing with computational power, PoS systems select validators based on how many coins they’ve “staked” or locked up as collateral. Ethereum’s transition from PoW to PoS in 2022 (“The Merge”) was the highest-profile adoption of this mechanism, reducing the network’s energy consumption by over 99%.

PoS offers several advantages: dramatically lower energy consumption, faster transaction finality, and the ability to process more transactions. Altcoins like Cardano, Polkadot, and Tezos have built their networks on PoS from the ground up. The tradeoff? PoS is newer and less battle-tested than Bitcoin’s PoW, and critics argue it may lead to greater centralization since wealthier validators can stake more coins and earn more rewards.

Beyond PoW and PoS, altcoins experiment with numerous other consensus mechanisms. Delegated Proof-of-Stake (DPoS) used by EOS and TRON allows token holders to vote for a small number of validators, increasing speed but reducing decentralization. Proof-of-Authority (PoA) relies on pre-approved validators, offering high performance for private or consortium blockchains. Some altcoins even combine multiple mechanisms in hybrid approaches. Each consensus mechanism involves different tradeoffs between security, speed, decentralization, and energy efficiency,core differences that fundamentally distinguish how Bitcoin and various altcoins operate.

6. Use Cases and Functionality

Bitcoin serves a focused purpose: it’s designed to be a peer-to-peer electronic cash system and, increasingly, a store of value,digital gold for the internet age. You can use Bitcoin to transfer value directly to anyone worldwide without banks or payment processors, or you can hold it as an inflation hedge and long-term investment. This singular focus on being money,nothing more, nothing less,defines Bitcoin’s identity and value proposition.

Bitcoin’s simplicity is intentional. It doesn’t try to be everything to everyone. It doesn’t host applications, execute complex programs, or enable elaborate smart contract functionality. This narrow focus allows Bitcoin to excel at its core mission: providing a secure, decentralized, censorship-resistant monetary system with a fixed supply cap.

Bitcoin as Digital Gold vs. Altcoins for Specialized Applications

Altcoins pursue vastly more diverse use cases, often positioning themselves as solutions to specific problems or enablers of particular applications. Ethereum functions as a global computer, hosting thousands of decentralized applications spanning finance, gaming, identity, supply chain, and more. Its smart contract functionality enables programmable money and automated agreements that execute without intermediaries.

Other altcoins target even more specialized niches. Chainlink provides decentralized oracle services that connect blockchains to real-world data. Filecoin offers decentralized file storage. Basic Attention Token aims to revolutionize digital advertising. Privacy coins like Monero and Zcash focus specifically on anonymous transactions. Stablecoins like USDC and Tether provide crypto versions of traditional currencies, combining blockchain benefits with price stability.

Some altcoins function primarily as governance tokens, giving holders voting rights over protocol decisions. Others serve as utility tokens that grant access to specific platforms or services. DeFi protocols issue tokens that represent ownership stakes or provide yield farming opportunities. Gaming-focused altcoins enable play-to-earn models and true digital ownership of in-game assets.

This functional diversity means altcoins compete not just with Bitcoin but with traditional industries and each other. Bitcoin competes with gold and fiat currency: Ethereum competes with cloud computing platforms: various altcoins compete with banks, insurance companies, data storage providers, and countless other sectors. While this diversity creates innovation opportunities, it also means most altcoins face existential competition and uncertain futures. Bitcoin’s singular focus on being money gives it a clearer, more defensible value proposition.

7. Energy Consumption and Environmental Impact

Bitcoin’s energy consumption is substantial,and intentional. The Proof-of-Work consensus mechanism requires miners worldwide to expend enormous computational power, consuming energy comparable to that of some countries. Critics frequently cite this as Bitcoin’s most significant drawback, arguing that the environmental cost is too high for a payment system.

But, context matters. Much of Bitcoin mining uses stranded or renewable energy that would otherwise go to waste,hydroelectric power during wet seasons, natural gas that would be flared at oil wells, or excess capacity from wind and solar installations. Bitcoin miners are economically incentivized to seek the cheapest energy available, which increasingly means renewables. Still, there’s no denying that Bitcoin’s energy footprint is large, and this remains a legitimate concern for environmentally conscious investors.

Many altcoins have adopted more energy-efficient consensus mechanisms specifically to address this criticism. Proof-of-Stake systems like those used by Ethereum 2.0, Cardano, and Algorand reduce energy consumption by over 99% compared to Proof-of-Work. Instead of massive mining operations consuming gigawatts of power, PoS networks run on hardware comparable to standard servers.

This dramatic energy efficiency advantage makes many altcoins more attractive from an environmental perspective. For investors, institutions, or governments concerned about carbon footprints and sustainability, PoS altcoins offer blockchain benefits without Bitcoin’s energy intensity. Some altcoins even market themselves specifically as “green” or “eco-friendly” alternatives to Bitcoin.

That said, energy consumption isn’t purely negative. Bitcoin advocates argue that the energy expenditure is precisely what makes the network secure,it’s prohibitively expensive to attack. The question becomes whether the security Bitcoin’s energy consumption provides is worth the environmental cost. Altcoins bet that alternative mechanisms can provide sufficient security with far less energy, though they lack Bitcoin’s long track record proving this assumption. As environmental concerns grow globally, this difference between Bitcoin and altcoins will likely become increasingly important in regulatory discussions and investment decisions.

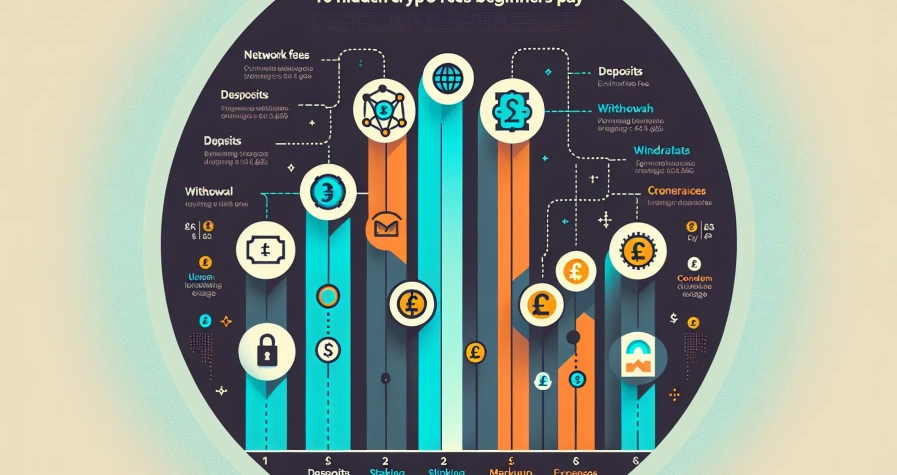

8. Transaction Costs and Fees

Bitcoin transaction fees fluctuate based on network demand and congestion. When many people want to send Bitcoin simultaneously, they bid up fees to prioritize their transactions, sometimes resulting in costs of $20, $30, or even more during peak demand periods. During quieter times, fees might drop to just a few dollars or less. This variability can make Bitcoin impractical for small purchases,nobody wants to pay a $15 fee to buy a $10 item.

Bitcoin’s fee structure is essentially a marketplace: users bid for limited space in each block, and miners prioritize transactions offering higher fees. While this creates efficiency from an economic perspective, it can price out smaller users during busy periods. Solutions like the Lightning Network aim to address this by enabling tiny, instant transactions off-chain, though adoption is still growing.

How Network Congestion Affects Costs

Network congestion directly drives up transaction costs on Bitcoin and most other blockchains. When demand for block space exceeds supply,which happens during market frenzies, popular NFT drops, or increased trading activity,fees spike dramatically. You’re competing in an auction for limited space, and those willing to pay more get their transactions processed faster.

Many altcoins were designed to keep transaction fees low even during high demand. Blockchains with higher throughput and faster block times can process more transactions, reducing congestion and keeping fees down. Some altcoins have implemented innovative fee structures to manage costs more predictably.

Ethereum introduced EIP-1559, which burns a portion of transaction fees rather than giving them all to miners, creating deflationary pressure while making fees more predictable (though they can still spike during congestion). Altcoins like Solana, Polygon, and Avalanche prioritize low fees as core features, often processing transactions for fractions of a penny even during busy periods.

But, ultra-low fees sometimes indicate low network demand or centralization rather than superior technology. A blockchain with few users naturally has low fees because there’s no competition for block space. The real test comes when networks scale to millions of users,can altcoins maintain low fees under Bitcoin-level demand? Some can, others struggle once adoption grows. For your purposes as a user, though, current fee differences are significant: altcoins often enable affordable microtransactions and everyday use cases that Bitcoin’s base layer can’t economically support right now.

9. Security and Network Strength

Bitcoin’s security is legendary in the cryptocurrency space. After 15+ years of operation, countless attempted hacks, and billions of dollars in bounties for anyone who could break it, Bitcoin’s core protocol has never been successfully compromised. This track record doesn’t guarantee future security, but it provides confidence that no other cryptocurrency can match. Bitcoin has been battle-tested in ways that newer altcoins simply haven’t.

The network’s strength comes from its massive scale. Thousands of nodes distributed worldwide validate and store the complete blockchain, creating redundancy that makes the network virtually impossible to shut down. Even if governments seized servers or miners went offline in entire countries, the Bitcoin network would continue operating. This decentralization isn’t just a technical feature,it’s the foundation of Bitcoin’s censorship resistance and resilience.

The Role of Network Size in Protection

Network size directly correlates with security in Proof-of-Work systems. Bitcoin’s mining network is so vast that executing a 51% attack,where an attacker controls enough mining power to manipulate the blockchain,would require billions of dollars in specialized hardware and ongoing electricity costs. The economic incentive structure makes attacking Bitcoin far more expensive than mining honestly, aligning security with rational self-interest.

Altcoins with smaller networks face more significant security vulnerabilities. Smaller PoW altcoins can be attacked relatively cheaply by renting hash power, and several have suffered 51% attacks. Even large altcoins don’t match Bitcoin’s security budget,the combined value of block rewards and fees that incentivize miners or validators to protect the network.

Proof-of-Stake altcoins approach security differently. Instead of computational expense deterring attacks, PoS relies on economic penalties,attackers would lose their staked coins if caught acting maliciously. In theory, this can provide robust security, but it’s less proven than Bitcoin’s approach. PoS systems also face different attack vectors, like “nothing at stake” problems where validators have little cost to support multiple competing blockchain versions.

For investors, Bitcoin’s superior security makes it the safest store of large amounts of value. Altcoins may offer innovative features and growth potential, but they generally can’t match Bitcoin’s security assurances. If you’re holding significant wealth in cryptocurrency, Bitcoin’s proven resilience and massive network strength provide peace of mind that most altcoins can’t yet deliver. That security premium is a big reason why Bitcoin maintains its dominant position even though newer competitors.

10. Investment Risk and Volatility

Bitcoin is volatile,there’s no sugarcoating it. Price swings of 10-20% in a single day aren’t uncommon, and Bitcoin has experienced multiple boom-bust cycles with drawdowns exceeding 80% from peak to trough. For traditional investors accustomed to stable stocks and bonds, Bitcoin’s volatility can be shocking. Yet even though this volatility, Bitcoin is actually the least volatile cryptocurrency.

Bitcoin’s relative stability (within the crypto context) comes from its size, liquidity, and broad adoption. With hundreds of billions in market capitalization, massive trading volume across numerous exchanges, and a diverse global investor base, Bitcoin absorbs shocks better than smaller cryptocurrencies. Institutional involvement,from hedge funds to corporations to ETFs,has further stabilized Bitcoin compared to its early, wild-west days.

Understanding Risk Profiles for Different Cryptocurrencies

Altcoins, especially those with smaller market capitalizations, experience dramatically higher volatility than Bitcoin. It’s not unusual for altcoins to double or triple in value within weeks during bull markets, only to crash 90% or more when sentiment shifts. This extreme volatility creates both opportunity and danger,potential for outsized gains, but equally massive losses.

Several factors drive altcoin volatility. Lower liquidity means relatively small buy or sell orders can move prices significantly. Smaller communities mean sentiment shifts can cause rapid swings. Many altcoins have concentrated ownership, where a few large holders (“whales”) can dramatically impact prices with their trading. News about technological updates, partnerships, regulatory concerns, or competitive threats affects altcoins more dramatically than Bitcoin.

Altcoins also face existential risks that Bitcoin doesn’t. Projects can fail, development teams can abandon projects, better competitors can emerge, or critical vulnerabilities can be discovered. Many altcoins from previous cycles have gone to zero or near-zero. Bitcoin, as the most established cryptocurrency with the strongest network effects, faces virtually no risk of complete failure absent a catastrophic, currently unknown technical flaw.

From an investment perspective, this creates different risk-reward profiles. Bitcoin offers relative stability and preservation of value within crypto, functioning as a portfolio anchor similar to how gold or blue-chip stocks work in traditional portfolios. Altcoins offer higher potential returns but come with significantly higher risk,they’re more like venture capital bets on unproven technologies and teams.

Your risk tolerance and investment objectives should guide your allocation between Bitcoin and altcoins. Conservative crypto investors might hold 70-100% Bitcoin with small altcoin positions. More aggressive investors might hold 50% or less in Bitcoin, using altcoins to chase higher returns while accepting greater risk. Most financial advisors suggest that if you can’t afford to lose your investment completely, you probably shouldn’t be heavily exposed to altcoins. Bitcoin isn’t safe by traditional standards, but within cryptocurrency, it’s the closest thing to a relatively conservative choice you’ll find.

Conclusion

Bitcoin and altcoins serve fundamentally different roles in the cryptocurrency ecosystem, and understanding these differences helps you make smarter investment decisions. Bitcoin has established itself as the most secure, recognized, and relatively stable digital asset,digital gold with a proven track record spanning over fifteen years. Its simplicity, fixed supply, massive network, and battle-tested security make it the foundation of most crypto portfolios and the gateway for institutional adoption.

Altcoins function as innovation laboratories, constantly experimenting with new technologies, consensus mechanisms, use cases, and economic models. They offer faster transactions, lower fees, smart contract functionality, and specialized applications that Bitcoin simply wasn’t designed to handle. This innovation creates opportunities for significant returns but comes with substantially higher risk and volatility.

The choice between Bitcoin and altcoins isn’t binary,most successful crypto investors hold both. Bitcoin provides the anchor: proven, relatively stable (within crypto), and unlikely to disappear. Altcoins provide the growth potential: innovative, specialized, and capable of explosive returns when successful. Your allocation should reflect your risk tolerance, investment timeline, and belief about which technologies will thrive.

As you navigate the crypto landscape, remember that Bitcoin’s advantages,security, adoption, liquidity, and scarcity,make it the market leader for good reasons. Altcoins’ advantages,innovation, functionality, and specialized solutions,make them compelling even though higher risk. Don’t invest in any cryptocurrency without understanding what makes it unique, what problem it solves, and what risks you’re accepting. The differences between Bitcoin and altcoins aren’t just technical details,they’re fundamental distinctions that should shape your entire crypto strategy.

Frequently Asked Questions

What is the main difference between Bitcoin and altcoins?

Bitcoin is the original cryptocurrency designed primarily as digital money and a store of value, while altcoins are alternative cryptocurrencies that often offer specialized features like smart contracts, faster transactions, or specific use cases beyond simple value transfer.

Why does Bitcoin use more energy than most altcoins?

Bitcoin uses Proof-of-Work consensus, requiring miners to solve complex puzzles using massive computational power. Most altcoins use Proof-of-Stake or other mechanisms that consume 99% less energy while validating transactions through staking rather than mining.

Are altcoins riskier investments than Bitcoin?

Yes, altcoins typically carry higher investment risk due to lower liquidity, smaller networks, concentrated ownership, and potential project failure. While Bitcoin is volatile, it’s the most established cryptocurrency with the lowest risk of complete failure within the crypto space.

Can Bitcoin process smart contracts like Ethereum?

No, Bitcoin’s blockchain is intentionally simple and designed for secure peer-to-peer transactions, not smart contracts. Ethereum and other altcoins built specialized architectures to support self-executing programs and decentralized applications that Bitcoin cannot natively handle.

How many altcoins should I hold in my portfolio?

Portfolio allocation depends on your risk tolerance. Conservative investors often hold 70-100% Bitcoin with small altcoin positions, while aggressive investors might allocate 50% or less to Bitcoin, using altcoins for higher growth potential despite increased risk.

Will Bitcoin’s fixed supply make it more valuable over time?

Bitcoin’s hard cap of 21 million coins creates absolute scarcity, supporting its ‘digital gold’ narrative. Unlike fiat currencies that can be printed infinitely, this mathematically enforced scarcity is designed to preserve and potentially increase value as demand grows.